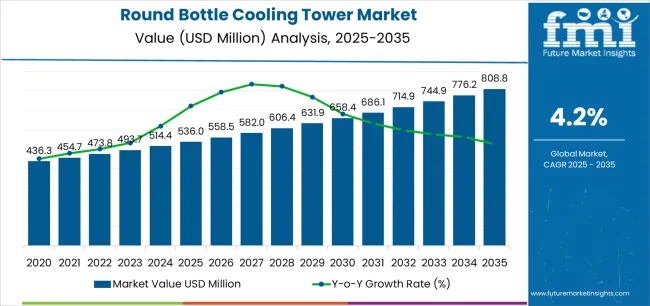

The global round bottle cooling tower market is projected to reach USD 808.8 million by 2035, recording an absolute increase of USD 272.8 million over the forecast period. The market is valued at USD 536 million in 2025 and is set to rise at a CAGR of 4.2% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for energy-efficient cooling solutions in industrial facilities and commercial buildings, driving demand for compact, high-performance cooling systems and increasing investments in power generation infrastructure and HVAC modernization projects globally.

The market demonstrates steady growth momentum driven by expanding data center construction requiring efficient heat rejection systems, rising industrial manufacturing activity necessitating process cooling infrastructure, and growing emphasis on water conservation favoring closed-loop cooling tower designs. Growth is particularly concentrated in HVAC applications serving commercial buildings, hospitality facilities, and institutional complexes, power generation installations requiring condenser cooling and auxiliary systems, and oil and gas operations where process cooling supports refining, petrochemical, and LNG facilities. The global push toward energy efficiency and operational cost reduction continues to drive substantial demand, with round bottle cooling towers serving as space-efficient, aesthetically versatile solutions for applications where circular tower configurations offer installation advantages and architectural compatibility.

Technology advancement in fill media design and airflow optimization is reshaping market dynamics, with manufacturers developing enhanced heat transfer surfaces improving thermal performance, corrosion-resistant materials extending equipment life in harsh environments, and variable speed fan controls enabling demand-based operation reducing energy consumption. The sustainability movement creates sustained demand for cooling towers featuring reduced water consumption through advanced drift eliminators, minimized chemical treatment requirements, and noise reduction technologies addressing urban installation constraints. Urbanization trends, particularly in emerging markets where commercial and industrial development accelerates, drive adoption of round bottle towers whose compact footprints and cylindrical profiles suit constrained sites and rooftop installations.

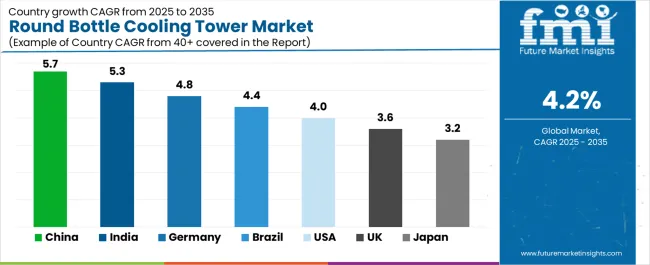

Regional dynamics show accelerated growth across Asia Pacific markets, led by China's massive infrastructure development and India's expanding manufacturing base, while established markets in North America and Europe maintain steady investments through equipment replacement cycles and efficiency upgrade programs. However, initial capital cost considerations affecting project economics, competition from alternative cooling tower configurations including rectangular counterflow designs, and maintenance complexity in certain cylindrical tower designs may pose challenges to market expansion in cost-sensitive applications and projects with limited technical support infrastructure.

Between 2025 and 2030, the round bottle cooling tower market is projected to expand from USD 536 million to USD 658.4 million, resulting in a value increase of USD 122.4 million, which represents 44.9% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for energy-efficient cooling infrastructure in commercial and industrial sectors, product innovation in fill media technologies and fan drive systems offering enhanced performance, as well as expanding data center development and industrial facility construction driving comprehensive cooling system requirements. Companies are establishing competitive positions through investment in computational fluid dynamics (CFD) optimization, corrosion-resistant material development, and strategic market expansion across HVAC, power generation, and industrial process cooling applications.

From 2030 to 2035, the market is forecast to grow from USD 658.4 million to USD 808.8 million, adding another USD 150.4 million, which constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart cooling tower technologies incorporating IoT sensors and predictive maintenance capabilities, strategic collaborations between cooling tower manufacturers and facility management service providers, and an enhanced focus on water conservation technologies and hybrid cooling systems. The growing emphasis on operational efficiency and environmental sustainability will drive demand for advanced, reliable round bottle cooling tower solutions across diverse commercial, industrial, and power generation applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 536 million |

| Market Forecast Value (2035) | USD 808.8 million |

| Forecast CAGR (2025-2035) | 4.2% |

The round bottle cooling tower market grows by enabling facility operators and industrial managers to achieve efficient heat rejection, space-optimized installations, and aesthetically compatible cooling solutions while meeting thermal load requirements across diverse applications. Industrial and commercial cooling operations face mounting pressure to optimize energy consumption and operational efficiency, with modern round bottle cooling towers typically delivering 15-25% energy savings through advanced fan controls and optimized airflow compared to older tower designs, making these systems essential for cost-effective facility cooling and process temperature management. The HVAC industry's need for compact, efficient cooling solutions creates demand for round bottle towers that can deliver substantial cooling capacity within limited footprint areas, particularly for rooftop installations and urban sites where space constraints and aesthetic considerations influence equipment selection.

Government energy efficiency standards and building codes drive adoption in commercial construction, industrial facilities, and power generation applications, where cooling system performance has a direct impact on overall facility energy consumption and environmental compliance. The global expansion of data centers and cloud computing infrastructure accelerates round bottle cooling tower demand as operators seek reliable, efficient heat rejection systems supporting critical IT infrastructure requiring 24/7 operation and precise temperature control. However, higher initial capital costs compared to some alternative configurations and specialized maintenance requirements may limit adoption rates among smaller facilities and projects with constrained budgets or limited technical support capabilities.

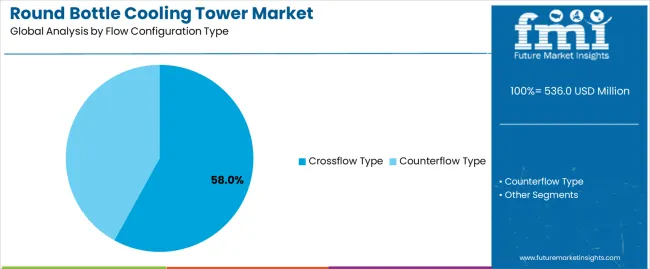

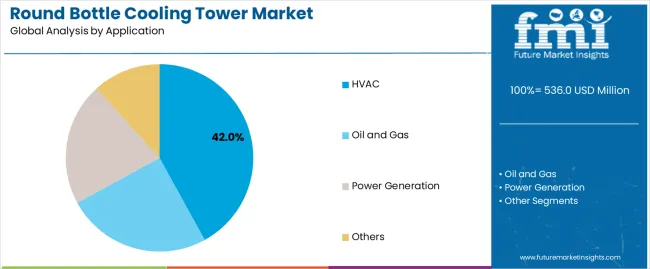

The market is segmented by flow configuration type, application, and region. By flow configuration type, the market is divided into crossflow type and counterflow type. Based on application, the market is categorized into HVAC, oil and gas, power generation, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

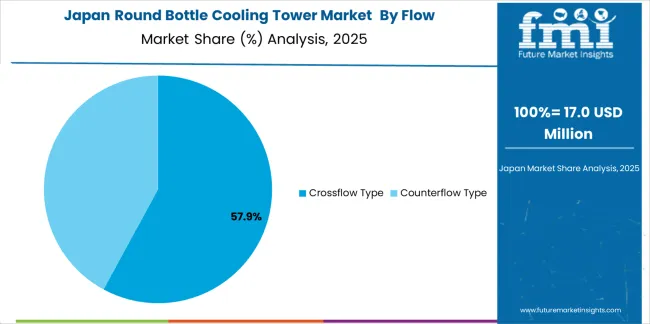

The crossflow type segment represents the dominant force in the round bottle cooling tower market, capturing approximately 58% of total market share in 2025. This established configuration encompasses designs where air flows horizontally through fill media while water cascades vertically downward, delivering maintenance advantages through easier access to fill media and distribution systems, lower pumping head requirements reducing energy consumption, and operational flexibility enabling single-cell operation during low-load conditions. The crossflow segment's market leadership stems from its superior serviceability enabling straightforward inspection and maintenance of internal components, reduced pump energy requirements through lower static water levels compared to counterflow alternatives, and proven reliability across diverse applications from commercial HVAC to industrial process cooling.

The counterflow type segment maintains a substantial 42.0% market share, serving applications requiring maximum thermal efficiency, minimal footprint requirements, and superior performance in water-scarce regions where every degree of temperature approach matters for operational efficiency and water conservation.

Key advantages driving the crossflow type segment include:

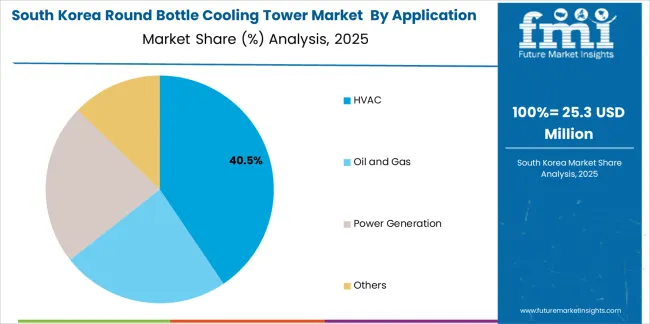

HVAC applications dominate the round bottle cooling tower market with approximately 42% market share in 2025, reflecting the critical importance of efficient heat rejection in commercial buildings, hospitality facilities, healthcare institutions, and educational campuses requiring reliable comfort cooling and ventilation system support. The HVAC segment's market leadership is reinforced by extensive commercial construction activity globally, building modernization programs replacing aging cooling infrastructure, and growing demand for energy-efficient systems meeting green building certification requirements including LEED and BREEAM standards.

The oil and gas segment represents 24.0% market share through process cooling requirements in refineries, petrochemical complexes, and LNG facilities where temperature control supports catalytic reactions, product separation, and equipment protection. Power generation accounts for 22.0% share, driven by condenser cooling needs, auxiliary system requirements, and combined-cycle plant installations. Other applications including manufacturing, food processing, and pharmaceutical production represent the remaining 12.0% market share.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to infrastructure development and efficiency requirements. First, global data center expansion creates increasing requirements for reliable cooling systems, with hyperscale facilities consuming 200-500 watts per square foot necessitating massive heat rejection capacity requiring efficient, compact cooling tower solutions supporting critical IT infrastructure. Second, industrial manufacturing growth drives process cooling demand, with chemical processing, automotive manufacturing, and electronics production requiring precise temperature control and reliable heat rejection supporting production quality and equipment protection. Third, energy efficiency initiatives through building codes, utility incentive programs, and corporate sustainability commitments accelerate adoption of high-efficiency cooling towers reducing electricity consumption through optimized fan controls, advanced fill media, and variable speed drives.

Market restraints include capital cost considerations affecting adoption decisions, particularly for smaller facilities where USD 100,000-500,000 investment ranges for round bottle towers create budget challenges compared to lower-cost alternatives or equipment retrofit approaches. Maintenance complexity regarding cylindrical tower designs poses challenges in certain configurations where access to internal components requires specialized procedures and trained technicians, potentially increasing operational costs and limiting adoption among facilities with limited technical resources. Competition from alternative cooling tower configurations including rectangular induced-draft and forced-draft designs creates market pressure, as alternative geometries may offer advantages in specific applications regarding installation flexibility, thermal performance, or maintenance accessibility.

Key trends indicate accelerated adoption of hybrid cooling towers combining wet and dry operation, particularly in water-scarce regions where hybrid systems enable significant water savings while maintaining acceptable thermal performance during most operating conditions. Technology advancement trends toward smart cooling tower systems incorporating IoT sensors, cloud connectivity, and predictive analytics are enabling remote monitoring, performance optimization, and predictive maintenance scheduling reducing downtime and extending equipment life. However, the market thesis could face disruption if alternative heat rejection technologies including air-cooled condensers or innovative closed-loop systems achieve comparable performance at lower total cost of ownership, potentially reducing cooling tower market share in certain application segments.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

The round bottle cooling tower market is gaining momentum worldwide, with China taking the lead thanks to massive infrastructure construction and industrial capacity expansion driving comprehensive cooling system requirements. Close behind, India benefits from rapid commercial development and manufacturing sector growth requiring efficient cooling infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where industrial excellence and energy efficiency standards strengthen its role in European cooling technology markets. The USA demonstrates robust growth through data center proliferation and commercial building construction, signaling continued investment in advanced cooling infrastructure. Meanwhile, Japan stands out for its technology leadership and quality-focused industrial cooling applications, while the UK continues recording progress through building modernization and efficiency upgrade programs. Together, China and India anchor the global expansion story, while established markets build efficiency improvements and technology advancement into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Round Bottle Cooling Tower Market with a CAGR of 5.7% through 2035. The country's leadership position stems from comprehensive infrastructure development programs including massive commercial construction, expanding industrial manufacturing capacity, and growing data center investments supporting digital economy transformation. Growth is concentrated in major economic centers, including Beijing, Shanghai, Guangzhou, and Shenzhen regions, where commercial building development, industrial parks, and technology infrastructure require substantial cooling capacity serving HVAC systems, process cooling, and IT facility heat rejection. Government support through energy efficiency standards and green building initiatives accelerates adoption of high-performance cooling towers meeting stringent efficiency requirements. The country's domestic manufacturing capabilities combined with substantial project pipeline create favorable environment for sustained market expansion across diverse application segments.

Key market factors:

In major metropolitan regions including Mumbai, Delhi, Bangalore, and Hyderabad, the deployment of cooling tower infrastructure is accelerating across commercial developments, industrial facilities, and IT parks, driven by rapid urbanization, manufacturing sector expansion, and growing commercial real estate development. The market demonstrates strong growth momentum with a CAGR of 5.3% through 2035, linked to comprehensive infrastructure modernization and increasing focus on energy-efficient cooling solutions addressing tropical climate requirements and operational cost pressures. Indian facility operators are implementing round bottle cooling towers in commercial buildings, manufacturing plants, and technology campuses while navigating cost sensitivity and building operational expertise managing sophisticated cooling equipment.

Germany's advanced industrial sector demonstrates sophisticated cooling tower integration, with established manufacturing facilities, commercial complexes, and institutional buildings requiring reliable, efficient heat rejection systems meeting stringent performance and environmental standards. The country's cooling infrastructure in major industrial regions showcases integration of advanced cooling technologies with existing systems, leveraging expertise in process engineering and energy management. German facility operators emphasize efficiency standards and environmental compliance, creating demand for high-performance cooling towers featuring optimized thermal design, low noise operation, and comprehensive monitoring capabilities. The market maintains steady growth through facility modernization and efficiency optimization, with a CAGR of 4.8% through 2035.

Key development areas:

Brazil's expanding industrial sector and commercial development create growing cooling tower requirements, with manufacturing facilities, commercial buildings, and power generation installations requiring efficient heat rejection infrastructure. The country shows solid potential with a CAGR of 4.4% through 2035, driven by industrial capacity expansion, commercial real estate development, and energy infrastructure investments supporting economic growth. Brazilian facility operators implement cooling towers serving diverse applications from petrochemical complexes to commercial HVAC systems while managing equipment selection, installation quality, and ongoing maintenance in diverse climate conditions.

Key market characteristics:

The U.S. market demonstrates substantial installed cooling tower base and continuing investments serving commercial buildings, industrial facilities, and power generation installations. The country shows solid potential with a CAGR of 4.0% through 2035, driven by data center proliferation, commercial building construction, and equipment replacement cycles addressing aging infrastructure. American facility operators deploy diverse cooling tower configurations optimized for specific applications from hyperscale data centers to industrial process cooling, leveraging extensive contractor networks and technical expertise supporting installation and service requirements.

Leading market segments:

The UK's cooling tower market emphasizes building modernization, efficiency upgrades, and replacement of aging infrastructure serving commercial buildings, institutional facilities, and industrial operations. The country maintains steady momentum with a CAGR of 3.6% through 2035, driven by building energy efficiency initiatives, cooling system replacement programs, and commercial development in major urban centers. British facility operators implement cooling tower upgrades meeting current efficiency standards and environmental regulations while managing building constraints and operational continuity requirements during equipment replacement projects.

Key market characteristics:

In major industrial and commercial centers including Tokyo, Osaka, Nagoya, and Fukuoka regions, facility operators utilize advanced cooling tower systems supporting commercial buildings, manufacturing facilities, and institutional complexes, with documented preferences for high-quality equipment, reliable operation, and comprehensive maintenance support. The market shows steady growth potential with a CAGR of 3.2% through 2035, linked to equipment replacement cycles, efficiency upgrade programs, and technology leadership in cooling system design and manufacturing. Japanese operators demonstrate particular emphasis on earthquake-resistant designs, space-efficient configurations, and low-noise operation reflecting dense urban environments and stringent construction standards.

Market development factors:

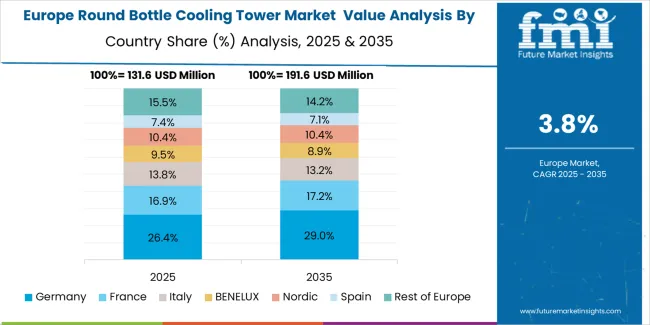

The round bottle cooling tower market in Europe is projected to grow from USD 168.0 million in 2025 to USD 245.0 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its extensive industrial infrastructure and major manufacturing regions including Baden-Württemberg, Bavaria, and North Rhine-Westphalia. France follows with a 19.8% share in 2025, projected to reach 20.2% by 2035, driven by commercial development and industrial facility requirements.

The United Kingdom holds a 17.5% share in 2025, expected to rise to 17.8% by 2035 through building modernization and commercial construction. Italy commands a 13.2% share in both 2025 and 2035, backed by industrial manufacturing and commercial cooling needs. Spain accounts for 9.5% in 2025, rising to 9.8% by 2035 on growing commercial development. The Netherlands maintains 6.8% in 2025, reaching 7.1% by 2035 on industrial and greenhouse cooling applications. The Rest of Europe region is anticipated to hold 4.7% in 2025, expanding to 4.8% by 2035, attributed to diverse infrastructure developments across Nordic countries and emerging Central & Eastern European industrial growth.

The Japanese round bottle cooling tower market demonstrates mature technology integration characterized by high-quality equipment specifications, rigorous maintenance standards, and sophisticated engineering addressing seismic requirements and urban installation constraints. Japan's emphasis on reliability and operational excellence drives demand for premium cooling tower systems featuring corrosion-resistant construction, earthquake-resistant designs, and low-noise operation meeting stringent urban environmental standards.

The market benefits from domestic manufacturing excellence and established supply relationships between Japanese cooling tower manufacturers and facility operators, creating stable procurement ecosystems prioritizing quality, reliability, and comprehensive after-sales support. Major industrial and commercial centers showcase advanced cooling tower installations serving electronics manufacturing, automotive production, commercial complexes, and institutional facilities where performance consistency and operational reliability support critical facility operations.

The South Korean round bottle cooling tower market is characterized by growing industrial development and commercial construction, with facility operators maintaining cooling infrastructure through semiconductor fabrication facilities, petrochemical complexes, commercial buildings, and district cooling systems serving urban development projects. The market demonstrates emphasis on energy efficiency and environmental compliance, as Korean operators increasingly adopt high-performance cooling towers incorporating variable speed controls, advanced fill media, and monitoring systems supporting operational optimization.

Domestic manufacturers supply substantial market share while international suppliers provide specialized equipment for demanding applications requiring proven performance and advanced features. The competitive landscape shows established domestic cooling tower manufacturers serving mainstream applications complemented by international providers offering premium systems and specialized technologies for sophisticated industrial and commercial installations.

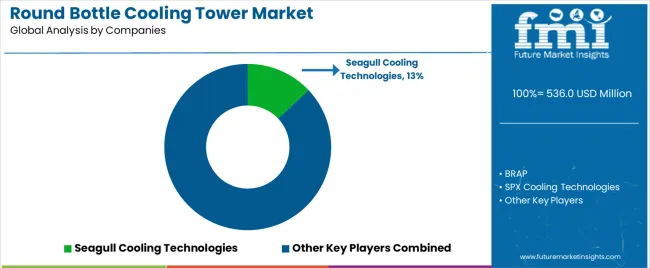

The round bottle cooling tower market features approximately 25-35 meaningful players with moderate fragmentation, where established cooling tower manufacturers and specialized regional suppliers compete across diverse application segments and geographic markets. Market share distributes across global industrial equipment manufacturers, regional cooling tower specialists, and local fabricators serving specific markets, with competition varying by application segment, capacity range, and geographic region. Competition centers on thermal performance, equipment reliability, and total cost of ownership rather than equipment price alone, as end-users prioritize proven designs, vendor technical support, and lifecycle economics in cooling tower selection and procurement decisions.

Seagull Cooling Technologies leads the market with 13% share because of its high-efficiency designs, durable FRP construction, and strong service network that ensures reliable performance across industrial and HVAC applications. Market leaders include Seagull Cooling Technologies, BRAP, and SPX Cooling Technologies, which maintain competitive advantages through decades of cooling tower engineering experience, comprehensive product portfolios spanning multiple capacity ranges and configurations, and global project execution capabilities supporting equipment supply, installation supervision, and commissioning services. These companies leverage extensive installed base providing operational experience and customer relationships, research and development capabilities advancing fill media designs and airflow optimization, and comprehensive service networks supporting equipment maintenance and performance optimization across diverse operating environments.

Challengers encompass Hamon, ENEXIO, and Baltimore Aircoil Company (BAC), which compete through specialized technology focus, regional market strength, or integrated cooling solutions combining towers with auxiliary equipment. Specialized manufacturers, including Kobelco Eco-Solutions, Paharpur Cooling Towers, and EBARA, focus on particular geographic markets or application niches including industrial process cooling or power generation applications, offering differentiated capabilities in corrosion-resistant construction, customized designs, or value-engineered solutions.

Regional suppliers including Laxun Cooling Tower, EVAPCO, KUKEN, and others create competitive dynamics through localized manufacturing advantages, responsive customer service, and cost-effective solutions serving specific markets. Market dynamics favor companies that combine proven thermal performance with comprehensive support services and flexible commercial approaches addressing diverse customer requirements from turnkey supply through equipment-only procurement, alongside ongoing service relationships ensuring optimal system performance, efficient operation, and extended equipment life through preventive maintenance programs and performance optimization services.

Round bottle cooling towers represent specialized heat rejection systems that enable facility operators to achieve efficient cooling within compact footprints and aesthetically compatible cylindrical configurations, typically delivering 15-25% energy savings through optimized designs compared to older tower technologies while supporting diverse applications from commercial HVAC to industrial process cooling. With the market projected to grow from USD 536 million in 2025 to USD 808.8 million by 2035 at a 4.2% CAGR, these engineered systems offer compelling value - space efficiency, operational reliability, and performance optimization - making them essential for HVAC applications (42.0% market share), oil and gas facilities (24.0% share), and industrial operations requiring efficient heat rejection within constrained sites, rooftop installations, and urban environments where circular tower profiles offer installation advantages and architectural compatibility. Scaling effective deployment and optimizing performance requires coordinated action across energy policy, technical standards, equipment manufacturers, engineering contractors, and operator training initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 536 million |

| Flow Configuration Type | Crossflow Type, Counterflow Type |

| Application | HVAC, Oil and Gas, Power Generation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Seagull Cooling Technologies, BRAP, SPX Cooling Technologies, Hamon, ENEXIO, Baltimore Aircoil Company (BAC), Kobelco Eco-Solutions, Paharpur Cooling Towers, EBARA, Laxun Cooling Tower |

| Additional Attributes | Dollar sales by flow configuration type and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with established cooling tower manufacturers and specialized regional suppliers, thermal performance optimization through advanced fill media and airflow design, energy efficiency technologies including variable speed drives and demand-based controls, water conservation approaches including hybrid cooling and closed-loop systems, installation considerations for rooftop and constrained sites, and operational optimization strategies including predictive maintenance and performance monitoring capabilities. |

The global round bottle cooling tower market is estimated to be valued at USD 536.0 million in 2025.

The market size for the round bottle cooling tower market is projected to reach USD 808.8 million by 2035.

The round bottle cooling tower market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in round bottle cooling tower market are crossflow type and counterflow type.

In terms of application, hvac segment to command 42.0% share in the round bottle cooling tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Ground and Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Resistance Testers Market Growth - Trends & Forecast 2025 to 2035

Ground Fault Circuit Interrupter Market

Wraparound Case Packers Market Size and Share Forecast Outlook 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Wrap Around Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Aboveground Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Underground Cabling EPC Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Wrap Around Label Films Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Wrap-Around Label Industry

Competitive Overview of Underground Mining Equipment Market Share

Wrap-Around Label Market from 2025 to 2035

Underground Storage Tanks Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA