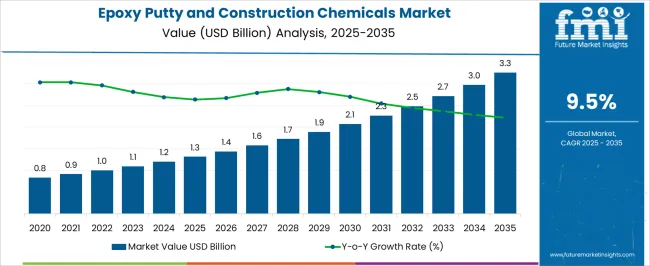

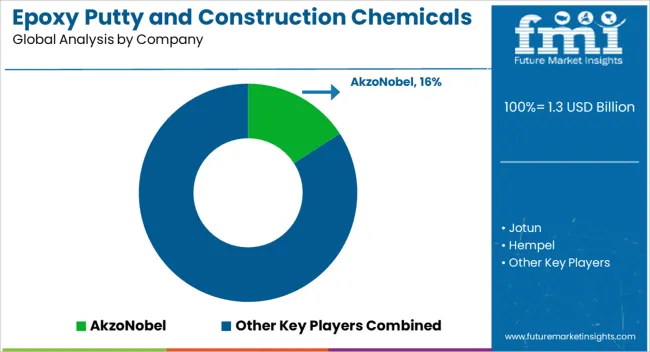

The Epoxy Putty and Construction Chemicals Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Epoxy Putty and Construction Chemicals Market Estimated Value in (2025 E) | USD 1.3 billion |

| Epoxy Putty and Construction Chemicals Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The epoxy putty and construction chemicals market is experiencing steady growth, driven by increasing demand for durable, high-performance materials in construction, repair, and industrial applications. The market is being shaped by rising investments in infrastructure development, urbanization, and residential and commercial construction projects globally. Advancements in material formulations, including multi-functional epoxies and chemical additives, are improving adhesion, mechanical strength, and resistance to environmental factors, which enhances long-term performance.

Sustainability and efficiency are becoming key considerations, with manufacturers focusing on low-emission and environmentally compliant chemical solutions. Growing awareness about reducing maintenance costs and improving structural durability is further stimulating adoption of epoxy-based repair and construction products.

Additionally, increasing application of chemical solutions in specialized industrial sectors such as transportation, marine, and heavy machinery is supporting market expansion As construction standards evolve to incorporate advanced materials and stringent safety regulations, the epoxy putty and construction chemicals market is positioned for sustained growth with opportunities in both retrofit and new-build applications worldwide.

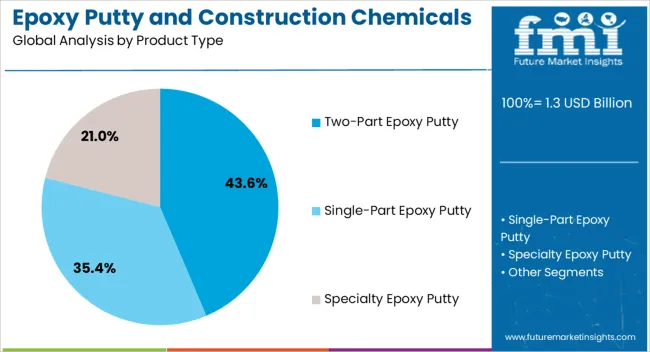

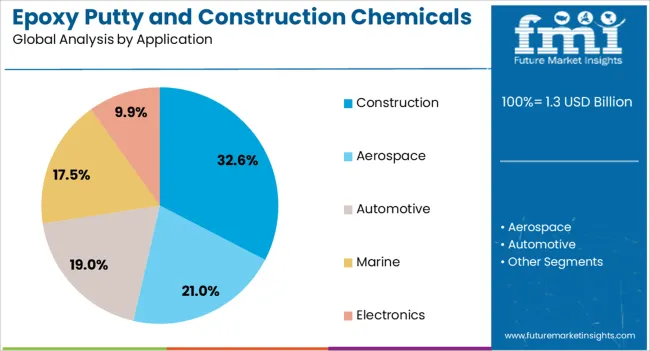

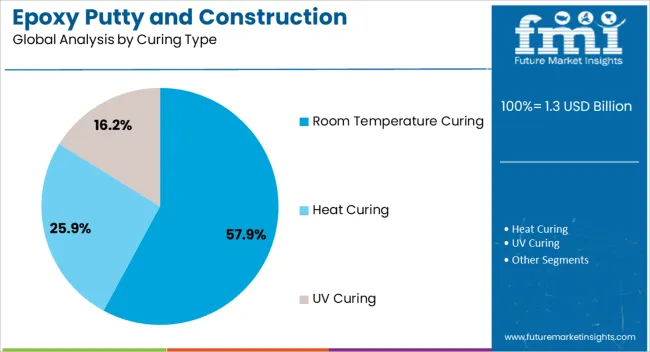

The epoxy putty and construction chemicals market is segmented by product type, application, curing type, end-user industry, features, and geographic regions. By product type, epoxy putty and construction chemicals market is divided into Two-Part Epoxy Putty, Single-Part Epoxy Putty, and Specialty Epoxy Putty. In terms of application, epoxy putty and construction chemicals market is classified into Construction, Aerospace, Automotive, Marine, and Electronics. Based on curing type, epoxy putty and construction chemicals market is segmented into Room Temperature Curing, Heat Curing, and UV Curing.

By end-user industry, epoxy putty and construction chemicals market is segmented into Industrial, DIY/Home Improvement, Arts and Crafts, Electronics, and Medical. By features, epoxy putty and construction chemicals market is segmented into Water-Resistant, Fast-Setting, High-Temperature Resistance, Flexible, and Non-toxic. Regionally, the epoxy putty and construction chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two-part epoxy putty segment is projected to hold 43.6% of the epoxy putty and construction chemicals market revenue share in 2025, establishing it as the leading product type. Its dominance is being driven by the superior adhesion, strength, and chemical resistance provided by the two-component formulation, which allows for precise control over curing and performance characteristics.

The mix-and-apply feature enables tailored consistency and adaptability for various substrates, making it suitable for repair, bonding, and filling applications. This segment is also supported by its ability to withstand thermal and mechanical stresses, which enhances durability and reduces maintenance costs in construction projects.

The widespread acceptance of two-part epoxy putties in both commercial and industrial applications, coupled with their compatibility with other construction chemicals, is reinforcing adoption Continuous innovation in formulations to improve curing times, workability, and environmental compliance is expected to further strengthen the segment’s market share and maintain its position as the preferred choice for high-performance applications.

The construction application segment is anticipated to account for 32.6% of the epoxy putty and construction chemicals market revenue share in 2025, making it the leading application area. Its leadership is being reinforced by the increasing demand for high-quality materials that enhance the durability, safety, and aesthetic appeal of residential, commercial, and infrastructure projects.

Epoxy putties and construction chemicals are being integrated into various construction processes, including bonding, sealing, filling, and surface repair, due to their excellent adhesion and resistance to moisture, chemicals, and temperature variations. The segment’s growth is also being supported by regulatory standards that promote structural safety and energy efficiency, which require the use of advanced chemical solutions in modern construction practices.

Manufacturers are focusing on delivering versatile and environmentally compliant products, further boosting adoption Additionally, the growing trend toward renovation and retrofitting projects, along with the need to minimize downtime and maintenance costs, is driving consistent demand for epoxy putties and related chemicals in the construction sector.

The room temperature curing segment is expected to hold 57.9% of the epoxy putty and construction chemicals market revenue share in 2025, positioning it as the dominant curing type category. This preference is being driven by the convenience, efficiency, and cost-effectiveness offered by products that cure without the need for external heat or specialized equipment.

Room temperature curing enables faster application, reduced energy consumption, and simplified installation, making it highly suitable for on-site construction and repair projects. Its adoption is further supported by its ability to deliver consistent mechanical strength and chemical resistance across various environmental conditions.

The segment also benefits from compatibility with multiple substrates, including concrete, metal, and composites, which enhances versatility and reduces the need for multiple specialized products Growing demand for solutions that improve operational efficiency, reduce project timelines, and comply with environmental regulations is reinforcing the leadership of room temperature curing epoxy putties and chemicals within the global market.

Construction chemicals are broadly used for waterproofing repairs, bonding agents, crack and expansion joint fillers, tile adhesives, retarders, plasticizers, air entraining compounds accelerators and others. Epoxy putty is a hardening substance utilized as a space-filling adhesive in the construction industry.

Construction chemicals are mainly classified into product segments such as protective coatings and sealers, grouts and mortars caulks and adhesives, cement and asphalt additives and polymer flooring and others. All such construction chemical products are widely used in the end-user industries such as residential construction, non-residential construction and non-building construction.

The rising demand from the rapidly growing construction industry across the globe, especially the Asia Pacific region, is expected to drive the global epoxy putty and construction chemicals market in the next few years.

The USA is the largest consumer of construction chemicals and epoxy putty across the globe and is closely followed by Europe and Asia Pacific regions. Latin America, Africa and the Middle East account for smaller portion of the market. Asia Pacific is expected to be the fastest growing market for epoxy putty and construction chemicals the next six years.

The major reason for this is the growing demand from developing countries such as China, India and South East Asian countries such as Thailand, Indonesia, Vietnam and Malaysia. In addition, the countries in the geographies such as Africa, South America and the Middle East are showing remarkable economic growth since the last few years.

These nations largely include South Africa, Brazil, Saudi Arabia, Egypt, Jordan, Qatar and Israel. Additionally, the USA and the European economies are gradually recovering from the economic slowdown.

All such economic, industrial and demographic factors are ultimately creating a positive prospect for the global industrial scenario. Considering this positive industry outlook, construction and related industries are anticipated to record a staggering growth in the next six years. There is a mammoth market potential for the construction industry in the countries such as India, China, Indonesia, Qatar, Thailand and Brazil due to rapid infrastructure development taking place in these countries.

Moreover, countries like Brazil and Qatar are hosting giant events such as Olympics and FIFA world Cup in the next few years and are developing numerous state-of-the-art stadiums and other infrastructure for those events. Owing to this, the demand for construction related products is expected to grow at a notable rate in the next few years.

This will eventually generate a huge demand for epoxy putty and construction chemicals in these emerging nations. The major infrastructure companies are focusing on these developing nations for tapping their gigantic market potential in terms of infrastructure projects. The key producers of epoxy putty and construction chemicals are installing robust production facilities in these growing countries to meet the rising regional demand.

Therefore, the global epoxy putty and construction chemicals market is expected to witness a substantial growth in the next few years.

Some of the major companies operating in the global epoxy putty and construction chemicals market are 3M Company, Akzonobel N.V., Adco Inc., Arkema S.A., Albemarle Corporation, Ashland Inc., Bolton Group, BASF SE, Bostik Inc., Pidilite Industries Ltd., Cementaid (N.S.W.) Pty. Ltd., Cico Technologies Ltd., Chryso S.A.S., E. I. Dupont De Nemours and Company, Lafarge S.A., Fosroc International Ltd., Mapei South Africa Pty. Ltd., Muhu (China) Construction Materials Co. Ltd., Conmix Ltd., RPM International Inc., Sika AG, Terraco Holdings Ltd., Selena FM S.A., The Dow Chemical Company and W.R. Grace and Co. among Others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

Epoxy putty & construction chemicals market demand is expected to increase over the forecast period owing to the surging population of sports enthusiasts, along with the growing number of regional as well as international sports leagues. In addition to this, factors such as rapid urbanisation, the growing popularity of these chemicals, and inflating disposable incomes are predicted to contribute towards epoxy putty & construction chemicals market share. The market is further being facilitated by the emergence of an e-commerce channel, which offers an extensive variety of premium-quality, legitimate merchandise in addition to providing a smooth shopping experience to customers at competitive prices. Moreover, the rising prevalence of construction chemicals and epoxy putty manufacturers is anticipated to assist the market growth in the coming years.

The wide application spectrum of epoxy putty, such as in adhesives, paints and coatings, electrical systems and electronics, and industrial tooling and composites, is predicted to bolster the epoxy putty & construction chemicals market size. The potential benefits and successful large-scale implementation of the construction outsourcing model in the United States is an emerging trend that is expected to boost the demand for epoxy putty and construction chemicals in the region.

Regionally, the Asia Pacific epoxy putty & construction chemicals market is expected to witness rapid growth. This can be attributed to the thriving construction and building industry that utilises construction chemicals to achieve significant qualities, such as durability and workability of projects. Additionally, the epoxy putty & construction chemicals market is emerging in demand in the region, owing to favourable government policies for the construction industry, coupled with rising new buildings as well as renovation projects.

The market is expected to be driven by the various product launches and acquisitions by market key players. In addition to this, several opportunities exist in the construction chemicals market, which is expected to push the market development over the forecast period.

In February 2025, Nuvoco Vistas Corp. Ltd. launched Zero M Epoxy Tile Grout in Delhi, Haryana, Punjab, and West UP. Zero M Epoxy Tile Grout offers distinct features like flexural, high compression, resistance to acids and corrosive agents, and shear adhesion strength, and is applicable in commercial and residential spaces. These value-added products are recommended for bathrooms, kitchens, terraces, swimming pools, and balconies.

In January 2025, Birla Corporation Limited announced the debut of wall putty and construction chemicals as an add-on to Perfect Plus, its premium brand of cement. The company has launched three products, namely Latex and Perfect Plus Wall Putty, Perfect Plus SBR (styrene butadiene rubber), and Perfect Plus IWP (integral waterproofing). Birla Corporation has a yearly production capacity of 15.5 million tons. With this launch, the company is likely to develop new partnerships with retailers of construction materials, including hardware and paints.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

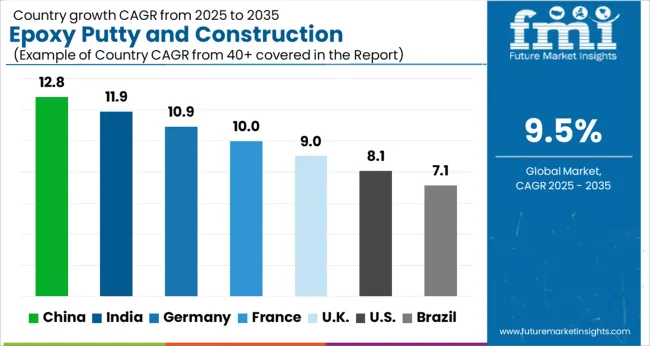

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

The Epoxy Putty and Construction Chemicals Market is expected to register a CAGR of 9.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.8%, followed by India at 11.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.1%, yet still underscores a broadly positive trajectory for the global Epoxy Putty and Construction Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.9%. The USA Epoxy Putty and Construction Chemicals Market is estimated to be valued at USD 489.5 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 8.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 62.5 million and USD 45.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Two-Part Epoxy Putty, Single-Part Epoxy Putty, and Specialty Epoxy Putty |

| Application | Construction, Aerospace, Automotive, Marine, and Electronics |

| Curing Type | Room Temperature Curing, Heat Curing, and UV Curing |

| End-User Industry | Industrial, DIY/Home Improvement, Arts and Crafts, Electronics, and Medical |

| Features | Water-Resistant, Fast-Setting, High-Temperature Resistance, Flexible, and Non-toxic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel, Jotun, Hempel, PPG Industries, Kansai, Chugoku Marine Paints, Sherwin-Williams, BASF, Nippon Paint, and Dupont |

The global epoxy putty and construction chemicals market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the epoxy putty and construction chemicals market is projected to reach USD 3.3 billion by 2035.

The epoxy putty and construction chemicals market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in epoxy putty and construction chemicals market are two-part epoxy putty, single-part epoxy putty and specialty epoxy putty.

In terms of application, construction segment to command 32.6% share in the epoxy putty and construction chemicals market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA