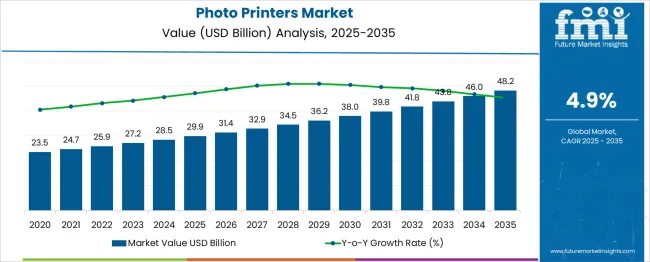

The Photo Printers Market is estimated to be valued at USD 29.9 billion in 2025 and is projected to reach USD 48.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. This early-phase growth is driven by increasing demand for high-quality photo printing solutions in consumer electronics, retail, and event-based printing services. The market will benefit from technological advancements in portable photo printers, improvements in wireless connectivity, and the growing trend of instant photo printing in social and family gatherings.

The second half (2030–2035) will contribute USD 9.1 billion, representing 54.7% of the total growth, driven by sustained demand from emerging markets, technological upgrades, and expanding applications in professional and commercial settings. Annual increments average USD 1.8 billion per year in the first phase, with the later years expected to see stronger growth driven by innovations in smart printing devices and multi-functional printer solutions. Manufacturers focusing on portability, wireless capabilities, and eco-friendly printing will capture significant value in this USD 17.2 billion growth opportunity.

| Metric | Value |

|---|---|

| Photo Printers Market Estimated Value in (2025 E) | USD 29.9 billion |

| Photo Printers Market Forecast Value in (2035 F) | USD 48.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Photo Printers market is experiencing significant growth, driven by the rising consumer preference for high-quality, instant photo printing solutions across both personal and professional domains. The current landscape reflects strong demand for compact, efficient, and versatile devices as documented in corporate announcements, product press releases, and investor presentations from leading imaging companies.

Increased awareness about preserving memories in physical formats and the growing popularity of creative printing for businesses have contributed to market expansion. Future growth is expected to be supported by advances in wireless connectivity, improvements in print resolution, and the increasing integration of mobile and cloud-based printing applications.

Trade journals and annual reports have highlighted sustainability trends and innovations in consumables, which are extending product life cycles and reducing operational costs. These factors combined are anticipated to drive the Photo Printers market steadily, offering growth opportunities across diverse customer segments globally.

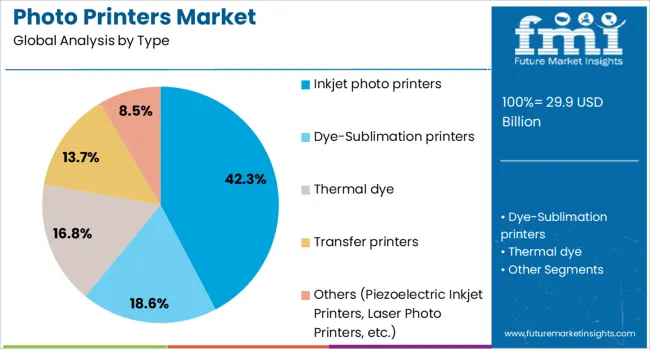

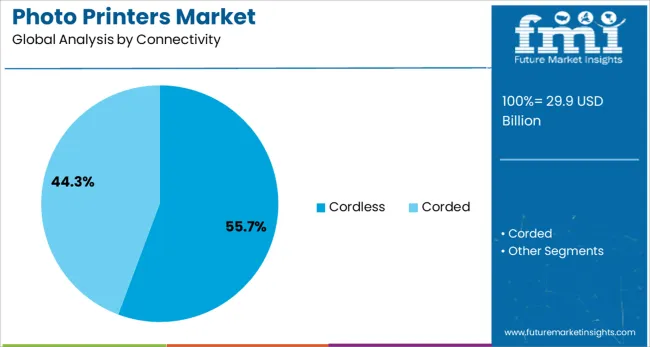

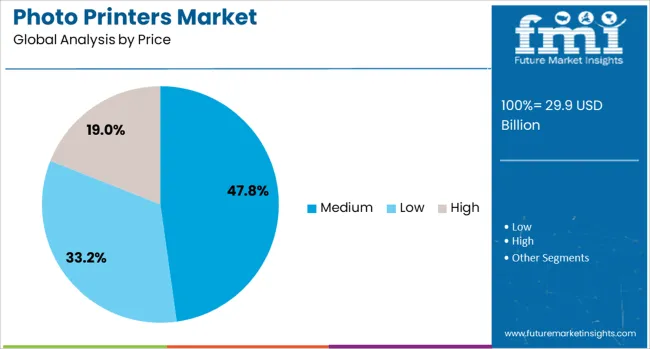

The photo printers market is segmented by type, connectivity, price, end-use distribution channel, and geographic regions. The photo printers market is divided into Inkjet photo printers, Dye-Sublimation printers, Thermal dye, Transfer printers, and Others (Piezoelectric Inkjet Printers, Laser Photo Printers, etc.). In terms of connectivity, the photo printers market is classified into Cordless and Corded. Based on the price, the photo printer market is segmented into Medium, Low, and High.

The photo printers market is segmented by end use into Professional photographers, Home users, Photography studios, Event planners, and Others (Educational Institutions, small business owners, etc.). The distribution channel of the photo printers market is segmented into Online and Offline. Regionally, the photo printers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inkjet photo printer type is projected to account for 42.3% of the Photo printer market revenue share in 2025, making it the leading type segment. This leadership is being driven by the segment’s ability to deliver superior image quality, vibrant color reproduction, and adaptability for varied printing needs as outlined in technical whitepapers and product specifications.

Both consumers and professionals have preferred inkjet technology due to its capability to handle different media sizes and finishes with precision. Press releases and product showcases have emphasized its compact design and cost-efficient operation, making it suitable for both home and studio environments.

The segment has also benefited from advancements in ink formulations and print head technologies that enhance durability and reduce maintenance. These advantages, coupled with its strong availability and competitive pricing, have ensured its dominant position in the market for 2025.

The cordless connectivity segment is anticipated to hold 55.7% of the Photo Printers market revenue share in 2025, establishing it as the leading connectivity segment. This prominence has been reinforced by the growing demand for portable, clutter-free printing solutions compatible with smartphones and tablets, as reported in technology news and company updates.

Adoption of cordless photo printers has been supported by advancements in Bluetooth, Wi-Fi Direct, and NFC technologies that simplify user interaction and enable seamless on-the-go printing. Investor presentations have highlighted that customers increasingly prefer cordless models to avoid cable management issues and enhance workspace aesthetics.

The segment has also gained momentum as businesses and individuals embrace mobility and flexibility in creative tasks. These factors have contributed to the segment’s leadership by addressing the modern requirements of convenience, efficiency, and compatibility with digital ecosystems.

The medium price segment is expected to contribute 47.8% of the Photo Printers market revenue share in 2025, maintaining its position as the largest price segment. Growth in this segment has been supported by its balanced value proposition, offering premium features at an accessible price point, as evidenced in product catalogs and corporate presentations.

Customers have shown a strong inclination toward medium-priced models that deliver professional-grade output without the premium cost associated with high-end devices. Trade publications have observed that this segment appeals to both small businesses and discerning consumers who seek quality and durability within budget constraints.

Furthermore, companies have strategically positioned their most innovative yet affordable models in this segment to maximize reach and adoption. The medium price segment’s ability to satisfy performance expectations while maintaining affordability has ensured its continued dominance in the Photo Printers market.

The photo printer market is growing due to the increasing demand for personalized, high-quality photo printing solutions, particularly in portable and smartphone-compatible formats. Emerging trends like inkless printing and wireless connectivity are reshaping the market, while challenges such as high initial costs and limited durability may hinder broader adoption. By 2025, overcoming these challenges with affordable, durable products will be key to sustaining market growth.

The photo printers market is expanding due to the increasing demand for high-quality, personalized photo printing solutions. Consumers and businesses alike are seeking easy-to-use, portable printers for producing high-resolution images at home or on-the-go. The rise of social media and digital photography continues to drive this demand for instant photo printing, especially with the growing popularity of events like weddings and parties. By 2025, the market will continue benefiting from this trend, as the desire for physical memories from digital images strengthens.

Opportunities in the photo printer market are growing with the demand for portable and smartphone-compatible photo printers. The increasing use of smartphones for capturing and sharing photos has spurred the development of compact printers that seamlessly connect to mobile devices. This trend is expected to boost market growth, especially as consumers look for instant printing solutions during travel or social events. By 2025, the demand for portable photo printers, driven by convenience and ease of use, will continue to rise.

Emerging trends in the photo printer market include the rise of inkless and wireless printing technology. Inkless printers, which use heat to produce high-quality prints without ink cartridges, are becoming increasingly popular for their convenience and cost-effectiveness. Additionally, wireless connectivity through Bluetooth or Wi-Fi allows for hassle-free printing from smartphones and tablets. By 2025, these innovations are expected to dominate the market, providing consumers with greater flexibility and reducing the ongoing cost of ink.

Despite the market’s growth, challenges such as high initial costs and limited durability of photo printers remain significant. While advanced photo printers offer high-quality prints, their high upfront cost can deter price-sensitive consumers. Additionally, some portable models suffer from limited durability, which may impact long-term usability. These challenges may slow market adoption, particularly in emerging markets. By 2025, overcoming these barriers through affordable pricing strategies and more durable products will be crucial for continued growth.

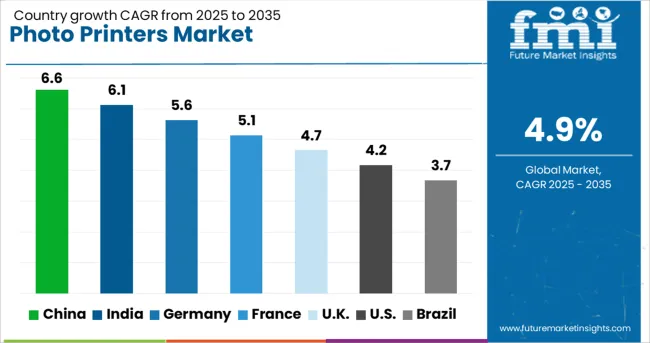

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

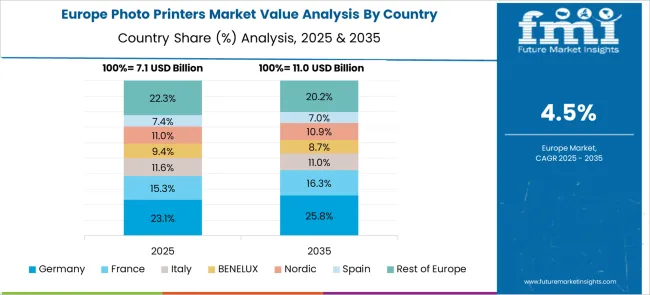

The global photo printers market is projected to grow at a 4.9% CAGR from 2025 to 2035. China leads with a growth rate of 6.6%, followed by India at 6.1%, and Germany at 5.6%. The United Kingdom records a growth rate of 4.7%, while the United States shows the slowest growth at 4.2%. These differences in growth rates are influenced by factors such as increasing consumer demand for personalized photo products, advancements in printing technology, and rising disposable incomes. Emerging markets like China and India are witnessing higher growth due to increasing adoption of photo printing services, rising e-commerce trends, and digital photography, while more mature markets like the USA and the UK show steady growth driven by existing demand for high-quality printing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The photo printers market in China is growing at a rapid pace, with a projected CAGR of 6.6%. The increasing adoption of digital photography, coupled with rising consumer demand for personalized photo products, is driving market growth. The country’s growing disposable income, expanding middle class, and increasing interest in home-based photo printing solutions further contribute to the demand for photo printers. Additionally, the rise of e-commerce platforms and digital printing services, alongside the growing trend of printing photographs for home decoration and gifts, is fueling the expansion of the market.

The photo printers market in India is projected to grow at a CAGR of 6.1%. The growing popularity of digital photography, increased disposable income, and rising consumer interest in home-based photo printing solutions are key drivers of market growth. With the rise of social media and e-commerce, consumers are increasingly looking to print their favorite moments, leading to higher demand for photo printers. Furthermore, India’s growing middle class and increasing penetration of smartphones and digital cameras further support the adoption of photo printing services, making the market highly attractive for photo printer manufacturers.

The photo printers market in Germany is projected to grow at a CAGR of 5.6%. Germany’s well-established consumer electronics market, along with its growing demand for personalized photo products and services, is driving the need for advanced photo printers. The increasing interest in photo printing for home décor, gifts, and special occasions is further supporting market growth. Additionally, Germany’s strong e-commerce sector, along with increasing interest in high-quality, compact photo printers for personal use, contributes to the market’s steady growth. The demand for professional-grade photo printers in businesses and commercial settings also drives the market.

The photo printers market in the United Kingdom is projected to grow at a CAGR of 4.7%. The UK is experiencing steady demand for photo printers driven by increasing consumer interest in printing personal photos, home décor items, and gifts. The rise in smartphone usage and digital photography has significantly contributed to the demand for affordable, high-quality home printing solutions. The UK’s strong e-commerce market and consumer preference for on-demand, personalized photo products further accelerate market growth. Despite slower growth compared to emerging economies, steady demand for compact and professional photo printers ensures the market’s continued expansion.

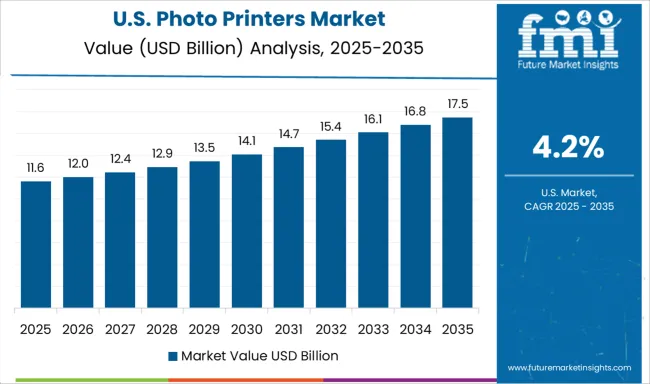

The photo printers market in the United States is expected to grow at a CAGR of 4.2%. The USA market is mature but continues to see steady demand for photo printers, driven by the increasing popularity of personalized photo products and gifts. The rise of digital photography and social media has led to an increase in consumer interest in printing photographs. Additionally, the growth of e-commerce and on-demand printing services further drives market demand. However, the market growth is relatively slower compared to emerging markets due to market maturity and the prevalence of existing consumer printing solutions.

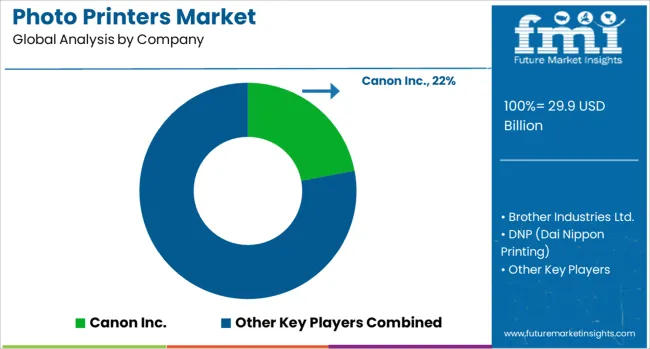

The photo printers market is dominated by Canon Inc., which leads with its wide range of high-performance photo printing solutions designed for both professional photographers and consumer use. Canon’s dominance is supported by its innovative printing technologies, superior image quality, and strong brand presence across the globe. Key players such as Epson Corporation, Fujifilm Holdings Corporation, and Hewlett-Packard (HP) maintain significant market shares by offering reliable photo printers that cater to various needs, from compact consumer models to advanced professional-grade printers. These companies focus on providing high-resolution, versatile, and easy-to-use printers with a focus on efficiency, speed, and photo-quality output.

Emerging players like DNP (Dai Nippon Printing), HiTi Digital, Inc., and Kodak Alaris are expanding their market presence by offering specialized photo printing solutions for niche applications, such as instant photo printing at events, photo booths, and retail kiosks. Their strategies include enhancing print speeds, improving wireless connectivity, and developing portable, cost-effective models. Market growth is driven by the increasing demand for high-quality photo prints, the rise of mobile printing solutions, and the popularity of personalized photo gifts and experiences. Innovations in inkless printing technology, advanced printing materials, and integration with social media platforms are expected to continue shaping competitive dynamics and fuel further growth in the global photo printers market.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.9 Billion |

| Type | Inkjet photo printers, Dye-Sublimation printers, Thermal dye, Transfer printers, and Others (Piezoelectric Inkjet Printers, Laser Photo Printers, etc.) |

| Connectivity | Cordless and Corded |

| Price | Medium, Low, and High |

| End Use | Professional photographers, Home users, Photography studios, Event planners, and Others (Educational Institutions, small business owners, etc.) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Canon Inc., Brother Industries Ltd., DNP (Dai Nippon Printing), Epson Corporation, Fujifilm Holdings Corporation, Hewlett-Packard (HP), HiTi Digital, Inc., Kodak Alaris, Lexmark International, LG Electronics, Mitsubishi Electric Corporation, Ricoh Company, Ltd., Samsung Electronics, Sony Corporation, and Zebra Technologies |

| Additional Attributes | Dollar sales by printer type and application, demand dynamics across consumer, commercial, and photo booth sectors, regional trends in photo printer adoption, innovation in wireless printing and high-definition imaging technologies, impact of regulatory standards on safety and quality, and emerging use cases in mobile photo printing and instant photography services. |

The global photo printers market is estimated to be valued at USD 29.9 billion in 2025.

The market size for the photo printers market is projected to reach USD 48.2 billion by 2035.

The photo printers market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in photo printers market are inkjet photo printers, dye-sublimation printers, thermal dye, transfer printers and others (piezoelectric inkjet printers, laser photo printers, etc.).

In terms of connectivity, cordless segment to command 55.7% share in the photo printers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photovoltaic Silane Coupling Agent Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Photomask Inspection Market Forecast and Outlook 2025 to 2035

Photostability Chamber Market Size and Share Forecast Outlook 2025 to 2035

Photo-Label Verifiers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Photographic Paper Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Alignment Film Market Size and Share Forecast Outlook 2025 to 2035

Photomultiplier Tube Accessories Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Grade High Purity Crystalline Silicon Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Photographic Film Processing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Photoresist and Photoresist Ancillaries Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Photo Printing and Merchandise Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Photoluminescent Paints Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Mounting System Market Analysis - Size, Share, and Forecast 2025 to 2035

Photosensitive Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA