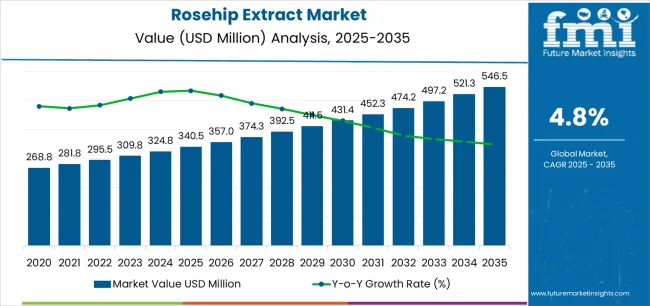

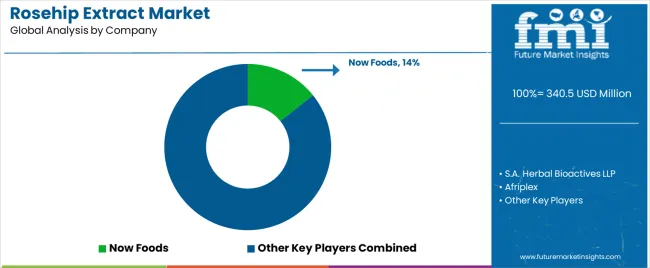

The Rosehip Extract Market is estimated to be valued at USD 340.5 million in 2025 and is projected to reach USD 546.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The rosehip extract market is experiencing steady growth, supported by increasing consumer awareness of natural and botanical-based health and beauty products. The extract’s high content of vitamins, antioxidants, and essential fatty acids has reinforced its role in skincare, dietary supplements, and pharmaceutical formulations.

Demand is driven by the shift toward organic and clean-label products, as consumers seek safer and sustainable alternatives to synthetic ingredients. The current market environment benefits from advancements in extraction technologies that preserve bioactive compounds and enhance product stability.

Expanding applications across cosmetics, nutraceuticals, and beverages are broadening revenue streams, while manufacturers are focusing on product differentiation through standardization and formulation innovation. With rising demand for natural ingredients in preventive healthcare and personal care sectors, the rosehip extract market is poised for continued expansion in the coming years.

| Metric | Value |

|---|---|

| Rosehip Extract Market Estimated Value in (2025 E) | USD 340.5 million |

| Rosehip Extract Market Forecast Value in (2035 F) | USD 546.5 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

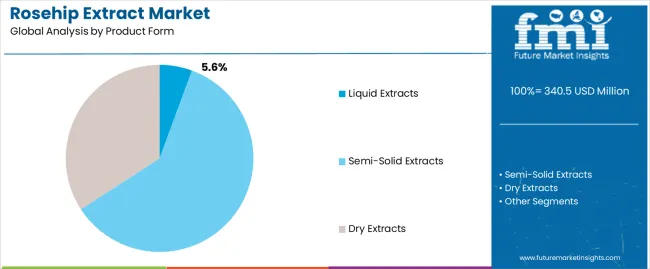

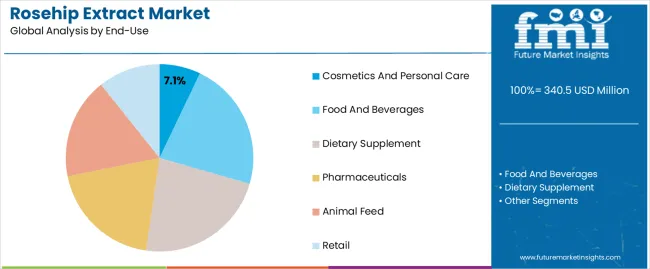

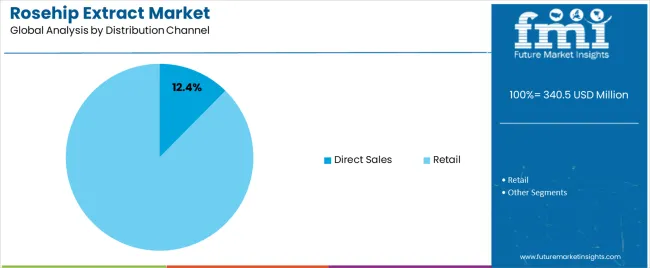

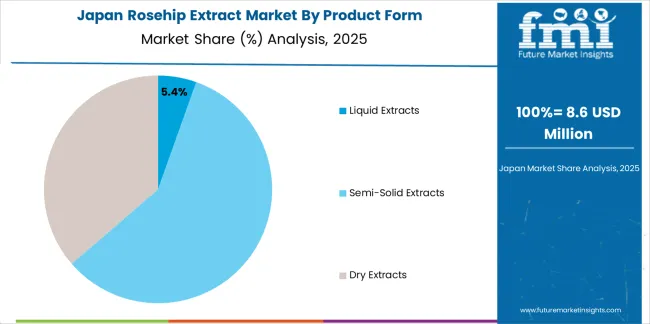

The market is segmented by Product Form, End-Use, and Distribution Channel and region. By Product Form, the market is divided into Liquid Extracts, Semi-Solid Extracts, and Dry Extracts. In terms of End-Use, the market is classified into Cosmetics And Personal Care, Food And Beverages, Dietary Supplement, Pharmaceuticals, Animal Feed, and Retail. Based on Distribution Channel, the market is segmented into Direct Sales and Retail. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid extracts segment accounts for approximately 5.60% share of the product form category, driven by its superior solubility, easy incorporation in formulations, and faster absorption compared to powdered alternatives. This segment’s growth is supported by its extensive use in skincare serums, beverages, and dietary supplements.

Manufacturers prefer liquid forms for their flexibility in product development and ability to retain the natural aroma and color of rosehip. Rising demand for ready-to-use and mixable liquid concentrates in the cosmetics and nutraceutical industries further strengthens this segment’s market share.

With continuous innovation in solvent-free and cold-press extraction processes, the liquid extracts segment is expected to experience gradual yet steady expansion across global markets.

The cosmetics and personal care segment represents approximately 7.10% share in the end-use category, primarily driven by the growing consumer inclination toward natural skincare formulations. Rosehip extract is valued for its anti-aging, moisturizing, and skin-regenerating properties, making it a key ingredient in facial oils, creams, and serums.

The segment benefits from increasing adoption by premium cosmetic brands emphasizing botanical actives and sustainability. Growing awareness of the extract’s effectiveness in treating scars, pigmentation, and dryness supports continuous inclusion in personal care products.

With rising disposable incomes and expanding beauty product portfolios in emerging markets, this segment is expected to retain a significant growth trajectory.

The direct sales segment holds approximately 12.40% share of the distribution channel category, supported by personalized marketing strategies and brand-driven consumer engagement. This channel allows manufacturers to establish strong customer relationships through online and door-to-door sales models, enhancing trust and brand loyalty.

Increasing demand for organic and customized beauty solutions has boosted the effectiveness of direct sales platforms, particularly for niche botanical extracts like rosehip. The segment also benefits from digital transformation, where social commerce and influencer-led marketing amplify reach.

With the rising popularity of direct-to-consumer brands and subscription-based wellness models, the direct sales segment is projected to maintain its steady presence in the global market.

The global rosehip extract sales grew at a CAGR of 4.3% from 2020 to 2025. The growth of rosehip extracts from 2020 to 2025 can be attributed to a convergence of factors:

Through 2035, the rosehip extract market is expected to book a 5.1% CAGR.

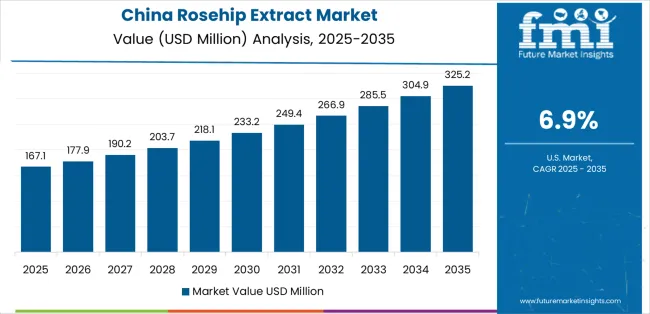

The table below shows the estimated growth rates of the top five countries. The United States, China, and India are set to record high CAGRs of 4.5%, 5.6%, and 6.4%, respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| United Kingdom | 3.4% |

| China | 5.6% |

| India | 6.4% |

| Japan | 4.1% |

The table below explains the rosehip extract market size of the top five countries for 2035. Among them, the United States is anticipated to remain at the forefront by reaching a valuation of USD 546.5 million. The United Kingdom is expected to reach around USD 54.7 million by 2035, less than China's USD 98.4 million.

| Countries | Market Size (2035) |

|---|---|

| United States | USD 546.5 million |

| United Kingdom | USD 54.7 million |

| China | USD 98.4 million |

| India | USD 49.2 million |

| Japan | USD 38.2 million |

The United States rosehip extract industry is invoked to book a CAGR of 4.5% during the forecast period. By 2035, the market in the United States is expected to reach USD 546.5 million.

Rosehip extract demand in China is expected to register a steady CAGR of 5.6% during the forecast period, helped by the following factors:

Japan's rosehip extract market is anticipated to reach the height of around USD 38.2 million by 2035 due to a mix of factors including:

The demand for rosehip extracts is increasing in the United Kingdom, with a projected CAGR of 3.4% through 2035. The following factors influence demand in the United Kingdom:

The rosehip extract market is forecasted to book a CAGR of 6.4% in India over the forecast period. The factors driving the market’s growth are as follows:

The section below shows the liquid extract segment dominating by product form. It is predicted to hold a market share of 5.6% in 2025. Based on end-use, the cosmetics and personal care segment is anticipated to generate a dominant share through 2025. It is set to hold a share of 7.1% in 2025.

| Segment | Market Share (2025) |

|---|---|

| Liquid Extract (Product Form) | 5.6% |

| Cosmetics and Personal Care (End-use) | 7.1% |

The demand for liquid rosehip extracts is expected to be prominent, based on the product form.

Based on end-use, the cosmetics and personal care segment is expected to hold a significant market share in 2025.

The leading manufacturers of rosehip extracts strive to enhance the quality of their products continually to match the altering set of expectations and needs of consumers. They are implementing complex strategies for mergers, acquisitions, partnerships, distribution agreements, collaborations, advertisements, and celebrity endorsements to further strengthen their positions in the market.

For instance

The global rosehip extract market is estimated to be valued at USD 340.5 million in 2025.

The market size for the rosehip extract market is projected to reach USD 546.5 million by 2035.

The rosehip extract market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in rosehip extract market are liquid extracts, semi-solid extracts and dry extracts.

In terms of end-use, cosmetics and personal care segment to command 7.1% share in the rosehip extract market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA