The global insect feed market is currently valued at around USD 2.16 billion and is anticipated to progress at a CAGR of 18% to reach USD 11.31 billion by 2035.

This exponential growth reflects the accelerating shift toward sustainable and circular feed sources in animal nutrition. Insect-derived feed ingredients, particularly those sourced from black soldier fly (BSF) larvae, are gaining considerable traction as an ecologically viable and nutritionally dense alternative to traditional protein sources such as fishmeal and soymeal.

A growing consensus among aquaculture nutritionists and sustainability experts suggests that the high protein content, favorable amino acid profile, and low environmental impact of insect meals position them as the feed protein of the future.

The aquaculture segment, which already commands 44% of the total market value in 2025, has been observed to be the most proactive adopter of insect feed-primarily driven by commercial fish farmers’ need to reduce dependence on overexploited fish stocks and volatile fishmeal prices. Similarly, poultry and pet food sectors are beginning to integrate insect proteins to enhance digestive health and reduce allergens, especially in premium and hypoallergenic pet formulations.

Regulatory developments in Europe, North America, and parts of Asia have notably supported market expansion by easing restrictions around insect-derived feed usage in various livestock segments. Furthermore, vertically integrated players such as Protix and Innovafeed have been instrumental in scaling production with precision farming technologies, enabling more predictable output, traceability, and cost efficiency.

These companies, along with EnviroFlight and Entobel, are not only investing in facility expansion but are also actively engaging in partnerships across aquafeed manufacturers and livestock producers to secure offtake agreements and develop tailored feed blends.

While challenges related to price parity, scalability, and public perception remain, the market outlook is overwhelmingly positive. Market participants are increasingly channeling funds into R&D, automation, and genetic enhancement of larvae strains to improve yield per substrate input. With climate-conscious procurement strategies becoming mainstream, the insect feed market is being viewed as a critical pillar in the transition toward regenerative and resilient food systems.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global insect feed market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 16.3% (2024 to 2034) |

| H2 | 16.9% (2024 to 2034) |

| H1 | 17.4% (2025 to 2035) |

| H2 | 19.0% (2025 to 2035) |

The above table presents the expected CAGR for the global insect feed demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 16.3%, followed by a slightly higher growth rate of 16.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 17.4% in the first half and remain relatively moderate at 19.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

The aquaculture segment is projected to maintain its dominant position in the insect feed market, holding a 44% value share in 2025 and continuing to lead growth through 2035. Adoption of insect-based feeds in fish farming has been driven by nutritional efficacy and the imperative to reduce dependency on fishmeal.

This segment plays a foundational role in validating insect-derived proteins as viable mainstream feed ingredients. High digestibility, optimal amino acid profiles, and favorable feed conversion ratios have positioned insect meals as a sustainable solution to overfishing and the volatility of marine protein supply chains.

Aquaculture producers, especially in Europe and Southeast Asia, have been early adopters due to regulatory support and a strong innovation ecosystem linking feed manufacturers, insect protein startups, and research institutions. The segment is also benefiting from ESG-linked investment inflows targeting sustainable aquaculture practices.

By aligning environmental stewardship with production efficiency, aquaculture has become the proving ground for insect feed at scale. Future growth is expected to be underpinned by hybrid diets integrating insect meal, driven by rising demand for low-impact seafood and traceable sourcing. As scalability and cost optimization mature, aquaculture will likely catalyze broader acceptance across terrestrial livestock and companion animal segments, reinforcing its strategic significance.

The pet food segment is projected to register a CAGR of over 16% through 2035, emerging as the most dynamic non-livestock category in the insect feed market. Although smaller in absolute volume, its growth trajectory signals a high-value strategic shift in premium and functional pet nutrition.

Insect protein has increasingly been adopted in pet food due to its hypoallergenic properties, digestibility, and alignment with clean-label and sustainability-conscious pet owner expectations. This segment’s acceleration is being reinforced by rising pet humanization trends, particularly in North America and Europe, where discerning consumers are seeking ethically sourced, novel proteins that support digestive health and skin sensitivity. Insect feed suppliers have responded with targeted formulations addressing these needs, often co-developed with veterinary professionals and animal nutritionists to enhance credibility and clinical performance.

Regulatory clarity in the EU and growing openness in markets such as the USA, South Korea, and Australia are further easing market entry. Premium pet brands are leveraging insect protein to differentiate SKUs and reduce environmental footprint, leading to favorable margins and brand loyalty. As sustainability narratives grow more mainstream in pet food marketing, insect feed’s role will evolve from niche innovation to a core pillar of next-generation premium and therapeutic formulations.

Increased Adoption in Aquaculture

The aquaculture industry is increasingly embracing insect larvae, particularly black soldier fly larvae, as a sustainable protein source. This shift is largely driven by the need for high-quality feed that promotes optimal fish growth and health while addressing the environmental concerns associated with traditional fishmeal, which is often sourced unsustainably.

Insect feed boasts a nutritional profile rich in protein, essential fatty acids, and micronutrients, making it well-suited to meet the dietary requirements of various fish species. As aquaculture producers seek to enhance feed efficiency and sustainability, the incorporation of insect larvae into aquafeeds is becoming a preferred choice, contributing to a more resilient and eco-friendly aquaculture sector.

Rising Demand for Sustainable Livestock Feed

As environmental awareness among consumers continues to grow, there is an increasing demand for sustainable livestock feed options. Insect feed presents a viable solution by utilizing organic waste and by-products, thereby contributing to a circular economy that minimizes waste and resource consumption. This trend is particularly pronounced in pig and poultry nutrition, where farmers are actively seeking alternatives to conventional feed sources that often have a higher environmental impact.

By incorporating insect feed into their livestock diets, producers can reduce their carbon footprint and enhance the sustainability of their operations. This shift not only meets consumer expectations for environmentally responsible practices but also supports the long-term viability of the livestock industry.

Technological Advancements in Insect Farming

Innovations in insect farming technologies are significantly enhancing the efficiency and scalability of production processes. Advances such as automated farming systems, optimized breeding techniques, and improved feed formulations are enabling producers to increase yield while reducing operational costs. These technological developments streamline the farming process, making it easier to manage large-scale insect production and ensuring consistent quality in the feed produced.

As a result, insect feed is becoming more accessible and appealing to a broader range of applications, including livestock and aquaculture. The ongoing investment in research and development within the insect farming sector is expected to drive further innovations, solidifying insect feed's position as a key player in sustainable animal nutrition.

Global Insect Feed sales increased at a CAGR of 16.8% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on insect feed will rise at 18.0% CAGR

The global population is projected to reach nearly 10 billion by 2050, leading to an unprecedented increase in the demand for animal protein, including meat, dairy, and fish products. This rising demand places significant pressure on traditional livestock and aquaculture systems to produce high-quality feed efficiently.

Insect feed emerges as a sustainable alternative, providing a rich source of protein that can be produced with minimal environmental impact. By incorporating insect feed, producers can help meet the growing protein needs of the population while promoting sustainable practices.

Insect feed presents a viable solution to the challenges posed by the increasing demand for animal protein. Unlike conventional feed sources, insect farming requires significantly less land, water, and feed to produce comparable protein levels.

This efficiency not only helps alleviate the strain on natural resources but also reduces greenhouse gas emissions associated with traditional livestock farming. As consumers and manufacturers prioritize sustainability, insect feed offers an innovative approach to meeting protein demands while supporting environmentally responsible food production practices.

Tier 1 Companies represent the industry leaders with annual revenues exceeding USD 20 million and a market share of approximately 40% to 50%. These companies are characterized by their high production capacities, extensive product portfolios, and robust geographical reach.

They possess advanced manufacturing capabilities and a deep understanding of regulatory compliance across multiple regions. Prominent players in this tier include Protix, AgriProtein, and Ynsect, which have established themselves as frontrunners in the insect protein sector. Their strong consumer bases and innovative approaches to insect farming position them as key influencers in shaping market trends and driving sustainability initiatives.

Tier 2 Companies consist of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and significantly influence local markets. They are characterized by their solid technological capabilities and a good understanding of consumer preferences, although they may lack the extensive global reach of Tier 1 companies.

Notable Tier 2 players include Enterra Feed Corporation, InnovaFeed, and Aspire Food Group. These companies are well-positioned to capitalize on regional demand for insect-based feed solutions and often engage in strategic partnerships to enhance their market presence and technological advancements.

Tier 3 Companies encompass a large number of small-scale enterprises with revenues below USD 5 million. These companies primarily operate in niche markets, focusing on local demand and specific applications of insect protein. They are often characterized by limited production capacities and geographical reach, making them less influential on a global scale.

However, they play a crucial role in catering to localized needs and fostering innovation within the sector. This tier is often seen as unorganized, with many players lacking formal structures compared to their larger counterparts.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 1,697.7 million |

| Germany | USD 1,131.8 million |

| China | USD 905.5 million |

| India | USD 565.9 million |

| Japan | USD 226.4 million |

The aquaculture industry in the USA is experiencing rapid growth due to rising consumer demand for seafood, driven by health trends and sustainability concerns. Insect feed offers a high-quality protein source that is particularly beneficial for fish and shrimp, essential components of the seafood market.

Rich in essential amino acids, vitamins, and minerals, insect protein enhances the nutritional profile of aquaculture feeds, promoting better growth and health in aquatic species. Additionally, using insect feed supports sustainable practices by reducing reliance on traditional fishmeal and minimizing environmental impacts, making it an attractive option for aquaculture producers aiming for efficiency and sustainability.

In Germany, the circular economy is increasingly recognized as a vital approach to sustainable development, emphasizing waste reduction and resource efficiency. Insect farming plays a crucial role in this model, as insects can be cultivated on organic waste and by-products, such as food scraps and agricultural residues.

This process not only diverts waste from landfills but also transforms it into high-quality protein for animal feed. By utilizing waste materials, insect farming contributes to a more sustainable agricultural system, aligning with Germany's environmental goals. This innovative approach enhances resource efficiency, reduces environmental impact, and supports the transition to a circular economy in food production.

India grapples with significant organic waste management challenges, especially in urban areas, where food waste and agricultural by-products accumulate. Insect farming presents a viable solution by converting this waste into high-quality protein, effectively addressing waste management issues while providing a sustainable feed source.

This process fosters a circular economy within the agricultural sector, promoting resource efficiency and reducing environmental impact. Concurrently, the Indian government is increasingly recognizing the potential of insect farming to enhance food security and support sustainable agriculture. Emerging initiatives focus on research, development, and commercialization of insect protein, encouraging farmers and entrepreneurs to invest in insect feed production.

Key players are investing in research and development to enhance production efficiency and nutritional profiles of insect feed. Strategic partnerships with agricultural firms and research institutions are being formed to leverage expertise and resources. Additionally, companies are expanding their product offerings to cater to diverse livestock and aquaculture needs, while emphasizing eco-friendly practices to attract environmentally conscious consumers.

For instance

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.16 billion |

| Projected Market Size (2035) | USD 11.31 billion |

| CAGR (2025 to 2035) | 18% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in kilotons |

| By Insect Type | Fly Larvae, Silkworms, Cicadas, Other Insects |

| By Application | Aquaculture, Pig Nutrition, Poultry Nutrition, Dairy Nutrition, Other Applications |

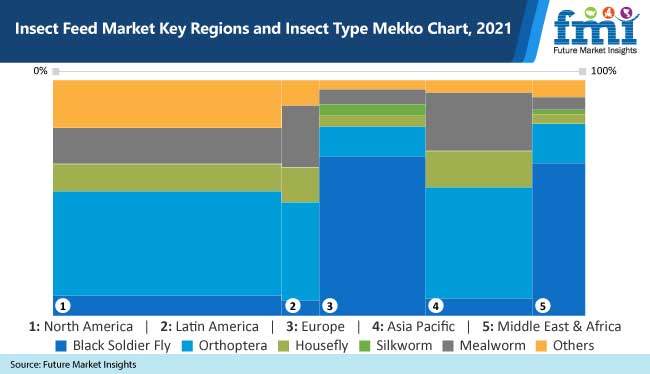

| By Region | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Key Players | Nextprotein, Buhler AG, Hexafly, Entofood, Diptera Nutrition, Enviroflight, Coppens, Agriprotein, Alltech Coppens BV, Hipromine SA, Other Market Players |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Additional Attributes | Dollar sales by insect type (fly larvae, silkworms, cicadas), Dollar sales by application (aquaculture, pig, poultry, dairy), Adoption of insect feed in sustainable agriculture, Regional demand patterns in feed innovation, Regulatory trends supporting alternative proteins, Integration of insect meal in aquafeed and livestock supply chains |

| Customization and Pricing | Customization and Pricing Available on Request |

This segment is further categorized into Fly Larvae, Silkworms, Cicadas, and Other Insects.

This segment is further categorized into Aquaculture, Pig Nutrition, Poultry Nutrition, Diary Nutrition, and Other Applications.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Insect Feed industry is estimated at a value of USD 2.16 billion in 2025.

Sales of Insect Feed increased at 16.8% CAGR between 2020 and 2024.

Nextprotein, Buhler AG, Hexafly, Entofood, Diptera Nutrition are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 24% over the forecast period.

North America holds 34% share of the global demand space for Insect Feed.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Insect Feed Market, By Type, By Application, By Region, Opportunities and Forecast, 2025 to 2035

Korea Insect Feed Market Analysis and Forecast by Product Type, End-User and Region 2025 to 2035

Western Europe Insect Feed Market Analysis by Insect Type, Application, and Country Through 2025 to 2035

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Insect Oil Market Size And Share Forecast Outlook 2025 to 2035

Insect-based Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Insect Repellent Apparel Market Size and Share Forecast Outlook 2025 to 2035

Insect-Based Snacks Market Analysis - Size, Share & Forecast 2025 to 2035

Insect Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insect Cell Lines Market - Growth, Applications & Forecast 2025 to 2035

Insect-Based Pet Food Market Growth - Sustainable Nutrition & Demand 2025 to 2035

Bioinsecticides Market Growth - Trends & Forecast 2025 to 2035

Natural Insect Repellent Market Analysis - Trends, Growth & Forecast 2025 to 2035

Carbamate Insecticides Market Trends & Outlook 2025 to 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA