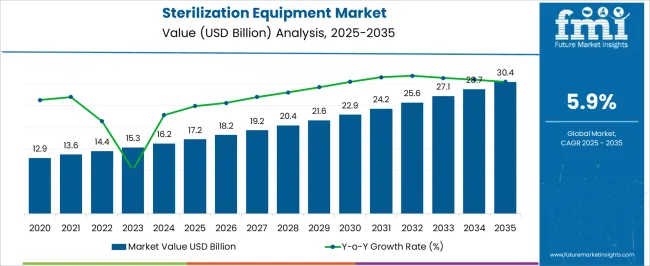

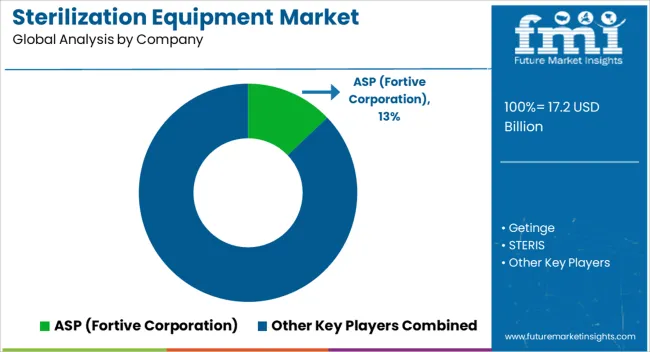

The Sterilization Equipment Market is estimated to be valued at USD 17.2 billion in 2025 and is projected to reach USD 30.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Sterilization Equipment Market Estimated Value in (2025 E) | USD 17.2 billion |

| Sterilization Equipment Market Forecast Value in (2035 F) | USD 30.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The Sterilization Equipment market is witnessing steady expansion, driven by the growing need to maintain stringent infection control practices across healthcare and industrial sectors. Rising concerns over hospital-acquired infections, stricter regulatory standards, and increasing surgical procedures are major factors driving demand. Advancements in sterilization technologies such as low-temperature methods, plasma sterilization, and automation are enabling greater efficiency, safety, and cost-effectiveness, making sterilization equipment essential in modern healthcare facilities.

Beyond healthcare, growing applications in pharmaceuticals, food processing, and laboratory environments are contributing to market growth. The emphasis on eco-friendly sterilization methods that reduce toxic emissions is further shaping the industry’s trajectory. Investments in healthcare infrastructure, particularly in developing economies, are supporting demand for advanced sterilization equipment.

Furthermore, global pandemic preparedness and heightened awareness of hygiene have accelerated adoption rates With the convergence of technology, compliance requirements, and sustainability objectives, the sterilization equipment market is expected to experience robust growth, establishing its role as a critical enabler of infection prevention and product safety across diverse industries.

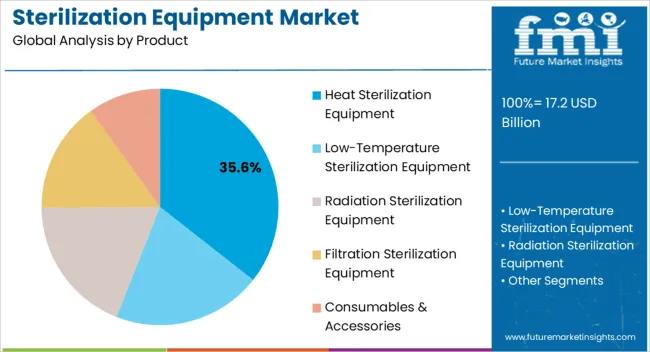

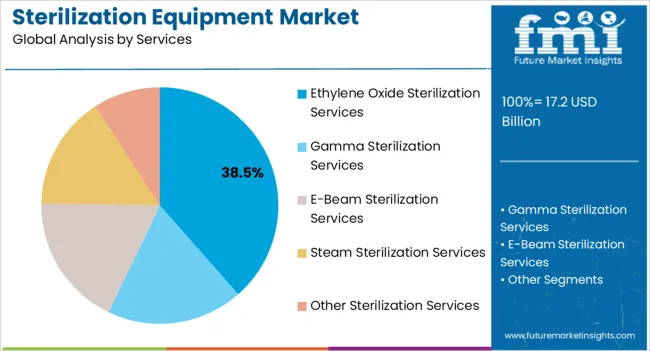

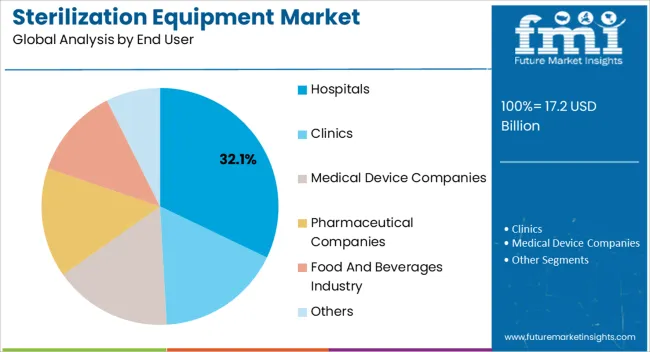

The sterilization equipment market is segmented by product, services, end user, and geographic regions. By product, sterilization equipment market is divided into Heat Sterilization Equipment, Low-Temperature Sterilization Equipment, Radiation Sterilization Equipment, Filtration Sterilization Equipment, Consumables & Accessories, Sterilants, Instrument Packaging & Pouches, and Others. In terms of services, sterilization equipment market is classified into Ethylene Oxide Sterilization Services, Gamma Sterilization Services, E-Beam Sterilization Services, Steam Sterilization Services, and Other Sterilization Services. Based on end user, sterilization equipment market is segmented into Hospitals, Clinics, Medical Device Companies, Pharmaceutical Companies, Food And Beverages Industry, and Others. Regionally, the sterilization equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The heat sterilization equipment product segment is projected to hold 35.6% of the market revenue in 2025, positioning it as the leading product type. This growth is being supported by the reliability, simplicity, and proven effectiveness of heat sterilization in eliminating a broad spectrum of pathogens. Hospitals and laboratories continue to prefer heat-based equipment due to its cost efficiency, minimal environmental impact, and well-established operational protocols.

The widespread use of autoclaves in surgical instrument sterilization and laboratory applications has reinforced the dominance of this product type. Heat sterilization is also highly adaptable across various industries, including pharmaceuticals and food processing, where ensuring safety and compliance is paramount. The ability to provide consistent sterilization without introducing toxic residues makes heat sterilization equipment a preferred choice globally.

Additionally, advancements in energy-efficient systems and automated features are enhancing operational performance while reducing costs With demand for affordable and effective sterilization methods rising, the heat sterilization segment is expected to maintain its strong market position.

The ethylene oxide sterilization services segment is anticipated to account for 38.5% of the market revenue in 2025, making it the dominant service category. This segment’s strength lies in its ability to sterilize delicate and heat-sensitive medical devices that cannot withstand high temperatures or radiation. Its effectiveness in penetrating complex device geometries and ensuring sterility without damaging materials has made it indispensable for the healthcare industry.

The growing demand for single-use medical instruments and complex surgical equipment is further driving reliance on ethylene oxide services. Outsourcing sterilization services is increasingly being adopted by manufacturers and hospitals to reduce infrastructure costs and ensure regulatory compliance.

The segment is also supported by ongoing improvements in safety standards and emission control technologies, addressing environmental concerns linked to ethylene oxide usage As the demand for advanced medical devices continues to rise, ethylene oxide sterilization services are expected to sustain growth, supported by strong regulatory oversight and their critical role in ensuring patient safety and product effectiveness.

The hospitals end user segment is expected to hold 32.1% of the market revenue in 2025, emerging as the leading end-use category. Growth in this segment is being driven by the increasing number of surgical procedures, the rising patient population, and heightened emphasis on infection control within healthcare facilities. Hospitals rely heavily on sterilization equipment to ensure the safety of surgical instruments, patient-care devices, and clinical environments.

The importance of maintaining compliance with international standards and preventing hospital-acquired infections has further reinforced demand in this segment. Additionally, the integration of automated sterilization systems within hospital workflows is improving operational efficiency and reducing risks associated with manual handling. Investments in expanding hospital infrastructure, particularly in developing regions, are creating significant opportunities for sterilization equipment adoption.

The rising trend of multi-specialty hospitals and the growing focus on advanced patient care services are also strengthening the segment’s position With infection prevention remaining a top healthcare priority, hospitals are expected to continue driving demand for sterilization equipment globally.

Global sterilization equipment market is predicted to reach USD 16.2 billion by 2025. According to industry projections, the market will reach USD 28.8 billion by 2035. The sales of such equipment are to garner a CAGR of 5.9% through 2035.

The trends reflect significant advancements driven by technology, regulatory standards, and the evolving needs of the healthcare sector. Automation and digitization are at the forefront, with smart sterilization systems utilizing IoT and AI for real-time monitoring and control, enhancing precision and efficiency.

Regulatory and compliance enhancements drive innovation, with stricter standards necessitating advanced methods for validation and monitoring. Integration with hospital IT systems allows for centralized control and streamlined operations, while interoperability ensures seamless functioning with other medical devices.

The integration of data logging and traceability features also helps ensure compliance and reduce human error. Environmental considerations are increasingly important, leading to the development of eco-friendly sterilization methods, such as low-temperature hydrogen peroxide gas plasma and ozone sterilization, which are less toxic and more energy-efficient.

Advanced technologies like low-temperature sterilization techniques and UV-C light are becoming more common, providing effective sterilization for sensitive instruments and rapid disinfection of surfaces and air.

| Attributes | Details |

|---|---|

| Sterilization Equipment Market Size (2025E) | USD 16.2 billion |

| Sterilization Equipment Market Projected Size (2035F) | USD 28.8 billion |

| Value CAGR (2025 to 2035) | 5.9% |

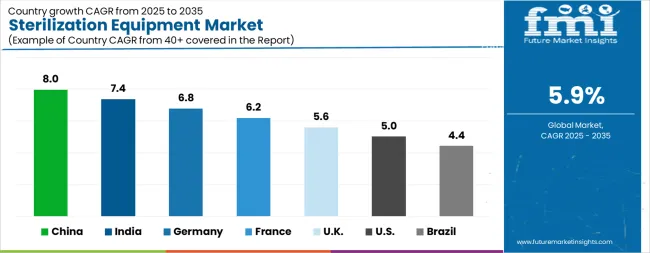

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The Sterilization Equipment Market is expected to register a CAGR of 5.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.0%, followed by India at 7.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Sterilization Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.8%. The USA Sterilization Equipment Market is estimated to be valued at USD 5.9 billion in 2025 and is anticipated to reach a valuation of USD 9.6 billion by 2035. Sales are projected to rise at a CAGR of 5.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 846.8 million and USD 490.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.2 Billion |

| Product | Heat Sterilization Equipment, Low-Temperature Sterilization Equipment, Radiation Sterilization Equipment, Filtration Sterilization Equipment, Consumables & Accessories, Sterilants, Instrument Packaging & Pouches, and Others |

| Services | Ethylene Oxide Sterilization Services, Gamma Sterilization Services, E-Beam Sterilization Services, Steam Sterilization Services, and Other Sterilization Services |

| End User | Hospitals, Clinics, Medical Device Companies, Pharmaceutical Companies, Food And Beverages Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASP (Fortive Corporation), Getinge, STERIS, Steelco S.p.A., Shinva Medical Instrument Co., Ltd., MATACHANA, 3M, MMM Group, Stryker, Andersen Sterilizers, HUMAN MEDITEK CO., LTD., SOLSTEO, Scitek Global Co., Ltd., Renosem, and Labtron Equipment Ltd |

The global sterilization equipment market is estimated to be valued at USD 17.2 billion in 2025.

The market size for the sterilization equipment market is projected to reach USD 30.4 billion by 2035.

The sterilization equipment market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in sterilization equipment market are heat sterilization equipment, _ moist heat sterilizers, _ dry heat sterilizers, low-temperature sterilization equipment, _ hydrogen peroxide/gas plasma sterilization, _ ethylene oxide sterilizers, _ ozone-based medical sterilizers, _ formaldehyde sterilizers, _ other, radiation sterilization equipment, filtration sterilization equipment, consumables & accessories, _ biological indicators, _ chemical indicators, sterilants, instrument packaging & pouches and others.

In terms of services, ethylene oxide sterilization services segment to command 38.5% share in the sterilization equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Sterilization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Sterilization Equipment Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Sterilization Box Market Insights - Demand, Size & Forecast 2025 to 2035

Competitive Breakdown of Sterilization Tunnel Manufacturers

Sterilization Tunnel Market Analysis by Segments, By Belt Size, Application, End Use, and Region through 2025 to 2035.

Sterilization Monitoring Market

Sterilization Tape Market

Sterilization Roll Market

Sterilization Wrap Market

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA