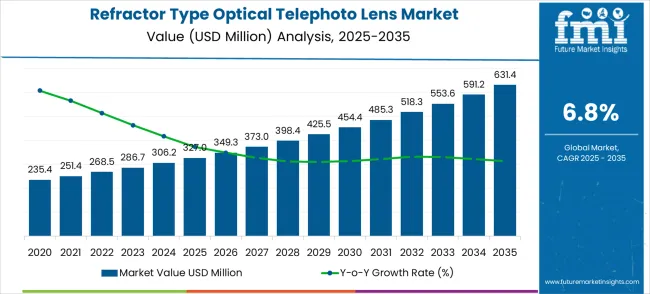

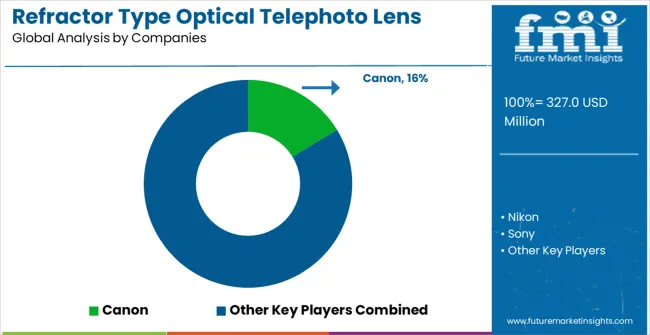

The refractor type optical telephoto lens market is forecasted to grow from an estimated USD 327.0 million in 2025 to USD 631.4 million by 2035, representing a CAGR of 6.8%. This ten-year period reflects a robust expansion in global demand for telephoto optical lenses, driven by increasing applications in professional photography, surveillance, and high-end optical devices.

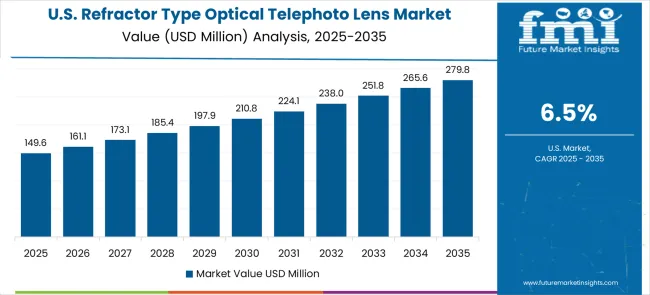

The market’s growth trajectory begins with USD 349.3 million in 2026, progressing to USD 398.4 million by 2028, indicating steady annual growth contributions. In this early phase, the adoption of advanced lens coatings, optical stabilization technologies, and enhanced zoom capabilities accounts for a significant proportion of year-on-year expansion, reflecting the technology-driven nature of the market.

The global refractor-type optical telephoto lens market is valued at USD 327.0 million in 2025 and is slated to reach USD 631.4 million by 2035, recording an absolute increase of USD 304.4 million over the forecast period. This translates into a total growth of 93.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.93X during the same period, supported by increasing demand for professional imaging solutions, growing adoption of high-quality optical systems in surveillance applications, and rising consumer preference for precision telephoto performance across diverse photography and monitoring applications.

From 2029 to 2032, the market value rises from USD 425.5 million to USD 518.3 million, highlighting the mid-decade acceleration in growth contribution. During this period, professional photography and broadcast media lenses emerge as primary sub-segments contributing to the bulk of YoY gains. These segments collectively account for nearly 55–60% of the annual growth, driven by increasing content creation and live event coverage requirements. Advancements in telephoto lens precision, coupled with rising adoption among hobbyist photographers, further enhance market penetration and ensure consistent contribution to total growth over these years.Between 2025 and 2030, the refractor type optical telephoto lens market is projected to expand from USD 327.0 million to USD 454.3 million, resulting in a value increase of USD 127.3 million, which represents 41.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing professional photography demand, rising adoption of surveillance systems, and growing demand for precision optical components in security monitoring and astronomical observation applications. Manufacturers are expanding their refractor type optical telephoto lens capabilities to address the growing demand for superior image quality and enhanced long-distance imaging performance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 327.0 million |

| Forecast Value in (2035F) | USD 631.4 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The period between 2033 and 2034, with values increasing from USD 553.6 million to USD 591.2 million, demonstrates slightly moderated annual growth rates relative to earlier years. This deceleration can be attributed to market saturation in established geographies and incremental adoption in emerging regions, where affordability and availability of high-quality refractor lenses still lag behind demand. Nevertheless, the launch of next-generation lens variants with improved optical clarity and reduced chromatic aberration continues to sustain growth, ensuring that each year contributes meaningfully to the cumulative ten-year expansion.

By 2035, the market reaches USD 631.4 million, completing a steady growth pattern over the decade. Analysis of the ratio and proportion of growth indicates that mid-decade years contribute most significantly to the cumulative market increase, accounting for over 50% of the total value addition. The combined influence of professional photography, broadcast optics, and consumer-level high-end telephoto lenses underpins sustained market momentum. The market demonstrates a balanced growth distribution, with early technological adoption and mid-decade segment expansion driving the majority of value creation across the forecast period.From 2030 to 2035, the market is forecast to grow from USD 454.3 million to USD 631.4 million, adding another USD 177.1 million, which constitutes 58.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of long tele lens and super tele lens technologies, the integration of advanced optical stabilization and auto-focus systems, and the development of premium high-performance telephoto solutions. The growing adoption of artificial intelligence in imaging systems and smart surveillance infrastructure will drive demand for refractor type optical telephoto lenses with enhanced optical precision and superior image processing compatibility.

Between 2020 and 2025, the refractor type optical telephoto lens market experienced steady growth, driven by increasing demand for professional imaging equipment and growing recognition of refractor optical telephoto lenses as essential components for high-quality long-distance photography with superior optical clarity and image precision. The market developed as photography professionals and surveillance system operators recognized the potential for refractor telephoto lenses to improve image quality while maintaining optical accuracy and delivering exceptional performance in demanding imaging applications. Technological advancement in optical design and coating technologies began emphasizing the critical importance of maintaining image sharpness and color accuracy in advanced telephoto imaging systems.

Market expansion is being supported by the increasing global demand for professional imaging solutions and the corresponding need for precision optical equipment that can provide superior long-distance imaging performance and reliable optical quality while maintaining image clarity across various photography and surveillance applications. Modern imaging professionals are increasingly focused on implementing optical solutions that can deliver exceptional image resolution at long distances, minimize optical aberrations, and provide consistent performance in challenging environmental conditions. Refractor type optical telephoto lenses' proven ability to deliver superior optical performance, enhanced image quality, and versatile application compatibility make them essential components for contemporary professional photography and surveillance monitoring solutions.

The growing emphasis focus on security surveillance and wildlife photography is driving demand for refractor type optical telephoto lenses that can support long-distance imaging requirements, maintain optical precision, and enable reliable performance in demanding observation conditions with superior image clarity. Optical system processors' preference for components that combine optical excellence with operational durability and cost-effectiveness is creating opportunities for innovative refractor telephoto lens implementations. The rising influence of social media content creation and professional photography trends is also contributing to increased adoption of telephoto lenses that can provide superior imaging solutions without compromising optical quality or operational convenience.

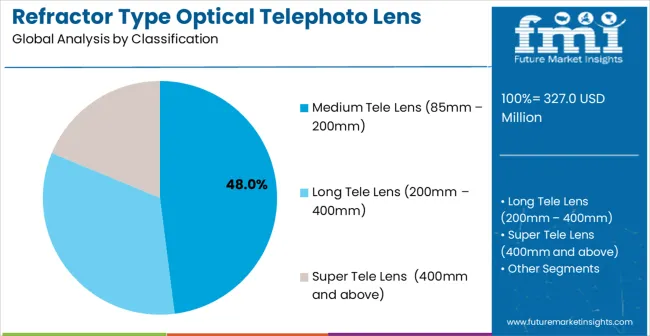

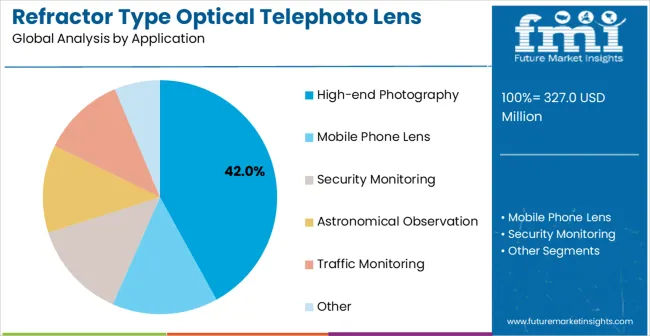

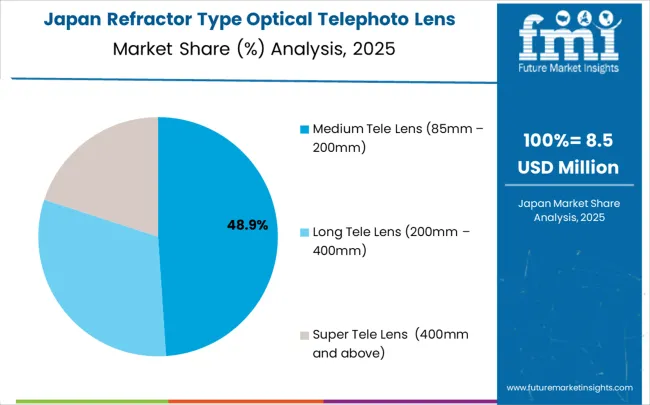

The market is segmented by classification, application, and region. By classification, the market is divided into medium tele lens (85mm - 200mm), long tele lens (200mm - 400mm), and super tele lens (400mm and above). Based on application, the market is categorized into mobile phone lens, high-end photography, security monitoring, astronomical observation, traffic monitoring, and other. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The medium tele lens (85mm - 200mm) segment is projected to account for 48.0% of the refractor type optical telephoto lens market in 2025, reaffirming its position as the leading classification category. Photography professionals increasingly utilize medium tele lenses for their superior versatility, proven optical performance, and convenience in portrait photography, event photography, and general telephoto applications across professional studios, commercial photography, and outdoor imaging environments. Medium tele lens technology's established focal length capabilities and consistent image output directly address the professional requirements for reliable optical performance and operational flexibility in diverse photographic applications.

This classification segment forms the foundation of modern professional photography operations, as it represents the focal length range with the greatest application versatility and established market demand across multiple photography disciplines and imaging requirements. Photographer investments in enhanced medium tele lens technologies and optical quality systems continue to strengthen adoption among imaging professionals. With photographers prioritizing consistent optical performance and proven application flexibility, medium tele lenses align with both creative objectives and technical requirements, making them the central component of comprehensive professional photography strategies.

High-end photography applications are projected to represent 42.0% of refractor type optical telephoto lens demand in 2025, underscoring highlighting their critical role as the primary application market for precision optical equipment in professional photography studios, commercial imaging services, and artistic photography applications. Professional photographers prefer refractor type optical telephoto lenses for their exceptional optical quality, superior image sharpness, and ability to deliver outstanding results while maintaining color accuracy and minimizing optical distortions. Positioned as essential equipment for modern professional photography, refractor type optical telephoto lenses offer both optical advantages and creative benefits.

The segment is supported by continuous growth in professional photography industry and the growing availability of specialized optical technologies that enable premium imaging with enhanced resolution and superior optical performance requirements. Additionally, professional photographers are investing in advanced lens systems to support high-quality imaging projects and creative excellence for demanding commercial and artistic applications. As image quality standards become more demanding and photography sophistication increases, high-end photography will continue to dominate the end-user market while supporting advanced optical utilization and imaging innovation strategies.

The refractor type optical telephoto lens market is advancing steadily due to increasing demand for professional imaging equipment and growing adoption of high-quality optical technologies that provide enhanced image performance and superior optical clarity across diverse photography and surveillance applications. However T, the market faces challenges, including high manufacturing costs, intense competition from alternative lens technologies, and the need for continuous optical innovation investments. Innovation in optical stabilization systems and advanced coating technologies continues to influence product development and market expansion patterns.

The growing adoption of long tele lens and super tele lens configurations with enhanced optical characteristics is enabling lens manufacturers to produce premium refractor type optical telephoto lenses with superior image quality, enhanced focal length capabilities, and advanced optical performance systems. Advanced optical systems provide improved imaging precision while allowing more efficient light transmission and consistent output across various focal length ranges and environmental conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced optical capabilities for product differentiation and premium market positioning in demanding professional imaging segments.

Modern refractor type optical telephoto lens producers are incorporating advanced image stabilization technologies and smart optical features to enhance image quality, reduce camera shake, and ensure consistent performance delivery to professional photographers and imaging professionals. These technologies improve optical reliability while enabling new applications, including handheld telephoto photography and challenging shooting conditions. Advanced feature integration also allows manufacturers to support premium positioning and professional satisfaction beyond traditional telephoto lens capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

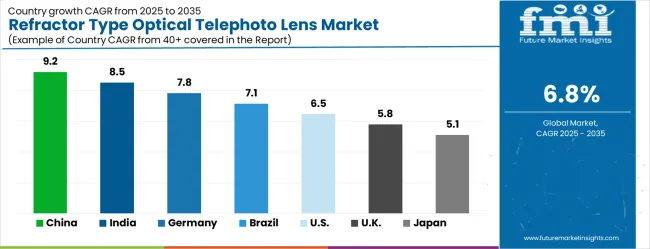

The global market is projected to grow at a CAGR of 6.8% between 2025 and 2035, driven by rising demand in photography, surveillance, and scientific imaging applications. China leads with 9.2% growth, supported by expanding consumer electronics production and adoption of advanced optical systems. India follows at 8.5%, reflecting growing interest in professional photography, research, and security applications. Germany records 7.8%, driven by high-quality optics manufacturing and industrial imaging demand. Brazil is projected at 7.1%, supported by increasing adoption in media, wildlife photography, and surveillance sectors. The United States grows at 6.5%, influenced by steady demand for precision lenses, while the United Kingdom expands at 5.8% and Japan at 5.1%, reflecting consistent use in mature markets and specialized optical applications.The refractor type optical telephoto lens market is experiencing strong growth globally, with China leading at a 9.2% CAGR through 2035, driven by the expanding optical manufacturing industry, growing photography market, and significant investment in surveillance infrastructure development. India follows at 8.5%, supported by large-scale electronics manufacturing, emerging optical production facilities, and growing domestic demand for imaging equipment and security systems. Germany shows growth at 7.8%, emphasizing technological innovation and premium optical component development. Brazil records 7.1%, focusing on surveillance market expansion and optical equipment modernization. The USA demonstrates 6.5% growth, prioritizing advanced optical technologies and high-performance imaging solutions. The UK exhibits 5.8% growth, emphasizing optical manufacturing capabilities and quality imaging equipment adoption. Japan shows 5.1% growth, supported by precision optical manufacturing excellence and advanced lens technology innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is projected to expand at a CAGR of 9.2% from 2025 to 2035, driven by rising demand from professional photography, surveillance systems, and astronomical observatories. Refractor type optical telephoto lenses are increasingly adopted due to their high resolution, low chromatic aberration, and precision in long-range imaging applications. Chinese manufacturers are investing in advanced glass materials, aspherical elements, and multi-coating technologies to enhance image quality. Growth is further supported by the expansion of media production, security monitoring, and astronomical research initiatives. Collaborations with global optics firms are enhancing design capabilities and technology transfer. Rising domestic consumption in consumer optics and professional imaging equipment continues to fuel market expansion.

India is expected to grow at a CAGR of 8.5% during 2025–2035, supported by growing adoption in wildlife photography, sports coverage, surveillance, and industrial imaging. Refractor telephoto lenses are favored for their long-range optical clarity and low maintenance in varied environmental conditions. Domestic manufacturers are improving lens coatings, glass quality, and manufacturing precision. Rising investments in media production, wildlife conservation research, and industrial monitoring are accelerating demand. Collaborations with global optics companies are helping Indian firms develop high-performance lenses for professional and consumer use. The market is further strengthened by increasing amateur photography and hobbyist segments seeking long-focus lenses.

Germany is projected to grow at a CAGR of 7.8% between 2025 and 2035, driven by demand in professional photography, scientific research, and defense imaging systems. Refractor telephoto lenses are widely used due to superior resolution, reduced chromatic aberration, and long-distance optical performance. German manufacturers focus on premium optical glass, aspherical elements, and precision coatings to cater to high-end professional equipment. Growth is reinforced by the country’s strong media production industry, observatories, and automotive vision systems. Collaborations with international optics suppliers and universities enable continuous innovation. Rising consumer interest in premium photography equipment further supports domestic market growth.

Brazil is expected to grow at a CAGR of 7.1% from 2025 to 2035, supported by demand from wildlife photography, sports broadcasting, and security surveillance. Refractor telephoto lenses are preferred for their long focal length, clarity, and durability in tropical and variable environmental conditions. Local manufacturers are producing cost-effective lenses while importing high-performance optics from Asia and Europe for professional applications. Demand is being strengthened by growing media production, nature tourism, and environmental research projects. Partnerships with international optics suppliers enhance product quality and accessibility.

The United States is projected to grow at a CAGR of 6.5% between 2025 and 2035, driven by media production, defense, and astronomical research. Refractor telephoto lenses are widely used in professional photography, wildlife observation, and telescope systems due to superior optical performance. Leading manufacturers focus on precision coatings, aspherical glass elements, and long focal-length designs. Adoption is fueled by expansion in professional media, sports photography, and defense surveillance. Rising demand in consumer photography and telescope segments further strengthens market growth. Collaboration between domestic optics manufacturers and international firms accelerates technology transfer and production efficiency.

The United Kingdom is expected to grow at a CAGR of 5.8% from 2025 to 2035, with adoption driven by media production, wildlife photography, and research applications. Refractor telephoto lenses are favored for their optical clarity, minimal chromatic distortion, and long-distance performance. UK manufacturers focus on high-quality lens coatings, durable glass, and precision assembly to meet professional and amateur photography needs. Expansion in national parks, wildlife research, and sports broadcasting contributes to demand. Collaborations with European optics companies ensure technological advancement and innovation in lens design. Increasing consumer photography interest and professional studio usage further supports market growth.

Japan is projected to grow at a CAGR of 5.1% during 2025–2035, influenced by professional photography, media production, and astronomical observatories. Refractor telephoto lenses are widely adopted for long-range imaging due to high optical performance, precision, and durability. Japanese manufacturers focus on compact designs, advanced multi-coatings, and high-quality glass to cater to domestic and export markets. Demand is further strengthened by the growing interest in wildlife and sports photography, as well as government-supported astronomy programs. Collaborations with global optics firms facilitate technological advancement and high-precision manufacturing.

Revenue from refractor type optical telephoto lenses in China is projected to exhibit exceptional growth with a CAGR of 9.2% through 2035, driven by expanding optical manufacturing infrastructure and rapidly growing surveillance and photography markets supported by government technology development initiatives. The country's abundant optical manufacturing capacity and increasing investment in precision lens technology are creating substantial demand for advanced optical solutions. Major optical companies and imaging equipment manufacturers are establishing comprehensive telephoto lens capabilities to serve both domestic and international markets.

Government support for optical industry development and surveillance infrastructure expansion is driving demand for refractor type optical telephoto lens technologies throughout major manufacturing regions and technology centers. Strong optical manufacturing sector growth and an expanding network of imaging equipment facilities are supporting the rapid adoption of precision optical components among manufacturers seeking enhanced product performance and export competitiveness.

Revenue from refractor type optical telephoto lenses in India is expanding at a CAGR of 8.5%, supported by the country's growing electronics manufacturing capacity, emerging optical production facilities, and increasing domestic demand for advanced imaging equipment and surveillance technologies. The country's developing optical supply chain and growing electronics industry are driving demand for sophisticated lens capabilities. International technology providers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for refractor type optical telephoto lens products.

Rising electronics manufacturing industry development and expanding surveillance deployment patterns are creating opportunities for optical telephoto lens adoption across imaging equipment manufacturers, security system suppliers, and optical component facilities in major industrial areas. Growing government focus on manufacturing excellence and optical technology modernization is driving adoption of advanced lens technologies among manufacturing enterprises seeking enhanced product quality and market competitiveness.

Revenue from refractor type optical telephoto lenses in Germany is expanding at a CAGR of 7.8%, supported by the country's advanced optical industry, strong emphasis on technological innovation, and robust demand for high-performance imaging solutions among quality-focused manufacturers. The nation's mature optical manufacturing sector and high adoption of precision lens technologies are driving sophisticated optical capabilities throughout the supply chain. Leading manufacturers and technology providers are investing extensively in premium lens development and advanced optical methods to serve both domestic and export markets.

Rising manufacturer preference for high-precision optics and advanced imaging quality is creating demand for sophisticated refractor type optical telephoto lens systems among optical manufacturers seeking enhanced product performance and image quality optimization. Strong technological expertise and growing emphasis on optical excellence are supporting adoption of premium lens solutions across professional photography and precision imaging applications in major technology centers.

Revenue from refractor type optical telephoto lenses in Brazil is growing at a CAGR of 7.1%, driven by expanding surveillance infrastructure development, increasing security system modernization patterns, and growing investment in optical technology adoption. The country's developing security resources and modernization of surveillance facilities are supporting demand for advanced lens technologies across major deployment regions. Security system operators and optical equipment companies are establishing comprehensive capabilities to serve both domestic security centers and emerging surveillance markets.

Government initiatives promoting security infrastructure development and surveillance technology expansion are driving adoption of modern optical systems including precision telephoto lenses and advanced imaging methods. Rising demand for advanced surveillance solutions in urban areas is supporting market expansion, while robust security sector growth provides opportunities for optical component adoption throughout the country's surveillance deployment facilities.

Revenue from refractor type optical telephoto lenses in the USA is expanding at a CAGR of 6.5%, supported by the country's advanced optical industry, emphasis on high-performance optical supply, and strong demand for sophisticated imaging solutions among technology-focused companies. The USA's established optical manufacturing sector and technological expertise are supporting investment in advanced lens capabilities throughout major technology centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium optical solutions.

Innovations in optical technologies including enhanced lens systems and advanced coating methods are creating demand for superior optical performance and advanced imaging capability among quality-focused manufacturers. Growing technological advancement and rising demand for high-performance imaging are driving adoption of sophisticated refractor type optical telephoto lenses across optical manufacturing and professional imaging applications throughout the country.

Revenue from refractor type optical telephoto lenses in the UK is growing at a CAGR of 5.8%, driven by the country's optical industry, emphasis on quality optical adoption, and strong demand for high-performance imaging solutions among established producers. The UK's mature optical sector and focus on technology excellence are supporting investment in advanced lens capabilities throughout major technology centers. Optical companies are establishing comprehensive lens systems to serve both domestic and international markets with quality imaging solutions.

Advanced optical expertise and established imaging equipment capabilities are creating opportunities for premium lens adoption and enhanced optical performance among quality-focused producers throughout major technology regions. Growing emphasis on optical innovation and technological advancement is driving adoption of refractor type optical telephoto lens systems across professional photography and precision imaging applications throughout the country.

Revenue from refractor type optical telephoto lenses in Japan is expanding at a CAGR of 5.1%, supported by the country's focus on precision manufacturing excellence, advanced optical applications, and strong preference for high-quality imaging solutions. Japan's sophisticated optical manufacturing industry and emphasis on lens precision are driving demand for advanced optical technologies including premium telephoto lenses and high-performance coating methods. Leading manufacturers are investing in specialized capabilities to serve optical component production, imaging equipment manufacturing, and precision lens applications with premium optical offerings.

Regional specialization in precision manufacturing and advanced technology development is creating opportunities for premium optical positioning and distinctive product development throughout major manufacturing regions. Strong emphasis on manufacturing quality combined with advanced optical requirements is driving adoption of lens technologies that deliver exceptional image quality while meeting contemporary imaging performance needs.

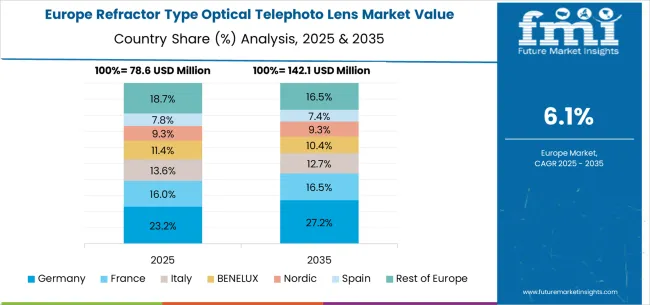

The refractor type optical telephoto lens market in Europe is projected to grow from USD 72.0 million in 2025 to USD 138.9 million by 2035, registering a CAGR of 6.8% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, declining slightly to 23.5% by 2035, supported by its strong optical manufacturing industry, advanced lens production facilities, and comprehensive imaging equipment supply network serving major European markets.

France follows with an 18.5% share in 2025, projected to reach 18.8% by 2035, driven by robust demand for refractor type optical telephoto lenses in professional photography, surveillance applications, and precision imaging equipment production, combined with established optical traditions incorporating advanced lens technologies. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.7% by 2035, supported by strong optical sector demand but facing challenges from competitive pressures and market restructuring. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.5% in 2025, expected to reach 12.8% by 2035. The Netherlands maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 10.5% to 10.3% by 2035, attributed to increasing adoption of professional imaging equipment in Nordic countries and growing optical manufacturing activities across Eastern European markets implementing technology modernization programs.

The market is highly competitive, driven by optical precision, focal length performance, and image quality. Canon, Nikon, and Sony lead with premium lenses designed for professional photography, cinematography, and surveillance applications. Their competitive advantage lies in proprietary lens coatings, advanced optical designs, and global distribution networks. Product brochures emphasize high resolution, low chromatic aberration, and reliable performance in low-light conditions, appealing to professional photographers, broadcasters, and defense imaging users.

Sigma, Tamron, and Fujinon compete by offering versatile telephoto lenses with cost-effective performance and compatibility across multiple camera systems. Sigma and Tamron focus on lightweight construction and fast autofocus, while Fujinon emphasizes ruggedized lenses for industrial and broadcast environments. Edmund Optics, Hanwha Vision, NAVITAR, and Ricoh target niche markets, including machine vision, scientific imaging, and surveillance, differentiating through customized optics, IR sensitivity, and specialized coatings.

Competition in this market is defined by optical clarity, build quality, and adaptability to diverse applications. Leading players invest in advanced glass materials, multi-layer coatings, and precision assembly to maintain performance leadership, while regional and niche manufacturers leverage affordability, rapid customization, and application-specific design. Product brochures highlight lens focal ranges, aperture flexibility, and environmental durability. The market remains technology-driven, with innovation in image fidelity, focal precision, and telephoto reach central to sustaining a competitive advantage among global and regional suppliers.The refractor type optical telephoto lens market is characterized by competition among established optical manufacturers, specialized imaging equipment suppliers, and integrated camera system providers. Companies are investing in advanced optical technology research, lens design optimization, coating technology development, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective refractor type optical telephoto lens solutions. Innovation in optical formulations, image stabilization systems, and precision manufacturing is central to strengthening market position and competitive advantage.

Canon leads the market with a strong market share, offering comprehensive imaging solutions with a focus on professional photography applications and advanced optical systems. Nikon provides specialized photography capabilities with an emphasis on high-performance lens formulations and optical excellence. Sony delivers innovative imaging solutions with a focus on mirrorless systems and product versatility. Sigma specializes in optical manufacturing and advanced lens solutions for photography markets. Tamron focuses on telephoto lens technology and integrated optical operations. Edmund Optics offers specialized optical components with emphasis on precision applications and technical markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 327.0 Million |

| Classification | Medium Tele Lens (85mm - 200mm), Long Tele Lens (200mm - 400mm), Super Tele Lens (400mm and above) |

| Application | Mobile Phone Lens, High-end Photography, Security Monitoring, Astronomical Observation, Traffic Monitoring, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Canon, Nikon, Sony, Sigma, Tamron, and Edmund Optics |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in optical systems, lens innovation, coating development, and manufacturing optimization |

The global refractor type optical telephoto lens market is estimated to be valued at USD 327.0 million in 2025.

The market size for the refractor type optical telephoto lens market is projected to reach USD 631.4 million by 2035.

The refractor type optical telephoto lens market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in refractor type optical telephoto lens market are medium tele lens (85mm – 200mm), long tele lens (200mm – 400mm) and super tele lens (400mm and above).

In terms of application, high-end photography segment to command 42.0% share in the refractor type optical telephoto lens market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refractories Market Size and Share Forecast Outlook 2025 to 2035

Refractory Cement Market Growth – Trends & Forecast 2024-2034

Refractor Type Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Checkpoint Inhibitor Refractory Cancer Market Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

USB Type C Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA