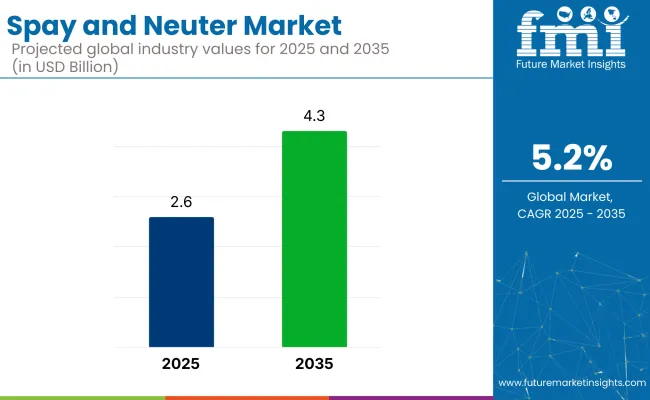

The global spay and neuter market is anticipated to grow from USD 2.6 billion in 2025 to approximately USD 4.3 billion by 2035, progressing at a CAGR of 5.2%.

A growing emphasis on responsible pet ownership, coupled with efforts to reduce stray animal populations, continues to drive the demand for surgical sterilization services worldwide. Increasing pet humanization trends, combined with awareness of the health benefits of sterilization-including reduced risk of cancers and other diseases-are persuading pet owners to opt for these procedures.

The industry represents a small yet important share within its parent markets. Within the pet care market, surgical sterilization services account for approximately 5-7%, focusing primarily on animal health and wellness. In the veterinary services market, the share is higher at 10-12%, as spaying and neutering are common procedures performed in clinics and animal hospitals.

Within the broader animal health market, it makes up around 3-5%, reflecting its role in promoting overall animal well-being and controlling pet populations. In the pet population management market, surgical sterilization programs contribute significantly, accounting for around 20-25% due to their direct impact on managing overpopulation. Lastly, in the non-profit animal welfare market, spay and neuter services are a key part of their operations, representing 15-20% of their activities.

A culturally significant moment for this industry was influenced by public figures such as Bob Barker, the former host of The Price Is Right, who famously signed off every show from 1979 until his retirement in 2007 with the line: "Help control the pet population. Have your pets spayed or neutered." This call to action, as highlighted by The New York Times and other reputable media outlets, played a pivotal role in shaping public discourse on the importance of sterilization as a means to prevent pet overpopulation.

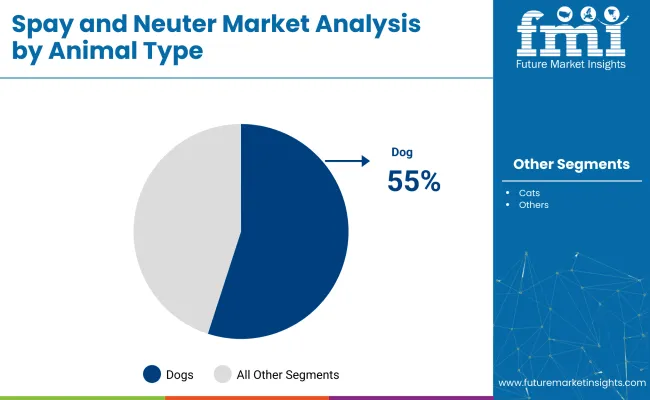

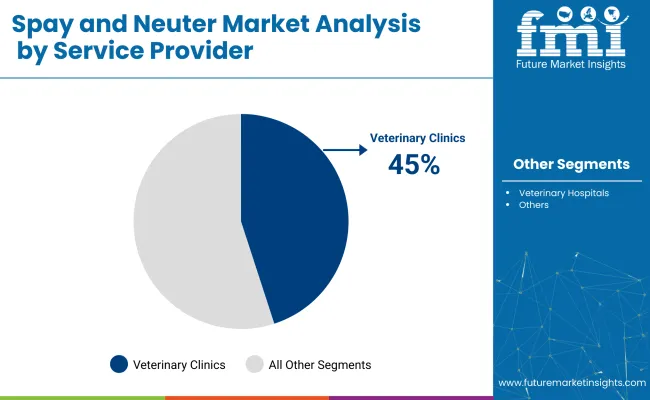

The industry is led by dog procedures accounting for 55% industry share, veterinary clinics dominate with 45%, reflecting increased pet ownership, welfare awareness, and accessible veterinary services worldwide.

The dog segment remains dominant in the industry, capturing 55% of the share.

The growth in global dog ownership, particularly in urban households, has driven the demand for sterilization procedures. These procedures help control stray populations and prevent reproductive diseases. Veterinary associations widely recommend spaying and neutering to reduce health risks such as cancer and infections in dogs.

Major campaigns in regions like the USA, Canada, and Europe have also promoted early-age sterilization. This increase in awareness, supported by veterinary organizations and animal welfare bodies, ensures sustained demand for dog sterilization services, contributing to industry growth.

Veterinary clinics lead the service provider segment, holding 45% of the industry share.

Clinics offer accessible, cost-effective, and community-based surgical sterilization services, making them the preferred choice for pet owners. The proliferation of small and mid-sized veterinary practices across urban and suburban areas has significantly improved access to surgical care for dogs, cats, and other companion animals.

Established clinics like Banfield Pet Hospital and VCA Animal Hospitals offer sterilization as part of their routine wellness services. Additionally, government-supported clinic programs and mobile veterinary units are gaining popularity, particularly in developing regions, further driving growth in this sector.

The industry is expanding due to increasing veterinary healthcare awareness and animal population control initiatives. Clinics and mobile services are focusing on affordable, accessible sterilization procedures for pets and community animals.

Rising Emphasis on Population Control and Public Health

Municipal and animal welfare organizations are increasingly focusing on sterilization programs to control stray populations and prevent the spread of diseases. Local governments are funding subsidized spay and neuter clinics, while mobile veterinary units reach underserved areas. Early-age neutering for kittens and puppies is becoming standard practice, contributing to healthier pet populations and reducing public safety issues.

Enhanced Access Through Mobile Clinics and Affordable Services

Mobile veterinary clinics are making sterilization services more accessible, especially in areas lacking local veterinary care. One-day service models and sliding-scale pricing based on income are improving affordability. Public-private partnerships support programs for feral animal populations, and online scheduling reduces wait times and no-shows, enhancing both accessibility and pet healthcare outcomes.

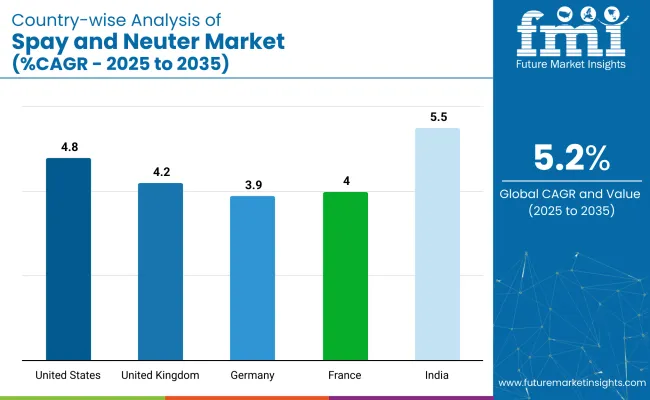

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

| United Kingdom | 4.2% |

| Germany | 3.9% |

| France | 4% |

| India | 5.5% |

The global industry is projected to grow at a CAGR of 5.2% from 2025 to 2035. The United States, with a CAGR of 4.8%, shows steady growth, supported by strong pet ownership and increasing awareness about the benefits of spaying and neutering for pet health and population control. The United Kingdom follows with a CAGR of 4.2%, reflecting a mature industry with ongoing support from animal welfare organizations and government initiatives.

Germany, at 3.9%, experiences slower growth, with an established pet care industry but limited increase in demand for these services. France shows a modest CAGR of 4%, benefiting from an increase in pet population and public awareness programs. India leads with the highest CAGR of 5.5%, a growing middle class, and rising awareness about responsible pet ownership and population control. While OECD countries show gradual growth, India stands out as the fastest-growing industry, indicating a shift towards emerging economies as key players in shaping the future of the industry.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The United States is projected to grow at a CAGR of 4.8% from 2025 to 2035.

Government-sponsored programs and partnerships with animal welfare organizations are expanding the reach of low-cost sterilization services. Established veterinary chains like Banfield Pet Hospital and VCA Animal Hospitals are increasing their service portfolios to include spaying and neutering. The high rate of pet ownership and regulatory support from animal control agencies further cements the USA as the largest industry for spay and neuter services. Awareness campaigns on responsible pet ownership continue to drive the adoption of sterilization procedures.

The United Kingdom is expected to grow at a CAGR of 4.2% during the forecast period.

Legislative enforcement and animal welfare advocacy ensure that neutering remains standard practice, particularly for shelter animals. Organizations like the Royal Society for the Prevention of Cruelty to Animals (RSPCA) are promoting subsidized sterilization clinics. There is increasing demand for responsible breeding practices and companion animal welfare, which supports steady industry growth. These efforts are expected to continue driving the expansion of services throughout the UK.

The industry in Germany is anticipated to grow at a CAGR of 3.9% from 2025 to 2035.

Strong veterinary healthcare infrastructure and public awareness campaigns on stray animal control support the adoption of procedures. Urban centers like Berlin and Munich are reporting rising demand for preventive surgeries, boosted by local government incentives. The German Veterinary Association’s guidelines for animal welfare emphasize spaying and neutering as key practices to reduce stray animal populations, reinforcing the industry’s stability.

The industry in France is expected to grow at a CAGR of 4% from 2025 to 2035.

The modernization of veterinary practices and the growing trend of pet humanization are encouraging early-age sterilization. Municipal authorities, particularly in Paris, are supporting stray population control programs, which boosts demand for these services. Additionally, pet insurance schemes are increasingly covering neutering costs, further driving consumer adoption. France’s strong tradition of animal welfare and responsible pet ownership continues to shape a positive industry landscape for surgical sterilization services.

India is expected to emerge as the fastest-growing industry, with a projected CAGR of 5.5% from 2025 to 2035.

The rapid growth of the urban stray dog population has led municipal corporations and NGOs to implement widespread Animal Birth Control (ABC) programs. State-supported campaigns, such as those under the Swachh Bharat Abhiyan and Smart City initiatives, are intensifying sterilization drives. Additionally, the rising adoption rates of pets and increased awareness of zoonotic diseases are driving demand for spaying and neutering, positioning India as the fastest-growing industry for these services.

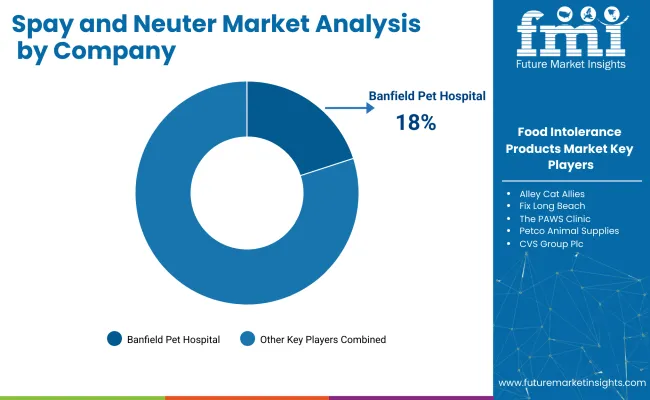

The leading providers like Banfield Pet Hospital, Ethos Veterinary Health, and Vet Partners Group Limited holding significant industry shares through extensive clinic networks, veterinary expertise, and community outreach programs. Emerging players such as Alley Cat Allies, Auburn Valley Humane Society, and Houston Humane Society focus on targeted regional campaigns and trap-neuter-return (TNR) initiatives to manage feral and stray populations.

Rising players including Animal Spay-Neuter Clinic, Companions Spay & Neuter, and The PAWS Clinic serve niche communities with affordable and accessible services. Key industry growth is driven by rising awareness of responsible pet population control, increasing government and NGO partnerships, and expanding low-cost spay/neuter clinics supported by animal welfare organizations.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 2.6 billion |

| Projected Industry Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million procedures for volume |

| Animal Types Analyzed (Segment 1) | Dogs (Spaying, Neutering), Cats (Spaying, Neutering), Other animal types (Spaying, Neutering) |

| Service Providers Analyzed (Segment 2) | Veterinary clinics, Veterinary hospitals, Other service providers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Spain, Italy, Netherlands, China, Japan, India, Australia, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE |

| Key Players influencing the Industry | Alley Cat Allies, Auburn Valley Humane Society, Animal Spay-Neuter Clinic, Banfield Pet Hospital, CVS Group Plc, Companions Spay & Neuter, Ethos Veterinary Health, Fix Long Beach, Holt Road Pet Hospital, Houston Humane Society, Indian Street Animal Clinic, Naoi Animal Hospital, Petco Animal Supplies, S/Nipped Clinic, The PAWS Clinic, VetPartners Group Limited |

| Additional Attributes | Dollar sales by animal type and service provider, growth in veterinary clinic segment, rising awareness on animal population control, regional procedure volume variations, impact of animal welfare initiatives |

The industry is segmented by animal type into dogs (spaying, neutering), cats (spaying, neutering), and other animal types (spaying, neutering).

The sector includes veterinary clinics, veterinary hospitals, and other service providers.

The industry is categorized into North America , Europe, Asia Pacific, Latin America, Middle East and Africa .

The industry is projected to reach USD 2.6 billion in 2025.

The industry is expected to reach USD 4.3 billion by 2035.

The industry is expected to grow at a CAGR of 5.2% from 2025 to 2035.

The dog segment is expected to dominate the industry with a 55% share in 2025.

Veterinary clinics are projected to capture a 45% share of the industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA