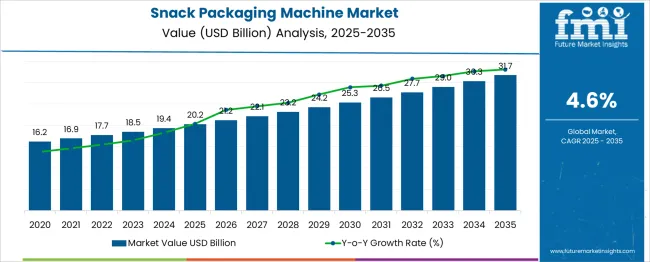

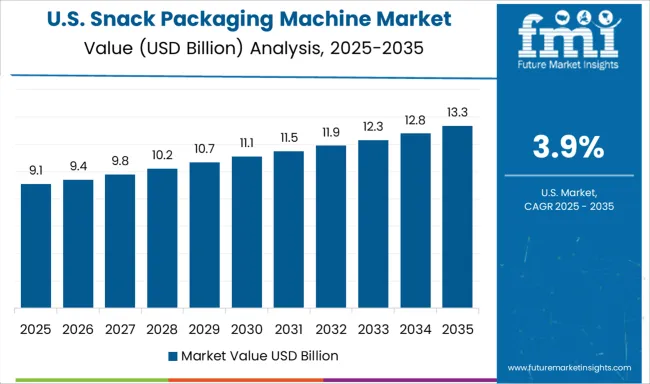

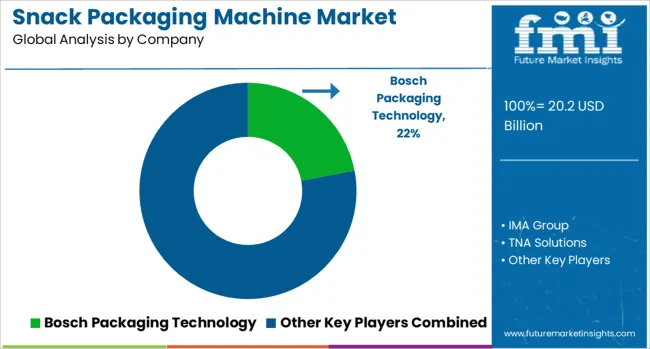

The snack packaging machine market is estimated to be valued at USD 20.2 billion in 2025. It is projected to reach USD 31.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. Annual increments range from USD 1.0 billion to USD 1.4 billion, indicating a largely linear growth path with minimal deviation. Between 2025 and 2029, yearly additions rise gradually from USD 1.0 billion to USD 1.1 billion, suggesting a mild acceleration phase as automation demand increases and mid-cap food processing units upgrade packaging lines. This initial uptick is supported by operational cost optimization and growing SKU variety.

Between 2030 and 2032, the growth curve stabilizes, with annual increases plateauing at USD 1.2 billion. This marks a brief deceleration window, where expansion continues but with no further lift in year-on-year gains. However, in the final years of the forecast, acceleration resumes, with annual additions rising to USD 1.4 billion by 2035.

This late-stage boost reflects renewed equipment cycles, increased demand for flexible packaging formats, and investment in high-speed, multi-lane systems. While the overall growth pattern remains steady, the data shows alternating phases of controlled acceleration and soft deceleration, driven by adoption cycles, product mix complexity, and capital spending by contract packagers and snack manufacturers.

| Metric | Value |

|---|---|

| Snack Packaging Machine Market Estimated Value in (2025 E) | USD 20.2 billion |

| Snack Packaging Machine Market Forecast Value in (2035 F) | USD 31.7 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The market draws support from five core parent industries, each contributing distinct demand drivers. The food and beverage processing sector accounts for approximately 37%, as automated packaging lines integrate machines for chips, nuts, and confectionery products. About 26% stems from contract packaging and co-manufacturing operations that require flexible systems for diverse snack portfolios. The retail packaging machinery market contributes nearly 18%, where customizable formats like stand-up pouches and multi-packs drive equipment specifications.

Roughly 12% is linked to small-scale and artisanal producers who invest in compact packaging units for premium snack lines. The remaining 7% comes from export and bulk processing facilities, which utilize high-speed packaging systems to meet global shipping standards while ensuring product integrity. The industry is expanding rapidly due to rising global snack consumption, shifting product formats, and higher automation demand. Leading innovators include Ishida, Coesia Group, Syntegon Technology, Tetra Pak and IMA Group.

These firms deliver high speed form fill seal machines, multi-head weighers, and modular lines that support single-serve, resealable pouch and flow wrap formats. Key trends include AI-enabled throughput optimization, predictive maintenance, and vision inspection systems for food safety. Manufacturers invest in flexible platforms capable of handling a growing SKU mix and recyclable packaging materials. High growth regions in Asia Pacific, Latin America, and Africa are driving demand for local assembly, fast delivery and service networks.

The snack packaging machine market is demonstrating consistent growth, driven by the increasing demand for packaged snack products that require precision, speed, and hygienic processing. As consumer preferences shift toward ready-to-eat and on-the-go snacks, manufacturers are prioritizing advanced packaging machinery that enhances shelf life while maintaining product quality. The market is being further shaped by technological innovations that improve operational efficiency, reduce downtime, and support sustainability goals through material optimization.

Automation and smart features such as IoT-enabled diagnostics, real-time monitoring, and predictive maintenance are becoming standard, contributing to cost savings and production scalability. The global snack industry’s expansion across urban and semi-urban areas, especially in developing regions, is also creating significant demand for flexible and high-speed packaging solutions.

Emphasis on packaging designs that enhance brand visibility and convenience is prompting investments in modern packaging machines. As a result, the market outlook remains strong, with evolving technology and growing snack consumption patterns continuing to shape future opportunities..

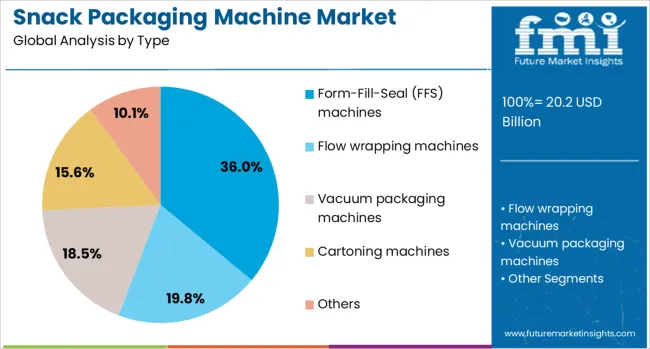

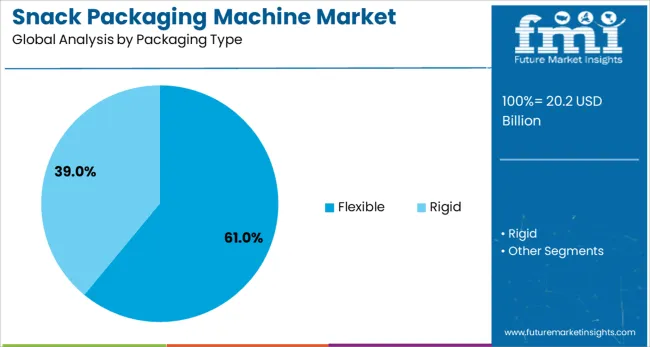

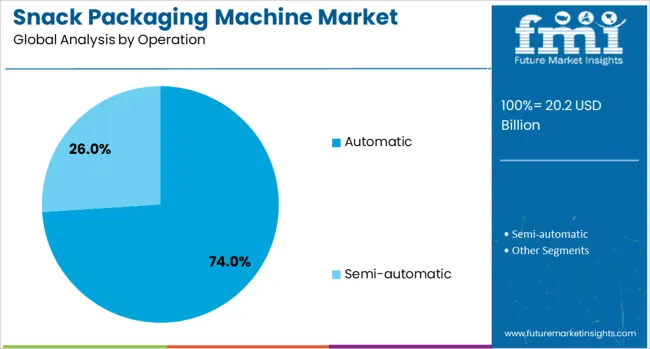

The snack packaging machine market is segmented by type, packaging type, operation, application, packaging material, and distribution channel and geographic regions. By type of the snack packaging machine market is divided into Form-Fill-Seal (FFS) machines, Flow wrapping machines, Vacuum packaging machines, Cartoning machines, and Others. In terms of packaging type of the snack packaging machine market is classified into Flexible and Rigid. Based on operation of the snack packaging machine market is segmented into Automatic and Semi-automatic. By application of the snack packaging machine market is segmented into Savory snacks, Bakery products, Confectionery, Nuts & dried fruits, and Others. By packaging material of the snack packaging machine market is segmented into Plastic, Paper & paperboard, Metal, and Others. By distribution channel of the snack packaging machine market is segmented into Direct and Indirect. Regionally, the snack packaging machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The form fill seal (FFS) type segment is projected to account for 36% of the Snack Packaging Machine market revenue in 2025, emerging as the leading machine type. This dominance has been driven by the integrated nature of FFS machines, which perform forming, filling, and sealing in a single process, significantly increasing production efficiency.

These machines have been widely adopted in high-volume snack manufacturing operations due to their ability to handle a wide range of pouch formats and sizes with minimal manual intervention. The high speed and consistent sealing quality offered by FFS systems have supported the growing need for operational accuracy and hygienic packaging.

Their compatibility with various packaging materials and the adaptability to different product consistencies have made them suitable for diverse snack products. Furthermore, the ability to incorporate smart sensors and automation modules has strengthened their position as a preferred solution for modern snack producers aiming to streamline workflow and reduce packaging waste..

The flexible packaging type segment is expected to hold a commanding 61% of the Snack Packaging Machine market share in 2025. This segment's growth has been supported by the rising consumer preference for lightweight, portable, and resealable packaging formats that align with fast-paced lifestyles. Flexible packaging has been adopted widely due to its lower material costs, reduced transportation footprint, and superior design versatility.

Manufacturers have increasingly invested in machines capable of handling pouches, bags, and wraps that preserve product freshness and improve shelf appeal. The proliferation of single-serve snack portions and multipack offerings has further propelled the demand for flexible packaging lines.

Additionally, improvements in film materials and sealing technologies have enhanced the protective capabilities of flexible packs, supporting longer shelf life without compromising product integrity. As branding and convenience continue to influence consumer choices, flexible packaging has remained a dominant format in the snack industry, reinforcing its leadership in the packaging equipment segment..

The automatic operation segment is anticipated to represent 74% of the Snack Packaging Machine market revenue share in 2025, establishing itself as the primary mode of operation. Growth in this segment has been driven by the need for faster production rates, labor cost reduction, and enhanced precision in packaging. Automatic machines have become the standard in modern snack manufacturing environments where consistency, hygiene, and minimal human interference are critical.

The integration of sensors, programmable logic controllers, and automated feeding systems has enabled seamless operations with minimal supervision. These machines offer real-time data tracking, efficient troubleshooting, and predictive maintenance capabilities, all of which contribute to reduced downtime and improved operational control.

The scalability of automatic systems allows snack producers to meet increasing consumer demand without compromising on quality. Additionally, automation aligns with industry trends focused on digital transformation and lean manufacturing, making it a strategic investment for manufacturers seeking long-term efficiency and compliance with evolving food safety standards..

Vertical form-fill-seal (VFFS) and horizontal flow wrap units represented over 48 % of new equipment sales in 2024. Expansion was led by snack food processors, accounting for 37 % of order volumes, especially within rice chips, nuts, and confectionery segments. A rise in small-batch and artisanal brands drove the adoption of compact line solutions. Automation upgrades delivering nitrogen flushing and multi-lane filling were incorporated in 28 % of deployments.

Snack packaging machine adoption has been driven by consumer demand for fresh, convenient, portioned snacks—particularly single-serve and variety packs. In busy retail environments, nearly 33 % of newer packaging developments are for multipacks, resealable pouches, or on-the-go snack formats. Food manufacturers have accelerated automation to meet high output targets, with VFFS machines enabling speeds of 120 bags per minute in nearly 42 % of installations. Multi-material packaging compatibility allowed flexible use of films, compostable laminates, and foil wraps across 37 % of newer lines. Equipment with inline metal detection, check-weighing, and nitrogen flush modules enhanced shelf life and safety, adopted in 28 % of hygienic design upgrades. Modularity supporting small production runs was prioritized by artisanal brands capturing emerging market segments.

Advanced snack packaging machines involve high initial capital, with automation premiums around 26 % over semi-automatic models. Integration of multi-lane dosing, nitrogen gas flush, and vision inspection modules extended commissioning cycles by nearly 15 %. Specialized film unwinding, sealing jaws, and synchronisation drives increased layout complexity in 22 % of factory configurations, reducing flexibility for legacy facilities. Small-scale producers faced cost sensitivity, as ROI thresholds were not met in units producing below 100 bags per minute throughput. Maintenance of servo interfaces and spare parts availability caused downtime in approximately 7 % of cases. Changeover between flavor-inserts or multi-pack SKU types remained labor-intensive for nearly 18 % of deployment shades.

Emerging growth has been noted in retrofitting older machines with flexible-tooling kits, allowing quick film and size format switching. Retrofit units capturing up to 19 % of demand enabled upgrades with reduced capital expenditure. Compostable films and recycled PET formats have been integrated into 18 % of new machine configurations, where sustainable packaging is mandated. Snack machine manufacturers are partnering with film producers to deliver co-engineered line kits for shelf-stable food service meals and premium healthy snacks. Compact cart-mounted packaging cells targeted at micro-factory lines have supported seasonal product rollouts, capturing 21 % of artisanal brand orders. Predictive maintenance packages and remote diagnostics are being bundled in select models sold under service‑based ownership models.

HMI touchscreen interfaces and PLC-based recipe control systems have become standard in 36 % of newly delivered machines, allowing precise portioning and rapid SKU changeovers. Integration of smart sensors with alerting and remote monitoring features has enhanced uptime in 27 % of modern lines. Multi-format setups that handle both pouch and rigid tray packaging were introduced in nearly 29 % of flexible plant projects. Automatic cleaning-in-place (CIP) routines and sterilization modules were used in 22 % of new high-speed machinery to comply with stricter hygiene standards. Machine designs with minimal areas for product residue and quick-disassembly frames support fast cleaning cycles. Remote diagnostics and predictive alerts have enabled uptime-based service models among leading equipment providers.

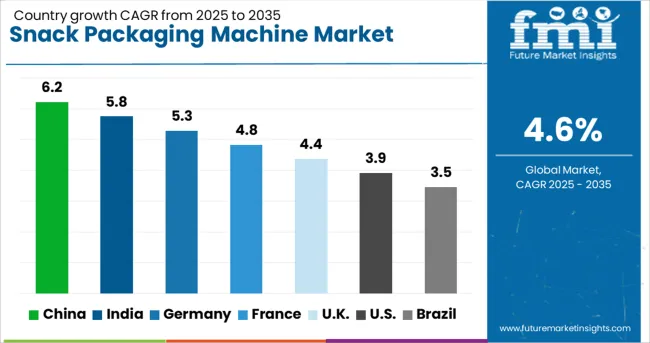

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

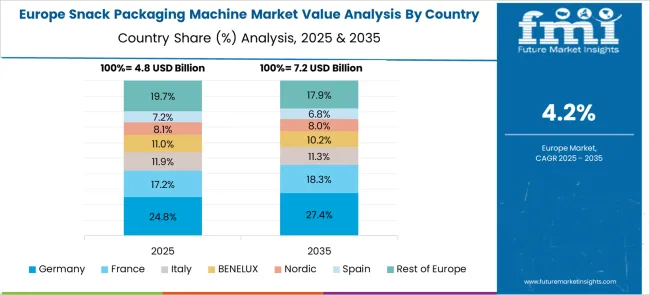

The snack packaging machine market is forecast to grow globally at a CAGR of 4.6% between 2025 and 2035. China leads with a growth rate of 6.2%, nearly 35% above the global average, supported by automation-focused investments across the snack manufacturing sector. India follows at 5.8%, expanding 26% faster than the global benchmark, with growing demand for packaged traditional snacks in urban and semi-urban regions. Germany records a 5.3% CAGR, showing a 15% higher pace than global growth, linked to its efficiency-focused food processing industry. The UK is nearly aligned with the global rate at 4.4%, while the US, at 3.9%, trails by 15%. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China held a 6.2% share in 2025, led by vertical integration in food processing zones across Guangdong and Zhejiang. Domestic demand grew due to rapid throughput requirements in flexible film and pillow-pack machines. Automation adoption expanded in mid-size snack manufacturers, with firms such as Gachn and Soontrue increasing their production capacity. Cross-sector compatibility for pouch and flow-wrap formats enabled machinery exports to ASEAN markets. Servo-based filling technologies saw widespread use in ready-to-eat snack lines, allowing quicker format changeover.

India accounted for a 5.8% share in 2025, driven by demand from tier-II snack brands and contract food packagers. Local manufacturers in Noida and Ahmedabad expanded rotary and horizontal form-fill-seal (HFFS) machine production, catering to salty snacks and extruded products. The sector benefited from the rise of indigenous snack startups using pouch-pack and pillow-pack formats for volume distribution. The industry saw a shift towards intermittent motion packaging for small-batch runs with lower power consumption.

Germany registered a 5.3% share in 2025, backed by demand for high-speed flow-wrappers and precision feeders. Food equipment suppliers in Baden-Württemberg and Lower Saxony focused on advanced controls and hygienic machine design. Snack packaging lines with inline quality control and automated cartoning modules saw higher adoption, especially among gluten-free and organic snack producers. Multivac, Theegarten-Pactec, and Syntegon Technologies remained leading suppliers across Europe for integrated snack wrapping solutions.

The United Kingdom held a 4.4% share in 2025, with small-batch and artisanal snack producers driving machine innovation. Compact packaging solutions and low-footprint vertical form-fill-seal machines gained traction across Scotland and Wales. Specialty food brands focused on resealable and mono-material films, prompting machinery upgrades for film sealing versatility. Domestic demand increased for machines equipped with nitrogen flushing for extended shelf life, especially in nut, crisp, and granola packaging.

The United States had a 3.9% share in 2025, where automation in co-packing and private label operations supported new installations. High-speed packaging systems using ultrasonic sealing and quick tool changeovers were preferred for mixed-format snack lines. OEMs in Illinois, California, and Ohio developed modular snack packaging lines capable of handling varied film thicknesses and custom die-cut formats. The market favored sustainable film compatibility and real-time data tracking systems for operational visibility.

The snack packaging machine market comprises manufacturers offering automated systems for primary and secondary packaging of chips, extruded snacks, granola, and confectionery. Bosch Packaging Technology, now operating under Syntegon Technology, produces vertical form-fill-seal (VFFS) machines and flow wrappers designed for high-speed packing with minimal product waste. IMA Group delivers turnkey packaging lines integrating feeding, weighing, bagging, and sealing systems for flexible and rigid snack formats, particularly in multi-flavor and mixed pack applications.

Between 2023 and 2025, the snack packaging machine market expanded through modular designs, regional scale-ups, and performance-focused upgrades by major and mid-sized players. Syntegon launched high-speed vertical pouch machines with interchangeable heads and format-free changeovers, targeting high-throughput snack applications. Mespack introduced compact rotary systems tailored for resealable pouches, reducing downtime with quick-clean components. Nichrome India expanded localized manufacturing and deployed servo-driven machines across Southeast Asia. ILAPAK and TNA Solutions enhanced flow-wrapping systems with dual-lane configurations for multi-size snack lines. Across all segments, demand rose for precise portioning, real-time diagnostics, and compact machines supporting quick setup and SKU variety. Asia-Pacific led new installations, driven by increased snack output and evolving packaging preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.2 Billion |

| Type | Form-Fill-Seal (FFS) machines, Flow wrapping machines, Vacuum packaging machines, Cartoning machines, and Others |

| Packaging Type | Flexible and Rigid |

| Operation | Automatic and Semi-automatic |

| Application | Savory snacks, Bakery products, Confectionery, Nuts & dried fruits, and Others |

| Packaging Material | Plastic, Paper & paperboard, Metal, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Packaging Technology, IMA Group, TNA Solutions, Ishida Co., Ltd., and Syntegon Technology |

| Additional Attributes | Dollar sales by machine type (vertical form‑fill‑seal, multi-head weighers, rotary machines) and application (chips, nuts, confectionery), demand across snack manufacturers, contract packers and retail brands, led by Asia‑Pacific with North America catching up, innovation in high-speed servo automation and sustainable packaging integration. |

The global snack packaging machine market is estimated to be valued at USD 20.2 billion in 2025.

The market size for the snack packaging machine market is projected to reach USD 31.7 billion by 2035.

The snack packaging machine market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in snack packaging machine market are form-fill-seal (ffs) machines, flow wrapping machines, vacuum packaging machines, cartoning machines and others.

In terms of packaging type, flexible segment to command 61.0% share in the snack packaging machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Assessing Snack Food Packaging Market Share & Industry Trends

Snack Food Packaging Market Analysis by Flexible and Rigid Packaging Through 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Premix Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Diaper Packaging Machines Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Diaper Packaging Machines Manufacturers

Market Leaders & Share in the Sachet Packaging Machines Industry

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Doypack Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Gable Top Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA