The USA Fish Oil Market is poised for significant growth, with its market size expected to reach USD 978.3 million by 2025 and further expand to USD 2,044.7 million by 2035. Growth is also supported by technological advancements in yeast fermentation, increasing consumer preference for clean-label ingredients, and expanding applications in pet food and dietary supplements.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 978.3 million |

| Industry Value (2035F) | USD 2,044.7 million |

| CAGR (2025 to 2035) | 7.7% |

At this time, the USA Fish Oil Market is being developed steadily. Increasing demand from the consumer market for omega-3-rich supplement, pharmaceutical application, and functional food formulations drives the market.

Shifting dietary patterns, a rising preference for natural health solutions, and increasing consciousness about heart health benefits through fish oil consumption shape the market. Companies differentiate themselves through more sustainable sourcing, advanced refining techniques and product innovation like high-purity fish oil concentrates.

The competitive battle in the market is still intense as companies compete to capture a higher share of the fast-changing industry landscape through strategic acquisitions and improving their distribution channels.

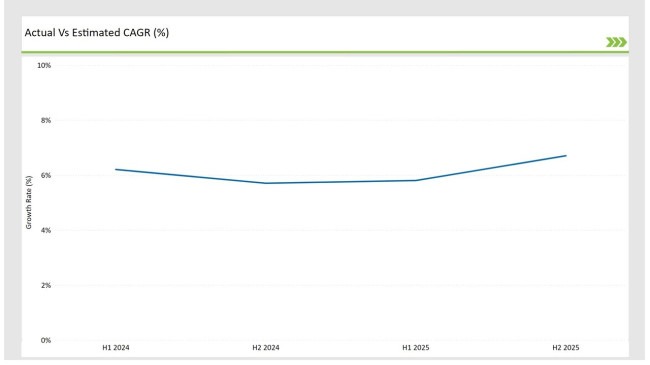

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Fish Oil market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 6.2% |

| H2 Growth Rate (%) | 5.7% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.8% |

| H2 Growth Rate (%) | 6.7% |

For the USA market, the Fish Oil sector is projected to grow at a CAGR of 6.2% during the first half of 2024, with an increase to 5.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 5.8% in H1 and reach 6.7% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Norwegian firm Aker BioMarine launched a new concentrated fish oil with 90% omega-3 content using proprietary enzyme technology. The product achieves unprecedented purity levels while maintaining oxidative stability. |

| Oct-2024 | Pelagia AS expanded their fish oil refining facility in Norway with a USD 50 million investment. The expansion includes new molecular distillation units that increase production capacity by 40%. |

| Aug-2024 | Omega Protein introduced a traceable fish oil sourcing program using blockchain technology. The system provides complete transparency from catch to finished product, ensuring sustainability compliance. |

| Jun-2024 | BASF and Cargill formed a joint venture for sustainable fish oil production in Peru. The partnership focuses on reducing environmental impact while maintaining high-quality standards. |

| Apr-2024 | Golden Omega launched a new fish oil concentrate specifically for pregnancy nutrition. The product features a specialized DHA:EPA ratio optimized for fetal development. |

Rising Preference for High-Purity and Concentrated Omega-3 Formulations

There is growing demand for highly pure and concentrated omega-3 fish oil. Consumers and pharmaceutical companies are in search of better, more bioavailable formulations that will prove more effective. Cardiovascular health, cognitive function, and anti-inflammatory benefits are leading to increased investments in advanced refining technologies to boost EPA and DHA concentrations.

The ultra-pure fish oil supplements of brands such as DSM Nutritional Products and Nordic Naturals have been gaining inroads with clinical backing to meet the growing demand for premium-quality functional health products.

Sustainable Sourcing and Traceability are Becoming Key Market Differentiators

With increased focus on marine biodiversity as well as fishing, firms take up initiatives about sustainable fish oil sourcing and traceability. Organizations such as BASF Corporation as well as Omega Protein Corporation can use certified sustainable fisheries along with blockchain-based traceability systems that ensure responsible sourcing and transparency.

Regulatory pressures and environmentally conscious consumers are driving the demand for Marine Stewardship Council (MSC)-certified fish oils, challenging brands to develop alternative sourcing solutions, including algal-based omega-3 solutions, in an effort to avoid dependence on wild fish stocks.

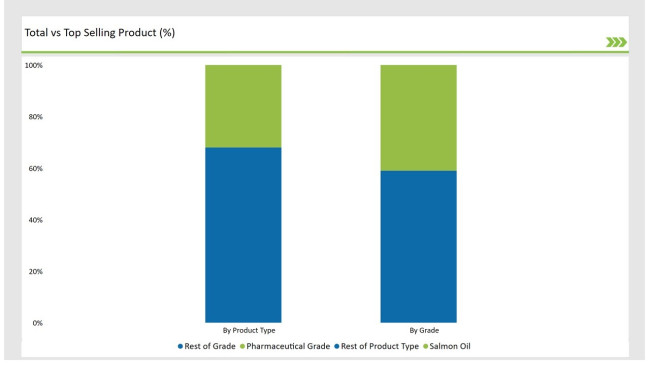

| By Product Type | Market Share |

|---|---|

| Salmon Oil | 42% |

| Remaining Segments | 58% |

Salmon oil is coming out as the leading product type, accounting for 32% of the market share, led by its high content of omega-3s, mild taste, and diversified applications in pharmaceuticals, supplements, and functional foods.

Salmon oil has higher EPA and DHA content compared to other products, making it a preferred source for cardiovascular and cognitive health applications. Other fish oils, including cod liver and sardine oils, remain the largest market shares but are now under intense competition from formulations from salmon, marketed as premium and highly bioavailable in the USA market.

| By Grade | Market Share |

|---|---|

| Pharmaceutical Grade | 53% |

| Remaining Segments | 47% |

Market Leader- Pharmaceutical Grade Fish Oil dominates 41% of the market on account of a high level of purity, strict quality, and prescription based drug for use by people suffering from cardiovascular diseases, hypertriglyceridemia, and inflammatory diseases. The major pharmaceutical companies are showing an interest in conducting clinical trials for FDA approved formulation to gain a strong foothold in this category.

Meanwhile, food-grade and feed-grade fish oils continue to cater to functional food applications and animal nutrition but come under much tighter scrutiny from the regulators, making pharmaceutical-grade variants the most profitable and rapidly expanding segment.

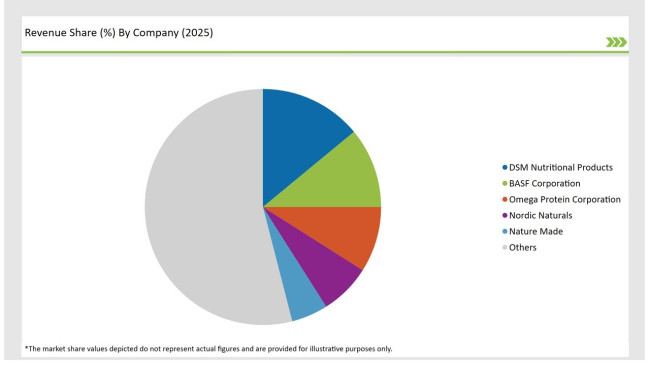

The USA Fish Oil Market is filled with large multinational corporations leading the industry, such as DSM Nutritional Products, BASF Corporation, and Omega Protein Corporation. Regional or specialized players such as Nordic Naturals and Barlean's cater to niche market segments.

Vertically integrated suppliers control the raw material sourcing base, mid-sized companies are in an attempt to establish product differentiation on premium offerings, and small-scale companies focus on cost leadership.

MNCs occupy the market shares of the highest purity of pharmaceutical and supplements whereas regional companies target natural, and sustainably sourced fish oil formulation for organic, and environment friendly consumers.

| Company | Market Share |

|---|---|

| DSM Nutritional Products | 14% |

| BASF Corporation | 11% |

| Omega Protein Corporation | 9% |

| Nordic Naturals | 7% |

| Nature Made (Pharmavite LLC) | 5% |

| Other Players | 54% |

To gain a competitive edge, the leading players are undertaking vertical integration, elaborate refining processes, and responsible sourcing practices. DSM and BASF have their processing and R&D facilities based in New Jersey and Texas in the USA with an emphasis on pharmaceutical-grade fish oil for heart health.

Omega Protein Corporation owns fishing fleets along the Gulf Coast to source the raw materials directly for economies of scale in cost. Companies like Nordic Naturals and Nature Made have local distribution and local retail chains for sales penetration as e-commerce has improved and pharmaceutical store sales.

Feed Grade: 50%, Food Grade: 30%, Pharma Grade: 20%

Salmon Oil: 42%, Tuna Oil: 28%, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, Menhaden Oil and Others

Crude Fish Oil: 30%, Refined Fish Oil: 60%, Modified Fish Oil: 10%

Aqua-Feed: 50%, Food and Beverages: 20%, Dietary Supplements: 20%, Cosmetic and Beauty Products: 10%

By 2025, the USA Fish Oil market is expected to grow at a CAGR of 7.7%, driven by rising demand for omega-3-rich supplements and pharmaceutical formulations.

By 2035, the sales value of the USA Fish Oil Market is projected to reach approximately USD 2,044.7 million, reflecting sustained consumer interest in heart and brain health benefits.

Key factors fueling market growth include increasing consumer awareness of omega-3 health benefits, expansion of functional foods, rising pharmaceutical applications, and the shift toward sustainable fish oil sourcing.

In the USA, coastal regions such as California, New York, and Florida drive the highest consumption due to high health awareness, strong supplement sales, and large-scale pharmaceutical production.

Major manufacturers in the USA Fish Oil Market include DSM Nutritional Products, BASF Corporation, Omega Protein Corporation, Nordic Naturals, and Nature Made (Pharmavite LLC), with their production and distribution networks spread across multiple states.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA