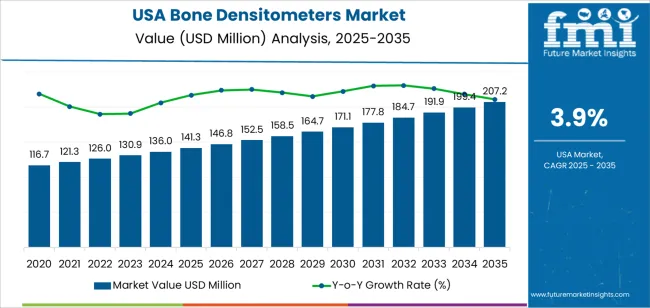

The demand for bone densitometers in the USA is projected to reach USD 207.1 million by 2035, reflecting an absolute increase of USD 65.8 million over the forecast period. Starting at USD 141.3 million in 2025, the demand is expected to grow at a steady CAGR of 3.9%. Bone densitometers, which are used to measure bone mineral density (BMD), play a crucial role in the diagnosis and management of osteoporosis and other bone-related disorders. As the population ages and the prevalence of bone diseases increases, the demand for bone densitometers is expected to grow steadily.

The primary drivers of this growth include the rising incidence of osteoporosis, particularly in the aging population, increasing awareness about bone health, and the growing demand for non-invasive diagnostic tools. Advances in technology, such as dual-energy X-ray absorptiometry (DXA) systems, which offer faster, more accurate, and lower-dose measurements, will also contribute to the demand for these devices. The increasing focus on preventive healthcare and early detection of bone-related diseases will further fuel industry growth.

Technological advancements in the field of bone densitometry, such as the development of lower-radiation and more accurate systems, will also contribute to the growth of the industry. These innovations will improve the quality of care provided to patients, as well as make screening more accessible and efficient. The integration of bone densitometers with electronic health records (EHR) systems will enhance workflow efficiency in clinical settings, further increasing their adoption.

Between 2025 and 2030, the demand for bone densitometers in the USA is projected to grow from USD 141.3 million to approximately USD 146.8 million, adding USD 5.5 million, which accounts for about 8.4% of the total forecasted growth for the decade. This phase will see steady growth driven by the rising awareness of osteoporosis and other bone-related diseases, particularly among post-menopausal women and older adults. Technological advancements in bone densitometry systems, such as improved accuracy and reduced radiation exposure, will also contribute to this growth.

From 2030 to 2035, the demand is expected to experience more significant growth, rising from USD 146.8 million to USD 207.1 million, adding USD 60.3 million, which constitutes about 91.6% of the overall growth. This acceleration in demand will be driven by an increasing elderly population, a greater focus on bone health, and continued innovations in diagnostic technologies. The growing emphasis on early diagnosis and preventive care will further contribute to the sharp rise in demand for bone densitometers during this phase.

| Metric | Value |

|---|---|

| USA Bone Densitometers Sales Value (2025) | USD 141.3 million |

| USA Bone Densitometers Forecast Value (2035) | USD 207.1 million |

| USA Bone Densitometers Forecast CAGR (2025 to 2035) | 3.90% |

The demand for bone densitometers in the USA is increasing as these devices play a vital role in diagnosing conditions like osteoporosis and assessing fracture risk, particularly among aging populations. With the number of older adults growing, the need for early detection and bone health screening is more critical than ever. As awareness around the importance of bone health rises, healthcare facilities and diagnostic clinics are investing in bone densitometry equipment to meet the demand for accurate, non-invasive testing. Preventive care initiatives and guidelines that recommend regular screening for high-risk groups further support this growth.

Technological advancements in bone densitometers are also contributing to the rise in demand. Newer models offer faster scan times, reduced radiation exposure, and portability, making them more accessible for use in both hospitals and outpatient settings. The integration of these devices with electronic health records enhances their appeal, allowing for seamless data sharing and improving patient care.

The expansion of clinical specialties such as endocrinology, geriatrics, and orthopaedics, where bone health is crucial, is driving further demand. Conditions like osteoporosis, chronic kidney disease, and rheumatoid arthritis significantly affect bone density, increasing the need for reliable diagnostic tools. As healthcare providers continue to focus on early diagnosis and preventive treatment of bone disorders, the demand for bone densitometers is expected to remain robust through 2035, ensuring broad adoption across various healthcare sectors.

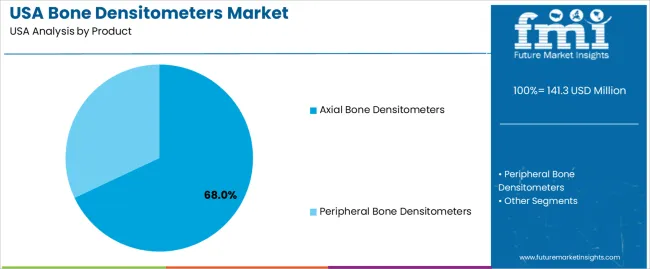

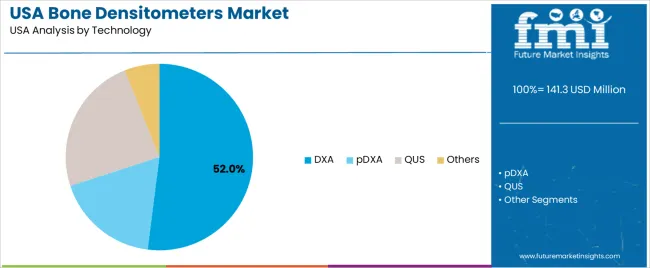

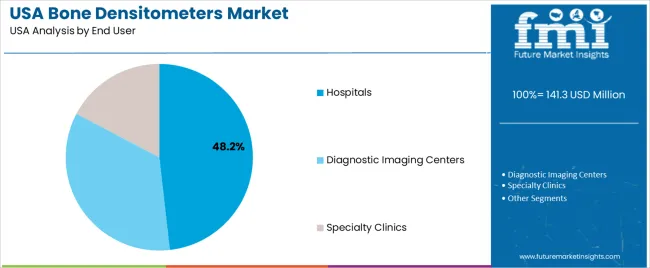

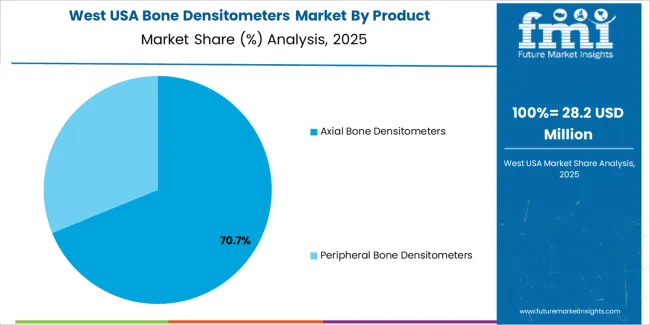

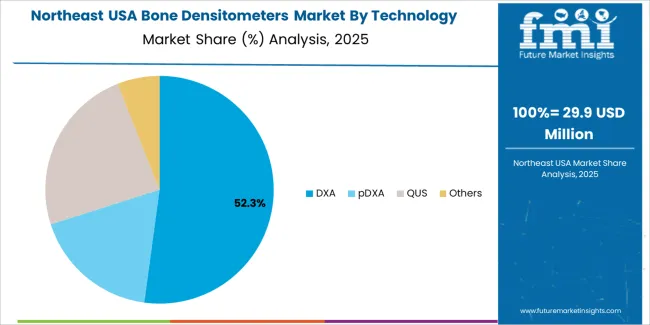

Demand is segmented by product, technology, and end user. By product, demand is divided into axial bone densitometers and peripheral bone densitometers, with axial bone densitometers holding the largest share. In terms of technology, the industry is categorized into DXA, pDXA, QUS, and others, with DXA dominating. The industry is also segmented by end user, including hospitals, diagnostic imaging centers, and specialty clinics, with hospitals accounting for the largest share. Regionally, demand is divided into West, South, Northeast, and Midwest.

Axial bone densitometers account for 68% of the demand for bone densitometers in the USA. These devices are widely used in clinical settings to measure bone mineral density (BMD), particularly in the spine and hip areas, which are the most common sites for osteoporosis-related fractures. Axial bone densitometers are preferred because they provide highly accurate and reliable results, which are essential for diagnosing osteoporosis, monitoring bone health, and assessing fracture risk.

The demand for axial bone densitometers is driven by the growing aging population in the USA, which is increasingly at risk for osteoporosis and other bone-related conditions. Hospitals and diagnostic centers rely on axial bone densitometers for comprehensive bone health assessments, as these devices offer greater precision for assessing central skeletal sites. As bone health continues to be a major focus in preventive healthcare, axial bone densitometers will continue to dominate the industry due to their diagnostic capabilities and widespread clinical use.

DXA (Dual-Energy X-ray Absorptiometry) accounts for 52% of the demand for bone densitometers in the USA. DXA is the gold standard in bone mineral density measurement, offering precise and reliable results for diagnosing osteoporosis and assessing fracture risk. DXA technology is widely used in both clinical and research settings due to its accuracy in evaluating bone density at key skeletal sites, such as the hip and spine.

The dominance of DXA technology is driven by its widespread adoption and ability to produce consistent, high-quality results. It is non-invasive and requires minimal preparation, making it the preferred method for routine screening and diagnosis of bone diseases, particularly in postmenopausal women and older adults. As the need for early osteoporosis detection and monitoring grows, DXA remains the leading technology for bone densitometry in the USA, ensuring its continued dominance in the industry.

Hospitals account for 48.2% of the demand for bone densitometers in the USA. Hospitals are the primary setting for advanced diagnostic procedures, and bone densitometry is essential in diagnosing and managing conditions such as osteoporosis, osteopenia, and bone loss. The ability to perform accurate bone mineral density measurements at central skeletal sites, such as the spine and hip, makes bone densitometers indispensable for hospital-based patient care.

The demand for bone densitometers in hospitals is further driven by the increasing aging population and the rising incidence of bone-related conditions. Hospitals use these devices to conduct routine screenings, monitor bone health, and guide treatment decisions for patients at risk of fractures. With ongoing advancements in medical technology and a greater focus on preventive healthcare, hospitals will continue to be the largest end-user of bone densitometers in the USA. As osteoporosis becomes a more significant public health issue, the need for bone densitometers in hospital settings will continue to rise.

Bone densitometry is widely used in diagnosing osteoporosis, evaluating fracture risk, and monitoring treatment efficacy. Key drivers include the rising prevalence of osteoporosis, the focus on early detection of bone density issues, growing awareness about bone health, and advancements in bone densitometer technology (e.g., portable and high-resolution devices). Restraints include high costs of advanced systems, reimbursement challenges, and the need for specialized healthcare providers to interpret results.

Demand for bone densitometers in the USA is growing due to an aging population that faces a higher risk of osteoporosis and bone fractures. As the number of older adults increases, there is a greater focus on the early detection of bone health issues. This has led to a rise in preventive healthcare practices, with regular screenings for bone density being a key component of maintaining health in high-risk groups such as postmenopausal women and the elderly. Bone densitometers are essential in assessing bone mineral density (BMD) and fracture risk, making them vital for early diagnosis and treatment, further driving their adoption across healthcare settings.

Technological innovations are enhancing the growth of bone densitometers in the USA by improving their functionality, precision, and accessibility. Newer systems provide higher resolution imaging, enabling more accurate BMD measurements. Advances in dual-energy X-ray absorptiometry (DXA) technology have reduced scan times and increased the efficiency of testing. Portable devices have expanded access, allowing testing in a broader range of healthcare settings, including outpatient clinics and mobile units. The development of alternative scanning methods, such as quantitative ultrasound, has diversified bone density testing, making these devices more versatile and widely used in clinical practice, driving further adoption.

Despite increasing demand, the adoption of bone densitometers in the USA faces several challenges. One of the main barriers is the high upfront cost of advanced systems, which can be prohibitive for smaller healthcare facilities and clinics. Reimbursement issues and the need for specialized training to interpret bone mineral density (BMD) results further complicate adoption. Limited awareness about bone health and the need for early detection in some regions and patient groups hampers efforts to expand usage. Competition from alternative diagnostic methods, such as biomarkers and MRI-based techniques, also limits the widespread use of bone densitometers in certain clinical settings.

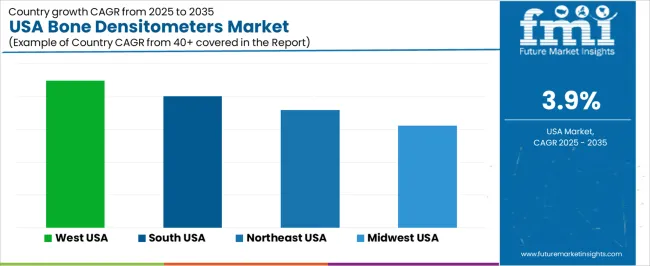

| Region | CAGR (%) |

|---|---|

| West | 4.5% |

| South | 4.0% |

| Northeast | 3.6% |

| Midwest | 3.1% |

The demand for bone densitometers in the USA is growing across all regions, with the West leading at a 4.5% CAGR. This growth is driven by increased awareness of bone health, particularly in aging populations. The South follows with a 4.0% CAGR, bolstered by a strong healthcare infrastructure and growing demand for osteoporosis screening. The Northeast shows a 3.6% CAGR, influenced by the region’s aging demographic and medical advancements. The Midwest experiences moderate growth at 3.1%, driven by increasing adoption in both healthcare facilities and community clinics.

The West is seeing the highest demand for bone densitometers in the USA, with a 4.5% CAGR. This growth can be attributed to the region’s high awareness of health and wellness, particularly among its aging population. Cities like Los Angeles and San Francisco are major hubs for healthcare innovation, where advanced medical technologies, including bone densitometers, are widely used for osteoporosis screening and bone health assessment. The growing focus on preventative healthcare and early detection of bone diseases is further driving the demand.

The West also leads in adopting newer technologies, as medical centers and healthcare systems in the region continue to invest in equipment that enhances patient care. The region’s active lifestyle culture encourages a strong focus on bone health, further increasing the adoption of bone densitometers for routine screening. As the aging population continues to rise and awareness about bone health grows, the demand for bone densitometers in the West is expected to remain strong.

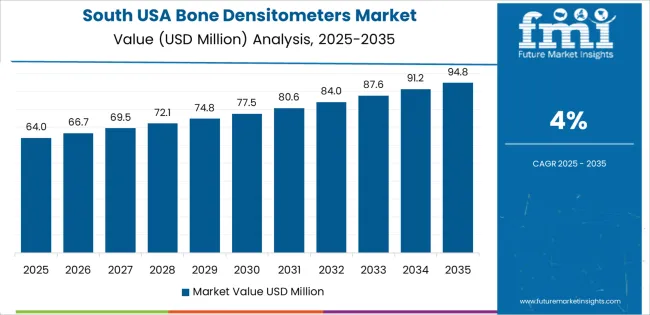

The South is experiencing steady demand growth for bone densitometers, with a 4.0% CAGR. The region’s healthcare system, particularly in states like Texas, Florida, and Georgia, is growing rapidly, contributing to the increasing use of bone densitometers for osteoporosis screening and other bone health assessments. The aging population in the South is one of the key drivers behind this growth, as older adults are more prone to bone-related issues, prompting healthcare providers to increase the use of bone densitometry for early detection.

The South's rising focus on preventative healthcare and chronic disease management contributes to the adoption of advanced diagnostic tools such as bone densitometers. The growing availability of these devices in outpatient clinics, hospitals, and senior living communities ensures that more individuals have access to bone health screenings. As the healthcare infrastructure in the South continues to expand and improve, demand for bone densitometers is expected to grow at a steady pace.

The Northeast is seeing steady growth in demand for bone densitometers, with a 3.6% CAGR. This is largely due to the region’s large aging population, particularly in cities like New York, Boston, and Philadelphia, where healthcare systems are well-established and focused on managing chronic conditions such as osteoporosis. As people in the Northeast age, there is an increasing need for regular bone density screenings, driving the demand for bone densitometers.

The Northeast is home to many leading academic medical centers and research institutions that prioritize advanced diagnostic technologies. These centers are continuously adopting the latest tools to improve patient care, including bone densitometers. As healthcare providers emphasize early detection and preventative care, the demand for bone health screenings will continue to rise in the region. With an increased focus on improving quality of life and managing bone diseases, the Northeast will continue to experience steady growth in the use of bone densitometers.

The Midwest is seeing moderate growth in demand for bone densitometers, with a 3.1% CAGR. This growth is driven by an increasing focus on osteoporosis screening and bone health, particularly in states like Illinois, Michigan, and Ohio. As healthcare access improves and awareness about bone diseases rises, more hospitals and clinics in the Midwest are adopting bone densitometry technologies to offer better care for their patients.

The region’s aging population and the rise in chronic diseases such as osteoporosis contribute to the demand for regular screenings and early diagnosis. As healthcare facilities in the Midwest upgrade their diagnostic capabilities, bone densitometers are becoming a common tool for bone health evaluation. While growth in the Midwest is slower than in other regions, the ongoing investments in healthcare infrastructure, especially in rural and community settings, will continue to support moderate growth in the adoption of bone densitometers across the region.

The demand for Bone Densitometer systems in the United States is gaining strong momentum, reflecting an increased focus on skeletal health among aging populations and rising awareness of osteoporosis and other bone‑density disorders. These devices, including DEXA (Dual‑Energy X‑Ray Absorptiometry) systems, are increasingly deployed in hospitals, diagnostic centers, and outpatient clinics as part of preventive care strategies and bone‑health initiatives. Emerging trends such as portable bone‑densitometry solutions, improved patient access, and expanded screening programs are further amplifying demand.

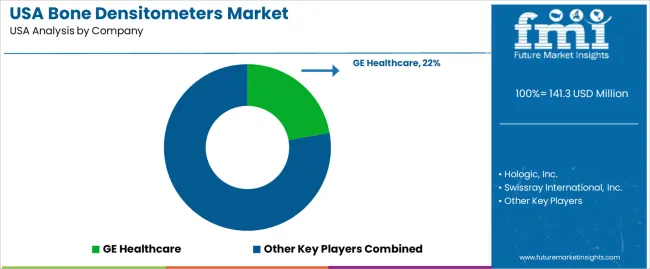

Within the USA demand landscape, GE Healthcare leads the segment with an approximate 22.2% share, indicating its strong presence across healthcare networks and its broad portfolio of densitometry devices tailored for USA clinical settings. Other major contributors include Hologic, Inc., Swissray International, Inc., DMS Imaging, and BeamMed Ltd., all of which supply bone‑densitometry systems or components to support the growing clinical demand.

Several factors are driving this demand in the USA First, the rapidly expanding demographic of older adults increases the prevalence of osteoporosis, prompting greater use of bone‑density assessment. Second, healthcare providers are placing stronger emphasis on early detection and treatment to reduce fracture risk and associated costs. Third, advances in imaging technologies and screening protocols are making bone‐density testing more accessible and efficient. Despite the positive trend, challenges remain such as high equipment cost, reimbursement uncertainties, and the need for trained operators. Still, the outlook for bone‐densitometry adoption in the USA remains positive, anchored by sustained clinical focus on bone health and evolving diagnostic capacities.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product | Axial Bone Densitometers, Peripheral Bone Densitometers |

| Technology | DXA, pDXA, QUS, Others |

| End User | Hospitals, Diagnostic Imaging Centers, Specialty Clinics |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | GE Healthcare, Hologic, Inc., Swissray International, Inc., DMS Imaging, BeamMed Ltd. |

| Additional Attributes | Dollar sales for bone densitometers are driven by product types such as axial and peripheral models, with technologies like DXA, pDXA, and QUS leading the industry. Key end users include hospitals, diagnostic imaging centers, and specialty clinics. Regional trends show growth across the West, South, Northeast, and Midwest, with a focus on healthcare, diagnostics, and specialty sectors. |

The global demand for bone densitometers in USA is estimated to be valued at USD 141.3 million in 2025.

The market size for the demand for bone densitometers in USA is projected to reach USD 207.2 million by 2035.

The demand for bone densitometers in USA is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in demand for bone densitometers in USA are axial bone densitometers and peripheral bone densitometers.

In terms of technology, dxa segment to command 52.0% share in the demand for bone densitometers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bone Densitometers Analysis by Product Type, by Technology and by End User through 2035

Demand for Bone Densitometers in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bone Grafts and Substitutes in USA Size and Share Forecast Outlook 2025 to 2035

Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Bone Metabolism Test Market Size and Share Forecast Outlook 2025 to 2035

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometer Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA