The demand for pet snacks and treats in USA is valued at USD 5.1 billion in 2025 and is projected to reach USD 8.2 billion by 2035, reflecting a CAGR of 4.8%. Growth in the first half of the forecast period is shaped by rising pet ownership, broader acceptance of pets as household companions, and steady increases in discretionary spending on nutrition-focused products. Dog and cat owners show strong interest in treats that support dental health, digestion, weight control, and overall wellness. The shift toward convenient packaging and portion-controlled items also contributes to stable demand. Retail channels continue to expand assortments, supported by online platforms that offer subscription options and rapid delivery services for recurring treat purchases.

As the period advances toward 2035, demand maintains a consistent upward pattern influenced by ongoing product diversification, including limited-ingredient treats, protein-rich formulations, and functional blends aimed at senior or active pets. Manufacturers refine processing methods to improve texture, freshness, and storage life while balancing cost and ingredient quality. Growth is also supported by increased awareness of pet nutrition through veterinary guidance and digital content. Broader distribution across mass retail, specialty stores, and e-commerce outlets ensures continuous availability, allowing the market to progress at a stable pace throughout the later forecast years.

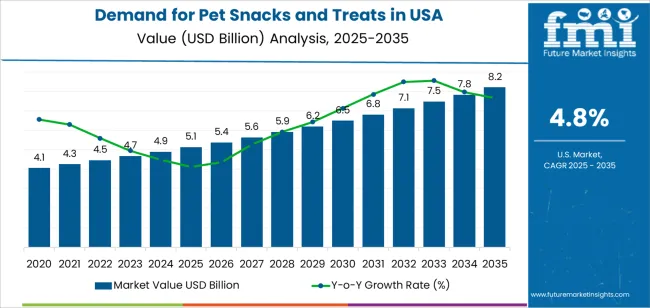

From 2020 to 2035, demand for pet snacks and treats in USA is forecasted to grow from USD 4.1 billion to USD 8.2 billion, reflecting a compound annual growth rate (CAGR) of approximately 4.8%. Between 2020 and 2025, demand is expected to increase from 4.1 to 5.1 billion, a growth of USD 1.0 billion. The subsequent period, 2025 to 2030, will see a rise from 5.1 to 6.2 billion, marking an additional USD 1.1 billion. From 2030 to 2035, the demand is projected to increase by USD 1.3 billion, reaching 7.5 billion by 2033, and 8.2 billion by 2035. Over the entire 15-year period, the total increase in demand will amount to USD 4.1 billion.

The growth of the pet snacks and treats sector is supported by several key factors. These include a 3% annual increase in pet ownership, a shift toward premium and health-conscious product, and an expanding retail landscape, with e-commerce accounting for 25% of sales by 2030. The rise in demand for specialized snacks such as functional treats for dental health and joint mobility is expected to account for 30% of the total revenue by 2035. This trend is driven by pet owners increasingly viewing their pets as family members, thus prioritizing higher-quality, health-focused products.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 5.1 billion |

| Forecast Value (2035) | USD 8.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The pet snacks and treats sector in the USA is seeing rapid growth as more pet owners prioritize the health and well-being of their pets. Snacks are increasingly viewed not just as occasional indulgences but as essential components of a balanced diet. The growing demand for organic, functional, and premium pet treats aligns with trends in human nutrition, as consumers seek products with added benefits like probiotics, joint support, and novel proteins. Retail sales across e-commerce platforms, pet specialty stores, and supermarkets are also rising, with subscription-based models gaining popularity. This shift reflects a broader focus on premium, health-conscious offerings, meeting the evolving expectations of modern pet owners.

Growth in the pet snacks and treats sector is also driven by rising pet adoption rates and shifting consumer demographics. Younger generations, in particular, are more likely to invest in high-quality, specialized products for their pets, fueling the demand for innovation. Marketing strategies now emphasize personalization, with treats tailored to specific life stages, breed sizes, and dietary requirements. As pets are increasingly viewed as family members, their dietary needs are prioritized, driving consumer interest in snacks and treats that contribute to overall health and longevity. This growing focus on pet wellness is supporting the continued expansion of the pet snacks and treats segment across the USA.

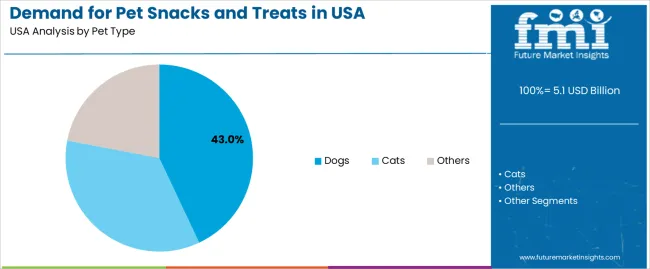

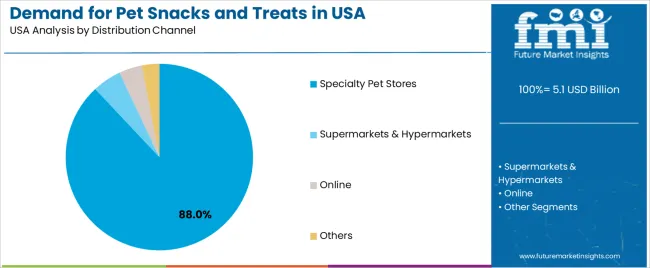

The pet snacks and treats industry in the USA is segmented by pet type, distribution channel, and region. By pet type, the demand is divided into dogs, cats, and others. Based on the distribution channel, it is categorized into specialty pet stores, supermarkets and hypermarkets, online, and others. These segments reflect differences in consumer preferences, shopping habits, and regional trends in pet food and treat purchasing.

The dog segment accounts for approximately 43% of the total demand for pet snacks and treats in USA in 2025, making it the leading pet type category. This position is driven by the high number of dog owners in the country, who increasingly seek quality treats and snacks for their pets. Dog treats are commonly used for training, rewarding, and promoting good health, contributing to their high demand.

Adoption is particularly strong in urban and suburban areas, where pet ownership rates are high. The growth of premium and natural dog treats further strengthens the segment, as pet owners seek healthier, nutritious options for their dogs. Specialty pet stores, supermarkets, and online platforms are the primary distribution channels for dog snacks and treats. The dog segment maintains its leadership because dogs remain the most popular pet in the USA, driving consistent demand for a wide variety of snacks and treats across multiple retail channels.

Specialty pet stores represent a significant share of the total demand for pet snacks and treats in USA, driven by their ability to offer a wide variety of specialized products for pets. These stores cater to pet owners who prefer quality, niche, or premium products that may not be available at larger retail chains. As pet owners seek unique and health-focused options for their pets, specialty stores provide a personalized shopping experience that emphasizes high-quality, safe, and often organic snacks and treats.

Specialty stores are particularly popular among dog and cat owners who are willing to invest in premium pet food products. The strong adoption of these stores in North America and the growth of the online pet product industry further contribute to their prominence in this segment. Specialty pet stores maintain a strong position because they cater to the increasing demand for specialized, healthy pet snacks and treats, offering convenience and expert guidance to pet owners seeking the best products for their animals.

The demand for pet snacks and treats in USA is experiencing significant growth, driven by the increasing humanization of pets, higher disposable incomes, and a greater preference for premium, health-oriented products. Pet owners are increasingly viewing their pets as family members, leading to higher spending on quality, functional treats. This growth is supported by the rise in e-commerce, the shift to subscription models, and the demand for products offering health benefits, such as dental care and joint support. However, challenges such as rising ingredient costs and intense competition may limit further expansion.

The growing trend of treating pets as family members has led to increased spending on premium pet snacks. Pet owners now prioritize high-quality, health-focused treats, including those offering specific benefits such as dental health support, joint care, and digestion. There is also a strong demand for treats made with natural, organic ingredients that align with the health-conscious mindset of many pet owners. This trend is fueling the demand for premium and functional pet treats, as pet owners seek to improve the overall wellbeing of their pets.

The growth of pet snacks and treats demand faces challenges, particularly related to the cost of premium ingredients. As these ingredients become more expensive, the retail prices of products rise, which may affect affordability for some consumers. Additionally, concerns around the authenticity and quality of ingredients can cause hesitation among pet owners, especially when it comes to brand trust. The market is also becoming increasingly competitive, with many brands vying for market share, leading to price wars and market fragmentation, which could hinder long-term growth.

Key trends include an increasing focus on natural and healthy ingredients, with pet owners prioritizing products free from artificial additives, preservatives, and fillers. Functional pet treats that promote dental health, joint support, and digestive wellness are becoming more popular. The rise of e-commerce is shifting the distribution channels, with more consumers turning to online shopping for convenience and access to a wider range of products. Additionally, the cat treat segment is seeing faster growth than dog treats, as more households adopt cats and look for specialized treats.

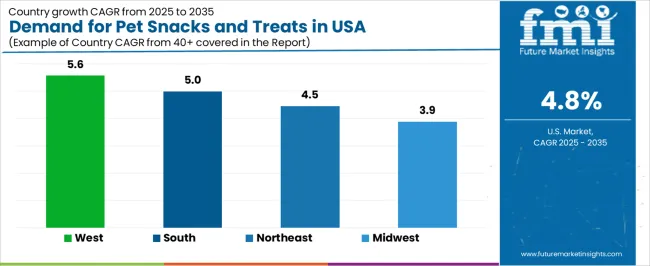

| Region | CAGR (%) |

|---|---|

| West | 5.6% |

| South | 5.0% |

| Northeast | 4.5% |

| Midwest | 3.9% |

The demand for pet snacks and treats in USA is witnessing steady growth, with the West leading at a 5.6% CAGR, driven by increasing pet ownership and a preference for premium, organic, and functional pet products. The South follows at 5.0%, supported by a large pet population and rising consumer interest in natural and nutritious treats. In the Northeast, the market grows at 4.5%, with well-established retail networks and strong consumer spending on pet care and wellness products. Meanwhile, the Midwest records the lowest growth at 3.9%, but demand is still driven by a rise in pet adoption and a shift towards healthier, more convenient treat options. Across the USA, regional growth is fueled by evolving consumer preferences, higher disposable incomes, and expanding retail channels.

The West region of the USA is projected to grow at a CAGR of 5.6% through 2035 in demand for pet snacks and treats. The growing pet ownership and increasing demand for high-quality, nutritious pet treats drive the trend. Consumers in the West prioritize natural ingredients, organic products, and treats tailored to pets’ specific needs. The rise in pet wellness trends, such as weight management and dental health, further supports this demand. Regional pet food retailers and e-commerce platforms play a significant role in meeting the demand for premium pet snacks and treats.

The South region of the USA is projected to grow at a CAGR of 5% through 2035 in demand for pet snacks and treats. With an expanding pet-owning population, there is a growing demand for convenient, tasty, and nutritious snacks and treats for pets. Pet owners in the South are increasingly looking for products that cater to their pets' health needs, such as weight management and dental care. Local pet stores and national retailers play a key role in providing these products. The rise of pet-centric events and festivals also stimulates demand in the region.

The Northeast region of the USA is projected to grow at a CAGR of 4.5% through 2035 in demand for pet snacks and treats. The increasing awareness of pet health and wellness in the Northeast contributes to higher demand for nutritious, high-quality pet treats. Consumers are focused on premium and functional pet products that address specific health concerns, such as skin care and digestive health. The region’s urban pet owners, with access to a wide range of retailers and e-commerce platforms, are helping drive demand through their preference for convenient, healthy options for their pets.

The Midwest region of the USA is projected to grow at a CAGR of 3.9% through 2035 in demand for pet snacks and treats. With a stable pet ownership rate, the demand for quality pet snacks and treats remains steady in this region. Midwest consumers are increasingly inclined toward products made from natural ingredients and those catering to their pets’ dietary and health needs. Regional pet stores and large retail chains play a significant role in ensuring product availability. The Midwest continues to be influenced by trends in pet health and wellness, although at a slightly slower pace.

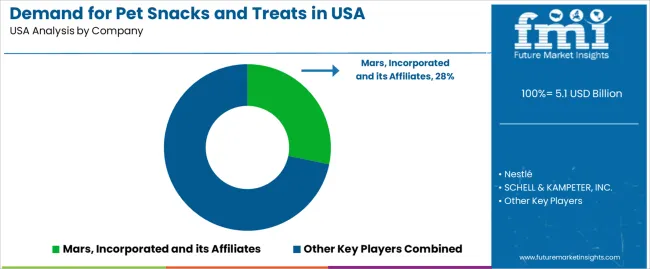

The demand for pet snacks and treats in USA is witnessing significant growth, fueled by an increase in pet ownership and the rising trend of pet humanization. Mars, Incorporated and its Affiliates lead the charge with their extensive range of treats that cater to various pet needs, from nutrition to fun indulgence, while prioritizing ingredient quality and health benefits. Nestlé follows closely with its vast array of pet snack offerings, promoting premium formulations that focus on both taste and wellness. SCHELL & KAMPETER, INC. and The J.M. Smucker Company contribute with specialized snacks designed to support health functions like dental care, weight management, and overall well-being. Hill's Pet Nutrition, Inc. rounds out the competitive landscape by pairing therapeutic pet food with treats that cater to specific health concerns, giving them a significant foothold in the health-focused pet snack segment.

Key factors driving this market's expansion include the increasing number of pet owners treating their pets like family and the demand for natural, functional, and health-boosting treats. As pet owners become more conscientious about their pets' diets, the focus on treats that offer health benefits such as improved digestion, joint support, and dental care is growing. The competition in this space is fierce, with brands innovating to meet the demand for high-quality, nutritious treats, as well as eco-friendly options. With the continued rise in pet ownership and consumer demand for healthier options, brands that prioritize nutrition, sustainability, and functional benefits are set to dominate the future of pet snacks and treats in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Pet Type | Dogs, Cats, Others |

| Distribution Channel | Specialty Pet Stores, Supermarkets & Hypermarkets, Online, Others |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Mars, Incorporated and its Affiliates, Nestlé, SCHELL & KAMPETER, INC., The J.M. Smucker Company, Hill's Pet Nutrition, Inc. |

| Additional Attributes | Dollar sales by pet type, distribution channels, health benefits like joint support, dental care, packaging trends, shift toward premium & functional snacks, rising e-commerce sales, consumer shift toward natural & organic ingredients, pet health awareness, price sensitivity. |

The global demand for pet snacks and treats in USA is estimated to be valued at USD 5.1 billion in 2025.

The market size for the demand for pet snacks and treats in USA is projected to reach USD 8.2 billion by 2035.

The demand for pet snacks and treats in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in demand for pet snacks and treats in USA are dogs, cats and others.

In terms of distribution channel, specialty pet stores segment to command 88.0% share in the demand for pet snacks and treats in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA