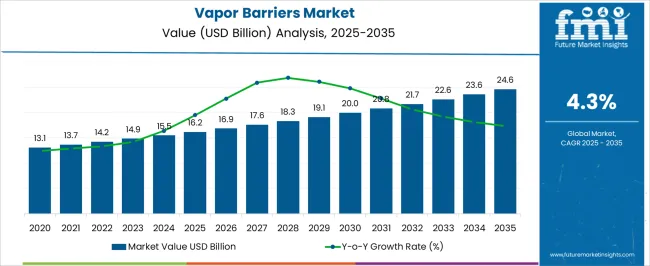

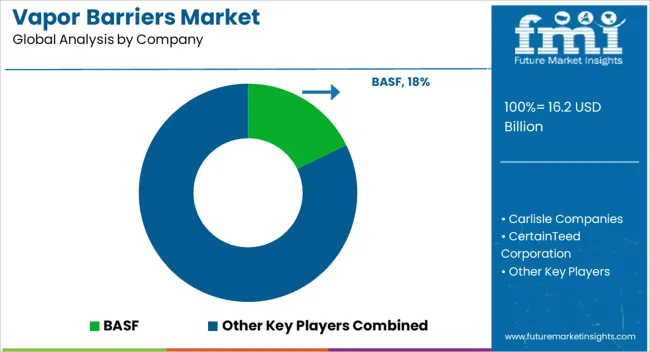

The vapor barriers market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The vapor barriers market is set for steady expansion, with its valuation projected to rise from USD 16.2 billion in 2025 to USD 24.6 billion by 2035 at a CAGR of 4.3%. Growth is shaped by the rising importance of moisture control in residential, commercial, and industrial construction projects. Vapor barriers are widely deployed to prevent moisture penetration, safeguard structural integrity, and enhance energy efficiency. Expanding urban infrastructure and strict building codes on insulation and waterproofing are reinforcing adoption across developed economies, while rapid construction in emerging regions adds further momentum.

Demand for advanced polymer-based materials such as polyethylene and polypropylene sheets is accelerating, as these provide superior resistance and longer service life. Integration of vapor barriers with insulation systems is increasingly preferred to optimize building performance. Green construction practices and rising awareness of indoor air quality also contribute to market expansion, as barriers help reduce mold and structural damage risks. However, fluctuations in raw material costs and limited awareness in underpenetrated markets remain challenges. Continuous innovation in product formulations, coupled with strong distribution networks, will define competitive differentiation in the coming years.

| Metric | Value |

|---|---|

| Vapor Barriers Market Estimated Value in (2025 E) | USD 16.2 billion |

| Vapor Barriers Market Forecast Value in (2035 F) | USD 24.6 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The vapor barriers market is experiencing steady expansion, supported by increasing demand for moisture control solutions in construction, industrial, and infrastructure projects. Industry reports and building material publications have noted that stricter building codes and energy efficiency regulations are driving the adoption of vapor barriers to prevent structural damage, mold growth, and insulation degradation caused by moisture infiltration.

Advances in barrier materials, including higher permeability resistance and improved durability, have broadened application scope across varied climatic conditions. Additionally, sustainability trends are encouraging the use of recyclable and environmentally friendly materials, influencing product development strategies.

Rising urbanization, coupled with the growth of large-scale residential and commercial construction, has further strengthened market uptake. Investments in energy-efficient building envelopes and retrofitting of existing structures are also creating long-term demand. Over the coming years, growth is expected to be led by polymer-based materials, insulation applications, and strong uptake within the construction industry, reflecting their combined role in improving building performance and longevity.

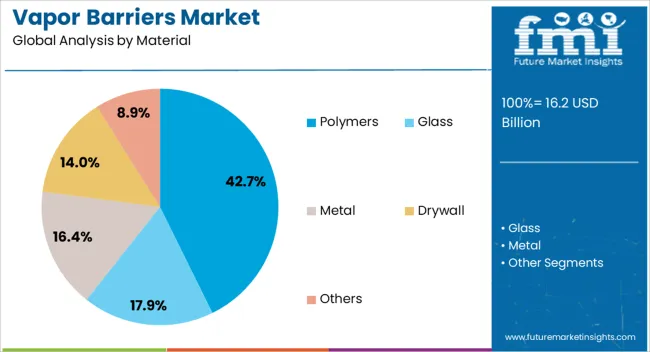

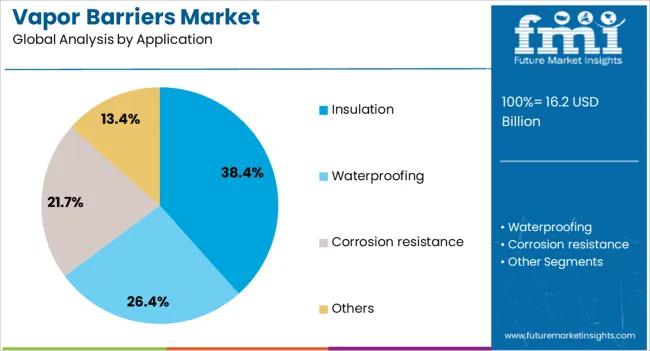

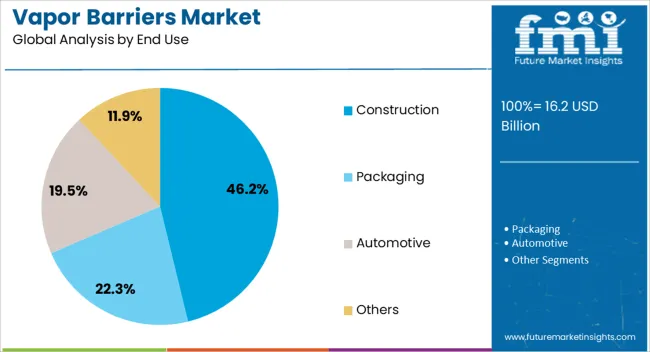

The vapor barriers market is segmented by material, application, end use, and geographic regions. By material, vapor barriers market is divided into Polymers, Glass, Metal, Drywall, and Others. In terms of application, vapor barriers market is classified into Insulation, Waterproofing, Corrosion resistance, and Others. Based on end use, vapor barriers market is segmented into Construction, Packaging, Automotive, and Others. Regionally, the vapor barriers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymers segment is projected to account for 42.7% of the vapor barriers market revenue in 2025, maintaining its leading position due to its superior moisture resistance, flexibility, and adaptability in diverse applications. Polymers such as polyethylene and polypropylene have been widely utilized for their lightweight nature, ease of installation, and cost-effectiveness compared to alternatives like metal foils or bitumen sheets.

Manufacturing advancements have enabled the development of multi-layer polymer films with enhanced puncture resistance and long-term performance under varying environmental conditions. Additionally, polymer vapor barriers can be customized in thickness and permeability ratings, meeting specific building code requirements.

Their recyclability and alignment with green building certifications have further bolstered adoption, particularly in environmentally conscious projects. These attributes, combined with their proven performance in both residential and commercial structures, ensure that the polymers segment remains the preferred choice in the market.

The insulation segment is projected to hold 38.4% of the vapor barriers market revenue in 2025, reflecting its crucial role in enhancing building energy efficiency and moisture protection. Vapor barriers are extensively integrated with insulation systems to prevent condensation within walls, roofs, and floors, thereby preserving thermal performance and extending material lifespan.

Industry updates and building science research have emphasized that improper moisture control can significantly reduce insulation efficiency, leading to higher energy costs and potential structural damage.

Polymer-based vapor barriers in insulation applications have gained preference for their ability to combine vapor resistance with ease of handling during installation. Additionally, the growth of energy retrofitting projects in older buildings has expanded demand for vapor barriers as part of upgraded insulation systems. With climate-conscious building designs and regulatory mandates promoting high-performance insulation, this application segment is expected to remain a key driver of market demand.

The construction segment is projected to contribute 46.2% of the vapor barriers market revenue in 2025, solidifying its position as the dominant end-use category. This growth is fueled by the rising volume of residential, commercial, and infrastructure projects that require effective moisture control for structural integrity and occupant comfort.

Building regulations in many regions mandate the use of vapor barriers to comply with energy efficiency and indoor air quality standards. The segment has also benefited from increased awareness among architects and contractors regarding the long-term cost savings and performance benefits of incorporating vapor barriers during construction.

Large-scale urban development projects and the expansion of smart cities are further boosting market uptake. Moreover, the demand for high-performance building envelopes in both new builds and renovations is reinforcing the construction industry’s reliance on vapor barriers, ensuring continued leadership of this segment in the overall market.

The vapor barriers market is expanding as construction industries adopt advanced moisture control solutions to protect buildings from condensation, mold, and structural degradation. These materials, often used in walls, roofs, and flooring systems, provide reliable resistance against water vapor penetration, improving thermal insulation and energy efficiency. With strict building codes emphasizing energy performance and durability, vapor barriers are being recognized as essential components across residential, commercial, and industrial projects. The shift toward high-performance building envelopes positions vapor barriers as critical elements in modern infrastructure development.

Vapor barriers are increasingly used to meet stringent energy codes and certifications such as LEED and passive house standards. Their ability to reduce air leakage and moisture transfer ensures better indoor air quality while lowering energy costs. Builders are turning to multi-layered membranes and smart barriers with variable permeability that adjust performance based on humidity conditions. This adaptability makes them suitable for diverse climates, from cold regions requiring airtight solutions to hot, humid zones needing controlled vapor diffusion. The push for energy-efficient buildings has strengthened demand, as vapor barriers directly contribute to meeting long-term performance goals and compliance benchmarks.

Aging building stock across developed regions creates opportunities for retrofitting with advanced vapor barriers. Renovation projects often require moisture protection upgrades to address condensation issues and insulation failures. Coatings, spray-applied barriers, and laminate systems are being integrated into refurbishment projects to extend the lifespan of existing buildings. Demand is also rising in infrastructure renovations, including healthcare facilities, schools, and commercial complexes where moisture control is critical to safety and comfort. The retrofit segment represents a strong growth avenue as governments incentivize energy-efficient renovations, creating new demand for advanced vapor barrier technologies.

The development of eco-friendly vapor barriers using recyclable polymers, biodegradable coatings, and low-VOC adhesives is accelerating adoption. Manufacturers are also integrating vapor control layers directly into insulation and structural panels, reducing installation complexity and improving system performance. Advances in hybrid materials and smart membranes allow for fine-tuned moisture management, reducing risks of condensation and structural damage. Production processes are being optimized for large-scale manufacturing, helping lower costs and expand product availability. As supply chains mature and more cost-effective options emerge, vapor barriers are transitioning from a niche specification to a standard building practice worldwide.

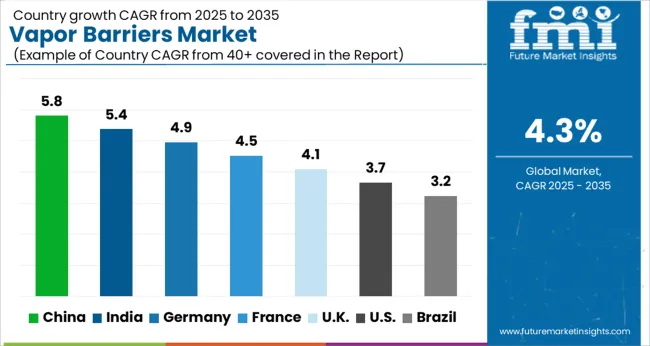

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

China is exceeding at a CAGR of 5.8% between 2025 and 2035. Rising investments in urban housing, high-rise construction, and industrial projects drive steady demand for advanced vapor control systems. Energy efficiency targets and insulation mandates are pushing builders to integrate vapor barriers into large-scale developments. Expanding infrastructure programs, coupled with stringent building performance regulations, reinforce adoption.

Expansion of commercial and residential projects raising moisture control needs

Government building codes emphasizing thermal insulation and air tightness

Widespread adoption in industrial and logistics construction projects

India is exceeding at a CAGR of 5.4%. Growing middle-class housing demand, rapid urban infrastructure upgrades, and government incentives for green buildings accelerate uptake. Developers are incorporating vapor barriers to address rising humidity challenges and to extend building lifespans. Local manufacturers are also expanding production capacity to meet regional cost-sensitive requirements.

Rising disposable incomes increasing demand for premium residential projects

Government initiatives encouraging energy-efficient construction practices

Greater acceptance of moisture protection systems in new housing developments

Germany is exceeding at a CAGR of 4.9%. Adoption is driven by strong energy efficiency regulations, renovation of older housing stock, and advanced construction practices emphasizing durability. Manufacturers are introducing eco-friendly vapor control products to comply with EU environmental guidelines. Retrofit projects for schools, healthcare facilities, and commercial complexes add to steady demand.

EU-driven climate and energy directives influencing product specifications

Focus on retrofitting aging infrastructure with moisture control systems

Innovation in recyclable and hybrid vapor barrier materials boosting acceptance

France is exceeding at a CAGR of 4.5%. Government-backed energy renovation schemes and improved awareness of moisture-related building issues drive installations. Builders are incorporating advanced multi-layer vapor membranes in both residential and commercial projects to meet compliance standards. The retrofit sector remains a vital contributor to demand.

Public funding programs supporting energy renovation and upgrades

Increased awareness of health risks tied to poor moisture management

Builders adopting variable-permeability barriers suited to diverse climates

The UK is exceeding at a CAGR of 4.1%. Market demand is shaped by strong focus on energy-efficient housing, government compliance codes, and moisture mitigation in both residential and non-residential buildings. Renovation and retrofit projects, particularly in historic properties, expand opportunities for advanced vapor barrier solutions.

Energy efficiency policies influencing adoption in residential construction

Renovation of historic and aging buildings creating retrofit demand

Manufacturers focusing on hybrid barriers offering flexible performance

The USA is exceeding at a CAGR of 3.7%. Adoption is driven by energy code compliance, heightened focus on indoor air quality, and moisture protection in commercial construction. Builders adopt vapor barriers in large-scale projects such as healthcare, education, and office complexes. Growing retrofit activity further supports steady expansion.

Adoption influenced by state-level energy and building regulations

Demand from healthcare and institutional construction projects

Rising retrofit and renovation activities increasing product penetration

Brazil is exceeding at a CAGR of 3.2%. Rising middle-class housing demand, coupled with high humidity challenges, drives the adoption of vapor control solutions. Growing construction in coastal and tropical regions requires effective barriers to prevent condensation and structural deterioration.

Climatic conditions increasing reliance on vapor barriers in housing projects

Growth in middle-income housing construction expanding adoption

Regional manufacturers introducing cost-effective options for local builders

The competitive landscape for the vapor barriers market is marked by a mix of global polymer and construction material companies, specialized barrier manufacturers, and regional players focusing on local building standards. Major players include companies such as DuPont, Sika, W. R. Grace, Georgia-Pacific, Carlisle, and Dow, which leverage their R&D, material science capabilities, and global distribution networks to supply advanced membranes, coatings, and integrated barrier systems. These firms compete on product performance—particularly permeability control, mechanical strength, durability, and compatibility with insulation and structure systems.

Regional and niche vendors differentiate through localized formulations, cost-efficiency, and ease of installation tailored to regional climates. Some specialize in retrofit or decorative barrier options for heritage buildings or irregular structures. Competition is increasingly shaped by innovation in “smart” vapor barriers that change permeability based on humidity, and hybrid systems combining barrier and insulating functions. Alliances with insulation providers, roof and wall system integrators, and architectural firms help expand reach. Quality certifications, warranties, and technical support become critical competitive levers. As demand grows for sustainable and high-performance structures, companies that can balance cost, performance, and adaptability will capture leading positions in both mature and emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.2 Billion |

| Material | Polymers, Glass, Metal, Drywall, and Others |

| Application | Insulation, Waterproofing, Corrosion resistance, and Others |

| End Use | Construction, Packaging, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Carlisle Companies, CertainTeed Corporation, Dow Chemical Company, DuPont de Nemours, Firestone Building Products, GAF Materials Corporation, GCP Applied Technologies, Honeywell, Johns Manville, Sika, and Soprema Group |

| Additional Attributes | Dollar sales vary by material type, including polyethylene, aluminum foil, bituminous sheets, and reinforced films; by application, such as roofing, walls, flooring, and foundations; by end-use industry, spanning residential, commercial, and industrial construction; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising construction activities, energy efficiency requirements, and demand for moisture protection and building durability. |

The global vapor barriers market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the vapor barriers market is projected to reach USD 24.6 billion by 2035.

The vapor barriers market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in vapor barriers market are polymers, polyethylene, polypropylene, polyvinyl chloride, others, glass, metal, drywall and others.

In terms of application, insulation segment to command 38.4% share in the vapor barriers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vaporized Hydrogen Peroxide Sterilization System Market Size and Share Forecast Outlook 2025 to 2035

Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Vapor Barrier Films Market Analysis by Material, Thickness, End-Use Industry, and Region through 2035

Vapor Degreasing Solvents Market

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Evaporative Cooling Market Size, Share, Trend & Forecast 2024-2034

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Vapor Sorption Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Evaporators Market Size, Growth, and Forecast 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Tungsten Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Conduction Vaporizers Market Analysis by Product Type, Heating Material, Sales Channel,End-User and Region 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Short Path Evaporator for Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA