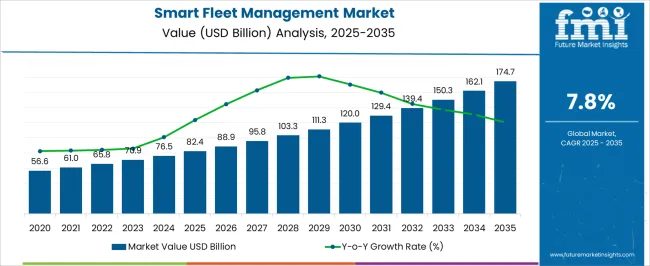

The smart fleet management market is projected to grow from USD 82.4 billion in 2025 to USD 174.7 billion by 2035, which represents a CAGR of 7.8%. This anticipated growth is driven by increasing adoption of connected vehicle technologies, telematics, and data-driven fleet optimization strategies across logistics, transportation, and delivery industries.

Between 2025 and 2027, the market is expected to grow from USD 82.4 billion to USD 88.9 billion, reflecting early adoption of AI-powered route optimization, predictive maintenance, and fuel management systems by large fleet operators. From 2028 to 2031, revenues are projected to rise from USD 95.8 billion to USD 111.3 billion, with incremental gains fueled by regulatory mandates for vehicle tracking, emission reduction, and driver safety compliance. The mid-phase growth benefits from expansion in urban and intercity logistics networks, as well as integration of IoT-enabled sensors and cloud platforms for real-time monitoring.

From 2032 to 2035, the market further strengthens to USD 174.7 billion, supported by widespread deployment of autonomous vehicles, advanced telematics solutions, and predictive analytics platforms. Fleet operators are increasingly relying on software-as-a-service models, mobile applications, and integrated dashboards to achieve operational efficiency, cost savings, and enhanced driver performance, making smart fleet management a critical tool for commercial transportation ecosystems worldwide.

The smart fleet management market is strongly influenced by multiple interconnected parent markets, each contributing uniquely to overall demand and technological advancement. The commercial logistics and transportation market holds the largest share at 35%, as trucking, last-mile delivery, and intercity freight operators increasingly adopt telematics, GPS tracking, and route optimization tools to improve operational efficiency, reduce fuel costs, and ensure timely deliveries.

The passenger and public transport market contributes 25%, with buses, taxis, and ride-sharing fleets implementing smart management systems for vehicle tracking, predictive maintenance, and driver performance monitoring, enhancing safety, reliability, and customer satisfaction. The automotive leasing and rental market accounts for 15%, where operators leverage fleet analytics, condition monitoring, and automated reporting to optimize utilization, reduce downtime, and manage maintenance schedules.

The enterprise mobility and corporate fleet market holds a 15% share, supplying organizations with software and hardware solutions for vehicle scheduling, fuel management, and compliance reporting. Finally, the government and municipal fleet market represents 10%, supporting police, emergency, and municipal vehicle operations through GPS-enabled dispatch, monitoring, and maintenance systems.

Collectively, commercial transport, passenger services, and corporate fleets account for 75% of total demand, emphasizing that operational efficiency, cost reduction, and safety are primary growth drivers, while rental, leasing, and government segments provide incremental adoption opportunities globally.

| Metric | Value |

|---|---|

| Smart Fleet Management Market Estimated Value in (2025 E) | USD 82.4 billion |

| Smart Fleet Management Market Forecast Value in (2035 F) | USD 174.7 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The smart fleet management market is experiencing robust growth, supported by increasing adoption of advanced telematics, real-time tracking, and predictive maintenance systems across diverse transport networks. Rising regulatory mandates for safety, emissions monitoring, and operational transparency are accelerating integration of intelligent solutions by fleet operators. Hardware advancements, including sensors, on-board diagnostics, and tracking units, have improved efficiency in monitoring and asset utilization.

Market expansion is further being fueled by the proliferation of IoT-enabled platforms, enhanced connectivity infrastructure, and cloud-based analytics, enabling data-driven decision-making. Strong uptake in road transportation is being supported by e-commerce growth, last-mile delivery demands, and urban logistics expansion.

Strategic collaborations between technology providers and transport operators are fostering end-to-end fleet solutions that integrate hardware, software, and services Over the forecast period, sustained investment in digital transformation, AI-powered analytics, and connected infrastructure is expected to strengthen market competitiveness, drive operational cost reductions, and expand adoption across both developed and emerging economies.

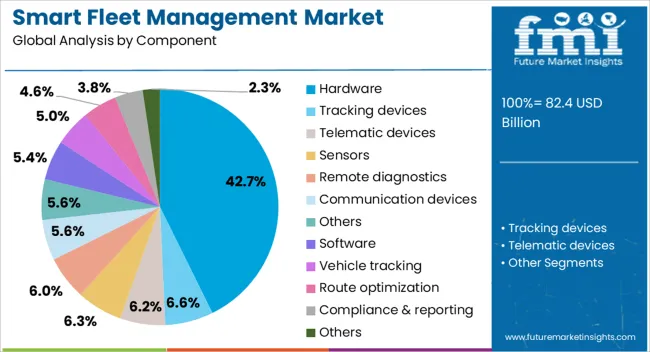

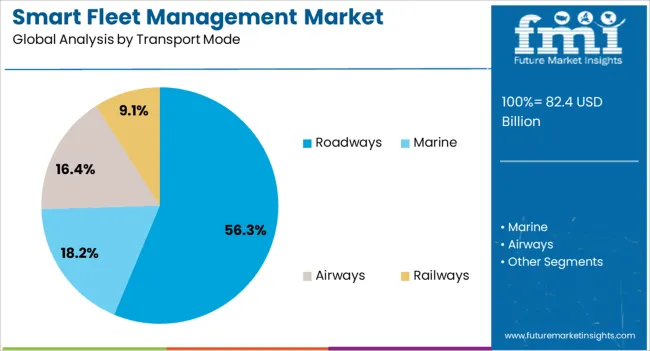

The smart fleet management market is segmented by component, transport mode, connectivity, and geographic regions. By component, smart fleet management market is divided into Hardware, Tracking devices, Telematic devices, Sensors, Remote diagnostics, Communication devices, Others, Software, Vehicle tracking, Route optimization, Compliance & reporting, and Others. In terms of transport mode, smart fleet management market is classified into Roadways, Marine, Airways, and Railways.

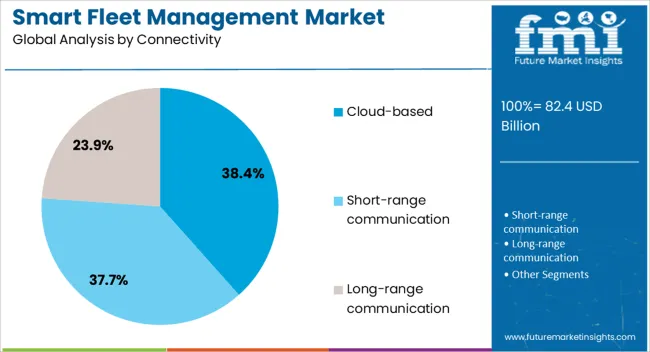

Based on connectivity, smart fleet management market is segmented into Cloud-based, Short-range communication, and Long-range communication. Regionally, the smart fleet management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, commanding 42.7% of the component category, is driving market leadership through the deployment of advanced GPS modules, telematics devices, and diagnostic tools that enable real-time fleet monitoring and performance optimization. This dominance is reinforced by the critical role hardware plays in enabling data capture for subsequent analysis through connected platforms.

Technological improvements in sensor accuracy, miniaturization, and energy efficiency have enhanced system reliability while reducing maintenance requirements. High adoption rates in commercial fleets are being fueled by the necessity to comply with regulatory safety and tracking mandates, as well as the demand for reducing operational downtime.

Integration with cloud-based platforms has further enhanced the value proposition of hardware solutions, enabling seamless data flow and remote diagnostics Continued investment in rugged, durable devices capable of withstanding diverse environmental conditions is expected to sustain the hardware segment’s competitive position and facilitate long-term adoption across multiple transport sectors.

The roadways segment, holding 56.3% of the transport mode category, has retained its dominance due to the sheer scale and operational scope of global road transport networks. Extensive adoption of smart fleet solutions within this segment is being driven by the growth of e-commerce, expansion of last-mile delivery services, and rising freight volumes in urban and intercity routes.

Advanced telematics and tracking systems have enabled greater route optimization, fuel efficiency, and predictive maintenance capabilities for road-based fleets. Fleet operators are prioritizing these technologies to reduce downtime, enhance driver safety, and meet tightening environmental regulations.

The relatively lower infrastructure requirements compared to other modes of transport make roadways a preferred choice for rapid technology deployment Strategic investments in AI-powered dispatch systems and real-time traffic analytics are anticipated to further strengthen the efficiency gains in this segment, ensuring its continued market leadership in the foreseeable future.

The cloud-based segment, representing 38.4% of the connectivity category, is at the forefront of market growth due to its scalability, cost-efficiency, and ease of deployment. Cloud platforms enable centralized fleet data management, real-time analytics, and seamless integration with third-party applications, enhancing overall operational visibility. Adoption is being accelerated by the increasing demand for remote fleet management capabilities, particularly in geographically dispersed operations.

Enhanced cybersecurity measures and compliance with international data protection regulations have improved trust and adoption among enterprise customers. Cloud connectivity supports continuous software updates, predictive analytics, and AI-driven decision-making, which collectively enhance fleet productivity and cost optimization.

The flexibility to scale resources based on fleet size and operational demands makes cloud-based solutions highly attractive to both large and small operators Future growth will be supported by integration with emerging technologies such as edge computing and 5G, further enhancing responsiveness and reliability in fleet operations.

Operational efficiency, safety, and cost optimization drive smart fleet management adoption. Real-time data analytics and predictive insights continue to enhance fleet performance and strategic decision-making worldwide.

The smart fleet management market is increasingly driven by the need to enhance operational efficiency across commercial and public transport fleets. Fleet operators are implementing telematics, GPS tracking, and automated route optimization to minimize idle time, reduce fuel consumption, and improve delivery timelines. Predictive maintenance solutions help identify potential mechanical issues before failures occur, lowering repair costs and downtime. Driver behavior monitoring is adopted to enforce safety compliance, reduce accidents, and ensure regulatory adherence. Integration with enterprise resource planning (ERP) systems allows seamless coordination between logistics, inventory, and fleet operations. The emphasis on operational cost reduction and improved asset utilization continues to propel the adoption of connected fleet management systems globally, making efficiency a primary growth driver.

Safety and compliance requirements are significant factors influencing the smart fleet management market. Commercial and government fleets adopt monitoring tools to ensure adherence to traffic regulations, emission standards, and driver working hours. Advanced telematics provide real-time alerts for speeding, harsh braking, or route deviations, reducing accidents and improving driver accountability. Regulatory mandates, such as Hours of Service (HOS) in logistics and vehicle emission reporting, necessitate automated tracking and documentation. Insurance providers are also incentivizing fleets to deploy connected management systems by offering reduced premiums for monitored and safer operations. Consequently, safety, compliance, and risk mitigation are integral dynamics shaping fleet technology adoption and supporting long-term operational sustainability.

Cost optimization in fuel consumption and vehicle maintenance is a crucial market driver. Smart fleet management platforms analyze driving patterns, route efficiency, and fuel usage to implement strategies that minimize waste and operational expenses. Predictive maintenance schedules reduce unplanned downtime and extend vehicle lifecycle, improving total cost of ownership. Fleet operators are leveraging analytics to forecast repair needs, parts replacement, and vehicle rotations, enabling budget optimization. Telematics integration provides insights into idling, engine performance, and route congestion, allowing managers to optimize dispatch decisions. By reducing operational and maintenance expenditures, companies gain a competitive advantage, driving broader adoption of smart fleet solutions across logistics, corporate, and public transport sectors worldwide.

Data-driven insights are transforming fleet management by enabling better decision-making and performance optimization. Smart fleet solutions collect and analyze real-time data on vehicle location, speed, fuel consumption, and maintenance needs. Fleet managers utilize dashboards and predictive analytics to plan routes, allocate resources efficiently, and monitor driver performance. Integration with mobile applications and cloud platforms allows centralized management of large-scale operations and ensures transparency across multiple fleet types. Analytics-driven maintenance, risk assessment, and scheduling improve operational resilience. Performance benchmarking across fleets supports informed strategic decisions, cost reduction, and enhanced service delivery. Data intelligence remains a core dynamic in accelerating smart fleet management adoption globally.

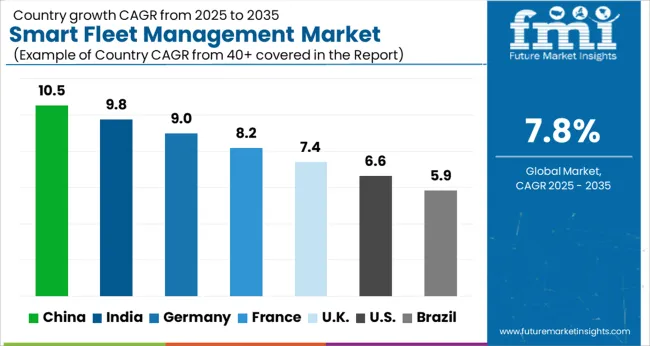

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global smart fleet management market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads at 10.5%, followed by India at 9.8%, France at 8.2%, the UK at 7.4%, and the USA at 6.6%. Growth is fueled by rising demand for operational efficiency, predictive maintenance, fuel optimization, and regulatory compliance.

Asia-Pacific markets, particularly China and India, exhibit rapid adoption due to expanding logistics, e-commerce, and public transport sectors. Europe and North America emphasize performance monitoring, driver safety, and integration with enterprise management systems. Telematics, real-time tracking, and cloud-based analytics drive efficiency gains, reduce costs, and enhance fleet reliability globally. The analysis spans over 40+ countries, with the leading markets shown below.

The smart fleet management market in China is projected to grow at a CAGR of 10.5% from 2025 to 2035, driven by rapid expansion of logistics, e-commerce, and public transportation networks. Fleet operators are increasingly adopting IoT-enabled telematics, GPS tracking, and predictive maintenance solutions to optimize route planning, fuel consumption, and driver performance. Urban delivery fleets, long-haul trucking, and municipal transportation services are investing in cloud-based platforms for real-time monitoring and analytics.

Domestic technology providers are partnering with international telematics and software companies to offer integrated, scalable solutions tailored to local regulatory and operational requirements. Government policies promoting smart mobility and emission reduction further accelerate adoption, while data-driven insights are enabling improved operational efficiency and cost management.

India’s smart fleet management market is expected to grow at a CAGR of 9.8% from 2025 to 2035, fueled by increasing logistics demand, e-commerce growth, and urban mobility challenges. Fleet operators are implementing GPS-based tracking, vehicle diagnostics, and predictive maintenance solutions to reduce downtime, improve safety, and optimize fuel usage. Large-scale transport companies, courier services, and ride-sharing operators are investing in software platforms for real-time fleet analytics and compliance monitoring.

Collaborations with IoT solution providers and telematics companies are enabling scalable, cost-effective deployments. Regulatory frameworks on driver safety, emissions, and transport efficiency are boosting demand for connected fleet solutions. Data-driven decision-making and automated reporting further enhance operational performance and profitability.

The smart fleet management market in France is projected to grow at a CAGR of 8.2% from 2025 to 2035, supported by expanding commercial transport, logistics, and municipal fleet operations. Fleet operators are integrating GPS, telematics, and driver behavior monitoring systems to optimize fuel efficiency, reduce accidents, and ensure regulatory compliance.

Public transport authorities, private logistics firms, and utility companies are leveraging cloud-based fleet management platforms for predictive maintenance, route optimization, and real-time analytics. European initiatives focused on reducing carbon emissions and improving traffic management are driving adoption. OEMs and software providers are collaborating with fleet operators to offer tailored solutions meeting EU safety and data security standards. Focus on sustainability, efficiency, and digitalization is enhancing market penetration.

The smart fleet management market in the UK is expected to grow at a CAGR of 7.4% from 2025 to 2035, driven by commercial transportation, delivery services, and public sector fleet modernization. Fleet operators are deploying IoT-enabled sensors, GPS tracking, and telematics solutions to improve operational efficiency, minimize vehicle downtime, and enhance driver safety.

Government programs promoting smart city mobility and emission reduction targets encourage adoption across urban fleets. Collaborations between fleet service providers and telematics companies facilitate deployment of real-time monitoring, predictive maintenance, and automated reporting solutions. Focus on compliance with Department for Transport regulations, fuel optimization, and data analytics ensures measurable cost savings and performance improvements across commercial and municipal operations.

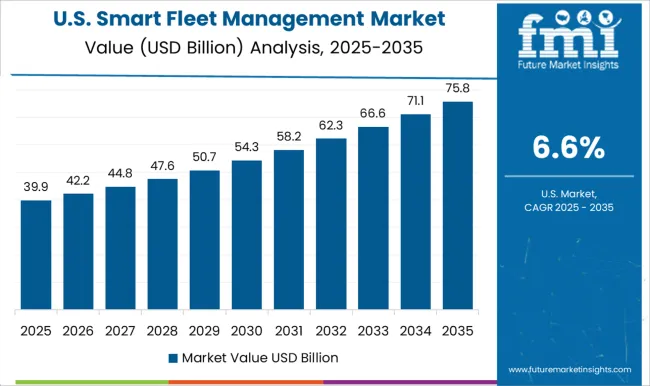

The smart fleet management market in the USA is projected to grow at a CAGR of 6.6% from 2025 to 2035, fueled by the expanding logistics, e-commerce, and utility fleet sectors. Fleet operators are increasingly adopting connected vehicle technologies, telematics, and predictive analytics to optimize routes, monitor driver performance, and improve fuel efficiency.

Regulatory standards on safety, emissions, and commercial vehicle operations drive compliance-focused technology adoption. Large-scale fleet operators, last-mile delivery services, and municipal authorities are leveraging cloud-based platforms and integrated telematics systems for enhanced operational visibility. Strategic partnerships with IoT providers, analytics platforms, and vehicle manufacturers enable scalable deployment and continuous innovation. Data-driven decision-making ensures cost reduction, reliability, and operational efficiency.

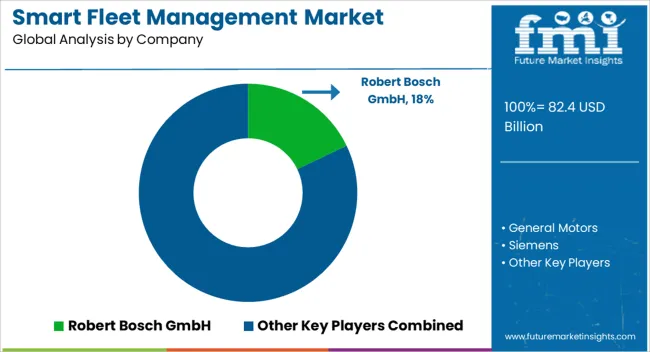

Competition in the smart fleet management market is driven by connectivity, data analytics capabilities, and integration with telematics and IoT platforms. Robert Bosch GmbH leads with end-to-end fleet solutions, offering GPS tracking, predictive maintenance, and driver behavior monitoring tailored for commercial, municipal, and industrial fleets. General Motors differentiates through connected vehicle technologies, integrating OEM telematics with fleet management software for real-time operational insights and improved fuel efficiency.

Siemens competes with digital infrastructure solutions, emphasizing smart mobility platforms, data analytics, and cloud connectivity for large-scale fleet operators. Cisco Systems focuses on networked vehicle communication, cybersecurity, and IoT integration to enable seamless data flow across fleet ecosystems. Regional and specialized players such as Continental AG and Denso Corporation provide advanced sensor technologies, vehicle diagnostics, and telematics hardware that complement software platforms. Avnet acts as a distribution and integration partner, supplying hardware and IoT components to fleet management providers, enabling scalable deployments.

Strategies emphasize modularity, interoperability, and regulatory compliance for emissions, driver safety, and transport efficiency. Partnerships with OEMs, software developers, and service providers are leveraged to accelerate solution adoption. Product offerings include real-time GPS tracking, predictive maintenance modules, fuel consumption analytics, driver behavior monitoring, and reporting dashboards. Brochures and technical guides detail installation, compatibility, integration options, and cybersecurity protocols. The market focuses on improving operational efficiency, safety, regulatory adherence, and cost optimization across commercial and municipal fleets.

| Item | Value |

|---|---|

| Quantitative Units | USD 82.4 Billion |

| Component | Hardware, Tracking devices, Telematic devices, Sensors, Remote diagnostics, Communication devices, Others, Software, Vehicle tracking, Route optimization, Compliance & reporting, and Others |

| Transport Mode | Roadways, Marine, Airways, and Railways |

| Connectivity | Cloud-based, Short-range communication, and Long-range communication |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, General Motors, Siemens, Cisco Systems, Continental AG, Denso Corporation, and Avnet |

| Additional Attributes | Dollar sales, regional and segment share, CAGR, adoption trends, connectivity and IoT integration, regulatory compliance, OEM partnerships, telematics hardware/software demand, fleet type preference, and competitive landscape. |

The global smart fleet management market is estimated to be valued at USD 82.4 billion in 2025.

The market size for the smart fleet management market is projected to reach USD 174.7 billion by 2035.

The smart fleet management market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in smart fleet management market are hardware, tracking devices, telematic devices, sensors, remote diagnostics, communication devices, others, software, vehicle tracking, route optimization, compliance & reporting and others.

In terms of transport mode, roadways segment to command 56.3% share in the smart fleet management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA