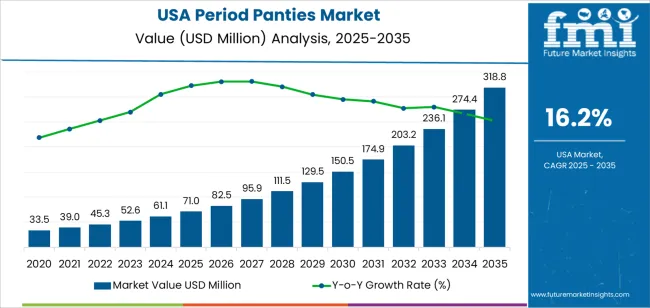

The demand for period panties in the USA is expected to grow from USD 71.0 million in 2025 to USD 318.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 16.20%. Period panties have gained significant popularity for their convenience, comfort, and eco-friendliness compared to traditional menstrual products like pads and tampons. As more consumers seek sustainable alternatives to disposable hygiene products, the demand for period panties is expected to rise steadily. Innovations in fabric technology, along with growing awareness of menstrual health and sustainability, will contribute to this growth.

The period panties market is driven by an increasing trend of consumers choosing reusable and eco-friendly products. Period panties are not only designed for comfort but also provide a sustainable solution by reducing the waste created by disposable menstrual products. As the demand for environmentally conscious products continues to rise, period panties are becoming more mainstream. The increased focus on women’s health and hygiene products, along with the convenience of period panties, will continue to expand their adoption. The market for period panties is expected to see further innovations in product design and fabric technology, enhancing comfort, absorbency, and performance.

The growth rate volatility index for period panties in the USA indicates some fluctuations in demand over the forecast period. Between 2025 and 2030, demand will increase from USD 71.0 million to USD 82.6 million, showing steady growth. This gradual rise can be attributed to the growing consumer awareness and adoption of sustainable menstrual products. The growth rate during this phase will be relatively stable, with an increase driven by product availability, improved marketing, and consumer education on the benefits of period panties.

From 2030 to 2035, demand will experience a more pronounced surge, increasing from USD 82.6 million to USD 320.0 million, reflecting a sharp acceleration in market adoption. This phase is expected to show higher volatility, driven by broader acceptance and the increasing availability of period panties in retail stores, online platforms, and as part of mainstream health and wellness initiatives. As innovations in product offerings and fabric technologies continue, along with heightened consumer demand for sustainable alternatives, the market will see greater fluctuations in growth rates, but with an overall upward trajectory. The expected sharp rise between 2030 and 2035 will reflect the market reaching a tipping point as period panties become a key component of menstrual hygiene solutions.

| Metric | Value |

|---|---|

| Demand for Period Panties in USA Value (2025) | USD 71.0 million |

| Demand for Period Panties in USA Forecast Value (2035) | USD 318.8 million |

| Demand for Period Panties in USA Forecast CAGR (2025 to 2035) | 16.20% |

The demand for period panties in the USA is growing as more consumers seek alternative, eco-friendly, and comfortable options for menstrual hygiene. As awareness of the environmental impact of single-use products such as tampons and pads increases, period panties offer a reusable and sustainable solution. These products appeal to individuals looking for convenience, comfort, and long-term cost savings. Period panties, designed with absorbent and leak-proof materials, provide a practical and discreet alternative to traditional menstrual products, making them particularly attractive to consumers seeking convenience.

The growing focus on women’s health and wellness is another driver behind the increasing popularity of period panties. As more women prioritize personal care products that align with their values such as sustainability and comfort period panties are becoming a more widely accepted choice. Advancements in fabric technology, such as improved moisture-wicking, odor control, and antimicrobial properties, have enhanced the product’s appeal.

As the market for period care products evolves, period panties are gaining traction not only as an alternative to disposable items but also as a complement to other menstrual products. With increased marketing, better product availability, and changing consumer preferences, the demand for period panties in the USA is expected to continue to grow steadily through 2035.

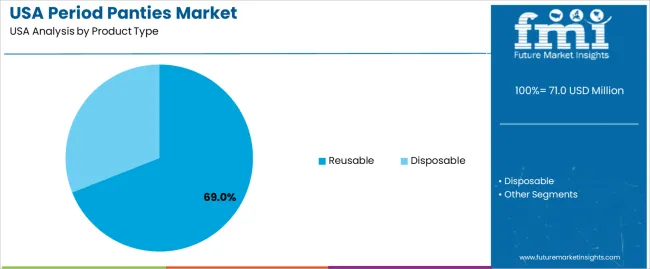

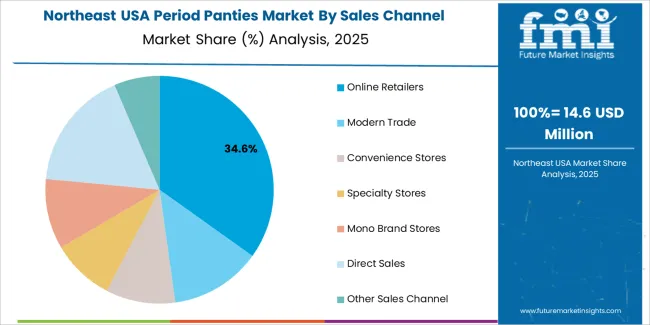

Demand for period panties in the USA is segmented by product type and sales channel. By product type, demand is divided into reusable and disposable period panties, with reusable holding the largest share at 69%. The demand is also segmented by sales channel, including online retailers, modern trade, convenience stores, specialty stores, mono brand stores, direct sales, and other sales channels, with online retailers leading the demand at 35.4%. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Reusable period panties account for 69% of the demand for period panties in the USA. These products are preferred for their environmental sustainability, cost-effectiveness, and long-term usability. Reusable period panties are designed to be washed and reused multiple times, offering a eco-friendlier alternative to disposable options that contribute to plastic waste. With growing consumer awareness about environmental issues and the increasing shift towards sustainable living, reusable period panties have become a top choice for many. They provide better value over time, reducing the need for constant repurchase, making them a smart choice for those seeking a cost-effective, sustainable solution. As the demand for eco-conscious products continues to rise, reusable period panties will remain dominant in the market.

Online retailers account for 35.4% of the demand for period panties in the USA. The convenience of shopping online and the wide range of available brands, sizes, and styles make e-commerce platforms the preferred sales channel for period panties. Consumers can easily compare prices, read reviews, and access a broader selection of products than they would find in physical stores. Online shopping also offers privacy, allowing customers to make discreet purchases and have products delivered directly to their homes. The rise of subscription services and the growing interest in sustainable and health-conscious products have further boosted online sales of period panties. As e-commerce continues to grow and consumers increasingly prefer the convenience of shopping from home, online retailers will continue to dominate the market for period panties in the USA.

Key drivers include growing awareness around menstrual health and hygiene, rising preference for sustainable and reusable products over single-use alternatives, and increasing consumer focus on comfort and convenience. The rise of eco-consciousness and the demand for plastic-free products in personal care are contributing to the adoption of period panties. Restraints include higher upfront costs compared to traditional menstrual products, limited product awareness, and challenges in market penetration outside eco-conscious segments. Resistance to changing menstrual product habits among some consumers, and concerns about durability and absorbency, also affect adoption.

In USA, demand for period panties is growing due to the increasing shift toward sustainable and reusable menstrual care options. As consumers become more aware of the environmental impact of disposable products like pads and tampons, period panties are emerging as an eco-friendly alternative. There is also a growing focus on comfort, convenience, and effective leakage protection during menstruation, which enhances their appeal. The rise of online retail and word-of-mouth marketing is making period panties more accessible. Innovations in fabric technology, including improved breathability and absorbency, are enhancing the design, leading to greater consumer satisfaction and confidence in adopting period panties.

Technological innovations are driving growth in the period panties market by enhancing functionality, comfort, and performance. Developments in fabric technology, such as moisture-wicking, antimicrobial, and odor-neutralizing materials, ensure a more hygienic and comfortable experience for users. Improvements in absorbency and leak-proof designs have made period panties more reliable, addressing concerns about their effectiveness. Manufacturers are also expanding their product ranges, offering various styles and sizes to cater to different body types and preferences. These innovations provide a more attractive alternative to traditional menstrual products, making period panties appealing to those seeking sustainability, convenience, and comfort.

Despite growing demand, adoption of period panties in USA faces several challenges. A key issue is their higher upfront cost compared to traditional menstrual products like pads and tampons, which can be a barrier for budget-conscious consumers. There is limited awareness, especially among older generations, regarding the benefits and effectiveness of period panties, hindering widespread adoption. Concerns over durability and absorbency are also factors that some consumers consider. Cultural resistance to changing menstrual product habits may further slow the shift toward period panties, particularly among conservative consumer segments. These challenges need to be addressed for broader market acceptance and adoption.

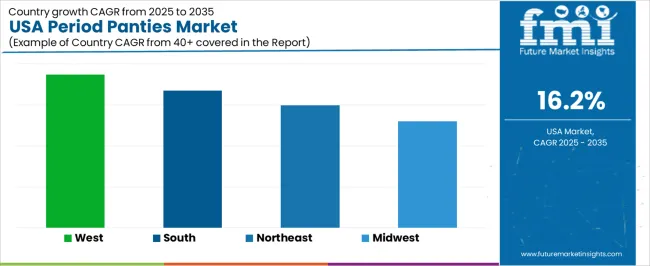

| Region | CAGR (%) |

|---|---|

| West | 18.7 |

| South | 16.7 |

| Northeast | 14.9 |

| Midwest | 13.0 |

Demand for period panties in USA is growing rapidly across all regions, with the West leading at an 18.7% CAGR. This growth is driven by increasing awareness of menstrual health and the rising popularity of eco-friendly and sustainable menstrual products. The South follows with a 16.7% CAGR, supported by growing acceptance of innovative menstrual products and expanding retail availability. The Northeast shows a 14.9% CAGR, with an increasing focus on wellness and personal care products. The Midwest experiences moderate growth at 13.0%, as consumer interest in alternative menstrual solutions continues to rise.

The West is experiencing the highest demand for period panties in USA, with an 18.7% CAGR. This growth is largely driven by the region’s strong focus on sustainability and health-conscious consumer trends. Cities like Los Angeles, San Francisco, and Seattle are leaders in adopting eco-friendly products, and period panties fit well into the growing movement towards reducing disposable menstrual products like tampons and pads. The region’s population is highly receptive to new and innovative products, and period panties are gaining popularity as a comfortable, reusable alternative.

The West has seen a rise in menstrual health awareness, with more women turning to products that support their personal health while minimizing environmental impact. Retailers and online stores in the West are increasingly offering period panties as a key product in their wellness and feminine hygiene categories. The combination of sustainability, innovation, and growing consumer demand is driving significant growth in period panties adoption in this region.

The South is seeing strong demand for period panties in USA, with a 16.7% CAGR. This growth is supported by a shift towards more sustainable, comfortable, and cost-effective menstrual products. States like Texas, Florida, and Georgia have witnessed an increasing acceptance of period panties, as more consumers look for eco-friendly alternatives to traditional period products. The South’s growing focus on health and wellness has encouraged women to explore new products that not only cater to menstrual needs but also contribute to overall well-being.

As awareness of period panties grows, their benefits, such as comfort, reusability, and the reduction of menstrual waste, are resonating with Southern consumers. Retailers across the region are expanding their product offerings to include period panties, and marketing campaigns are helping to normalize their use. This increased availability, combined with the ongoing shift in consumer attitudes toward sustainable products, is expected to drive continued growth in the demand for period panties in the South.

The Northeast is experiencing steady demand for period panties in USA, with a 14.9% CAGR. This growth is driven by the region’s growing interest in personal health, wellness, and eco-conscious living. Cities like New York and Boston have seen a significant rise in awareness about menstrual health, and as a result, period panties have gained traction as an alternative to disposable menstrual products. The region’s focus on innovation and sustainability aligns well with the benefits of period panties, which are marketed as both environmentally friendly and economically efficient.

In addition to the growing interest in sustainable living, the Northeast is home to a highly engaged consumer base that is open to trying new products. Period panties fit into the region's broader trends of wellness and self-care, making them increasingly popular among health-conscious individuals. As the demand for eco-friendly products continues to rise, the Northeast will likely see sustained growth in the use of period panties, supported by greater retail availability and ongoing education on their benefits.

The Midwest is experiencing moderate demand for period panties in USA, with a 13.0% CAGR. While the growth rate is slower than in other regions, the Midwest is seeing increased interest in sustainable menstrual products, driven by greater awareness of their environmental and health benefits. States like Illinois, Michigan, and Ohio are seeing more women seek alternatives to traditional menstrual products, and period panties are gaining popularity as a reusable option. The Midwest’s focus on practicality and cost-effectiveness is a key factor, as consumers are drawn to the long-term savings associated with period panties.

Retailers in the region are starting to expand their offerings to include period panties as part of their personal care and wellness sections, making these products more accessible. As the Midwest continues to embrace health and sustainability trends, demand for period panties is expected to rise steadily. As consumers become more aware of their benefits, the Midwest will likely see continued adoption of period panties, especially among environmentally conscious individuals.

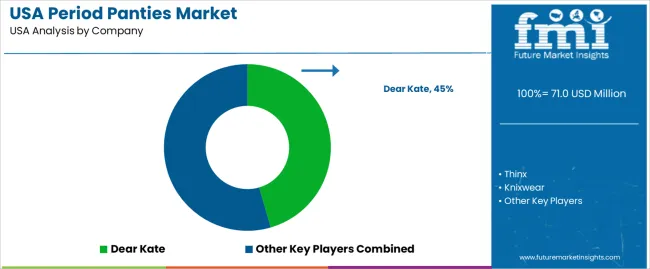

In the USA, demand for period panties is expanding significantly as more consumers look for alternatives to traditional menstrual products. Leading brands in this space include Dear Kate with a 45.5 % share, Thinx, Knixwear, Modibodi and Saalt. These companies serve a growing base of consumers looking for comfort, convenience and performance during menstruation.

Dear Kate has secured a leading position through focused marketing, a strong direct‑to‑consumer sales model and a broad product range. The other brands differentiate themselves through design innovations (such as leak‑proof gussets, absorbency for heavy flow), variations in style (briefs, bikini cut, hi‑waist) and improvements in material quality. Since the product category blends function (absorbency, leak protection) with fashion (style, fit, brand identity), companies that deliver compelling design, strong branding and reliable performance are best positioned.

Competition is driven by increased consumer awareness about menstrual health, growth of e‑commerce platforms, and partnerships with influencers and retailers. At the same time, barriers remain such as pricing compared to conventional pads/tampons, consumer education on product function, and the need for ongoing innovation to stand out. Companies able to combine standout design, strong brand story and seamless online/offline access will capture the expanding demand for period panties in the USA.

| Items | Values |

|---|---|

| Quantitative Unit | USD Million |

| Product Type | Reusable, Disposable |

| Sales Channel | Online Retailers, Modern Trade, Convenience Stores, Specialty Stores, Mono Brand Stores, Direct Sales, Other Sales Channel |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Dear Kate, Thinx, Knixwear, Modibodi, Saalt |

| Additional Attributes | Dollar sales by product type, sales channel, and regional trends focusing on online and retail sales channels for reusable and disposable period panties. Market penetration of key players in different regions and evolving trends in menstrual health products. |

The demand for period panties in usa is estimated to be valued at USD 71.0 million in 2025.

The market size for the period panties in usa is projected to reach USD 318.8 million by 2035.

The demand for period panties in usa is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in period panties in usa are reusable and disposable.

In terms of sales channel, online retailers segment is expected to command 35.4% share in the period panties in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Period Panties Market Analysis – Size, Growth & Forecast 2025 to 2035

India Period Panties Market Insights – Demand, Growth & Forecast 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

Demand for Period Panties in Japan Size and Share Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Period Patch Market Trends – Demand, Growth & Forecast 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA