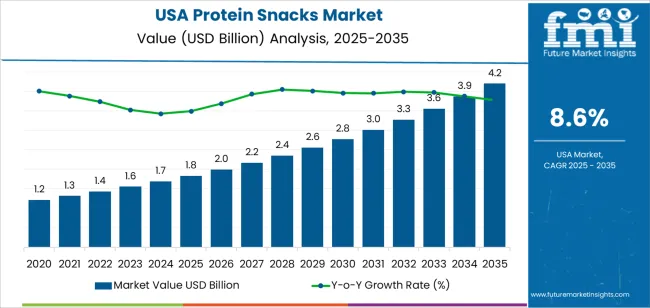

The demand for protein snacks in the USA is projected to rise from USD 1.8 billion in 2025 to USD 4.2 billion by 2035, supported by a CAGR of 8.6%. The steady expansion reflects consumers' growing preference for high-protein, convenient food options in search of healthier alternatives to traditional snacks. Increasing awareness of balanced nutrition, combined with rising interest in fitness-oriented eating habits, is driving the broad adoption of protein snacks across consumer groups. The market is seeing increasing demand among busy professionals, athletes, students, and on-the-go consumers, each seeking portable snacks that offer energy, satiety, and nutritional benefits. The ongoing diversification into formats such as bars, chips, cookies, shakes, and bite-sized snacks continues to expand product availability and choice.

The industry benefits from expanding retail presence across supermarkets, convenience stores, and online platforms, enabling wider distribution and easier access. Growth is also driven by manufacturers reformulating products with clean-label ingredients, natural sweeteners, and plant-based proteins, appealing to consumers seeking both taste and nutritional transparency. As interest shifts toward functional snacks, including options enriched with fiber, vitamins, and minerals, protein snacks continue to gain momentum. The demand trajectory is expected to stay strong across all distribution channels as consumers integrate protein-dense snacks into daily routines for both health and lifestyle reasons.

From 2025 to 2030, demand for protein snacks in the USA will increase from USD 1.8 billion to USD 2.8 billion, capturing USD 1.0 billion in incremental value during the first half of the decade. This period shows strong early expansion driven by rapid consumer adoption of high-protein diets, the growing popularity of meal-replacement snacks, and the influence of fitness-driven lifestyles. The first five years demonstrate faster market acceleration as consumers increasingly replace traditional snacks with protein-rich alternatives, and brands introduce new formats tailored to different consumption occasions. Product visibility improves significantly during this phase, especially through digital retail channels, helping drive broader adoption.

From 2030 to 2035, the market expands further from USD 2.8 billion to USD 4.2 billion, adding USD 1.4 billion in incremental value. This second half of the decade reflects continued, steady growth as protein snacks become firmly established in mainstream food consumption patterns. Adoption expands among general consumers as products diversify into more flavors, textures, and diet-specific lines, including options suitable for low-sugar, keto, and plant-focused preferences. While growth stabilizes as the market matures, demand remains strong because protein snacks continue to deliver everyday value through convenience, nutritional content, and expanded availability. The 10-year comparison highlights that the second half of the period contributes more incremental value than the first, reinforcing a stable, sustained demand curve for protein-enhanced snacks across the USA.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.8 billion |

| Industry Forecast Value (2035) | USD 4.2 billion |

| Industry Forecast CAGR (2025 to 2035) | 8.6% |

Demand for protein snacks in the USA is rising as consumers increasingly seek convenient, high nutrition snack options that fit active lifestyles and wellness goals. Products such as protein bars, jerky, bites, and high protein chips are gaining traction because they offer a satisfying way to bridge meals or replace traditional snack formats with something perceived as healthier. Market research indicates the U.S. protein snacks segment is expected to reach about USD 13.65 billion by 2032.

Another key factor is the growing emphasis on clean label ingredients, plant based protein sources, and functional appeals such as muscle support, appetite control, and weight management. Brands are leveraging claims like “high protein” on packaging to meet growing consumer awareness and demand for performance or diet friendly snacks. Further, e commerce and direct to consumer channels have expanded accessibility and visibility of niche protein snack brands, aiding market growth. Despite challenges such as ingredient cost pressures and competition from other snack formats, the alignment of protein snack innovation with consumer health and convenience trends indicates continued robust demand in the USA.

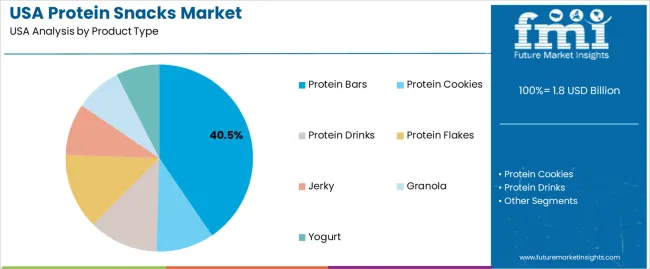

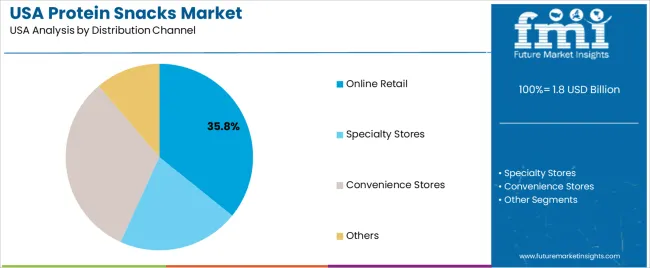

The demand for protein snacks in the USA is driven by product type and distribution channel. The leading product type is protein bars, which capture 41% of the market share, while online retail is the dominant distribution channel, accounting for 35.8% of the demand. Protein snacks have become increasingly popular among health-conscious consumers and those with active lifestyles, as they provide a convenient source of protein for muscle recovery, weight management, and overall wellness. The growth of online shopping and the rising awareness of fitness and nutrition continue to drive the demand for these products.

Protein bars lead the protein snack market in the USA, accounting for 41% of the demand. Protein bars are a convenient and portable source of protein, making them a popular choice for individuals with busy schedules or active lifestyles. These bars are commonly consumed as meal replacements, post-workout snacks, or quick energy boosts, and they come in a wide variety of flavors and formulations to cater to different dietary needs, including low-carb, gluten-free, and plant-based options.

The demand for protein bars is driven by the increasing popularity of fitness and health-conscious eating habits, as well as the growing trend of on-the-go snacking. As consumers continue to prioritize nutrition and convenience, protein bars remain a dominant category in the protein snack market. With ongoing innovations in flavors and formulations, protein bars are expected to maintain their leadership in this growing sector.

Online retail is the leading distribution channel for protein snacks in the USA, capturing 35.8% of the market share. The growth of e-commerce has transformed the way consumers purchase protein snacks, offering convenience, variety, and often better prices compared to traditional retail channels. Online platforms allow consumers to easily compare products, read reviews, and find specialized protein snacks that may not be available in physical stores.

The increasing popularity of online shopping, particularly in the food and beverage sector, has been further fueled by the COVID-19 pandemic, which led many consumers to opt for home delivery and online purchasing. As e-commerce continues to grow and consumers become more accustomed to buying food products online, the demand for protein snacks through online retail channels is expected to remain strong, making it a key driver in the overall market. The convenience and accessibility of purchasing protein snacks online have solidified it as the preferred distribution channel for many consumers.

What Are the Primary Growth Drivers for Protein Snack Demand in the United States? Several factors support growth. First, consumers increasingly prioritize high protein foods for muscle recovery, satiety and diet related weight management. Second, brand innovation and expanded product formats—such as protein packed chips, cookies and portable bars—enhance appeal beyond traditional health foods. Third, retailer shelf space is expanding for better for you snacks, improving visibility and accessibility. Fourth, non traditional protein sources (pea, soy, ancient grains, insect based alternatives) are entering the market, broadening appeal to flexitarian and plant based consumers.

What Are the Key Restraints Affecting Protein Snack Demand in the United States? Despite strong drivers, several constraints exist. Price premium of high protein snacks over conventional options may restrict adoption among cost sensitive shoppers. Ingredient supply volatility (for example whey, pea, soy) can impact pricing and product launch timing. Some consumers may perceive protein snacks as niche or specialised, limiting mass market uptake. Additionally, concern over sugar content, taste and texture in protein fortified snacks may deter repeat use if sensory profiles do not meet expectations.

What Are the Key Trends Shaping Protein Snack Demand in the United States? Important trends include growth of plant based protein snack formats targeting vegetarians, vegans and flexitarians, which broaden the addressable audience. Another trend is clean label and simple ingredient positioning—snacks that highlight recognizable protein sources and avoid artificial additives. Texture and flavour innovation is also rising, bridging the gap between indulgence and health by offering protein snacks that taste like conventional treats. Finally, personalized nutrition and digital health platforms are influencing snack choices, with products marketed toward specific consumer segments (e.g., active lifestyle, older adults, weight management) and connected via apps or loyalty programmes.

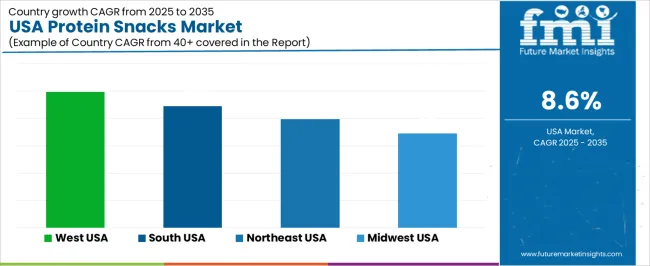

The demand for protein snacks in the USA is experiencing significant growth due to increasing health consciousness, the rising trend of on-the-go eating, and the growing popularity of high-protein diets. Protein snacks, which include products like protein bars, jerky, chips, and smoothies, are becoming increasingly popular among consumers seeking convenient, nutritious, and filling options. These snacks cater to a broad audience, including fitness enthusiasts, busy professionals, and health-conscious individuals who want to maintain or build muscle mass, manage weight, or simply enjoy a healthy snack. The growing preference for plant-based and natural ingredients, along with the demand for clean-label and functional food products, further drives the market. Regional variations in demand reflect differences in consumer behavior, dietary preferences, and lifestyle factors across different parts of the country. Below is an analysis of the demand for protein snacks across various regions in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 9.9% |

| South | 8.9% |

| Northeast | 8% |

| Midwest | 6.9% |

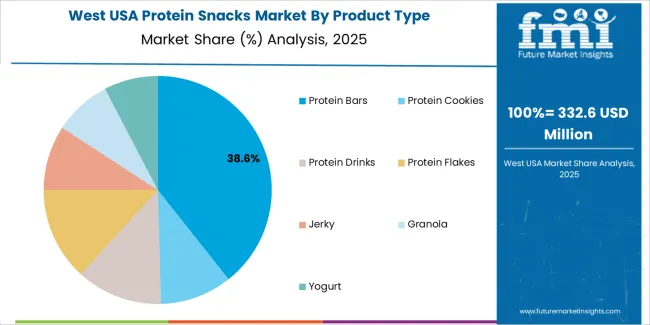

The West leads the demand for protein snacks in the USA with a CAGR of 9.9%. This can be attributed to the region's strong focus on health and wellness, particularly in states like California, Oregon, and Washington, where consumers are highly aware of nutrition and fitness. The West has a large population of individuals engaged in active lifestyles, including fitness enthusiasts, athletes, and those following high-protein or low-carb diets, all of whom contribute to the demand for protein-based snacks.

Additionally, the West is home to many health-conscious food brands and startups that focus on producing clean-label, plant-based, and protein-rich products, further fueling the market. The region’s cultural emphasis on wellness, coupled with increasing trends toward convenience and ready-to-eat healthy snacks, ensures that protein snacks remain in high demand in the West.

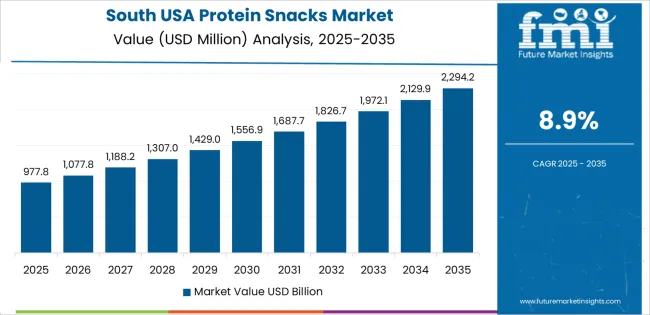

The South shows strong demand for protein snacks with a CAGR of 8.9%. The region's growing interest in healthier eating habits, combined with a large, diverse population, supports the increasing consumption of protein snacks. States like Texas, Florida, and Georgia are seeing rising interest in functional foods and snacks that provide health benefits, such as protein-enriched products that promote muscle growth and satiety.

The demand for protein snacks in the South is further supported by the region's booming health and fitness culture, with a growing number of gyms, fitness centers, and health food stores catering to individuals who prioritize convenience without compromising on nutrition. As more consumers in the South turn to protein snacks as part of their active, health-focused lifestyles, the market for these products continues to grow.

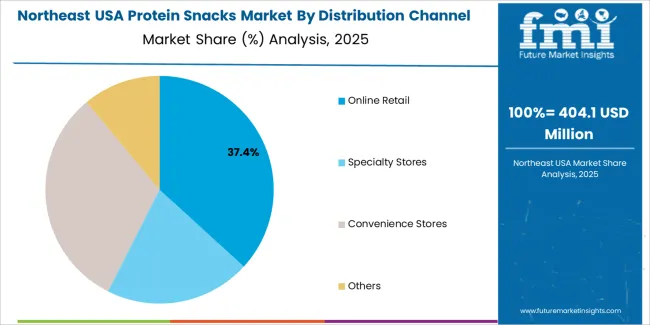

The Northeast shows steady demand for protein snacks with a CAGR of 8.0%. The region, which includes major urban areas such as New York, Boston, and Philadelphia, has a large, diverse population that increasingly seeks quick, healthy meal replacements and snacks. The demand for protein snacks in the Northeast is driven by busy professionals, fitness enthusiasts, and health-conscious individuals who are looking for convenient and nutritious on-the-go options.

As the Northeast's population becomes more aware of the health benefits of protein-rich foods, the demand for these snacks continues to grow, though at a slightly slower pace than in the West and South. The increasing availability of protein snacks in retail stores, gyms, and cafes in urban areas further supports the steady growth of the market in this region.

The Midwest shows moderate growth in the demand for protein snacks with a CAGR of 6.9%. While the region has a strong consumer base, particularly in areas like Illinois, Michigan, and Ohio, the demand for protein snacks is somewhat slower compared to the West, South, and Northeast. This can be attributed to a slightly slower adoption of health-conscious eating habits in certain areas, along with more traditional snack preferences.

However, the Midwest’s increasing interest in fitness, weight management, and healthier eating is gradually contributing to the rise in demand for protein snacks. As more retail outlets and fitness centers in the region offer protein snack options, the market is expected to continue growing at a moderate pace, especially with the growing popularity of protein diets and the need for convenient, nutrient-dense snacks.

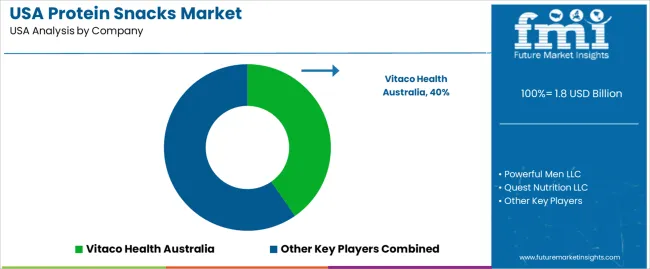

The demand for protein snacks in the United States is growing, driven by increased consumer interest in health and fitness, convenient on-the-go options, and high-protein, low-carb diets. Companies like Vitaco Health Australia (holding approximately 40.4% market share), Powerful Men LLC, Quest Nutrition LLC, General Mills (Nature Valley), Clif Bar & Company, and Kellogg Co. are key players in this market. Protein snacks, including protein bars, crisps, and shakes, are popular among athletes, fitness enthusiasts, and health-conscious consumers looking for nutritious, satisfying snack options that support their dietary needs.

Competition in the protein snacks industry is focused on product innovation, taste, and nutritional value. Companies are constantly improving the taste and texture of their protein-based products to ensure they appeal to a broad consumer base. Another key area of competition is the source of protein, with manufacturers offering a variety of protein types such as whey, plant-based, and collagen, catering to both traditional and vegan diets. Additionally, sustainability and clean-label ingredients are gaining traction, with consumers seeking snacks made from natural ingredients with minimal processing. Marketing materials often highlight protein content, health benefits, and convenient packaging. By aligning their products with the growing demand for healthy, tasty, and functional snacks, these companies aim to strengthen their position in the U.S. protein snacks market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Protein Bars, Protein Cookies, Protein Drinks, Protein Flakes, Jerky, Granola, Yogurt |

| Distribution Channel | Online Retail, Specialty Stores, Convenience Stores, Others |

| Type | Plant-Based Protein Snacks, Meat-Based Protein Snacks |

| Key Companies Profiled | Vitaco Health Australia, Powerful Men LLC, Quest Nutrition LLC, General Mills (Nature Valley), Clif Bar & Company, Kellogg Co. |

| Additional Attributes | The market analysis includes dollar sales by product type, distribution channel, and snack type categories. It also covers regional demand trends in the USA, driven by the increasing popularity of protein-based snacks for fitness, health-conscious, and on-the-go consumers. The competitive landscape highlights key players focusing on innovations in plant-based and meat-based protein snack offerings. Trends in the growing demand for protein bars, drinks, and jerky, as well as the expansion of online retail channels, are explored, along with advancements in packaging and nutritional content to meet diverse consumer preferences. |

The global demand for protein snacks in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand for protein snacks in USA is projected to reach USD 4.2 billion by 2035.

The demand for protein snacks in USA is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in demand for protein snacks in USA are protein bars, protein cookies, protein drinks, protein flakes, jerky, granola and yogurt.

In terms of distribution channel, online retail segment to command 35.8% share in the demand for protein snacks in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Monoprotein Market Report – Demand, Trends & Industry Forecast 2025-2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

United States Fish Protein Market Report – Demand, Size & Forecast 2025–2035

USA Chickpea Protein Market Report – Trends, Demand & Industry Forecast 2025–2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

Demand for Fruit Snacks in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Pet Snacks and Treats in USA Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA