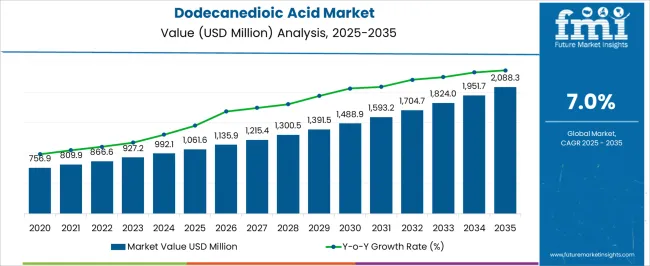

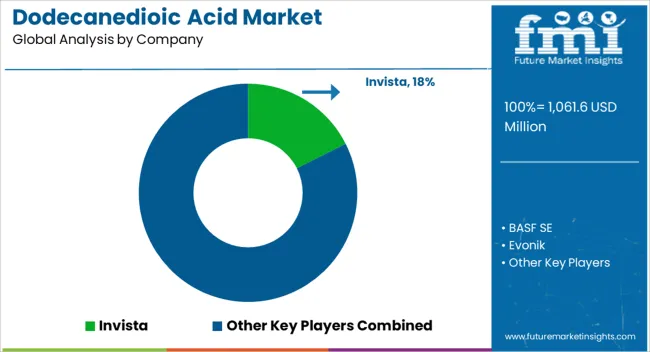

The Dodecanedioic Acid Market is estimated to be valued at USD 1061.6 million in 2025 and is projected to reach USD 2088.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Dodecanedioic Acid Market Estimated Value in (2025 E) | USD 1061.6 million |

| Dodecanedioic Acid Market Forecast Value in (2035 F) | USD 2088.3 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The Dodecanedioic Acid market is experiencing steady growth driven by increasing demand for high-performance polymers, coatings, and resins across various industrial applications. The market expansion is being supported by its widespread use in producing nylon, engineering plastics, and specialty polymers that enhance mechanical strength, chemical resistance, and thermal stability. Growing industrialization and rising demand for lightweight, durable, and sustainable materials in automotive, electronics, and industrial applications are driving adoption.

Technological advancements in synthetic production processes are improving yield, purity, and cost efficiency, making synthetic Dodecanedioic Acid increasingly preferred over natural sources. Furthermore, the material’s compatibility with bio-based feedstocks and environmentally conscious production methods is enhancing its appeal amid rising sustainability regulations.

Expansion of end-use industries such as automotive and industrial machinery, combined with rising investment in performance polymers, is further reinforcing demand As manufacturers focus on innovative applications in resins, coatings, lubricants, and composites, the market is expected to sustain long-term growth while addressing evolving performance, cost, and environmental requirements across global industries.

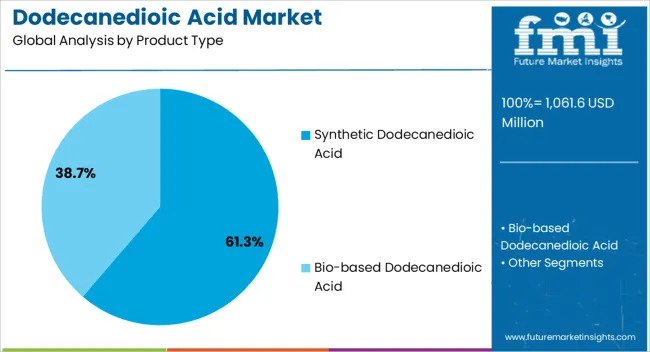

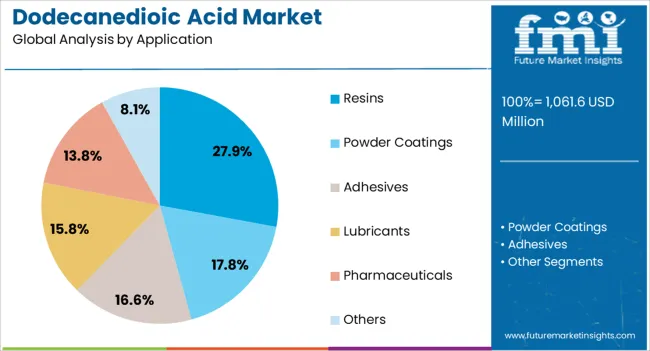

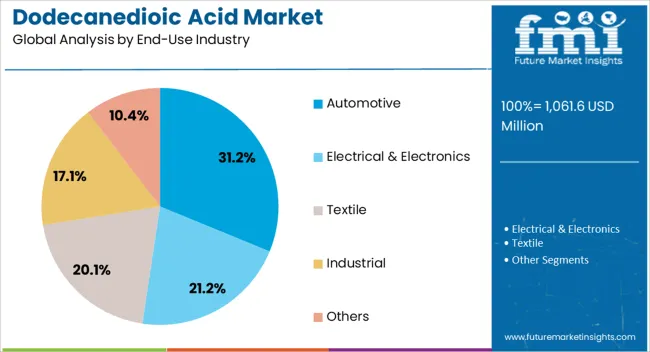

The dodecanedioic acid market is segmented by product type, application, end-use industry, and geographic regions. By product type, dodecanedioic acid market is divided into Synthetic Dodecanedioic Acid and Bio-based Dodecanedioic Acid. In terms of application, dodecanedioic acid market is classified into Resins, Powder Coatings, Adhesives, Lubricants, Pharmaceuticals, and Others. Based on end-use industry, dodecanedioic acid market is segmented into Automotive, Electrical & Electronics, Textile, Industrial, and Others. Regionally, the dodecanedioic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic Dodecanedioic Acid segment is projected to hold 61.3% of the market revenue share in 2025, establishing it as the leading product type. Its dominance is attributed to its consistent purity, high yield, and ability to meet stringent performance requirements in industrial applications. The synthetic variant allows for better control over chemical properties, which enhances its suitability for producing high-performance resins, polyamides, and engineering plastics.

It is preferred in large-scale manufacturing due to process efficiency and cost-effectiveness, particularly where material consistency and reliability are critical. The segment is also benefiting from advancements in synthetic processes that reduce environmental impact and energy consumption, further enhancing adoption.

Industries seeking high-strength, chemically stable, and thermally resistant polymers rely on synthetic Dodecanedioic Acid for product development Its scalability and compatibility with advanced polymerization processes reinforce its market leadership, and continued investments in production technology are expected to further consolidate its position as the preferred product type across multiple industrial sectors.

The resins application segment is anticipated to account for 27.9% of the Dodecanedioic Acid market revenue share in 2025, making it the leading application area. Growth in this segment is being driven by the demand for high-performance coatings, adhesives, and specialty polymers that require excellent thermal stability, chemical resistance, and mechanical strength.

Resins derived from Dodecanedioic Acid provide enhanced flexibility, durability, and processability, which makes them critical for applications in automotive, industrial machinery, and electronics. The segment’s expansion is further supported by the rising need for lightweight, high-strength, and environmentally compliant materials in end-use industries.

Increasing adoption of sustainable and high-performance resins in manufacturing processes is reinforcing the segment’s prominence Continuous innovation in resin chemistry, combined with strong integration across industrial applications, is ensuring that Dodecanedioic Acid-based resins remain a preferred solution for manufacturers aiming to optimize product performance while complying with environmental and safety regulations globally.

The automotive end-use industry segment is expected to hold 31.2% of the Dodecanedioic Acid market revenue share in 2025, positioning it as the largest end-use industry. This dominance is being driven by the growing demand for lightweight, high-strength, and chemically resistant materials in vehicle manufacturing, including polymer-based components, coatings, and high-performance adhesives.

Dodecanedioic Acid is being used extensively to improve durability, thermal stability, and corrosion resistance in automotive polymers, contributing to fuel efficiency and overall vehicle longevity. The segment is also benefiting from increasing production of electric and hybrid vehicles, which rely heavily on advanced polymers and specialty materials for battery enclosures, wiring insulation, and lightweight structural components.

Adoption is reinforced by stringent regulatory requirements for emission reduction and energy efficiency, encouraging manufacturers to integrate high-performance chemical intermediates such as Dodecanedioic Acid As automotive production grows globally and performance standards become more rigorous, the material’s role in improving component performance and sustainability is expected to drive sustained growth in this leading end-use industry segment.

The sales of dodecanedioic acid (DDDA) are rising due to:

Dodecanedioic acid is used by companies to create several types of nylon resins. Numerous end-use sectors are driving up demand for speciality nylon resins such as epoxy resins, aromatic hydrocarbon resins, phenolic resins, acrylates, lattices, and unsaturated polyester resins.

The rising demand for performance polymers in the building and transportation industries is the cause of the expanding popularity of different kinds of nylon resins. Favourable characteristics like flexibility, heat stability, and excellent scratch resistance in the automotive sector can be ascribed to a surge in demand for nylon from growing nations like China and India.

The automobile industry has witnessed an increase in product adoption as a result of these advantages. Due to the widespread adoption of dodecanedioic acid in the manufacture of paints, engineering plastics, corrosion inhibitors, coatings, adhesives, lubricants, and surfactants, dodecanedioic acid (DDDA) is in high demand.

The sales of dodecanedioic acid are being driven by emerging nations' strong industrial sectors. Depending on how it is stored, dodecanedioic acid has a lengthy shelf life of three years.

“The research-based biopharmaceutical sector is estimated to have spent USD 210 billion on biopharmaceutical R&D globally in 2025, according to research.”

Dodecanedioic acid has great fatigue resistance and good welding performance due to these characteristics. Due to their great stiffness and strength even at high temperatures as well as their toughness at low temperatures, nylon 6 resins are widely employed as engineering plastics. As a result, dodecanedioic acid manufacturers are more likely to experience growth as engineering plastics are used in more applications.

The manufacturing of polyesters involves the usage of dodecanedioic acid. Numerous products, such as toothbrushes, cosmetics, perfumes, fuel line tubing, and others, are made using these polyesters.

The growth of the global dodecanedioic acid market size is also anticipated to be fueled by the usage of dodecanedioic acid in the production of antiseptics and other medicinal goods, among other things. As a result, the growing cosmetic and pharmaceutical sectors fuel the growth of the global dodecanedioic acid market share.

Dodecanedioic acid (DDDA) is a dicarboxylic acid. DDDA is a white solid with slight odor. Its melting point is 1280C and boiling point is 2500C. DDDA is used in various applications such as surfactants, corrosion inhibitors, paints and medical applications among others. It is used as adhesives, capacitor electrolyte and as plasticizer in various applications.

It can be used as an ingredient for heat transfer fluid and corrosion resistant coats. Additionally, DDDA is used as a stabilizing and curing agent in powder coatings. However, in spite of its’ several applications, the major application of DDDA is polyesters, especially polyamides, epoxy resins. DDDA is manufactured from butadiene through a chemical process. There is no health issue associated with inhalation of DDDA due to its lower vapor pressure. DDDA is neither genotoxic nor mutagenic.

The market for dodecanedioic acid was mainly driven by polyamides market. Dodecanedioic acid is majorly used in manufacturing of polyamide 6,12. Polyamide 6,12 is majorly used in manufacturing nylon products.

DDDA is also used in polyester coatings, diester synthetic lubricants and fibers among others. Dodecanedioic acid is used in flame retardants, fertilizers, flavors and fragrances, cleaning agents and dyestuffs among others. Investing in biodegradable DDDA has been the major opportunity for the dodecanedioic acid market.

The manufactures are focusing on bio-based DDCA in near future. Verdezyne Inc., a U.S. based company is planning to open new DDDA plant in Malaysia. The plant will utilize lauric acid as chemical feedstock in order to manufacture DDDA. The project emphasizes on bio-based DDDA manufacturing. However, environmental issues can act as a major restraint for the dodecanedioic acid market in upcoming years.

In terms of demand, Asia Pacific was the leading region in dodecanedioic acid market. Growing demand of dodecanedioic acid for nylon 6,12 market has been the major driver for the growth in the market. India and China are the major consumers for the DDDA market.

The demand for polyamides and paints products is more in this region helping the DDDA market to grow in this region. Asia Pacific was followed by Europe where the demand for dodecanedioic acid is anticipated to grow in upcoming years owing to huge nylon, adhesives and plasticizers market. The demand for DDDA is more from European countries such as Germany, the UK and Italy.

North America is expected to be growing market for dodecanedioic acid in near future. The demand is likely to grow from textile and industrial end-user applications. There is huge demand for polyamides in this market. The U.S. and Canada are the major consumers in the North America region.

The Rest of the World market is expected to show steady growth for dodecanedioic acid market in upcoming years. The Middle East, North Africa and Latin America are anticipated to exhibit higher demand for DDDA in upcoming years due to increasing demand for nylon products from various end-user applications.

Some of the key manufacturers in the dodecanedioic acid (DDDA) market are Beyo Chemcial Co. Ltd., Cathay Industrial Biotech Ltd., Evonik Industries AG, Invista, Sinopec Qingjiang Petrochemical Co., Ltd. US Biotech Company, Verdezyne, Inc. and Zibo Guangtong Chemical Co.,Ltd. among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

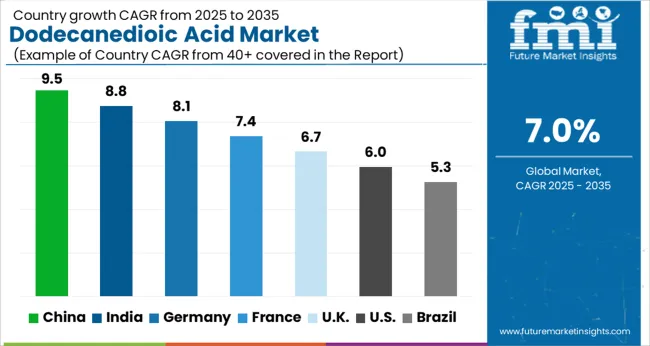

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The Dodecanedioic Acid Market is expected to register a CAGR of 7.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.5%, followed by India at 8.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Dodecanedioic Acid Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.1%. The USA Dodecanedioic Acid Market is estimated to be valued at USD 386.8 million in 2025 and is anticipated to reach a valuation of USD 689.5 million by 2035. Sales are projected to rise at a CAGR of 6.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 54.7 million and USD 36.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1061.6 Million |

| Product Type | Synthetic Dodecanedioic Acid and Bio-based Dodecanedioic Acid |

| Application | Resins, Powder Coatings, Adhesives, Lubricants, Pharmaceuticals, and Others |

| End-Use Industry | Automotive, Electrical & Electronics, Textile, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Invista, BASF SE, Evonik, UBE Industries, Verdezyne, Cathay Industrial Biotech, Cathay, Santa Cruz Biotechnology, and Ube |

The global dodecanedioic acid market is estimated to be valued at USD 1,061.6 million in 2025.

The market size for the dodecanedioic acid market is projected to reach USD 2,088.3 million by 2035.

The dodecanedioic acid market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in dodecanedioic acid market are synthetic dodecanedioic acid and bio-based dodecanedioic acid.

In terms of application, resins segment to command 27.9% share in the dodecanedioic acid market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA