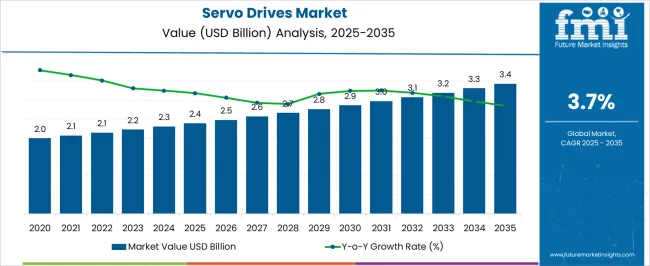

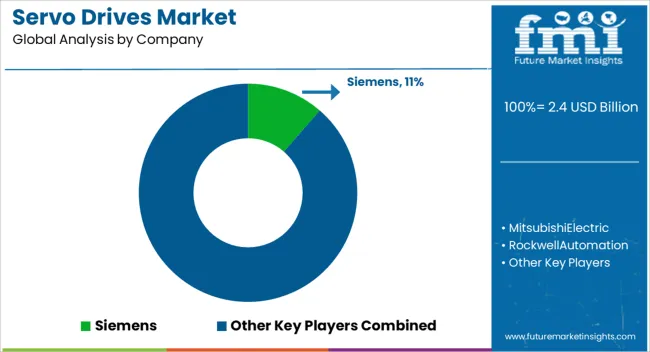

The Servo Drives Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The pace indicates a market that is relatively mature compared with emerging automation categories, where expansion tends to be more aggressive. Early growth between 2025 and 2030 is likely to be driven by incremental investments in automotive and electronics manufacturing, where precision control systems are essential for enhancing production efficiency.

From 2030 to 2035, the upward trend is expected to continue, but gains will be moderate as competitive pressures and cost optimization influence industry strategies. The incremental opportunity of USD 1.0 billion over the forecast period highlights the need for suppliers to focus on differentiation, emphasizing energy-efficient designs, compact formats, connectivity integration, and after-sales service models to strengthen their foothold in a market where growth is consistent but not rapid.

| Metric | Value |

|---|---|

| Servo Drives Market Estimated Value in (2025 E) | USD 2.4 billion |

| Servo Drives Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

Transition from conventional mechanical systems to digital, high-precision control systems has been supported by advancements in feedback control technologies, integrated motion platforms, and compact drive architectures.

As smart manufacturing becomes the operational norm, demand for servo drives with real-time responsiveness, improved torque density, and seamless integration with PLC and CNC environments has risen sharply. The growing emphasis on energy efficiency and predictive maintenance is encouraging industries to adopt servo systems with regenerative braking, low standby consumption, and real-time monitoring.

Additionally, increased deployment of industrial robots, cobots, and automated guided vehicles has elevated the importance of servo drives capable of multi-axis synchronization and dynamic performance. Future growth in the market is expected to be supported by continued investments in digital infrastructure, wider adoption of Industry 4.0 frameworks, and rising interest in modular, software-configurable motion control systems across both developed and emerging economies.

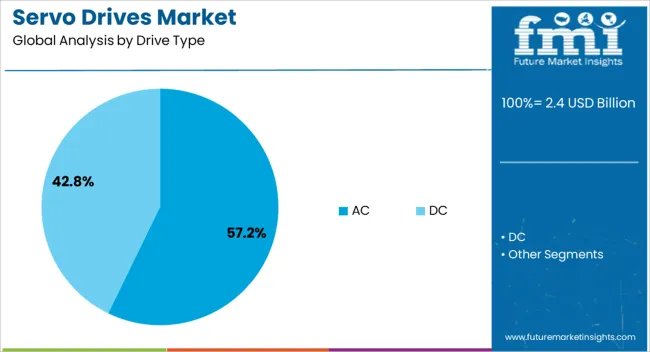

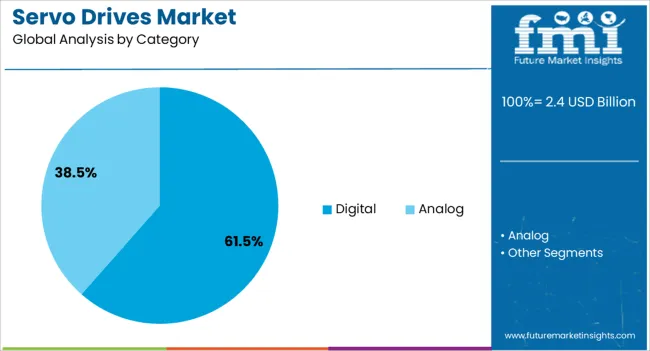

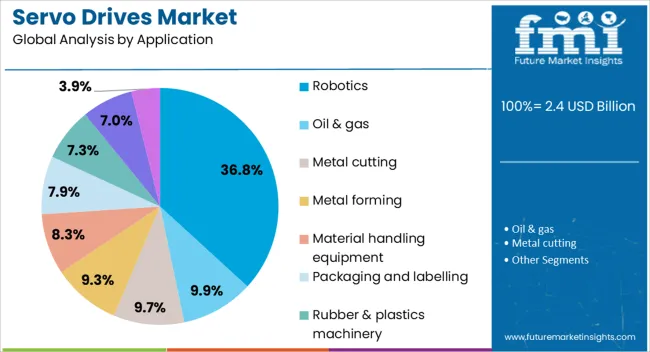

The servo drives market is segmented by drive type, category, application, and geographic regions. By drive type, servo drives market is divided into AC and DC. In terms of category, servo drives market is classified into Digital and Analog. Based on application, servo drives market is segmented into Robotics, Oil & gas, Metal cutting, Metal forming, Material handling equipment, Packaging and labelling, Rubber & plastics machinery, Semiconductor machinery, and Other industries. Regionally, the servo drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

AC drive types are expected to account for 57.2% of the overall revenue share in the servo drives market by 2025. Their dominance has been driven by the widespread use of alternating current motors in industrial settings, which demand high-performance, energy-efficient motion control systems. AC drives have been favored for their ability to offer variable speed control, improved power efficiency, and adaptability to a broad range of automation equipment.

The integration of vector control and sensorless feedback mechanisms has further enhanced their appeal in applications requiring precise torque and speed regulation. The segment has also benefited from the increasing adoption of servo systems in harsh environments, where AC motors paired with robust drives deliver consistent performance under thermal and electrical stress.

Compatibility with standard three-phase infrastructure, reduced maintenance requirements, and lower installation costs have further supported the growth of AC drive solutions. As industries prioritize scalable and efficient motor control platforms, the AC drive type continues to remain the most utilized and economically viable option.

Digital servo drives are expected to account for 61.5% of the revenue share in the servo drives market by 2025, driven by the growing demand for real-time data exchange, precision control, and advanced diagnostics in industrial automation. These drives have gained significant traction due to their ability to interface seamlessly with modern control architectures through protocols such as EtherCAT, Profinet, and Modbus TCP.

Their capability to deliver higher processing speeds, enhanced loop performance, and support for adaptive tuning has positioned them as essential components in complex motion systems. Software-defined functionalities, remote configuration, and predictive maintenance features have further reinforced their value proposition for manufacturers seeking reliability and operational agility.

The scalability and modularity offered by digital drives make them suitable for a range of applications, from small-scale assembly lines to large industrial robots. As industries adopt more interconnected and data-centric systems under Industry 4.0, digital drives are expected to be at the forefront of motion control innovation and deployment.

The robotics application segment is projected to account for 36.8% of the servo drives market revenue share in 2025, reflecting its leading role in next-generation automation. Servo drives in robotics have gained widespread adoption due to their ability to deliver precise motion control, rapid acceleration and deceleration, and high torque consistency across multi-axis systems.

As robotic systems become more complex and compact, servo drives offering high power density and software-based configurability have become essential to meet performance and footprint constraints. Integration with machine vision, sensor arrays, and AI algorithms has increased the reliance on responsive, intelligent drive systems capable of handling real-time commands.

The demand for robotic solutions in automotive manufacturing, logistics automation, electronics assembly, and healthcare has reinforced the need for servo drives that support synchronous operation, zero-position error, and adaptive motion profiles. As global industries accelerate their investment in autonomous and semi-autonomous systems, robotics remains a primary application driving the sustained growth of servo drive technologies.

The servo drives market is projected to grow at a steady pace, driven by the increasing automation in manufacturing industries and the rising demand for high-precision equipment. As industries demand more precise control systems for robotics and machinery, servo drives play a pivotal role. The market is influenced by advancements in control technologies and the push for energy-efficient systems. Demand is also fueled by industries like automotive, packaging, and robotics, further enhancing the market's potential.

The servo drives market is primarily driven by the growing adoption of industrial automation across various sectors. As industries strive for higher productivity, precision, and efficiency, servo drives are increasingly being integrated into machinery and robotic systems to control motion with high accuracy. In manufacturing processes, servo drives are used in applications such as CNC machines, assembly lines, and packaging equipment to ensure optimal machine performance and reduce errors.

The increasing demand for robotics in industries like automotive, electronics, and food processing is accelerating the use of servo drives, as they enable precise and reliable movement. As industries move toward digital transformation and Industry 4.0, the demand for advanced, high-performance servo drive systems is expected to rise significantly.

A significant challenge in the servo drives market is the high initial investment required for these advanced motion control systems. The cost of servo drives, combined with the price of servo motors, installation, and training, can be prohibitive, especially for small and medium-sized enterprises (SMEs). This can limit their adoption, particularly in emerging markets where budget constraints exist. Furthermore, integrating servo drives with existing machinery and automation systems can be complex and require specialized knowledge and expertise.

Compatibility issues with legacy systems, as well as the need for continuous software updates and maintenance, add to the complexity and cost. These challenges require manufacturers to offer cost-effective solutions and ensure seamless integration with existing equipment to overcome barriers to adoption.

The servo drives market presents numerous opportunities driven by technological advancements in motion control and the increasing adoption of robotics and automation systems. Innovations in servo drive technology, such as smaller, more energy-efficient drives with advanced communication capabilities, are enabling manufacturers to improve machine performance while reducing energy consumption and operational costs. The growth of the robotics industry is opening up new opportunities for servo drive manufacturers, as robotic systems require precise and responsive motion control.

The rising demand for collaborative robots (cobots) in industries like manufacturing, logistics, and healthcare is further boosting the market for servo drives. Moreover, the integration of artificial intelligence (AI) and machine learning with servo systems presents additional opportunities to optimize machine performance and enhance predictive maintenance capabilities.

A significant trend in the servo drives market is the miniaturization of servo drive systems. Manufacturers are focusing on developing smaller, more compact servo drives that offer the same high performance and precision control while reducing space requirements and installation time. These compact drives are particularly beneficial for applications where space is limited, such as robotics and automated machinery. Another trend is the integration of smart technologies into servo drive systems, allowing for remote monitoring, diagnostics, and real-time optimization.

The use of IoT-enabled devices and cloud-based platforms is enhancing the connectivity and performance of servo systems, allowing for better data analysis, predictive maintenance, and system monitoring. These trends reflect the industry's push toward more intelligent, efficient, and compact servo drive solutions to meet the evolving needs of industries focused on automation and precision control.

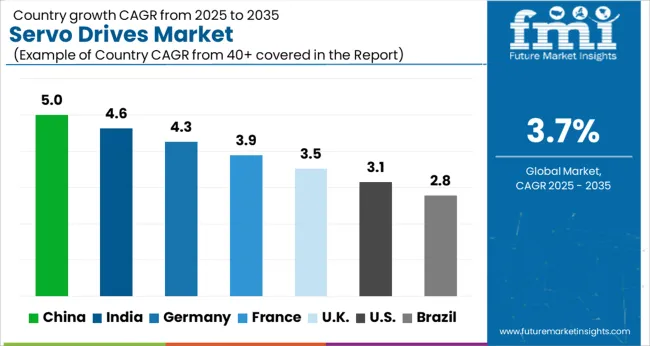

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global servo drives market is projected to expand at a CAGR of 3.7% from 2025 to 2035. China leads with a growth rate of 5.0%, followed by India at 4.6%, and Germany at 4.3%. The United Kingdom and the United States record slower growth at 3.5% and 3.1%, respectively. These variations highlight regional trends, with China and India experiencing faster growth due to increasing industrial automation and manufacturing advancements.

In contrast, more mature markets like the United States and the United Kingdom see steadier demand, supported by well-established infrastructure and widespread adoption in key industries such as automotive and robotics. The ongoing push for energy efficiency and precision control in manufacturing is a key driver across all regions, ensuring sustained market expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

China is leading the global servo drives market with a projected growth rate of 5.0% CAGR from 2025 to 2035. The country’s rapid industrialization and increasing focus on automation, particularly in manufacturing sectors like automotive, electronics, and robotics, are key factors driving this growth. China’s government policies promoting smart manufacturing are accelerating the adoption of servo drives, especially for precision control, speed, and energy efficiency in production processes. The expansion of China’s 3D printing and robotics sectors also demands advanced servo drive technologies, increasing market potential. As Chinese companies push for automation and energy-saving solutions, servo drives are expected to play a critical role in enhancing operational efficiency.

Sale of servo drivesin India is set to grow at a rapid pace, with a projected CAGR of 4.6% from 2025 to 2035. The increasing adoption of digital manufacturing solutions across industries such as automotive, construction, and healthcare is driving this growth. As the country’s manufacturing sector embraces automation, the need for accurate product design and inspection tools such as 3D scanning is rising. The government’s initiatives to digitize and modernize industries, combined with the availability of affordable scanning technologies, are further propelling market growth.

Demand for servo drives in Germany is set for steady growth with a projected CAGR of 4.3% from 2025 to 2035. The country’s leadership in precision engineering and industrial automation continues to drive the demand for high-performance servo drives, which are used extensively in CNC machines, robotics, and factory automation. Germany’s commitment to innovation supports the integration of servo drives in smart manufacturing systems. Furthermore, the country's focus on reducing energy consumption across industries increases the adoption of energy-efficient servo drives, helping companies meet regulatory requirements.

The United Kingdom is projected to experience moderate growth in the servo drives market with a CAGR of 3.5% from 2025 to 2035. Despite being a more mature market, the UK’s industrial sectors, particularly automotive, aerospace, and packaging, continue to demand advanced servo drive technologies for automation and precision control. The country’s ongoing push for digital transformation, driven by government initiatives and industry incentives, supports the adoption of servo drives in various manufacturing processes. The UK’s high standards for product quality, and energy efficiency also contribute to the demand for energy-efficient servo drive solutions.

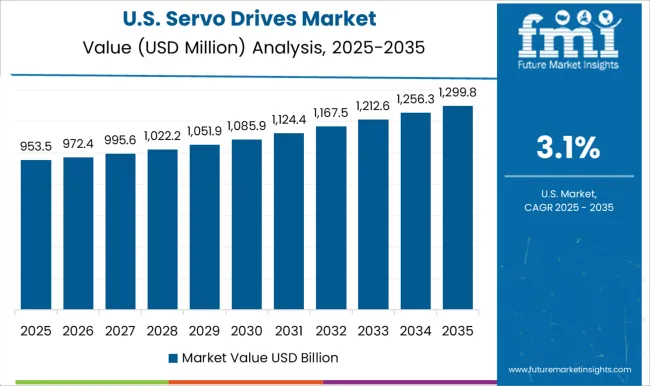

The servo drives market in the United States is projected to grow at a slower rate, with a CAGR of 3.1% from 2025 to 2035. While growth in the US market is more moderate compared to emerging economies, there remains a steady demand for servo drives, particularly in industries like automotive, aerospace, and robotics. The widespread adoption of automation systems and robotics in manufacturing processes continues to drive the demand for servo drives, particularly in precision control applications. The USA government’s focus on manufacturing efficiency further supports the integration of servo drive technologies.

The servo drives market is characterized by the dominance of key players delivering innovative solutions across various industries, particularly in industrial automation, robotics, and manufacturing. Siemens leads the market with high-precision, energy-efficient servo drives tailored for diverse industrial applications. Mitsubishi Electric follows closely, offering highly reliable, customizable solutions to enhance automation systems' performance in manufacturing and robotics.

Rockwell Automation is a significant player, providing integrated servo drive solutions that offer scalability and compatibility with a wide range of systems, while Schneider Electric emphasizes energy efficiency and sustainability through its broad portfolio of servo drive products. ABB’s high-performance servo systems excel in seamless integration with industrial automation processes, boosting operational efficiency. Panasonic’s precision-driven servo drives are highly regarded in robotics and industrial sectors, while Delta Electronics specializes in energy-saving servo drive solutions that optimize system performance. Omron focuses on flexible, high-performance servo drives that serve various industrial applications, driving automation and efficiency.

Parker Hannifin offers servo systems renowned for their durability and adaptability, with Nidec Motor providing customized servo drive solutions for industrial machines. Kollmorgen’s high-torque systems stand out for precision and customizability, while Beckhoff Automation integrates advanced servo drive solutions with its motion control technologies. KEBA Automation excels with high-performance drives for machine builders, while Leadshine offers cost-effective and reliable servo solutions. Danfoss focuses on energy-efficient servo systems, and Advanced Motion Controls offers compact, high-performance drives. WEG, DMM Technology, and CM Robotics round out the competitive landscape, offering solutions optimized for performance, energy efficiency, and advanced robotics applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Drive Type | AC and DC |

| Category | Digital and Analog |

| Application | Robotics, Oil & gas, Metal cutting, Metal forming, Material handling equipment, Packaging and labelling, Rubber & plastics machinery, Semiconductor machinery, and Other industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Mitsubishi Electric, Rockwell Automation, Schneider Electric, ABB, Panasonic, Delta Electronics, Omron, Parker Hannifin, Nidec Motor Corporation, Kollmorgen, Beckhoff Automation, KEBA Industrial Automation GmbH (KEBA), Leadshine, Danfoss, Advanced Motion Controls, WEG, DMM Technology Crop |

| Additional Attributes | Dollar sales by product type (servo motors, controllers, amplifiers, feedback systems) and end-use segments (automotive, robotics, packaging, manufacturing, energy). Demand dynamics are fueled by the increasing automation across industries such as automotive, robotics, and manufacturing, as well as the growing need for energy-efficient motion control solutions. Regional trends show robust growth in North America, Europe, and Asia-Pacific, driven by advancements in automation technologies, smart manufacturing, and the increasing adoption of robotics and AI in industrial applications. |

The global servo drives market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the servo drives market is projected to reach USD 3.4 billion by 2035.

The servo drives market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in servo drives market are ac and dc.

In terms of category, digital segment to command 61.5% share in the servo drives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Reservoir Media Bottle Market

Venous Reservoirs Market

Automotive Coolant Reservoir Tank Market

Multichannel Reagent Reservoir Market Size and Share Forecast Outlook 2025 to 2035

AC Drives Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

Conveyor Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Pod Drives Market Size and Share Forecast Outlook 2025 to 2035

Brushless Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Automotive Driveshaft Couplings Market

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Chain Drives Market Size, Growth, and Forecast 2025 to 2035

Automotive Sunroof Drives Market Size and Share Forecast Outlook 2025 to 2035

Marine Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA