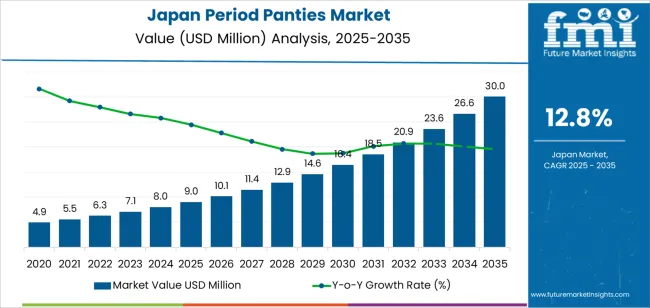

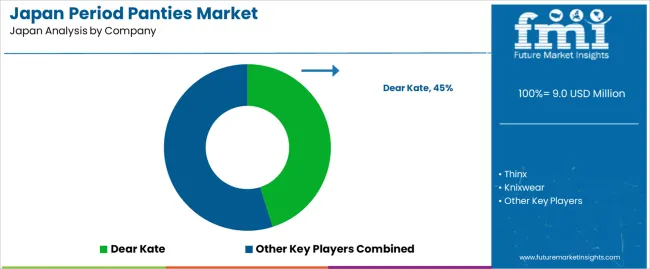

The demand for period panties in Japan is valued at USD 9.0 million in 2025 and is projected to reach USD 30.0 million by 2035, reflecting a compound annual growth rate of 12.8%. Market share dynamics during this period are shaped by the gradual shift from disposable menstrual products toward reusable alternatives. Established brands in sanitary pads and tampons face slow but noticeable share erosion as consumers explore longer lasting options supported by comfort, durability and reduced replacement frequency. As awareness grows and product availability widens, more customers integrate period panties into monthly routines. This transition contributes to incremental share gains for manufacturers offering varied absorbency levels, enhanced fit and discreet designs suited to everyday use in different age groups and lifestyle patterns.

The growth curve shows steady year-by-year expansion, rising from USD 4.9 million in earlier years to USD 9.0 million in 2025 before advancing toward USD 30.0 million by 2035. Market share gain favors companies positioned with diverse product ranges, efficient sizing systems and strong distribution through both retail shelves and online channels. Traditional disposable hygiene brands retain large overall category presence, yet their share gradually declines as reusable options expand. Companies offering period panties capture increasing share through repeat purchases and broader consumer acceptance driven by convenience, washable construction and multi-day usability. As competitive pressure intensifies, firms emphasizing material comfort, reliable leak protection and accessible pricing strengthen their foothold, while legacy competitors face ongoing substitution effects that contribute to steady market share realignment across Japan’s menstrual care landscape.

Demand for period panties in Japan is projected to rise from USD 9.0 million in 2025 to USD 30.0 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 12.8%. Starting at USD 4.9 million in 2020, demand increases steadily through USD 8.0 million in 2024 and USD 9.0 million in 2025. Between 2025 and 2030, demand is expected to reach USD 16.4 million, supported by growing awareness of menstrual hygiene, rising adoption of reusable and eco friendly menstrual products, and innovations in comfort, design, and absorbency. By 2035, demand is forecast to achieve USD 30.0 million, driven by increased consumer adoption across urban and semi urban populations and expanding retail and online availability.

The growth contribution index over the forecast period highlights the role of volume and value in driving demand. Approximately 65% of the USD 21.0 million uplift from 2025 to 2035 is attributed to volume growth, as more consumers adopt period panties due to lifestyle shifts, awareness campaigns, and broader distribution. The remaining 35% is driven by value growth, supported by product premiumisation, higher-quality fabrics, advanced absorbency features, and eco-conscious manufacturing. Over time, the contribution of value rises as innovative features and differentiated products command higher per-unit prices. This combination of increasing adoption and enhanced product offerings underpins sustained growth toward USD 30.0 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 9.0 million |

| Forecast Value (2035) | USD 30.0 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

The demand for period panties in Japan is growing as more consumers seek comfortable, reliable and reusable menstrual solutions. Many Japanese women face daily routines in urban environments where convenience, hygiene and discretion are important. Period panties offer a leak-proof, cloth-based alternative to pads and tampons and fit into the lifestyle of frequent commuting, office hours and social settings. Brands local to Japan market them with features tailored to Japanese users such as slim fits, absorbent layers and leak protection. This trend is supported by increasing acceptance of reusable menstrual wear and a shift in preference toward products that align with sustainability values and lower-waste habits.

In addition, the retail and online distribution channels in Japan are enhancing access to period panties. Drugstores, convenience stores and e-commerce platforms are stocking multiple brands and styles, which helps to normalise their usage across different age groups. Cultural awareness around menstrual hygiene has been rising, reducing stigma and encouraging trial of products beyond conventional sanitary pads. At the same time, pricing sensitivity and competition from budget alternatives remain considerations for consumers. Despite these factors, the blend of convenience, comfort, environmental alignment and broad-based retail access is fostering steady growth in the demand for period panties in Japan.

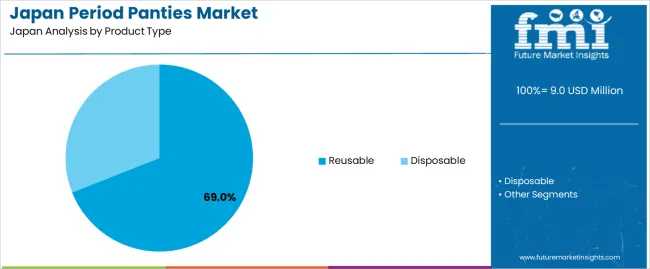

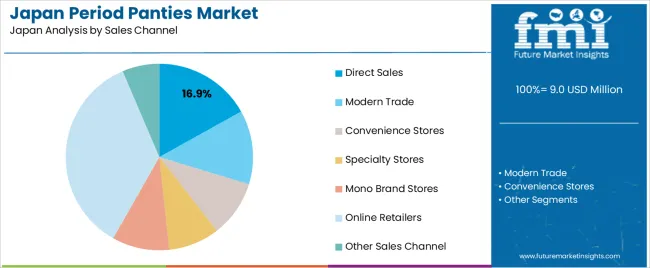

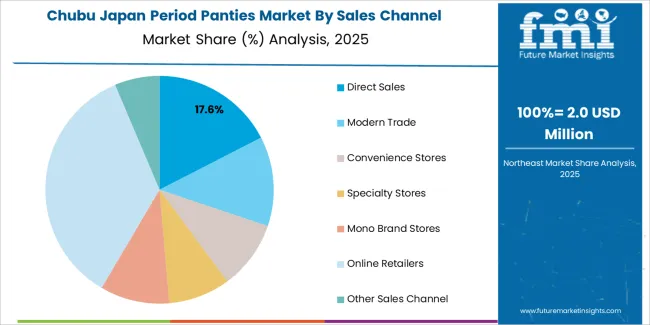

The demand for period panties in Japan is shaped by product type preferences and the sales channels through which consumers access these products. Product types include reusable and disposable variants designed to offer comfort, leakage protection and convenience. Sales channels span direct sales, modern trade, convenience stores, specialty stores, mono brand stores, online retailers and other outlets, each supporting different purchasing habits. As consumers seek reliable, comfortable and environmentally considerate menstrual solutions, the combination of product durability and channel accessibility guides overall adoption across Japanese households.

Reusable period panties account for 69% of total demand in Japan. Their leading position reflects consumer preference for products offering long service life, reduced waste and consistent comfort during daily use. Reusable designs provide dependable absorption and can be incorporated easily into routine laundering. Many users value their soft fabrics, secure fits and reduced reliance on disposable items. The repeat usability lowers long-term costs, which appeals to buyers seeking practical menstrual solutions. These features support widespread adoption across different age groups and lifestyle needs.

Demand for reusable period panties also grows as familiarity with reusable menstrual products increases. Clear product instructions and diverse size options help consumers transition from disposable alternatives. Manufacturers offer varied absorbency levels and style choices that match different flow patterns, improving practicality. Their discreet appearance and comfort encourage regular use. As retailers highlight reusable options within broader personal care categories, these products maintain strong visibility in Japan. These combined factors strengthen the leading role of reusable period panties across the market.

Direct sales account for 16.9% of total demand for period panties in Japan. This share reflects interest in personalized purchasing experiences where consumers receive detailed product descriptions and fit guidance. Direct sales channels often provide tailored recommendations that help buyers select the most suitable absorbency levels and fabric types. These channels support careful decision-making for buyers who prioritize comfort and performance. The ability to examine product samples or receive explanations encourages confident adoption among first-time users of period panties.

Demand through direct sales also benefits from structured demonstrations and brand representatives who clarify product care and longevity. This format helps reassure consumers unfamiliar with reusable menstrual products. Direct sales events often introduce expanded product ranges, encouraging exploration of different styles. These interactions build trust and support repeat purchasing. As consumers increasingly seek informed buying experiences for intimate apparel, direct sales continue to maintain relevance as a reliable entry point for period panty adoption in Japan.

Demand for period panties in Japan is growing as women seek menstrual hygiene solutions that combine comfort, convenience and sustainability. Rising awareness of menstrual health, increased working-women participation and interest in reusable alternatives support adoption. At the same time, barriers include higher price compared with traditional sanitary products, social stigma around non-traditional menstrual garments and limited retail penetration in some regions. These dynamics shape how quickly period panties gain visibility and acceptance across Japanese consumer segments.

Japanese consumers are increasingly balancing busy work-oriented lifestyles with wellness and environmental concerns, prompting interest in menstrual underwear that reduces waste and simplifies hygiene routines. As more women spend longer days outside home, demand increases for leak-proof, discreet and comfortable period panties that allow confident mobility. Additionally, eco-consciousness encourages reusable formats. This behavioural shift supports greater uptake of period underwear in Japan’s modern retail and online channels.

Growth opportunities exist in premium, reusable and lifestyle-oriented period panty segments in Japan. Brands can tap online sales, subscription models and smaller boutique stores that cater to younger, style-savvy consumers. There is scope in athletic wear, travel gear or maternity markets where added comfort and functionality matter. Also, as retail chains expand and brand awareness increases, more women may switch from disposables to period panties. Suppliers that offer well-designed, culturally adapted and high-function products are well positioned.

Despite favourable conditions, several challenges slow broader adoption. The initial investment cost for reusable period panties often remains higher than single-use options, which may deter price-sensitive consumers. Cultural perceptions and habit-based preference for traditional pads or tampons may limit conversion. Also, availability of product sizes, absorbency levels and after-sales washing-care support can affect user confidence. These factors moderate how quickly period panties become mainstream in the Japanese menstrual-care market.

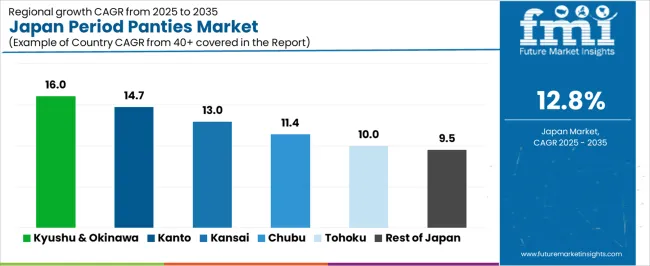

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 16.0% |

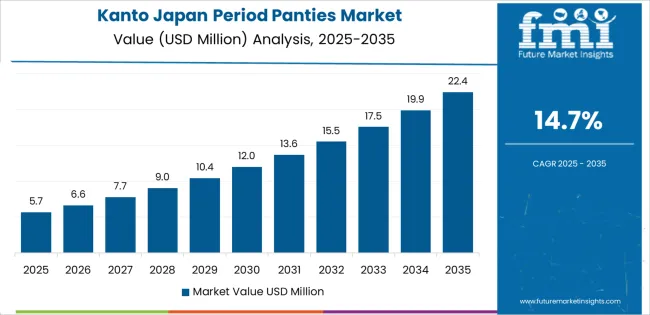

| Kanto | 14.7% |

| Kinki | 13.0% |

| Chubu | 11.4% |

| Tohoku | 10.0% |

| Rest of Japan | 9.5% |

Demand for period panties in Japan is rising quickly across regions, and Kyushu and Okinawa lead at 16.0%. Growth in this region reflects expanding retail distribution and strong interest in reusable menstrual products among younger consumers. Kanto follows at 14.7%, supported by dense urban markets and broad availability across major retailers. Kinki records 13.0%, shaped by steady purchasing from working households seeking practical options. Chubu grows at 11.4%, with regional stores increasing their product ranges as awareness improves. Tohoku reaches 10.0%, showing consistent uptake across smaller cities. The rest of Japan posts 9.5%, reflecting gradual but stable adoption as reusable hygiene products gain visibility nationwide.

Kyushu & Okinawa is projected to grow at a CAGR of 16.0% through 2035 in demand for period panties. Urban and semi-urban consumers, particularly in Fukuoka, are increasingly adopting reusable, comfortable, and high-absorbency menstrual underwear. Rising awareness of sustainable menstrual products, hygiene, and comfort drives adoption. Manufacturers are providing varied sizes, designs, and absorbency levels to meet female consumer needs. Retailers and e-commerce platforms expand product accessibility across households and wellness stores. Health, lifestyle, and eco-conscious trends further support growth in the adoption of period panties throughout Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 14.7% through 2035 in demand for period panties. Tokyo and surrounding urban areas are increasingly using reusable and comfortable menstrual underwear to improve hygiene and convenience. Rising female awareness of sustainable menstrual solutions and eco-friendly products drives adoption. Manufacturers provide high-absorbency, ergonomically designed, and washable period panties suitable for different lifestyles. Retailers and online channels ensure accessibility across urban households and wellness stores. Population density, lifestyle focus, and preference for sustainable menstrual products contribute to steady adoption and growth in Kanto.

Kinki is projected to grow at a CAGR of 13.0% through 2035 in demand for period panties. Cities including Osaka and Kyoto are increasingly adopting reusable, comfortable, and high-performance menstrual underwear. Consumer preference for hygienic, sustainable, and convenient menstrual products drives adoption. Manufacturers produce a range of sizes, absorbency levels, and designs suitable for working women and students. Retail stores and e-commerce platforms improve product accessibility. Health-conscious and eco-aware consumers in Kinki are driving steady adoption of period panties, supporting long-term growth across urban and suburban areas of the region.

Chubu is projected to grow at a CAGR of 11.4% through 2035 in demand for period panties. Urban centers, particularly Nagoya, are increasingly adopting high-absorbency, reusable, and comfortable menstrual underwear for personal hygiene and convenience. Rising awareness of sustainable menstrual solutions and eco-friendly products drives adoption. Manufacturers are producing ergonomic designs with varied absorbency levels to meet female consumer needs. Retail and online channels expand product accessibility across households and wellness outlets. Growing health consciousness, lifestyle trends, and urban adoption patterns support steady growth in period panties across the Chubu region.

Tohoku is projected to grow at a CAGR of 10.0% through 2035 in demand for period panties. Smaller cities and towns are gradually adopting reusable and high-absorbency menstrual underwear. Rising female awareness of hygiene, convenience, and eco-friendly products drives adoption. Manufacturers supply durable, ergonomic, and washable period panties suitable for urban and semi-urban consumers. Retailers and e-commerce platforms expand accessibility to meet regional demand. Lifestyle trends, health consciousness, and growing interest in sustainable menstrual solutions support steady adoption in Tohoku, ensuring consistent growth in period panties across the region.

The Rest of Japan is projected to grow at a CAGR of 9.5% through 2035 in demand for period panties. Rural and semi-urban areas are gradually adopting reusable, high-absorbency, and ergonomic menstrual underwear. Rising awareness of hygiene, sustainability, and comfort drives adoption. Manufacturers provide washable, durable, and ergonomically designed products to meet local consumer needs. Retailers and online platforms ensure access across less urbanized areas. Growing interest in eco-friendly menstrual solutions, health consciousness, and convenience supports steady adoption, ensuring continuous growth in period panties consumption across the Rest of Japan.

The demand for period panties in Japan is influenced by shifting attitudes toward menstrual health, growing interest in reusable and sustainable hygiene solutions, and the increasing workforce participation of women. Japanese consumers, especially younger cohorts, are seeking alternatives to conventional sanitary products that offer comfort, leak-protection and minimal environmental impact. Digital direct-to-consumer brands and e-commerce channels support this demand by offering stylish designs and discreet purchasing options. Rising awareness of feminine hygiene, along with product innovations such as moisture-wicking fabrics and odour control, further enhance attractiveness of period underwear in Japan’s market.

Key players shaping the period underwear segment include Dear Kate, Thinx, Knixwear, Modibodi and Saalt. These brands provide menstrual underwear designed for absorption, comfort and style, aimed at consumers moving beyond disposable pads or tampons. They emphasise functionality such as multiple absorbency levels, leak-proof lining and modern fits and align with Japanese consumer expectations for quality and convenience. Their marketing often focuses on empowerment, sustainability and inclusive sizing, enabling them to influence how period panties are adopted and positioned in Japan’s intimate apparel and hygiene market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Reusable, Disposable |

| Sales Channel | Direct Sales, Modern Trade, Convenience Stores, Specialty Stores, Mono Brand Stores, Online Retailers, Other Sales Channels |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Dear Kate, Thinx, Knixwear, Modibodi, Saalt |

| Additional Attributes | Dollar by sales by product type, sales channel, and region; regional CAGR and growth trends; market share erosion and gain dynamics for reusable vs. disposable products; adoption by urban, semi-urban, and rural consumers; consumer awareness and lifestyle influence on product uptake; eco-conscious purchasing trends; premiumisation and absorbency differentiation; repeat purchase behavior; online and retail penetration; product comfort, fit, and durability considerations; targeted marketing for different age groups; distribution network coverage across Japan. |

The demand for period panties in japan is estimated to be valued at USD 9.0 million in 2025.

The market size for the period panties in japan is projected to reach USD 30.0 million by 2035.

The demand for period panties in japan is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in period panties in japan are rejapanble and disposable.

In terms of sales channel, direct sales segment is expected to command 16.9% share in the period panties in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Period Panties Market Analysis – Size, Growth & Forecast 2025 to 2035

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

India Period Panties Market Insights – Demand, Growth & Forecast 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Period Patch Market Trends – Demand, Growth & Forecast 2025 to 2035

Periodontal Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA