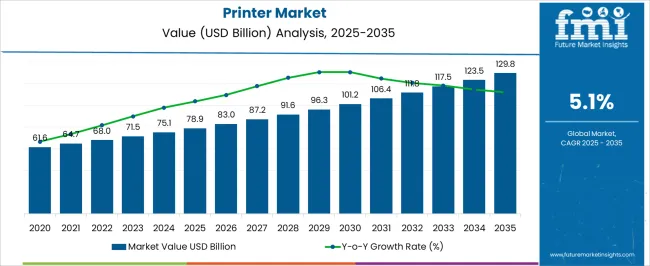

The Printer Market is estimated to be valued at USD 78.9 billion in 2025 and is projected to reach USD 129.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. This growth, supported by a steady CAGR of 5.1%, is driven by increasing demand for high-efficiency printing solutions, expansion of 3D printing applications, and the growing need for office automation. During the first five years (2025 to 2030), the market will rise from USD 78.9 billion to USD 101.2 billion, adding USD 22.3 billion, or 43.8% of the total incremental growth, with a 5-year multiplier of 1.28x.

The second phase (2030–2035) contributes USD 28.6 billion, representing 56.2% of incremental growth, reflecting stronger demand for printers in high-end commercial and industrial sectors, particularly for packaging, textiles, and 3D printing. Annual increments increase from USD 4.5 billion in early years to USD 6.2 billion by 2035, indicating strong momentum as digital printing, customized print products, and eco-friendly technologies become increasingly important. Manufacturers focusing on cost-efficient, sustainable printing solutions and enhanced connectivity features will capture the largest share of this USD 50.9 billion opportunity.

| Metric | Value |

|---|---|

| Printer Market Estimated Value in (2025 E) | USD 78.9 billion |

| Printer Market Forecast Value in (2035 F) | USD 129.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The printer market is evolving with rapid digitization of workplaces, increasing home-office setups, and demand for seamless document management across both personal and professional environments. Market dynamics are being influenced by the rising need for multifunctional devices that support print, scan, and copy operations in a compact footprint.

At the same time, advancements in wireless technology and mobile device integration have made connectivity a key determinant in purchasing behavior. Sustainability has also emerged as a central theme, with consumers favoring ink-efficient systems, recycled materials, and energy-saving features.

The demand for printers is expected to remain steady across sectors such as education, healthcare, logistics, and small enterprises, while innovation in ink formulation and cloud-based print services continues to shape long-term product development strategies. The market outlook remains optimistic, supported by hybrid work models and a renewed focus on cost-effective, on-demand printing solutions.

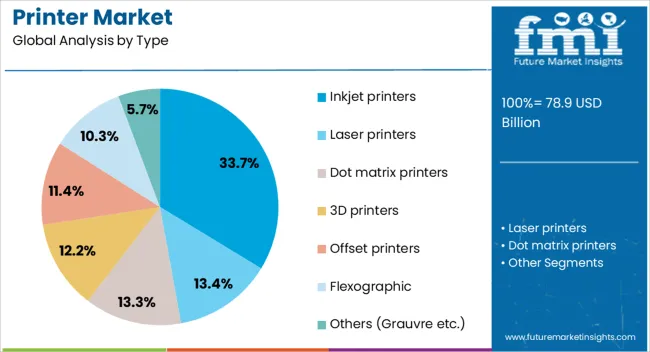

The printer market is segmented by type, functionality, connectivity, price, end use, distribution channel, and geographic regions. The printer market is divided into Inkjet printers, Laser printers, Dot matrix printers, 3D printers, Offset printers, Flexographic, and Others (Grauvre, etc.). In terms of functionality, the printer market is classified into Multifunction printers and single-function printers. The printer market is segmented into Cordless and Corded. The printer market is segmented by price into Medium, Low, and High. The end use of the printer market is segmented into Commercial, Industrial, and Residential. By distribution channel of the printer market is segmented into Offline and Online. Regionally, the printer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Inkjet printers are projected to contribute 33.70% of the total market revenue in 2025, making them the leading product type. Their leadership is driven by their affordability, compact size, and ability to produce high-quality color outputs for both images and text.

This makes them particularly suitable for home offices, students, and photo printing applications. The continued development of pigment-based inks and low-cost refill systems has enhanced their cost-efficiency while meeting sustainability goals.

Inkjet models also support a wide range of media types, including specialty papers and labels, which has expanded their relevance across personal, educational, and light business uses. Their quiet operation, easy maintenance, and versatility have strengthened their preference among first-time and low-volume users.

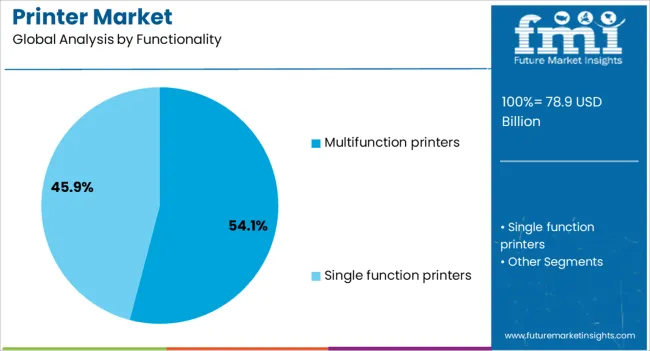

Multifunction printers are anticipated to capture 54.10% of the total printer market revenue in 2025, making them the dominant functionality category. This growth is being powered by the convergence of printing, scanning, copying, and faxing into single, space-efficient units that address the needs of modern offices and remote work setups.

Businesses are increasingly prioritizing operational efficiency, and multifunction devices reduce equipment costs and energy consumption while enhancing productivity. Integrated document management features, cloud connectivity, and app-based controls have made these systems indispensable in digital-first workflows.

Their utility in healthcare, education, and administrative environments has reinforced their broad-based demand. The ability to handle varied media types and automate repetitive tasks has made them a central component in small to mid-sized enterprises seeking value-driven solutions.

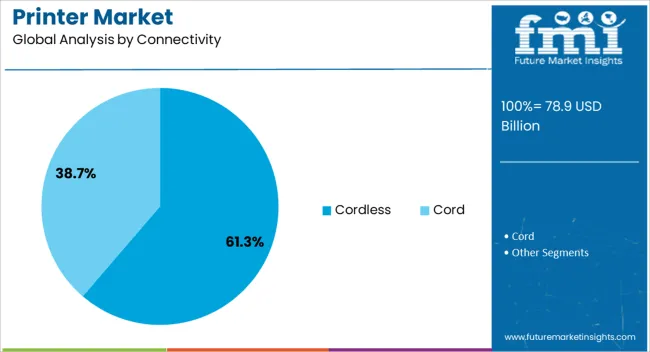

Cordless printers are expected to lead the market by connectivity type, accounting for 61.30% of the total revenue share in 2025. This dominance is attributed to increasing consumer and business demand for wireless and mobile-enabled printing solutions.

With the proliferation of smartphones, tablets, and laptops, the ability to print via Wi-Fi, Bluetooth, or cloud services has become essential. Cordless printers reduce cable clutter and enhance workspace flexibility, making them ideal for both shared office environments and mobile setups.

Integration with mobile operating systems, cloud storage platforms, and secure printing protocols has strengthened adoption across sectors. As remote work continues to rise and on-the-go printing becomes more prevalent, cordless printers are expected to remain a critical enabler of agile document handling and decentralized workflows.

The printer market is experiencing growth driven by increasing demand from the commercial, educational, and home sectors. In 2024 and 2025, major growth drivers include the rising need for high-quality printing solutions and advancements in wireless printing technology. Opportunities arise in the expanding demand for 3D printing in manufacturing and healthcare. Emerging trends include the shift toward eco-friendly printers with reduced waste. However, high operational costs and market saturation in developed regions act as restraints, limiting growth potential.

The major growth driver for the printer market is the increasing demand for high-quality printing solutions. In 2024, businesses and educational institutions sought printers that offered superior resolution, faster printing speeds, and enhanced color accuracy. This growth was fueled by the rise of digital printing technologies that support custom designs and high-volume printing. As businesses and consumers prioritize print quality, demand for advanced printers that offer precision and reliability is expected to grow significantly.

Opportunities in the printer market lie in the growing use of 3D printing in the healthcare and manufacturing sectors. In 2025, the healthcare industry adopted 3D printing for medical device production, prosthetics, and personalized medical treatments, creating a new market segment. In manufacturing, 3D printing allows for rapid prototyping and more efficient production processes. As these industries expand, the demand for advanced 3D printers is expected to increase, presenting significant opportunities for growth and innovation.

Emerging trends in the printer market include the shift toward eco-friendly printers designed to reduce waste and energy consumption. In 2024, manufacturers began introducing energy-efficient printers that use biodegradable materials and recyclable components. These printers cater to consumers and businesses seeking sustainable solutions in their printing processes. With increasing environmental concerns, eco-conscious consumers are driving demand for printers that produce less waste and offer more efficient energy consumption, which will shape the future of the printer market.

Key market restraints include high operational costs and market saturation in developed regions. In 2024 and 2025, the high cost of consumables such as ink, toner, and paper remained a major barrier for price-sensitive consumers and businesses. Additionally, the printer market in developed regions became saturated, leading to intense competition among manufacturers. As demand stabilizes, growth potential in mature markets is limited, prompting companies to explore emerging markets for expansion opportunities.

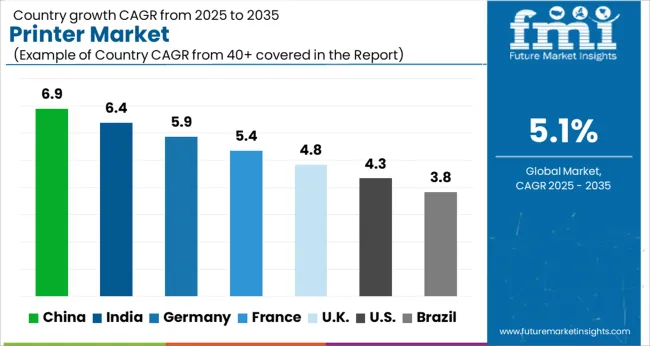

The global printer market is projected to grow at 5.1% CAGR from 2025 to 2035. China leads with 6.9% CAGR, driven by the rapid growth of the printing industry, including both consumer and commercial printing. India follows at 6.4%, supported by rising demand for printers in both personal and commercial applications. France records 5.4% CAGR, driven by the increasing need for high-performance printers in industries such as retail, education, and corporate sectors. The United Kingdom grows at 4.8%, while the United States posts 4.3%, reflecting steady demand in mature markets with a focus on innovative printing technologies and sustainability. Asia-Pacific leads market growth, while Europe and North America focus on product innovations and efficient printing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The printer market in China is forecasted to grow at 6.9% CAGR, driven by strong demand across the commercial and consumer printing sectors. As China’s e-commerce and retail sectors expand, the need for high-quality, cost-effective printers continues to rise. Additionally, increasing demand for personalized printing solutions, packaging printing, and commercial advertising further accelerates market growth. The government’s initiatives to support manufacturing and technology adoption also contribute to the market’s expansion.

The printer market in India is projected to grow at 6.4% CAGR, driven by the increasing use of printers in both personal and business environments. As India’s growing small and medium-sized businesses (SMBs) expand, there is a rising need for efficient, cost-effective printers. The education sector’s increasing reliance on printed materials and documents further drives demand. Additionally, the expansion of retail and logistics industries fuels the need for high-performance printers in labeling, packaging, and point-of-sale applications.

The printer market in France is expected to grow at 5.4% CAGR, driven by steady demand in corporate, retail, and educational sectors. With a growing emphasis on efficiency and sustainability, there is increasing demand for energy-efficient and high-performance printers in these industries. The adoption of digital printing technologies, including 3D printing and personalized printing services, further contributes to market expansion. The rise in online retail and the need for efficient document printing continue to fuel market growth in France.

The printer market in the United Kingdom is projected to grow at 4.8% CAGR, supported by the increasing demand for advanced printing technologies in businesses and commercial applications. The adoption of eco-friendly printing solutions, along with the rise of online retail, drives the need for high-quality printers. Additionally, the growing demand for home-office printing solutions and efficient corporate printing systems further strengthens market growth in the UK.

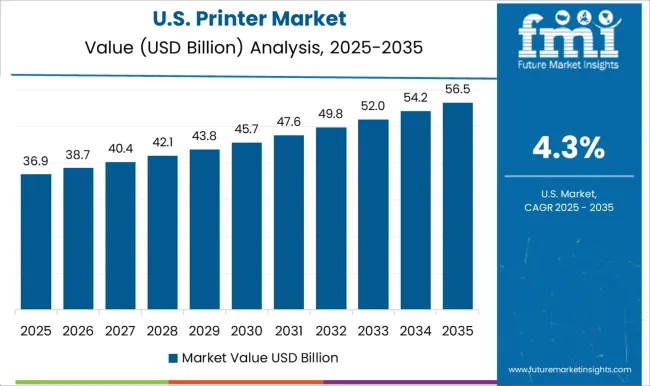

The printer market in the United States is projected to grow at 4.3% CAGR, driven by steady demand for printing solutions across consumer, business, and industrial sectors. The increasing use of 3D printing, along with advancements in digital and personalized printing technologies, continues to shape the market. Demand from the corporate sector for cost-effective, high-speed printing solutions, along with the growing need for labeling, packaging, and point-of-sale (POS) printers, further contributes to market growth.

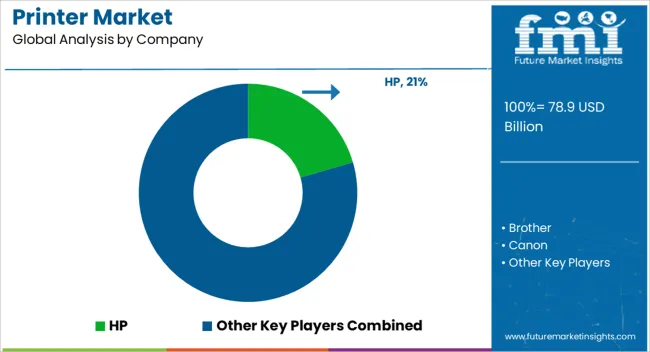

The printer market is dominated by HP, which leads with its extensive portfolio of high-performance printers catering to both consumer and business applications. HP’s dominance is supported by its strong brand presence, innovative technologies such as inkjet and laser printing, and a comprehensive range of printers designed for home, office, and industrial use.

Key players such as Brother, Canon, Epson, and Xerox maintain significant market shares by offering a variety of solutions, including all-in-one printers, wide-format printers, and multifunction devices. These companies focus on delivering reliable, cost-effective printing solutions that meet the growing demand for productivity and efficiency in both personal and professional environments. Emerging players like Lexmark, Oki, Kyocera, Ricoh, Fujifilm, and Konica Minolta are expanding their market presence by offering specialized printers with advanced features such as cloud connectivity, mobile printing capabilities, and eco-friendly technologies.

Their strategies focus on catering to niche markets like large-format printing, 3D printing, and label printing, while also improving product sustainability and energy efficiency. Market growth is driven by the increasing adoption of digitalization, rising demand for high-quality printing solutions in education, healthcare, and retail, and the shift toward remote work and cloud printing. Innovations in wireless connectivity, ink technologies, and smart printing solutions are expected to further shape competitive dynamics in the global printer market.

Companies like HP, Stratasys, and 3D Systems have significantly advanced the capabilities of 3D printers, which are now used for rapid prototyping, product development, and even end-product manufacturing. 3D printers are also being increasingly used in medical applications, such as creating customized implants and prosthetics.

| Item | Value |

|---|---|

| Quantitative Units | USD 78.9 Billion |

| Type | Inkjet printers, Laser printers, Dot matrix printers, 3D printers, Offset printers, Flexographic, and Others (Grauvre etc.) |

| Functionality | Multifunction printers and Single function printers |

| Connectivity | Cordless and Cord |

| Price | Medium, Low, and High |

| End Use | Commercial, Industrial, and Residential |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HP, Brother, Canon, Dell, Epson, Fujifilm, Konica Minolta, Kyocera, Lexmark, Oki, Ricoh, Roland, Sharp, Toshiba, and Xerox |

| Additional Attributes | Dollar sales by printer type and application, demand dynamics across consumer, commercial, and industrial sectors, regional trends in printer adoption, innovation in 3D printing and wireless printing technologies, impact of regulatory standards on energy efficiency, and emerging use cases in personalized printing and smart packaging solutions. |

The global printer market is estimated to be valued at USD 78.9 billion in 2025.

The market size for the printer market is projected to reach USD 129.8 billion by 2035.

The printer market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in printer market are inkjet printers, laser printers, dot matrix printers, 3D printers, offset printers, flexographic and others (grauvre etc.).

In terms of functionality, multifunction printers segment to command 54.1% share in the printer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printer Ribbon Market Trends – Growth & Forecast 2024-2034

NCR Printers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of NCR Printers Companies

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Line Printer Market Size and Share Forecast Outlook 2025 to 2035

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Card Printers Market

Photo Printers Market Size and Share Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

ID Card Printer Market Forecast and Outlook 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA