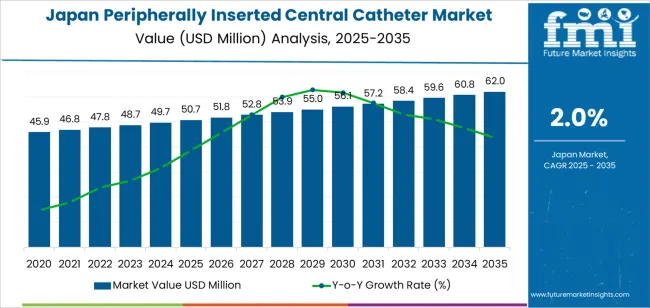

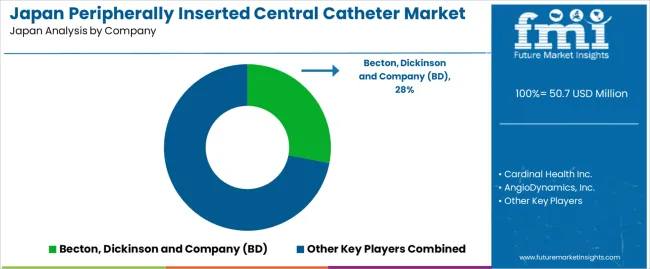

The demand for peripherally inserted central catheters (PICC) in Japan is valued at USD 50.7 million in 2025 and is projected to reach USD 62.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.0%. The growth in demand is primarily driven by the increasing prevalence of chronic conditions, such as cancer, that require long-term intravenous treatments. Additionally, the growing need for safer, minimally invasive vascular access procedures in hospitals and outpatient settings contributes to the rise in PICC adoption. The demand is further supported by advancements in catheter technology that enhance patient safety and reduce complications, making these devices a preferred option in clinical settings.

Over the forecast period, demand is expected to grow steadily, with incremental year-on-year increases. Starting at USD 45.9 million in earlier years, the market reaches USD 50.7 million in 2025 and continues to expand, reaching USD 62.0 million by 2035. The year-to-year growth is relatively stable, with incremental increases from USD 50.7 million in 2025 to USD 51.8 million in 2026, and progressing incrementally throughout the period. This steady growth reflects the ongoing need for PICCs in various medical treatments, particularly in Japan’s aging population, where these devices play a key role in long-term patient care.

A major inflection point for the demand for peripherally inserted central catheters (PICC) in Japan takes place in the mid 2020s, around 2025. At that time demand crosses USD 50.7 million and begins accelerating as the healthcare system evolves. The combination of expanding outpatient infusion therapies, increased use in home and long term care settings, and institutional initiatives to shift from more invasive central venous access devices contributes to this shift. The value moves from USD 45.9 million in 2020 to USD 50.7 million in 2025, marking a transition from steady growth into a phase of stronger momentum.

A second inflection point occurs around 2030. Demand in Japan moves from approximately USD 55.0 million in 2030 to USD 62.0 million by 2035, reflecting increased adoption of PICC lines across oncology, parenteral nutrition, and complex infusion therapies. Training of specialist insertion teams, introduction of advanced PICC technologies (e.g., antimicrobial coatings, power injectables) and greater demand for long term intravenous access collectively drive this later surge. After this inflection the market enters a more mature stage, with growth increasingly led by device upgrades, higher complexity applications and replacement cycles rather than broad new volume expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 50.7 million |

| Forecast Value (2035) | USD 62.0 million |

| Forecast CAGR (2025 to 2035) | 2.0% |

The demand for peripherally inserted central catheters (PICC) in Japan is largely driven by the country’s aging population and the increasing prevalence of chronic conditions such as cancer, cardiovascular diseases, and infections, which often require long-term intravenous treatments. PICCs offer a safer and more comfortable alternative to traditional central venous catheters, especially for patients needing prolonged therapy. These devices are favored in both hospital and home healthcare settings because they reduce the frequency of needle insertions and provide stable venous access for extended periods. The growing emphasis on improving patient outcomes and comfort in Japan's healthcare system is contributing to the increased use of PICCs.

In addition to demographic trends, changes in healthcare delivery models are supporting the demand for PICCs. Japanese healthcare facilities are increasingly focusing on reducing hospital stays and enabling patients to continue treatment at home or in outpatient settings. This shift requires reliable and easy-to-manage solutions like PICCs that can be used for prolonged periods without causing discomfort or increasing the risk of complications. The country’s strong healthcare infrastructure and the availability of trained medical professionals further promote the adoption of PICCs, though challenges such as device-related complications and reimbursement concerns continue to affect the overall adoption rates.

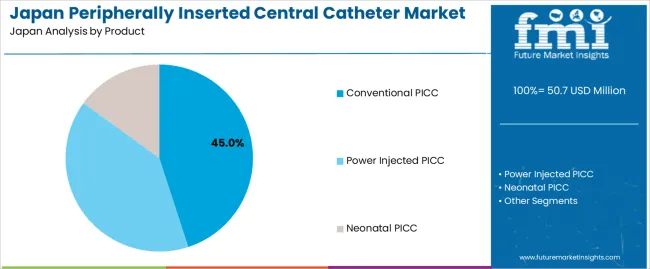

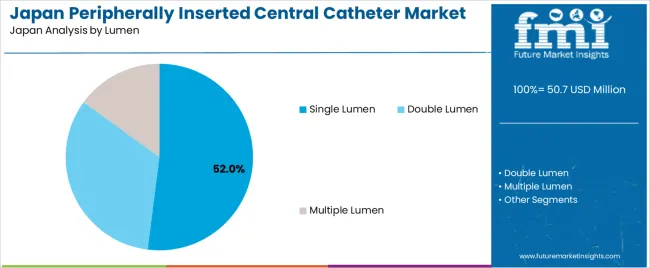

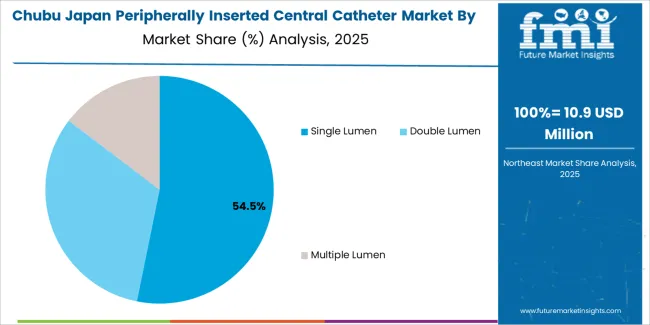

The demand for peripherally inserted central catheters (PICC) in Japan is shaped by the type of product and the lumen configuration. The product types include conventional PICC, power injected PICC, and neonatal PICC, each designed for different patient needs. Lumen configurations include single lumen, double lumen, and multiple lumen, with each offering varying capabilities for the administration of fluids, medications, and other treatments. These segments reflect the growing need for flexible and efficient vascular access solutions in Japan, particularly in hospitals and healthcare settings that require advanced catheter options for long-term treatments.

Conventional PICC accounts for 45% of the total demand in Japan. This product type is popular due to its versatility, ease of insertion, and suitability for a wide range of medical conditions requiring long-term venous access. Conventional PICC lines are commonly used for patients requiring prolonged intravenous therapies such as chemotherapy, antibiotics, and nutrition. The growing prevalence of chronic diseases, cancer treatments, and the need for long-term drug administration have led to the widespread adoption of conventional PICC lines across Japanese healthcare settings.

The demand for conventional PICC is also driven by its relatively lower cost compared to more specialized catheter types. As healthcare institutions in Japan look for reliable, cost-effective solutions for venous access, conventional PICC lines remain a preferred choice for treating patients requiring extended medical interventions. This continued preference, supported by its ease of use and the ability to deliver consistent, safe treatment, ensures its leading position in the market.

Single lumen PICC accounts for 52.0% of the total demand for peripherally inserted central catheters in Japan. This configuration is preferred for applications that require the infusion of a single substance at a time, such as antibiotics, nutrition, or chemotherapy. The demand for single lumen PICC is driven by its simplicity, cost-effectiveness, and efficiency in handling one treatment or infusion pathway at a time. These catheters are widely used for patients needing intravenous therapy for relatively straightforward medical conditions or temporary treatments.

The growing adoption of single lumen PICC is also attributed to the increasing number of procedures requiring vascular access for a limited duration. In Japan, where healthcare providers emphasize precise and efficient treatment protocols, the use of single lumen catheters ensures optimal control and safety during drug administration. As medical professionals seek practical, reliable solutions for intravenous therapy, the demand for single lumen PICC lines is expected to remain high.

In Japan, demand for PICCs is gaining traction as the healthcare system adapts to rising numbers of patients requiring long term intravenous therapies, including oncology, antibiotic administration and nutritional support. The ageing population, expansion of home care services and increasing preference for minimally invasive vascular access contribute to uptake. At the same time, barriers such as higher device cost, procedural training requirements and differing hospital adoption rates hinder uniform expansion across all regions. Understanding these factors is vital for companies and providers operating in the Japanese PICC segment.

What developments are encouraging increased use of PICCs in Japan?

The shift toward managing chronic conditions and delivering care outside of intensive inpatient settings is encouraging PICC adoption in Japan. As more patients receive chemotherapy, long term antibiotics or parenteral nutrition, PICCs offer a reliable venous access option with potentially fewer insertions and lower complication risk compared to repeated peripheral IVs. Hospitals and outpatient centres are increasingly integrating protocols for PICC placement, making the device more common in Japan’s evolving care pathways.

What opportunities exist for PICC growth in Japan?

A clear opportunity in Japan lies in home based infusion therapy and ambulatory care settings. With healthcare reimbursement models and institutional focus gradually shifting toward outpatient and home care, PICCs present a practical option for extended intravenous treatment outside the hospital. Device manufacturers and service providers can leverage this trend by offering PICC systems and support services tailored for home use, remote monitoring and patient education in Japan’s advanced healthcare environment.

What challenges may slow broader PICC adoption in Japan?

Despite positive dynamics, several challenges may restrain PICC uptake in Japan. Device cost and procedural overheads remain significant, especially when compared to simpler venous access methods. Insertion and maintenance of PICCs require trained staff, and the risk of complications such as infection or thrombosis may limit use in certain settings. Furthermore, reimbursement frameworks and institutional adoption may lag in some regional hospitals, leading to uneven penetration of PICC usage across Japan.

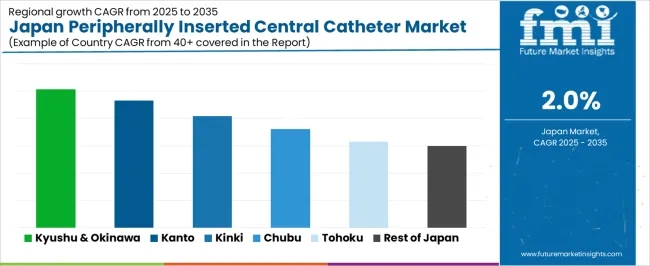

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.5% |

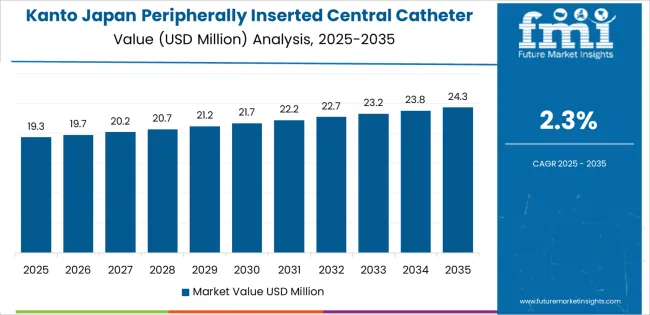

| Kanto | 2.3% |

| Kinki | 2.0% |

| Chubu | 1.8% |

| Tohoku | 1.6% |

| Rest of Japan | 1.5% |

The demand for peripherally inserted central catheters (PICC) in Japan is growing across regions, albeit at a moderate pace. Kyushu and Okinawa lead with a 2.5% CAGR, driven by increasing healthcare infrastructure and a demand for minimally invasive procedures. Kanto follows at 2.3%, influenced by its advanced medical facilities and higher healthcare utilization rates. Kinki records a 2.0% growth, supported by large hospitals and expanding adoption of PICC lines for patient care. Chubu grows at 1.8%, with steady use in regional healthcare systems. Tohoku reaches 1.6%, with gradual adoption in its medical centers. The rest of Japan shows a 1.5% growth, reflecting a slow but consistent demand for these devices in less populated areas.

Kyushu & Okinawa is projected to grow at a CAGR of 2.5% through 2035 in demand for peripherally inserted central catheters (PICC). The region’s growing healthcare infrastructure, especially in areas like Fukuoka, supports the demand for advanced medical devices. With an aging population and increasing chronic diseases, the need for long-term intravenous therapy is rising. The adoption of PICCs, known for their efficiency in providing long-term access to veins, helps improve patient outcomes and reduces complications. Additionally, healthcare initiatives aimed at improving patient care in the region continue to drive the demand for PICCs.

Kanto is projected to grow at a CAGR of 2.3% through 2035 in demand for peripherally inserted central catheters (PICC). As one of Japan’s most populous regions, Kanto, including Tokyo, sees significant adoption of PICCs in healthcare settings. The region’s advanced medical facilities are increasingly using PICCs for patients requiring long-term intravenous therapy, especially in oncology and intensive care units. The rising demand for minimally invasive procedures and the shift towards outpatient care further drive the use of PICCs as a safer, more efficient alternative to traditional central venous catheters.

Kinki is projected to grow at a CAGR of 2.0% through 2035 in demand for peripherally inserted central catheters (PICC). The region’s strong healthcare infrastructure, particularly in Osaka and Kyoto, supports the increasing use of PICCs in hospitals and clinics. As the elderly population grows, the demand for long-term intravenous therapies also rises. States like Osaka lead the way in implementing PICCs for chemotherapy, total parenteral nutrition, and other medical treatments requiring prolonged venous access. The adoption of PICCs continues to improve patient comfort and reduce risks associated with traditional catheter insertion methods.

Chubu is projected to grow at a CAGR of 1.8% through 2035 in demand for peripherally inserted central catheters (PICC). The region, with its focus on industrial healthcare and aging demographics, shows steady growth in PICC adoption. Cities like Nagoya, home to several hospitals and clinics, are leading the way in utilizing PICCs for efficient venous access. The increasing prevalence of chronic diseases such as cancer and diabetes, combined with the need for long-term intravenous therapy, continues to contribute to the demand for these advanced medical devices.

Tohoku is projected to grow at a CAGR of 1.6% through 2035 in demand for peripherally inserted central catheters (PICC). The region’s healthcare sector, although less developed than other areas, is increasingly adopting PICCs in response to the growing elderly population and rising chronic diseases. With fewer healthcare facilities than larger regions, the demand for efficient and safe venous access solutions is significant. The region’s commitment to improving healthcare delivery, particularly in rural areas, further contributes to the growing adoption of PICCs for long-term intravenous therapies.

The Rest of Japan is projected to grow at a CAGR of 1.5% through 2035 in demand for peripherally inserted central catheters (PICC). Regions outside major urban areas are adopting PICCs for long-term venous access, particularly in rural and suburban healthcare facilities. As healthcare systems nationwide work to streamline intravenous therapy and improve patient care, the adoption of PICCs continues to rise. The Rest of Japan’s healthcare providers focus on improving efficiency and reducing the risks associated with traditional central venous access, contributing to the steady growth of the market.

The demand for peripherally inserted central catheters (PICC) in Japan is driven by the country's aging population and the increasing prevalence of chronic conditions requiring long-term intravenous therapies. PICCs are preferred over traditional central venous catheters due to their lower complication rates, easier management, and ability to be used in outpatient settings. As hospitals in Japan strive to improve patient comfort while reducing infection risks, PICCs are becoming an essential component of vascular access solutions. The increased use of PICCs is also linked to advancements in insertion techniques and better training for healthcare providers, enabling their safe and effective use in a variety of medical conditions such as cancer, sepsis, and long-term nutrition therapy.

Key players shaping the market for PICCs in Japan include Becton, Dickinson and Company (BD), Cardinal Health Inc., AngioDynamics, Inc., Teleflex Incorporated, and Vygon Group. These companies offer a range of PICC products, including catheters, accessories, and insertion tools, which are designed to meet Japan's high standards for patient safety and clinical efficacy. BD leads with its Groshong® PICC series, providing users with a reliable, safe option for long-term vascular access. Teleflex, Cardinal Health, AngioDynamics, and Vygon offer various specialized PICCs that cater to different clinical needs, including specific catheter sizes, material types, and insertion systems. These companies are instrumental in expanding the use of PICCs in Japan’s healthcare system.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use | Hospitals, Cancer Research Institutes, Long Term Care Centers, Independent Infusion Centers, Ambulatory Surgical Centers |

| Product Type | Conventional PICC, Power Injected PICC, Neonatal PICC |

| Lumen Configuration | Single Lumen, Double Lumen, Multiple Lumen |

| Application | Chemotherapy, Long-term IV Infusion, Parenteral Nutrition, Blood Transfusion, Difficult Intravenous Access |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Becton, Dickinson and Company (BD), Cardinal Health Inc., AngioDynamics, Inc., Teleflex Incorporated, Vygon Group |

| Additional Attributes | Dollar by sales across product type, lumen configuration, and application sectors, healthcare provider adoption rates, patient demand for PICC devices, advancements in catheter insertion techniques, and reimbursement policies for long-term intravenous access. |

The demand for peripherally inserted central catheter in Japan is estimated to be valued at USD 50.7 million in 2025.

The market size for the peripherally inserted central catheter in Japan is projected to reach USD 62.0 million by 2035.

The demand for peripherally inserted central catheter in Japan is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in peripherally inserted central catheter in Japan are conventional picc, power injected picc and neonatal picc.

In terms of lumen, single lumen segment is expected to command 52.0% share in the peripherally inserted central catheter in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA