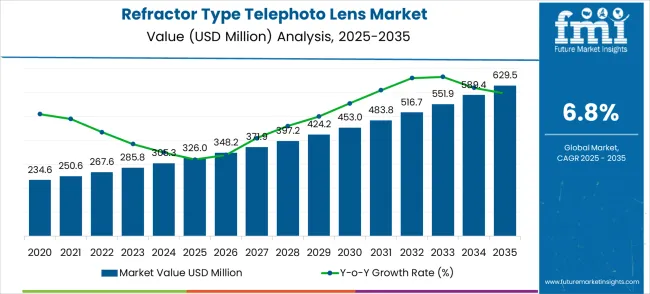

The refractor type telephoto lens market is projected to grow from USD 326.0 million in 2025 to USD 629.5 million by 2035, with a CAGR of 6.8%. From 2025 to 2030, the market exhibits steady, consistent growth, moving from USD 234.6 million in 2025 to USD 326.0 million in 2030. Annual increments are moderate, with values increasing from USD 250.6 million in 2026, USD 267.6 million in 2027, and USD 285.8 million in 2028.

The market expansion during this phase is driven by the rising adoption of telephoto lenses in both the photography and sports sectors, where high-quality, long-range imaging is essential. The growth curve during these years is characterized by gradual and predictable upward movement, reflecting the steady demand for advanced optical systems.

From 2030 to 2035, the market sees an accelerated pace of growth, with values advancing from USD 348.2 million in 2031 to USD 629.5 million by 2035. The market accelerates sharply from USD 371.9 million in 2032 to USD 397.2 million in 2033, and USD 424.2 million in 2034, driven by technological advancements and growing consumer interest in high-performance lenses for professional and amateur photography. The sharp growth in the latter half of the decade indicates a strong demand surge, influenced by increasing interest in telephoto lenses for applications in wildlife photography, sports events, and advanced visual technology.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 326.0 million |

| Forecast Value in (2035F) | USD 629.5 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The refractor type telephoto lens market is a specialized segment driven by the increasing demand for high-quality long-distance lenses used in photography, surveillance, and astronomy. In the optical lens market, refractor telephoto lenses account for approximately 4-6% of the total market share. These lenses are essential for high-magnification applications, offering sharp, clear images over long distances, making them integral to cameras, telescopes, and microscopes. In the photography equipment market, refractor telephoto lenses represent around 7-9%, driven by their use in professional and amateur photography. Photographers involved in wildlife, sports, and nature photography rely on these lenses for capturing distant subjects with high resolution and clarity.

In the surveillance and security market, the refractor telephoto lens share is about 5-7%, reflecting their role in security cameras used for long-range monitoring and tracking. These lenses help enhance surveillance capabilities in both public and private sectors, offering precise vision over large areas. In the astronomy market, refractor telephoto lenses contribute approximately 3-5%, as they are widely used in telescopes for observing distant celestial bodies. Their high magnification and sharpness are essential for astronomers seeking to capture clear images of stars, planets, and galaxies. In the consumer electronics market, the share of refractor type telephoto lenses is around 2-4%, as they are increasingly integrated into smartphones and tablets to enhance zoom functionality.

Market expansion is being supported by the increasing global demand for high-quality imaging solutions and the corresponding need for precision optical equipment that can provide superior image quality and long-distance performance while maintaining optical clarity across various professional photography and surveillance applications. Modern imaging professionals are increasingly focused on implementing optical solutions that can deliver exceptional image sharpness, minimize optical aberrations, and provide consistent performance in demanding environmental conditions. Refractor type telephoto lenses' proven ability to deliver superior optical performance, enhanced image quality, and versatile application compatibility make them essential components for contemporary professional imaging and optical surveillance solutions.

The growing emphasis on security surveillance and astronomical observation is driving demand for refractor type telephoto lenses that can support long-distance imaging requirements, maintain optical precision, and enable reliable performance in challenging observation conditions with minimal image distortion. Imaging equipment processors' preference for optical components that combine performance excellence with operational durability and cost-effectiveness is creating opportunities for innovative refractor telephoto lens implementations. The rising influence of mirrorless camera technology and advanced imaging trends is also contributing to increased adoption of telephoto lenses that can provide superior optical solutions without compromising image quality or system performance.

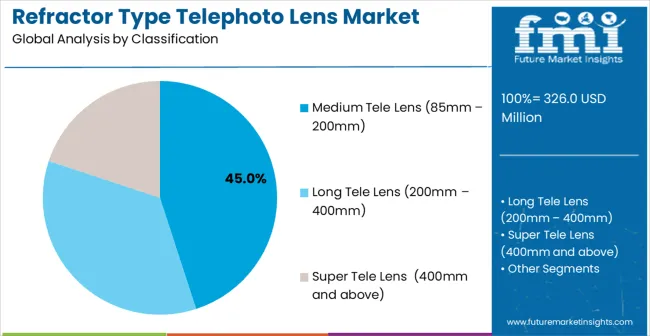

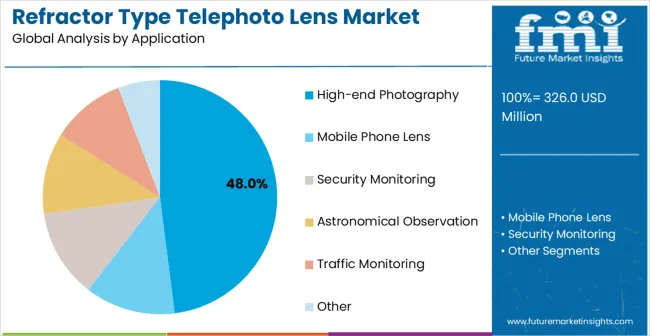

The market is segmented by classification, application, and region. By classification, the market is divided into medium tele lens (85mm - 200mm), long tele lens (200mm - 400mm), and super tele lens (400mm and above). Based on application, the market is categorized into mobile phone lens, high-end photography, security monitoring, astronomical observation, traffic monitoring, and other. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

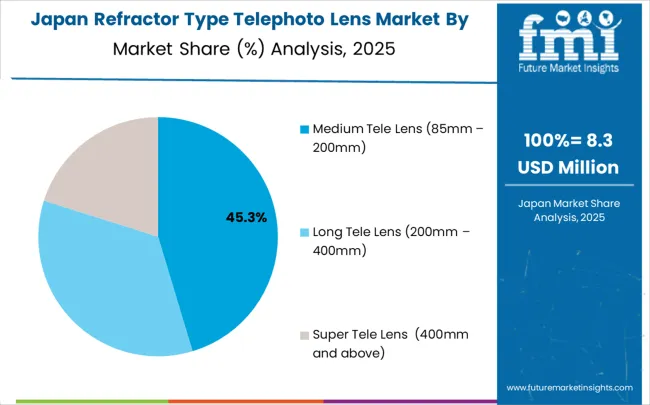

The medium tele lens (85mm - 200mm) segment is projected to account for 45.0% of the refractor type telephoto lens market in 2025, reaffirming its position as the leading classification category. Photography professionals increasingly utilize medium tele lenses for their superior versatility, proven optical performance, and convenience in portrait photography, sports photography, and general telephoto applications across professional studios, event photography, and outdoor imaging environments. Medium tele lens technology's established focal length capabilities and consistent image output directly address the professional requirements for reliable optical performance and operational flexibility in diverse photographic applications.

This classification segment forms the foundation of modern professional photography operations, as it represents the focal length range with the greatest application versatility and established market demand across multiple photography disciplines and imaging requirements. Manufacturer investments in enhanced medium tele lens technologies and optical quality systems continue to strengthen adoption among photography professionals. With photographers prioritizing consistent optical performance and proven application flexibility, medium tele lenses align with both creative objectives and technical requirements, making them the central component of comprehensive professional photography strategies.

High-end photography applications are projected to represent 48.0% of refractor type telephoto lens demand in 2025, underscoring their critical role as the primary application market for precision optical equipment in professional photography studios, commercial imaging services, and artistic photography applications. Professional photographers prefer refractor type telephoto lenses for their exceptional optical quality, superior image sharpness, and ability to deliver outstanding results while maintaining color accuracy and minimizing optical distortions. Positioned as essential equipment for modern professional photography, refractor type telephoto lenses offer both optical advantages and creative benefits.

The segment is supported by continuous growth in professional photography industry and the growing availability of specialized optical technologies that enable premium imaging with enhanced resolution and superior optical performance requirements. Additionally, professional photographers are investing in advanced lens systems to support high-quality imaging projects and creative excellence for demanding commercial and artistic applications. As image quality standards become more demanding and photography complexity increases, high-end photography will continue to dominate the end-user market while supporting advanced optical utilization and imaging innovation strategies.

The refractor type telephoto lens market is advancing steadily due to increasing demand for professional imaging equipment and growing adoption of high-quality optical technologies that provide enhanced image performance and superior optical clarity across diverse photography and surveillance applications. The market faces challenges, including high manufacturing costs, competition from alternative lens technologies, and the need for continuous optical innovation investments. Innovation in optical coating technologies and advanced glass formulations continues to influence product development and market expansion patterns.

The growing adoption of long tele lens and super tele lens configurations with enhanced optical characteristics is enabling lens manufacturers to produce premium refractor type telephoto lenses with superior image quality, enhanced focal length capabilities, and advanced optical performance systems. Advanced optical systems provide improved imaging precision while allowing more efficient light transmission and consistent output across various focal length ranges and application conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced optical capabilities for product differentiation and premium market positioning in demanding professional imaging segments.

Modern refractor type telephoto lens producers are incorporating advanced image stabilization technologies and sophisticated optical coatings to enhance image quality, reduce optical aberrations, and ensure consistent performance delivery to professional photographers and imaging professionals. These technologies improve optical reliability while enabling new applications, including handheld telephoto photography and challenging lighting conditions. Advanced technology integration also allows manufacturers to support premium positioning and professional satisfaction beyond traditional telephoto lens capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

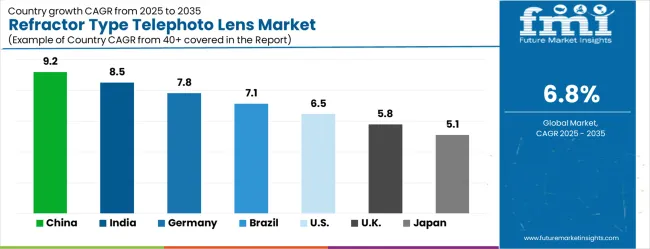

The refractor type telephoto lens market is experiencing strong growth globally, with China leading at a 9.2% CAGR through 2035, driven by the expanding optical manufacturing industry, growing photography market, and significant investment in surveillance infrastructure development. India follows at 8.5%, supported by large-scale electronics manufacturing, emerging optical production facilities, and growing domestic demand for imaging equipment and security systems. Germany shows growth at 7.8%, emphasizing technological innovation and premium optical component development. Brazil records 7.1%, focusing on surveillance market expansion and optical equipment modernization. The USA demonstrates 6.5% growth, prioritizing advanced optical technologies and high-performance imaging solutions. The UK exhibits 5.8% growth, emphasizing optical manufacturing capabilities and quality imaging equipment adoption. Japan shows 5.1% growth, supported by precision optical manufacturing excellence and advanced lens technology innovation.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from refractor type telephoto lenses in China is projected to exhibit exceptional growth with a CAGR of 9.2% through 2035, driven by expanding optical manufacturing infrastructure and rapidly growing surveillance and photography markets supported by government technology development initiatives. The country's abundant optical manufacturing capacity and increasing investment in precision lens technology are creating substantial demand for advanced optical solutions. Major optical companies and imaging equipment manufacturers are establishing comprehensive lens capabilities to serve both domestic and international markets.

The refractor type telephoto lens market in India is expanding at a CAGR of 8.5%, supported by the country's growing electronics manufacturing capacity, emerging optical production facilities, and increasing domestic demand for advanced imaging equipment and surveillance technologies. The country's developing optical supply chain and growing electronics industry are driving demand for sophisticated lens capabilities. International technology providers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for refractor type telephoto lens products.

Demand for refractor type telephoto lenses in Germany is expanding at a CAGR of 7.8%, supported by the country's advanced optical industry, strong emphasis on technological innovation, and robust demand for high-performance imaging solutions among quality-focused manufacturers. The nation's mature optical manufacturing sector and high adoption of precision lens technologies are driving sophisticated optical capabilities throughout the supply chain. Leading manufacturers and technology providers are investing extensively in premium lens development and advanced optical methods to serve both domestic and export markets.

The refractor type telephoto lens market in Brazil is set to grow at a CAGR of 7.1%, driven by expanding surveillance infrastructure development, increasing security system modernization patterns, and growing investment in optical technology adoption. The country's developing security resources and modernization of surveillance facilities are supporting demand for advanced lens technologies across major deployment regions. Security system operators and optical equipment companies are establishing comprehensive capabilities to serve both domestic security centers and emerging surveillance markets.

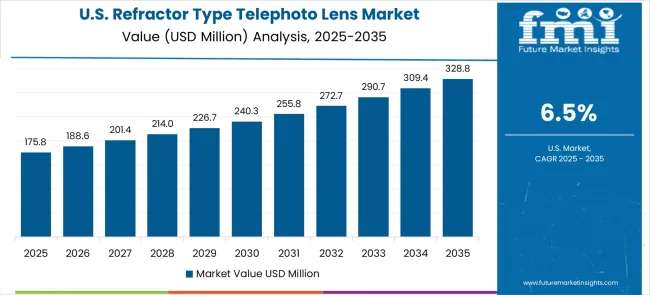

Sale of refractor type telephoto lenses in the USA is expected to expand at a CAGR of 6.5%, supported by the country's advanced optical industry, emphasis on high-performance optical supply, and strong demand for sophisticated imaging solutions among technology-focused companies. The USA's established optical manufacturing sector and technological expertise are supporting investment in advanced lens capabilities throughout major technology centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium optical solutions.

Revenue from refractor type telephoto lenses in the UK is anticipated to grow at a CAGR of 5.8%, driven by the country's optical industry, emphasis on quality optical adoption, and strong demand for high-performance imaging solutions among established producers. The UK's mature optical sector and focus on technology excellence are supporting investment in advanced lens capabilities throughout major technology centers. Optical companies are establishing comprehensive lens systems to serve both domestic and international markets with quality imaging solutions.

The refractor type telephoto lens market in Japan is expanding at a CAGR of 5.1%, supported by the country's focus on precision manufacturing excellence, advanced optical applications, and strong preference for high-quality imaging solutions. Japan's sophisticated optical manufacturing industry and emphasis on lens precision are driving demand for advanced optical technologies including premium telephoto lenses and high-performance coating methods. Leading manufacturers are investing in specialized capabilities to serve optical component production, imaging equipment manufacturing, and precision lens applications with premium optical offerings.

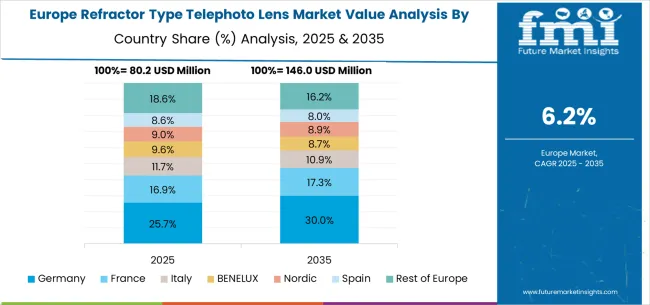

The refractor type telephoto lens market in Europe is projected to grow from USD 71.7 million in 2025 to USD 138.5 million by 2035, registering a CAGR of 6.8% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, declining slightly to 23.5% by 2035, supported by its strong optical manufacturing industry, advanced lens production facilities, and comprehensive imaging equipment supply network serving major European markets.

France follows with an 18.5% share in 2025, projected to reach 18.8% by 2035, driven by robust demand for refractor type telephoto lenses in professional photography, surveillance applications, and precision imaging equipment production, combined with established optical traditions incorporating advanced lens technologies. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.7% by 2035, supported by strong optical sector demand but facing challenges from competitive pressures and market restructuring. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.5% in 2025, expected to reach 12.8% by 2035. The Netherlands maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 10.5% to 10.3% by 2035, attributed to increasing adoption of professional imaging equipment in Nordic countries and growing optical manufacturing activities across Eastern European markets implementing technology modernization programs.

The refractor type telephoto lens market is characterized by competition among established optical manufacturers, specialized imaging equipment suppliers, and integrated camera system providers. Companies are investing in advanced optical technology research, lens design optimization, coating technology development, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective refractor type telephoto lens solutions. Innovation in optical formulations, image stabilization systems, and precision manufacturing is central to strengthening market position and competitive advantage.

Canon leads the market with a strong market share, offering comprehensive imaging solutions with a focus on professional photography applications and advanced optical systems. Nikon provides specialized photography capabilities with an emphasis on high-performance lens formulations and optical excellence. Sony delivers innovative imaging solutions with a focus on mirrorless systems and product versatility. Sigma specializes in optical manufacturing and advanced lens solutions for photography markets. Tamron focuses on telephoto lens technology and integrated optical operations. Edmund Optics offers specialized optical components with emphasis on precision applications and technical markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 326.0 million |

| Classification | Medium Tele Lens (85mm - 200mm), Long Tele Lens (200mm - 400mm), Super Tele Lens (400mm and above) |

| Application | Mobile Phone Lens, High-end Photography, Security Monitoring, Astronomical Observation, Traffic Monitoring, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Canon, Nikon, Sony, Sigma, Tamron, and Edmund Optics |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in optical systems, lens innovation, coating development, and manufacturing optimization |

The global refractor type telephoto lens market is estimated to be valued at USD 326.0 million in 2025.

The market size for the refractor type telephoto lens market is projected to reach USD 629.5 million by 2035.

The refractor type telephoto lens market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in refractor type telephoto lens market are medium tele lens (85mm – 200mm), long tele lens (200mm – 400mm) and super tele lens (400mm and above).

In terms of application, high-end photography segment to command 48.0% share in the refractor type telephoto lens market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refractor Type Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Refractories Market Size and Share Forecast Outlook 2025 to 2035

Refractory Cement Market Growth – Trends & Forecast 2024-2034

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Checkpoint Inhibitor Refractory Cancer Market Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

USB Type C Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA