The weight loss and obesity management market is projected to expand steadily from USD 16.3 billion in 2025 to USD 54.4 billion by 2035, advancing at a CAGR of 12.8%. This growth reflects rising global obesity prevalence, increasing health awareness, adoption of personalized weight loss programs, and advances in both pharmaceutical and device-based obesity management solutions.

By 2030, the market is forecasted to reach USD 29.8 billion, showing strong growth across the first half of the period. The absolute dollar growth between 2025 and 2035 is expected to be USD 38.1 billion, indicating significant expansion driven by demand for effective weight loss therapies, lifestyle management, and surgical options. Growth is expected to be back-loaded as greater penetration of minimally invasive procedures, telehealth-based coaching, and digital health platforms overcome earlier market barriers. Increasing investments in R&D, government health initiatives, and rising disposable income in emerging markets such as India and China also contribute to this upward trajectory.

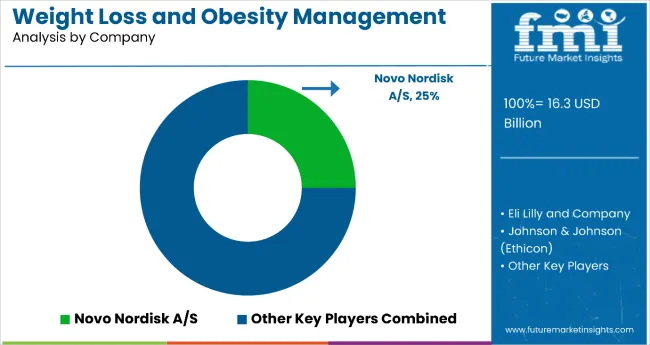

Key companies in the market are consolidating their positions by scaling production capacities and investing in innovations focused on personalized therapies, technology integration, and minimally invasive solutions. Leading companies like Novo Nordisk, Eli Lilly, Johnson & Johnson, Medtronic, and Allurion Technologies are driving growth through development and launch of GLP-1 agonists, bariatric surgery devices, and digital health platforms. Their innovation pipelines emphasize a shift toward combined pharmaceutical and device-based treatments, integration of telehealth and AI for personalized weight management, and expansion into emerging markets with tailored products.

The market accounts for 41% of the dietary supplements market, driven by demand for appetite control, metabolism boosters, and natural fat burners. It accounts for around 34% of the fitness and wellness nutrition market, supported by protein shakes, low calorie bars, and functional beverages. The market contributes nearly 29% to the medical weight management programs market, particularly for patients requiring structured interventions. It accounts for close to 25% of the prescription anti-obesity drugs market, where novel therapies are prescribed to meet clinical needs. The share in the digital health and lifestyle apps market reaches about 3%, reflecting preference for personalized coaching and behavior tracking platforms.

The market is undergoing structural change driven by increasing consumer focus on holistic weight control solutions. Advanced pharmacological therapies, meal replacements, and telehealth consultations have expanded treatment options while reducing dependency on invasive bariatric procedures. Manufacturers are introducing customized formulations with plant-based ingredients, functional fibers, and low glycemic blends tailored for specific population groups. Strategic partnerships between pharmaceutical companies, digital health startups, and nutrition brands have accelerated adoption of hybrid care models. Personalized nutrition, AI driven health tracking, and preventive healthcare positioning have widened acceptance, forcing conventional supplement makers and clinical providers to adapt to integrated, consumer centric solutions.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 16.3 billion |

| Forecast Value in 2035 (F) | USD 54.4 billion |

| Forecast CAGR (2025 to 2035) | 12.8% |

The market is expanding due to increasing consumer awareness about the health risks associated with obesity, such as diabetes, heart disease, and hypertension. National government campaigns, widespread media coverage, scientific research, and easy access to health information through the internet and social media platforms have significantly boosted public consciousness about obesity prevention and control.

Advancements in technology, especially the expansion of digital health platforms like mobile apps, wearable fitness trackers, virtual coaching, and online weight loss programs, are revolutionizing how individuals manage weight. These tools support personalized, accessible, and continuous weight management, which is driving market growth.

The market is also propelled by the rising adoption of pharmacological treatments, including innovative drugs like GLP-1 receptor agonists, which offer effective options for managing moderate to severe obesity.

Geographically, the Asia Pacific region is expected to experience the fastest growth due to rapid urbanization, increased disposable incomes, and evolving lifestyles in countries such as China and India. Government health initiatives and private sector healthcare improvements contribute to enhanced access to advanced weight loss treatments.

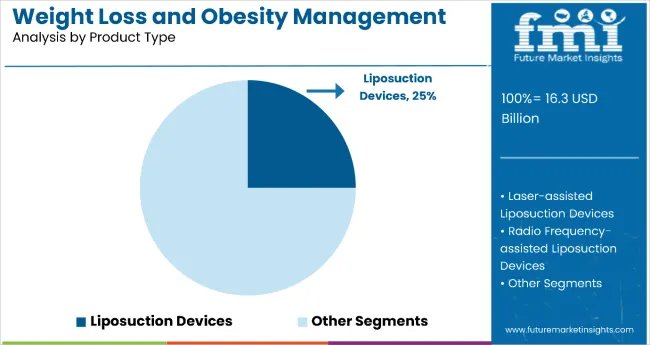

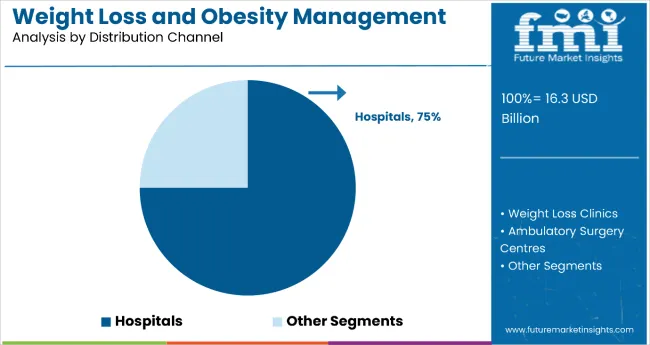

The market is segmented by product type, distribution channel, and region. By product type, the market is categorized into liposuction devices, laser-assisted liposuction devices, radio frequency-assisted liposuction devices, ultrasound-assisted liposuction devices, bariatric stapling devices, gastric bands, gastric balloon systems, gastric emptying systems, gastric electrical stimulation systems. Based on distribution channel, the market is divided into hospitals, weight loss clinics, ambulatory surgery centres. Regionally, the market is classified into North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

The liposuction devices segment holds an estimated 25% market share of the global weight loss and obesity management market as of 2025. This is the largest share among the product types, reflecting its position as the most lucrative and widely adopted category within the market.This segment's growth is driven by increasing demand for minimally invasive body contouring and fat reduction procedures as aesthetic awareness rises globally. Among these, laser-assisted, radio frequency-assisted, and ultrasound-assisted liposuction devices are gaining rapid traction due to their enhanced safety profiles, reduced recovery times, and improved patient outcomes.

The segment benefits from technological innovations such as precision targeting, reduced invasiveness, and combination therapies, attracting both medical professionals and consumers seeking effective alternatives to traditional surgical methods. Additionally, growing disposable incomes and societal trends favoring body image enhancement contribute to segment expansion. While bariatric stapling devices and gastric balloon systems also represent significant opportunities, liposuction devices maintain supremacy due to their broad application span, evolving technology, and acceptance across diverse age groups and geographies.

Hospitals dominate the weight loss and obesity management distribution channel with 75% market share in 2025, largely due to their capacity to provide comprehensive, multidisciplinary care. These institutions offer a broad spectrum of services including initial diagnosis, treatment planning, surgical procedures such as bariatric surgeries (gastric bypass, sleeve gastrectomy, adjustable gastric band), pharmaceutical therapies, and ongoing long-term follow-up care. Hospitals have the infrastructure, advanced technology, and specialized multidisciplinary teams comprising bariatric surgeons, endocrinologists, dietitians, and psychologists to manage complex cases safely and effectively.

They are equipped for major surgical interventions that require hospitalization and intensive monitoring, which cannot be accommodated in outpatient facilities. Additionally, hospitals integrate nutritional counseling, behavioral therapy, and physical rehabilitation programs, providing a holistic approach to weight loss. This full-service model positions hospitals as the preferred destination for patients seeking effective, medically supervised weight loss solutions, thereby driving their dominant share and pivotal role in industry growth.

Rising awareness about obesity-related health risks, including diabetes and cardiovascular diseases, is a primary driver of the Weight Loss and Obesity Management Market from 2025 to 2035. Growing consumer demand for effective, personalized weight loss solutions is propelling investments in advanced pharmaceuticals, minimally invasive surgical procedures, and digital health platforms. Increasing adoption of GLP-1 receptor agonists and non-invasive fat reduction treatments is expanding market opportunities.

Growing Consumer Health Awareness Drives Market Growth

The steady rise in health consciousness among consumers is amplifying demand for safe, effective, and accessible weight management therapies. Telehealth and AI-powered tools enhance personalized care, enabling broader reach and improved adherence to treatment plans. Additionally, a shift towards holistic lifestyle management encompassing diet, exercise, and behavioral therapy complements pharmaceutical and surgical interventions.

Innovation in Product Development Expands Market Opportunities

Technological innovations ranging from enhanced drug formulations to advanced surgical devices like laser- and radio frequency-assisted liposuction are enhancing treatment efficacy, safety, and patient satisfaction. Market players prioritizing R&D and product diversification, including digital therapeutics and combination therapies, are well-positioned for sustained growth. Expansion in emerging economies with rising obesity prevalence further supports market momentum.

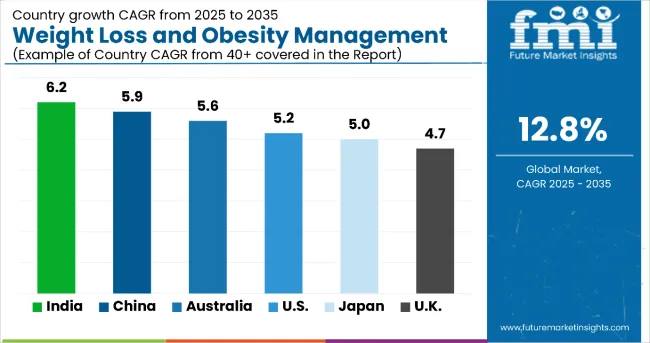

| Countries | CAGR (%) |

|---|---|

| India | 6.2 |

| China | 5.9 |

| Australia | 5.6 |

| USA | 5.2 |

| Japan | 5.0 |

| UK | 4.7 |

The weight loss and obesity management market is projected to grow at a strong CAGR globally, reflecting rising obesity rates and increasing health consciousness. The USA market is expected to grow at 5.2% CAGR, supported by advanced healthcare infrastructure, insurance coverage, and digital health adoption. Japan follows closely with 5.0% CAGR, driven by government health initiatives and growing consumer awareness. Australia shows promising growth at a 5.6% CAGR, helped by rising obesity and expanding treatment accessibility. China, with a rapid urban lifestyle shift, surpasses many with a 5.9% CAGR. India leads the pack with a high CAGR of 6.2%, fueled by increasing obesity prevalence, telemedicine growth, and affordable treatments. The UK grows steadily at 4.7%, supported by NHS programs and private clinics.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

The USA weight loss and obesity management market is projected to grow at a CAGR of 5.2% from 2025 to 2035, supported by a sophisticated healthcare system and strong R&D investments. The USA leads globally with advanced infrastructure enabling pharmaceutical, surgical, and telehealth innovations. Insurance coverage and government-backed initiatives accelerate adoption, while rising public health awareness sustains demand. Obesity prevalence and related lifestyle diseases create steady treatment needs, balancing preventive and therapeutic approaches. Key players headquartered in the USA aggressively drive innovation and patient-centric solutions, while digital health tools enhance personalization and adherence across diverse populations.

The weight loss and obesity management market in Japan is forecast to grow at a CAGR of 5.0% between 2025 and 2035, driven by an aging population and increasing chronic disease prevalence. Despite lower obesity rates than Western nations, Japan’s mature healthcare infrastructure ensures broad adoption of preventive and therapeutic programs. Government emphasis on preventive medicine fosters stable demand, while pharmacological therapies with proven efficacy see wide usage. Multidisciplinary teams integrate surgery, medication, and behavioral approaches, supported by technology-driven remote monitoring. Patient adherence remains relatively high, ensuring strong outcomes. Strict quality and safety regulations further reinforce consistent growth and high treatment standards.

Sales of weight loss and obesity management in Australia are projected to register a CAGR of 5.6% from 2025 to 2035, supported by rising obesity prevalence and increasing health awareness. Australia’s strong healthcare infrastructure, alongside government campaigns promoting healthy lifestyles, ensures widespread access to advanced treatments including pharmaceuticals, surgery, and digital health solutions. Consumer demand favors minimally invasive procedures and personalized weight management programs. Telehealth and e-commerce expand service reach across urban and regional populations, while collaboration between public agencies and private providers strengthens preventive healthcare. The expanding role of digital solutions supports holistic management and long-term disease prevention.

Revenue from weight loss and obesity management in the UK is expected to grow at a CAGR of 4.7% during 2025-2035, supported by NHS initiatives and private sector expansion. NHS-backed programs broaden access to treatments, while anti-obesity drugs are gaining wider acceptance. Private clinics complement public offerings with specialized solutions. Digital health platforms improve personalization, adherence, and patient outcomes. Patient education and engagement enhance treatment effectiveness, while funding reforms expand insurance coverage. Research-driven innovations strengthen therapeutic advancements, supported by coordinated healthcare delivery models that enable long-term obesity management and prevention.

Demand for weight loss and obesity management in China is forecast to expand at a CAGR of 5.9% through 2035, fueled by urbanization, lifestyle shifts, and rising obesity prevalence. Strong government campaigns targeting obesity prevention stimulate demand. Rapid expansion of bariatric surgery centers addresses rising patient volumes, while e-commerce and telemedicine platforms broaden accessibility. Higher disposable incomes enhance affordability of advanced therapies, while collaborations between global and local players diversify offerings. Growing preference for pharmaceuticals and minimally invasive procedures underscores consumer demand, while integration with chronic disease management systems supports holistic and sustainable growth.

Sales of weight loss and obesity management in India are projected to grow at a CAGR of 6.2% from 2025 to 2035, making it one of the fastest expanding globally. Rising obesity and diabetes prevalence is driving treatment demand, supported by rapid improvements in urban healthcare infrastructure. Affordable bariatric surgeries are attracting more patients, while government and NGO programs promote preventive health awareness. Telemedicine is bridging healthcare access gaps in rural and semi-urban areas, while private providers launch innovative treatments and digital health services. Rising disposable incomes and cultural acceptance of weight management create strong momentum for future expansion.

The global obesity management and metabolic health market is moderately consolidated, with leading players differentiating themselves through pharmaceutical innovation, medical device development, and integrated digital health ecosystems. Novo Nordisk A/S and Eli Lilly and Company dominate the landscape, driven by their advanced GLP-1 receptor agonist therapies and strong clinical pipelines targeting obesity, diabetes, and related metabolic disorders. Johnson & Johnson (Ethicon US, LLC) and Medtronic plc play pivotal roles through their surgical and minimally invasive devices, offering effective bariatric and metabolic intervention options.

Allurion Technologies, Reshape Lifesciences Inc., and Aspire Bariatrics Inc. contribute through innovative non-surgical weight-loss devices and digital monitoring platforms, enhancing patient adherence and long-term outcomes. Meanwhile, Pfizer Inc., F. Hoffmann-La Roche Ltd., and GlaxoSmithKline plc leverage global R&D and commercialization capabilities to expand into metabolic therapeutics and lifestyle-related treatment portfolios.

Key competitive strengths include robust R&D investment, regulatory compliance, and broad distribution networks. Entry barriers remain moderate due to the high cost of clinical trials, complex safety regulations, and the requirement for sustained efficacy evidence. Future competitiveness will hinge on personalized treatment approaches, telehealth integration, and sustainable manufacturing practices aligned with evolving global healthcare priorities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 16.3 billion |

| Product Type | Liposuction Devices, Laser-assisted Liposuction Devices, Radio Frequency-assisted Liposuction Devices, Ultrasound-assisted Liposuction Devices, Bariatric Stapling Devices, Gastric Bands, Gastric Balloon Systems, Gastric Emptying Systems, Gastric Electrical Stimulation Systems |

| Distribution Channel | Hospitals, Weight Loss Clinics, and Ambulatory Surgery Centres |

| Regions Covered | North America, Latin America, Asia Pacific, Europe, Middle East & Africa |

| Countries Covered | United States, Mexico, Canada, Germany, Brazil, China, India, Japan, South Korea, France, Australia, UK, 40+ others |

| Key Companies Profiled |

Novo Nordisk A/S, Eli Lilly and Company, Johnson & Johnson (Ethicon US, LLC), Medtronic plc, Allurion Technologies, Pfizer Inc., F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Reshape Lifesciences Inc., Aspire Bariatrics Inc. |

| Additional Attributes | Dollar sales by product type and distribution channel, penetration of non-invasive procedures, growth in telehealth services, rising consumer health awareness, evolving regulatory frameworks, and adoption of personalized weight management therapies |

The global weight loss and obesity management market is estimated to be valued at USD 16.3 billion in 2025.

The market size for weight loss and obesity management is projected to reach USD 54.4 billion by 2035.

The weight loss and obesity management market is expected to grow at a 12.8% CAGR between 2025 and 2035.

Liposuction devices are projected to lead in the weight loss and obesity management market with 25% share in 2025.

In terms of distribution channel, hospitals are projected to command 75% share in the weight loss and obesity management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Weight Training Market Analysis - Size, Share, and Forecast 2025 to 2035

Weight Management Supplement Market Analysis by Product Type, Form and Sales Channel Through 2035

Weight Management Market Trends – Growth, Demand & Forecast 2025 to 2035

Weight Management Dog Food Market

Weight Loss Supplements Market – Growth, Demand & Health Trends

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Drop Weight Tear Tester Market

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Canine Weight Loss Drugs Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ultra-High Molecular Weight Polyethylene Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA