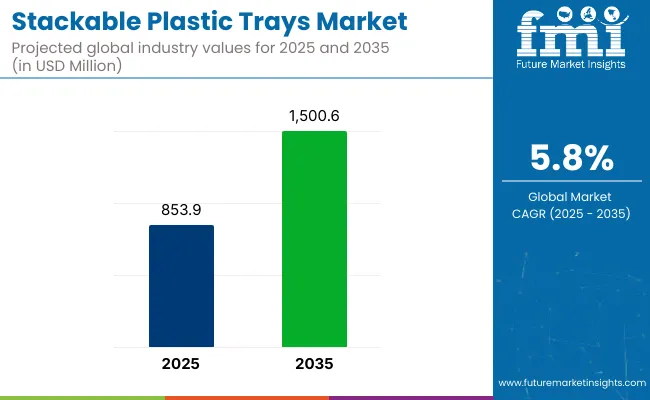

The stackable plastic trays market is projected to grow from USD 853.9 million in 2025 to USD 1,500.6 million by 2035, registering a CAGR of 5.8% during the forecast period. Sales in 2024 reached USD 807.0 million. Increasing emphasis on space-saving storage, improved handling in logistics, and reusability are encouraging adoption in automotive, electronics, and food sectors.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 853.9 million |

| Projected Market Size in 2035 | USD 1,500.6 million |

| CAGR (2025 to 2035) | 5.8% |

High demand is being observed in industrial settings where stacking strength and material durability are essential. Additionally, rising automation in warehousing has been favorably impacting the usage of standard-sized stackable trays compatible with robotic handling systems.

In April 2025, Klöckner Pentaplast (kp), a global leader in rigid and flexible packaging and specialty film solutions, has achieved Tray Circularity Evaluation Platform (TCEP) endorsement for its flagship kp Elite® range of modified atmosphere packaging (MAP) trays. "We're excited to have gained TCEP endorsement for kp Elite®," said Paul Rawlings, Launch Manager at kp Food Packaging.

TCEP represents the most comprehensive and practical testing protocol available for assessing PET thermoform recyclability. The organization’s technical expertise and rigorous evaluation process makes it the clear choice for validating packaging designs that will truly support a circular economy”. kp has held a gold rating from EcoVadis, the leading platform for environmental, social and ethical performance ratings. This ranks kp in the top 1% of companies rated in the manufacturing of plastics products sector.

The stackable plastic trays market has witnessed significant advancements in terms of sustainability and technology. Manufacturers are increasingly utilizing recyclable and biodegradable materials to produce trays, addressing environmental concerns and regulatory requirements. Technological innovations, such as the incorporation of RFID tags and IoT-enabled tracking systems, have enhanced inventory management and traceability.

In India, the government's push towards sustainable practices has encouraged local manufacturers to adopt eco-friendly materials and processes. These developments not only contribute to environmental conservation but also offer cost savings and operational efficiencies for businesses. The integration of automation in production lines has further streamlined manufacturing processes, ensuring consistency and scalability.

The stackable plastic trays market is driven by the increasing need for efficient storage and transportation solutions across industries. Emerging economies, particularly in Asia-Pacific, present significant opportunities due to rapid industrialization and urbanization. In India, the government's initiatives to boost the manufacturing sector and infrastructure development are expected to augment the demand for stackable plastic trays.

Additionally, the emphasis on food safety and hygiene standards will further drive adoption in the food and beverage industry. Manufacturers focusing on innovation, sustainability, and customization are likely to gain a competitive edge in the market. Collaborations and partnerships with end-user industries can also open new avenues for growth and diversification

The market is segmented based on material type, load capacity, end-use industry, and region. By material type, the segmentation includes polypropylene (PP), polyethylene (PE), high-density polyethylene (HDPE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and biodegradable/bio-based plastics, with HDPE leading due to its strength, chemical resistance, and durability in industrial handling.

Load capacity segments include up to 5 kg, 6-15 kg, 16-30 kg, and above 30 kg, with the 6-15 kg range dominating as it meets the optimal balance for manual handling and automated logistics use.

End-use industries comprise food & beverage processing, pharmaceuticals & laboratories, agriculture & horticulture, electronics & semiconductors, automotive components, and retail & distribution centers where hygiene, weight-to-strength ratio, and stack ability are key purchase drivers. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

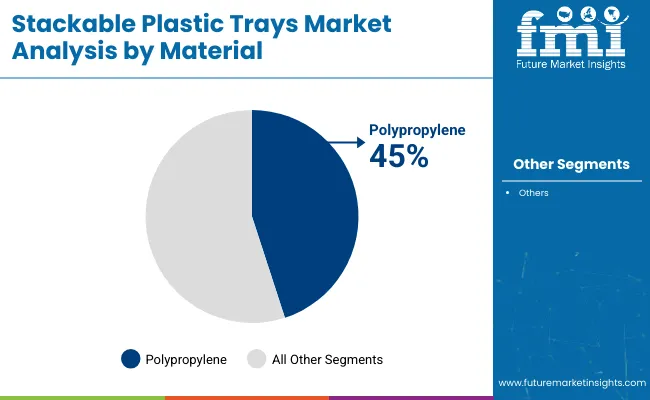

Polypropylene (PP) trays are projected to account for approximately 45% of the global stackable plastic trays market by 2025. Their high strength-to-weight ratio and chemical resistance have made them ideal for various applications. The affordability of PP compared to other materials has further driven its widespread adoption.

Additionally, PP's recyclability aligns with increasing environmental concerns. The versatility of PP trays has allowed for their use across multiple industries, including food processing and pharmaceuticals. Their ability to withstand sterilization processes has made them suitable for hygienic environments. Manufacturers have favored PP for its ease of molding into various shapes and sizes. This adaptability has facilitated the production of customized tray solutions.

In logistics and warehousing, PP trays have been utilized for their durability and stack ability. Their resistance to impact and wear has ensured longevity in demanding conditions. The lightweight nature of PP has contributed to reduced transportation costs. Furthermore, their compatibility with automated systems has enhanced operational efficiency.

As industries continue to seek cost-effective and sustainable packaging solutions, the demand for PP trays is expected to remain strong. Ongoing innovations in PP formulations are anticipated to further improve their performance characteristics. The projected market share reflects the material's established position and future growth potential. Therefore, PP trays are poised to maintain their dominance in the stackable plastic trays market.

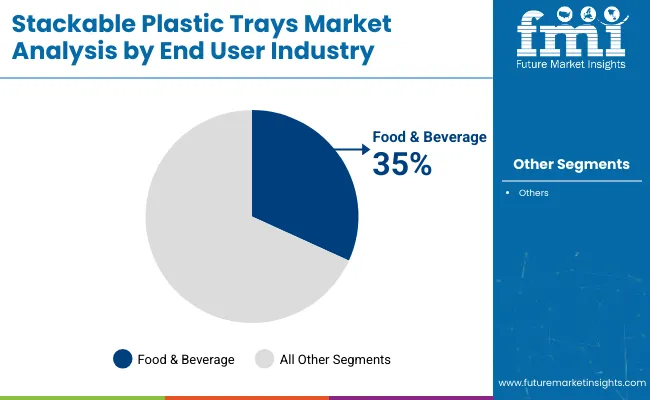

The food and beverage processing industry is estimated to hold a 35% share of the stackable plastic trays market by 2025. Trays have been extensively used for organizing, storing, and transporting food products. Their design has facilitated efficient handling and minimized contamination risks.

Compliance with food safety regulations has been a key driver for their adoption. The reusability and ease of cleaning of plastic trays have supported sustainable practices within the industry. Their durability has reduced the need for frequent replacements, leading to cost savings. The ability to customize tray dimensions has allowed for optimized space utilization. This has been particularly beneficial in high-volume processing facilities.

In cold storage and distribution, stackable trays have enabled efficient use of space and improved product protection. Their resistance to moisture and temperature fluctuations has preserved product quality. The integration of trays into automated systems has streamlined operations. This has enhanced productivity and reduced labor costs.

As consumer demand for packaged and processed foods continues to rise, the reliance on stackable plastic trays in the food and beverage industry is expected to grow. Innovations in tray materials and designs are anticipated to further align with industry needs. The projected market share underscores the critical role of trays in ensuring food safety and operational efficiency. Consequently, their significance in the food and beverage processing sector remains substantial.

Environmental Regulations, Recycling Complexity, and Cost Pressures

Furthermore, at the business level, global regulatory pressure to eliminate single-use plastics and surging consumer resistance to harmful packaging are seen as posing rising threats to the stackable plastic trays market. Numerous countries are adopting tough guidelines on packaging waste, plastic taxes, and extended producer responsibility (EPR) policies, which impact the use of plastic trays across food, agricultural, and industrial sectors.

Multi-layer structures, contamination, and uneven local recycling infrastructure make recycling stackable trays even more difficult. At the same time, increasing raw material prices and price competition from fiber-based or biodegradable alternatives exert margin pressures on manufacturers.

Growth in Food Packaging, Automation-Ready Logistics, and Reusable Systems

The market is flourishing even with challenges posed due to regulation, driven by an increase in the need for flexible, lightweight, and space-efficient packaging in industries like fresh produce, bakery, meat processing, electronics, and warehouse automation. Cost. Opting for stackable trays introduce space-saving vertical storage while decreasing breakage, and are also well-suited to maintaining simplified handling in the distribution center and production line.

Recyclable polypropylene trays, RFID-embedded containers, and modular designs are allowing for better integration with robotic pick and place equipment, smart shelves, and temperature controlled supply chains Innovations such as recyclable polypropylene trays, RFID-embedded containers, and modular designs are enabling better integration with robotic pick-and-place equipment, smart shelves, and temperature-controlled supply chains.

There is also a trend toward custom-molded, industry-specific tray designs for pharmaceuticals, automotive components, and foodservice operations.

With growing demand in automated warehouses, food processors and logistics providers, the US market is growing. Plastic Jerpas for stock control and product integrity retailers invest in reusable, returnable plastic trays for fresh food and grocery distribution Specialized tray moulds for conveyor systems are becoming popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

Retail sustainability goals in the UK are fueling market growth, as well as initiatives on reusable packaging in foodservice and grocery sectors. Rules on plastic tax are driving a move to stackable trays made of recyclable or post-consumer resin, especially in the fresh produce sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The EU market has enforced waste management directives and circular packaging initiatives that is widely adapted in meat processing, bakery chains, butchery, and electronics distribution. Such systems are adopted at retail logistics in countries such as Germany, the Netherlands, and Italy: Closed-loop tray reuse systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.8% |

Compact storage, food quality preservation and automation-friendly designs are driving demand for lightweight, easy-to-clean and stack-stable trays in Japan. Applications are sushi transport, retail meal prep, pharmaceutical logistics where purity and form factor are crucial.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Growth in South Korea is being powered by high-tech logistics hubs, smart vending networks and ready-to-eat food packaging. We are witnessing a rise in robotic food delivery, packaging automation, and micro-fulfillment centers driven by the government-backed smart city initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

Owing to rising demand in food packaging, industrial logistics, agriculture, and pharmaceutical sectors stackable plastic trays market is gaining traction. The growing applications of cold-chain distribution, reusable packaging, and automated storage systems drive innovations to produce durable, nestable, and recyclable tray solutions.

Companies are making investments in lightweight polymers, as well as RFID-integrated trays, and FDA-compliant materials for hygiene-sensitive industries. Automation, collateral savings with robotic handling systems, sustainability, and space efficiency are all core areas of interest both for market leaders as well as regional suppliers to the region.

The overall market size for the stackable plastic trays market was USD 853.9 Million in 2025.

The stackable plastic trays market is expected to reach USD 1,500.6 Million in 2035.

The demand for stackable plastic trays is rising due to increasing use in food packaging, logistics, and industrial storage applications, supported by their durability, space-saving design, and reusability. Growing emphasis on sustainable packaging and advancements in material innovation are further fueling market growth.

The top 5 countries driving the development of the stackable plastic trays market are the USA, China, Germany, Japan, and India.

Solid Wall Trays and Polypropylene Material are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stackable Beaker Market Size and Share Forecast Outlook 2025 to 2035

Stackable Container Market Size and Share Forecast Outlook 2025 to 2035

ESD Stackable Box Market Trends & Industry Analysis 2024-2034

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA