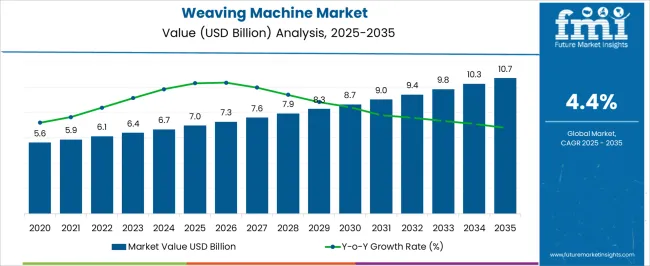

The Weaving Machine Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 10.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

In the initial phase from 2025 to 2030, the market progresses from USD 5.6 billion to USD 7.0 billion, driven by increasing demand for advanced textile machinery in apparel and home furnishing industries. This period is characterized by the modernization of textile manufacturing facilities in emerging economies, where rising consumption of fabrics fuels the adoption of automated and semi-automated weaving machines. From 2031 to 2035, the market advances further from USD 7.3 billion to USD 9.4 billion, contributing an additional USD 2.1 billion. This stage reflects growing demand for high-speed, energy-efficient, and digitally integrated weaving technologies capable of handling diverse materials such as synthetic fibers, technical textiles, and blends used in industrial applications. Innovations in programmable looms and smart weaving solutions enhance productivity and reduce operational costs, making them attractive for manufacturers. In the final phase from 2036 to 2040, the weaving machine market expands from USD 9.8 billion to USD 10.7 billion, adding USD 0.9 billion. This growth is supported by steady replacement demand, investments in eco-friendly machinery, and expansion of textile exports in Asia and Africa. Overall, the weaving machine market maintains consistent growth, underpinned by industrial modernization, technology integration, and rising global textile consumption, positioning it as a key enabler of efficiency in the fabric manufacturing ecosystem.

| Metric | Value |

|---|---|

| Weaving Machine Market Estimated Value in (2025 E) | USD 7.0 billion |

| Weaving Machine Market Forecast Value in (2035 F) | USD 10.7 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The weaving machine market is witnessing steady expansion, supported by the rapid modernization of textile manufacturing facilities and the increasing emphasis on efficiency, precision, and customization in fabric production. Technological innovations, particularly in electronic controls and automated systems, are enabling higher productivity while reducing operational downtime. The industry is transitioning toward advanced weaving technologies that allow seamless adaptation to varying yarn types, intricate patterns, and high-quality fabric output without compromising on production speed.

Increasing global demand for home textiles, apparel, and industrial fabrics is further driving investment in advanced machinery. Sustainability initiatives in the textile sector, including energy-efficient motors and reduced material wastage, are also influencing procurement preferences.

Additionally, the competitive advantage offered by integrating weaving machines with IoT-based monitoring systems is paving the way for predictive maintenance and optimized workflow management In the coming years, rising export-oriented production and the shift toward premium fabric categories are expected to further accelerate the adoption of advanced weaving solutions across established and emerging markets.

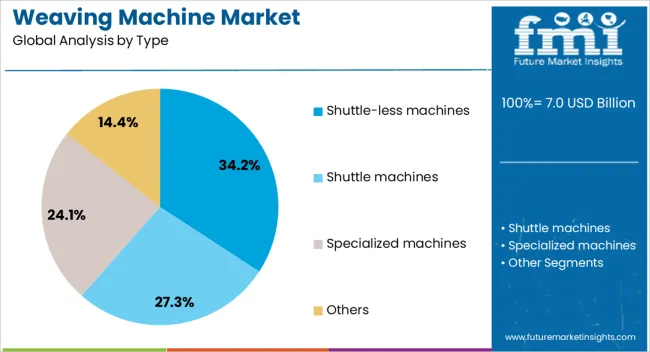

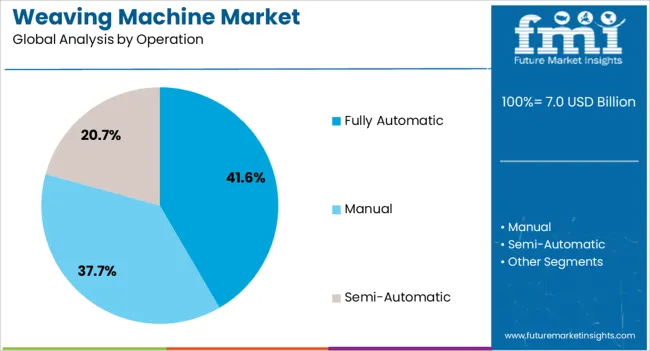

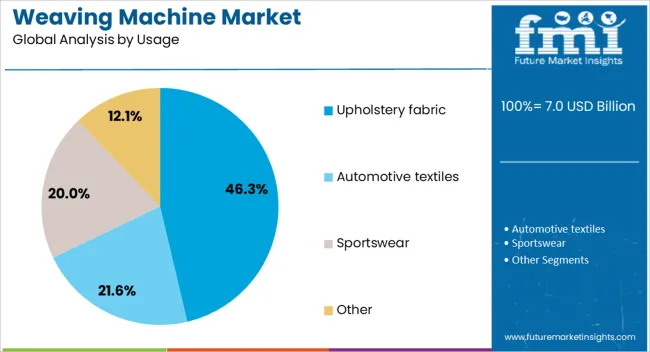

The weaving machine market is segmented by type, operation, usage, distribution channel, and geographic regions. By type, weaving machine market is divided into Shuttle-less machines, Shuttle machines, Specialized machines, and Others. In terms of operation, weaving machine market is classified into Fully Automatic, Manual, and Semi-Automatic. Based on usage, weaving machine market is segmented into Upholstery fabric, Automotive textiles, Sportswear, and Other. By distribution channel, weaving machine market is segmented into Direct and Indirect. Regionally, the weaving machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Shuttle-less machines are projected to hold 34.2% of the total revenue share in the weaving machine market in 2025, making them the leading type segment. Their dominance is being driven by superior weaving speeds, reduced vibration, and lower maintenance requirements compared to traditional shuttle machines. The capability to produce high-quality fabrics with minimal yarn breakage and consistent weaving tension has made them highly suitable for both apparel and technical textile applications.

The growing adoption of electronic jacquard and dobby attachments in shuttle-less machines has enabled the creation of complex patterns while maintaining high throughput. Additionally, these machines support greater versatility in fabric width and yarn type, allowing manufacturers to cater to diverse customer demands.

The reduction in noise levels and operational energy consumption has also contributed to their market appeal, particularly in regions focusing on sustainable textile production The combination of efficiency, precision, and adaptability has solidified shuttle-less machines’ leadership in the weaving machinery landscape.

Fully automatic weaving machines are expected to account for 41.6% of the total revenue share in the weaving machine market by 2025, reflecting their strong position in operational efficiency. The segment’s growth is influenced by the increasing need for high-volume, uninterrupted production runs in textile manufacturing facilities. Automated warp and weft insertion systems, coupled with real-time monitoring and fault detection features, have significantly reduced downtime and improved fabric quality consistency.

The capability to integrate with digital control interfaces and IoT-enabled platforms allows predictive maintenance and streamlined workflow management, further enhancing operational productivity. Fully automatic systems minimize the dependency on skilled labor, addressing workforce shortages in several textile-producing regions.

Their ability to adapt weaving parameters swiftly without manual intervention supports rapid order customization and short production cycles As competitive pressures in textile exports intensify, the adoption of fully automatic weaving machines is expected to continue rising, driven by the dual benefits of quality assurance and cost efficiency.

The upholstery fabric usage segment is projected to represent 46.3% of the weaving machine market revenue share in 2025, highlighting its significant contribution to overall demand. Growth in this segment is being driven by the rising consumption of home furnishings, automotive interiors, and commercial upholstery across global markets.

The need for durable, aesthetically appealing, and customizable fabrics has encouraged manufacturers to invest in advanced weaving machines capable of producing a variety of textures, designs, and patterns with high precision. The capability to work with thicker yarns and blended materials while maintaining uniform quality has enhanced the relevance of weaving machines in upholstery fabric production.

Increased urbanization and rising disposable incomes have fueled demand for premium home and commercial interiors, further supporting this segment Additionally, global trends in hospitality and office space design are favoring unique, high-quality upholstery fabrics, making weaving machinery investments crucial for manufacturers aiming to meet evolving consumer preferences.

Automotive portable LFP batteries are gaining market share through their durability, safety, and adaptability across diverse automotive applications. Growth is supported by OEM adoption, aftermarket opportunities, and their suitability for off-grid mobility and auxiliary power systems.

Automation has become a central driver in the weaving machine industry, with manufacturers adopting computerized control systems, sensors, and advanced software for higher precision. Automated looms enable real-time monitoring, pattern customization, and improved defect detection, which minimizes waste and enhances productivity. The shift toward digitalized weaving has empowered textile producers to achieve faster turnaround times, greater consistency, and flexibility in handling varied fabric types. Demand for automated weaving solutions has grown stronger in apparel, home textiles, and industrial fabrics, as producers seek to balance cost efficiency with improved quality. Investments in automation are therefore seen as essential for maintaining competitiveness in both large-scale textile hubs and smaller, specialized weaving operations.

The weaving machine market has witnessed significant traction in technical textiles, where durability and performance are essential. Machines are being deployed for fabrics used in automotive upholstery, industrial filtration, medical textiles, and geotextiles. Technical weaving requires high-tensile strength fabrics with intricate patterns, pushing manufacturers to develop specialized weaving technologies. Air-jet and rapier looms are increasingly favored for their speed and adaptability to complex materials. Growth in end-user industries has encouraged investments in machinery capable of delivering fabrics that meet strict safety, strength, and reliability requirements. This diversification into technical textiles has elevated weaving machines beyond traditional clothing applications, creating fresh revenue streams for manufacturers and textile producers worldwide.

Energy consumption in textile manufacturing has been a long-standing challenge, and weaving machines are now being designed with energy efficiency as a key consideration. Manufacturers are introducing high-speed looms with optimized airflow, lower friction components, and reduced vibration systems that significantly cut power requirements. These improvements are not only reducing operational costs for textile producers but also enhancing machine durability and lifespan. Energy-efficient designs are in high demand, especially in large textile mills where savings translate into substantial cost advantages. The integration of efficient looms has also supported consistent fabric quality at higher production speeds. These dynamics continue to strengthen energy-conscious weaving machine adoption across global textile hubs.

Competition in the weaving machine market has intensified, with global and regional players focusing on innovation, after-sales service, and customization to differentiate themselves. Larger companies are expanding through acquisitions and strategic alliances, integrating weaving solutions with broader textile machinery portfolios. Smaller manufacturers are carving out niches by offering cost-competitive machines targeted at regional markets. There has also been a noticeable increase in R&D spending, focusing on smart weaving solutions with IoT connectivity and remote monitoring. This consolidation trend has enhanced the global footprint of leading brands, while smaller players emphasize affordability. The combination of mergers, partnerships, and competitive pricing strategies continues to reshape the weaving machine market dynamics.

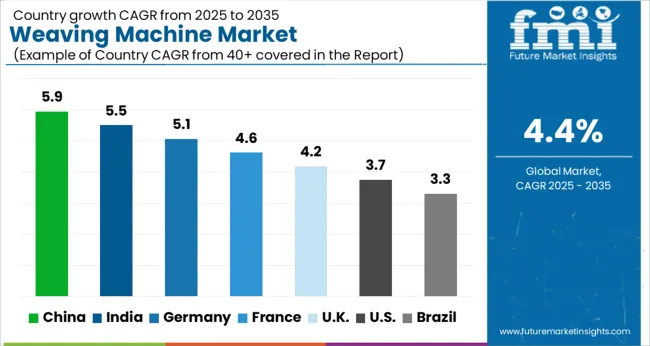

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The weaving machine market is expected to expand globally at a CAGR of 4.4% from 2025 to 2035, supported by rising demand in apparel, home textiles, and technical fabric production. China leads with a CAGR of 5.9%, driven by large-scale textile manufacturing clusters, export-oriented production, and rising adoption of high-speed looms. India follows at 5.5%, supported by strong government initiatives, expanding domestic consumption of textiles, and modernization of weaving units across regional hubs. France grows at 4.6%, leveraging its luxury fashion industry, strong presence of design-led weaving, and demand for high-value fabrics. The United Kingdom posts 4.2%, shaped by technical textile applications and the revival of niche weaving clusters. The United States records 3.7%, with steady demand from industrial fabrics, upholstery, and automation-driven weaving adoption. The analysis highlights Asia’s dominance in weaving machine deployment, while Europe and North America maintain their relevance through premium textiles, technical fabric applications, and machinery upgrades.

China is projected to achieve a CAGR of 5.9% during 2025–2035, surpassing the global average of 4.4%. This improvement builds upon a CAGR of around 5.2% between 2020–2024, when the industry was driven by large-scale fabric exports, capacity expansions in apparel clusters, and strong domestic consumption. The acceleration into the next phase is supported by automation in shuttle-less looms, rising adoption of energy-efficient weaving systems, and technical fabric applications in automotive and construction. Export competitiveness has remained central to China’s position, while domestic demand for home furnishing textiles has added further growth. With investments in digital monitoring and high-speed air-jet looms, China continues to anchor global weaving machine capacity.

India is expected to record a CAGR of 5.5% during 2025–2035, higher than the global average of 4.4%. From 2020–2024, growth stood closer to 4.9%, shaped by domestic consumption of apparel fabrics, expansion of textile parks, and early adoption of automated looms. The rise in CAGR is linked to supportive government initiatives, low-cost labor advantages, and increasing exports of woven fabrics to Europe, Africa, and the Middle East. With strong two-tier weaving clusters, India is balancing between small-scale power loom units and industrial-scale automated weaving centers. Upgradation of legacy looms has become a priority, while exporters are driving demand for machines that can meet high-quality compliance standards.

France is forecasted to grow at a CAGR of 4.6% during 2025–2035, above its earlier rate of 4.1% during 2020–2024. The uplift is largely shaped by the luxury apparel sector, which demands high-quality woven fabrics and intricate pattern designs. The earlier phase showed moderate growth as premium fashion remained the mainstay, but the upcoming period reflects diversification into technical textiles such as automotive upholstery and medical fabrics. France’s design-led weaving centers are adopting advanced shuttle-less looms to address premium customers, while boutique textile units focus on customization and exclusivity. Exports of luxury fabrics continue to support steady machine upgrades, making weaving machines a vital element of the French textile identity.

The United Kingdom is projected to post a CAGR of 4.2% during 2025–2035, rising from 3.8% in 2020–2024. The increase reflects growing demand for weaving machines in niche textile clusters, particularly in technical textiles and high-performance fabrics. Earlier growth remained limited due to slower investments in large-scale textile production and reliance on imports for basic fabrics. The step-up has been enabled by machine upgrades, energy-efficient designs, and integration of weaving technology into advanced materials manufacturing. UK-based textile firms are investing in weaving systems for aerospace, defense, and automotive applications, alongside high-value fashion fabrics. This diversification strengthens long-term prospects, even though the country remains a smaller-scale weaving hub compared to Asia.

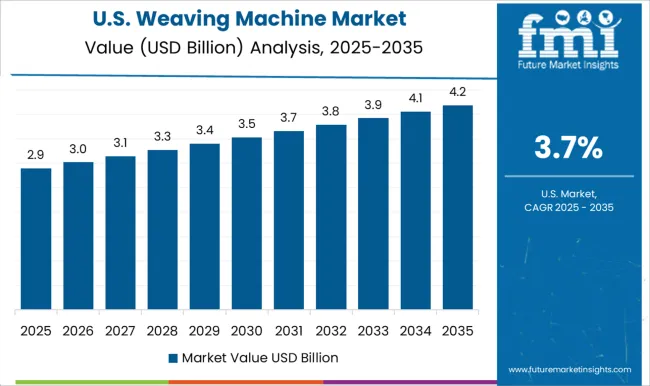

The United States is set to register a CAGR of 3.7% during 2025–2035, improving from 3.2% in 2020–2024, though remaining below the global average. The earlier period reflected sluggish growth due to mature consumer markets and higher reliance on imports for apparel textiles. The rise is attributed to steady demand for weaving machines in industrial applications such as filtration fabrics, protective textiles, and upholstery for automotive and furniture. Adoption of high-speed rapier looms and energy-efficient weaving solutions is increasing in technical fabric units. The USA weaving machine market, while smaller in volume, is evolving through focus on industrial fabrics rather than consumer apparel, ensuring relevance in global supply chains.

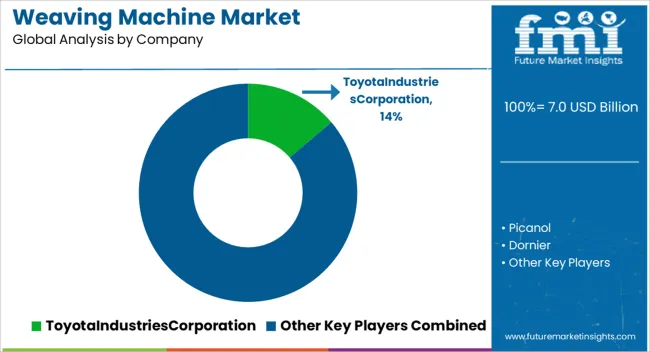

The weaving machine market features a diverse mix of established global manufacturers and regional specialists competing on technology, efficiency, and customization. Toyota Industries Corporation maintains a leading role with high-speed air-jet and water-jet looms, supported by advanced automation and strong after-sales services. Picanol and Dornier emphasize precision and energy-efficient weaving systems, particularly in technical and high-performance textiles. KARLMAYER dominates in warp preparation and knitting-related solutions, offering integrated systems that complement weaving operations. Itema and Staubli compete strongly with shuttle-less weaving technologies, enhancing productivity across apparel and industrial textile production.

Saurer Group leverages its broad textile machinery portfolio, focusing on weaving preparation and spinning integration, while Fong’s National Engineering provides cost-effective machinery solutions tailored to Asian markets. Lohia Corp Limited specializes in weaving machines for polypropylene and technical fabrics, securing a significant niche in industrial textiles. Zhejiang Hengtai and RIFA are strengthening their global position by scaling affordable weaving machine production for emerging economies. Vamatex has built strong credibility in rapier weaving solutions, while Weaving Machinery Solutions delivers tailored systems for niche segments. Nisshinbo Industries brings expertise in precision machinery, ensuring high-quality fabric output, whereas Laxmi Group focuses on accessible, price-competitive looms catering to South Asian producers.

Competitive strategies across these players include advancing shuttle-less technologies, investing in automation, and expanding regional service networks. The industry is seeing partnerships with textile manufacturers to develop specialized weaving solutions, while companies also focus on digital monitoring, energy efficiency, and modular loom designs. With competition intensifying, manufacturers are differentiating through a balance of innovation, affordability, and global reach.

Toyota Industries Corporation

Picanol

Dornier

KARL MAYER

Itema S.p.A.

Stäubli

Saurer Group

Fong’s National Engineering Co. Ltd.

Lohia Corp Limited

Zhejiang Hengtai Weaving Machinery Co., Ltd.

Vamatex (now part of Itema Group)

Weaving Machinery Solutions

Nisshinbo Industries, Inc.

Laxmi Group

RIFA Textile Machinery (RIFA Group)

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Shuttle-less machines, Shuttle machines, Specialized machines, and Others |

| Operation | Fully Automatic, Manual, and Semi-Automatic |

| Usage | Upholstery fabric, Automotive textiles, Sportswear, and Other |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Industries Corporation; Picanol; Dornier (Lindauer DORNIER); KARL MAYER; Itema (incl. Vamatex); Stäubli; Saurer Group; Fong’s National Engineering; Lohia Corp; Zhejiang Hengtai; RIFA; Nisshinbo Industries; Laxmi Group; Weaving Machinery Solutions. |

| Additional Attributes | Dollar sales, share, CAGR, regional textile demand, adoption of shuttle-less looms, penetration in technical textiles, pricing benchmarks, competitive moves, supply chain risks, after-sales service trends. |

The global weaving machine market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the weaving machine market is projected to reach USD 10.7 billion by 2035.

The weaving machine market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in weaving machine market are shuttle-less machines, shuttle machines, specialized machines and others.

In terms of operation, fully automatic segment to command 41.6% share in the weaving machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Glazed Kraft Paper Market Growth - Demand & Forecast 2024 to 2034

Machine Condition Monitoring Market Insights – Trends & Forecast 2024-2034

Asia Pacific Machine Glazed Paper Market Trends & Forecast 2024-2034

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA