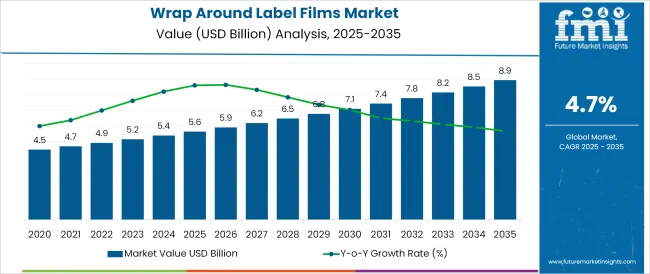

The Wrap Around Label Films Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The wrap around label films market is witnessing steady expansion fueled by demand from beverage, personal care, and food packaging sectors seeking high-speed, cost-efficient, and visually engaging labeling formats. As brands intensify shelf-appeal strategies and sustainability initiatives, wrap around labels are being adopted for their printability, recyclability, and compatibility with high-throughput packaging lines.

Manufacturers are focusing on material innovations, particularly in polyolefin and polyethylene-based films, which offer durability and clarity while supporting eco-friendly initiatives such as monomaterial packaging. Advancements in surface treatments and coatings are enhancing ink adhesion, scuff resistance, and gloss retention, making these films more functional and brand aligned.

Moreover, the growing shift toward roll-fed labeling systems and shrink-sleeve alternatives is accelerating demand for lightweight and cost-effective labeling solutions. The market is expected to continue its trajectory of innovation with developments in recyclable barrier coatings, smart label compatibility, and regional expansions by packaging converters catering to FMCG and industrial segments.

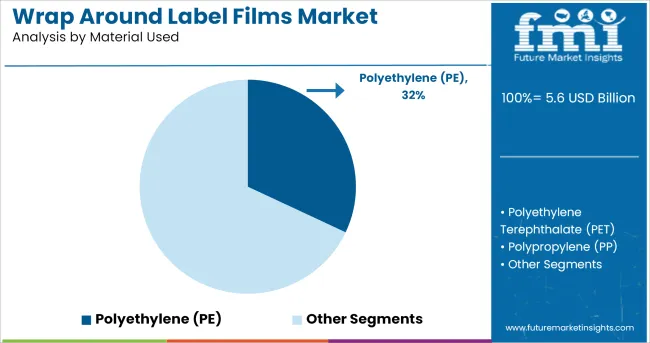

The market is segmented by Material Used, Film Type, Appearance, Printing, and End-Use Industries and region. By Material Used, the market is divided into Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Biaxial Oriented Polypropylene (BOPP), Cast Propylene (CPP), and Others (Glass, Papers, etc.).

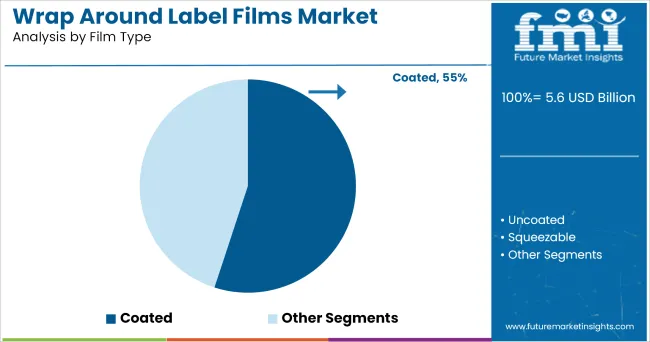

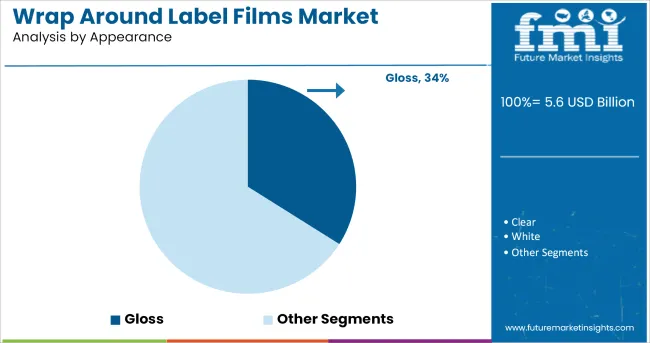

In terms of Film Type, the market is classified into Coated, Uncoated, and Squeezable. Based on Appearance, the market is segmented into Gloss, Clear, White, and Metallic. By Printing, the market is divided into Flexographic and Digital. By End-Use Industries, the market is segmented into Food & Beverages, Homecare, Pharmaceuticals, Personal care & Cosmetics, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene-based wrap around label films are projected to account for 32.0% of total revenue by 2025, positioning this material as a leading choice in the market. This dominance is underpinned by PE’s inherent flexibility, low density, and cost-effectiveness, which make it suitable for high-speed application on curved containers across beverage and dairy products.

The material’s compatibility with both gravure and flexographic printing, as well as its recyclability, has reinforced its preference in sustainable packaging solutions. Technological enhancements have improved PE film clarity, stiffness, and ink adhesion broadening its functional scope.

Additionally, PE films are increasingly being engineered as monomaterial laminates, supporting circular economy goals while maintaining branding effectiveness. These advantages have ensured continued adoption of polyethylene in wrap around label film manufacturing, particularly among converters serving volume-driven packaging sectors.

Coated films are anticipated to hold a commanding 55.0% revenue share by 2025 within the film type category, making them the top-performing segment. This leadership stems from the enhanced functionality coatings provide, including better ink adhesion, moisture resistance, heat stability, and surface durability.

Coated films enable superior print finishes, ensuring color vibrancy and brand consistency even under challenging storage or transport conditions. The coatings also contribute to the label’s ability to withstand condensation and abrasion, which is critical in cold-chain environments such as beverage and dairy packaging.

Manufacturers have been investing in barrier and scuff-resistant coating technologies that not only elevate the visual appeal but also extend the lifecycle of the label. The value-added performance and aesthetic enhancements offered by coated films have solidified their dominant role in wrap around labeling applications.

Gloss-finished wrap around label films are forecast to command 34.0% of total revenue by 2025 in the appearance category, placing them at the forefront of visual performance preference. The popularity of glossy finishes is driven by their ability to deliver a premium, high-impact look that enhances brand visibility on crowded retail shelves. Gloss surfaces amplify color vibrancy, sharpness, and depth, which are critical for marketing and consumer engagement.

In addition, advancements in coating and calendaring techniques have led to improved gloss retention, scratch resistance, and UV protection, ensuring long-term durability without compromising appearance.

Gloss labels are especially favored in product segments such as carbonated drinks, personal care, and premium dairy, where visual differentiation is central to brand positioning. These attributes have ensured sustained demand for gloss-finished films across diverse labeling applications.

Wrap around label films (WAL) are used to make products differentiable due to visual factors. Packaging industry is extensively benefitted from usage of wrap around label films. Wrap around label films create a brand value and provide extensive features to a product and increases its point of sales.

Some of the major properties include resistance to water, heat sealing, tamper evident, colour protection and tear strength. WAL films are mostly used in FMCG, healthcare, cosmetics and personal care industries. Most importantly wrap around label films can be easily customized in accordance to desirable attributes stated by client. These factors will augment the demand for wrap around label films in the forecasted period.

Wrap around label films are an important product for brand owners in packaging of their products. This market is majorly driven by need of sustainable packaging for unique identification of an exquisite product and differentiate it from other products available in the market.

Increasing concerns of resource degradation and environment protection, the factor for sustainability also contribute to the rise in demand for biodegradable wrap around label films. Rise in FMCG sector will exponentially increase the demand for wrap around label films during forecast period. These factors are anticipated to accelerate the wrap around label films market.

Manufacturers are aiming for a continuous product level improvement in wrap around label films. Major opportunity has risen in recent times as stores and hypermarkets has enhanced the 360-degree product wrapping which has ascended the growth of wrap around label films market.

Cosmetics, home care and healthcare industries have significantly increased the usage of wrap around label films to differentiate their product in market. This factors have created vast opportunities for key players in wrap around label films market.

Changing environmental protection policies and implementation of stringent rules and regulations has created a surge in production of biodegradable wrap around films. This trend has gained a prominent base in North American and European markets, and is continuing to spread across the globe.

Moreover, upcoming printing technology such as UV, Flexography and Gravure is showing promising results in trial runs. These trends will positively impact the target market towards a profitable future.

High costs and recycling issues are the factors which pose a threat to growth of wrap around label films market. But with changing trends and adoption of biodegradable wrap around label films the recycling issues are overcome and it augments the demand of wrap around label films for the forecast period.

Global Players:

APAC Players:

The players operating in the wrap around label films market are trying to increase their market reach by expanding their presence in the untapped regions. Also, the key players are trying to focus on increasing their production capacity by developing their manufacturing facilities or through acquisitions:

South Korea will capture a significant portion of the wrap around label films market by the end of the 2035 due to an exponential increase in packaging for personal care & cosmetics, pharmaceutical products. Also, factors that will lead to South Korea’s rise in market share are low tax rate on cosmetics and personal care products and skilled labour which is extensively available and cheap.

The increasing numbers of South Korean end-use industries such as FMCG, online retail, home care products will cause a positive impact of the country’s share in APAC market. All these factors considered South Korea will have a major hold in the wrap around label films market during forecast period.

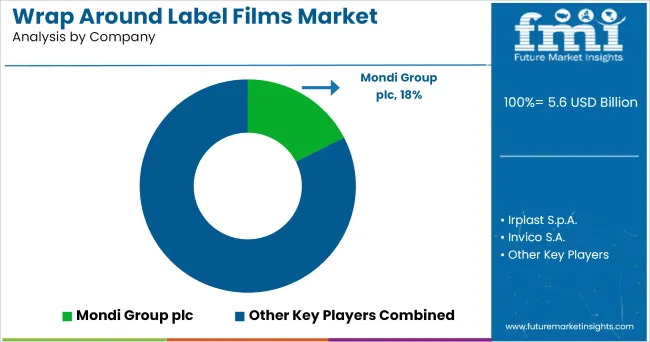

The global wrap around label films market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the wrap around label films market is projected to reach USD 8.9 billion by 2035.

The wrap around label films market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in wrap around label films market are polyethylene (pe), polyethylene terephthalate (pet), polypropylene (pp), biaxial oriented polypropylene (bopp), cast propylene (cpp) and others (glass, papers, etc.).

In terms of film type, coated segment to command 55.0% share in the wrap around label films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Wrapping Tissues Market Size and Share Forecast Outlook 2025 to 2035

Wrapping and Bundling Machines Market Size and Share Forecast Outlook 2025 to 2035

Wrapping Machine Market

Wraparound Case Packers Market Size and Share Forecast Outlook 2025 to 2035

Wrap Around Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Wrap-Around Label Industry

Wrap-Around Label Market from 2025 to 2035

Wrap Around Labelling Machine Market

C Wrap Labelling Machine Market

Overwrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Overwrapping Machine Manufacturers

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Book Wraps Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Hand Wrappers Market Trends - Growth & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA