The demand for coffee extracts in the USA is valued at USD 0.5 billion in 2025 and is projected to reach USD 0.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.2%. The market is driven by the growing popularity of coffee-based beverages, including ready-to-drink (RTD) coffee drinks, which increasingly incorporate coffee extracts. These extracts are valued for their concentrated flavor, cost efficiency, and versatility in food, beverages, and health supplements. As consumer preferences continue to shift towards high-quality, convenient coffee options, the demand for coffee extracts is expected to grow steadily, particularly in the RTD segment, as well as in the health-conscious market.

Over the forecast period, the demand for coffee extracts is projected to grow at a steady pace, from USD 0.4 billion in earlier years to USD 0.5 billion in 2025, continuing incrementally to USD 0.8 billion by 2035. The demand increases gradually each year, with slight year-on-year growth observed across the forecast period. The annual increments are expected to remain consistent, with values rising from USD 0.5 billion in 2025 to USD 0.6 billion in 2026, continuing through to USD 0.8 billion by 2035. This reflects the market's stable expansion, driven by the increasing consumption of coffee beverages and the continued shift towards coffee extracts in both consumer and industrial applications.

Demand in USA for coffee extracts is projected to increase from USD 0.5 billion in 2025 to USD 0.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.2%. The value rises from USD 0.4 billion in 2020, moves to USD 0.5 billion around 2025, then continues upward through USD 0.7 billion by 2030 and ultimately reaches USD 0.8 billion by 2035. Growth is driven by rising consumer demand for natural and specialty coffee flavours, increasing incorporation of extracts in food and beverage applications, and growing interest in functional ingredients derived from coffee.

As the segment matures, the pace of growth will depend increasingly on product innovation and premiumisation rather than sheer volume expansion. Early gains are being driven by larger usage in conventional beverages, ready to drink formats and bakery applications. Over the coming years, higher per unit value opportunities such as organic, speciality and functional extracts will bolster growth. While underlying volume growth remains modest, improvements in sourcing, extraction technology and value added positioning will support sustained demand increase.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 0.5 billion |

| Forecast Value (2035) | USD 0.8 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The demand for coffee extracts in USA is being propelled by multiple interlinked trends. One primary driver is the expansion of premium and specialty coffee products, including ready to drink beverages, cold brews, and flavored offerings that utilise coffee extracts for consistent flavour and aroma. Consumers increasingly prefer convenience formats and distinctive taste profiles, which make coffee extracts a valuable ingredient. Another factor is the growth of coffee infused applications across bakery, confectionery, dairy, and nutritional segments, where extracts deliver authentic coffee notes without full brewing processes.

Functional and wellness trends are further supporting demand. Coffee extracts are appearing in products that emphasise antioxidants, clean label ingredients, and plant based alternatives, appealing to health aware consumers. Advances in extraction and formulation technology are making high purity extracts more accessible, boosting adoption. At the same time supply chain pressures and raw material volatility impose constraints, which may influence pricing and product development. Overall the demand trajectory for coffee extracts in USA remains upward as manufacturers adapt to evolving consumer preferences and application opportunities.

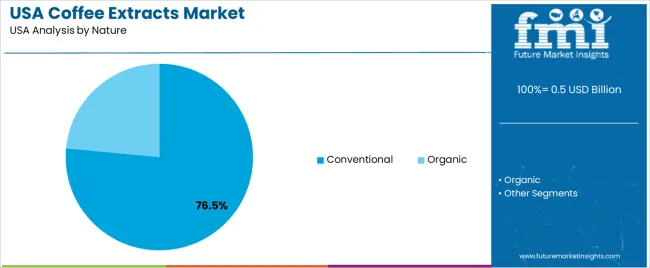

The demand for coffee extracts in the USA is influenced by the nature of the extract and the product form in which it is offered. Coffee extracts are available in conventional and organic varieties, each catering to different consumer preferences. The product forms include liquid concentrate, dried form, and capsules or tablets, each providing a convenient way to consume coffee extracts depending on the application. These segments highlight the growing interest in coffee extracts, particularly as consumers seek more versatile and health-conscious options in their coffee consumption.

Conventional coffee extracts account for 76.5% of the total demand in the USA. This high demand is driven by the widespread availability and cost-effectiveness of conventional coffee, which is typically produced using traditional agricultural methods. Conventional coffee extracts are widely used in various products, including beverages, flavorings, and as a concentrated form for ready-to-consume drinks. The lower price point compared to organic coffee extracts makes them more accessible to a broader market, further boosting their demand across various industries.

The popularity of conventional coffee extracts is also fueled by their versatility and the high demand for ready-to-use coffee products. As coffee continues to be a staple in American diets, conventional coffee extracts remain the preferred choice for manufacturers producing coffee-based beverages, coffee flavorings, and other related products. Their ability to offer consistent flavor and quality, coupled with the scale of production, supports their continued dominance in the market.

Liquid concentrate coffee extracts make up 45.0% of the total demand in the USA. This product form is favored for its convenience and ease of use, as it provides a concentrated, ready-to-mix option for consumers looking for a quick coffee solution. Liquid concentrates are popular in ready-to-drink beverages, coffee pods, and syrups, making them ideal for both commercial and consumer use. The growing preference for instant coffee solutions, particularly among busy consumers, drives the demand for liquid concentrate coffee extracts.

The demand for liquid concentrate is also supported by its flexibility in product development. Manufacturers can easily adjust the strength of the coffee flavor by diluting the concentrate to suit different consumer tastes. As the trend for on-the-go coffee consumption continues to rise, liquid concentrate coffee extracts are expected to maintain their popularity. Their ability to deliver a consistent and high-quality flavor in a convenient format positions them as a key product in the coffee extract market.

The demand for coffee extracts in the USA is expanding as producers and manufacturers seek concentrated, versatile flavor sources that serve ready to drink beverages, bakery items and confectionery products. Growing consumer interest in specialty coffee flavors, home brewing and functional beverages supports this growth. At the same time, factors such as fluctuating raw material costs and regulatory or supply chain constraints pose barriers. Overall, the desire for efficient flavor delivery and premium taste profiles is exerting upward pressure on coffee extract usage in the United States.

The rise of specialty and artisan coffee consumption in the USA is encouraging ingredient manufacturers to offer extracts with more refined flavor profiles. As more consumers seek single origin, organic or premium coffee experiences at home or in foodservice, the demand for extracts that deliver authentic taste in smaller format or incorporated into other products is growing. This evolution in consumer preference is helping coffee extracts become standard ingredients in bakery, confectionery, dairy and ready to drink applications where the sought after coffee flavour must be consistent and scalable.

Manufacturers in the USA are increasingly turning to coffee extracts because they offer convenient integration of coffee flavour and aroma without the need for full brewing or bean handling infrastructure. These extracts allow beverage producers, dessert makers and food service operators to incorporate coffee notes into products with less variability and improved shelf stability. Additionally, the growth in home brewing, premium RTD (ready to drink) formats and subscription based coffee services is indirectly boosting extract demand by increasing overall coffee flavour consumption in alternative formats.

Despite positive demand drivers, the coffee extract segment in the USA faces a number of constraints. Supply chain volatility in coffee bean sourcing affects extract pricing and availability. Some manufacturers are cautious about investing in high purity extract production due to variable raw material cost and regulatory scrutiny around food service grade ingredients. Additionally, competition from whole bean or ground coffee formats and alternative flavour systems (such as chocolate or tea extracts) may reduce the rate at which extract based solutions are adopted in some product lines.

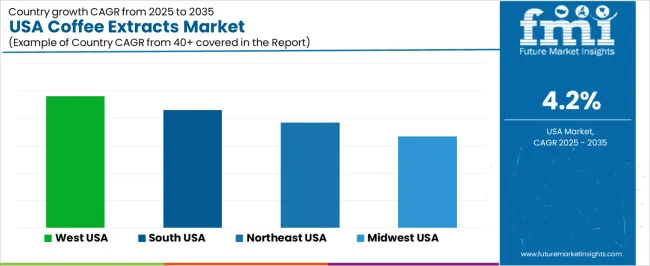

| Region | CAGR (%) |

|---|---|

| West | 4.8% |

| South | 4.3% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The demand for coffee extracts in the USA is growing across all regions, with the West leading at a 4.8% CAGR. This growth is driven by a strong coffee culture, a high concentration of coffee-related businesses, and a rising demand for convenient coffee solutions in both food and beverage sectors. The South follows with a 4.3% growth, supported by increasing consumption of ready-to-drink coffee beverages and the expansion of coffee-based product offerings. The Northeast experiences a 3.8% growth, driven by urban populations and a strong presence of coffee retailers. The Midwest, growing at 3.3%, shows steady demand, influenced by local coffee shops and increasing interest in coffee extract for use in both commercial and home kitchens.

The West region of the USA is projected to grow at a CAGR of 4.8% through 2035 in demand for coffee extracts. With a strong food and beverage industry, particularly in states like California and Washington, the West continues to lead in the adoption of coffee extracts for use in beverages, baked goods, and confectionery. The region’s growing coffee culture and increasing consumer demand for ready-to-drink coffee products and coffee-flavored snacks contribute significantly to this market growth. The rise of health-conscious consumers and preference for natural coffee ingredients further accelerates this demand.

The South region of the USA is projected to grow at a CAGR of 4.3% through 2035 in demand for coffee extracts. With a growing food processing and beverage sector, states like Texas and Florida contribute significantly to the demand for coffee extracts in a variety of applications. The rising popularity of coffee-flavored beverages, snacks, and desserts increases the usage of coffee extracts. The region’s expanding coffee consumption, combined with the trend towards premium and specialty coffee products, further stimulates the demand for coffee extracts as an ingredient in diverse consumer products.

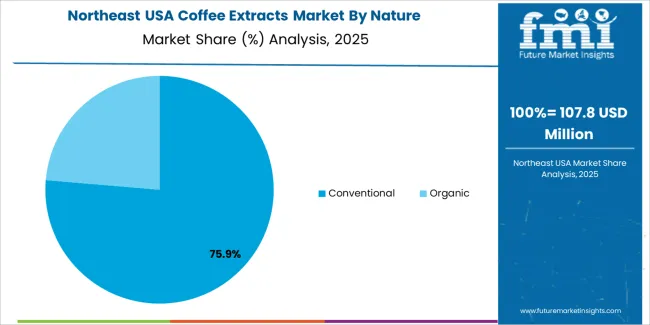

The Northeast region of the USA is projected to grow at a CAGR of 3.8% through 2035 in demand for coffee extracts. With its high concentration of food manufacturers and coffee consumers, the Northeast remains a strong market for coffee extracts. States like New York and Massachusetts, home to large coffeehouse chains and food manufacturers, significantly contribute to the use of coffee extracts in beverages, desserts, and snack products. The region’s growing interest in innovative coffee beverages and the demand for convenient coffee-based products further fuel the market’s growth.

The Midwest region of the USA is projected to grow at a CAGR of 3.3% through 2035 in demand for coffee extracts. As a key manufacturing and food processing hub, states like Illinois and Ohio play a crucial role in the demand for coffee extracts. The region’s expanding coffee consumption, particularly in beverages and confectionery, boosts the market. With an increasing preference for flavored coffee products, including energy drinks and snacks, the demand for coffee extracts in the Midwest continues to rise steadily, supported by trends in convenience and ready-to-consume coffee products.

The demand for coffee extracts in the USA is driven by consumers seeking natural ingredients, enriched functionality and more flavour diversity in beverages, snacks and nutraceutical products. The rise of specialty coffee culture, paired with the growth of ready to drink coffee and coffee infused food items, enhances interest in concentrated coffee components. Greater awareness of health benefits associated with compounds in coffee extracts also contributes to demand. Innovations in extraction methods and supply chain developments support broader application across food, beverage and wellness sectors.

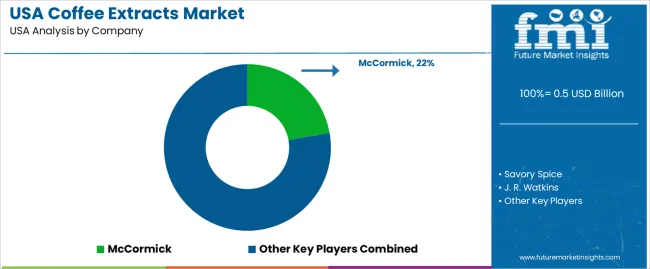

Key players in the USA coffee extract industry include McCormick, Savory Spice, J. R. Watkins, NatureWise and Sports Research. These companies supply a variety of extract formats powdered, liquid, organic that cater to different segments such as flavouring, functional ingredients and supplements. Their competitive positioning rests on product quality, clean label credentials and distribution reach. The ongoing focus on formulation support, consumer trends and ingredient partnerships enables these firms to influence how coffee extract applications evolve in the USA industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Beverage Industry, Food Industry, Desserts, Baking Goods, Savory Dishes, Pharmaceutical Industry, Others |

| Nature | Conventional, Organic |

| Product | Liquid Concentrate, Dried Form, Capsules or Tablets |

| Formulation | Roasted, Unroasted |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | McCormick, Savory Spice, J. R. Watkins, NatureWise, Sports Research |

| Additional Attributes | Dollar by sales across nature, product, and end-use segments, supply chain analysis, coffee extract applications in various industries, innovations in extraction and formulation methods, clean-label product demand, market adoption rates across regions. |

The global demand for coffee extracts in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the demand for coffee extracts in USA is projected to reach USD 0.8 billion by 2035.

The demand for coffee extracts in USA is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand for coffee extracts in USA are beverage industry, food industry, desserts, baking goods, savory dishes, pharmaceutical industry and others.

In terms of nature, conventional segment to command 76.5% share in the demand for coffee extracts in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Coffee Decoction Maker Market

Coffee Brewers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA