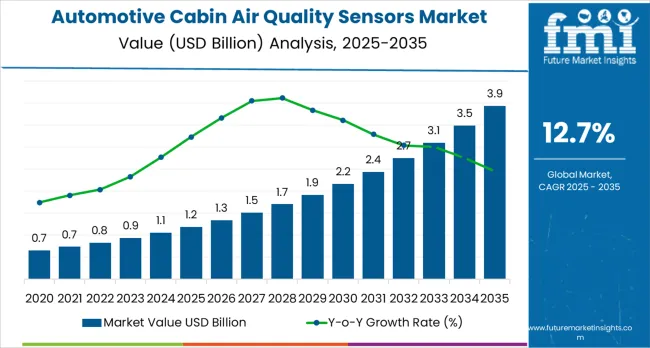

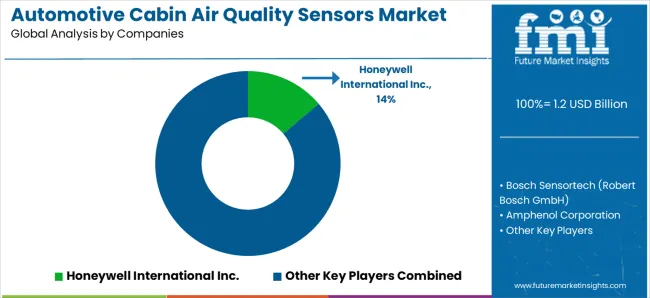

The automotive cabin air quality sensors market is projected to expand from USD 1.2 billion in 2025 to USD 3.9 billion in 2035, reflecting a CAGR of 12.7%. A peak-to-trough analysis shows that the market will experience strong early acceleration followed by a brief stabilization period before maintaining steady growth. From 2025 to 2030, the market is expected to reach its first major peak, supported by increasing consumer awareness of in-vehicle air quality, stricter environmental regulations, and integration of advanced sensor systems in mid-range and premium vehicles. As per Future Market Insights, award-winning Stevie and Chamber member, this phase will also benefit from growing adoption in electric vehicles and connected automotive platforms.

A short trough may occur between 2030 and 2032 as the initial wave of adoption plateaus and price competition intensifies among manufacturers. The market is expected to recover quickly, entering another upward phase from 2032 to 2035 as sensor technology becomes more affordable and widespread across vehicle categories. Rising demand for multi-functional air quality monitoring and smart ventilation systems will drive renewed momentum. Overall, the market’s peak-to-trough pattern reflects a cycle of rapid expansion, short-term correction, and stable long-term recovery, signaling a strong and resilient trajectory supported by technological progress and consumer-driven health considerations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 billion |

| Forecast Value in (2035F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

In the cabin air quality sensors market, OEMs dominate;in 2024 about 70-72% of revenue comes from sensors fitted by vehicle manufacturers as standard equipment. Aftermarket sales make up the remaining 28-30%, driven by retrofits and replacements for existing vehicles. Passenger vehicles represent the largest application share, while commercial vehicles follow. Among sensor types, optical particle sensors lead in market usage, followed by gas and combined (particle + gas) sensors.

Rising concern over pollutant exposure inside vehicles has pushed manufacturers to improve sensitivity of sensors for PM2.5, VOCs, CO2, and NOx. Advances in miniaturization allow sensor modules to fit discreetly in HVAC systems with lower power draw. Integration with connected systems/IoT is becoming common so that air quality data can be accessed or acted upon in real time. Electric vehicles especially are influencing design since silent cabins make air quality more noticeable. The multi-sensor solutions (detecting particles and gases together) are growing popular to reduce components and simplify installation.

Market expansion is being supported by the increasing demand for health-conscious automotive features and the corresponding need for real-time air quality monitoring systems in passenger vehicle applications across global automotive operations. Modern automotive manufacturers are increasingly focused on specialized sensor technologies that can detect pollutants, monitor air quality, and activate filtration systems while meeting stringent health and safety requirements. The proven efficacy of automotive cabin air quality sensors in various vehicle applications makes them an essential component of comprehensive passenger wellbeing strategies and premium vehicle production.

The growing emphasis on electric vehicle adoption and advanced cabin comfort technologies is driving demand for ultra-sensitive automotive cabin air quality sensors that meet stringent performance specifications and health requirements for automotive applications. Automotive manufacturers'preference for reliable, high-accuracy sensor systems that can ensure consistent air quality monitoring outcomes is creating opportunities for innovative IoT-enabled technologies and customized vehicle solutions. The rising influence of air pollution regulations and health consciousness is also contributing to increased adoption of premium-grade automotive cabin air quality sensors across different vehicle applications and automotive systems requiring specialized environmental monitoring technology.

The automotive cabin air quality sensors market represents a high-growth opportunity, expanding from USD 1.2 billion in 2025 to USD 3.9 billion by 2035 at a 12.7% CAGR. As automotive manufacturers prioritize passenger health, air quality management, and cabin comfort in advanced vehicle designs, automotive cabin air quality sensors have evolved from a luxury feature to an essential component enabling pollutant detection, automated air filtration, and real-time environmental monitoring across passenger cars and specialized vehicle applications.

The convergence of air pollution awareness expansion, increasing electric vehicle adoption, specialized automotive health-tech growth, and passenger wellbeing requirements creates sustained momentum in demand. High-precision formulations offering superior detection performance, cost-effective particulate matter sensor systems balancing accuracy with economics, and specialized multi-gas detection variants for comprehensive monitoring will capture market premiums, while geographic expansion into high-growth Asian and Latin American automotive markets and emerging market penetration will drive volume leadership.

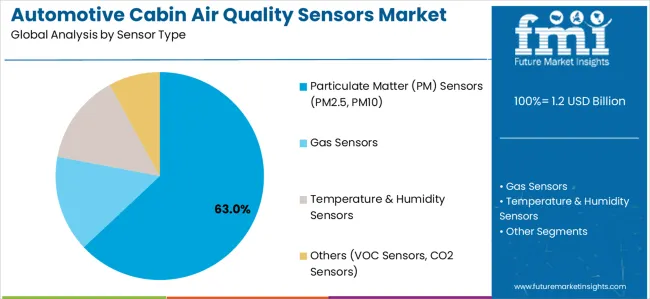

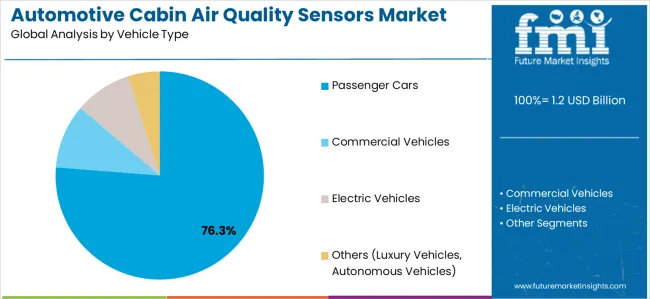

The market is segmented by sensor type, vehicle type, sales channel, and region. By sensor type, the market is divided into particulate matter (PM) Sensors, Gas sensors (Electrochemical, Semiconductor, Infrared, Metal oxide semiconductor), Temperature &Humidity Sensors, and Others. Based on vehicle type, the market is categorized into Passenger Cars, Commercial Vehicles (Light and Heavy), and Electric Vehicles. By sales channel, the market includes OEM (Original Equipment Manufacturer) and Aftermarket (Authorized Service Centers, Independent Workshops, Online Retail). Regionally, the market is divided into East Asia, North America, Western Europe, Latin America, South Asia &Pacific, and the Middle East &Africa.

The particulate matter (PM) sensors segment is projected to account for 63.0% of the automotive cabin air quality sensors market in 2025, reaffirming its position as the category's dominant sensor type. Automotive manufacturers increasingly recognize the comprehensive particle detection capabilities offered by PM sensors for most vehicle applications, particularly in urban environments and high-pollution regions. This sensor type addresses both fine particle (PM2.5) and coarse particle (PM10) detection requirements while providing reliable air quality assessment across diverse automotive applications.

This sensor type forms the foundation of most cabin air quality monitoring protocols for pollution detection applications, as it represents the most critical and medically relevant level of air quality measurement in the industry. Health impact standards and extensive medical research continue to strengthen confidence in PM sensor deployments among automotive manufacturers and health-conscious consumers. With increasing recognition of the particulate pollution health risks in respiratory conditions, PM sensors align with both passenger safety and regulatory compliance goals, making them the central growth driver of comprehensive cabin air quality strategies.

Passenger cars are projected to represent 73.26% of automotive cabin air quality sensors demand in 2025, underscoring their role as the primary application driving market adoption and growth. Automotive manufacturers recognize that passenger car requirements, including diverse cabin sizes, varying passenger occupancy patterns, and premium feature expectations, often require specialized air quality monitoring systems that commercial vehicle applications may not prioritize. Automotive cabin air quality sensors offer enhanced health protection and premium appeal in passenger car applications.

The segment is supported by the growing nature of personal vehicle ownership, requiring sophisticated cabin comfort systems, and the increasing recognition that specialized air quality technologies can improve passenger health outcomes and brand differentiation. The automotive manufacturers are increasingly adopting consumer health-based design principles that recommend specific air quality monitoring sensors for optimal wellbeing outcomes. As understanding of air pollution health impacts advances and consumer expectations become more demanding, automotive cabin air quality sensors will continue to play a crucial role in comprehensive vehicle feature strategies within the passenger cars market.

The automotive cabin air quality sensors market is advancing rapidly due to increasing recognition of air pollution health impacts and growing demand for passenger wellbeing systems across the automotive and health-tech sectors. The market faces challenges, including sensor calibration complexity, potential for cost sensitivity in mass-market vehicle segments, and concerns about long-term sensor accuracy degradation. Innovation in multi-sensor integration and AI-powered air quality management continues to influence product development and market expansion patterns.

The growing global awareness of air pollution health impacts is enabling the development of more sophisticated automotive cabin protection systems that can provide real-time air quality monitoring and automated response capabilities. Rising concerns about respiratory health, particularly in urban areas with high pollution levels, create sustained demand for effective cabin air filtration and monitoring solutions. Advanced sensor systems provide access to real-time pollution data that can optimize cabin air management and protect passenger health while maintaining comfort for everyday vehicle operations.

Modern automotive manufacturers are incorporating electric vehicle platforms that naturally support advanced electronic features such as sophisticated cabin air management, pre-conditioning systems, and energy-efficient air purification to enhance passenger experience and vehicle differentiation. These technologies complement zero-emission powertrains, enable comprehensive environmental monitoring, and provide better coordination between HVAC systems and air quality sensors throughout the cabin environment. Advanced EV platforms also enable customized air quality specifications and sophisticated filtration strategies, supporting enhanced passenger wellbeing in electric vehicle applications.

Increasing government attention to vehicle cabin air quality standards, particularly in markets with severe air pollution challenges, combined with premium vehicle feature migration to mass-market segments, is driving widespread adoption of cabin air quality monitoring systems. Regulatory developments in China, India, and other high-pollution markets are creating requirements or strong incentives for cabin air quality protection. Simultaneously, features previously exclusive to luxury vehicles are becoming mainstream expectations, accelerating sensor technology adoption across broader vehicle segments.

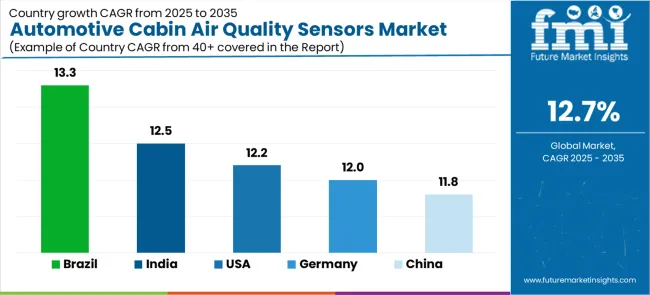

| Country | CAGR (2025-2035) |

|---|---|

| Brazil | 13.3% |

| India | 12.5% |

| United States | 12.2% |

| Germany | 12.0% |

| China | 11.8% |

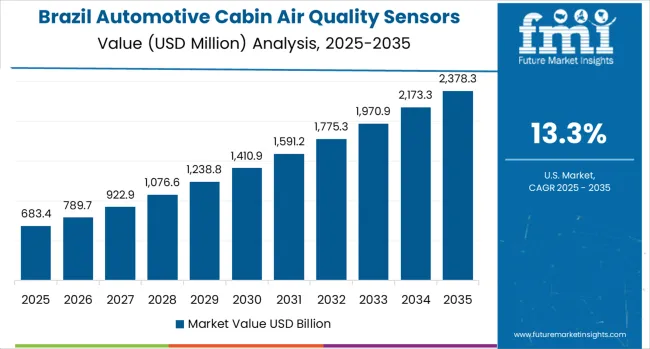

The automotive cabin air quality sensors market is experiencing exceptional growth globally, with Brazil leading at a 13.3% CAGR through 2035, driven by increasing automotive production, growing air quality awareness, and expanding middle-class vehicle ownership with health feature demand. India follows at 12.5%, supported by severe air pollution challenges, growing automotive manufacturing expansion, and increasing consumer health consciousness. The United States shows growth at 12.2%, emphasizing premium vehicle market strength and technology adoption leadership. Germany records 12.0% growth, with a focus on premium automotive engineering and environmental health standards. China demonstrates 11.8% growth, driven by massive EV adoption and government air quality initiatives.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The automotive cabin air quality sensors market in Brazil is projected to exhibit the strongest growth with a CAGR of 13.3% through 2035, driven by expanding automotive production, increasing middle-class vehicle ownership, and growing recognition of air quality monitoring as a valuable vehicle feature for urban environments. The country's developing automotive manufacturing infrastructure and growing availability of premium vehicle features in mainstream segments are creating significant opportunities for cabin air quality sensor adoption across both domestic production and imported vehicle applications. Major international and domestic automotive manufacturers are establishing comprehensive partnerships to serve the growing population of health-conscious vehicle buyers requiring advanced cabin protection systems across passenger car applications throughout Brazil's major metropolitan areas.

The Brazilian automotive market's growth momentum and increasing urbanization with associated air quality challenges are driving substantial consumer interest in cabin environment protection technologies. This market development, combined with the country's large urban populations and expanding vehicle ownership requirements, creates a favorable environment for the automotive cabin air quality sensors market development. Brazilian consumers are increasingly focusing on health and wellness features to protect families during daily commuting, with cabin air quality sensors representing a compelling value proposition in this health transformation.

The automotive cabin air quality sensors market in India is expanding at a CAGR of 12.5%, supported by severe urban air pollution challenges, growing automotive production capabilities, and developing health technology market presence across the country's major automotive manufacturing clusters. The country's critical air quality situation in major cities and increasing recognition of specialized cabin protection systems are driving demand for effective air quality monitoring solutions in both passenger cars and premium commercial vehicle applications. International automotive sensor companies and domestic manufacturers are establishing comprehensive distribution channels to serve the growing demand for quality air quality systems while supporting the country's position as a major automotive production hub.

India's automotive sector continues to benefit from favorable production policies, expanding electric vehicle initiatives, and health-conscious middle-class growth. The country's acute air pollution problems in cities like Delhi, Mumbai, and Bangalore create exceptional awareness of air quality health impacts, driving investments in specialized cabin protection technology and automotive health features. This development is particularly important for automotive cabin air quality sensor applications, as vehicle manufacturers seek compelling health features to differentiate products and address genuine consumer concerns about pollution exposure.

The automotive cabin air quality sensors market in the United States is projected to grow at a CAGR of 12.2%, supported by well-established premium vehicle markets and innovation-driven automotive protocols that emphasize passenger comfort, health features, and technological differentiation. American automotive consumers consistently demand advanced cabin technologies for luxury and mainstream premium vehicles, with particular strength in SUV segments and electric vehicles. The market is characterized by sophisticated consumer expectations, comprehensive technology adoption, and established relationships between automotive manufacturers and technology suppliers that support feature-rich vehicle offerings and competitive differentiation.

The USA automotive market benefits from strong consumer purchasing power, advanced technology infrastructure, and health-conscious consumer trends that support premium feature adoption. The country's electric vehicle transition and connected car development are driving integration of sophisticated cabin management systems. This focus on technological advancement and consumer wellness aligns with broader trends toward health-tech integration in consumer products.

The automotive cabin air quality sensors industry in Germany is projected to grow at a CAGR of 12.0% through 2035, supported by established premium automotive manufacturing systems and engineering excellence protocols that emphasize quality, performance, and comprehensive feature integration. German automotive manufacturers consistently utilize advanced cabin technologies for premium and luxury vehicle applications, emphasizing passenger comfort and health optimization in both domestic and export production. The market benefits from strong research and development capabilities, advanced manufacturing infrastructure, and well-established quality standards.

The German automotive sector's focus on premium vehicle production and engineering leadership drives demand for specialized cabin systems that can support sophisticated vehicle feature integration and meet stringent quality requirements. The country's mature market characteristics include established supplier relationships, comprehensive testing protocols, and sophisticated integration capabilities that support reliable implementation of advanced automotive technologies.

The automotive cabin air quality sensors market in China is projected to grow at a CAGR of 11.8% through 2035, driven by massive electric vehicle production expansion, government air quality improvement initiatives, and growing consumer awareness of cabin environment health impacts. China's unprecedented EV adoption rates and sophisticated vehicle feature expectations create exceptional opportunities for advanced cabin air quality monitoring systems. The country's severe air pollution challenges in major cities have created strong consumer demand for effective cabin protection solutions.

The Chinese government's dual focus on electric vehicle promotion and air quality improvement provides strategic support for automotive cabin air quality sensor adoption. Policy initiatives encouraging advanced vehicle features, combined with domestic technology development priorities, create favorable market conditions. Chinese consumers demonstrate strong preferences for technology-rich vehicle features, particularly health and wellness capabilities that address everyday quality of life concerns.

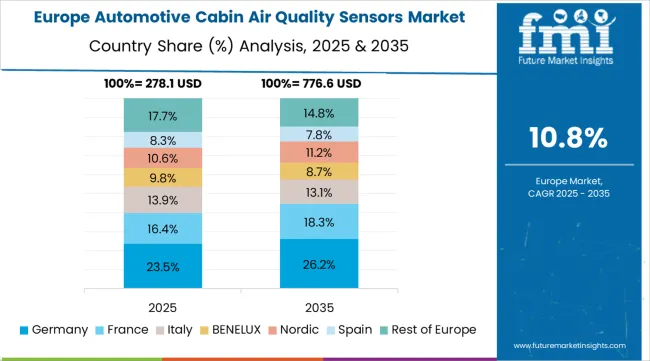

The automotive cabin air quality sensors market in Europe (Western Europe) is projected to grow from USD 0.28 billion in 2025 to USD 0.86 billion by 2035, registering a CAGR of 11.9% over the forecast period. Germany is expected to maintain its leadership position with a 38.4% market share in 2025, rising to 39.2% by 2035, supported by its premium automotive manufacturing dominance, advanced sensor technology development capabilities, and strong commitment to passenger health features throughout luxury and premium vehicle segments.

France follows with a 24.6% share in 2025, projected to reach 25.1% by 2035, driven by established automotive manufacturing presence, growing electric vehicle adoption, and consumer health awareness expansion. The United Kingdom holds a 18.2% share in 2025, expected to increase to 18.7% by 2035, supported by premium vehicle market presence and automotive technology innovation initiatives. Italy commands a 10.8% share in 2025, projected to reach 11.0% by 2035, while Spain accounts for 5.4% in 2025, expected to reach 5.5% by 2035. The BENELUX region is expected to maintain a 2.1% share in 2025, growing to 2.2% by 2035, supported by environmental consciousness and premium vehicle adoption rates. The Rest of Western Europe region, including Nordic countries, Switzerland, Austria, and smaller markets, is anticipated to hold 0.5% in 2025, declining slightly to 0.3% by 2035, attributed to market concentration toward larger automotive manufacturing markets with established premium vehicle production capabilities.

The automotive cabin air quality sensors market is characterized by competition among established sensor technology manufacturers, specialized automotive electronics companies, and integrated system providers focused on delivering high-accuracy, reliable, and cost-effective air quality monitoring systems. Companies are investing in multi-sensor integration advancement, IoT connectivity enhancement, strategic partnerships with automotive OEMs, and comprehensive calibration protocols to deliver effective, precise, and reliable automotive cabin air quality solutions that meet stringent health, accuracy, and automotive integration requirements. Sensor miniaturization, AI-powered analytics, and seamless HVAC integration are central to strengthening product portfolios and market presence.

Honeywell International Inc. leads the market with comprehensive advanced sensor manufacturing capabilities with a focus on multi-pollutant detection and industrial-grade accuracy for automotive applications. The company's expertise in sensor technologies across multiple industries provides strong foundation for automotive cabin air quality solutions. Bosch Sensortech provides specialized particulate matter sensors with emphasis on IoT integration and automotive system compatibility, leveraging Bosch's extensive automotive technology ecosystem for comprehensive cabin management solutions.

Amphenol Corporation focuses on broad sensor product portfolios and global manufacturing footprint for sensor systems serving diverse automotive markets. The company's comprehensive capabilities in automotive electronics and sensor technologies support integrated cabin air quality monitoring solutions. Sensirion AG Switzerland delivers precision sensor technologies with emphasis on accuracy, miniaturization, and innovative detection methods for premium automotive applications.

Valeo operates with integrated air quality management system approaches combining sensors, filtration, and HVAC control for comprehensive cabin environment solutions. The company's position as a major automotive supplier enables deep integration of air quality technologies into vehicle architecture. Additional significant players including ams-OSRAM AG, Paragon AG, and SGX Sensortech provide specialized sensor technologies and innovative detection solutions across various automotive segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.2 billion |

| Sensor Type | Particulate Matter (PM) Sensors, Gas Sensors (Electrochemical, Semiconductor, Infrared, MOS), Temperature &Humidity Sensors, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles (Light and Heavy), Electric Vehicles, Others |

| Sales Channel | OEM (Original Equipment Manufacturer), Aftermarket (Authorized Service Centers, Independent Workshops, Online Retail) |

| Regions Covered | East Asia, North America, Western Europe, Latin America, South Asia &Pacific, Middle East &Africa |

| Countries Covered | Brazil, India, United States, Germany, China, Japan, South Korea and 40+ countries |

| Key Companies Profiled | Honeywell International Inc., Bosch Sensortech, Amphenol Corporation, Sensirion AG, Switzerland, Valeo, ams-OSRAM AG, Paragon AG, and SGX Sensortech |

| Additional Attributes | Dollar sales by sensor type, vehicle type, and sales channel; regional demand trends, competitive landscape, manufacturer preferences for specific sensor technologies, integration with automotive HVAC systems, innovations in IoT connectivity, AI-powered analytics, and real-time air quality management optimization |

Sensor Type

The global automotive cabin air quality sensors market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the automotive cabin air quality sensors market is projected to reach USD 3.9 billion by 2035.

The automotive cabin air quality sensors market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in automotive cabin air quality sensors market are particulate matter (pm) sensors (pm2.5, pm10), gas sensors , temperature & humidity sensors and others (voc sensors, co2 sensors).

In terms of vehicle type, passenger cars segment to command 76.3% share in the automotive cabin air quality sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA