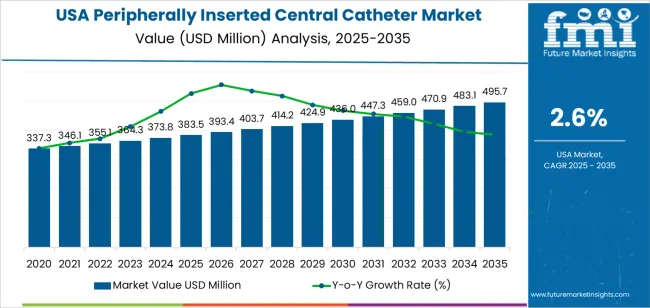

The demand for peripherally inserted central catheters (PICC) in the USA is projected to reach USD 494.0 million by 2035, reflecting an absolute increase of USD 110.5 million over the forecast period. Starting at USD 383.5 million in 2025, the demand is expected to grow at a steady CAGR of 2.6%. PICCs are increasingly used in clinical settings for patients requiring long-term intravenous access, including those undergoing chemotherapy, long-term antibiotic treatment, and nutrition. Their widespread adoption is driven by their ability to provide stable, reliable access to the bloodstream for prolonged periods, reducing the need for repeated vein punctures.

The primary drivers of this demand include the increasing prevalence of chronic diseases such as cancer, diabetes, and kidney disease, which require prolonged intravenous therapy, as well as the growing number of elderly patients who need these devices. As the aging population in the USA grows, so too does the demand for long-term intravenous access. Advancements in PICC technology, such as improved designs that enhance comfort and reduce complications, are likely to contribute to industry growth.

The Year-on-Year (YoY) growth analysis for peripherally inserted central catheters (PICC) in the USA shows consistent demand growth throughout the forecast period. From 2025 to 2026, demand increases from USD 383.5 million to USD 393.3 million, reflecting a 2.5% growth. This steady increase will be driven by the ongoing adoption of PICCs in clinical settings, particularly in patients requiring extended intravenous treatments such as chemotherapy and long-term antibiotics. The growth rate will remain moderate during this period, reflecting the continued integration of PICCs into hospital and outpatient practices.

From 2026 to 2030, the growth rate gradually increases, with demand rising from USD 393.3 million in 2026 to USD 435.2 million in 2030, reflecting an incremental increase of approximately 2.6% to 2.9% annually. During this phase, innovations in PICC technology, such as enhanced safety and comfort features, will drive adoption, particularly as more elderly and chronically ill patients require long-term intravenous therapy. The demand will be particularly influenced by the growing number of cancer and chronic disease treatments requiring these devices.

As the technology evolves, with improvements in insertion techniques and patient comfort, the adoption of PICCs will accelerate, contributing to increased demand. From 2030 onwards, steady growth will continue at a rate between 2.8% and 3.0% annually, reflecting the broader use of advanced PICC technologies across healthcare settings and continued emphasis on improving patient outcomes and safety in intravenous care.

| Metric | Value |

|---|---|

| USA Peripherally Inserted Central Catheter Sales Value (2025) | USD 383.5 million |

| USA Peripherally Inserted Central Catheter Forecast Value (2035) | USD 494.0 million |

| USA Peripherally Inserted Central Catheter Forecast CAGR (2025 to 2035) | 2.60% |

The demand for peripherally inserted central catheters (PICC) in the USA is rising as healthcare providers increasingly opt for long‑term vascular access solutions that are less invasive and offer improved patient comfort. PICC lines are ideal for extended intravenous therapies, such as chemotherapy, parenteral nutrition, and antibiotic infusions, without the need for repeated peripheral venous access. This is particularly important as the prevalence of chronic conditions requiring ongoing treatment continues to rise.

Hospitals and ambulatory care settings are focusing on safer insertion techniques and advanced monitoring to reduce complications such as catheter‑related bloodstream infections (CRBSIs). The development of antimicrobial coatings, ultrasound‑guided insertion methods, and improved catheter materials is further boosting demand. The growing shift toward home infusion therapy, driven by patient preferences and cost-saving pressures, is making PICCs even more vital as they enable long‑term treatment outside of traditional hospital environments.

These combined clinical advancements, along with the increased demand for at‑home healthcare, are contributing to the steady rise in demand for PICC lines in the USA. As more patients require ongoing treatments in less invasive and more convenient ways, the industry for peripherally inserted central catheters is expected to continue growing.

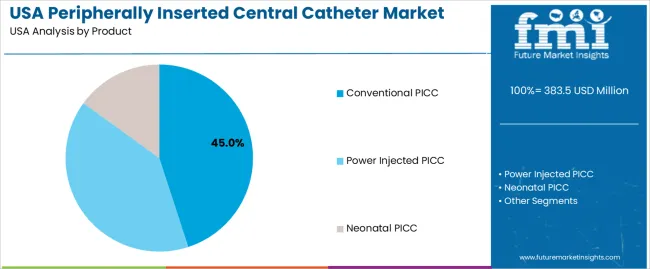

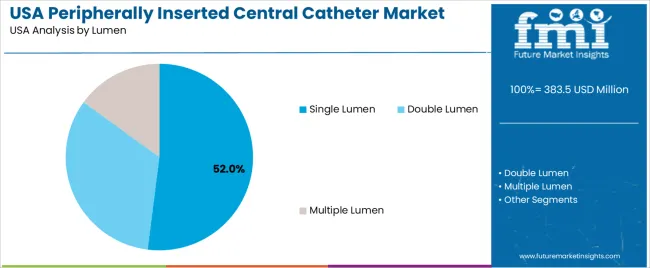

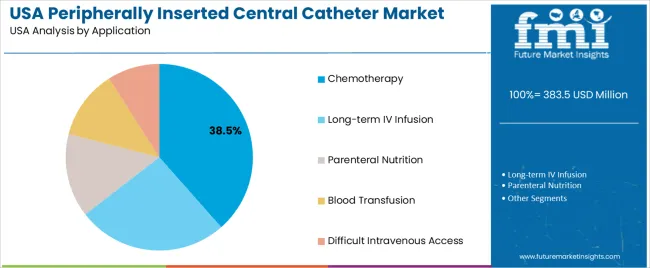

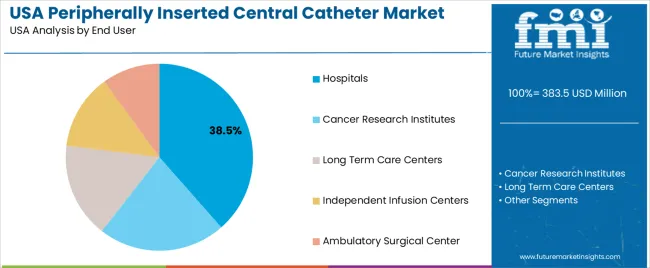

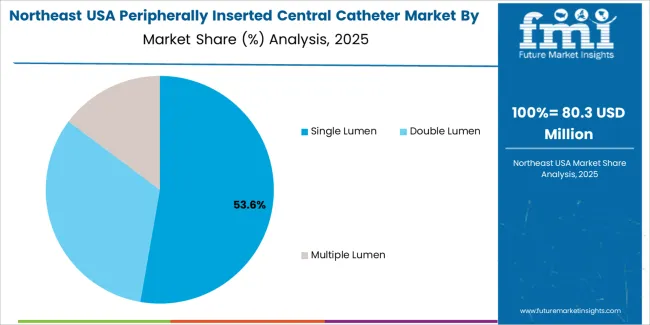

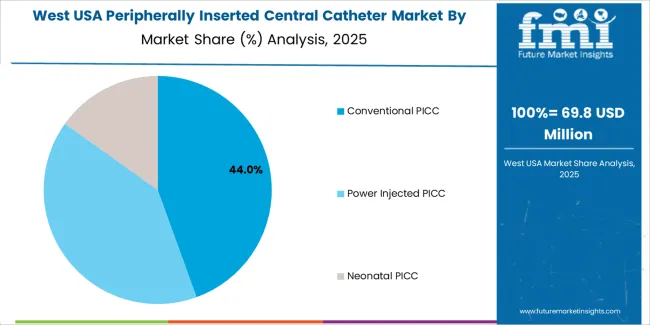

Demand is segmented by product type, lumen, application, and end user. By product type, demand is divided into conventional PICC, power injected PICC, and neonatal PICC. In terms of lumen, the industry is categorized into single lumen, double lumen, and multiple lumen, with single lumen being the most common. The industry is also segmented by application, including chemotherapy, long-term IV infusion, parenteral nutrition, blood transfusion, and difficult intravenous access. The end-user segmentation includes hospitals, cancer research institutes, long-term care centers, independent infusion centers, and ambulatory surgical centers. Regionally, demand is divided into West, South, Northeast, and Midwest.

Conventional PICC accounts for 45% of the demand for peripherally inserted central catheters (PICC) in the USA. These catheters are widely used due to their versatility, ease of insertion, and effectiveness in providing long-term venous access. Conventional PICC lines are typically used in a variety of clinical settings for intravenous drug administration, nutrition, and other medical treatments. Their ability to be inserted peripherally and provide central venous access for extended periods makes them the go-to choice in hospitals, oncology centers, and home care settings.

The growing demand for conventional PICC is driven by the increasing number of patients requiring long-term intravenous therapies, including chemotherapy, long-term IV infusion, and parenteral nutrition. They are particularly preferred for their ease of use in outpatient and home care settings, offering a less invasive and more comfortable alternative to traditional central venous catheters. As the healthcare system continues to prioritize minimally invasive procedures and the management of chronic conditions, the demand for conventional PICC lines is expected to remain strong.

Single lumen catheters account for 52% of the demand for peripherally inserted central catheters in the USA. Single lumen catheters are preferred for many applications because they are simpler to use and maintain compared to their multi-lumen counterparts. These catheters are designed for use in situations where only one intravenous access line is needed, such as for chemotherapy, long-term IV infusion, or parenteral nutrition.

The demand for single lumen PICC catheters is driven by their cost-effectiveness and the ease with which they can be inserted and maintained. They are particularly favored in outpatient settings and by patients who require less complex therapies. With the growing prevalence of conditions requiring long-term intravenous access, including chronic illness and cancer treatments, the need for single lumen catheters continues to rise. Their simple, straightforward design makes them a practical and reliable choice for healthcare providers, ensuring their continued dominance in the industry.

Chemotherapy accounts for 38.5% of the demand for peripherally inserted central catheters in the USA. PICC lines, particularly the conventional and power-injected types, are commonly used in oncology for the administration of chemotherapy drugs, which often need to be delivered in high volumes or over extended periods. PICC lines provide a central venous access point, allowing for the safe and efficient delivery of chemotherapy drugs while reducing the risk of infection and complications.

The demand for PICC lines in chemotherapy applications is driven by the increasing incidence of cancer and the growing need for long-term treatment options. Cancer patients often require prolonged courses of chemotherapy, making reliable, long-term venous access essential. PICC lines, especially power-injected PICCs, are also preferred for their ability to facilitate faster and more efficient administration of certain chemotherapy medications. As the focus on improving cancer treatment outcomes and patient comfort increases, the demand for PICC lines in chemotherapy will continue to be a significant driver in the industry.

Hospitals account for 39% of the demand for peripherally inserted central catheters in the USA. Hospitals are the primary end-user of PICC lines, as they are frequently used for a wide range of medical treatments, including chemotherapy, long-term IV infusion, parenteral nutrition, and blood transfusion. Hospitals handle a large volume of complex medical cases and have the infrastructure to support the use of PICC lines, which require trained professionals to insert and manage them.

The demand for PICC lines in hospitals is driven by the increasing number of patients needing long-term venous access for various treatments. Hospitals are often the primary site for surgeries, cancer treatments, and critical care, where the need for safe and effective intravenous access is paramount. As patient care becomes more specialized and the need for long-term treatment grows, hospitals will continue to be the largest end-user segment for PICC lines in the USA, driving the demand for these devices.

Hospitals and outpatient care settings prefer PICCs due to lower complication rates and overall cost‑savings compared to traditional central venous catheters. Key drivers include an aging population, rising incidence of cancer and chronic diseases, shift to home‑based care, and advances in catheter technology (e.g., antimicrobial coatings). Restraints include reimbursement pressures, device‑associated infection risks, the need for skilled staff for insertion and maintenance, and competition from other vascular access methods (e.g., mid‑line catheters).

Why is Demand for PICC Lines Growing in USA?

The USA is seeing higher demand for PICCs because the healthcare system is increasingly oriented toward outpatient and home‑care models where long‑term IV access is required. With cancer treatments, complex IV antibiotics, and nutrition therapy shifting outside traditional inpatient settings, PICCs offer a safer and more convenient access option. Hospitals are motivated to reduce stay‑lengths and complications, and PICCs support these goals by facilitating earlier discharge and outpatient infusion. Technological improvements and rising clinician familiarity also encourage uptake.

How are Technological Innovations Driving Growth of PICCs in the USA?

Innovations are enhancing PICC line adoption in the USA by improving insertion safety, durability, and patient comfort. Features like ultrasound‑guided placement kits, antimicrobial and antithrombogenic catheter coatings, power‑injectable PICC designs (for CT contrast), and multi‑lumen formats expand clinical use‑cases. These enhancements reduce complication rates, increase clinician confidence, and broaden deployment in settings including hospitals and homecare. As a result, PICCs become more attractive for both acute and extended‑care applications.

What Are the Key Challenges Limiting Adoption of PICC Lines in the USA?

Despite growth, PICC adoption in the USA faces challenges. One major barrier is cost and reimbursement complexity while PICCs offer long‑term value, acquiring the most advanced designs and managing required monitoring/training incur upfront costs and system investment. Infection and thrombosis risk remain concerns despite design improvements, making some clinicians cautious. Work‑flow and staffing requirements for insertion, maintenance, and patient education are more intensive than simpler vascular access. Lastly, competition from alternative devices (e.g., mid‑lines, implanted ports) limits PICC uptake in certain use‑cases.

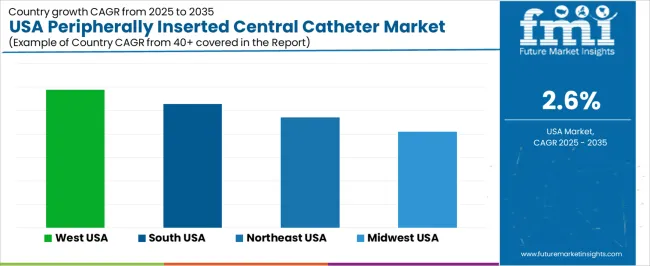

| Region | CAGR (%) |

|---|---|

| West | 2.9% |

| South | 2.6% |

| Northeast | 2.4% |

| Midwest | 2.1% |

The demand for peripherally inserted central catheters (PICC) in the USA is growing across all regions, with the West leading at a 2.9% CAGR. This growth is driven by increasing healthcare services, particularly in hospitals and long-term care settings. The South follows at 2.6%, supported by a strong healthcare infrastructure and rising adoption in critical care units. The Northeast shows a 2.4% CAGR, influenced by the region’s focus on advanced medical technologies. The Midwest experiences moderate growth at 2.1%, driven by healthcare modernization and the growing need for reliable intravenous access.

The West is seeing the highest demand for peripherally inserted central catheters (PICC), with a 2.9% CAGR. The region’s healthcare infrastructure, particularly in major cities like Los Angeles, San Francisco, and Seattle, drives this demand. These cities are home to numerous advanced hospitals and medical centers that perform a high volume of critical care procedures, where PICC lines are essential for long-term intravenous access, particularly for patients undergoing chemotherapy, extended antibiotic treatment, or those in intensive care.

The region’s focus on healthcare innovation and the use of minimally invasive techniques is promoting the adoption of PICC lines, which offer greater safety, comfort, and lower risk of infection compared to traditional central venous catheters. As the population ages and more patients require long-term intravenous therapies, the demand for PICC lines in the West is expected to continue growing. The region’s progressive healthcare systems and the increasing prevalence of chronic diseases will drive sustained growth in PICC usage.

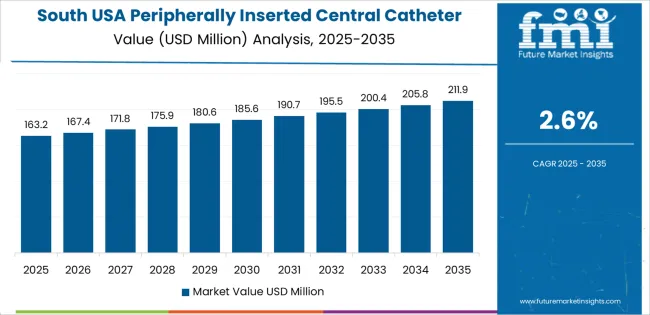

The South is experiencing steady demand for peripherally inserted central catheters (PICC), with a 2.6% CAGR. The region’s strong healthcare infrastructure and rising demand for critical care are key drivers behind this growth. Major healthcare hubs like Texas, Florida, and Georgia have seen an increase in medical facilities that utilize PICC lines for various treatments, such as chemotherapy, long-term antibiotics, and nutritional support.

The adoption of PICC lines is also growing due to their ability to provide safe and reliable intravenous access over extended periods, which is particularly important in the management of complex patients in ICU settings and those with chronic conditions. As the healthcare system in the South continues to modernize and more hospitals integrate advanced technologies, the demand for PICC lines is expected to rise steadily. The growing aging population in the South, along with increasing awareness about the benefits of PICC lines, will continue to drive adoption in the region.

The Northeast is seeing moderate growth in demand for peripherally inserted central catheters (PICC), with a 2.4% CAGR. The region’s strong focus on advanced medical technologies and high-quality healthcare services plays a significant role in the adoption of PICC lines. Hospitals in cities like New York, Boston, and Philadelphia are increasingly adopting PICC lines for patients requiring long-term intravenous access, particularly in oncology and intensive care units.

The Northeast’s well-established healthcare infrastructure, along with its emphasis on providing safe and efficient treatments, contributes to the steady demand for PICC lines. Hospitals in this region are actively investing in minimally invasive procedures, which include the use of PICC lines to reduce the risk of infection and improve patient comfort during extended treatments. As the demand for chronic disease management and critical care rises in the Northeast, the need for PICC lines will continue to grow, ensuring ongoing demand across the region.

The Midwest is experiencing moderate growth in demand for peripherally inserted central catheters (PICC), with a 2.1% CAGR. The region’s healthcare systems, particularly in cities like Chicago and St. Louis, are increasingly adopting PICC lines due to their safety, convenience, and efficiency in managing long-term intravenous therapies. The growing number of critical care and long-term care facilities in the Midwest is driving the demand for these devices.

While the growth rate is slower than in other regions, the Midwest’s steady adoption of PICC lines is supported by rising awareness among healthcare providers about the benefits of these catheters for patients who require prolonged intravenous treatment. As hospitals in the region continue to modernize and healthcare services expand, the demand for PICC lines will grow. The region’s increasing need for safe, effective, and low-risk intravenous access will continue to support moderate growth in PICC usage in the coming years.

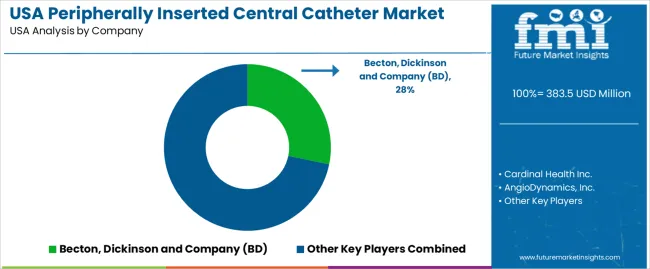

The demand for PICC devices in the United States is rising steadily, as long-term intravenous therapy becomes more common for patients undergoing chemotherapy, antibiotic treatment, and nutritional support outside traditional hospital settings. With the increasing prevalence of chronic diseases and the shift toward outpatient care and home‑based IV therapies, healthcare providers are equipping themselves with reliable vascular access solutions that support extended treatment durations while minimizing complications.

In the USA demand landscape, Becton, Dickinson and Company (BD) holds a leading share of approximately 28.2%, reflecting its strong position in the PICC device segment through established clinical relationships and comprehensive product offerings. Other important players contributing to U.S. demand include Cardinal Health Inc., AngioDynamics, Inc., Teleflex Incorporated, and Vygon Group, each supplying specialized PICC lines, insertion accessories, and support services that align with provider needs.

Key growth drivers in the U.S. include the rising number of outpatient infusion centers, increased adoption of PICC lines for long‑dwell IV access, and the proliferation of antimicrobial‑coated and power‑injectable PICC devices designed to reduce risks of infection and thrombosis. Despite the strong demand, challenges such as cost pressures, reimbursement complexities, and clinical training requirements for insertion and maintenance remain. The outlook for PICC demand in the U.S. remains positive, bolstered by continued growth in long‐term therapy settings and the emphasis on safe, efficient vascular access solutions.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product | Conventional PICC, Power Injected PICC, Neonatal PICC |

| Lumen | Single Lumen, Double Lumen, Multiple Lumen |

| Application | Chemotherapy, Long-term IV Infusion, Parenteral Nutrition, Blood Transfusion, Difficult Intravenous Access |

| End User | Hospitals, Cancer Research Institutes, Long Term Care Centers, Independent Infusion Centers, Ambulatory Surgical Centers |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Becton, Dickinson and Company (BD), Cardinal Health Inc., AngioDynamics, Inc., Teleflex Incorporated, Vygon Group |

| Additional Attributes | Dollar sales by product, lumen type, application, and regional trends focused on chemotherapy, long-term care, and infusion sectors |

The global demand for peripherally inserted central catheter in USA is estimated to be valued at USD 383.5 million in 2025.

The market size for the demand for peripherally inserted central catheter in USA is projected to reach USD 495.7 million by 2035.

The demand for peripherally inserted central catheter in USA is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in demand for peripherally inserted central catheter in USA are conventional picc, power injected picc and neonatal picc.

In terms of lumen, single lumen segment to command 52.0% share in the demand for peripherally inserted central catheter in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Demand for Peripherally Inserted Central Catheter in Japan Size and Share Forecast Outlook 2025 to 2035

Central Venous Catheter (CVC) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Central Computing Architecture Vehicle OS in USA Size and Share Forecast Outlook 2025 to 2035

Central Dialysis Fluid Delivery System (CDDS) Market Size and Share Forecast Outlook 2025 to 2035

Central Tube Optical Cable Market Size and Share Forecast Outlook 2025 to 2035

Central Computing Architecture Vehicle OS Market Forecast and Outlook 2025 to 2035

Central Reinforced Tape Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Central Monitoring Station Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Centralized Workstation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA