The demand for snack bars in USA is valued at USD 9.8 billion in 2025 and is projected to reach USD 23.3 billion by 2035, reflecting a compound annual growth rate of 9.0%. Growth is shaped by continued interest in portable, portion-controlled foods suited to varied daily routines. Snack bars, including protein, granola, fruit and functional varieties, maintain broad appeal across retail shelves and online platforms. As consumers seek options aligned with balanced eating patterns and convenience, manufacturers expand flavors, textures and nutritional formats. The category benefits from consistent placement in supermarkets, convenience stores and multipack offerings, contributing to rising adoption throughout the forecast period.

The growth curve shows a clear upward trajectory, beginning at USD 6.4 billion in earlier years and advancing to USD 9.8 billion in 2025 before moving toward USD 23.3 billion by 2035. Yearly values rise at steady intervals, progressing from USD 10.7 billion in 2026 to USD 11.7 billion in 2027 and continuing through predictable gains across later periods. This pattern reflects stable consumer habits and enduring preference for ready-to-eat snack formats. As producers broaden bar assortments and refine formulations to meet evolving dietary interests, demand maintains firm momentum. The market’s steady ascent highlights a maturing but expanding segment supported by routine household purchases and production scaling across USA’s packaged food landscape.

Demand for snack bars in USA is projected to grow from USD 9.8 billion in 2025 to USD 23.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 9.0%. Starting at USD 6.4 billion in 2020, the value rises to USD 9.0 billion by 2024 and USD 9.8 billion in 2025. From 2025 to 2030 the value climbs to around USD 15.1 billion, and by 2035 it reaches USD 23.3 billion. Growth is driven by increasing consumer demand for convenient, on the go nutrition options, heightened interest in functional snacks such as high protein, clean label and plant based bars, and expansion of e commerce and retail channels for snack bar distribution.

Over the forecast period, the uplift of USD 13.5 billion (from USD 9.8 billion to USD 23.3 billion) is underpinned by both volume expansion and increasing per unit value. In the early years, growth is volume led as more consumers adopt snack bars as part of snack occasions. In the later part of the decade, value growth becomes increasingly significant as product innovation, premium positioning such as added protein, adaptogens, plant based ingredients, and higher average selling prices take hold. As health driven snacking becomes mainstream and differentiation intensifies, snack bar suppliers and brands focusing on innovation, flavour variety and functional benefits are best positioned to capture the substantial growth toward USD 23.3 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 9.8 billion |

| Forecast Value (2035) | USD 23.3 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The demand for snack bars in USA is increasing as consumers seek convenient, ready-to-eat options that match busy lifestyles and more mindful eating habits. Many individuals consume snack bars as part of daily routines at work, on the move or between meals preferring formats that require no preparation yet deliver flavour and satisfaction. Growth in categories such as nutrition-enhanced bars (high-protein, low-sugar) and functional bars (fiber-rich, targeted for energy or recovery) reflects evolving consumer preferences. Manufacturers are responding with a range of formulations and packaging sizes to meet shifting consumption patterns within USA’s retail landscape.

In addition, snack bars benefit from strong retail distribution and shifting snacking occasions. Supermarkets, convenience stores, online platforms and subscription services are all increasing their snack-bar assortments, which improves product visibility and accessibility. Private-label and value brands are expanding in parallel with premium and niche segments, enabling a broader consumer base to access snack bars. At the same time, ingredients cost pressures, saturated shelf space and consumer scrutiny of nutritional claims pose challenges. Nevertheless, the steady growth in demand for snack bars in USA is expected to continue as consumers value portability, taste and nutrition in their snack choices.

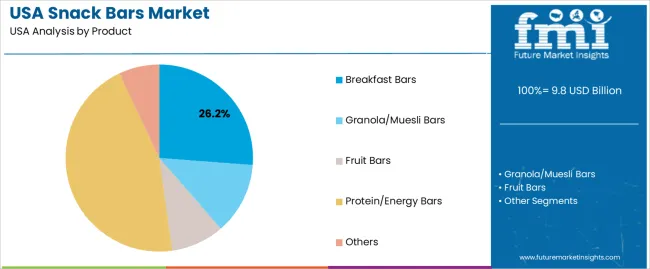

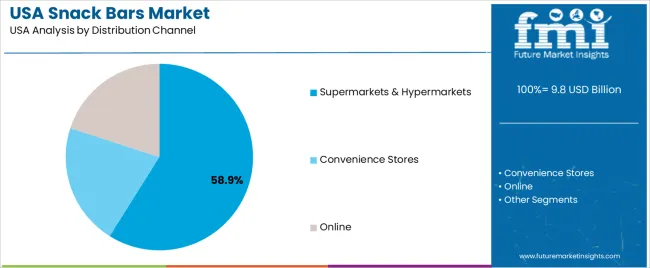

The demand for snack bars in USA is shaped by the variety of product formats available and the distribution channels that determine consumer access. Product categories include breakfast bars, granola or muesli bars, fruit bars, protein or energy bars and other specialized options that support different eating habits throughout the day. Distribution channels span supermarkets and hypermarkets, convenience stores and online platforms, each serving distinct purchasing routines. As consumers seek portable, portion-controlled items suited to busy schedules, the combination of product diversity and widespread retail availability influences overall demand across USA’s snack bar market.

Breakfast bars account for 26% of total demand across product categories in USA. Their leading share reflects strong integration into morning routines where quick, shelf-stable options support predictable meal timing. Breakfast bars suit consumers seeking balanced convenience with steady energy release during early hours. Manufacturers offer varied textures and flavor combinations that appeal to different age groups and dietary needs. The format’s ease of storage and straightforward consumption strengthens regular use. These features make breakfast bars a common choice for individuals looking for reliable, ready-to-eat items that complement rushed mornings and commute-based eating patterns across USA.

Demand for breakfast bars also increases as households adopt structured snacking habits that prioritize recognizable ingredients and consistent portion sizes. Their compatibility with lunchboxes, backpacks and workplace settings supports all-day accessibility. Many brands highlight whole grains and controlled sugar levels, reinforcing consumer trust. The bars’ ability to maintain freshness and stability under typical carrying conditions encourages routine purchasing. As consumers continue selecting items that combine practicality and predictable nutrition, breakfast bars maintain a strong presence within USA’s snack bar landscape.

Supermarkets and hypermarkets account for 58.9% of total demand across distribution channels in USA. Their leading position reflects the advantage of broad product assortments that allow consumers to compare flavors, sizes and nutritional profiles in a single visit. These stores offer consistent availability of national brands and private-label options that suit varied budgets. The ability to purchase snack bars alongside routine groceries supports frequent buying patterns. Shelf placement and promotional displays also help guide consumer decisions, reinforcing supermarkets as reliable access points for snack bar products.

Demand through supermarkets grows as shoppers prefer one-stop locations for restocking household items. The channel supports bulk purchasing and trial of new variants through multipacks and promotional bundles. Supermarkets also provide predictable freshness through fast stock rotation, supporting strong consumer confidence. Their stable pricing structure appeals to buyers managing weekly meal planning. As households continue relying on established retail formats for convenience and product variety, supermarkets and hypermarkets remain the dominant distribution channel for snack bars in USA.

Demand for snack bars in the USA is being driven by consumers seeking portable, convenient and “better‐for‐you” eating options amid busy lifestyles. Growth is supported by rising health consciousness, expansion of retail and e-commerce snack channels and increased product innovation (such as high‐protein, low sugar, functional ingredients). At the same time, barriers include intense competition among brands, retail shelf-space constraints and consumer sensitivity to price. These factors together shape how rapidly snack bars expand across USA snack markets.

How Are Lifestyle Changes and Retail Dynamics Influencing Demand for Snack Bars in USA?

In the USA, consumers are increasingly replacing traditional snack events with on-the-go formats and are more likely to buy via convenience stores, online subscriptions or mobile ordering. Retailers and manufacturers respond with snack bars that offer health claims (e.g., whole grains, clean label) and align with mobile consumption habits. Innovation in flavours, formats (e.g., mini bars, clusters, bites) and packaging supports this demand. Nonetheless, the variety of formats and channels also increases complexity for brands and may slow standardisation efforts in the snack bar category.

Where Are Growth Opportunities Emerging for Snack Bars in USA’s Market?

Opportunities exist in niche segments such as premium ingredient snack bars, plant-based bars, functional bars (e.g., protein, fiber, adaptogens) and subscription or direct-to-consumer models. Also, premiumisation of flavours, limited-edition launches and collaborations can attract consumers willing to try new formats. Smaller brands may use online channels for reach and marketing agility. Suppliers that support reduced sugar, clean label, novel formats and strong branding are well placed to capture these growth segments in the USA market.

What Challenges Are Limiting Wider Adoption of Snack Bars in USA?

Despite favourable conditions, several factors limit broader adoption or market expansion of snack bars in the USA. Price competition is significant: many consumers remain price-sensitive and may revert to lower-cost snack formats. Also, taste, texture and ingredient quality are key determinants of repeat purchase; innovations that fail on these frontiers may struggle. Retail space is limited and shelf-space competition is intense, making product launch and shelf visibility challenging. These constraints moderate how fast snack bars grow and how widely they are adopted beyond early adopter consumer segments.

| Region | CAGR (%) |

|---|---|

| West USA | 10.4% |

| South USA | 9.3% |

| Northeast USA | 8.3% |

| Midwest USA | 7.2% |

The demand for snack bars in USA is rising across all regions with the West showing strongest growth at 10.4% CAGR. This reflects growing consumer preference for convenient, on-the-go nutrition and lifestyle snacks in western states. The South follows at 9.3%, driven by expanding retail channels and rising purchase of packaged snacks. The Northeast at 8.3% shows steady demand fueled by urban dwellers seeking quick meal alternatives. The Midwest at 7.2% displays comparatively lower growth, possibly due to slower changes in snacking habits and lower rollout of newer snack products. Overall the market trend points to increasing adoption of snack bars as a mainstream snack option across the United States.

West USA is projected to grow at a CAGR of 10.4% through 2035 in demand for snack bars. California and neighboring states are increasingly adopting snack bars in retail, convenience stores, and online channels for on-the-go nutrition. Rising focus on protein-rich, plant-based, and functional snack options drives adoption. Manufacturers provide bars suitable for various dietary preferences, including gluten-free and high-protein variants. Distributors ensure availability across urban, semi-urban, and e-commerce channels. Growth in health-conscious consumers, convenience-focused lifestyles, and retail expansion supports steady adoption of snack bars in West USA.

South USA is projected to grow at a CAGR of 9.3% through 2035 in demand for snack bars. Texas, Florida, and Georgia are increasingly adopting snack bars in retail, convenience, and online channels for consumer snacking. Rising focus on functional, protein-enriched, and healthy snack options drives adoption. Manufacturers provide bars compatible with multiple dietary trends and packaging formats. Distributors expand accessibility across urban, semi-urban, and rural retail networks. Consumer preference for convenience foods, health-conscious choices, and growth in retail outlets supports steady adoption of snack bars across South USA.

Northeast USA is projected to grow at a CAGR of 8.3% through 2035 in demand for snack bars. New York, Massachusetts, and Pennsylvania are increasingly adopting snack bars in retail, vending, and e-commerce channels. Rising demand for protein-rich, healthy, and plant-based snacks drives adoption. Manufacturers provide bars suitable for various dietary requirements, including gluten-free and high-fiber variants. Distributors ensure accessibility across urban, semi-urban, and suburban locations. Growth in health-focused consumers, retail expansion, and convenience-oriented lifestyles supports steady adoption of snack bars across Northeast USA.

Midwest USA is projected to grow at a CAGR of 7.2% through 2035 in demand for snack bars. Illinois, Minnesota, and Wisconsin are gradually adopting snack bars in retail, convenience stores, and e-commerce channels for on-the-go nutrition. Rising focus on functional, protein-enriched, and healthy snack options drives adoption. Manufacturers provide bars compatible with multiple dietary preferences and packaging requirements. Distributors expand availability across urban, semi-urban, and rural retail outlets. Consumer trends toward convenience, healthy snacking, and protein-enriched diets support steady adoption of snack bars across Midwest USA.

The demand for snack bars in the USA is rising as consumers look for convenient, portable foods that fit into busy schedules and support balanced nutrition. Many Americans prefer snacks that offer quick energy, controlled portions and familiar flavours while aligning with health goals. The growing interest in clean-label ingredients, higher protein content and reduced sugar strengthens demand for new formulations across granola, cereal and functional bars. Expanding retail availability through supermarkets, convenience stores and online platforms also supports higher consumption. As households seek practical options for work, travel and school, snack bars remain a preferred category within the broader packaged-food landscape.

Key players shaping the snack bar sector in the USA include General Mills, Kellanova, Weetabix, The Quaker Oats Company and Mondelez International Group. These companies maintain strong brand recognition and wide distribution, offering bars tailored to varied preferences such as classic granola, high-protein formats or cereal-based options. Their product development strategies focus on taste, texture and nutritional clarity, ensuring alignment with evolving consumer expectations. By adapting flavours, packaging and ingredient profiles to shifting trends, these companies influence how snack bars are positioned and adopted across the USA market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Breakfast Bars, Granola/Muesli Bars, Fruit Bars, Protein/Energy Bars, Others |

| Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Online |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | General Mills, Kellanova, Weetabix, The Quaker Oats Company, Mondelez International Group |

| Additional Attributes | Dollar by sales by product type and distribution channel; regional CAGR and adoption patterns; uptake across retail, convenience, and e-commerce platforms; functional, high-protein, plant-based, and clean-label variants; premiumization and product innovation; consumer trends in on-the-go nutrition; online subscription and direct-to-consumer channels; projected growth toward USD 23.3 billion by 2035; impact of health-conscious lifestyles, convenience demand, and retail expansion on snack bar adoption. |

The demand for snack bars in usa is estimated to be valued at USD 9.8 billion in 2025.

The market size for the snack bars in usa is projected to reach USD 23.3 billion by 2035.

The demand for snack bars in usa is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in snack bars in usa are breakfast bars, granola/muesli bars, fruit bars, protein/energy bars and others.

In terms of distribution channel, supermarkets & hypermarkets segment is expected to command 58.9% share in the snack bars in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Snack Pellets Market Analysis – Demand, Growth & Forecast 2025-2035

Snack Bars Market – Growth, Demand & Functional Nutrition Trends

Demand for Snack Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Snacks in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Protein Snacks in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Pet Snacks and Treats in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Snack Pellet Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Snack Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA