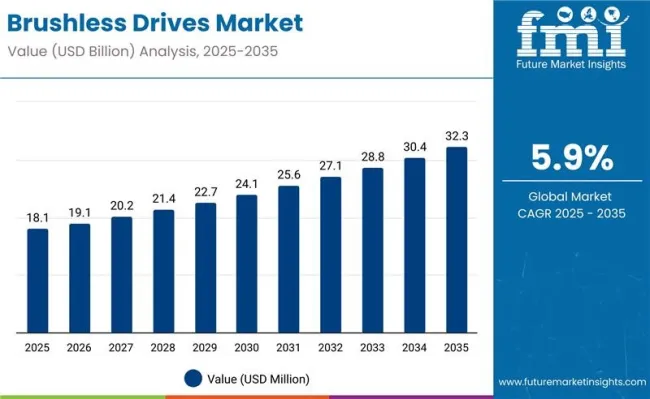

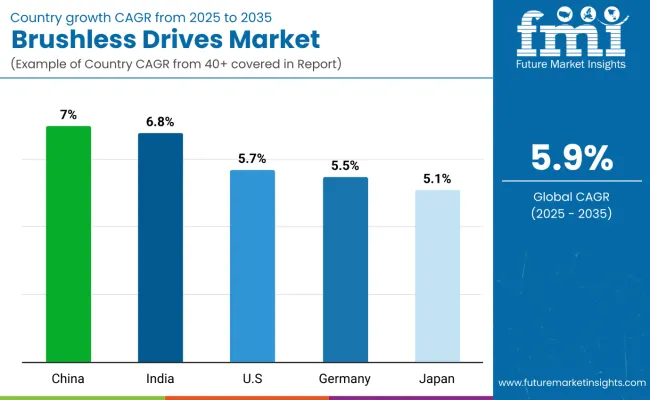

The global Brushless Drives market is expected to be valued at USD 18.1 billion in 2025 and is projected to reach approximately USD 32.3 billion by 2035. This reflects an absolute increase of USD 14.2 billion, equivalent to a growth of 78.5% over the forecast period. The expansion is forecast to occur at a CAGR of 5.9%, with the market size estimated to grow by nearly 1.77X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 18.1 billion |

| Industry Value (2035F) | USD 32.3 billion |

| CAGR (2025 to 2035) | 5.9% |

Between 2025 and 2030, the market is projected to expand from USD 18.1 billion to USD 24.1 billion, resulting in a value addition of USD 6 billion. This initial phase of growth is expected to be supported by the rapid scale-up of EV platforms, strong investment in industrial automation and robotics, and steady consumption in consumer electronics. Automakers are standardizing brushless (BLDC/Permanent-Magnet) drives for traction auxiliaries, pumps, HVAC, and ADAS actuators, while factories deploy brushless servo drives to unlock higher precision, longer service cycles, and predictive maintenance.

From 2030 to 2035, the market is expected to grow from USD 24.1 billion to USD 32.3 billion, accounting for a cumulative increase of USD 8.2 billion. This latter phase of growth is anticipated to be shaped by the adoption of wide-bandgap power electronics (SiC/GaN) in drive inverters, deeper sensorless FOC (field-oriented control) penetration, and regional localization of supply chains in North America, Europe, and Asia. Miniaturized outer-rotor designs will scale in consumer and personal mobility devices, while high-reliability inner-rotor drives will continue to lead in EV, aerospace, and industrial motion.

From 2020 to 2024, the brushless drives market expanded steadily, driven by accelerating vehicle electrification, rising robotics density on factory floors, and sustained demand in consumer electronics (drones, wearables, premium appliances).

During this period, the market value increased from USD 14.1 billion in 2020 to USD 17.3 billion in 2024, reflecting consistent adoption across both developed and emerging economies. Growth was further supported by greater availability of automotive-grade magnets and power semiconductors, as well as OEM preferences for long-life, low-maintenance drive systems.

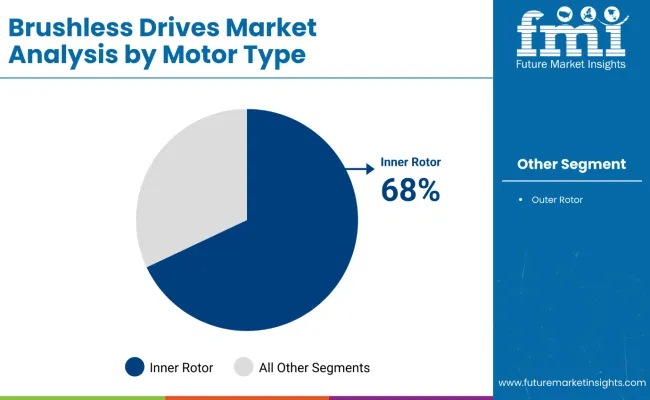

The industry landscape during this time was dominated by inner rotor architectures, which accounted for 68% of sales in 2024, supported by strong uptake in EV drivetrains, CNC machine tools, and aerospace systems that demand high torque density and compact footprints.

These designs gained favor due to efficiency, thermals, and tight control bandwidths, enabling wider penetration in high-precision industrial applications. Market participation was led by established drive and automation companies leveraging authorized integrator networks, global service support, and functional-safety certifications (e.g., IEC 61800-5-2) to win in regulated industries.

By 2025, the market is estimated to reach a valuation of USD 18.1 billion. This transition is being influenced by the rising preference for low-voltage drives in EV auxiliaries and compact robotics, improvements in inverter efficiency using SiC/GaN, and the integration of embedded diagnostics to support condition-based maintenance.

As industries continue to prioritize energy efficiency, high power density, and precise motion control, demand is shifting toward drives that combine advanced control algorithms (FOC), compact packaging, and robust thermal management. The 2025 baseline is set to serve as a springboard for more rapid growth, particularly as the sector aligns with net-zero roadmaps in Europe and Asia-Pacific and onshore manufacturing in North America.

The growth of the brushless drives market is being driven by multiple converging factors, including vehicle electrification, the automation of manufacturing, and advances in power electronics and control software. Vendors have introduced high-efficiency inner-rotor drives, low-loss inverters using SiC/GaN, and sensorless/FOC control that extend service life, enhance dynamic response, and reduce downtime, improving total cost of ownership for users in regions with high energy and labor costs.

The surge in robotics deployment and precision motion systems has reinforced the need for brushless drives that deliver repeatability and low maintenance. Brushless solutions are increasingly integrated into medical devices, aerospace platforms, and consumer technology, where compactness and reliability are non-negotiable. Product demand is also being influenced by the shift toward modular, integrated drive-motor-controller packages, which can be adapted for both industrial equipment and mass-market products.

Consumer-driven segments such as drones, e-bikes, and premium appliances are contributing to the expansion of miniaturized outer-rotor units. Growth in e-commerce distribution and direct-to-engineer channels is enhancing the visibility of configurable drives among SMEs and makers, particularly in North America and Western Europe.

Compliance with energy-efficiency mandates, functional-safety norms, and automotive quality standards is encouraging the adoption of brushless drives with onboard diagnostics, safe-torque-off (STO), and cyber-secure interfaces. Combined with improved magnet supply and more localized electronics manufacturing, these advancements are positioning brushless drives as the default choice across sectors ranging from EV subsystems in China to industrial robotics in Germany.

The brushless drives market is segmented by motor type into inner rotor and outer rotor configurations, offering varied performance characteristics and design flexibility for different motion control applications. Voltage range classifications include low voltage (below 60V), medium voltage (60V to 600V), and high voltage (above 600V), addressing a wide spectrum of use cases from compact electronics to industrial automation. Key application areas span automotive, industrial machinery, consumer electronics, aerospace and defense, and healthcare, indicating widespread demand across mobility, automation, and mission-critical sectors.

Inner rotor drives are estimated to capture 68% of the motor-type segment in 2025, sustaining their position through 2035. This dominance is attributed to their suitability for high-torque-density, fast-response applications, including EV powertrains and auxiliaries, CNC machine tools, collaborative robots, and aerospace actuation. In Japan, inner-rotor preference is also pronounced (60%), reflecting the country’s focus on compact, high-precision robotics and automotive systems that demand tight servo control and excellent thermal behavior.

Compared to outer rotor models, inner-rotor drives offer higher speed capability, tighter control bandwidth, and better packaging for dense equipment layouts, making them the preferred choice in Germany’s precision manufacturing and the USA aerospace sector. Outer-rotor drives continue to gain in consumer electronics, HVAC, and personal mobility where smoothness and low acoustic signature are prized, but the high-spec industrial core remains inner-rotor led.

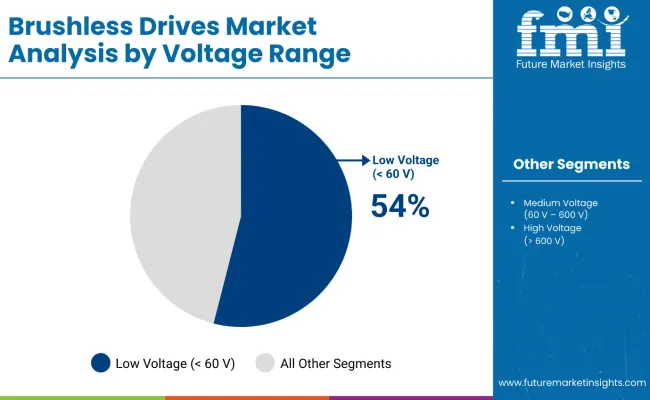

Low-voltage brushless drives are projected to hold 54% share of the voltage-range segment in 2025, with steady growth anticipated through the forecast period. Their appeal lies in battery compatibility, compact electronics, and safety, enabling designers to deploy them across EV auxiliaries, AMRs/AGVs, medical devices, drones, and premium appliances. This profile is especially visible in South Korea, where the split is 50% low voltage, 40% medium, 10% high voltage, reflecting the country’s electronics and mobility ecosystems.

In Europe and the USA, medium-voltage drives (38%) anchor conveyors, packaging lines, and process automation, while high-voltage drives (8%) serve aerospace, defense, and heavy machinery. Compared to higher-voltage classes, low-voltage drives also have faster replacement cycles and a wider supplier base, sustaining recurring revenue for manufacturers and distributors.

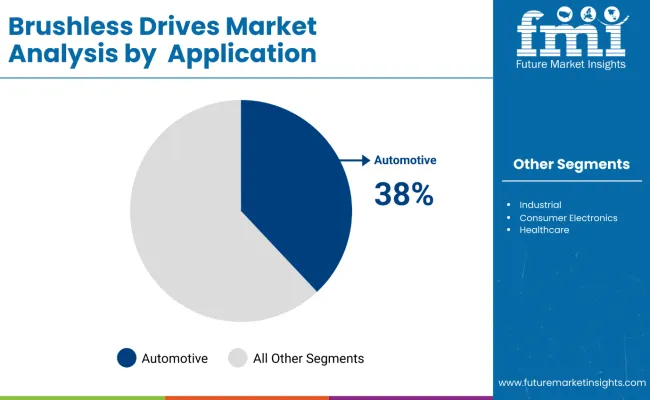

Brushless drives in automotive applications are expected to comprise 38% of the global market in 2025 and register a CAGR of 6.3% through 2035. These drives power systems such as electric power steering, HVAC compressors, drivetrain motors, and cooling pumps in both hybrid and electric vehicles. Their advantages in terms of low maintenance, energy efficiency, and high reliability are crucial for modern EV architectures. As automotive manufacturers continue shifting toward electrified platforms, the use of brushless drives is expected to scale rapidly, especially in high-volume passenger vehicles.

Demand for brushless drives is being supported by wide-bandgap power electronics move from pilots to volume, sensorless & advanced control become the default, integrated motor-drive-controller modules compress time-to-market, “local-for-local” supply chains de-risk delivery and compliance, functional safety and cybersecurity by default, battery platforms keep low-voltage in the lead, personal mobility, uavs, and small robotics expand outer-rotor volume, software-defined drives and digital twins shorten commissioning, and sustainability rules push higher efficiency and regenerative features.

Wide-bandgap power electronics move from pilots to volume

Silicon-carbide (SiC) and gallium-nitride (GaN) devices are shifting brushless drives from incremental to step-change efficiency. Higher switching frequencies and lower losses let OEMs shrink heat sinks and cabinets, raising power density and enabling sealed, IP-rated modules. In Germany and the USA, SiC inverters are now standard on high-spec servo lines and EV subsystems where every watt of loss affects OEE or range.

In China, automakers are cascading SiC from premium to mid-tier platforms, while machine-tool makers deploy GaN for compact spindles that need ultra-fast current loops. As costs fall through 2030, medium-voltage industrial drives will increasingly adopt SiC for continuous-duty efficiency gains.

Sensorless & advanced control become the default

Field-oriented control (FOC) is no longer a differentiator; it’s table stakes. What’s new is sensorless FOC with model-based observers that deliver smooth torque at low speed without mechanical feedback, trimming BOM cost and failure points.

Combined with auto-tuning and load-adaptive commutation, these drives cut commissioning time on Indian packaging lines and reduce jitter in Japanese precision robots that demand micron-level repeatability. Firmware upgrades are pushing features like field-weakening for extended speed range and safe-stop profiles, allowing a single drive family to cover more duty cycles.

Integrated motor-drive-controller modules compress time-to-market

OEMs are adopting drive-on-motor packages that combine rotor, inverter, and control electronics in one sealed unit. This architecture reduces cabling, EMI issues, and panel space, and it speeds line builds for systems integrators in the UK and Italy. In consumer and light-industrial gear, gimbals, HVAC blowers, AMRs/AGVs, outer-rotor pancakes with embedded electronics are winning on acoustic quality and ease of installation. For heavier duty, compact inner-rotor servos with integrated drives are appearing on German pick-and-place cells, where short MRO windows make plug-and-play swaps valuable.

“Local-for-local” supply chains de-risk delivery and compliance

Tariffs, shipping volatility, and critical-material risks are pushing drive makers to regionalize. Magnet sourcing (NdFeB) and power-stage assembly are being duplicated in the USA/EU while China continues to scale domestic value chains for EVs and automation. Vendors are dual-qualifying PCB fabs and firmware toolchains so the same drive SKU can be built in North America, Europe, or East Asia without re-validation. The result is shorter lead times for USA EV auxiliaries, faster ramp for European robotics, and price stability for APAC consumer-electronics programs.

Functional safety and cybersecurity by default

Industrial bids increasingly mandate STO/SBC (Safe Torque Off/Brake Control), SIL ratings, and certified safety libraries. On connected lines, drives must also support secure boot, signed firmware, and encrypted Industrial Ethernet (e.g., CIP Security, PROFINET with security profiles, or TSN-based segments). Automotive Tier-1s in Germany and aerospace integrators in the USA are writing these requirements into framework agreements, pushing suppliers to harmonize safety and security in one platform. The upshot: fewer model variants and simpler compliance for global rollouts.

Battery platforms keep low-voltage in the lead

Your dataset shows low-voltage drives at 54% globally (and 50% in South Korea), and the reason is clear: battery ecosystems are proliferating. AMRs in warehouses, e-bikes/e-scooters in cities, and medical devices in hospitals are standardizing around safe, low-voltage brushless systems. CAN-based BMS/drive communication and hot-swappable packs let Indian logistics operators run longer without grid constraints, while Korean electronics makers value the compactness and safety of LV servos in cleanrooms. Expect further gains as commercial micromobility and portable tooling scale.

Personal mobility, UAVs, and small robotics expand outer-rotor volume

While inner rotors dominate high-performance industry, outer-rotor designs are quietly building volume in drones, gimbals, compact HVAC, and home/consumer robots. These motors deliver excellent smoothness and acoustic behavior, key in Japanese consumer devices and European hospitality robots operating around people. Improvements in stator lamination and slot/pole combinations are reducing cogging, and tightly integrated controllers are enabling finer motion for camera platforms and inspection drones.

Software-defined drives and digital twins shorten commissioning

Drive vendors are bundling simulation models, auto-code-gen toolchains, and cloud analytics. Engineers can validate torque/speed envelopes and thermal limits in a digital twin before hardware is frozen, then push parameter sets to the floor. USA and German integrators report faster FAT/SAT cycles and fewer line restarts, while fleet analytics flag bearing wear or demagnetization early. Over-the-air updates keep AMRs and packaging cells current without rolling a truck.

Sustainability rules push higher efficiency and regenerative features

Energy audits in Europe and corporate net-zero programs in APAC/North America are putting kWh per unit of throughput under the microscope. Brushless drives with regenerative braking, active front ends, and higher power factor are displacing legacy systems on conveyors, hoists, and winders. Vendors that quantify lifetime energy savings and offer heat-recovery options on cabinets are winning retrofit decisions, especially in plants facing rising electricity tariffs.

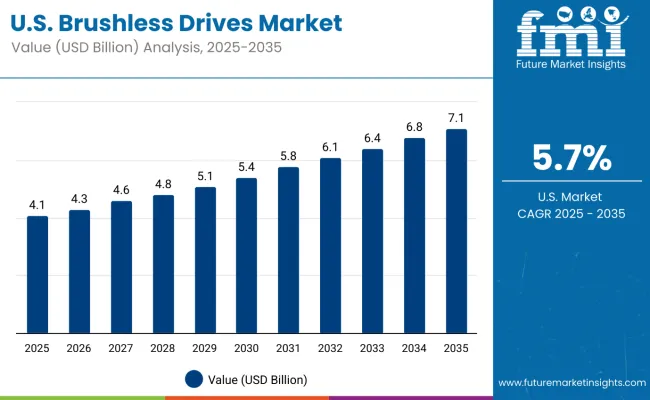

The USA brushless drives market is projected to grow at a CAGR of 5.5% (2025-2035), underpinned by the scale-up of EV platforms, resurgence in domestic manufacturing, and continued strength in aerospace & defense. Automakers and Tier-1 suppliers are standardizing inner-rotor servo drives for traction auxiliaries, thermal systems, active suspension and ADAS actuators. In parallel, factories are rolling out robotics, AMRs/AGVs, and precision motion cells, where brushless drives deliver higher torque density, tighter control bandwidths, and longer service intervals.

Regional clusters amplify demand: Texas (EV and battery plants) and Michigan/Ohio (auto) integrate low- and medium-voltage servos across new lines, while Washington and Alabama aerospace facilities specify high-reliability drives for actuators, test stands, and composites manufacturing. Onshoring and “local-for-local” procurement favor vendors with USA assembly, certified service networks, and safety-rated (STO/SIL) platforms.

In warehousing and e-commerce fulfillment, low-voltage brushless drives power conveyors and autonomous robots, improving uptime and energy intensity. Medical device makers adopt compact drives for pumps, imaging tables, and surgical tools, applications that value smooth torque at low speed and quiet operation.

China is the fastest-growing brushless drives market at 7.0% CAGR (2025-2035). Growth stems from NEV (new energy vehicle) mass production, rapid industrial robotics adoption, and the breadth of consumer electronics & appliance manufacturing. Vehicle plants in Shanghai, Changzhou and Guangzhou deploy inner-rotor servos for body, paint, and battery lines, while suppliers integrate low-voltage drives into pumps, fans, and thermal subsystems.

Electronics hubs in Shenzhen, Suzhou and Dongguan use compact outer-rotor drives in fans, blowers, gimbals and small robots, prioritizing acoustic performance and cost. Local ecosystems, magnets, PCBs, and power stages, enable short lead times and aggressive pricing, pushing brushless drives deep into mid-tier OEMs.

Municipal service robotics, smart logistics, and light industrial machinery expand the installed base, with controller vendors offering tightly coupled drive-motor packages and Chinese fieldbus stacks. As SiC costs fall, medium-voltage industrial drives in metals, chemicals and paper move toward higher efficiency.

Germany’s brushless drives market will expand at 5.5% CAGR through 2035, led by automotive Tier-1s, machine tools, packaging, and process industries. Machine-builder clusters in Baden-Württemberg and Bavaria specify inner-rotor, high-bandwidth servos with functional-safety suites and deterministic Industrial Ethernet (e.g., PROFINET, EtherCAT).

Automotive and battery supply chains deploy brushless servos on welding, laser cutting, and cell assembly, where repeatability and uptime are non-negotiable. Retrofitting programs focus on energy savings and OEE gains, adopting SiC-based inverters, regenerative features, and sealed “drive-on-motor” modules that shrink panels and simplify commissioning.

Pharma and food lines, heavy in Rhineland and Northern Germany, favor hygienic housings and integrated drives for washdown zones. With strong MRO practices, German users value drives that expose rich diagnostics (vibration, thermal models) to plant analytics.

India’s market is set to grow at 6.8% CAGR, propelled by 2W/3W EV adoption, electronics assembly, and packaging/pharma capacity additions. Low-voltage brushless drives power traction and auxiliaries in scooters and e-rickshaws, valued for efficiency and easy battery integration. Production-linked incentives and state EV policies accelerate localization of motors, controllers, and packs.

In FMCG and pharma, greenfield plants adopt medium-voltage servos on cartoners, fillers and palletizers, seeking better throughput with fewer changeovers. Warehouse automation and e-commerce hubs add low-voltage drives to AMRs and conveyor systems, improving uptime amid labor constraints.

Cost sensitivity shapes specifications: OEMs choose platforms that combine sensorless FOC, auto-tuning, and rugged thermal design to minimize field failures in hot, dusty environments.

Japan’s brushless drives market is forecast at 5.1% CAGR to 2035, anchored by robotics, precision machinery, medical devices, and automotive auxiliaries. Users favor inner-rotor drives (your split shows 60% in Japan) for high torque density, smooth low-speed control, and compact footprints essential to Nagoya/Osaka robotics clusters.

Medical OEMs specify ultra-smooth actuators for imaging tables, infusion systems and surgical tools, where acoustic comfort and precision are vital. Automotive suppliers adopt compact servos for pumps, fans and active aero systems; outer-rotor “pancake” designs grow in HVAC and consumer devices requiring quiet airflow.

Japanese buyers prioritize reliability and lifecycle support: long-life bearings, conformal coatings, sealed connectors and detailed self-diagnostics that feed TPM programs. Integration depth with PLC/robot controllers and clean-room compatibility are frequent selection criteria.

| Countries | 2025 |

|---|---|

| Germany | 28% |

| UK | 22% |

| France | 15% |

| Italy | 10% |

| Spain | 7% |

| BENELUX | 5% |

| Russia | 8% |

| Rest of Europe | 5% |

| Countries | 2035 |

|---|---|

| Germany | 25% |

| UK | 20% |

| France | 16% |

| Italy | 11% |

| Spain | 8% |

| BENELUX | 6% |

| Russia | 7% |

| Rest of Europe | 7% |

The European brushless drives market is projected to grow at a CAGR of 5.5% from 2025 to 2035, reaching about USD 7.6 billion by 2035, up from USD 4.4 billion in 2025. Market dynamics are expected to shift as countries respond to Industry 4.0 upgrades, EV supply-chain build-outs, functional-safety mandates, and energy-efficiency targets. Inner-rotor servo platforms remain the technical backbone for high-precision motion, while integrated motor-drive modules and SiC/GaN power stages raise power density and shrink panel footprints across greenfield and retrofit projects.

Europe’s demand is anchored in automation retrofits, precision manufacturing, and electrified mobility. Western Europe remains specification-heavy and replacement-led, while Southern and parts of Central/Eastern Europe are gaining share as new manufacturing footprints expand and public programs co-fund equipment modernization. Vendors that combine functional safety (STO/SIL), secure Industrial Ethernet (e.g., PROFINET/EtherCAT), and predictive diagnostics are winning multi-site rollouts.

The market in Germany accounts for around 28% of the European brushless drives market. Germany anchors regional demand with machine-builder clusters in Baden-Württemberg and Bavaria specifying inner-rotor servos with high bandwidth control, SiC-based inverters, and deterministic networking. Automotive and battery suppliers deploy brushless drives on welding, laser, and cell-assembly lines where repeatability and OEE are non-negotiable. Pharma/food sites add hygienic, integrated drive-motor modules for washdown zones, while plant teams value deep diagnostics that feed analytics and TPM programs.

Neraly 50% of the regional demand is attributed by Germany and the UK, of which UK accounts for around 22% share. UK integrators roll out brushless drive upgrades on packaging, logistics, and specialty processing lines, pairing sensorless FOC and auto-tuning to cut commissioning time. Aerospace and defense programs specify high-reliability inner-rotor servos for actuators and test stands, with secure firmware/ethernet now standard in bids. Brownfield estates prioritize compact, cabinet-less modules to save floor space and accelerate refurbishments.

The French market accounts for around 15% of the regional demand. Toulouse’s aerospace ecosystem and Île-de-France medical device clusters favor compact, quiet brushless servos with precise low-speed torque for assembly and imaging systems. Food & beverage and cosmetics producers extend adoption on filling, capping, and inspection lines, using regenerative features and energy-reporting to support sustainability KPIs. Vendors with robust local service and validated safety libraries gain preference in framework agreements.

Italy accounts for 10% of the European brushless drives demand. Italian OEMs in packaging, textile, and metalworking specify medium-voltage inner-rotor drives to raise throughput and shorten changeovers. Automotive component districts add brushless servos to machining and assembly cells, often as integrated motor-drive units that simplify wiring and EMC compliance. Cost-effective retrofits emphasize energy savings and predictive maintenance to reduce downtime in multi-shift operations.

Spain contributes with around 7% of the European market. Spanish plants expand brushless drive use on body-in-white, paint, and battery-module lines tied to EV programs. Logistics and food processing adopt low-voltage servos for conveyors and AMRs, targeting quick installs and low maintenance. Regional grants for efficiency and automation support upgrades from legacy drives to advanced, safety-rated platforms.

BENELUX accounts for around 5% of the market. Clean-process industries and large logistics hubs in Belgium and the Netherlands specify hygienic, integrated motor-drive modules with remote monitoring for multi-site asset management. Secure Industrial Ethernet and backup-safe states (STO/SBC) are now baseline requirements, and cold-chain/automated warehouses favor low-voltage brushless platforms for AMRs and sortation.

Japan’s brushless drives market is set for steady growth through 2035, with demand concentrated in inner-rotor architectures, which account for 60% of the market in 2025. The country’s production mix, precision robotics, machine tools, and compact automotive subsystems, favors high torque density, tight control bandwidths, and cleanroom-ready packaging.

Inner-rotor drives dominate because they deliver the best balance of power density, thermal performance, and servo responsiveness, aligning with cell-based assembly in Nagoya-Osaka robotics clusters and bay-by-bay integration on automotive lines. Outer-rotor platforms retain a meaningful role (40%), especially where acoustic smoothness and airflow are priorities, HVAC modules, consumer devices, and small UAVs.

South Korea’s market reflects its electronics and mobility ecosystems, with low-voltage drives at 50%, medium-voltage at 40%, and high-voltage at 10% in 2025. Low-voltage dominates battery-powered platforms including AMRs/AGVs in Gyeonggi logistics parks, consumer electronics lines in Suwon/Gumi, and EV auxiliaries, where safety, compact power stages, and fast start/stop are critical.

Medium-voltage drives scale across display and semiconductor fabs in Pyeongtaek and Cheonan, powering conveyors, handlers, and precision packaging with higher continuous duty. High-voltage remains a focused niche for Ulsan/Geoje shipyards and select heavy-equipment applications that require ruggedized servos. Across tiers, OEMs are standardizing on SiC-based inverters and predictive diagnostics to raise uptime and cut energy intensity.

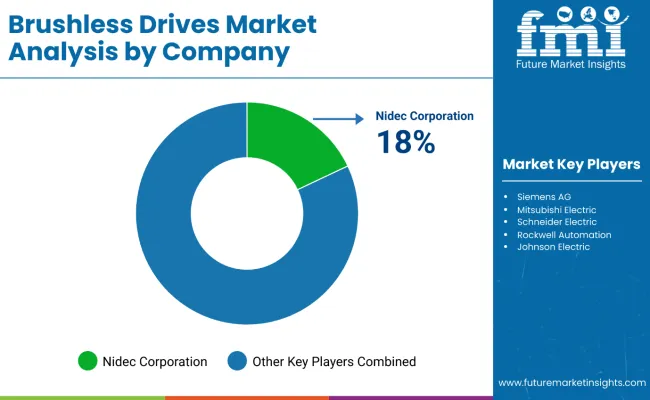

The brushless drives market is highly competitive, with global automation majors and specialized motion vendors expanding portfolios across inner-rotor servos, outer-rotor compact drives, and SiC/GaN-based inverter stages. Leaders are differentiating on power density, functional safety (STO/SIL), cyber-secure Industrial Ethernet, and predictive diagnostics, while mid-tier players compete on cost, lead time, and design-in support for fast-growing OEMs in EV, robotics, and consumer electronics.

Nidec, ABB, Siemens, Mitsubishi Electric, Schneider Electric, and Rockwell Automation anchor the high-spec end of the market with broad ecosystems such as PLC/robot controllers, drives, motors, gearheads, and application libraries, making them the default choice for multi-site industrial rollouts. Johnson Electric, AMETEK (Allied Motion/Allient), Maxon, and Faulhaber excel in compact and specialty motion, supplying high-precision drives for medical devices, lab automation, UAVs, and premium consumer products. In China and parts of APAC, domestic drive and motor makers are scaling rapidly, leveraging localized supply chains for magnets, PCBs, and power modules to shorten lead times and close capability gaps in mid-voltage segments.

Distributors and system integrators remain pivotal: European and North American channels win projects by bundling application engineering, safety validation, and lifecycle services (spares, remote monitoring, and uptime SLAs). Meanwhile, price-sensitive programs in India and Southeast Asia are pulling integrated motor-drive modules that compress cabinet space and commissioning time.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion (2025) |

| Motor Type | Inner Rotor, Outer Rotor |

| Voltage Range | Low Voltage, Medium Voltage, High Voltage |

| Application | Automotive, Industrial, Consumer Electronics, Healthcare, Aerospace & Defence, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, South Korea, Spain, BENELUX |

| Key Companies Profiled | Nidec Corporation, ABB Ltd., Siemens AG, Mitsubishi Electric, Schneider Electric, Rockwell Automation, Johnson Electric, AMETEK (Allied Motion / Allient), Maxon Motor AG, and Faulhaber Group |

The global Brushless Drives market is estimated at USD 18.1 billion in 2025, supported by strong demand from EV platforms, industrial automation/robotics, and consumer electronics that require high-efficiency, long-life motion systems.

The market is projected to reach USD 32.3 billion by 2035, reflecting wider adoption of SiC/GaN-based inverter stages, integrated motor-drive modules, and predictive-maintenance features across factories and electrified mobility.

The market is forecast to expand at a CAGR of 5.9% over 2025–2035, with growth driven by vehicle electrification, Industry 4.0 upgrades, and miniaturized drives in medical and consumer applications.

Inner-rotor drives are expected to maintain leadership with about 68% share in 2025, favored for high torque density and tight servo control in EV auxiliaries, machine tools, and robotics

Automotive is the leading application, accounting for roughly 38% of 2025 demand, spanning EV traction auxiliaries, thermal management, pumps, fans, and actuator systems.

Key companies include Nidec Corporation, ABB Ltd., Siemens AG, Mitsubishi Electric, Schneider Electric, Rockwell Automation, Johnson Electric, AMETEK (Allied Motion/Allient), Maxon Motor AG, and Faulhaber Group.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brushless Motor for AGV Market Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Brushless Car Wash Machine Market Growth – Trends & Forecast 2025 to 2035

AC Drives Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Servo Drives Market Size and Share Forecast Outlook 2025 to 2035

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

Conveyor Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Pod Drives Market Size and Share Forecast Outlook 2025 to 2035

Automotive Driveshaft Couplings Market

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Chain Drives Market Size, Growth, and Forecast 2025 to 2035

Automotive Sunroof Drives Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Marine Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA