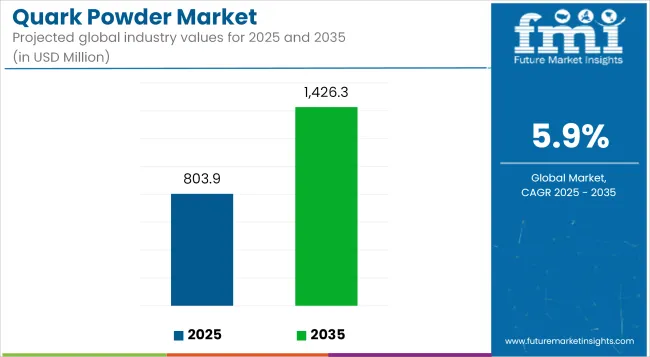

Between 2025 and 2035, the global quark powder market is expected to witness accelerated growth, increasing from USD 803.9 million to USD 1,426.3 million at a CAGR of 5.9%. This surge reflects the expanding demand for shelf-stable dairy ingredients across functional food categories. As manufacturers seek high-protein, low-lactose solutions with longer shelf life, quark powder has been positioned as a competitive ingredient in sports nutrition, bakery, and processed foods.

| Attributes | Description |

|---|---|

| Estimated Global Quark Powder Business Size (2025E) | USD 803.9 million |

| Projected Global Quark Powder Business Value (2035F) | USD 1,426.3 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

Market growth has been catalyzed by rising demand for convenient protein sources and a shifting consumer focus toward clean-label and nutritional products. Flavored quark variants have gained considerable traction, particularly among manufacturers formulating protein-rich snacks and dairy alternatives.

However, the market is being restrained by limited consumer awareness outside Europe and fluctuating raw milk prices that impact processing costs. A key trend observed involves the blending of quark powder with fiber and plant protein bases to increase satiety and nutritional density. Manufacturers have been actively introducing formulations with extended solubility and stability, targeting the premium wellness and clinical nutrition sectors without significant reformulation costs.

By 2025, food processing will remain the leading end-use category, underpinned by the application of quark powder in bakery fillings, frozen desserts, and dairy-based beverages. The functional beverage segment is poised to gain a measurable share, reflecting rising demand from meal replacement and recovery drink manufacturers. By 2035, flavored variants are expected to continue dominating product launches due to their versatility in both sweet and savory product formats.

The market is forecast to see deeper penetration across Asia-Pacific and North America as product awareness and distribution networks expand. Continued innovation around texture, mixability, and cross-functional blending will define next-generation quark powder solutions for nutraceutical and culinary applications.

The table below presents a comparative estimation of the CAGR changes over six months for the base year (2024) and the current year (2025) in the global quark powder market. This assessment has shown the key shifts in the market and the trends in revenue realization, thereby providing the stakeholders with the opportunity to have a better understanding of the growth of the sector. The first half of the year, which is from January to June, is denoted as H1 while the second half, which involves July to December, is H2.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.4% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 5.5% |

| H2 (2025 to 2035) | 6.0% |

The market is set to continue its rise during the period from 2025 to 2035, as the projection indicates, and the ongoing half of the year is showing an upward trend. The latter part of the decade is expected to experience a slight increase in people’s desire for protein-rich dairy products, which are both natural and beneficial. The move towards clean labelling and natural products isn't likely to be changed, even though some discrepancies may occur due to production costs and supply chain issues.

Clinical nutrition applications are anticipated to account for approximately 12.6% of the global quark powder market by 2025, reflecting their increasing use in dietary management products for elderly and metabolically compromised individuals. The segment is gaining traction due to the high bioavailability of milk proteins and the relatively low lactose content of quark powder, which enables its integration into lactose-restricted and protein-enriched nutritional formulas.

Companies such as Glanbia PLC and Armor Proteines have introduced quark-based blends customized for enteral feeding and sarcopenia-targeted nutritional products, especially in Europe and Japan. In the United States, products aligned with FDA guidance under the Medical Foods category have further supported this trend. Quark powder’s extended shelf life and solubility in both cold and heated solutions enhance its usability in clinical settings, minimizing preparation complexity for caregivers and institutions.

The segment’s future growth will also be supported by the rising prevalence of chronic illnesses and aging populations across Western Europe and Asia-Pacific. Regulatory alignment with EU Regulation (EU) No 609/2013 and Japan’s Food for Special Health Uses (FOSHU) framework continues to bolster innovation. Clinical nutrition is likely to emerge as a premium sub-segment with sustained R&D investments focusing on texture-neutral formats and fortification with micronutrients.

Private label brands are projected to contribute 18.9% of global quark powder sales in 2025, supported by increased supermarket penetration and B2B sourcing by value-tier brands. Retailers in North America and Western Europe, such as Carrefour and Aldi, have expanded their private label protein-rich offerings, often blending quark powder with oats, seeds, or fruit-based matrices.

These launches are positioned at accessible price points, helping to build mass-market awareness outside the traditionally strong European dairy markets. As price sensitivity remains a barrier to adoption in new markets, especially in parts of South Asia and Latin America, private label expansion offers a cost-effective pathway to increase consumer exposure.

The segment has also benefited from vertical integration strategies pursued by companies such as Kanegrade Ltd., which support stable pricing and consistent supply to retail partners. As sustainability credentials become a purchase driver, private labels have emphasized recyclable packaging and local sourcing in their marketing.

The private label segment will remain strategically important for converting conventional yogurt and dairy users to powdered dairy formats by offering smaller pack sizes and single-serve formats tailored for urban consumers with limited cold storage.

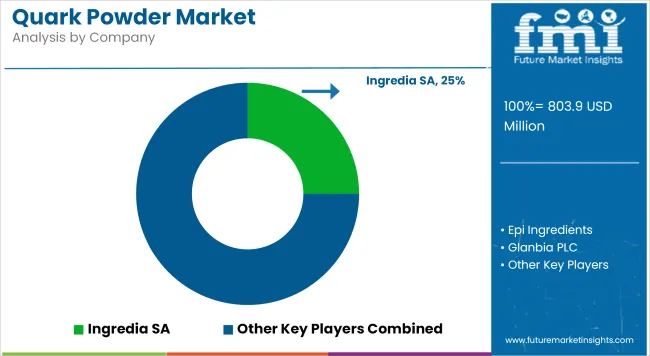

The global quark powder market is a typical concentration of a fragmented market comprising regional players and private label brands working together in the industry. While the large-scale dairy processors hold the keys to major markets, regional manufacturers, on the contrary, play a massive role in maintaining cost competitiveness, local product variations, and distribution channels.

Europe is the most developed market, where established regional players take advantage of well-structured dairy supply chains to generate high-level quark powder. The fact that small and mid-sized dairy processors are the ones producing different products results in a highly fragmented market.

In North America, the ongoing push for the inclusion of private label brands is being fueled by the retailers with the expansion of high-protein dairy ingredients in the supermarkets and specialty grocery chains. Supermarkets and specialty grocery chains are introducing their quark powder variants to leverage the swaying consumer's demand for affordable, protein-rich products.

This modification not only increases the competitiveness of prices but also forces the existing brands to set themselves apart through product quality, sourcing, and innovative formulations.

Asia-Pacific is turning into a marketplace of emerging markets where local dairy companies frequently start operations in quark powder. Consumer preference for dairy products is solidified by a rise in health awareness, development of the middle-class population and the adoption of Western diets. However, the market is still fragmented and the limited sourcing of regional production is leading to slow growth.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (USD Million) | USD 245.2 Million |

| CAGR (2025 to 2035) | 5.7% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | USD 156.0 Million |

| CAGR (2025 to 2035) | 5.5% |

| Country | China |

|---|---|

| Market Volume (USD Million) | USD 118.0 Million |

| CAGR (2025 to 2035) | 4.6% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | USD 102.6 Million |

| CAGR (2025 to 2035) | 4.0% |

| Country | India |

|---|---|

| Market Volume (USD Million) | USD 94.0 Million |

| CAGR (2025 to 2035) | 6.2% |

According to estimates, the USA quark powder market is set to undergo tremendous development, with its value reaching an impressive USD 245.2 million by 2025, while the compound annual growth rate (CAGR) will be 5.7% between 2025 and 2035.

The main source of this growth is the increasing number of consumers who know about high-protein diets and the application of quark powder in creative ways. As the USA dairy sector is solid, it is capable of backing up the market, while growing the wellness trend is persuading sports people and conscious consumers to include quark powder in their diet. Seeking for healthier choices, consumers place their demands on a rise in the amount of high-protein dairy products such as quark powder.

Germany's quark powder market is projected to attain a USD 156.0 million value by 2025, with a growth rate of 5.5% during the forecast period. Quark has always been a staple food in Germany, and its powdered form has become increasingly popular for its convenience and longer life. The market is supported by the strong dairy sector and a growing consumer preference for natural, protein-rich foods.

Extra, the surge of organic and clean-label products is quite compatible not only with the demand for high-quality minimally processed goods among the German population but also with the due regard to environmental health. This assertion is emerging as the market evolves, as consumers seek nutritional alternatives that align with their health-conscious choices while still allowing them to enjoy traditional cuisine.

In China, the quark powder business is expected to achieve a value of USD 118.0 million by 2025, and it will have a compound annual growth rate (CAGR) of 4.6% from 2025 to 2035. The rising middle-class population and the increase in health awareness are the primary drivers of the demand for nutritious and convenient food products.

Despite a long history of low dairy consumption in China, there is a turning point to incorporating dairy proteins in diets, which is a Western influence. The market growth is also propelled by state actions of promoting the consumption of dairy and increasing the standards of quality and yield of the internal dairy industry. As the interest in a healthier lifestyle is developing, quark powder is going to be a well-liked product among the Chinese buyers.

The global quark powder market is poised for significant growth from 2024, driven by increasing consumer demand for high-protein, low-fat dairy alternatives. Key players are focusing on product innovation, strategic partnerships, and expansion into emerging markets to strengthen their market positions. The competitive landscape is characterized by both established dairy giants and emerging regional producers, each aiming to capture a share of the expanding market.

For Instance

The global quark powder market is anticipated to grow at a CAGR of 5.9% over the forecast period.

The global quark powder market is expected to reach approximately USD 1,426.3 million by 2035.

Retail packaging is anticipated to witness the fastest growth due to rising consumer preference for convenience and ready-to-use dairy products.

The increasing demand for high-protein dairy ingredients, consumer preference for clean-label products, rising household adoption, and expansion of e-commerce sales channels are major growth drivers.

Some of the leading players in the market include Dairy Industries International, Deutsches Milchkontor (DMK Group), Valio Group, FrieslandCampina, Arla Foods, and Hochland Group.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fromage Frais And Quark Market Growth - Dairy Trends & Industry Expansion 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Dry Powder Refilling Machine Market

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA