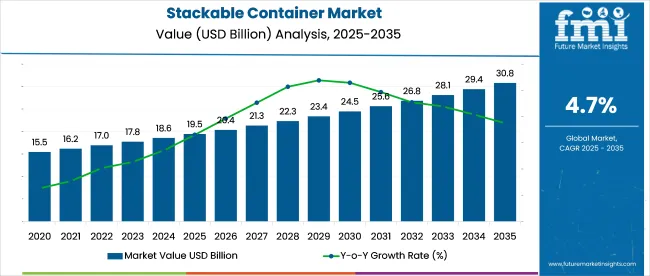

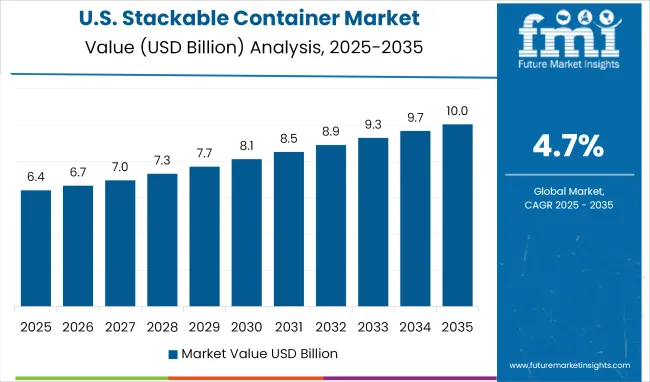

The Stackable Container Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The stackable container market is experiencing steady expansion due to the global shift toward sustainable packaging and storage solutions that improve operational efficiency and reduce logistics costs. As businesses increasingly focus on space utilization, standardization, and reusability, stackable containers are being adopted across warehousing, food processing, retail, and e-commerce sectors.

Demand is further supported by automation in material handling systems, where uniform stacking designs enable compatibility with conveyor systems and robotic palletizers. Growth in cold chain logistics and food-grade transport is also accelerating innovation in design and material durability.

Additionally, government directives favoring reusable over single-use packaging especially in food, agriculture, and consumer goods are encouraging manufacturers to invest in high-performance, recyclable container solutions.

As circular economy initiatives gain traction, companies are adopting stackable containers to meet sustainability goals while improving load stability, inventory visibility, and long-term cost savings.

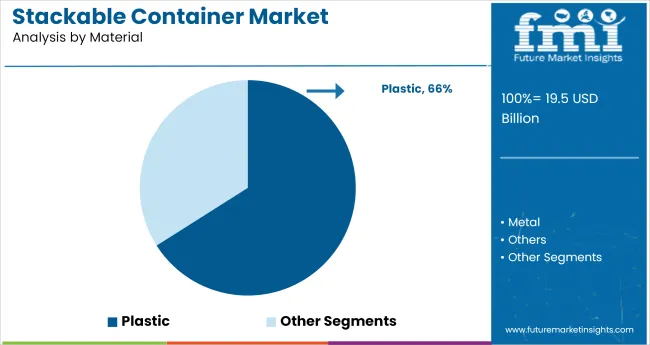

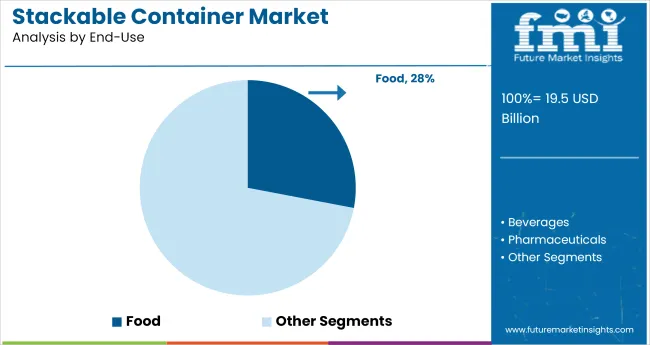

The market is segmented by Material and End-Use and region. By Material, the market is divided into Plastic, Metal, and Others. In terms of End-Use, the market is classified into Food, Beverages, Pharmaceuticals, Personal Care, Chemicals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is projected to hold a 66.0% revenue share in the stackable container market in 2025, positioning it as the leading material type. This dominance is being driven by plastic’s lightweight, impact-resistant nature, which allows for high stacking strength while minimizing transportation and handling costs. The material’s versatility supports a wide range of container designs from ventilated crates to solid bins making it ideal for food, industrial, and retail applications.

Advances in polymer formulation have enhanced durability under temperature variations, enabling safe use in cold chain and hygienic environments. Plastic containers also offer ease of cleaning and long service life, aligning with industry trends toward reusable, washable systems.

Furthermore, manufacturers are integrating post-consumer recycled (PCR) content and mono-material designs to meet sustainability targets. With high load-bearing efficiency, customizability, and recyclability, plastic remains the material of choice for scalable, stackable packaging and storage systems.

The food industry is anticipated to contribute 28.0% of total revenue in the stackable container market by 2025, establishing it as a key end-use segment. This leadership is being fueled by rising demand for hygienic, durable, and space-saving containers that meet food safety compliance across storage, transport, and retail display stages.

Stackable containers offer significant advantages in preserving product integrity, preventing spillage, and optimizing space utilization in cold chain logistics and distribution centers.

Their ability to be nested or stacked uniformly ensures maximum vehicle fill and storage efficiency, critical for reducing costs in high-volume food operations. The segment’s growth is also supported by the expansion of organized food retail and exports, where compliance with global packaging standards is necessary.

With increasing preference for reusable packaging in foodservice, processing, and fresh produce handling, stackable containers are becoming essential in supporting supply chain resilience and environmental sustainability in the food industry.

Containers which are stacked vertically and secured horizontally by stackers, lashing etc. are called stackable containers. Packaging contributes significantly to the product's value.

The market is predicted to grow in response to rising demand for protective packaging from the food and pharmaceutical industries in order to extend the shelf life of finished goods.

Because of its creative visual appeal for customer attractiveness and convenience, stackable container are becoming increasingly popular.

Changing lifestyles and food choices in developing nations such as China and India are likely to broaden the appeal of convenience foods, boosting packaging's utility.

The expanding adoption of novel technologies such as biodegradable packaging and aseptic packaging is predicted to play a critical role in extending product shelf life. Consumers are looking for innovative packaging items with a long shelf life because shelf life is regarded one of the most essential characteristics of a product.

Companies have developed alternate methods in response to the growing need for lightweight packaging. By shielding the product from oxygen, moisture, and other possible agents such as bacteria, the shelf life of the product can be increased. As a result, stackable container are the protective mediums with high barrier qualities that can protect the product from a variety of deteriorating agents.

The increasing relevance of e-commerce as a shopping medium on a global scale, as a result of the growing number of smartphone users, is predicted to play a key role in broadening the scope of packaging.

Concerns about non-degradable plastics are driving producers to create environmentally friendly, long-lasting plastic containers in order to attract new customers. In the face of a shaky global political infrastructure and subpar product designs, which have resulted in billions of tonnes of plastic garbage piling up in landfills, opportunities abound.

Plastic is the most preferred material for bottled water, carbonated soft drinks, and juice packaging because of its many advantages for both makers and customers. Plastic is a non-toxic and robust material that is also recyclable.

Plastic containers are used to carry about 70 percent of juice, mineral water, soft drinks. Furthermore, rising urbanisation and rising spending on cosmetics and home cleaners are predicted to expand HDPE packaging's application.

The price of raw materials for containers continues to fluctuate, limiting the expansion of the market. Local and regional regulations established by various administrative entities.

Strict anti-regulatory implications have been put on the usage of plastic material, which has had a significant impact on the demand. Market Revenue has had difficulties as a result of this.

With barely a tenth of discarded conventional plastics recycled globally, the need to produce environmentally friendly alternatives only serves to motivate major corporations to spend heavily in the field, providing sustainable options to minimise carbon footprints.

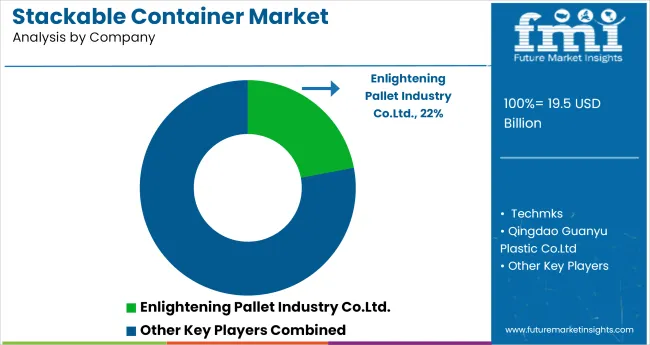

The following global key players such as

As China is an emerging economy, there is a steady increase in household income which directly affects the standard of living in middle-class families, as a result, there is a large consumption of extra income flowing to the food and beverage industries which are accounting for the increase in demand.

Also, low manufacturing and machines component cost in China is further escalate the market growth in China. Skyrocketing demand for convenient packaging products will propel the demand of the market over the forecast period.

Owing to the growth in the latest technology which has led to mark the innovation in stackable container manufacturing has created a significant demand for these container. Also, presence of the key players involved in the manufacturing of the stackable container is creating a significant impact on the growth of the market.

The global stackable container market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the stackable container market is projected to reach USD 30.8 billion by 2035.

The stackable container market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in stackable container market are plastic, metal and others.

In terms of end-use, food segment to command 28.0% share in the stackable container market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Containerboard Market Size and Share Forecast Outlook 2025 to 2035

Containerized Substation Market Size and Share Forecast Outlook 2025 to 2035

Container Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stackable Beaker Market Size and Share Forecast Outlook 2025 to 2035

Stackable Plastic Trays Market Size, Share & Forecast 2025 to 2035

Container Stacking Machine Market by Automation & System Type Through 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Analyzing Container Liner Market Share & Industry Leaders

Market Leaders & Share in the Container Stacking Machine Industry

Container Security Market

Container Coating Market

Container Mouth Inner Seal Market

PS Containers Market Size and Share Forecast Outlook 2025 to 2035

PP Container Liner Market

Tin Container Market Forecast and Outlook 2025 to 2035

PET Containers Market Growth, Demand and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA