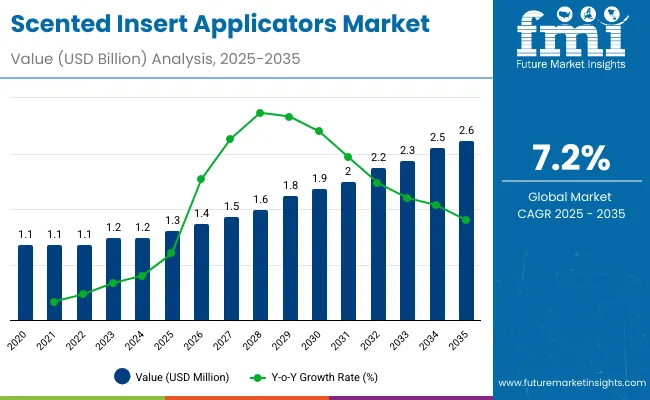

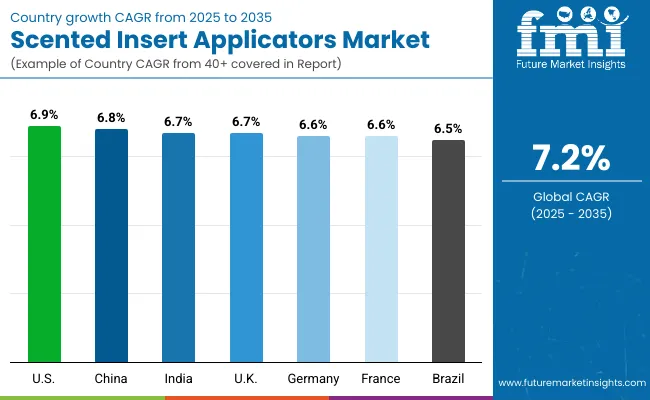

The Scented Insert Applicators Market will expand from USD 1.3 billion in 2025 to USD 2.6 billion by 2035, growing at a CAGR of 7.2%. Expansion is driven by automation in fragrance delivery systems and premiumization in packaging aesthetics. Robotic applicators dominate due to efficiency and precision in insert placement. From 2025 to 2030, fragrance technology integration will generate over USD 0.7 billion in new opportunities. By 2035, demand for personalized scents and digitally programmable inserts will strengthen adoption across FMCG and cosmetics manufacturing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 7.2% |

Between 2020 and 2024, scented insert automation advanced rapidly with smart packaging technologies enhancing sensory brand engagement. The trend toward personalized fragrance delivery in personal care and air freshener packaging boosted R&D investment. By 2035, the market will reach USD 2.6 billion, supported by microencapsulation, robotic precision systems, and sustainable refillable fragrance formats. Asia-Pacific leads with large-scale adoption in cosmetics packaging and luxury branding, while North America focuses on smart fragrance tracking integration.

Growth is fuelled by rising consumer preference for sensory packaging, premium product experiences, and automation in scent delivery. Brands increasingly integrate microencapsulated technology for controlled fragrance release, while robotic systems improve application accuracy. Growing demand for sustainable, refillable, and interactive packaging further supports adoption across cosmetics, home fragrance, and beverage industries.

The market is segmented by technology, fragrance delivery type, application, material compatibility, and region. Key technologies include robotic, semi-automatic, and pneumatic applicators. Fragrance types span microencapsulated, gel-based, and polymer-embedded inserts. Major applications include cosmetics, home care, and retail branding, while materials comprise plastic films, paper, and flexible laminates.

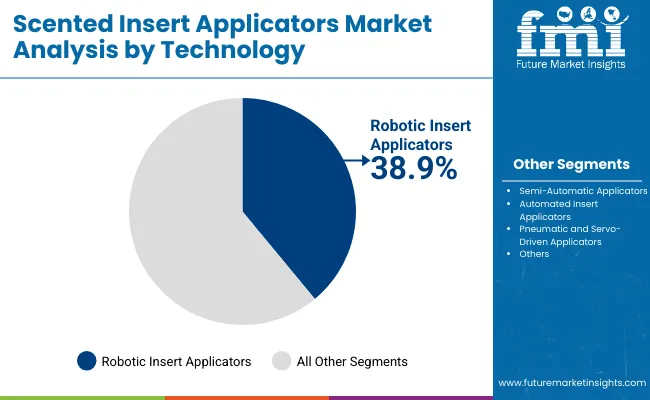

Robotic insert applicators will command 38.9% share in 2025, driven by automation efficiency and precision. These systems ensure consistent fragrance placement and reduce wastage. By 2035, integration of machine learning and adaptive robotics will optimize multi-line operations, enhancing throughput in personal care and retail packaging industries globally.

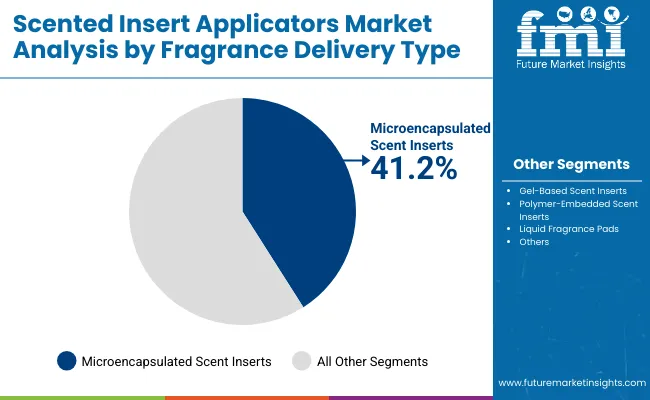

Microencapsulated scent inserts will capture 41.2% share in 2025 due to long-lasting scent performance and controlled diffusion. Their encapsulation technology maintains aroma quality through distribution. By 2035, innovations in biodegradable microcapsules will strengthen adoption across air freshener and cosmetic packaging segments.

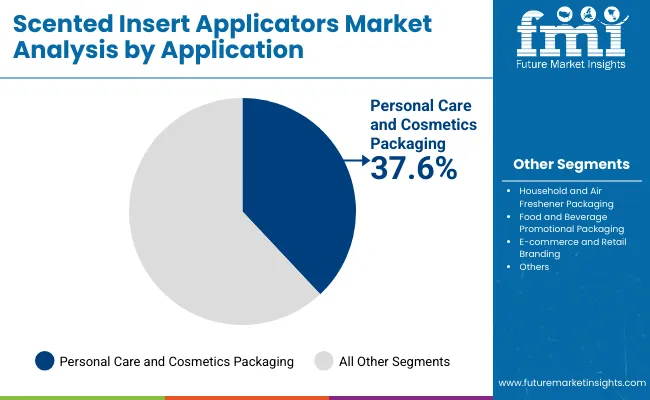

The personal care and cosmetics segment will hold 37.6% share in 2025, supported by luxury and fragrance-infused branding. Scented applicators enhance consumer engagement and brand recall. By 2035, integration of smart scent modulation systems and refillable fragrance pods will sustain segment dominance.

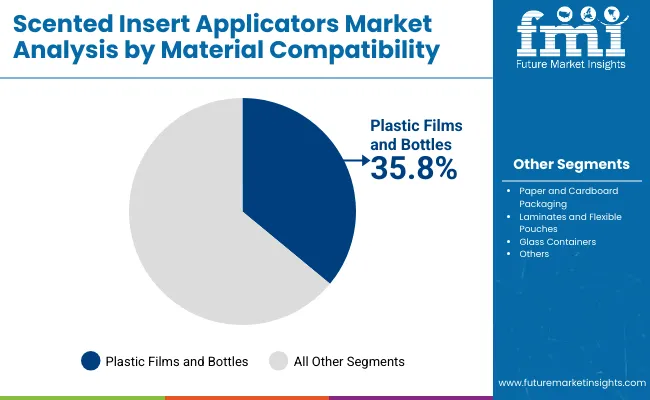

Plastic films and bottles will account for 35.8% share in 2025, favoured for cost-effectiveness and compatibility with automated applicators. These materials support transparent branding and controlled scent diffusion. By 2035, recyclable and bio-based plastics will become the material of choice in premium packaging.

The global scented insert applicators market is expanding as brands integrate fragrance automation to enhance sensory appeal, product identity, and consumer engagement. Asia-Pacific leads adoption with large-scale cosmetic and personal care production, while North America and Europe advance through sustainable, AI-driven scent packaging innovations. Automation, robotics, and eco-scent microcapsule technologies are revolutionizing the delivery of fragrances across cosmetics, home care, and retail packaging, supporting a transition toward smart, experiential product marketing.

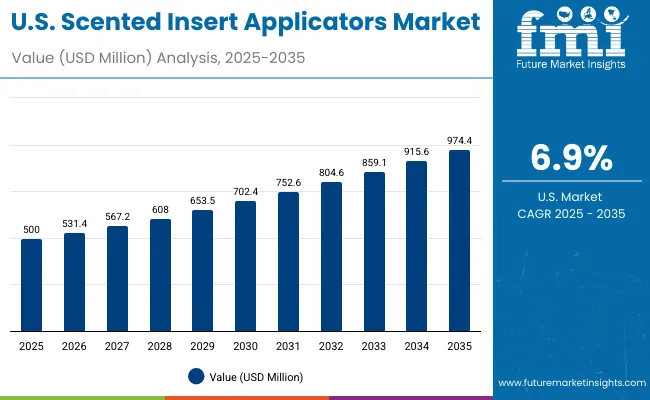

The USA will grow at 6.9% CAGR, driven by automation and premiumization in personal care and home fragrance packaging. Digital scent delivery programs are expanding adoption across luxury and lifestyle brands. AI-integrated robotics are enhancing production precision and aesthetic consistency in packaging lines. The demand for eco-scent formats made from biodegradable capsules is gaining traction, aligning with sustainable product development and green marketing strategies.

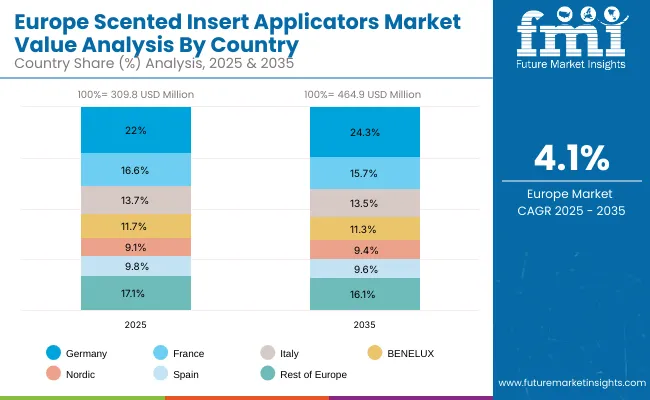

Germany will expand at 6.6% CAGR, focusing on sustainability and automation within fragrance applicator systems. Energy-efficient machinery is dominating new installations in cosmetics and home scent lines. Compliance with EU eco-design and emissions regulations is supporting the deployment of low-waste, recyclable insert technologies. Growth in Germany’s cosmetics and air-care industries continues to drive integration of automated fragrance dispensing systems across smart manufacturing environments.

The UK will grow at 6.7% CAGR, emphasizing personalization and luxury in fragrance packaging. Smart fragrance branding tools are being implemented across premium gift and e-commerce categories. Robotic automation is improving production line efficiency and scalability in scented product assembly. With the rise of digital retail and customized scent experiences, fragrance inserts are becoming key elements in online gifting and consumer interaction strategies.

China will grow at 6.8% CAGR, propelled by rapid industrial automation and domestic robotics expansion. Large-scale fragrance packaging production is improving output capacity and reducing manufacturing costs. Local robotics firms are innovating in AI-controlled applicator systems for cosmetics and home fragrance lines. Smart factory integration and rising consumer demand for affordable luxury fragrances continue to strengthen China’s leadership in automated scent packaging.

India will grow at 6.7% CAGR, supported by strong expansion in cosmetics, home fragrance, and FMCG sectors. Affordable automated systems are enabling mid-tier brands to adopt scented insert technology. Increasing fragrance adoption across detergent and personal care segments is driving demand for efficient applicator lines. Pilot projects in smart and recyclable scent packaging are gaining visibility among major FMCG producers.

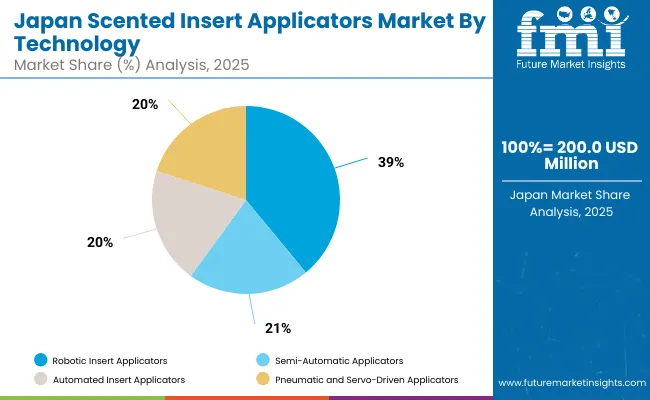

Japan will grow at 7.5% CAGR, leading innovation in robotic micro-scent technology for cosmetics and personal care applications. Precision automation ensures uniform scent distribution and product consistency. Smart insert controls are improving performance in compact packaging systems. R&D initiatives are focusing on recyclable and biodegradable microcapsules to align with Japan’s sustainability commitments and advanced materials engineering expertise.

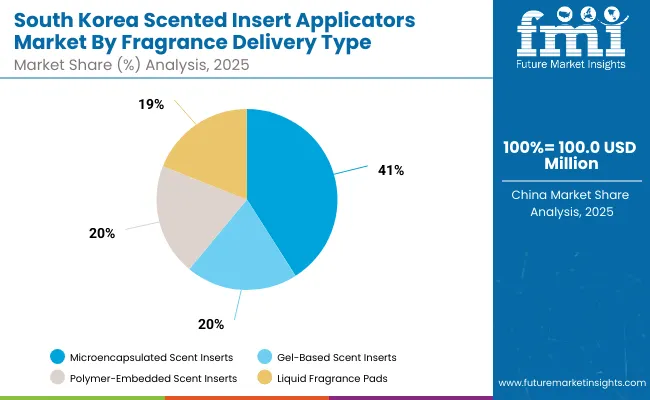

South Korea will lead with 7.6% CAGR, driven by K-beauty’s influence and luxury scent packaging integration. Smart fragrance automation is being deployed across premium cosmetics and skincare brands. AI and IoT technologies are optimizing delivery accuracy and refill efficiency in high-end product packaging. The trend of scented inserts in e-commerce packaging is rising rapidly, reflecting South Korea’s leadership in digital retail and experiential product design.

Japan’s scented insert applicators market, valued at USD 200.0 million in 2025, is led by robotic insert applicators with a 38.8% share, owing to their precision, efficiency, and reduced labor dependency. Semi-automatic applicators find demand in mid-scale packaging operations, offering a balance between automation and control. Automated insert applicators are gaining momentum in fragrance and cosmetic packaging. Pneumatic and servo-driven applicators support high-speed production, aligning with Japan’s industrial automation standards and sustainability-driven packaging innovation.

South Korea’s scented insert applicators market, valued at USD 100.0 million in 2025, is dominated by microencapsulated scent inserts, holding 40.8% share, favoured for long-lasting fragrance diffusion and controlled release properties. Gel-based scent inserts are popular in consumer goods and automotive interiors. Polymer-embedded scent inserts expand in premium product packaging, while liquid fragrance pads gain traction for personal care and ambient applications, supported by South Korea’s advanced material engineering and lifestyle-oriented innovation.

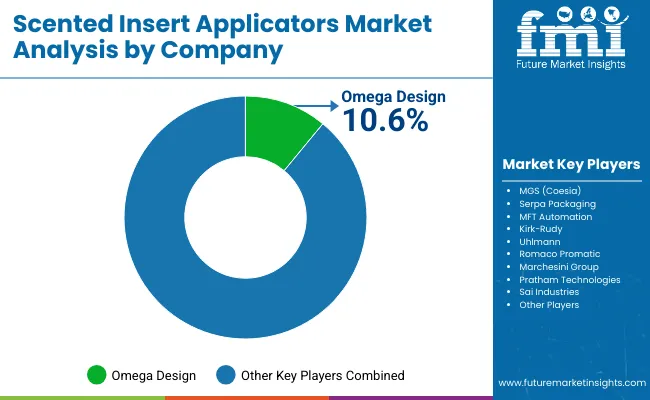

The market is moderately consolidated with Omega Design, MGS (Coesia), Serpa Packaging, MFT Automation, Kirk-Rudy, Uhlmann, RomacoPromatic, Marchesini Group, Pratham Technologies, and Sai Industries as key players. Companies focus on integrating robotics, high-speed automation, and eco-friendly scent systems. Omega Design and MGS lead with multi-line systems, while Marchesini and Romaco emphasize cosmetic packaging innovation.

Key Developments of Scented Insert Applicators Market

| Item | Value |

| Quantitative Units | USD 1.3 Billion |

| By Technology | Robotic, Semi-Automatic, Pneumatic |

| By Fragrance Delivery | Microencapsulated, Gel-Based, Polymer-Embedded, Liquid Pads |

| By Application | Cosmetics, Household, Food & Beverage, E-Commerce |

| By Material | Plastic, Paper, Laminates, Glass |

| Key Companies Profiled | Omega Design, MGS (Coesia), Serpa Packaging, MFT Automation, Kirk-Rudy, Uhlmann, Romaco Promatic, Marchesini Group, Pratham Technologies, Sai Industries |

| Additional Attributes | Growth driven by robotics, smart scent diffusion, and eco-friendly packaging automation. |

The Scented Insert Applicators Market is valued at USD 1.3 billion in 2025.

The market will reach USD 2.6 billion by 2035.

The Scented Insert Applicators Market will expand at a CAGR of 7.2%.

Robotic insert applicators lead with 38.9% share in 2025.

Microencapsulated scent inserts dominate with 41.2% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Scented Trash Bags Market Size and Share Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Scented Candle Market

Competitive Overview of Scented Trash Bags Companies

Scented Candlе Industry Outlook

Scented Paper Market Trends – Growth & Forecast 2024-2034

Insert Trays Market

Market Share Insights of Unscented Moisturizer Providers

Unscented Moisturiser Market Growth – Trends & Forecast 2024-2034

Shoe Insert Market Size and Share Forecast Outlook 2025 to 2035

Bolt Insertion Machine Market Size and Share Forecast Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Label Applicators Industry

Custom Inserts Market

Vaginal Inserts Market Size and Share Forecast Outlook 2025 to 2035

Mascara Applicators Market Size and Share Forecast Outlook 2025 to 2035

UK Shoe Insert Market Insights – Growth, Share & Industry Trends 2025-2035

Bio-Foam Insert Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hang Tag Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fastener Insertion Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Scarfing Inserts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA