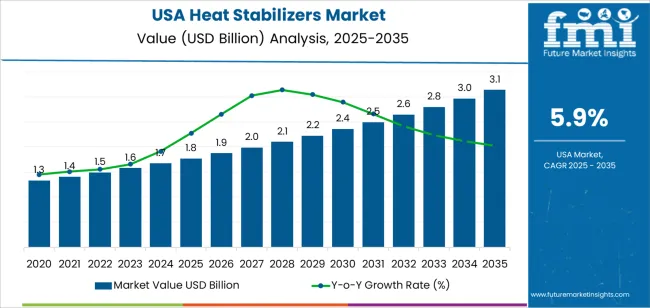

The demand for heat stabilizers in the USA is expected to grow from USD 1.8 billion in 2025 to USD 3.1 billion by 2035, reflecting a CAGR of 5.9%. Heat stabilizers are essential additives used in the plastics industry to protect materials from thermal degradation during processing. They are widely applied in the manufacturing of polyvinyl chloride (PVC), polystyrene, and other thermoplastics, and play a critical role in ensuring the durability, performance, and longevity of these materials. The growth in the demand for heat stabilizers is driven by the expanding construction and automotive industries, which rely on durable materials for pipes, cables, flooring, and automotive parts. Additionally, the increasing regulatory focus on product safety and quality control in manufacturing processes will support the adoption of heat stabilizers.

The market is also benefitting from innovations in stabilizer formulations, which improve environmental sustainability and efficiency. The rising trend towards eco-friendly products, such as lead-free stabilizers and biodegradable solutions, is further accelerating the demand for heat stabilizers. As industries in the USA continue to prioritize sustainability, the market for heat stabilizers will see steady growth, driven by a shift towards more sustainable manufacturing practices and a growing focus on non-toxic and high-performance materials.

From 2025 to 2026, the demand for heat stabilizers in the USA is projected to increase from USD 1.8 billion to USD 1.9 billion, contributing an additional USD 0.1 billion. This represents a YoY growth rate of 5.6%. The growth in this phase will be driven by the continued demand for high-quality plastic materials in the construction, automotive, and electronics industries. The increased use of heat stabilizers in manufacturing processes to ensure product durability and performance will play a major role in this early expansion. The market will benefit from increasing regulatory requirements for environmentally friendly and safe plastic materials. As industries continue to focus on sustainable manufacturing and product safety, the demand for heat stabilizers is expected to rise, especially in sectors that rely heavily on thermoplastics and composites.

From 2026 to 2027, the market will grow from USD 1.9 billion to USD 2.0 billion, contributing an additional USD 0.1 billion with a YoY growth rate of 5.3%. The primary driver in this period will be the adoption of lead-free and environmentally friendly stabilizers in response to increasing consumer demand for non-toxic and eco-friendly products. As industries continue to prioritize sustainability and health-conscious manufacturing practices, the demand for heat stabilizers will remain strong, though at a steadier growth rate compared to the early phase. This indicates that the market will continue to experience positive growth, with increasing market awareness of safe and high-performance materials across various sectors.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.8 billion |

| Industry Forecast Value (2035) | USD 3.1 billion |

| Industry Forecast CAGR (2025-2035) | 5.9% |

Demand for heat stabilizers in the USA is increasing due to the expanding use of polyvinyl chloride (PVC) and other polymers in construction, automotive, electrical wiring and packaging. As manufacturers seek to ensure material durability, thermal resistance and product longevity, heat stabilizers become essential additives. Growth in building renovation, infrastructure upgrades, and light weighting of vehicles are contributing to increased uptake of stabilizers in pipes, cables and automotive components. Analysts suggest that the broader heat stabilizer market is set for moderate growth in North America, supported by industrial transformation and infrastructure investments.

Environmental and regulatory pressures are also shaping demand. USA standards for product safety and material recyclability are encouraging adoption of non toxic, eco friendly stabilizer formulations, such as calcium zinc and organometallic compounds. This shift not only meets compliance obligations but also aligns with manufacturers’ sustainability goals, especially in packaging and automotive sectors. At the same time, challenges such as raw material price volatility, the need for reformulation of legacy materials, and competition from alternate additive systems may constrain rapid growth. Nevertheless, the combination of evolving legislation, material performance requirements and industrial demand signals steady expansion of the heat stabilizers market in the USA.

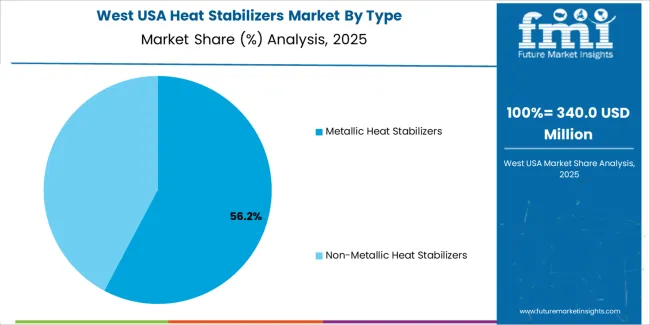

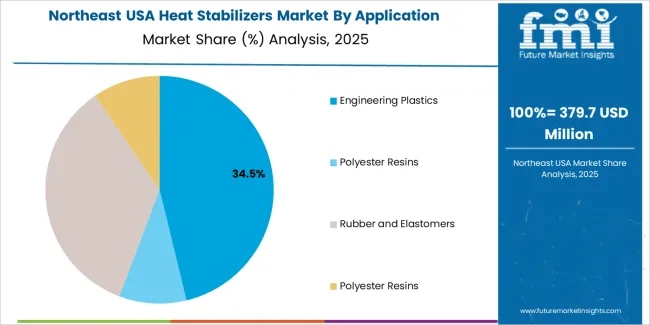

The demand for heat stabilizers in the USA is primarily driven by type and application. The leading type is metallic heat stabilizers, capturing 59% of the market share, while engineering plastics is the dominant application, accounting for 35% of the demand. Heat stabilizers are essential in various industries to protect materials from heat degradation during processing and usage, ensuring product longevity, performance, and safety. As the demand for high-performance materials continues to grow across different sectors, the use of heat stabilizers in applications like engineering plastics, resins, and rubber remains critical.

Metallic heat stabilizers lead the market for heat stabilizers in the USA, holding 59% of the demand. Metallic heat stabilizers are widely used in applications that require enhanced stability and performance under high-temperature conditions. These stabilizers typically contain metals like barium, calcium, or zinc, which are effective in preventing degradation of polymers and ensuring their long-term durability. They are often used in the processing of materials like PVC, engineering plastics, and rubber, where heat resistance is critical during both manufacturing and end-use applications.

The demand for metallic heat stabilizers is driven by their proven effectiveness in maintaining material integrity at elevated temperatures, making them ideal for use in industries such as automotive, construction, and packaging. The growing need for durable and heat-resistant materials, particularly in engineering plastics used in high-performance applications, ensures that metallic heat stabilizers will continue to dominate the market in the USA. Their efficiency, cost-effectiveness, and versatility across various applications make them a preferred choice for manufacturers.

Engineering plastics are the leading application segment for heat stabilizers in the USA, capturing 35% of the demand. Engineering plastics are known for their high strength, thermal stability, and resistance to heat, making them essential for applications in automotive, electronics, and industrial machinery, where materials must withstand high temperatures without degrading. Heat stabilizers play a crucial role in ensuring that these plastics maintain their properties during processing and throughout their lifecycle.

The demand for heat stabilizers in engineering plastics is driven by the increasing use of high-performance polymers in critical applications. As industries push for materials that can withstand harsher environments and higher temperatures, the need for effective stabilizers grows. Heat stabilizers prevent the degradation of engineering plastics during manufacturing and enhance their performance in end-use applications, ensuring the longevity and reliability of products. With the continued expansion of engineering plastics in industries like automotive, aerospace, and consumer electronics, the demand for heat stabilizers in this segment is expected to remain strong.

Demand for heat stabilizers in the USA is driven by the widespread use of PVC and other thermoplastics across construction, automotive, electrical and electronics, and packaging sectors. As polymers face higher processing temperatures and harsher service conditions, stabilizers play a crucial role in maintaining heat resistance, durability and regulatory compliance. At the same time, cost pressures on raw materials and strict regulation of certain stabilizer chemistries moderate growth. These dynamics together define the market trajectory for heat stabilizers in the USA

What Are the Primary Growth Drivers for Heat Stabilizer Demand in the United States?

Several growth drivers support demand. First, renovation and new construction activities fuel demand for PVC pipes, profiles, window frames and cables that require stabilizers to withstand thermal ageing. Second, the automotive industry’s shift to lighter, polymer based components under the hood and electrical systems increases the need for additives that preserve performance at elevated temperatures. Third, the expanding electronics and e mobility segments generate demand for thermally stable plastic parts, driving stabilizer usage. Fourth, the trend toward recycling and high performance plastics prompts formulators to use advanced stabilizers suited for reclaimed material streams and higher thermal loads.

What Are the Key Restraints Affecting Heat Stabilizer Demand in the United States?

Despite growth potential, several restraints exist. Regulatory limitations on certain stabilizer chemistries, such as lead based or heavy metal systems, limit usage of legacy solutions and require investment in newer technologies. Volatility in the cost of feedstocks and additives can reduce margin for stabilizer suppliers and end users alike. In some plastics segments, substitution of PVC with alternative polymers reduces demand for PVC specific stabilizers. Additionally, the maturity of many end use markets means incremental growth is moderate rather than exponential.

What Are the Key Trends Shaping Heat Stabilizer Demand in the United States?

Key trends include a shift toward non heavy metal stabilizer systems, such as calcium zinc and organo tin alternatives, to align with environmental and regulatory demands. There is also increased adoption of stabilizer masterbatches tailored for recycled plastics to support circular economy goals. Advanced stabilizer technologies that offer synergistic protection, such as heat, UV and oxidation, are gaining traction. Finally, end users are prioritizing additives that enable higher processing temperatures and faster cycle times, supporting productivity and energy efficiency in manufacturing.

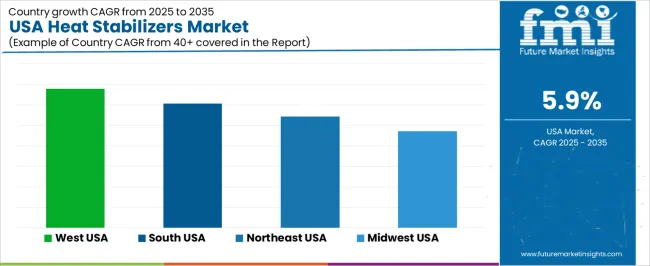

The demand for heat stabilizers in the USA is driven by their critical role in enhancing the thermal stability of polymers, especially in industries such as construction, automotive, packaging, and electrical. Heat stabilizers prevent the degradation of materials during processing or under high-temperature conditions, making them essential in the production of PVC and other plastics. As industries continue to embrace more durable and long-lasting materials, the need for heat stabilizers grows. Additionally, the increasing focus on improving product quality, environmental concerns related to material degradation, and stricter regulations on material safety are contributing factors to the market's expansion. Regional variations in demand are influenced by local manufacturing activity, industrial infrastructure, and the concentration of industries relying on heat-stable materials. Below is an analysis of the demand for heat stabilizers across different regions in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.8% |

| South | 6.1% |

| Northeast | 5.4% |

| Midwest | 4.7% |

The West leads the demand for heat stabilizers in the USA with a CAGR of 6.8%. The region is a major manufacturing hub, particularly in industries such as automotive, electronics, construction, and packaging, all of which rely heavily on heat-stable materials. States like California, Oregon, and Washington have a large presence of industries that use plastics and polymers, including those in construction materials, automotive parts, and electrical wiring, which require heat stabilizers to maintain their performance under high temperatures.

Additionally, the West’s focus on innovation and sustainable manufacturing practices is driving the demand for high-performance heat stabilizers. The region’s commitment to reducing environmental impacts and improving product durability further fuels the adoption of stabilizers that enhance the thermal properties of materials. As manufacturing and infrastructure projects continue to grow, the demand for heat stabilizers in the West is expected to remain strong.

The South shows strong demand for heat stabilizers with a CAGR of 6.1%. This growth is driven by the region’s diverse industrial base, which includes significant automotive, construction, and manufacturing sectors. States like Texas, Georgia, and Florida have growing industries that require high-performance plastics and composites that need heat stabilizers for improved durability and thermal stability.

The South's increasing focus on infrastructure development and industrial growth further contributes to the demand for heat-stable materials in applications such as construction and automotive manufacturing. Additionally, the region’s rising interest in environmentally friendly and durable materials supports the growing need for heat stabilizers that ensure the longevity and stability of these products under high temperatures. As the industrial sectors in the South continue to expand, the demand for heat stabilizers is expected to grow steadily.

The Northeast demonstrates steady demand for heat stabilizers with a CAGR of 5.4%. This region, which includes states like New York, Pennsylvania, and Massachusetts, has a strong presence of industries such as construction, automotive, and packaging that require heat-stable materials for their products. The demand in the Northeast is supported by the ongoing need for high-quality, durable materials in the production of building materials, automotive components, and packaging products.

The growth rate in the Northeast is slower than in the West and South, likely due to the region’s relatively mature industrial base and lower levels of manufacturing expansion. However, the demand remains strong due to the region’s focus on maintaining high standards of product quality and safety. As the region continues to invest in sustainable manufacturing and infrastructure projects, the demand for heat stabilizers is expected to continue steadily.

The Midwest shows moderate growth in the demand for heat stabilizers with a CAGR of 4.7%. The region’s industrial sectors, particularly automotive manufacturing and construction, are key drivers of demand for heat-stable materials. States like Michigan, Ohio, and Indiana have a significant presence of automotive and manufacturing companies, which rely on heat stabilizers to ensure the thermal stability and durability of their products.

While the growth rate in the Midwest is slower compared to the West and South, the region’s focus on manufacturing high-quality products and maintaining product performance under extreme conditions supports the continued use of heat stabilizers. The region’s mature industrial infrastructure, coupled with a strong emphasis on advanced manufacturing techniques, will contribute to steady demand for these stabilizers in the coming years.

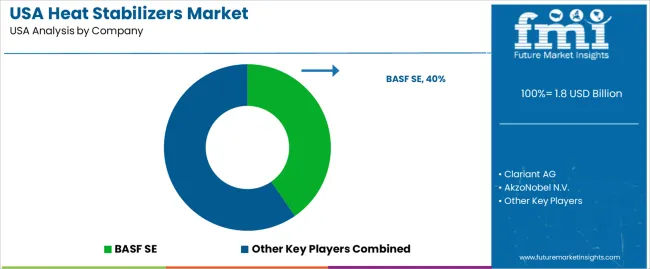

The demand for heat stabilizers in the United States is growing as industries such as plastics, automotive, and construction increasingly require materials that can withstand high temperatures without degrading. Companies like BASF SE (holding approximately 40.4% market share), Clariant AG, AkzoNobel N.V., Arkema S.A., Baerlocher GmbH, and Galata Chemicals are key players in this market. Heat stabilizers are critical in ensuring the durability, longevity, and safety of products made from thermoplastics and other materials exposed to high heat during manufacturing or end-use.

Competition in the heat stabilizers industry is driven by product performance, regulatory compliance, and the ability to offer sustainable solutions. Companies are focusing on developing heat stabilizers that not only protect materials from degradation but also meet increasingly strict environmental regulations regarding toxicity and emissions. Another area of competition is customization, as manufacturers demand stabilizers tailored to specific applications, such as those required for food-grade plastics, automotive components, or electrical cables. Companies are also investing in research to develop heat stabilizers that provide longer-lasting protection and reduce the need for frequent replacements. Marketing materials often emphasize factors such as product efficacy, compatibility with various polymers, and sustainability. By aligning their products with the growing need for durable, high-performance, and eco-friendly solutions, these companies aim to strengthen their position in the USA heat stabilizer market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Metallic Heat Stabilizers, Non-Metallic Heat Stabilizers |

| Application | Engineering Plastics, Polyester Resins, Rubber and Elastomers, Polyester Resins |

| End-Use Industry | Construction, Electrical and Electronics, Automotive, Packaging, Consumer Goods, Agriculture |

| Key Companies Profiled | BASF SE, Clariant AG, AkzoNobel N.V., Arkema S.A., Baerlocher GmbH, Galata Chemicals |

| Additional Attributes | The market analysis includes dollar sales by type, application, and end-use industry categories. It also covers regional demand trends in the USA, particularly driven by the growing use of heat stabilizers in industries like automotive, construction, and electronics. The competitive landscape highlights key players focusing on innovations in stabilizer technologies for engineering plastics, rubbers, and resins. Trends in the increasing adoption of non-metallic heat stabilizers due to regulatory pressures and advances in material performance are explored, along with their role in enhancing product durability and performance across multiple sectors. |

The global demand for heat stabilizers in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand for heat stabilizers in USA is projected to reach USD 3.1 billion by 2035.

The demand for heat stabilizers in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for heat stabilizers in USA are metallic heat stabilizers and non-metallic heat stabilizers.

In terms of application, engineering plastics segment to command 35.0% share in the demand for heat stabilizers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA