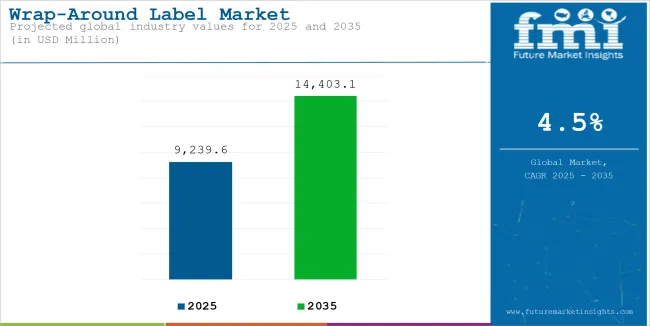

The market size of wrap-around label is estimated to be worth USD 9,239.6 million in 2025 and is anticipated to reach a value of USD 14,403.1 million by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. The revenue generated by wrap-around label in 2024 was USD 9,162.5 million.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 9,162.5 million |

| Estimated Size, 2025 | USD 9,239.6 million |

| Projected Size, 2035 | USD 14,403.1 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

Wrap-around labelling is commonly in use within the beverage sector as it has a wider surface area that can be used for branding purposes, nutritional information as well as designing eye-catching labels. Further, they can fit nearly all bottle shapes and the cost of high-volume production is low. Thereby, wrap-around labels are used heavily in the beverage industry for several beverages, thus this industry is estimated to have more than 36% share by 2035 of the wrap-around label market.

Shrink labels compared to other products are likely to account for over 32% of the market share over the forecast period. Brands use shrink labels since they tightly mould to the shape of a product, hence making it look smooth and attractive. They fit most container sizes, enhance branding visibility, and have tamper-evident features, which are suitable for beverages and consumer goods.

During the forecast period, the wrap-around label market is expected to offer profitable prospects, having an incremental opportunity of USD 5240. million and increasing 1.5 times the present value by 2035.

The below table presents the expected CAGR for the global wrap-around label market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 4.3% (2024 to 2034) |

| H2 | 4.7% (2024 to 2034) |

| H1 | 3.6% (2025 to 2035) |

| H2 | 5.4% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2033, the business is predicted to surge at a CAGR of 4.3%, followed by a slightly higher growth rate of 4.7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.6% in the first half and remain relatively moderate at 5.4% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed an increase of 70 BPS.

The section contains information about the leading segments in the industry. In terms of material, paper is estimated to account for a share of above 90% by 2035. By end use, beverages are projected to dominate by holding a share of 36.9% by the end 2035.

| Material | Paper |

|---|---|

| Market Share (2035) | 89.7% |

Paper labels have minimal impact on the environment since they are easy to degrade and recycle. This makes many of today's consumers more conscious about sustainability and therefore opt for those products that provide an environment-friendly packaging option.

Such factors coupled with superior print quality and environmental benefits, flexibility bring to a lot of usage of paper for wrap-around labels. Paper materials are easily printable and allow high-quality graphics and information written on them. This is important for branding, as intriguing designs catch consumers' eyes and help products stand out on shelves.

| End Use | Beverages |

|---|---|

| Market Share (2035) | 36.9% |

Wrap-around labels are primarily used for beverages because they allow for 360-degree branding and product information and also for regulatory requirements. Such labels are preferred by beverage companies to provide a fantastic design that attracts consumers and enhances shelf appeal. They use flexible materials that can adapt to bottle shapes and sizes for a smooth, professional look.

Wrap-around labels also resist moisture, making them ideal for refrigerated or chilled beverages. In addition, they have cost-effectiveness and compatibility with high-speed labelling machines, hence mass production is possible. It makes wrap-around labels the beverage favorite because it is durable, visually appealing, and can be applied easily.

High Demand for Wrap Around Labels for Improved Shelf Appeal of Products

The major driving factor for the increased demand for wrap-around labels is the improved shelf appeal they offer. These labels cover the entire circumference of a product with a view of all 360 degrees, which makes products a lot more visually interesting. Consumers are likely to pay more attention to the striking and unique designs of the products on the crowded shelves.

It allows showing branding, product details, and visuals from all sides, attracting attention and leaving a memorable impression. With growing competition in the market, brands are using wrap-around labels to differentiate their products, increase visibility, and capture consumer interest. This usually results in increased sales and, therefore, is one of the reasons for the popularity of wrap-around labels in different industries.

Need of Tamper Evident Packaging Drives Demand for Wrap Around Labels

Consumers have become concerned with regards to the security and authenticity of the goods they purchase. For this reason, brands incorporate packaging solutions that display clear signs of tampering. Wrap-around labels may be an effective way for clients to implement their tamper-evident features, which include seals or perforations, which will be broken when the package is opened.

This visual indicator makes sure that customers know that nothing has been altered or compromised about the product. In food, beverages, and pharmaceuticals where the safety of the product becomes a critical issue, tamper-evident labels are gaining importance. This attribute of creating tamper-evident seals promotes product safety, which is the most important issue for consumer confidence and a primary motivator for the wrap-around labels market.

High Material Costs and Incompatibility with Irregular Shaped Products May Limit Adoption

Manufacturers using regular labelling equipment often have problems in applying wrap-around labels consistently and accurately, particularly on high-speed production lines. These problems result in misalignment, wrinkles, or improper application, which ultimately affect the overall quality of the packaging. Achieving the desired precision may require manufacturers to upgrade their equipment, thereby increasing operational costs.

Labelling errors also can cause slower production speeds, resulting in decreased efficiency, increased production time, and higher labour costs. Such technological constraints may act as a hindrance to the growth of the wrap-around labels market, especially for small businesses with fewer investments in new equipment.

The global wrap-around label market recorded a CAGR of 3.9% during the historical period between 2020 and 2024. Market growth of wrap-around label was positive as it reached a value of USD 9,162.5 million in 2024 from USD 7,558.1 million in 2020.

In recent years, worldwide sales of wrap-around labels have been increasing due to growing interest in customized, visually appealing packages. The highest demand has arisen from beverage and food companies followed closely by pharmaceutical and other related segments, using them mainly for enhanced brand identity and anti-tamper features.

Growth has been supported by innovations in sustainable materials and automated application methods, but material costs and compatibility with non-conventional packaging shapes remain challenges.

The coming years will experience an increase in the demand for wrap-around labels because of the changing consumer preference to green packaging and increased rules on product safety. Brands will use recyclable and biodegradable materials to support their sustainability goals. The market will also grow across cosmetic and personal care sectors, where the packaging aspect supports brand visibility and product integrity.

Tier 1 companies comprise market leaders with significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Amcor plc, Huhtamaki Oyj, Sato Holdings Ltd, Avery Dennison Corp, among others.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Klockner Pentaplast Group, Multi Color Corporation, Derksen Co; Traco Packaging, Edwards Label, Inc., CCL Industries Inc., Holostik Group, Dase-Sing Packaging Technology Co., Fuji International Inc., Century Label, Resource Label Group and Cosa.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for the wrap-around label market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. Canada is anticipated to remain at the forefront in North America, with a CAGR of 3.8% through 2035. In Europe, Spain is projected to witness a CAGR 3.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Germany | 3.7% |

| China | 5.1% |

| UK | 3.9% |

| Spain | 3.6% |

| India | 5.3% |

| Canada | 3.8% |

Wrap-around labels are increasingly being used in the retail sector of India, as they contain important product information and help to differentiate brands. Changes in consumer preference in the form of packaging and increasing spending bring this demand even further, making it an important part of their retail marketing strategies.

In addition, growing environmental awareness has made several companies opt for eco-friendly alternatives in their wrap-around labels, which further increases the demand in the retail market. Wrapping of products has increased with the increase in the number of products and has developed into a necessity due to their importance in effective branding in the retail landscape in India.

Wrap-around labels are in demand more as the products are sold more directly to the customers. Due to e-commerce, firms have to resort to efficient labelling solutions so that their products may be differentiated and meet all guidelines.

They come with 360-degree visibility; hence, they are ideal for branding and any sort of details one needs to make on the products, such as ingredients or how to use the product. This is because more consumers today order products over the internet, and thus, there is a very important demand for clearly attractive packaging that leads to an increase in wrap-around labels mostly in e-commerce.

Key players of wrap-around label industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Wrap-Around Label Market

In terms of material, the wrap-around label market is divided into paper and plastic.

In terms of product, the wrap-around label market is segmented into stretch label, shrink label, cut and stack label, roll fed label and pressure sensitive label.

The wrap-around label market includes rotogravure printing, flexographic printing, offset printing, digital printing, letterpress printing, thermal printing.

Some of end users in the wrap-around label market include food, beverages, cosmetics & personal care, pharmaceuticals, chemicals, home care and pet care and other consumer goods.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

The wrap-around label industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global wrap-around label industry stood at USD 9,162.5 million in 2024.

Global wrap-around label industry is anticipated to reach USD 9,239.6 million by 2035 end.

South Asia & Pacific is set to record a CAGR of 5.3% in assessment period.

The key players operating in the wrap-around label industry are Amcor plc, Huhtamaki Oyj, Sato Holdings Ltd, Avery Dennison Corp, among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Positioning & Share in the Wrap-Around Label Industry

Labels Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Competitive Overview of Labels Companies

Key Players & Market Share in the Label Applicators Industry

Competitive Breakdown of Labeling Equipment Providers

Labeling Software Market Growth - Trends & Forecast through 2034

Label Printing Software Market – Smart Labeling & Automation

GHS Label Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

GMO Labelling Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among USA Labels Providers

Leading Providers & Market Share in GHS Label Industry

Foam Labels Market Trends and Growth 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA