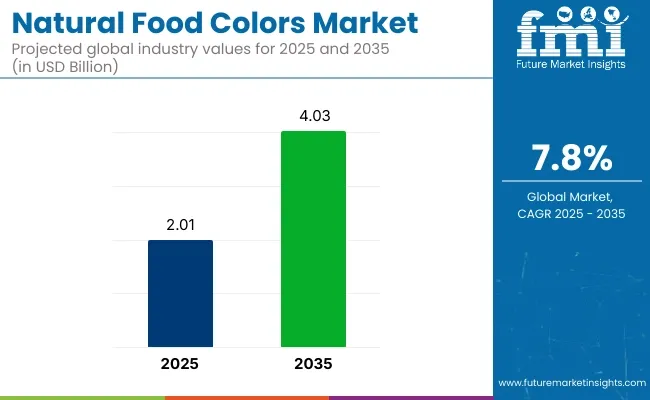

The global natural food colors market is projected to increase from USD 2.01 billion in 2025 to USD 4.03 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% during the forecast period. This growth is driven by rising consumer demand for clean-label ingredients, increasing adoption of plant-based and organic food products, and regulatory pressures phasing out synthetic food dyes.

The expanding usage of natural colorants across beverages, dairy, bakery, confectionery, and savory products further boosts the market. Additionally, innovations in extraction technologies, growing preference for non-GMO formulations, and the popularity of functional foods are expected to enhance dollar sales and market share across global regions.

Natural food colours have moved from niche to mainstream, yet average global intake remains modest. Consumers worldwide use about 17-20g of finished natural colour extracts per person in 2024.

Western Europe combines stringent labelling laws with a high share of packaged foods, making it the most color-intensive region.

United States consumers used just nearly 23 g of natural colours per capita in 2024, but spent almost as much as Western Europe.

Per-capita usage across Asia averages under 10 g, yet regional outliers reveal latent demand.

The natural food colors market is undergoing a major transformation, driven by regulatory momentum and consumer demand for clean-label ingredients. Reflecting this shift, Ricky Cassini, CEO of biotech startup Michroma, stated, “Producing food colors with fermentation is more efficient and easier to scale than agriculture or other traditional processes.”

In a significant recent development, Kraft Heinz announced in June 2025 that it will eliminate synthetic dyes from all USA products by the end of 2027, aligning with growing public health concerns and FDA-backed initiatives to phase out petroleum-based dyes. This move underscores the accelerating industry pivot toward safer, natural alternatives.

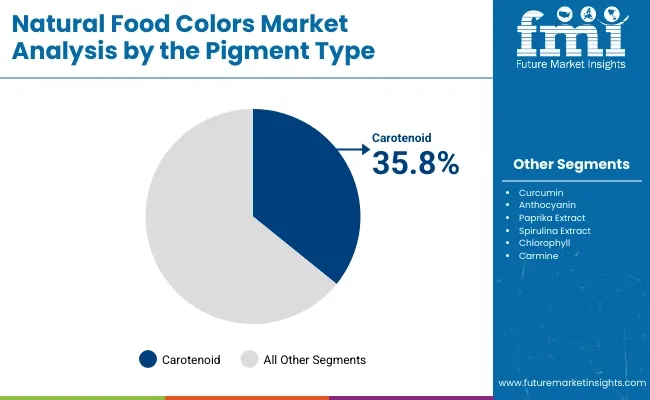

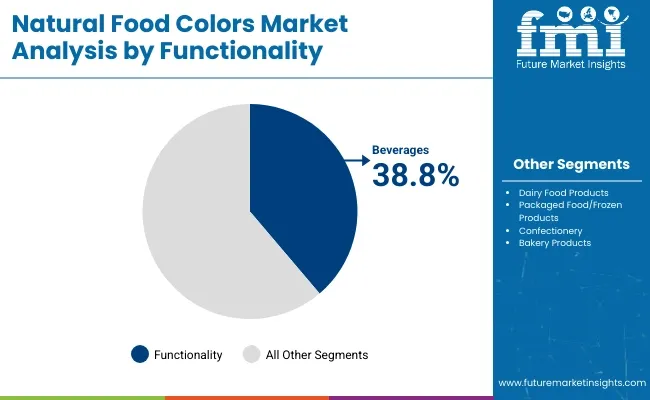

Carotenoid pigments will dominate the product segment with a 35.8% share, while beverages will lead the application segment with a 38.8% share by 2025, driven by growing demand for natural and healthier food color alternatives.

Carotenoid pigments are projected to capture 35.8% of the natural food colors market by 2025.

Beverages are expected to hold 38.8% of the market share in the natural food colors application segment by 2025.

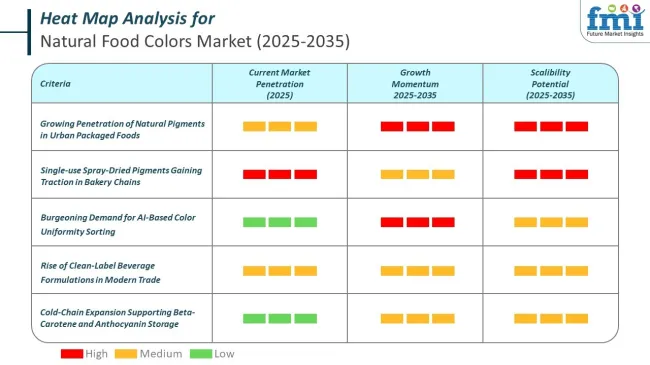

The natural food colors market is expanding rapidly due to rising demand for clean-label, additive-free products. Consumers are actively seeking food and beverages free from synthetic dyes, while manufacturers adapt to evolving regulations and ethical sourcing expectations.

Recent Trends in the Natural Food Colors Industry

Challenges in the Natural Food Colors Market

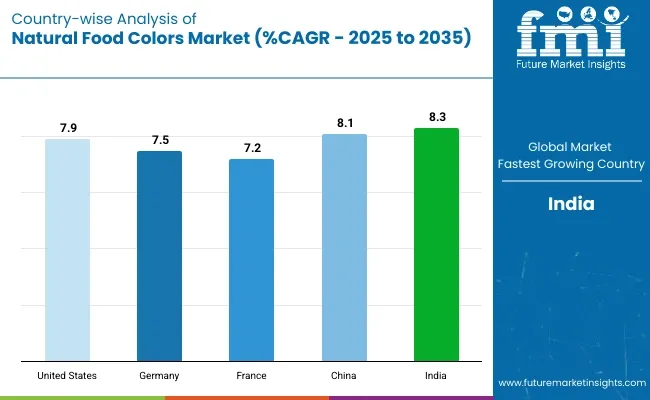

The global natural food colors market is growing rapidly, driven by rising demand for clean-label products, natural ingredients, and regulatory pressure on synthetic dyes. Countries like the United States, Germany, France, China, and India lead the value chain across production, R&D, and global supply.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

| Germany | 7.5% |

| France | 7.2% |

| China | 8.1% |

| India | 8.3% |

The USA market is forecasted to grow at 7.9% CAGR, driven by the dominance of functional foods, personalized nutrition, and clean-label positioning. With R&D hubs across California and the Midwest, companies are exploring advanced encapsulation technologies to improve pigment stability. Natural colors are integrated into plant-based meats and dairy-free beverages. The regulatory landscape, including pressure from the FDA and consumer watchdogs, is also reducing tolerance for synthetic dyes in children’s foods.

Germany’s natural food colors market is projected to grow at 7.5% CAGR, with strong alignment between consumer activism and sustainable supply chains. Major German confectionery producers are investing in bio-fermented colorants to reduce dependency on agricultural volatility. A rising market for bio-supplements and herbal elixirs is also expanding demand. Cross-industry collaborations between biotech and food tech firms are enhancing innovation.

France, with a projected CAGR of 7.2%, is uniquely driven by its gourmet and artisanal food sector. Natural colors are heavily used in pâtisserie, craft cheeses, and wine-based marinades. French consumers are increasingly influenced by “gastronomic aesthetics,” fueling demand for visually striking, naturally pigmented foods. Domestic companies are innovating in pigment enhancement through enzymatic extraction and natural stabilization agents.

China is set to grow at 8.1% CAGR, supported by a thriving functional beverage sector and rapid modernization of food processing industries. There's high usage of native botanicals like gardenia and safflower in domestic snack foods. Additionally, the Chinese government’s “Healthy China 2030” plan is driving mass reformulation of school and packaged foods to eliminate artificial dyes.

India, with the fastest CAGR of 8.3%, is leveraging its botanical biodiversity and low-cost extraction advantage. The market is dominated by turmeric-curcumin, annatto, and marigold derivatives, supported by government subsidies under the Ayush and Make in India initiatives. Demand is rising from both mass-market processed food and international exports, especially to clean-label-focused EU countries.

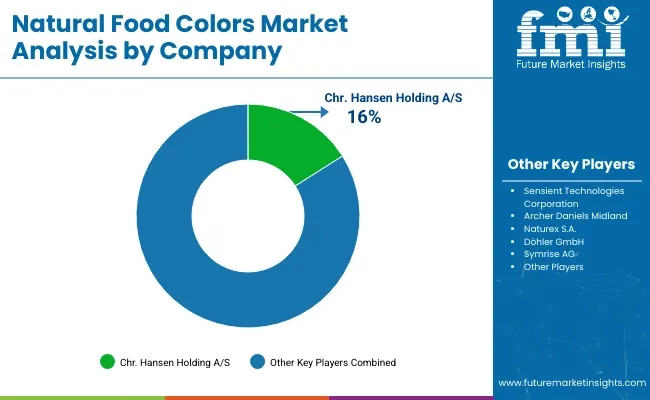

Chr. Hansen Holding A/S is a leading player with 16% market share

The global natural food colors market is moderately fragmented but exhibits signs of gradual consolidation, driven by M&As, strategic alliances, and R&D investments. Tier 1 players like Sensient Technologies, ADM, and Chr. Hansen lead with advanced extraction technologies, global supply chains, and continuous product innovation-e.g., Chr. Hansen’s recent launch of FruitMax® Yellow 1000 derived from turmeric.

Tier 2 includes innovators like Döhler, GNT, and Symrise, focusing on clean-label solutions and sustainable sourcing, while Tier 3 suppliers such as Aakash Chemicals and AFIS operate regionally with niche portfolios.

Key strategies include natural pigment stabilization, new botanical sourcing, and clean-label reformulations. DDW (a Givaudan brand) emphasizes anthocyanin-based color blends, while Kalsec prioritizes oleoresin-based coloring.

Entry barriers remain high due to regulatory compliance, pigment instability, and R&D intensity. Although regional players thrive, market access is challenged by certifications, IP protection, and distribution costs. The market continues to evolve through innovation, partnerships, and strategic global expansion.

Recent Natural Food Colors Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.01 billion |

| Projected Market Size (2035) | USD 4.03 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Pigment Types Analyzed (Segment 1) | Carotenoids (Beta-carotene, Annatto, Lutein, Lycopene), Curcumin, Anthocyanin, Paprika Extract, Spirulina Extract, Chlorophyll, Carmine |

| Functional Applications Analyzed (Segment 2) | Dairy Food Products, Beverages, Packaged Food/Frozen Products, Confectionery, Bakery Products |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, Australia, South Africa |

| Key Players Influencing the Market | Sensient Technologies Corporation, Archer Daniels Midland, Naturex S.A., Döhler GmbH, Symrise AG, McCormick & Company, Kalsec Inc., DDW The Color House, ROHA Dyechem Pvt. Ltd., Aakash Chemicals, AFIS, San-Ei Gen F.FI Inc., GNT International BV (EXBERRY), Adama Agricultural Solutions Ltd. (LycoRed), Chr. Hansen Holding A/S, Others |

| Additional Attributes | Dollar sales, share, and growth trends by pigment, key regions, buyer preferences, regulatory shifts, tech innovations, major players, raw material sourcing, and emerging market opportunities. |

The natural food colors market is segmented by pigment types, including carotenoids (such as beta carotene, annatto, lutein, and lycopene), curcumin, anthocyanin, paprika extract, spirulina extract, chlorophyll, and carmine.

Based on application functionality, the market is classified into dairy food products, beverages, packaged/frozen foods, confectionery, and bakery products.

The industry is also segmented by source, including plant-based, animal-based (e.g., carmine), and microbial sources such as spirulina.

Natural food colors are available in liquid, powder, and gel forms.

Regionally, the market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The global natural food color market is expected to reach USD 4.03 billion by 2035, doubling from USD 2.01 billion in 2025, with a strong CAGR of 7.2%.

Carotenoid pigments are anticipated to lead the pigment category with a 35.8% market share in 2025 due to their vibrant color properties and health benefits.

Beverages are projected to dominate the application segment, accounting for 38.8% of the market share in 2025, driven by growing demand for clean-label and naturally colored drinks.

India is forecasted to be the fastest-growing country in this market, with a CAGR of 8.3% between 2025 and 2035, supported by rising health awareness and food processing investments.

Chr. Hansen Holding A/S is a leading player with a 16% market share, known for its innovations in natural ingredients and strong presence across multiple application sectors.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Food and Beverage Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Pet Food Market Insights - Nutrition & Consumer Trends 2025 to 2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Caramel Food Colors Market Growth - Applications & Demand 2025 to 2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Germany Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Anthocyanin Food Colors Market Analysis by Source, Form, and End Use Industry

Plant-Based Food Colors Market Growth - Types & Solubility Trends

Aluminum-free Natural Food Color Market Size and Share Forecast Outlook 2025 to 2035

United States Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Demand for Caramel Food Colors in Japan Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA