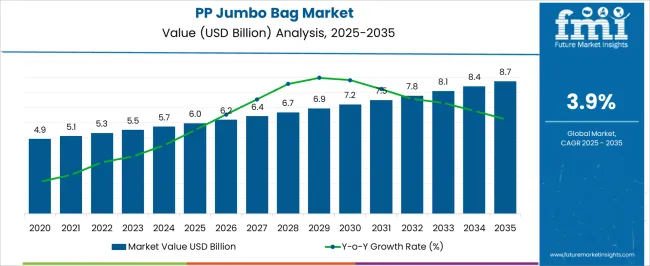

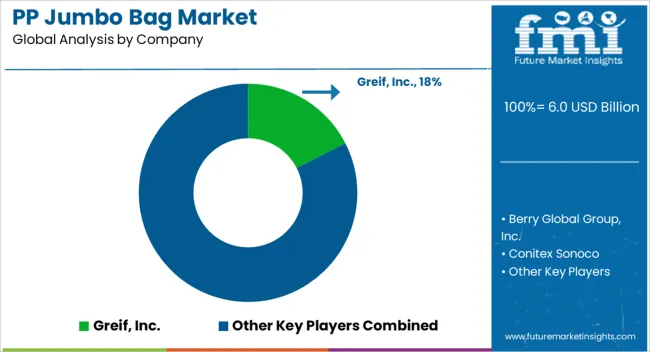

The PP Jumbo Bag Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| PP Jumbo Bag Market Estimated Value in (2025 E) | USD 6.0 billion |

| PP Jumbo Bag Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The PP jumbo bag market is experiencing consistent expansion driven by increasing demand from bulk packaging applications across construction, agriculture, chemicals, and food industries. Rising global trade activities and the need for cost-efficient, durable, and lightweight packaging solutions are supporting adoption. Current dynamics are shaped by the versatility of PP jumbo bags, which provide high strength-to-weight ratio, efficient storage, and ease of handling for bulk goods.

Sustainability initiatives and regulatory focus on reducing secondary packaging waste are also favoring the use of recyclable polypropylene materials. The future outlook is marked by continuous improvements in weaving, lamination, and coating technologies that enhance bag durability and safety under diverse conditions.

Growth rationale is founded on rising preference for bulk packaging solutions that optimize logistics costs, expanding application scope across emerging economies, and the ability of manufacturers to offer customized designs meeting international safety standards These factors are expected to sustain market share growth and support wider penetration across global supply chains.

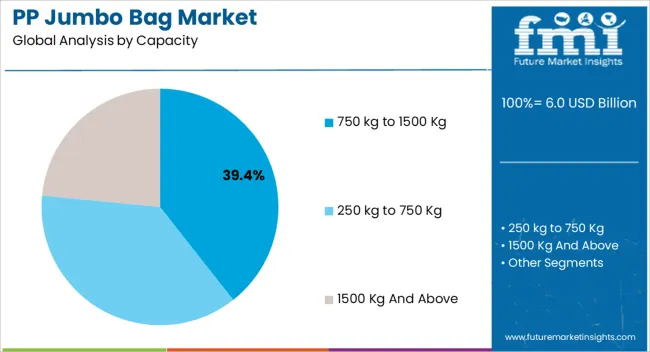

The 750 kg to 1500 kg capacity segment, holding 39.4% of the category, has remained dominant due to its suitability for a broad range of bulk handling requirements. Its adoption has been favored by versatility across industries including agriculture, construction, and industrial chemicals.

Operational convenience, combined with standardized lifting and filling features, has reinforced its preference among logistics providers. The segment’s durability and ability to optimize transport costs without compromising safety have supported sustained demand.

Manufacturers have been focusing on enhancing tensile strength and ensuring compliance with international transport regulations, which has further strengthened buyer confidence The segment is expected to retain its leadership through continued integration into supply chains where mid-range capacity offers the most cost-effective balance between load efficiency and handling convenience.

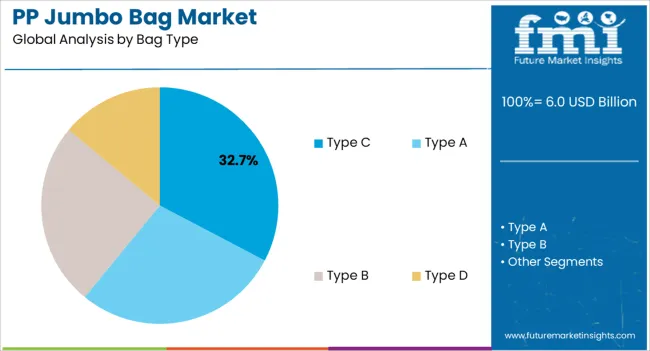

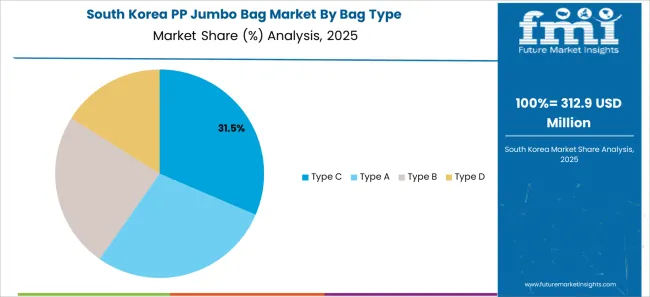

The Type C bag segment, representing 32.7% of the bag type category, has achieved a leading position due to its critical role in handling flammable or combustible materials safely. The ability of Type C bags to dissipate electrostatic charges through grounding mechanisms has made them the preferred choice for industries dealing with sensitive powders and chemicals.

Market acceptance has been reinforced by strict adherence to safety regulations and the growing awareness of workplace safety standards. Continued adoption has been supported by improvements in conductive yarn weaving and cost-effective production methods, ensuring consistent availability.

The segment’s dominance is expected to continue as industrial users prioritize safe handling of volatile substances and regulatory bodies enforce stringent compliance for electrostatic discharge protection in material transport and storage.

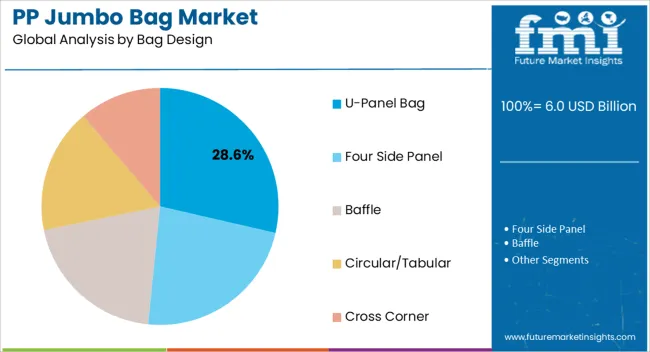

The U-Panel bag segment, accounting for 28.6% of the bag design category, has sustained its leadership due to its balance between strength, cost-efficiency, and ease of use. The structural design provides stability and efficient weight distribution, making it widely applicable for both granular and powdered materials.

Its preference has been supported by lower production costs compared to complex bag designs, while maintaining sufficient durability for multi-trip applications. Adoption has been reinforced by its compatibility with standard filling and discharging equipment, reducing operational complexities in industrial packaging processes.

Ongoing improvements in stitching and lamination techniques have enhanced product lifespan and load-bearing capacity The segment is projected to remain a preferred choice for industries seeking reliable, practical, and cost-effective packaging solutions within the PP jumbo bag market.

The market for PP jumbo bags is heavily reliant on the performance of the manufacturing and packaging industry. The last few years were a real roller coaster ride for the PP jumbo bag market. As the world faced shutdowns, enterprises, especially manufacturing, underwent tremendous losses, leading to decreased demand for PP jumbo bags.

While in some sectors, like agriculture and food, the need for PP jumbo bags was still stable, others, like construction, faced reduced demand.

As the world returns to normalcy, industries are gaining traction, and it can be confidently projected that the market for PP jumbo bags is likely to gain momentum in the coming years.

| Attributes | Key Statistics |

|---|---|

| Expected Base Year Value (2020) | USD 4.46 billion |

| Anticipated Forecast Value (2025) | USD 5.2 billion |

| Estimated Growth (2020 to 2025) | 3.9% CAGR |

Factors Adversely Affecting the PP Jumbo Bag Market

In terms of bag type, demand for type C bags is expected to account for a dominant share of the global PP jumbo bag market. These bags, also known as conductive FIBCs or groundable bulk bags, are considered safe packaging solutions for the transportation of combustible materials and products.

Type C bags hold a significant global revenue share of 41.3% of the overall PP jumbo bag market. These bags can withstand heavy loads while resisting tears and punctures.

| Attributes | Details |

|---|---|

| Bag Type | Type C |

| Market share | 41.3% |

Type C bags are also in great demand as they offer protection against electrostatic discharges built due to the grounding of the bag during the filling and discharging processes. Their significance in the chemical industries is growing as they are used to transport and store flammable powders like magnesium. They also act as a resistive barrier between chemicals stored inside and outer elements that can be used to transport and store combustible powders like magnesium in factory units.

PP jumbo bags play a pivotal role in the agriculture and food industry, meeting the demand for efficient and bulk packaging solutions. In agriculture, these robust bags are commonly used for storing and transporting grains, seeds, and fertilizers. The demand for these bags in agriculture is driven by their ability to safeguard products from moisture, pests, and contamination.

The agriculture and food sector accounts for a significant 35.1% of the global PP jumbo bag market.

| Attributes | Details |

|---|---|

| End User | Agriculture and Food |

| Market share | 35.1% |

PP jumbo bags are in high demand for packaging bulk food products in the food industry. These bags are often used to store commodities like rice, sugar, flour, and animal feed. Their large capacity and durability make them ideal for transporting and storing these essential food staples. With the growing trend of online grocery shopping and increased focus on food safety, PP jumbo bags have become indispensable for ensuring food items' efficient and hygienic packaging.

The agriculture sector is one of the significant contributors to India’s economy. As the sector expands to meet the increasing food demands of the nation’s growing population, the demand for PP jumbo bags also touches the skies.

Farmers heavily rely on these bulk bags to store large quantities of fertilizers, seeds, pesticides, etc. Their ability to protect crops from moisture, pests, and contamination, coupled with cost-effectiveness, makes PP jumbo bags an attractive choice for farmers with low financial resources.

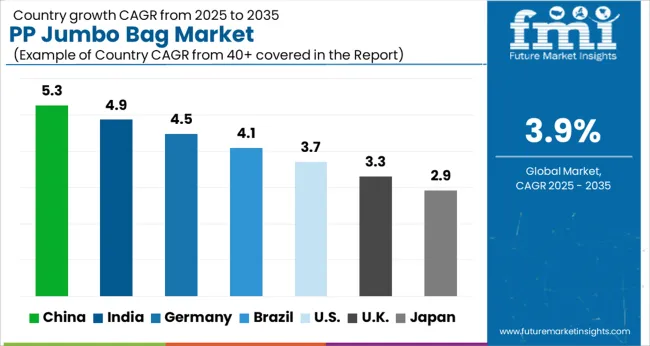

The market for PP jumbo bags in India is anticipated to grow at a remarkable rate of 6.3% from 2025 to 2035. This demand can also be attributed to the fact that PP jumbo bags are not only used in the agriculture sector but also in the packaging of finished products before they are processed in nearby factory units.

The market for PP jumbo bags is on the rise in China, primarily due to the country's thriving packaging industry. China's rapidly growing economy has increased demand for cost-effective and versatile packaging solutions. PP jumbo bags offer a reliable option for bulk packaging, especially in industries like agriculture, construction, chemicals, and logistics.

This growth in China's packaging industry and the need for efficient and secure bulk transportation have driven the demand for PP jumbo bags.

The China PP jumbo bag market is anticipated to exhibit a significant growth rate of 5.7% from 2025 to 2035. Many businesses in China are shifting toward more sustainable packaging options, and PP jumbo bags meet these criteria by reducing waste and offering a green alternative.

As China continues to focus on sustainable development, the market for PP jumbo bags is expected to expand even further in response to these evolving industry demands.

With numerous infrastructure projects, urban development initiatives, and a rapidly growing construction industry, the demand for PP jumbo bags is on the rise. PP jumbo bags are known in the construction industry for their ability to transport and store construction materials like sand, gravel, and cement. Their large capacity, durability, and ease of handling make them indispensable in this sector.

The cost-efficiency and reusability of PP jumbo bags have further fueled their demand in the Thai construction industry. As construction projects continue to expand, the need for a reliable and cost-effective solution for transporting and storing bulk materials has led to a surge in their adoption.

As Thailand continues to invest in its infrastructure and urban development, the market for PP jumbo bags is set to remain on a growth trajectory.

South Korea has emerged as a key player in the global pharmaceutical market in the past few years, with an increasing demand for high-quality packaging solutions. PP jumbo bags are used to package and transport a wide range of raw pharmaceutical materials and products.

The stringent quality requirements of the pharmaceutical industry make PP jumbo bags an excellent choice for preserving the integrity and purity of these sensitive substances during storage and transportation.

The market for PP jumbo bags in South Korea is anticipated to grow at a modest rate of 5.3% for the forecast period of 2025 to 2035. With the rise of South Korea's pharmaceutical sector, the market for PP jumbo bags is set to continue its growth trajectory in the country.

The global PP jumbo bag market has reached a level of saturation where there is little room for innovation in the said field. Despite the prominence of key international players in the market, the industry has many challenges. Supply chain disruptions due to war-like situations and recessionary economic times have often affected the global PP jumbo bag market.

New entrants are constantly developing sustainable packaging solutions to cater to the market's demand locally. With growing environmental concerns regarding the reusability of these bags, the future of PP jumbo bags seems uncertain.

Recent Developments in the PP Jumbo Bag Market:

The global PP jumbo bag market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the PP jumbo bag market is projected to reach USD 8.7 billion by 2035.

The PP jumbo bag market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in PP jumbo bag market are 750 kg to 1500 kg, 250 kg to 750 kg and 1500 kg and above.

In terms of bag type, type c segment to command 32.7% share in the PP jumbo bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

PP Laminating Films Market

PP Container Liner Market

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

App Store Optimization Software Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Upper Limb Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Apple Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Appendage Management Market Size and Share Forecast Outlook 2025 to 2035

Applicator Tips Market Size and Share Forecast Outlook 2025 to 2035

Application Specific Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Applicant Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA