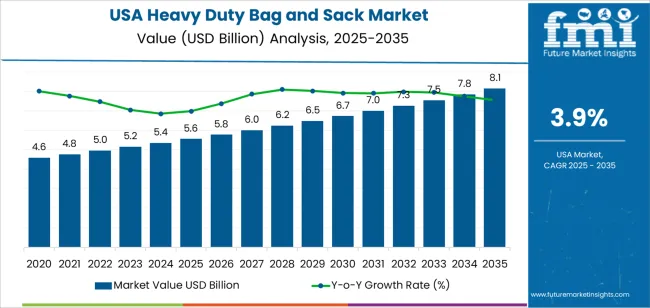

The demand for heavy-duty bags and sacks in the USA is expected to grow from USD 5.6 billion in 2025 to USD 8.1 billion by 2035, reflecting a CAGR of 3.9%. Heavy-duty bags and sacks, used for packaging bulk materials like grains, chemicals, and construction materials, are essential in industries such as agriculture, construction, and manufacturing. The growing demand for sustainable and durable packaging solutions will drive the market, as businesses seek high-quality bags that can withstand heavy loads and provide protection against moisture, dust, and contamination.

The rise in e-commerce and logistics operations, along with supply chain demands for efficient bulk packaging solutions, will also contribute to the market’s growth. Innovations in biodegradable materials and the shift towards eco-friendly packaging will further accelerate demand, as businesses move toward sustainable packaging options to meet both regulatory requirements and consumer preferences for more environmentally responsible products.

From 2025 to 2030, the market for heavy-duty bags and sacks in the USA is expected to grow from USD 5.6 billion to USD 6.7 billion, contributing an increase of USD 1.1 billion in value. This growth will be driven by rising demand across industrial applications, particularly in agriculture, construction, and logistics, where bulk packaging plays a key role in operations. The increase in demand for robust and eco-friendly packaging solutions will also contribute to the growth, as businesses aim to reduce their environmental footprint while improving the efficiency of their packaging operations. The first half of the forecast period will see strong growth due to increased industrial production and rising logistics needs.

From 2030 to 2035, the market will grow from USD 6.7 billion to USD 8.1 billion, adding USD 1.4 billion in value. This phase will see steady growth, supported by the continued shift toward sustainable packaging and the increasing adoption of biodegradable and eco-conscious alternatives. Additionally, innovations in packaging materials and design will drive demand as businesses focus on improving efficiency, storage, and transportation of bulk goods. While the growth rate may moderate as the market matures, the continued need for heavy-duty packaging solutions in various sectors will ensure a consistent market expansion.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 6.5 billion |

| Industry Forecast Value (2035) | USD 8.1 billion |

| Industry Forecast CAGR (2025 to 2035) | 3.9% |

Demand for heavy duty bags and sacks in the USA is growing as industries such as agriculture, construction, chemicals and mining require durable packaging solutions to transport bulk materials safely and efficiently. These sectors rely on heavy duty bags made from woven polypropylene, multi layer laminates or coated fabrics that resist moisture, tearing and UV damage. Growth in infrastructure spending, increased mining activity and agricultural expansion all contribute to increased consumption of such packaging formats. The trend toward mechanised handling of bulk products and automated bagging lines also supports the use of standardised heavy duty sacks to enable quicker fill rates and improved containment.

Another factor bolstering this demand is the increasing emphasis on sustainability and reuse in industrial packaging. Manufacturers and end users are favoring bags that can be reused multiple times or recycled, reducing total cost of ownership and environmental footprint. Additionally, regulatory pressures on packaging waste and landfill diversion motivate companies to choose heavy duty sacks that meet both performance and eco efficiency criteria. Challenges include fluctuations in raw material costs, competition from alternative containment systems such as bulk bins and flexible intermediate bulk containers (FIBCs), and stringent safety standards for bags used in hazardous materials transport. Nonetheless, the combination of industrial growth, mechanised packaging trends and sustainability imperatives suggests that demand for heavy duty bags and sacks in the USA will continue to expand.

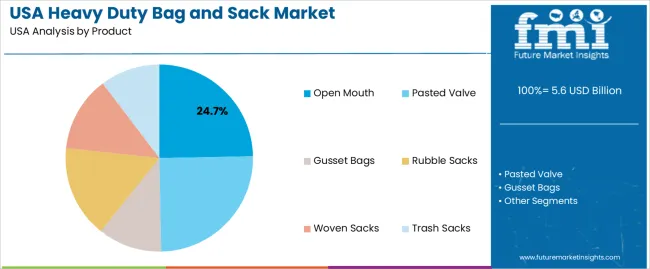

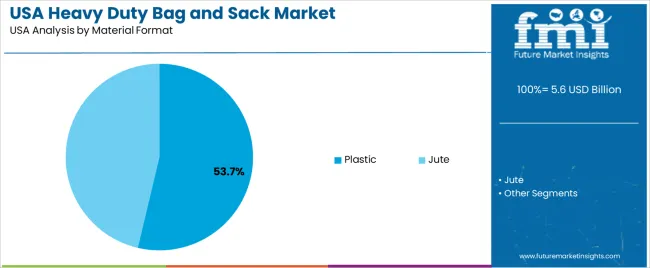

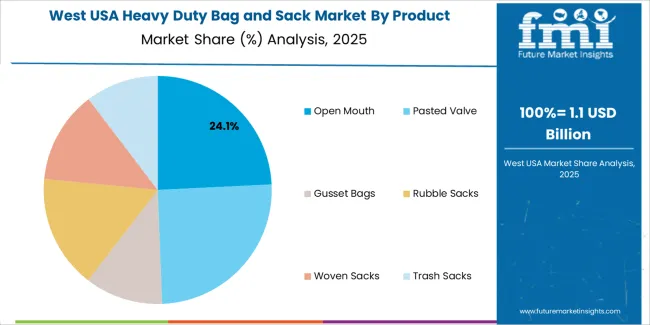

The demand for heavy-duty bags and sacks in the USA is primarily driven by product type and material format. The leading product type is open mouth bags, which capture 24.7% of the market share, while plastic is the dominant material format, accounting for 53.7% of the demand. Heavy-duty bags and sacks are essential in a wide range of industries, including agriculture, construction, and retail, for packaging, storing, and transporting bulk materials. The demand for these bags continues to grow as industries increasingly require durable, high-quality packaging solutions.

Open mouth bags are the leading product type in the heavy-duty bags and sacks market in the USA, accounting for 24.7% of the demand. Open mouth bags are commonly used for packaging bulk materials such as grains, fertilizers, and chemicals. These bags are typically made from durable materials such as plastic or woven fabric and are designed for easy filling and sealing.

The demand for open mouth bags is driven by their versatility, cost-effectiveness, and suitability for a wide range of industries. They are particularly popular in agriculture, manufacturing, and construction, where large quantities of materials need to be stored and transported. Open mouth bags offer ease of use and efficiency in handling and are ideal for materials that do not require an airtight seal. As industries continue to require packaging solutions that can handle large quantities and provide durability, open mouth bags are expected to remain a dominant product type in the market.

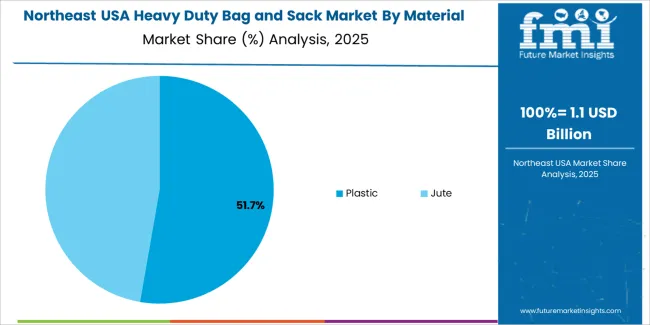

Plastic is the leading material format for heavy-duty bags and sacks in the USA, holding 53.7% of the demand. Plastic bags are preferred for their strength, flexibility, and moisture resistance, making them ideal for packaging a wide variety of bulk materials. Plastic is particularly useful for heavy-duty sacks that are used to transport items such as chemicals, fertilizers, construction materials, and food products.

The demand for plastic-based bags is driven by their ability to offer a cost-effective, durable, and versatile solution for a wide range of industries. Plastic bags can be manufactured in various sizes, strengths, and designs to meet specific requirements, from bulk packaging to retail and industrial use. Additionally, plastic bags are lightweight, easy to store, and can be sealed effectively, ensuring that the contents remain secure during transportation and storage. As industries continue to demand efficient and durable packaging solutions, plastic bags will remain a dominant choice in the heavy-duty bag and sack market in the USA.

Demand in the USA is driven by industries requiring durable packaging for transport, storage and handling of bulk materials-such as agriculture, chemicals, construction and shipping. As manufacturing and logistics operations grow, the need for strong bags that can bear heavy loads and resist tear or moisture increases. At the same time, environmental regulation, raw material cost volatility (for plastics, paper or woven polypropylene) and competition from alternative packaging formats present moderation in demand growth.

Several drivers bolster market growth. One is the rise of bulk material handling in agriculture (feed, grain, fertiliser) which needs large capacity sacks. Another is the construction and infrastructure sector where materials must be packaged securely for transport and storage. Third, the expanding e commerce and logistics sectors place higher requirements on durable sacks for shipping and returning heavy goods. Fourth, improvements in material technology-such as woven plastics, multi wall paper sacks and higher strength fabrics-enable heavier loads and better protection, opening more applications.

Despite positive progress, some restraints exist. Rising cost of raw materials (such as polypropylene, HDPE or kraft paper) can drive up final product price and limit demand. Regulatory pressure and sustainability initiatives may lead users to seek alternative packaging formats (for instance reusable containers or pallets) or lower single use sack volumes. Some sectors may already be mature, meaning incremental demand is limited. Additionally, imported competition and pricing pressure reduce margins for domestic producers.

Key trends include increased adoption of multi wall paper sacks and reusable or returnable heavy duty bags in line with sustainability goals. There is greater use of speciality sacks that offer moisture, UV or chemical resistance for applications in harsh environments. Customisation-such as printed branding, specific valve types, gussets or high capacity (> 40 kg) formats-is growing. Suppliers are also developing sacks compatible with automated filling and packaging equipment to support higher throughput and efficiency in industrial settings.

The demand for heavy-duty bags and sacks in the USA is driven by their widespread use across various industries, including agriculture, construction, food packaging, and waste management. These durable packaging solutions are essential for transporting bulk materials such as grains, chemicals, construction materials, and waste. Heavy-duty bags and sacks are also increasingly used for packaging consumer goods, as businesses prioritize protective, robust, and cost-effective packaging for products.

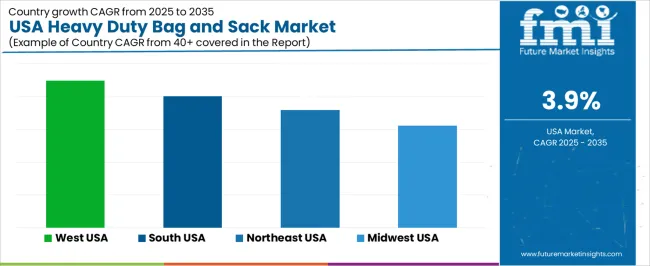

Additionally, the growing emphasis on sustainability in packaging solutions, coupled with the rise of eco-friendly alternatives like biodegradable bags, is further supporting the market's growth. The increasing demand for bulk handling, combined with regulations encouraging environmentally responsible packaging practices, plays a significant role in the rise of heavy-duty bags and sacks. Regional variations in demand are influenced by the industrial activities, production volumes, and sustainability preferences in different parts of the USA. Below is an analysis of the demand for heavy-duty bags and sacks across various regions in the USA.

| Region | CAGR (2025 to 2035) |

|---|---|

| West | 4.5% |

| South | 4% |

| Northeast | 3.6% |

| Midwest | 3.1% |

The West leads the demand for heavy-duty bags and sacks in the USA with a CAGR of 4.5%. This can be attributed to the region's strong agricultural, construction, and waste management sectors. States like California, Washington, and Oregon have significant agricultural production, including the cultivation of grains, fruits, and vegetables, which require durable packaging for storage and transportation. Additionally, the West’s focus on sustainable packaging solutions and increasing environmental regulations supports the rising demand for eco-friendly heavy-duty bags and sacks.

The region's rapid adoption of sustainable materials and the emphasis on reducing plastic waste further drive the demand for alternatives such as biodegradable or recyclable heavy-duty sacks. As industries in the West continue to focus on efficient, eco-friendly, and durable packaging solutions, the demand for heavy-duty bags and sacks remains strong and is expected to grow at a higher rate than other regions.

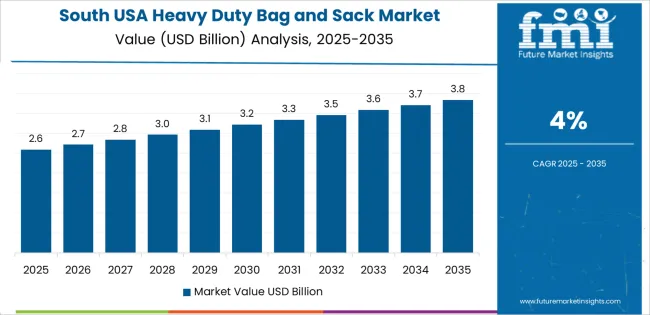

The South shows strong demand for heavy-duty bags and sacks with a CAGR of 4.0%. The region has a significant presence of agriculture, especially in states like Texas, Florida, and Georgia, where large volumes of grains, produce, and other bulk materials are produced and transported. This industrial activity contributes to the high demand for durable, large-capacity packaging solutions such as heavy-duty bags and sacks.

The South’s manufacturing base, including construction and packaging industries, also contributes to the growth in demand for these products. The region’s rising emphasis on sustainability and environmentally responsible packaging materials further supports this market trend. As the demand for bulk packaging continues to increase in sectors like agriculture and construction, the demand for heavy-duty bags and sacks will continue to grow steadily in the South.

The Northeast shows steady demand for heavy-duty bags and sacks with a CAGR of 3.6%. While the region is more industrialized and less focused on agriculture compared to the West and South, it still has significant demand for heavy-duty bags and sacks in industries such as food packaging, waste management, and construction. The region’s dense urban population and growing demand for packaged food products drive the need for durable packaging solutions like heavy-duty sacks.

Additionally, the Northeast’s focus on sustainability and environmental initiatives contributes to the increasing demand for eco-friendly alternatives to traditional plastic bags, such as compostable or biodegradable heavy-duty bags. While the growth rate is slower compared to the West and South, the steady demand for heavy-duty bags and sacks in the Northeast is expected to continue due to the region's focus on packaging innovation and sustainability.

The Midwest shows moderate growth in the demand for heavy-duty bags and sacks with a CAGR of 3.1%. The region is an important agricultural producer, especially in states like Illinois, Iowa, and Indiana, where grains and other bulk materials are grown and transported. However, compared to the West and South, the Midwest's demand for heavy-duty bags and sacks is slightly slower due to the region’s lower level of manufacturing activity in packaging and construction sectors.

Despite this, the Midwest’s large-scale farming operations and growing awareness of the need for sustainable and durable packaging materials contribute to a steady rise in demand. As more industries in the region seek efficient and eco-friendly packaging solutions, the market for heavy-duty bags and sacks is expected to continue growing at a moderate pace.

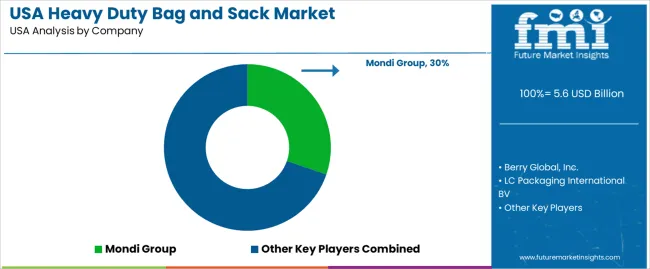

The demand for heavy-duty bags and sacks in the United States is increasing, driven by the need for durable, high-capacity packaging solutions across industries such as agriculture, construction, chemicals, and food products. Companies like Mondi Group (holding approximately 30.3% market share), Berry Global, Inc., LC Packaging International BV, Muscat Polymers Pvt. Ltd., Al-Tawfiq Company, and Inteplast Group are key players in this market. These bags are commonly used for packaging bulk goods like grains, sand, fertilizers, and other heavy materials that require secure, reliable, and cost-effective containment.

Competition in the heavy-duty bag and sack industry is primarily driven by material innovation, strength, and sustainability. Companies are focusing on developing high-quality, tear-resistant bags made from various materials, such as polypropylene, woven fabric, and plastic, that can withstand harsh handling and transport conditions. Another competitive factor is the growing emphasis on sustainability, with manufacturers increasingly offering eco-friendly bags made from recycled materials or that are fully recyclable themselves. Additionally, companies are providing customized solutions to meet the specific needs of industries, including printed branding, specialized closures, and sizes for various applications. Marketing materials often highlight features such as load capacity, durability, sustainability, and cost-effectiveness. By aligning their offerings with the increasing demand for high-performance, sustainable, and customizable packaging solutions, these companies aim to strengthen their position in the U.S. heavy-duty bag and sack market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product | Open Mouth, Pasted Valve, Gusset Bags, Rubble Sacks, Woven Sacks, Trash Sacks |

| Material Format | Plastic, Jute |

| Capacity | Less than 20 kg, 20-40 kg, Above 40 kg |

| End Use | Food Packaging, Agriculture Packaging, Chemical & Fertilizers Packaging, Building & Construction Related Product Packaging, Automotive Product Packaging, Others |

| Key Companies Profiled | Mondi Group, Berry Global, Inc., LC Packaging International BV, Muscat Polymers Pvt. Ltd., Al-Tawfiq Company, Inteplast Group |

| Additional Attributes | The market analysis includes dollar sales by product, material format, capacity, and end-use categories. It also covers regional demand trends in the USA, particularly driven by the increasing use of heavy-duty bags and sacks in packaging for various industries such as food, agriculture, and construction. The competitive landscape highlights key players focusing on innovations in bag and sack design, material strength, and functionality. Trends in the growing demand for eco-friendly packaging solutions, such as jute bags, and the expanding use of woven sacks and plastic bags for industrial applications are explored. |

The global demand for heavy duty bag and sack in USA is estimated to be valued at USD 5.6 billion in 2025.

The market size for the demand for heavy duty bag and sack in USA is projected to reach USD 8.1 billion by 2035.

The demand for heavy duty bag and sack in USA is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in demand for heavy duty bag and sack in USA are open mouth, pasted valve, gusset bags, rubble sacks, woven sacks and trash sacks.

In terms of material format, plastic segment to command 53.7% share in the demand for heavy duty bag and sack in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy Duty Bag and Sack Market from 2025 to 2035

Demand for Heavy Duty Bag and Sack in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Heavy Duty Pallet Rack in USA Size and Share Forecast Outlook 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA