The Shoe Insert market is experiencing steady growth driven by increasing awareness of foot health and the rising adoption of comfort-enhancing footwear solutions across global populations. The future outlook for this market is shaped by innovations in materials and ergonomic designs, which provide enhanced support, cushioning, and pressure distribution. Growing concerns regarding foot disorders, such as plantar fasciitis and flat feet, are encouraging consumers to invest in specialized insoles, further fueling demand.

Additionally, the expansion of the sports and athleisure sectors has contributed to the increasing use of shoe inserts to improve performance and reduce fatigue. Technological advancements in polymers and other base materials are enabling more durable and lightweight designs, enhancing consumer experience.

The market is further supported by rising disposable incomes and changing lifestyles, leading to higher spending on premium comfort and orthopedic products With an increasing focus on personalized and performance-driven footwear solutions, the Shoe Insert market is poised for continued growth across diverse demographic and geographic segments.

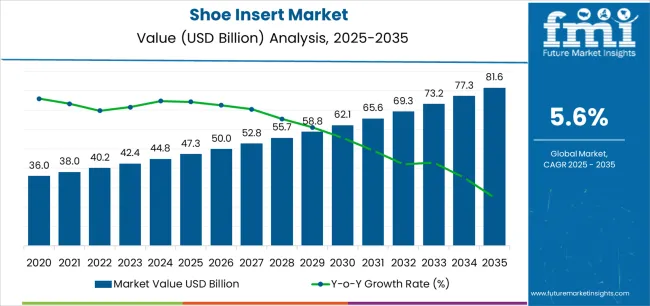

| Metric | Value |

|---|---|

| Shoe Insert Market Estimated Value in (2025 E) | USD 47.3 billion |

| Shoe Insert Market Forecast Value in (2035 F) | USD 81.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

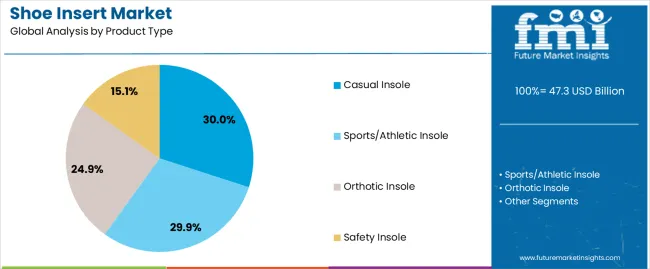

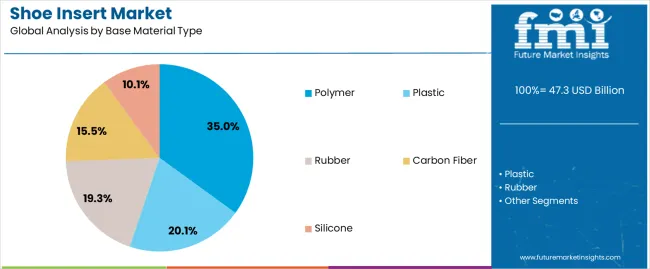

The market is segmented by Product Type, Base Material Type, Consumer Orientation, and Sales Channel and region. By Product Type, the market is divided into Casual Insole, Sports/Athletic Insole, Orthotic Insole, and Safety Insole. In terms of Base Material Type, the market is classified into Polymer, Plastic, Rubber, Carbon Fiber, and Silicone.

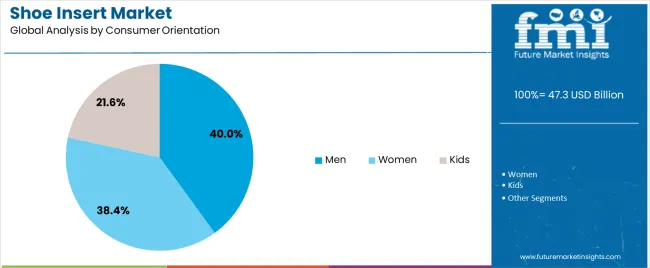

Based on Consumer Orientation, the market is segmented into Men, Women, and Kids. By Sales Channel, the market is divided into Direct, Indirect, Hypermarkets/Supermarkets, Departmental Stores, Specialty Stores, Multi-brand Stores, Exclusive Stores/Franchised Stores, Online Retailers, and Other Sales Channel.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The casual insole product type segment is projected to hold 30.00% of the Shoe Insert market revenue share in 2025, making it the leading product type. This dominance is driven by the widespread adoption of casual insoles in daily footwear for both comfort and injury prevention. The segment has benefited from increasing consumer preference for ergonomically designed solutions that can be easily integrated into existing shoes.

The versatility and adaptability of casual insoles for multiple shoe types have further reinforced their demand. Additionally, continuous innovation in cushioning and support technology has improved foot comfort, which has become a critical factor for consumers seeking relief during prolonged periods of standing or walking.

The availability of casual insoles in various sizes and materials, along with growing awareness regarding foot health, has contributed to their leading position As lifestyle and comfort considerations continue to influence footwear choices, casual insoles are expected to maintain their prominence in the market.

The polymer base material type segment is expected to account for 35.00% of the Shoe Insert market revenue share in 2025, making it the leading material segment. The growth of this segment is primarily driven by the superior cushioning, durability, and lightweight characteristics offered by polymer-based insoles. These materials provide enhanced shock absorption and maintain structural integrity over prolonged usage, which increases consumer trust and satisfaction.

The flexibility of polymer materials allows for customization in terms of thickness, density, and shape, meeting the specific needs of different footwear designs and consumer preferences. Additionally, polymer insoles are compatible with advanced manufacturing processes, enabling scalable production and cost efficiency.

The segment has also been supported by increasing awareness regarding material safety and hygiene, as polymers can offer antimicrobial and moisture-wicking properties The combination of performance benefits, comfort, and durability has reinforced the dominance of the polymer base material segment in the Shoe Insert market.

The men consumer orientation segment is anticipated to hold 40.00% of the Shoe Insert market revenue in 2025, establishing it as the leading demographic segment. This growth has been influenced by the increasing focus on male foot health and comfort, particularly among working professionals and athletes who are exposed to prolonged standing or high-impact activities. Men are increasingly investing in ergonomically designed insoles that provide better support, cushioning, and alignment, which helps in reducing fatigue and preventing injuries.

The preference for durable and performance-enhancing shoe inserts has further reinforced this trend. Additionally, marketing efforts and product designs targeting men, including size-specific and activity-specific insoles, have driven adoption.

Rising disposable income and heightened awareness regarding the long-term benefits of proper foot support have contributed to the prominence of this segment As male consumers continue to prioritize comfort, health, and performance, the men consumer orientation segment is expected to maintain its leading position in the Shoe Insert market.

The global shoe insert market has observed a constant growth rate with a historical CAGR of 4.5% from 2020 to 2025. During this period, there was a heightened emphasis on consumers to experience comfort in their feet and the need to improve foot conditions aches such as plantar fasciitis and flat-feet.

The demand also increased with the increase in participation in sporting activities, as people required inserts to enhance their efficacy during sporting activities and reduce the risk of developing complications. Two additional factors that contributed to market growth during these years included personalized footwear solutions.

It is possible to predict that during the period from 2025 to 2035, the shoe insert market will further develop, but it will have to do so under new circumstances. It can be expected that demand will continue to rise due to the development of material science and biomechanics to create better and more tailored methods.

But it will not be devoid of risks like the threat of new entrants, changes in laws and standards, and a shift in customer preferences toward more sustainable materials. Sophistication of the existing and new 3D solutions for custom-made orthotics, insertion of smart features, and better preventive foot care services will be the main future market drivers.

The need for comfort and orthopedic support among consumers has emerged as a key trend influencing shoe insert market. Because of the increasing awareness for people to take care of their health and avoid opting for corrective measures most especially for their feet and the lower body, the demand for such specific and high quality insert rather than a normal insert has risen.

These changes are particularly observable among the geriatrics and athletes which demand different levels of care about foot problems that younger persons may not necessarily show.

Major footwear producers are beginning to offer additions in the form of cushions that consist of materials like memory foam, gel, and polymers that are far better than traditional options. These materials do not only provide comfort to the citizens, but they are also beneficial for their health which makes these products attractive for the consumers.

Further, the market is witnessing the rising popularity of insert types with the use of natural and non-toxic components due to the growing green consciousness among the customers.

The development towards the usage of custom shoe inserts is set to increase since consumers are getting acquainted with the concepts of proper foot support. Close toed footwear inserts are personalized and made from scans and 3D technology; they fit better and more professionals than normal inserts to target particular foot problems.

Such an individualistic approach to foot care becomes critical in the maintenance of chronic ailments such as plantar fasciitis, flat feet, and over pronation.

The overall awareness of the public to foot health and the way in which their feet distribute their weight throughout the body is increasing. This is because people have started moving from the regular printed inserts that are manufactured in large quantities in favor of products that are customized.

The notion for the promotion of custom-fit inserts is being more persuasive than general statements, as people know that customized products offer better results of comfort, safety, and longevity of their feet than standard ones.

The shoe insert market is also finding approval from customers who are more conscious about their environment today than ever before. They also found that more and more manufacturers are using natural, biodegradable, and recyclable materials for shoe inserts due to the negative environmental effects of synthetic materials.

This trend is pronounced most notably among young consumers, who are known to give more attention to the environmental aspects of a product.

To cater to this demand, many manufacturers are developing inserts made from cork, natural latex and plant-based foams. These materials do not only have low effects on the environment but also fulfills the demand of consumers who want to buy environment-friendly goods.

due to this increased demand in the markets, firms that spend their resources in developing sustainable products are likely to pull through the increased number of customers who are working towards fulfilling their environmentally conscious goals.

In the North America region the shoe insert market is expected to grow at highest CAGR to reach USD 8,687.1 Million by 2025 with the USA shoe insert market contributing with the CAGR of 4.6% from 2025 to 2035. The demand for such a products is high in the USA due to several factors such as high disposable income, which allows the consumers to purchase products with features such as superior quality and high comfort and support for feet.

Furthermore, there is the aging population, who are more susceptible to foot problems including arthritis and plantar fasciitis, thereby leading to the need for therapeutic shoes and shoe inserts.

The USA has a strong background in sports and outdoor activities, which has enhanced the demand for performance-enhancing shoe inserts both in sports professionals and common users.

In addition, the availability of competitive footwear and orthopedic manufacturers in the USA also boosts production and availability hence making the country one of the key markets for shoe inserts.

Germany market is expected to be a large consumer in Europe of shoe inserts, with a projected CAGR of 2.4% in forecasting period. German markets and buyers are known to appreciate quality long lasting products, and therefore this also applies to footwear and inserts. It has a healthy tradition of engineering achievements and has consequently progressed towards designing highly usable shoes insoles that can meet most foot ailments.

Also, Germany has a relatively old population with a growing demand for foot care as a crucial component of supporting the mobility and general health of the population. This demographic feature is a disturbing factor in the ever growing need of orthopedic shoes and customized insole.

Also, healthy lifestyles with numerous Germans being physically active as they engage in hiking or walking add to the increasing demand of footwear that is comfortable to wear. The availability and accessibility of healthcare services and orthopedic aids insurance in the country also propels the growth of the shoe insert market in Germany, which has positioned the country as a leading exporter in the European market.

Meanwhile, India within the South Asia region has been experiencing a fast-growing market for shoe inserts with a projected CAGR of 7.0% from 2025 to 2035. Middle-income earners in the country mean they can afford health and footwear solutions.

Tobacco use, alcoholism, and poor diet due to increased urbanization and more sitting jobs have also contributed to more cases of diabetes and obesity which exert pressure on the feet. This has LED to the need for therapeutic and supportive shoe inserts that could help relieve the pain and possibly prevent other complications from arising.

Furthermore, the growth of the retail and e-commerce market in India has opened up the market for shoe inserts across the country and its consumers from low-end comfort shoe inserts to high-end orthopedic shoe inserts.

Another factor that is contributing to the market is the increase in health consciousness, especially among the youth, and the realization of the significance of foot care in general body health. Also, international brands have started entering into the Indian market with better technologies and better quality products, which will help to fuel the shoe insert market in India.

Orthotic insoles have the highest market share of 43.3% in 2025 because of the enhanced awareness of foot health and the need for supported and comfortable footwear especially for those with certain foot complications like flat feet, plantar fasciitis or diabetes.

Orthotic insoles are developed to cause changes in foot posture as well as alleviate discomfort and enhance the functionality of the feet, which is why it is considered a product with primary recommendation for use among consumers who are looking for guaranteed preventive and remedial footwear accessories.

Due to demographic shifts, the growth in the number of foot problems, ongoing technological advances, and the development of customized products, orthotic insoles are likely to remain the dominant product in the market.

The shoe insert market can be categorized based on its base material, which includes polymer, plastic, rubber, carbon fiber, and silicone among others. In this list, rubber-based inserts are a clear market leader, controlling 26.0% of the market share in 2025. Rubber was widely used due to its durability, flexibility, and ability to provide excellent cushioning to feet, thus suitable for everyday and athletic insoles.

Sole inserts made of rubber are preferred where comfort during walking or standing for an extended period is desirable, for normal wear and in sports. Furthermore, rubber based insoles provide better traction as opposed to slipping which is vital in safety insoles. It can thus be deduced that the demand of rubber-based insoles is likely to remain high as manufacturers fine-tune formulations and improve performance and feel.

Based on consumer orientation, the shoe insert market has been divided and is available in categories such as male, female, and children. Out of all the consumers, 37.3% are men. Men are more likely to look for insoles that can relieve pressure on certain areas of the feet while supporting and protecting them from possible injuries and improving athletic performance.

Besides, recent activeness among men in maintaining their health and fitness makes them more sensitive to orthopedic and customized arch supports. Therefore, it can also be asserted that the men’s shoe inserts market will remain in the lead in terms of both lifestyle requirements and better comfort and foot care solutions.

Some of the key players that are present in the global market are increasing their spending on research and development to use innovative materials in shoe inserts. The use of advanced fabrics in developing quality and soft insoles for clients offers a tremendous rivalry for various leading organizations.

For instance

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 47.3 billion |

| Projected Market Size (2035) | USD 81.6 billion |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Product Type | Casual Insole, Sports Insole, Orthotic Insole, Safety Insole |

| By Material Type | Polymer, Plastic, Rubber, Carbon Fibre, Silicone |

| By Consumer Orientation | Men, Women, Kids |

| By Sales Channel | Direct Sales, Indirect Sales, Hypermarkets/Supermarkets, Departmental Stores, Specialty Stores, Multi-Brand Stores, Exclusive Stores/Franchised Stores, Online Retailers, Other Retail Channel |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

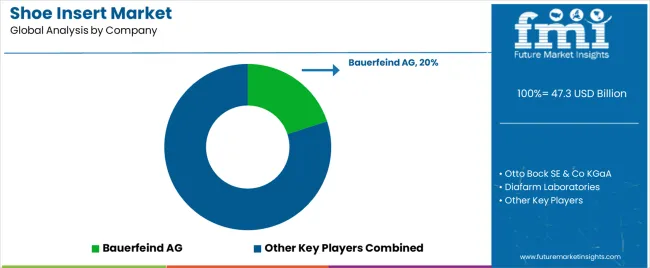

| Key Players | Otto Bock SE & Co KGaA, Diafarm Laboratories, Texon International Group Limited, Implus Footcare LLC, Sorbothane Incorporated, Aetrex Worldwide Inc., Peacocks Medical Group, Arneplant S.L., Birkenstock Digital GmbH, Atlantic Footcare Inc., Digitsole, Aline Systems, Inc., Foot Science International, Bauerfeind AG, Guangzhou Shunyang SM Co Ltd., Currex GmbH |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

The global shoe insert market is estimated to be valued at USD 47.3 billion in 2025.

The market size for the shoe insert market is projected to reach USD 81.6 billion by 2035.

The shoe insert market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in shoe insert market are casual insole, sports/athletic insole, orthotic insole and safety insole.

In terms of base material type, polymer segment to command 35.0% share in the shoe insert market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Shoe Insert Market Insights – Growth, Share & Industry Trends 2025-2035

USA Shoe Insert Market Outlook – Demand, Growth & Industry Forecast 2025-2035

GCC Shoe Insert Market Report – Size, Share & Growth 2025-2035

Japan Shoe Insert Market Trends – Size, Demand & Forecast 2025-2035

Germany Shoe Insert Market Analysis – Growth, Size & Industry Trends 2025-2035

Shoe Packaging Market Size and Share Forecast Outlook 2025 to 2035

Shoe Insoles Market Size and Share Forecast Outlook 2025 to 2035

Shoe Bite Tape Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Shoe Packaging Companies

Shoe Storage & Organizers Market

Shoe Dryers Market

Insert Trays Market

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Bolt Insertion Machine Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA