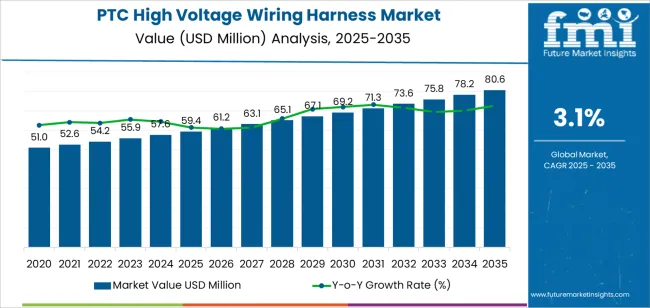

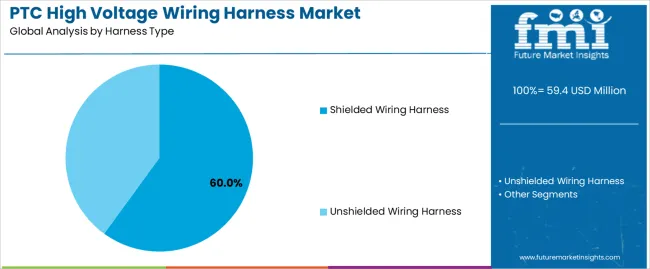

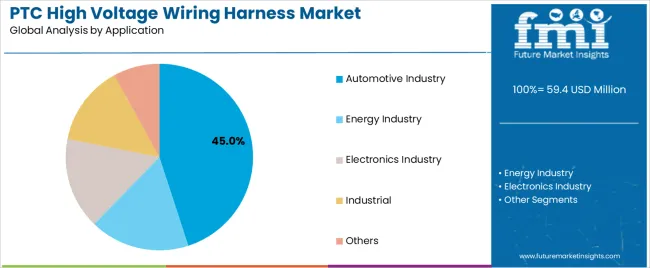

The PTC high voltage wiring harness market is valued at USD 59.4 million in 2025 and is projected to reach USD 80.6 million by 2035, advancing at a 3.1% CAGR and adding USD 21.2 million in new value across the decade. Demand is shaped by the expanding adoption of electric and hybrid vehicles, wider use of high-performance energy systems, and the integration of advanced wiring architectures that support high-voltage power transmission. Growth from 2025 to 2030 lifts the market to USD 69.2 million, reflecting consistent adoption of EV platforms and increased wiring requirements for battery-to-motor connectivity. The following phase, from 2030 to 2035, elevates the market to USD 80.6 million, driven by maturing electrification programs and continued investment in temperature-stable, safety-oriented wiring technologies. Shielded wiring harnesses hold a dominant 60% share due to their electromagnetic protection benefits, while the automotive industry leads application share at 45%.

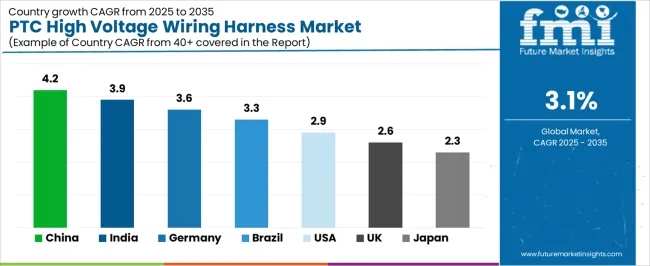

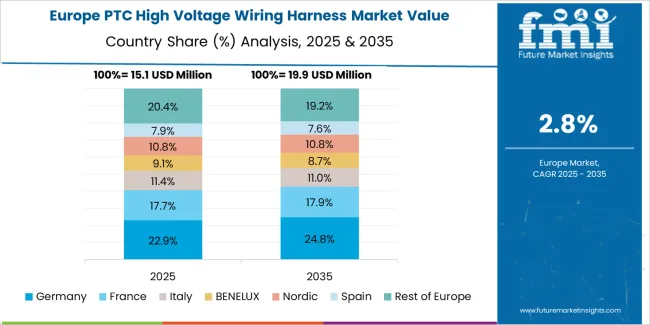

Country-level trends show China at 4.2% CAGR, India at 3.9%, Germany at 3.6%, Brazil at 3.3%, the USA at 2.9%, the UK at 2.6%, and Japan at 2.3%, reflecting different stages of EV and high-voltage system adoption. Material innovation, lightweight conductor development, and thermal-resistant insulation improvements strengthen product competitiveness as manufacturers refine designs for compact EV architectures. Challenges include material volatility, complex integration requirements, and uneven EV readiness across regions, though consistent policy support for electrification reinforces long-term demand. Key players such as Guchen Electronics, AUPINS, JTE, KINGSIGNAL, YONGRUI, Henan Hang Rui Electronic Technology, and RCCN continue to expand their production capabilities and technical performance to meet rising global demand for high-voltage wiring solutions.

The Breakpoint Analysis for the PTC high voltage wiring harness market highlights key inflection points during the forecast period from 2025 to 2035, identifying periods when the market’s growth rate or momentum may shift significantly.

In the first phase (2025-2030), the market will grow at a consistent CAGR of 3.1%, reaching USD 69.2 million by 2030. The early years of this phase will see moderate growth driven by the ongoing adoption of electric vehicles (EVs) and their related wiring requirements. However, the breakpoint will likely occur around 2028-2029, when EV adoption and investment in renewable energy infrastructure will reach a critical mass. At this point, the market will begin to experience a slight acceleration in demand, as more industries and consumers make the shift toward electric mobility and energy-efficient systems.

In the second phase (2030-2035), growth continues, but at a more stable pace as the market matures. By 2035, the market will reach USD 80.6 million, with steady but steady growth observed during the later years. The breakpoint in this period is expected around 2032-2033, when technological innovations in wireless energy transmission and advanced energy management technologies could alter market dynamics, potentially accelerating the adoption of alternative systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 59.4 million |

| Market Forecast Value (2035) | USD 80.6 million |

| Forecast CAGR (2025 to 2035 | 3.1% |

The PTC high voltage wiring harness market is expanding as automotive manufacturers accelerate their adoption of electric vehicles (EVs) and hybrid platforms. High-voltage wiring harnesses, typically defined as those operating at 60V and above, play a crucial role in transmitting power between battery packs, inverters, motors, and auxiliary systems. As EV penetration deepens and vehicle architectures evolve, demand for harnesses capable of managing higher voltages and currents is rising.

Technical improvements in materials and design are also supporting growth. Manufacturers are adopting lightweight metals such as aluminum alloys and advanced insulation materials to reduce weight and enhance thermal or chemical resistance. At the same time, stricter safety and performance regulations compel suppliers to design harnesses that meet rigorous standards for automotive-grade thermal, vibration, and fire performance. Challenges remain, such as the high cost of specialty materials and the complexity of integrating high-voltage systems, but the broader shift toward electrification and the rising production of high-voltage vehicles keep the market on an upward trajectory.

The PTC high voltage wiring harness market is segmented by harness type and application. The leading harness type is shielded wiring harness, holding 60% of the market share, while the dominant application segment is the automotive industry, accounting for 45% of the market. These sub-segments are crucial in driving market growth, supported by the increasing demand for advanced electrical systems in vehicles and other high-voltage applications across various industries.

The shielded wiring harness segment leads the PTC high voltage wiring harness market, commanding a 60% market share. Shielded wiring harnesses are preferred due to their ability to prevent electromagnetic interference (EMI) and reduce signal distortion, which is critical in high-voltage and sensitive electrical systems. These harnesses use materials like copper or aluminum foil to encase the wiring, ensuring the integrity of electrical signals, particularly in environments with significant electrical noise.

The growth of shielded wiring harnesses is largely driven by their application in industries where electrical safety and performance are paramount, such as in the automotive, energy, and industrial sectors. The increasing demand for electric vehicles (EVs), where high-voltage systems are essential for efficient power delivery and safety, has significantly boosted the use of shielded wiring harnesses. As the market for electric vehicles and other high-performance technologies grows, the shielded wiring harness segment is expected to maintain its leadership due to the increasing need for protection and reliability in wiring systems.

The automotive industry holds the largest share in the PTC high voltage wiring harness market, accounting for 45%. The automotive sector’s demand for high voltage wiring harnesses is driven by the growing adoption of electric and hybrid vehicles, which require advanced electrical systems to manage energy flow efficiently between the battery, electric motor, and other high-voltage components. Additionally, the increasing integration of automotive electronics and advanced driver assistance systems (ADAS) has contributed to the rising demand for specialized wiring harnesses that can handle higher voltage loads while ensuring safety and performance.

As the automotive industry shifts toward electrification, the demand for PTC high voltage wiring harnesses will continue to rise. Manufacturers are increasingly focusing on the development of high-quality, durable wiring solutions that can withstand the extreme conditions present in electric and hybrid vehicles. This trend, coupled with regulatory pressures to enhance vehicle safety and energy efficiency, positions the automotive industry as a key driver of the PTC high voltage wiring harness market’s growth. As electric vehicle production scales up, the automotive sector is expected to remain the leading application for high voltage wiring harnesses in the coming years.

The automotive high voltage wiring harness market is evolving rapidly with the global shift toward electrified vehicles. As originally internal combustion systems give way to battery electric and hybrid powertrains, the demand for robust wiring harnesses capable of handling high voltage currents and ensuring safety is increasing. The rise of electric vehicle platforms requires harnesses that provide reliable insulation, thermal management, and resistance to electromagnetic interference. At the same time, robust supply chains, rising material costs, and evolving vehicle architectures affect how harness manufacturers respond to growth opportunities.

What Are The Primary Growth Drivers For The Automotive High Voltage Wiring Harness Market?

The market is being driven primarily by the accelerated adoption of electric vehicles (EVs) and plug in hybrid vehicles across regions. As manufacturers scale up EV production, vehicles incorporate larger battery packs and high voltage systems, increasing the number and complexity of harnesses required. Moreover, regulatory mandates targeting vehicle emissions and incentives for zero emission vehicles create favourable conditions for harness demand. Advances in vehicle architecture such as 800 V systems in premium EVs and the growing integration of high power charging infrastructure further heighten the need for reliable high voltage wiring solutions.

What Are The Key Restraints In The Automotive High Voltage Wiring Harness Market?

Despite strong drivers, the market faces limitations that may slow growth. High voltage harnesses demand stricter standards for insulation, safety certification and lifecycle reliability, which increase development costs. Material price volatility, particularly for copper and specialty insulation materials, can impact profitability. OEMs must integrate harnesses into increasingly compact and complex vehicle layouts, which raises engineering and manufacturing challenges. Moreover, regional variation in EV penetration and infrastructure readiness means some markets advance faster than others, creating uneven demand.

What Are The Emerging Trends In The Automotive High Voltage Wiring Harness Market?

Several trends are shaping the future of this market. One major trend is the shift toward lightweight and compact harness designs using advanced materials (such as aluminium or hybrid conductors) to reduce vehicle weight and improve efficiency. Another trend is modular harness architectures that simplify manufacturing and enable reuse across different vehicle platforms. Manufacturers are also increasingly using digital engineering, simulation tools and automated routing to optimise harness assembly. Finally, the convergence of high voltage systems with vehicle software, power electronics and thermal management means harness suppliers are collaborating more deeply with OEMs earlier in the vehicle development cycle.

The PTC high voltage wiring harness market is experiencing steady growth as the global automotive industry shifts toward electric and hybrid vehicles. A PTC (Positive Temperature Coefficient) high voltage wiring harness is a critical component in electric vehicle systems, designed to manage power distribution efficiently while ensuring safety and thermal protection. With the rapid electrification of vehicles and the growing demand for sustainable transportation, the adoption of these wiring harnesses is increasing globally. Emerging economies like China and India are leading the market due to their growing electric vehicle production and supportive government policies, while developed countries like the USA and Germany are showing steady growth as part of their long-term sustainability goals. This analysis provides insights into how each country contributes to the expansion of the PTC high voltage wiring harness market.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| Brazil | 3.3% |

| USA | 2.9% |

| United Kingdom | 2.6% |

| Japan | 2.3% |

China is leading the PTC high voltage wiring harness market with a CAGR of 4.2%. The country's rapid growth in electric vehicle (EV) manufacturing and its strong commitment to clean energy are the main factors driving market expansion. As the largest producer and consumer of electric vehicles, China is heavily investing in developing reliable electrical systems that enhance vehicle safety and efficiency. The government’s incentives for electric vehicle adoption and infrastructure development are also boosting the market for high-performance wiring harnesses.

Local manufacturers are increasingly focusing on developing lightweight and thermally stable wiring solutions to improve vehicle performance. The rise in demand for electric buses, passenger EVs, and hybrid vehicles is further contributing to this growth. With China’s continued leadership in EV production, the demand for PTC high voltage wiring harnesses will remain strong in the coming years.

India’s PTC high voltage wiring harness market is growing steadily with a CAGR of 3.9%. The country’s automotive industry is rapidly transitioning toward electric mobility, driven by government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme. As electric vehicle production increases, the need for efficient, safe, and high-voltage wiring systems is becoming critical. PTC high voltage harnesses, known for their temperature control and thermal protection capabilities, are in growing demand.

India’s growing investment in EV infrastructure, combined with the rising consumer preference for sustainable mobility solutions, is further fueling market growth. Domestic manufacturers are collaborating with global suppliers to enhance product quality and reliability. As the Indian EV market matures, the demand for advanced electrical systems, including PTC high voltage wiring harnesses, is expected to increase significantly.

Germany’s PTC high voltage wiring harness market is projected to grow at a CAGR of 3.6%. As one of the leading automotive manufacturing hubs globally, Germany is driving innovation in electric and hybrid vehicles. The country’s focus on technological advancement, coupled with strong investments in EV infrastructure, is fueling demand for high-performance wiring harnesses. German automakers are incorporating advanced PTC technology to improve energy efficiency and ensure safety in high-voltage systems.

The emphasis on lightweight materials, durability, and safety in wiring components aligns with Germany’s broader goals of reducing carbon emissions and improving energy efficiency. With major automotive companies leading the transition to electric mobility, the market for PTC high voltage wiring harnesses is expected to expand steadily. The country's commitment to sustainable manufacturing practices will continue to support this growth.

Brazil’s PTC high voltage wiring harness market is expected to grow at a CAGR of 3.3%. The country’s growing automotive industry and gradual shift toward electric and hybrid vehicles are key drivers of this market. As Brazil focuses on reducing its dependence on fossil fuels, investments in cleaner and more energy-efficient automotive technologies are increasing, which supports the demand for advanced wiring systems.

With automotive manufacturers in Brazil starting to integrate electric models into their production lines, the need for high-quality wiring harnesses capable of managing high voltages safely is on the rise. The expansion of Brazil’s EV infrastructure and the increasing adoption of hybrid vehicles will continue to drive the demand for PTC high voltage wiring harnesses in the region.

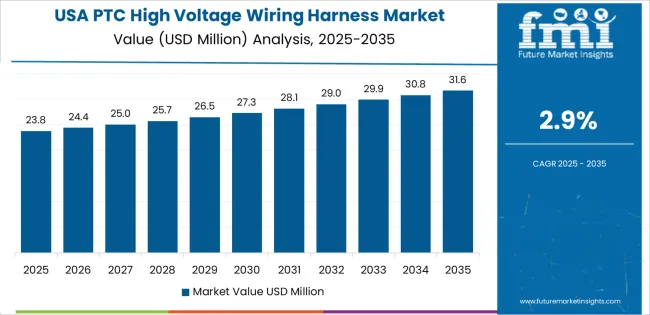

The United States has a projected CAGR of 2.9% for the PTC high voltage wiring harness market. The country’s focus on electric mobility and sustainable transportation is creating opportunities for growth in high-voltage wiring systems. Leading automotive manufacturers in the USA are investing heavily in electric and hybrid vehicle development, driving demand for efficient wiring harnesses that support higher voltages and improved safety standards.

Government incentives promoting electric vehicle adoption and the expansion of charging infrastructure are key contributors to the market’s growth. As the demand for electric vehicles increases, the need for advanced wiring harnesses with superior thermal management and durability is also growing. The USA market is expected to see continued expansion as the transition to clean transportation accelerates.

The United Kingdom’s PTC high voltage wiring harness market is projected to grow at a CAGR of 2.6%. The country’s strong push toward electric mobility and commitment to achieving net-zero emissions by 2050 are driving the adoption of electric vehicles and related technologies. The rising demand for high-voltage wiring systems in EVs is supported by government initiatives and incentives promoting sustainable transportation.

Manufacturers in the UK are focusing on developing advanced electrical systems that improve energy efficiency and safety. The growing integration of electric buses, hybrid vehicles, and plug-in electric cars is boosting the demand for reliable wiring harnesses. With the UK’s focus on innovation and green mobility, the PTC high voltage wiring harness market is expected to grow steadily.

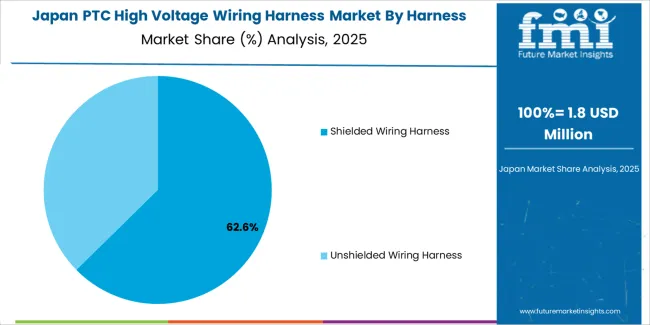

Japan’s PTC high voltage wiring harness market is expected to grow at a CAGR of 2.3%. The country is known for its advanced automotive industry and leadership in hybrid and electric vehicle technologies. As Japanese automakers continue to innovate in the field of electric mobility, the demand for efficient and safe wiring harness systems is increasing. PTC technology is becoming a key component in ensuring temperature stability and electrical safety in these vehicles.

Japan’s growing commitment to reducing emissions and promoting clean energy vehicles is also driving demand for high-voltage components. The expansion of the electric vehicle market and the government’s continued support for eco-friendly transportation solutions are expected to sustain market growth. As manufacturers continue to improve product performance and safety standards, Japan’s PTC high voltage wiring harness market will maintain steady progress.

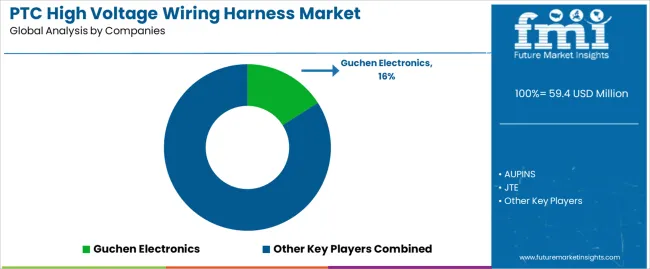

In the market for PTC high voltage wiring harnesses, the landscape is shaped by several core manufacturers with distinct strategy profiles. Guchen Electronics is reported to hold roughly 16% share, occupying a leading position. Other relevant firms include AUPINS, JTE, KINGSIGNAL, Yongrui, Henan Hang Rui Electronic Technology, and RCCN. The market growth is supported by the rise of electric vehicles and increasing demand for high voltage systems, especially those linking PTC heaters, battery packs, and onboard chargers. For example, Yongrui offers a PTC high voltage harness designed for electric vehicles, charging stations, and high voltage power systems. The harnesses are customised to support high voltages and environments typical of EV systems.

Key competitive strategies in this field revolve around product specification, manufacturing flexibility, and regional reach. One company emphasises high voltage capability, shielding, high-temperature resistance, and custom design services. For instance, Guchen highlights its harnesses’ ability to withstand voltages up to 1500V and offers custom design support. Another firm concentrates on volume output capacity and modular specification options. Yongrui, for example, advertises high daily output (5,000-10,000 pieces) and configurable conductor material and insulation. Several companies are also focusing on the Asia-Pacific region, where EV supply chain growth is strong, and aligning certifications with automotive manufacturer standards to access global OEM contracts. The market thus involves a mix of premium capability plays (advanced specifications, high voltage tolerance) and cost efficient scale plays (high volumes, simplified standardisation). Companies that can deliver both technical compliance and cost efficient mass production appear to be gaining relative advantage.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Harness Type | Shielded Wiring Harness, Unshielded Wiring Harness |

| Application | Automotive Industry, Energy Industry, Electronics Industry, Industrial, Others |

| Key Companies Profiled | Guchen Electronics, AUPINS, JTE, KINGSIGNAL, YONGRUI, HENAN HANG RUI ELECTRONIC TECHNOLOGY, RCCN |

| Additional Attributes | The market analysis includes dollar sales by harness type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the PTC high voltage wiring harness market, focusing on innovations in shielded and unshielded wiring technologies. Trends in the growing demand for high voltage wiring harnesses in automotive, energy, and electronics industries are explored, along with advancements in material technologies and industrial applications. |

The global PTC high voltage wiring harness market is estimated to be valued at USD 59.4 million in 2025.

The market size for the PTC high voltage wiring harness market is projected to reach USD 80.6 million by 2035.

The PTC high voltage wiring harness market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in PTC high voltage wiring harness market are shielded wiring harness and unshielded wiring harness.

In terms of application, automotive industry segment to command 45.0% share in the PTC high voltage wiring harness market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA