The demand for bone grafts and substitutes in USA is valued at USD 1.3 billion in 2025 and is projected to reach USD 1.7 billion by 2035, reflecting a compound annual growth rate of 2.9%. Growth is influenced by consistent surgical volumes across orthopedics, spine care and dental reconstruction, where grafting materials support structural repair and bone regeneration. Both natural and synthetic substitute options remain integral to procedures addressing fractures, degenerative joint conditions and trauma-related defects. As clinicians pursue materials with predictable integration and mechanical stability, procurement remains stable across hospitals and outpatient surgical centers. Incremental product improvements and routine caseloads continue to reinforce demand for bone graft solutions across USA’s healthcare system.

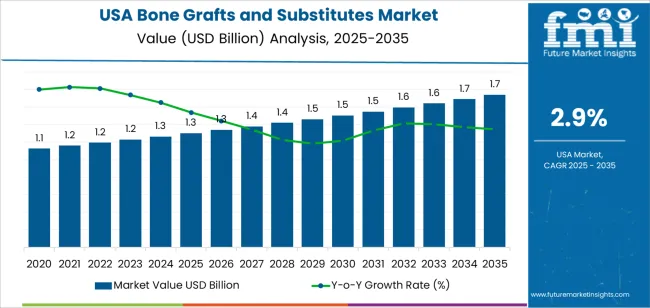

The growth curve shows a gradual and stable trajectory, beginning at USD 1.1 billion in earlier years and rising to USD 1.3 billion in 2025 before reaching USD 1.7 billion by 2035. Yearly values increase at modest intervals, moving from USD 1.3 billion in 2026 to USD 1.4 billion in 2027 and continuing with similar spacing through later years. This pattern reflects a mature category with predictable usage tied to standard surgical protocols and ongoing treatment of age-related conditions. As procedural volumes remain steady and grafting techniques continue to be integrated across orthopedic and dental practices, the market follows a consistent upward path anchored in regular clinical demand rather than abrupt expansions.

Demand in USA for bone grafts and substitutes is expected to rise from USD 1.3 billion in 2025 to USD 1.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 2.9%. Starting at USD 1.1 billion in 2020, the value remains flat through USD 1.2 billion around 2024, reaches USD 1.3 billion in 2025, and then gradually climbs to USD 1.7 billion by 2035. Growth is supported by increased surgical procedures in orthopaedics, trauma and spinal segments, moderate uptake of advanced graft technologies, and the replacement of legacy grafts with synthetic or biologic substitutes.

Over the forecast period the value uplift of USD 0.4 billion from USD 1.3 billion to USD 1.7 billion is supported by both volume growth and modest improvement in per unit value. In the early years, volume expansion is the dominant driver as more hospitals adopt graft and substitute products and procedural volumes grow. In the latter part of the decade, value growth contributes more significantly as higher specification graft technologies (such as enhanced biologics, synthetic composites and hybrid materials) gain adoption and average selling prices improve. Suppliers focusing on differentiation, clinical evidence and premium product lines will be best positioned to capture this incremental growth toward USD 1.7 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.3 billion |

| Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025–2035) | 2.9% |

The demand for bone grafts and substitutes in USA is increasing as a result of rising numbers of orthopedic surgeries, spinal fusions and trauma repairs. With an aging population and growing rates of degenerative bone conditions, hospitals and surgical centres require materials that assist bone regeneration. Surgeons are moving away from autografts due to donor-site complications and are choosing allografts, synthetics and composite substitutes which offer consistent supply and predictable outcomes. The trend toward minimally invasive procedures also push demand, as graft materials must integrate quickly and support enhanced recovery protocols in outpatient and ambulatory settings.

Another contributing factor is the expansion of dental implant procedures and revision surgeries, which increases need for graft substitute materials in oral-maxillofacial applications. Healthcare providers in USA are increasingly standardising treatment protocols that involve grafts to reduce hospital stay and revision rates, which improves cost-effectiveness. Manufacturers are meeting this demand with improved biomaterials that provide enhanced osteoconductive and osteoinductive properties. Cost and reimbursement challenges remain, but the overall need for effective bone repair solutions ensures continued growth in demand for bone grafts and substitutes in USA.

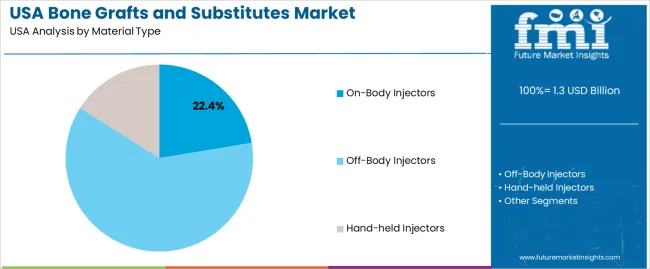

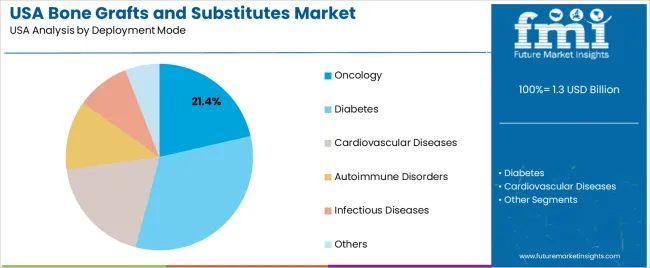

The demand for bone grafts and substitutes in USA is shaped by the material types listed in the provided structure and the deployment modes used across clinical settings. Material categories include on-body injectors, off-body injectors and hand-held injectors, each offering different handling, dosing and operational characteristics. Deployment modes span oncology, diabetes, cardiovascular diseases, autoimmune disorders, infectious diseases and other clinical areas, reflecting varied treatment pathways. As healthcare providers focus on reliable administration methods and controlled delivery, the combination of injector type and clinical application guides adoption across USA’s medical environments.

On-body injectors account for 22% of total demand within the provided material type categories. Their leading position reflects the benefit of controlled, hands-free medication delivery that supports adherence and reduces the need for clinical supervision. These systems offer consistent dosing schedules that suit treatment plans requiring steady therapeutic levels. Healthcare providers value their straightforward operation, predictable behavior and compatibility with routine outpatient care. Their ability to deliver medication while allowing patients to continue daily activities strengthens acceptance across different age groups and clinical conditions.

Demand for on-body injectors also grows as facilities adopt treatment approaches that reduce in-clinic time and support home-based care. Their compact design and clear instructions help patients manage injections confidently without extensive training. Providers rely on these systems to maintain dosing consistency across varied treatment durations. These qualities encourage ongoing use in settings where convenience, accuracy and patient confidence are important. As outpatient management expands, on-body injectors remain central to delivery choices in USA.

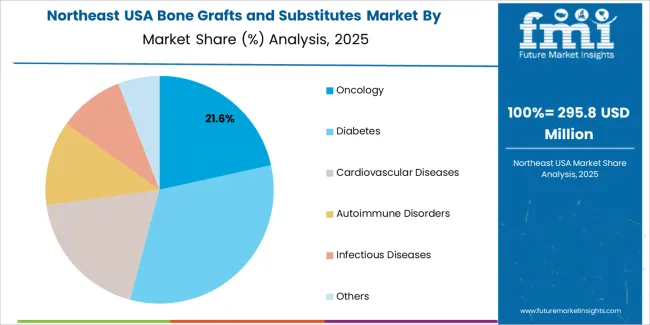

Oncology accounts for 21.4% of total demand within the deployment mode categories. This leading share reflects the need for reliable delivery systems that support structured cancer treatment schedules. Oncology care often involves repeated dosing and requires equipment capable of maintaining consistent therapeutic administration. Providers select systems that help reduce procedural steps while supporting stable patient experience during treatment cycles. These characteristics make oncology a primary user of the injector types listed in the provided structure.

Demand for oncology deployment is reinforced by the need for devices that assist clinicians in managing long treatment courses with predictable performance. Delivery systems that maintain dosing accuracy help reduce interruptions and support close monitoring across diverse oncology cases. Their alignment with outpatient infusion and home-based dosing pathways strengthens routine use. As cancer care continues to emphasize reliability and patient comfort, oncology remains a leading deployment mode shaping equipment selection across USA.

Demand for bone grafts and substitutes in the United States is growing as more patients undergo procedures for spinal fusion, trauma repair, joint reconstruction and dental bone augmentation. Manufacturers are increasingly offering synthetic and engineered biomaterials as alternatives to traditional autografts, supporting greater uptake. At the same time, high cost of advanced graft materials, regulatory and reimbursement hurdles, and competition from conventional graft options present constraints. These dynamics influence how quickly different graft technologies penetrate the US surgical and dental markets.

How Are Demographic Shifts and Surgical Practice Changes Driving Demand in USA?

An ageing population, rising incidence of osteoporosis and degenerative bone conditions, and high volumes of trauma and revision surgeries in the USA drive demand for bone graft and substitute products. Surgical practice is shifting toward less invasive procedures and multifunctional materials that reduce donor-site morbidity and improve recovery time. In dental and maxillofacial applications, growing adoption of implants and bone augmentation also increases need for graft substitutes. As these trends progress, use of specialized grafts and substitutes spreads across US hospitals and clinics.

Where Are Growth Opportunities Emerging for Bone Grafts and Substitutes in USA’s Market?

Growth opportunities in the USA lie in segments such as spinal fusion, revisions of joint implants, complex trauma repair and dental bone grafting. Synthetic bone graft substitutes such as ceramics, composites and polymers—offer potential to capture share due to their consistency and lower donor complications. Dental grafting presents demand via implant growth. Smaller specialty clinics and outpatient surgical centres adopting advanced graft materials also create new channels. Suppliers offering innovative, high-performing materials and services are well positioned to benefit.

What Challenges Are Limiting Broader Adoption of Bone Grafts and Substitutes in USA?

Despite promising growth, several challenges limit broader adoption in the USA. The upfront cost of advanced graft and substitute materials may discourage use in cost-sensitive settings. Reimbursement and coding complexities increase procurement risk for hospitals and clinics. Some surgeons may continue to prefer autografts or familiar graft products, particularly in less complex cases. Additionally, long-term clinical outcome data and surgeon comfort with newer materials remain points of consideration. These factors temper how quickly graft substitutes become the standard.

| Region | CAGR (%) |

|---|---|

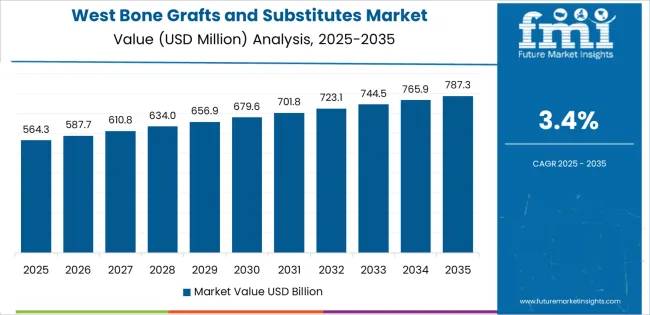

| West | 3.4% |

| South | 3.0% |

| Northeast | 2.7% |

| Midwest | 2.4% |

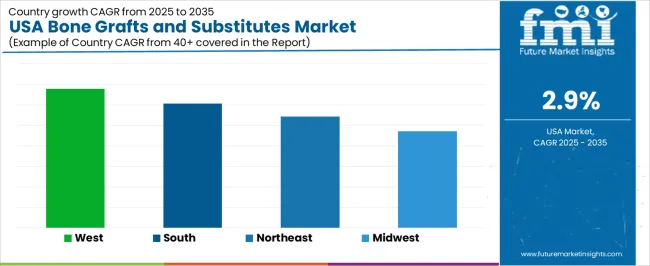

Demand for bone grafts and substitutes in the USA is increasing at a measured pace across regions. The West leads at 3.4%, supported by active orthopedic practices and steady procedural volumes tied to trauma, sports injuries, and age-related conditions. The South follows at 3.0%, where expanding hospital networks and growing patient populations contribute to consistent use of graft materials. The Northeast records 2.7%, shaped by established medical centers and routine adoption of synthetic and allograft options. The Midwest grows at 2.4%, reflecting stable orthopedic demand across regional health systems. These patterns show broad but gradual national uptake as hospitals and clinics maintain steady utilization of graft materials in surgical care.

West USA is projected to grow at a CAGR of 3.4% through 2035 in demand for bone grafts and substitutes. California and neighboring states are increasingly adopting autografts, allografts, and synthetic bone substitutes in hospitals, orthopedic clinics, and dental centers for fracture repair, spinal fusion, and dental procedures. Rising demand for minimally invasive surgeries, improved patient outcomes, and faster healing drives adoption. Manufacturers provide high-quality materials suitable for clinical and dental use. Distributors ensure availability across urban and semi-urban facilities. Growth in orthopedic procedures, dental implants, and surgical modernization supports steady adoption in West USA.

South USA is projected to grow at a CAGR of 3.0% through 2035 in demand for bone grafts and substitutes. Texas, Florida, and Georgia are increasingly adopting autografts, allografts, and synthetic substitutes for orthopedic, spinal, and dental procedures. Rising surgical volumes, patient demand for improved outcomes, and minimally invasive approaches drive adoption. Manufacturers supply high-quality graft materials compatible with hospital and clinic workflows. Retailers and distributors ensure access across urban and suburban medical facilities. Expansion in orthopedic and dental procedures, along with hospital modernization, supports steady adoption of bone grafts and substitutes in South USA.

Northeast USA is projected to grow at a CAGR of 2.7% through 2035 in demand for bone grafts and substitutes. Hospitals and clinics in New York, Boston, and Philadelphia are gradually adopting autografts, allografts, and synthetic substitutes for orthopedic and dental procedures. Rising demand for surgical precision, patient safety, and efficient recovery drives adoption. Manufacturers provide high-quality materials suitable for clinical workflows and dental implant procedures. Distributors expand accessibility across urban medical facilities. Hospital upgrades, increasing orthopedic procedures, and dental implant growth ensure steady adoption of bone grafts and substitutes across Northeast USA.

Midwest USA is projected to grow at a CAGR of 2.4% through 2035 in demand for bone grafts and substitutes. Chicago, Detroit, and Minneapolis hospitals and clinics are gradually adopting autografts, allografts, and synthetic substitutes for orthopedic, dental, and spinal procedures. Rising need for minimally invasive techniques, improved recovery, and patient outcomes drives adoption. Manufacturers provide graft materials suitable for small and medium-sized healthcare facilities. Distributors ensure availability across urban and semi-urban regions. Orthopedic surgery expansion, dental implant procedures, and hospital modernization support steady adoption of bone grafts and substitutes in Midwest USA.

The demand for bone grafts and substitutes in the USA is driven by a rising incidence of orthopedic and spinal disorders, a growing aging population and an increase in trauma-related surgeries. As patients live longer and remain active into later stages of life, conditions such as degenerative disc disease, fractures and osteoporosis become more prevalent. Healthcare providers are adopting advanced graft materials and substitutes to facilitate quicker recovery, reduce donor-site morbidity and support minimally invasive procedures. Innovations in synthetic grafts, biologics and 3D-printed scaffolds enhance treatment options and support broader adoption of graft substitutes across orthopedic, spine and dental applications.

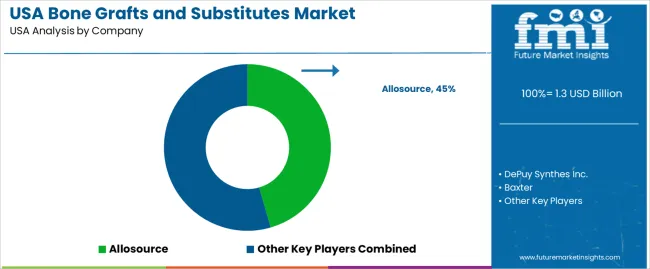

Key companies shaping the bone grafts and substitutes segment in the USA include AlloSource, DePuy Synthes Inc., Baxter International Inc., NuVasive Inc. and Smith & Nephew plc. These companies offer comprehensive graft and biologic product lines, including allografts, synthetic scaffolds and regenerative matrices suited to USA clinical environments. Their strategies emphasise regulatory compliance, surgeon training programs and partnerships with hospital systems to integrate graft-substitute solutions. Through product innovation, extensive distribution networks and focused marketing in orthopedic and spine segments, these firms influence how bone grafts and substitutes are selected and adopted within the USA healthcare ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material Type | On-Body Injectors, Off-Body Injectors, Hand-held Injectors |

| Deployment Mode | Oncology, Diabetes, Cardiovascular Diseases, Autoimmune Disorders, Infectious Diseases, Others |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | AlloSource, DePuy Synthes Inc., Baxter, NuVasive Inc., Smith & Nephew |

| Additional Attributes | Dollar by sales by material type and deployment mode; regional CAGR and adoption trends; usage across orthopedic, spinal and dental procedures; product adoption in hospitals and outpatient surgical centers; differentiation of autografts, allografts, synthetic and hybrid materials; clinical adoption patterns for trauma, revision, and elective procedures; regulatory and reimbursement factors; supplier strategies for training, clinical support, and distribution; incremental improvements in graft materials and technology; integration with minimally invasive techniques; long-term volume and unit value growth across the forecast period. |

The demand for bone grafts and substitutes in usa is estimated to be valued at USD 1.3 billion in 2025.

The market size for the bone grafts and substitutes in usa is projected to reach USD 1.7 billion by 2035.

The demand for bone grafts and substitutes in usa is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in bone grafts and substitutes in usa are on-body injectors, off-body injectors and hand-held injectors.

In terms of deployment mode, oncology segment is expected to command 21.4% share in the bone grafts and substitutes in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bone Grafts and Substitutes Market Overview - Size, Share & Forecast 2025 to 2035

Demand for Bone Grafts and Substitutes in Japan Size and Share Forecast Outlook 2025 to 2035

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bone Densitometers in USA Size and Share Forecast Outlook 2025 to 2035

Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Bone Metabolism Test Market Size and Share Forecast Outlook 2025 to 2035

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometer Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA