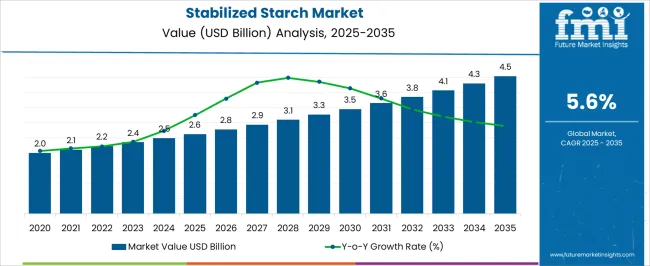

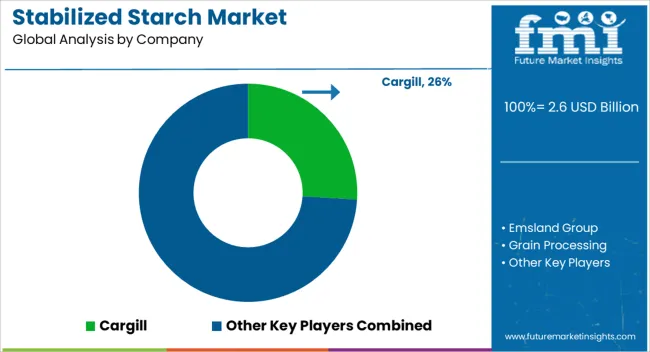

The Stabilized Starch Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Stabilized Starch Market Estimated Value in (2025 E) | USD 2.6 billion |

| Stabilized Starch Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Stabilized Starch market is witnessing steady growth due to increasing demand for functional ingredients in the food and beverage industry. Stabilized starch is being adopted for its ability to enhance texture, improve stability during processing, and extend shelf life of various products. In 2025, the market is driven by evolving consumer preferences for convenience foods and processed products that require consistent quality and longer storage periods.

Industrial adoption is being supported by technological advancements in starch modification and stabilization processes, enabling tailored solutions for specific applications. Growth opportunities are being further enhanced by the rising need for clean label ingredients and natural food additives that align with health-conscious consumer trends.

Manufacturers are increasingly leveraging maize as a primary raw material due to its wide availability, cost efficiency, and ease of processing As the food processing industry expands globally, demand for stabilized starch in applications such as bakery, confectionery, sauces, and convenience foods is expected to rise, offering robust market potential across both developed and emerging regions.

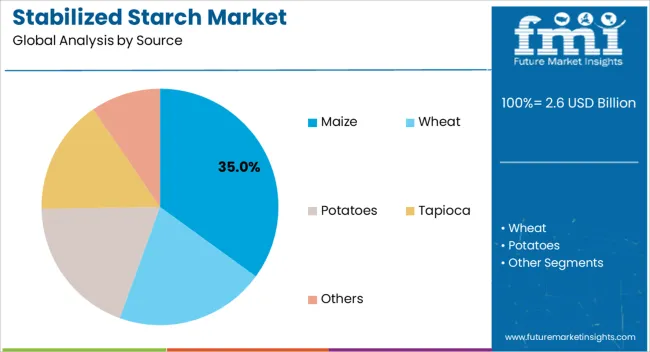

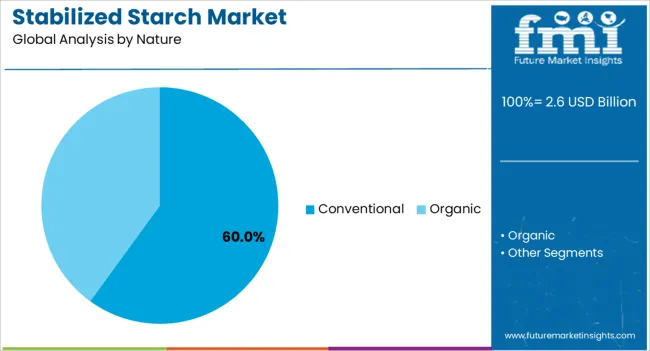

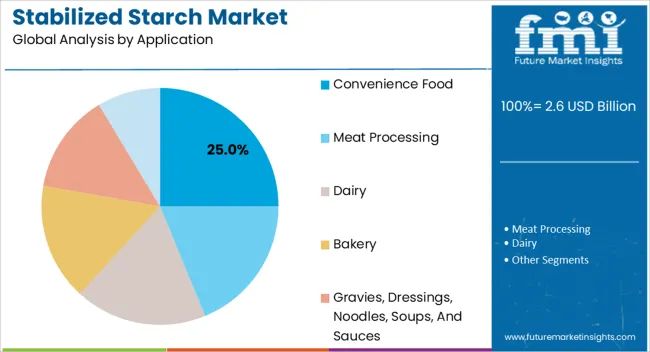

The stabilized starch market is segmented by source, nature, application, and geographic regions. By source, stabilized starch market is divided into Maize, Wheat, Potatoes, Tapioca, and Others. In terms of nature, stabilized starch market is classified into Conventional and Organic. Based on application, stabilized starch market is segmented into Convenience Food, Meat Processing, Dairy, Bakery, Gravies, Dressings, Noodles, Soups, And Sauces, and Others. Regionally, the stabilized starch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The maize source segment is projected to account for 35.00% of the Stabilized Starch market revenue in 2025, positioning it as the leading raw material type. This predominance is being attributed to maize's abundant availability, cost-effectiveness, and compatibility with large-scale starch processing techniques. Maize-based stabilized starch is favored for its high yield, consistent quality, and ease of chemical and physical modification, which allows for tailored functionality in various food applications.

The segment's growth is also being supported by the ability to produce starch with desired viscosity, gel strength, and thermal stability, making it suitable for both conventional and industrial applications. Manufacturers prefer maize as it can be processed efficiently to produce starch that meets regulatory and quality standards across regions.

Additionally, the scalability of maize starch production enables consistent supply to meet rising demand in convenience foods, bakery products, and sauces Future growth is anticipated to continue as food manufacturers increasingly require functional ingredients that enhance product performance while maintaining clean label and cost efficiency.

The conventional nature segment of stabilized starch is expected to account for 60.00% of the market revenue in 2025, establishing it as the dominant type. This leadership is being driven by widespread acceptance in traditional food processing applications due to predictable functionality and reliable performance. Conventional stabilized starch is being preferred because it delivers consistent viscosity, gel formation, and thermal stability in products such as sauces, soups, and bakery goods.

Its ease of integration into existing manufacturing processes and compatibility with various ingredients further supports adoption. The growth of this segment is also being influenced by its cost advantage compared to specialty or modified starches, allowing manufacturers to optimize operational expenses.

Additionally, conventional starch provides sufficient functional properties for most industrial and commercial food applications, making it a practical choice for large-scale production As the processed food industry continues to expand globally, the conventional stabilized starch segment is expected to maintain a strong market presence, supported by its proven performance, reliability, and broad application spectrum.

The convenience food application segment is anticipated to hold 25.00% of the Stabilized Starch market revenue in 2025, making it the leading application area. This dominance is being driven by rising consumer preference for ready-to-eat meals, packaged snacks, and pre-prepared food items that require extended shelf life and consistent texture. Stabilized starch enhances the stability, viscosity, and mouthfeel of convenience foods, which are critical for consumer acceptance and repeat purchase.

The growth of this segment is also being supported by the expansion of modern retail formats, fast food chains, and on-the-go eating trends, which have significantly increased demand for processed convenience products. Additionally, the ability to maintain quality during high-temperature processing and frozen storage makes stabilized starch an essential ingredient for this segment.

Manufacturers increasingly rely on this functional ingredient to deliver products that meet consumer expectations for texture, stability, and flavor As urbanization and dual-income households continue to rise, the demand for convenience foods incorporating stabilized starch is expected to expand steadily, reinforcing the segment’s leadership in the market.

Modified starch, often known as stabilized starch, is particularly helpful in the food sector. Amylum, also known as stabilized starch, is a polysaccharide carbohydrate made up of several glucose units bound together by glycoside linkages. It can be found in a variety of foods, including potatoes, rice, wheat, and others. The food business uses unmodified carbohydrates only sometimes. So, scientists create diverse techniques for starch modification, which call for a variety of chemicals and enzymes. As food additives, stabilized starch is utilized.

Improved properties of stabilized starch over native starch include a greater ability to hold water, heat resistance, stronger binding, less syneresis of starch, and better thickening. Pre-gelatinization (pre-cooked starches used as a thickener in cold water) and heat-treatment of starch are examples of physical modifications. Starch can be utilized as a fat substitute once it has undergone hydrolysis modification. Stabilized starch can be utilized for any purpose in the food processing sector by making various modifications.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Stabilized Starch.

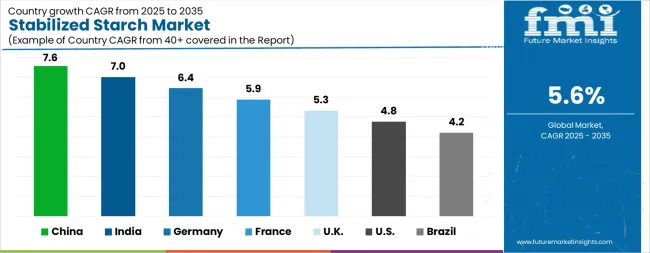

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Stabilized Starch Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Stabilized Starch Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Stabilized Starch Market is estimated to be valued at USD 911.8 million in 2025 and is anticipated to reach a valuation of USD 1.5 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 142.5 million and USD 85.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Source | Maize, Wheat, Potatoes, Tapioca, and Others |

| Nature | Conventional and Organic |

| Application | Convenience Food, Meat Processing, Dairy, Bakery, Gravies, Dressings, Noodles, Soups, And Sauces, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Emsland Group, Grain Processing, Agrana, Avebe, Samyang Holdings, BENEO, SMS Corporation, and Blattmann Schweiz AG. |

The global stabilized starch market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the stabilized starch market is projected to reach USD 4.5 billion by 2035.

The stabilized starch market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in stabilized starch market are maize, wheat, potatoes, tapioca and others.

In terms of nature, conventional segment to command 60.0% share in the stabilized starch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of UV Stabilized Films Providers

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Food Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA