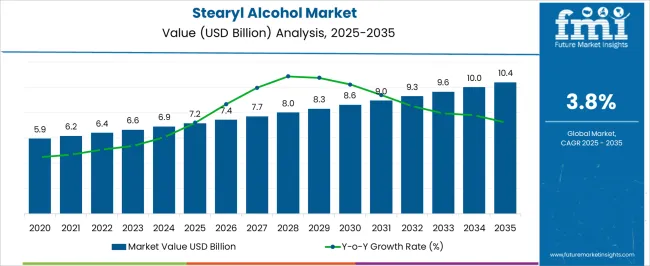

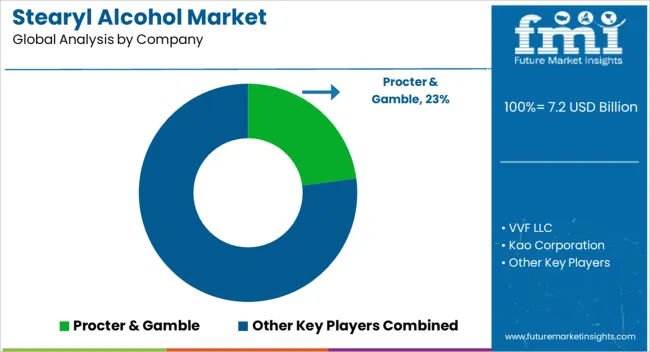

The stearyl alcohol market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The stearyl alcohol market is anticipated to expand from USD 7.2 billion in 2025 to USD 10.4 billion by 2035, reflecting a steady compound annual growth rate (CAGR) of 3.8%. In the first five-year growth block, the market is expected to reach approximately USD 8.6 billion by 2030, demonstrating incremental gains in demand driven by applications across personal care, cosmetics, and industrial formulations. Market value is being influenced by the adoption of stearyl alcohol in emollients, thickening agents, and stabilizers, with revenue generation being supported by consistent consumption patterns in both emerging and established markets.

During the 2025–2030 period, the stearyl alcohol market is being characterized by gradual accumulation of revenue as product utilization strengthens across key sectors. Companies supplying high-quality, refined alcohols are being positioned to capture meaningful market share, as formulation requirements and application diversity drive consistent uptake. Growth is being shaped by industry standards, product efficacy, and regional consumption trends, which collectively underpin market expansion. Market participants are being encouraged to leverage product availability and formulation versatility to secure competitive advantage and sustain long-term value creation throughout the forecast period.

| Metric | Value |

|---|---|

| Stearyl Alcohol Market Estimated Value in (2025 E) | USD 7.2 billion |

| Stearyl Alcohol Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The stearyl alcohol market is estimated to hold a notable proportion within its parent markets, accounting for approximately 15-17% of the fatty alcohols market, around 6-7% of the specialty chemicals market, close to 10-12% of the personal care ingredients market, about 8-9% of the cosmetic and skincare formulations market, and roughly 3-4% of the industrial surfactants market. Collectively, the cumulative share across these parent segments is observed in the range of 42-49%, reflecting the material’s significant influence across chemical, personal care, and industrial domains. The market has been driven by the wide application of stearyl alcohol as an emollient, thickener, and stabilizer in creams, lotions, conditioners, and other personal care formulations, where functional performance and consistency are highly prioritized.

Adoption has been reinforced by procurement decisions focused on quality, compatibility with other formulation ingredients, and cost-effectiveness. Its role in enhancing texture, moisture retention, and product stability has positioned it as a preferred ingredient across both consumer and industrial applications. Market participants have emphasized high-purity production processes and quality assurance to maintain reliability across multiple end-use segments. Consequently, the Stearyl Alcohol Market has not only captured a commanding share within fatty alcohols and personal care sectors but has also influenced cosmetic, skincare, and surfactant applications, demonstrating its central position in shaping ingredient portfolios across chemical and personal care supply chains.

The stearyl alcohol market is experiencing consistent growth driven by its widespread use in personal care, pharmaceuticals, and industrial applications. Increasing consumer demand for skin friendly and plant derived ingredients is boosting adoption in cosmetics and skincare formulations.

Regulatory support for biodegradable and non toxic raw materials has further encouraged its inclusion in hair conditioners, lotions, and ointments. Technological advancements in processing have enabled the production of high purity grades with improved emulsifying and thickening properties.

Additionally, the expansion of the pharmaceutical industry and the rising popularity of premium personal care products in emerging markets are creating sustained demand. The outlook remains positive as industries continue to focus on product safety, performance, and sustainability.

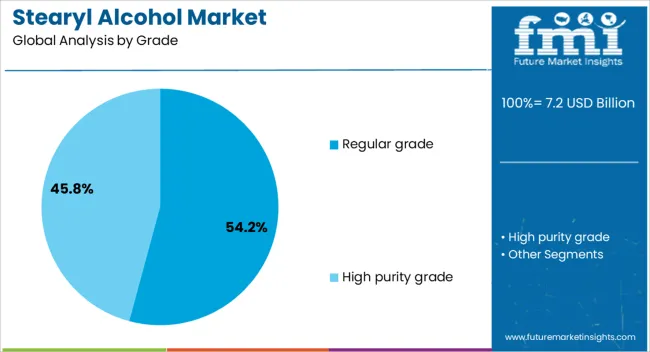

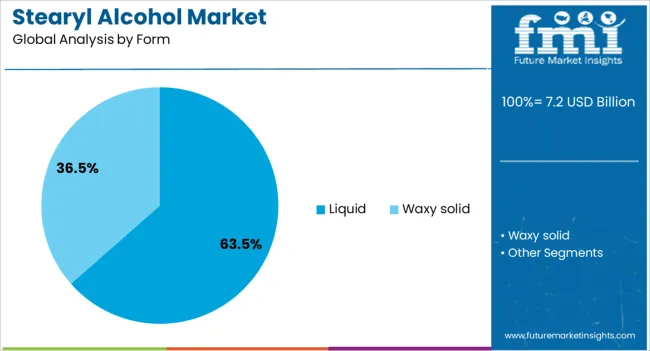

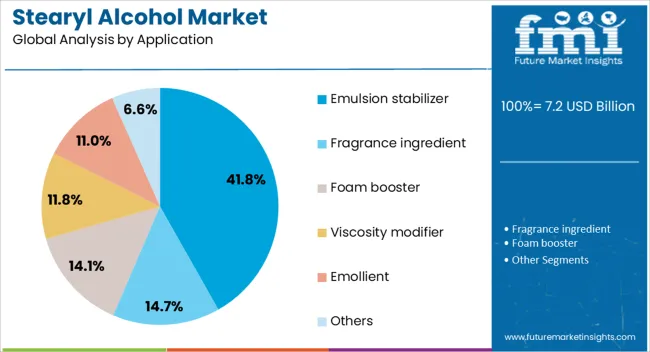

The stearyl alcohol market is segmented by grade, form, application, end-user industry, and geographic regions. By grade, stearyl alcohol market is divided into regular grade and high purity grade. In terms of form, stearyl alcohol market is classified into liquid and waxy solid. Based on application, stearyl alcohol market is segmented into emulsion stabilizer, fragrance ingredient, foam booster, viscosity modifier, emollient, and others. By end-user industry, stearyl alcohol market is segmented into cosmetics and personal care, pharmaceuticals, food and beverages, and others. Regionally, the stearyl alcohol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular grade segment is projected to account for 54.2% of total market revenue by 2025, making it the dominant grade category. This growth is supported by its balanced performance in emulsification, thickening, and stabilizing across a variety of formulations.

Cost effectiveness and compatibility with multiple product types have reinforced its preference among manufacturers.

The segment’s wide availability and proven performance across industrial and cosmetic applications have helped maintain its leadership position.

The liquid form segment is expected to hold 63.5% of the market by 2025, emerging as the leading form type.

Its ease of blending, superior solubility, and adaptability to automated production lines make it a preferred choice for large scale manufacturing.

Liquid form stearyl alcohol enables consistent product quality and efficient mixing in formulations, supporting its dominant share in the market.

The emulsion stabilizer segment is forecasted to capture 41.8% of total market revenue by 2025, positioning it as the largest application category.

The ability of stearyl alcohol to enhance product texture, improve stability, and prevent ingredient separation has driven its use in creams, lotions, and pharmaceutical emulsions.

Its multifunctional role as both a stabilizer and thickening agent ensures its continued prominence in the application segment.

The stearyl alcohol market is being driven by strong demand in personal care and cosmetic products, with opportunities emerging in pharmaceuticals and industrial applications. Trends highlight multi-functional and specialty-grade product adoption, while challenges persist from raw material volatility and production costs. Despite these constraints, stearyl alcohol remains essential in emulsions, creams, ointments, and industrial formulations, supporting steady market expansion and prompting manufacturers to deliver high-purity, performance-oriented solutions to meet evolving industry and consumer requirements.

The demand for stearyl alcohol has been significantly influenced by its widespread use in personal care and cosmetic formulations. It is frequently incorporated into creams, lotions, shampoos, and conditioners as an emollient, thickening agent, and stabilizer, enhancing texture and performance. Cosmetic manufacturers across North America, Europe, and Asia-Pacific are increasingly relying on stearyl alcohol to meet consumer expectations for smooth, non-greasy, and visually appealing products. Growing preference for premium skincare and haircare formulations has further strengthened adoption. Retailers and e-commerce channels have also contributed to increased visibility and availability, driving consistent market growth in personal care segments.

Opportunities for stearyl alcohol are expanding due to its applications in pharmaceuticals, lubricants, and industrial emulsions. In pharmaceuticals, it is used as a coating agent, excipient, and stabilizer in ointments and topical creams, enhancing product performance and shelf life. Industrially, stearyl alcohol finds use in waxes, polishes, and emulsifiers for specialized chemical processes. Companies are exploring novel blends and high-purity grades to cater to niche markets. The ongoing exploration of multi-functional uses and tailored formulations provides manufacturers with avenues to diversify product portfolios and penetrate growing end-use industries worldwide.

A notable trend in the stearyl alcohol market is the focus on multi-functional and specialty-grade variants. Manufacturers are introducing grades with enhanced melting points, higher purity levels, and improved compatibility with other formulation ingredients. Personal care and pharmaceutical producers are increasingly demanding customized solutions to meet specific product requirements and performance standards. This trend is driving research into consistent quality and formulation flexibility, allowing suppliers to differentiate offerings and strengthen partnerships with high-value end users. Consequently, the market is witnessing a gradual shift toward premium products designed to optimize texture, stability, and user experience.

The stearyl alcohol market faces challenges due to fluctuations in raw material supply and production costs. Derived primarily from natural fats, oils, or petrochemical sources, price variations in feedstock affect manufacturing expenses and profit margins. Supply chain disruptions, seasonal availability, and trade restrictions can further impact raw material sourcing. Manufacturers are compelled to optimize processes and negotiate long-term contracts to maintain cost efficiency. These challenges, coupled with stringent regulatory requirements for purity and quality, necessitate strategic planning, risk management, and quality assurance protocols to ensure competitive positioning in the global market.

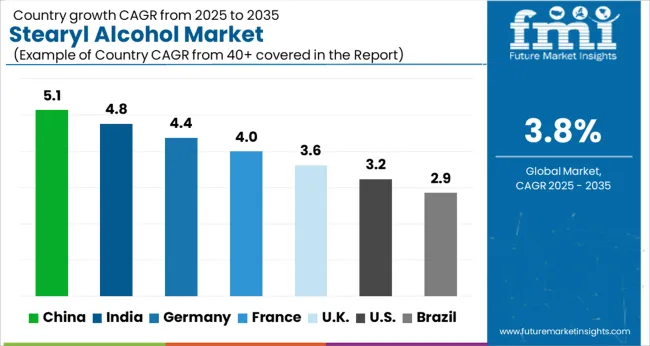

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

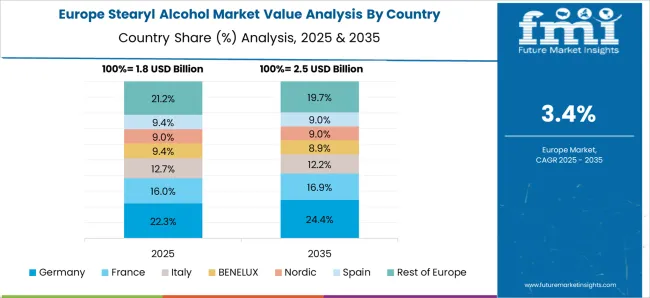

The global stearyl alcohol market is projected to grow at a CAGR of 3.8% from 2025 to 2035. China leads with a growth rate of 5.1%, followed by India at 4.8%, and France at 4%. The United Kingdom records a growth rate of 3.6%, while the United States shows the slowest growth at 3.2%. Rising demand for personal care and cosmetic products, coupled with increasing applications in pharmaceuticals, lubricants, and detergents, is driving global growth. Emerging economies such as China and India benefit from growing consumer bases, expanding manufacturing facilities, and rising urban consumption patterns. Developed markets like the USA, UK, and France experience steady growth supported by mature cosmetic and personal care industries, regulatory compliance, and consistent product demand. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The stearyl alcohol market in China is projected to grow at a CAGR of 5.1%. Rising consumption of personal care products, including creams, lotions, and hair care formulations, drives market demand. The pharmaceutical industry’s growing adoption of stearyl alcohol as an excipient, combined with applications in lubricants and detergents, further supports expansion. Industrial production is increasing with local manufacturers focusing on high-quality formulations and cost-effective production methods. E-commerce platforms and retail chains are enhancing product accessibility for consumers, while government support for chemical manufacturing and consumer goods industries contributes to steady market adoption. China’s growing middle-class population and rising disposable incomes continue to fuel market growth, strengthening the overall stearyl alcohol industry in the country.

The stearyl alcohol market in India is projected to grow at a CAGR of 4.8%. Increased consumption of cosmetics, skincare, and hair care products contributes to market expansion. Pharmaceutical manufacturers are increasingly incorporating stearyl alcohol in excipients, ointments, and emulsions. Rising disposable income, urbanization, and growing awareness of personal grooming support higher adoption rates. Local production facilities are enhancing product quality and scaling up operations to meet domestic demand. Distribution through organized retail chains and online platforms ensures accessibility across urban and semi-urban areas. Government incentives for chemical and cosmetic manufacturing further reinforce market growth. India’s focus on expanding the personal care sector alongside increasing pharmaceutical applications continues to drive steady market expansion.

The stearyl alcohol market in France is projected to grow at a CAGR of 4%. High consumer preference for premium personal care products, including skincare and haircare, supports steady market demand. The pharmaceutical sector utilizes stearyl alcohol in various formulations, while lubricants and detergents provide secondary applications. Local manufacturers focus on high-quality production standards, research on formulation improvements, and compliance with EU regulations, ensuring product reliability. Distribution channels across retail and e-commerce platforms enhance consumer access. Market growth is influenced by France’s well-established personal care and pharmaceutical industries, increasing consumer awareness of product benefits, and the continued development of specialized cosmetic formulations using stearyl alcohol.

The stearyl alcohol market in the United Kingdom is projected to grow at a CAGR of 3.6%. Steady demand for personal care products, cosmetics, and skincare formulations drives market adoption. Pharmaceutical manufacturers continue to use stearyl alcohol as an excipient in ointments, creams, and emulsions. Retail chains, e-commerce platforms, and specialized cosmetic stores ensure accessibility for consumers. Regulatory compliance with EU chemical and cosmetic standards strengthens consumer confidence. Growth is supported by an established personal care industry, rising awareness of ingredient quality, and ongoing innovation in cosmetic formulations using stearyl alcohol. These factors collectively contribute to moderate but stable market growth in the UK

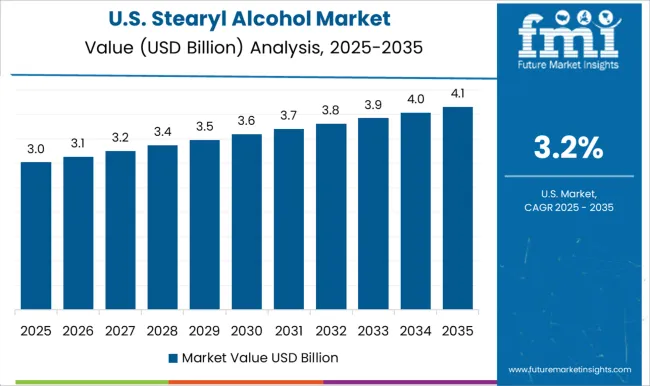

The stearyl alcohol market in the United States is projected to grow at a CAGR of 3.2%. Steady adoption in personal care and cosmetic products, including lotions, creams, and haircare, drives market demand. Pharmaceutical applications in ointments and emulsions provide additional growth opportunities. Manufacturers focus on compliance with FDA regulations and product quality standards, ensuring reliability. Distribution through mass-market retail, specialty stores, and online platforms enhances accessibility. The mature cosmetic and pharmaceutical markets, combined with growing consumer preference for ingredient transparency, support a stable growth trajectory. Continued focus on diversified applications in detergents, lubricants, and specialty formulations ensures the USA stearyl alcohol market maintains consistent expansion.

The stearyl alcohol market is dominated by major chemical and personal care ingredient producers competing to supply high-purity fatty alcohols for cosmetics, pharmaceuticals, and industrial applications. Procter & Gamble, VVF LLC, and Kao Corporation lead with broad portfolios emphasizing consistency, emollient properties, and multifunctional applications. Brochures highlight moisturizing, thickening, and stabilizing benefits, appealing to formulators in creams, lotions, and haircare products. Sasol Limited, BASF SE, and Reliance Industries Limited differentiate through scalable production and global supply networks, ensuring reliability for large-scale manufacturers.

Godrej Industries Limited and Oleon NV focus on sustainable feedstock sourcing and versatile application profiles, while Kuala Lumpur Kepong Berhad emphasizes integration into consumer products across Asia. Regional and specialty suppliers such as Jarchem Industries Inc., Berg + Schmidt GmbH & Co. KG, Behn Meyer Group, Jeeon Corporation, Pan Oleo Sdn Bhd, and KLK OLEO Group compete on price, local availability, and tailored solutions. Marketing materials highlight product quality, consistency, and formulation flexibility, emphasizing emulsion stability, viscosity control, and skin compatibility.

Competition is driven by purity, fatty alcohol chain length, processing efficiency, and regulatory compliance. Brochures frequently stress ease of use, reliability, and performance in end products, positioning stearyl alcohol as a key ingredient in cosmetics, pharmaceuticals, and personal care formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 billion |

| Grade | Regular grade and High purity grade |

| Form | Liquid and Waxy solid |

| Application | Emulsion stabilizer, Fragrance ingredient, Foam booster, Viscosity modifier, Emollient, and Others |

| End-User Industry | Cosmetics and personal care, Pharmaceuticals, Food and beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble, VVF LLC, Kao Corporation, Sasol Limited, BASF SE, Reliance Industries Limited, Godrej Industries Limited, Oleon NV, Kuala Lumpur Kepong Berhad, Jarchem Industries Inc., Berg + Schmidt GmbH & Co. KG, Behn Meyer Group, Jeeon Corporation, Pan Oleo Sdn Bhd, and KLK OLEO Group |

| Additional Attributes | Dollar sales by product type and application are growing, driven by rising demand for emulsifiers, stabilizers, and adoption in cosmetics, pharmaceuticals, and industrial uses. Technological advances and regulatory compliance are fueling market growth. |

The global stearyl alcohol market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the stearyl alcohol market is projected to reach USD 10.4 billion by 2035.

The stearyl alcohol market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in stearyl alcohol market are regular grade and high purity grade.

In terms of form, liquid segment to command 63.5% share in the stearyl alcohol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stearyl Tartrate Market

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA