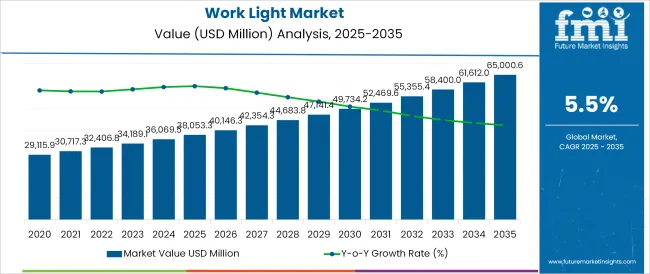

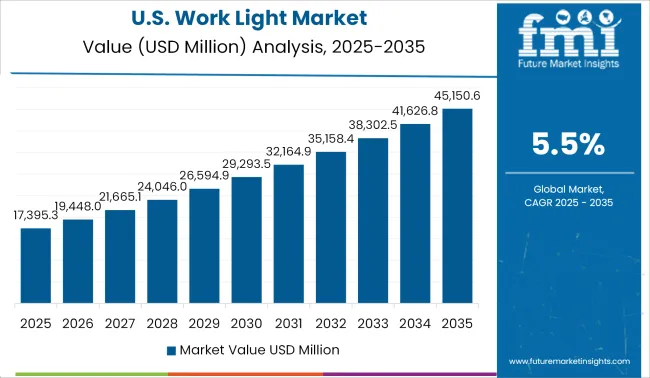

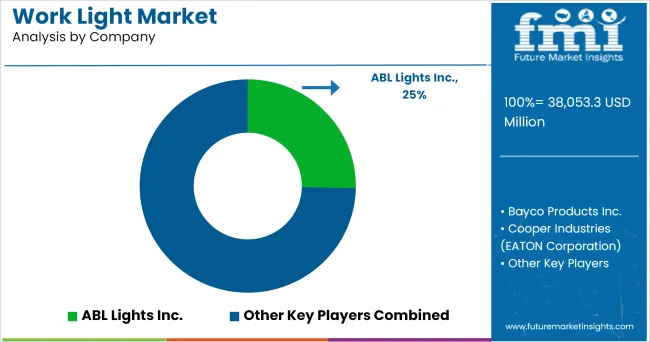

The Work Light Market is estimated to be valued at USD 38,053.3 million in 2025 and is projected to reach USD 65,000.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The work light market is expanding steadily, driven by the growing demand for portable and energy efficient lighting solutions across industrial and commercial sectors. Industry announcements and product innovation pipelines have highlighted a focus on rugged, long lasting work lights that can withstand harsh environments.

Increased activity in infrastructure projects, automotive repairs, and manufacturing operations has created sustained demand for reliable illumination tools. Advancements in LED technology and battery performance have improved energy efficiency and operational runtime, supporting wider adoption of cordless lighting solutions.

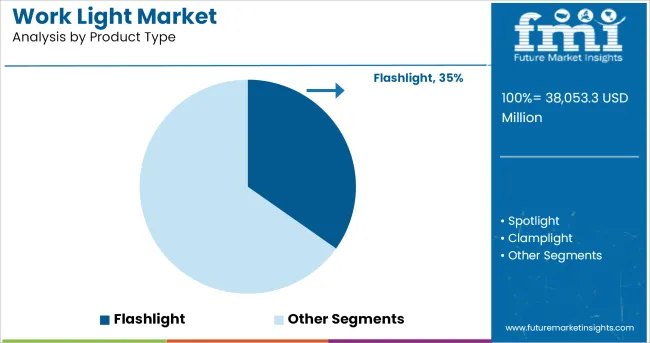

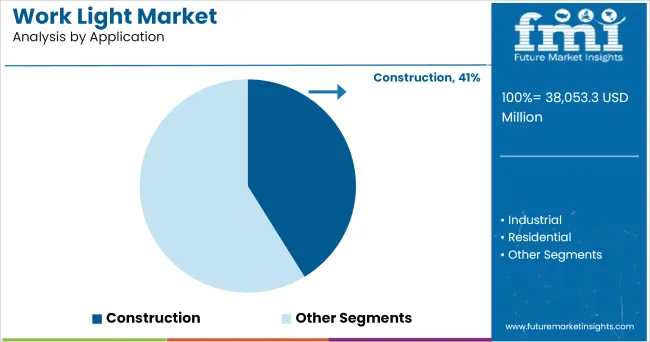

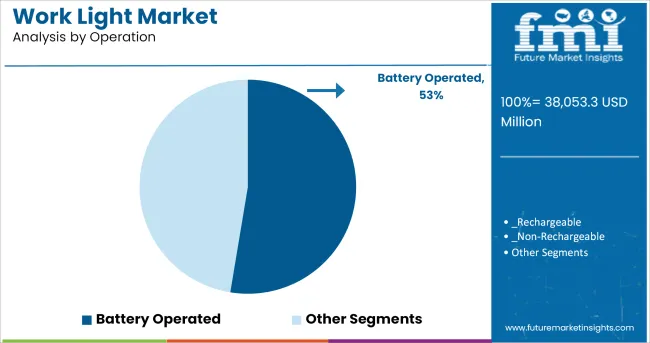

Furthermore, regulatory standards emphasizing workplace safety have reinforced the importance of proper lighting in construction and industrial environments. Manufacturers are also addressing ergonomic design, compactness, and water resistance in new product launches. Future market growth is anticipated through continued investment in smart lighting technologies and rechargeable power solutions. Segmental momentum is led by Flashlights in product type, Construction in application, and Battery Operated models in operation, reflecting end user preferences for portability, durability, and ease of use.

The market is segmented by Product Type, Application, Operation, and Sales Channel and region. By Product Type, the market is divided into Flashlight, Spotlight, Clamplight, Lantern, and Others. In terms of Application, the market is classified into Construction, Industrial, Residential, and Others. Based on Operation, the market is segmented into Battery Operated, Rechargeable, Non-Rechargeable, and Plug-in.

By Sales Channel, the market is divided into Supermarkets/Hypermarkets, Specialty Stores, Wholesalers/Distributors, Independent Retail Stores, Online Retailers, Convenient Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Flashlight segment is projected to contribute 34.8% of the work light market revenue in 2025, establishing its position as the leading product type. Growth of this segment has been supported by the versatility and ease of transport offered by flashlights, making them essential for both professional and personal applications.

Product innovations have focused on higher lumen output, beam adjustability, and rechargeable battery systems, enhancing their functionality in low light work environments. Construction workers, mechanics, and emergency responders have favored flashlights due to their ability to provide directional lighting in confined or hard to reach areas.

Additionally, the compact design and affordability of flashlights have made them accessible to a wide range of consumers beyond industrial users. With continuous improvements in durability, waterproofing, and battery longevity, the Flashlight segment is expected to retain its dominance, driven by the need for reliable, handheld lighting solutions across multiple sectors.

The Construction segment is projected to hold 41.2% of the work light market revenue in 2025, making it the largest application segment. Growth in this segment has been driven by the critical role of lighting in ensuring worker safety and task efficiency during low visibility conditions on job sites.

Construction environments often require rugged weather resistant lighting solutions capable of delivering broad illumination for large work areas and precision lighting for detailed tasks. Companies managing large scale infrastructure and residential projects have prioritized work light procurement to comply with occupational safety regulations and maintain productivity during early morning or evening hours.

Moreover, advancements in battery operated and cordless work lights have enabled flexible deployment across dynamic and remote construction sites. As global construction activity continues to rise, particularly in emerging markets, the Construction segment is expected to sustain its growth, reflecting ongoing investments in site safety and operational efficiency.

The Battery Operated segment is projected to account for 52.6% of the work light market revenue in 2025, securing its place as the leading operation mode. Growth in this segment has been driven by user demand for cordless convenience and mobility in work environments where fixed power sources are unavailable.

Improvements in battery technology, including the adoption of lithium ion and rechargeable batteries, have extended the runtime and reliability of work lights, reducing downtime associated with frequent recharging. Field workers across construction, automotive, and emergency services have increasingly relied on battery operated work lights to perform tasks without the limitations of power cords or generators.

Additionally, the shift towards lightweight and portable designs has enhanced user comfort and flexibility. Manufacturers have introduced quick swap battery systems and USB charging capabilities, further improving product usability. As industries prioritize operational flexibility and energy efficiency, the Battery Operated segment is expected to maintain its leadership in the work light market.

Adoption of light sources has taken a significant upsurge in the market of global residential lighting sales. The sales have augmented with increasing preference of fluorescent type lights sales in the residential sector, and that share is expected to continue expanding. The preference of such lights in DIY projects by increasing number of customers who prefer working at night has driven the market in upward projections.

One of the key factors driving the worldwide market's growth is rising need of such lights in commercial construction sites. The rise of LED as well as fluorescent lights that emit high intensity rays has attracted big construction companies for their preference. Furthermore, the market is predicted to grow in response to rising corporate infrastructure across the globe, acting as a major factor in the market growth.

Apart from being more energy-efficient, LED lights to have significantly extended lifetime as compared to that of conventional ones. This has been progressively affecting the market with such lights becoming more and more appealing to the consumers. As renovations and new infrastructures are followed by new installations, preferential purchase of LED work lights has been an important trend observed in recent times.

Furthermore, the increasing preference of people for different coloured LED lights has augmented since the past few years. Not only for industrial and personal use but also people operating in different areas such as fire and emergency service stations, police departments, military operations, etc., are opting for high efficiency LED lights that provide better application than its alternatives.

Such various factors have been leading to increase in volume of sales of LED lights at different workplaces.

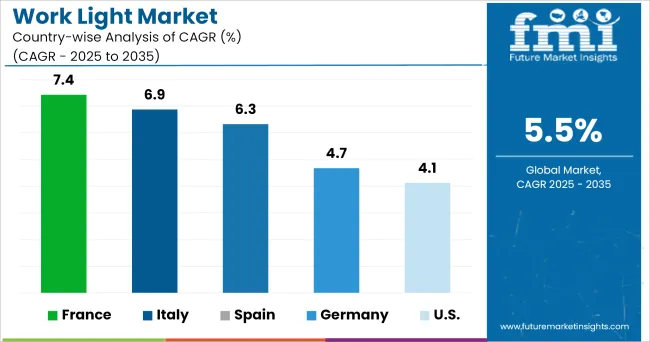

The rapidly growing infrastructure in regions like North America, as well as customer demand for high efficient lights in the region, are two major factors driving the use of work lights. Furthermore, due to a high number of work force in the region, there has been a reasonable demand for such lights recent years, and this, together with the rising number of construction projects in the region, has generated a potential market for the competitors.

One of the major trends in the USA and Canada region that is attracting customer attention is the variety of innovative products offered by the manufacturers. Moreover, the high level of penetration of key global brands in the region is another leading factor for market growth.

The preference of regional population for high intensity work lights on back of high spending power is one of the significant factor contributing towards market growth in the region.

The rapid development of technology in lights has enabled a better energy-efficient feature than traditional light sources. Being a huge producer of farm products, Europe stay ahead of the other region in terms of consumption of lights that are used at different workplaces. Also, application of lights in agricultural lighting can efficiently increase crop yields.

With an ongoing advancement in the contemporary lights, it has been assessed that Europe has emerged as a lucrative market. Moreover, countries are mandating standards that could eventually outlaw other high-wattage lighting solutions, thereby, attributing to the high sales of work lights.

Additionally, OSHA’s workplace lighting standards and regional regulations to avoid the usage of halogen and incandescent work lights are foreseen to bolster the demand for such lights.

Some of the leading manufacturers and suppliers of work light include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global work light market is estimated to be valued at USD 38,053.3 million in 2025.

The market size for the work light market is projected to reach USD 65,000.6 million by 2035.

The work light market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in work light market are flashlight, spotlight, clamplight, lantern and others.

In terms of application, construction segment to command 41.2% share in the work light market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Work Boot Market Forecast and Outlook 2025 to 2035

Workout Clothes Market Size and Share Forecast Outlook 2025 to 2035

Workforce Management Market Size and Share Forecast Outlook 2025 to 2035

Workforce Analytics Market Size and Share Forecast Outlook 2025 to 2035

Workplace Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Workstation Software Market Size and Share Forecast Outlook 2025 to 2035

Workplace Wellness Market Size and Share Forecast Outlook 2025 to 2035

Workflow Management Software (WMS) Market Size and Share Forecast Outlook 2025 to 2035

Workstation Market Trends - Growth & Forecast 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Workflow-as-a-service Market – Growth & Adoption 2025 to 2035

Work Piece Pre-heater Market Insights by Type, End Use, and Region through 2025 to 2035

Industry Share & Competitive Positioning in Work Boots Market

Market Share Insights for Workout Clothes Providers

Workflow Content Automation (WCA) Market Growth – Trends & Outlook 2023-2033

Workover Rigs Market

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

AI Workload Management Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA