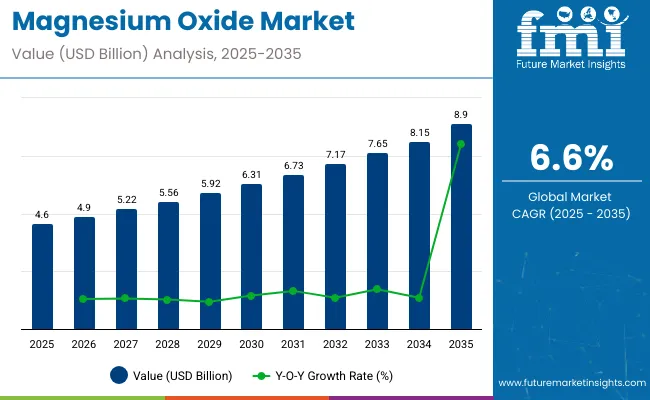

The global magnesium oxide market is poised to grow steadily, with its value expected to reach USD 4.6 billion in 2025 and expand to approximately USD 8.9 billion by 2035.

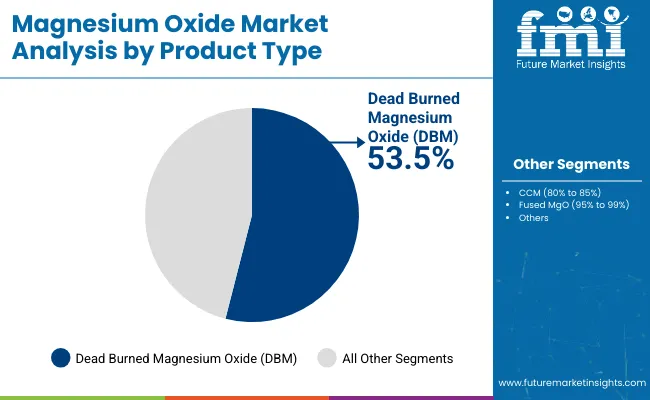

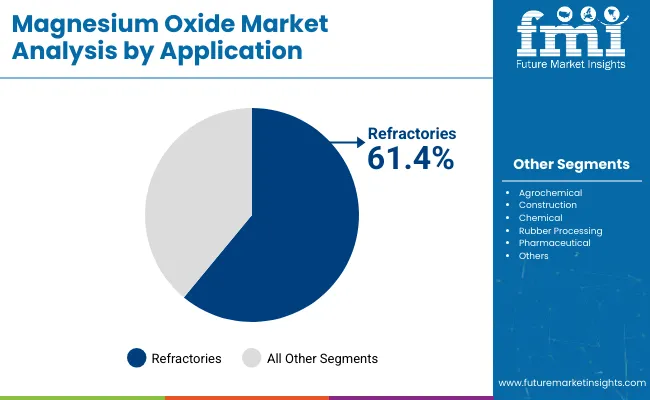

This expansion reflects a compound annual growth rate (CAGR) of 6.6% between 2025 and 2035. The Dead Burned Magnesium Oxide (DBM) segment is projected to maintain its dominance in product type, accounting for about 53.5% of the market share in 2025. Refractories will remain the key application area, holding an estimated 61.4% share of total market demand during the same period. Rising demand in iron & steel production, cement manufacturing, and glass industries will continue to drive consumption.

On 26 May 2025, RHI Magnesita officially announced during the MagForum 2025 event in Brazil that its Brumado mine in Bahia, Brazil, one of the world’s largest and purest magnesite reserves, has become fully operational as a global magnesia hub. This development includes an investment exceeding €100 million, the installation of a 150,000 tpa rotary kiln, cutting-edge automation technologies, and an advanced 90% water reuse system, significantly bolstering the company’s supply chain and production capabilities.

This landmark development was confirmed in an official press release published on the RHI Magnesita website on 26 May 2025. The operationalization of this site is expected to address growing global demand, ensuring a stable supply of high-quality magnesium oxide.

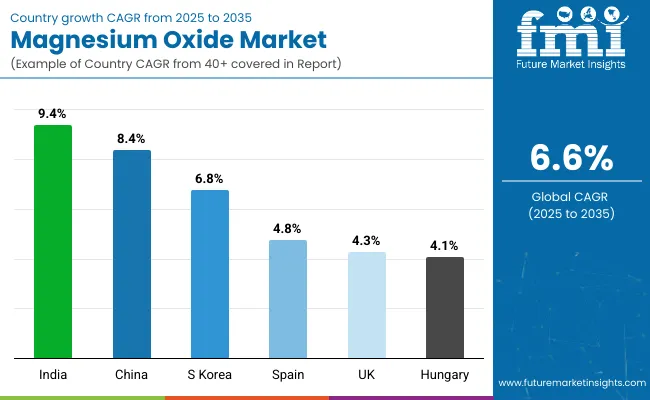

Asia Pacific is anticipated to lead the market regionally, driven by rising consumption in countries like China and India where infrastructural projects and steel production are booming. North America and Europe are set to witness moderate but steady growth due to the uptake of magnesium oxide in environmental applications, including wastewater treatment and flue gas desulfurization. The Middle East & Africa will see incremental growth supported by expanding cement and metallurgical industries.

Product-wise, Dead Burned Magnesium Oxide will continue to dominate owing to its high thermal resistance and suitability in refractory applications such as steelmaking, kiln linings, and cement production. The Refractories segment is expected to maintain the top position in applications, as industries increasingly focus on heat-resistant materials for critical processes. Significant investments in industrial infrastructure worldwide will contribute to this sustained demand.

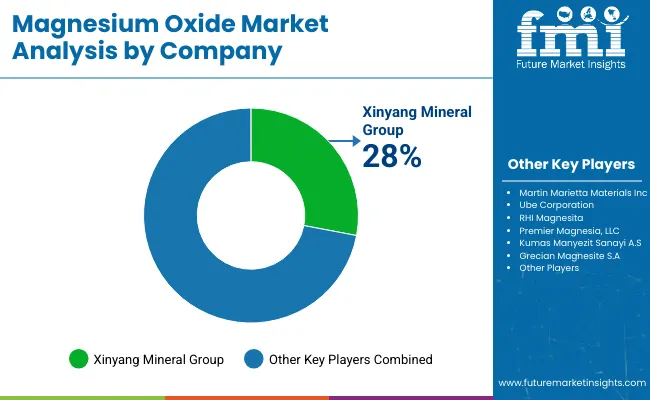

Prominent players such as RHI Magnesita, Martin Marietta Materials Inc., and Magnezit Group are enhancing production capacity, incorporating advanced technologies, and entering long-term supply agreements to meet the increasing global requirement for high-performance magnesium oxide materials. These strategic moves underscore the competitive landscape's focus on technological advancement and sustainable operations.

| Attribute | Detail |

|---|---|

| Industry Size (2025E) | USD 4.6 billion |

| Industry Size (2035F) | USD 8.9 billion |

| CAGR (2025 to 2035) | 53.5% |

Government regulations in the magnesium oxide (MgO) market primarily focus on environmental protection, occupational safety, quality control, and responsible mining and manufacturing practices. These regulations vary by region but generally aim to ensure that production and use of magnesium oxide are safe, sustainable, and compliant with international standards.

Trade regulations for magnesium oxide (MgO) based products are designed to ensure safe cross-border movement, standardize product quality, and protect health and the environment. These regulations apply across various applications including refractories, agriculture, construction, and pharmaceuticals.

Dead Burned Magnesium Oxide (DBM) accounted for a 53.5% share in 2025, supported by demand in high-temperature applications. The Refractories segment captured a 61.4% market share, driven by its critical use in steel and glass manufacturing. Expansion in iron, steel, and ceramics industries globally is driving segment growth.

Dead Burned Magnesium Oxide (DBM) held a 53.5% share of the magnesium oxide market in 2025, dominating the product type segment. Its superior thermal resistance and stability make it ideal for refractory bricks, crucibles, and kiln linings used in steel and glass industries. DBM is manufactured by sintering magnesite at temperatures above 1800°C, producing a dense, low-reactivity material suitable for harsh environments. Major steel producers worldwide rely on DBM for furnace linings that withstand extreme heat and corrosion.

Rising global steel production, especially in Asia Pacific, fuels demand for DBM. Additionally, its growing use in non-ferrous metal smelting and cement industries contributes to sustained market expansion. New mining projects and improved DBM processing technologies are expected to ensure supply chain stability. As environmental regulations tighten on industrial emissions, the need for durable and efficient refractory materials like DBM continues to rise across heavy industries worldwide.

The Refractories segment captured a 61.4% market share in the magnesium oxide market in 2025, leading the application category. Magnesium oxide’s excellent heat resistance and chemical stability make it essential for manufacturing refractory materials used in blast furnaces, electric arc furnaces, and cement kilns.

Steelmaking remains the primary driver, with refractory linings protecting production equipment from thermal and mechanical wear. The glass, ceramics, and non-ferrous metallurgy sectors also contribute significantly to demand.

In 2024, leading refractories producers introduced high-purity magnesia-based linings offering longer service life and improved energy efficiency. Expanding steel production in China and India has amplified regional demand.

Growing construction activities globally have further boosted glass and cement manufacturing, driving the need for reliable refractory materials. Innovations in magnesia-carbon bricks and unshaped refractories have enhanced performance standards, ensuring that the refractories segment remains indispensable to industrial operations requiring high-temperature endurance and corrosion resistance.

As per the latest analysis, East Asia is expected to retain its dominance in the global MgO industry during the forecast period. It is set to hold around 54.6% of the global market share in 2035. This is attributed to the following factors:

As per the report, magnesium oxide DBM is expected to dominate the global magnesium oxide market with a volume share of about 56.9% in 2025. This is attributable to the rising usage of magnesium oxide DBM due to its high-temperature resistance and superior insulating properties.

Magnesium oxide dead burned magnesia (DBM) has become highly popular globally. This is due to its versatile applications across various end-use industries. The distinctive properties of magnesium oxide DBM align seamlessly with the diverse specifications sought by end users.

The robust growth of the magnesium oxide DBM segment is underpinned by its adaptability in meeting stringent requirements across different sectors. End users appreciate its reliability in adhering to specified standards, making it a preferred choice in applications ranging from industrial processes to construction.

Magnesium oxide DBM is favored for its exceptional resistance to high temperatures. Industries requiring refractory materials, such as steelmaking and glass production, rely on DBM due to its ability to withstand extreme heat conditions without compromising its structural integrity.

Magnesium has become a versatile compound in diverse industries, including agriculture, refractories, and pharmaceuticals. Growing adoption across these industries is expected to boost the growth of the magnesium oxide market through 2035.

Caustic calcined magnesia (CCM), dead burned magnesia (DBM, and fused or electro-fused magnesia (FM/EFM) are the commonly used product types globally. They find application in refractories, steelmaking, environmental protection (such as wastewater treatment), and agriculture (as a soil amendment). They also serve as a foundational material for various magnesium-based products.

One of the primary drivers of magnesium oxide demand stems from its extensive use in industrial processes. Industries such as steelmaking, glass production, and refractories rely on magnesium oxide for its high-temperature resistance and refractory properties.

In steelmaking, magnesium oxide acts as a refractory lining in furnaces, withstanding extreme heat and maintaining structural integrity. Hence, the expansion of the steelmaking industry will likely fuel sales of magnesium oxide.

Magnesium oxide plays a vital role in agriculture, contributing to soil health and nutrient management. As modern farming practices evolve, the agricultural sector increasingly adopts magnesium oxide as a soil amendment. Its alkaline nature helps balance soil pH, and its magnesium content serves as a vital nutrient for plant growth.

The medical and pharmaceutical industries contribute significantly to the demand for magnesium oxide. Magnesium oxide serves therapeutic purposes with applications in antacids, laxatives, and pharmaceutical formulations. Its chemical stability, purity, and bioavailability make it a preferred choice in pharmaceutical manufacturing.

The global magnesium oxide market is characterized by ongoing research and technological advancements. Innovations in production methods and the discovery of new applications contribute to the market's dynamism. As industries seek materials that offer a balance of performance, environmental compatibility, and versatility, magnesium oxide is well-positioned to meet these requirements.

Leading magnesium oxide manufacturers are focusing on introducing high-purity magnesium oxide to boost their sales. This is projected to benefit the target market during the assessment period.

Growing demand for refractory materials, coupled with increasing industrialization, serves as a robust driver for the magnesium oxide market. Refractory materials are essential for applications in high-temperature environments and find extensive use in industries like steel, cement, and glass manufacturing.

Magnesium oxide is renowned for its high-temperature resistance and refractory properties. Hence, it has become pivotal in crafting refractory bricks and linings for furnaces and kilns in these sectors.

The need for durable and heat-resistant materials intensifies as industrialization gains momentum globally. Magnesium oxide, with its versatile applications in various industrial processes, becomes a preferred choice for ensuring the efficiency and longevity of equipment and infrastructure.

The escalating production of glass fibers is a significant driver for the magnesium oxide market. This is due to the rising usage of magnesium oxide in glass fiber production.

Magnesium oxide enhances glass fiber properties, providing durability and thermal stability. With the growing demand for lightweight and high-strength materials across the construction, automotive, and aerospace industries, glass fiber production is expected to surge globally. This is set to create growth prospects for the market.

The increasing emphasis on energy-efficient and environmentally friendly solutions fuels the demand for magnesium oxide-infused glass fibers in insulation applications. The construction industry, in particular, benefits from these advanced materials, promoting sustainable practices.

The burgeoning demand for magnesium oxide is significantly propelled by its key application in the animal feed sector. Magnesium is an essential mineral for the well-being of livestock and poultry, and magnesium oxide serves as a crucial source of this vital nutrient in animal diets.

As the global population grows, meat and dairy products demand rises. This is expected to create a high need for efficient and nutritionally balanced animal feed, fueling magnesium oxide sales.

With a growing emphasis on animal welfare and sustainable farming practices, the incorporation of magnesium oxide in animal feed becomes instrumental. Its alkaline properties also contribute to mitigating acidity in the digestive systems of livestock.

Magnesium oxide plays a pivotal role in maintaining the health and productivity of livestock. It aids in bone development, muscle function, and overall metabolic processes in animals.

The agriculture and livestock industries are increasingly recognizing the importance of magnesium oxide as a dietary supplement for livestock, ensuring optimal growth, reproduction, and disease resistance.

The magnesium oxide market faces significant challenges attributed to the substitution trend, where industries increasingly turn to alternative materials such as graphite and silicon carbide. Graphite, renowned for its excellent thermal conductivity and stability at high temperatures, has emerged as a formidable substitute for magnesium oxide in several applications.

Industries such as metallurgy, electronics, and energy storage find graphite particularly appealing for its lightweight nature and exceptional heat resistance. Thus, the growing usage of graphite will likely result in decreased magnesium oxide demand.

Industries seeking advanced materials for abrasive applications, semiconductor manufacturing, and refractory materials are turning to silicon carbide for its superior performance.

In refractory applications, silicon carbide's resistance to chemical corrosion and high temperatures makes it an attractive alternative to magnesium oxide, further challenging the magnesium oxide market share.

One of the significant impacts of substitution comes in the realm of refractories. Traditionally, magnesium oxide has been a preferred choice in the production of refractory bricks and linings for furnaces and kilns due to its high-temperature resistance.

However, the substitution trend, especially by silicon carbide and graphite, is affecting the demand for magnesium oxide in these critical applications.

The environmental impact of mining magnesite has garnered increasing attention, prompting industries to explore more environmentally friendly alternatives. Mining operations are projected to inflict habitat disruption, soil erosion, and ecosystem degradation, raising concerns about the ecological consequences.

The process of converting magnesite into MgO is acknowledged as energy-intensive. It contributes to the emission of greenhouse gasses into the atmosphere, resulting in global climate change.

The environmental challenges associated with traditional magnesite mining and MgO production are expected to limit market expansion. To counter this, industry experts are actively seeking cleaner and more sustainable approaches. The versatile nature of MgO, utilized in numerous industrial applications, underscores the importance of addressing these environmental concerns.

Efforts are underway to minimize habitat disruption and soil erosion caused by mining activities. Similarly, innovations are being explored to reduce the carbon footprint associated with MgO production.

The table below highlights the magnesium oxide market revenue in prominent nations. China, the United States, and India are expected to remain the top three consumers of magnesium oxide, with expected valuations of USD 4,190.6 million, USD 335.6 million, and USD 301.1 million, respectively, in 2035.

| Projected Magnesium Oxide Market Revenue (2035) | Countries |

|---|---|

| China | USD 4,190.6 million |

| United States | USD 335.6 million |

| India | USD 301.1 million |

| Germany | USD 271.8 million |

| Russia | USD 192.9 million |

| France | USD 191.0 million |

The table below shows the predicted growth rates of the top five nations. India, China, and South Korea are set to record higher CAGRs of 9.4%, 8.4%, and 6.8%, respectively, through 2035.

| Countries | Projected Magnesium Oxide CAGR (2025 to 2035) |

|---|---|

| India | 9.4% |

| China | 8.4% |

| South Korea | 6.8% |

| Spain | 4.8% |

| United Kingdom | 4.3% |

| Hungary | 4.1% |

As per the latest analysis, India’s magnesium oxide market size is estimated to reach USD 301.1 million by 2035. Over the assessment period, demand for magnesium oxide in India is projected to rise at 9.4% CAGR.

Several factors are expected to drive the growth of the magnesium oxide market in India. One such factor is India's robust infrastructure development initiatives, such as the construction of smart cities, highways, and urban infrastructure.

Essential in refractory applications, magnesium oxide is a key component in the production of construction materials, including refractory bricks and linings for furnaces. As India continues to invest in its infrastructure, the construction industry's reliance on magnesium oxide is poised for sustained growth.

Magnesium oxide plays a pivotal role in modern agricultural practices in India. As the agriculture sector adopts advanced farming techniques, the demand for magnesium oxide as a soil amendment rises.

The alkaline properties of magnesium oxide contribute to pH balance in the soil, enhancing nutrient availability and improving crop productivity. With a focus on sustainable and efficient farming, magnesium oxide's utilization aligns with the evolving needs of the Indian agricultural landscape.

The increasing awareness of environmental sustainability and stringent regulations will likely drive demand for magnesium oxide in environmental remediation projects in India. Used to neutralize acidic conditions in soil and water, magnesium oxide contributes to efforts aimed at improving environmental quality.

Leading manufacturers of magnesium oxide are expected to cater to the needs of these industries by providing high-quality magnesium oxide that meets the specific purity requirements of each sector. This is estimated to help them to boost their revenue and expand their customer base across India.

China remains the epicenter of market growth for magnesium oxide, and several compelling reasons underpin its enduring influence. As a global industrial powerhouse, China's insatiable demand for magnesium oxide is driven by its extensive use in various manufacturing processes.

The country's steel, cement, and glass industries heavily rely on magnesium oxide for its high-temperature resistance and refractory properties. Hence, the expansion of these industries is expected to play a key role in propelling magnesium oxide demand in China through 2035.

The agricultural sector in China, undergoing modernization and efficiency-driven transformations, contributes to the growth of magnesium oxide demand. The material's role as a soil amendment enhances soil fertility and supports increased crop yields, aligning with the country's commitment to food security.

China's relentless pursuit of infrastructural development contributes significantly to the growing sales of magnesium oxide. The country's construction boom necessitates the use of magnesium oxide in refractory applications, ensuring the durability and longevity of critical infrastructure components.

Sales of magnesium oxide in China are projected to soar at a CAGR of around 8.4% during the assessment period. Total valuation in China is anticipated to reach USD 4,190.6 million by 2035.

In the United States, the growth of the magnesium oxide market is propelled by a confluence of factors that span industrial resurgence and a commitment to sustainable practices. The resurgence of manufacturing in the United States is significantly contributing to the increasing demand for magnesium oxide.

The construction industry in the United States plays a pivotal role in driving the demand for magnesium oxide. As the nation witnesses an upswing in construction activities, sales of magnesium oxide are predicted to rise steadily across the United States.

Magnesium oxide is extensively used in various construction materials, including refractory cement and insulation. Its ability to enhance the performance and durability of these materials makes it indispensable in the dynamic construction landscape.

The commitment to sustainable practices is another key driver for MgO industry growth in the United States. The material's applications in environmental remediation projects, particularly in neutralizing acidic conditions in soil and water, align with the nation's focus on environmental responsibility.

The United States magnesium oxide market value is anticipated to total USD 335.6 million by 2035. Over the forecast period, sales of magnesium oxide in the United States are set to increase at a CAGR of 4.3%.

Japan’s magnesium oxide market is poised to exhibit a CAGR of 5.5% during the assessment period. It is expected to attain a market valuation of USD 171.8 million by 2035. This is attributable to the rising usage of magnesium oxide in applications like electronic devices and biomedical implants.

Japan is known for its advanced technological landscape, which drives the demand for magnesium oxide through constant innovation. The material finds applications in cutting-edge technologies and electronic components, benefiting from Japan's position as a global leader in electronics manufacturing.

Magnesium oxide's role as an insulator in electronic devices, including semiconductors and integrated circuits, contributes significantly to its growth. Similarly, the steel and metal industries in Japan contribute substantially to the demand for magnesium oxide.

The magnesium oxide market is competitive with major players including RHI Magnesita, Martin Marietta Materials, Premier Magnesia, Grecian Magnesite, Magnezit Group, Ube Industries, Nedmag, ICL Group, and Kumas Magnesite.

These companies focus on expanding production capacities, especially for high-purity and dead-burned magnesium oxide used in steel, ceramics, and environmental applications. RHI Magnesita emphasizes vertical integration and technological advancements in refractory solutions.

Premier Magnesia targets niche markets like agriculture and pharmaceuticals. Ube Industries invests in energy-efficient processes. Grecian Magnesite and Nedmag focus on sustainable mining practices. Global reach, strategic acquisitions, and supply chain optimization are key strategies driving competition.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.6 billion |

| Projected Market Size (2035) | USD 8.9 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Type (Segment 1) | CCM (80% to 85%), DBM (90% to 94%), Fused MgO (95% to 99%) |

| Application (Segment 2) | Agrochemical, Construction, Refractories, Chemical, Rubber Processing, Pharmaceutical, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, China, Japan, South Korea, India, ASEAN Countries, GCC Countries, South Africa |

| Key Players influencing the Market | Martin Marietta Materials Inc, Ube Corporation, RHI Magnesita, Premier Magnesia, LLC, Kumas Manyezit Sanayi A.S, Grecian Magnesite S.A, Israel Chemicals Ltd, Xinyang Mineral Group, Other Key Players |

| Additional Attributes | Dollar sales, share, High demand from refractories and construction industries, Growth in DBM and Fused MgO grades, Rising applications in rubber processing and pharmaceuticals, Increasing use in agrochemical formulations, Expansion of production capacities by major manufacturers, Asia Pacific to remain the dominant consumer, Technological upgrades in MgO purity enhancement, Notable capacity expansion by RHI Magnesita in Brazil strengthening global supply reliability and cost optimization. |

Table 01: Global Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 02: Global Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 03: Global Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Region

Table 04: North America Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 05: North America Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 06: North America Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 07: Latin America Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 08: Latin America Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 09: Latin America Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 10: Western Europe Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 11: Western Europe Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 12: Western Europe Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 13: Eastern Europe Market Volume (tons) and Value (million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 14: Eastern Europe Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 15: Eastern Europe Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 16: East Asia Market Volume (tons) & Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 17: East Asia Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 18: East Asia Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 19: South Asia and Pacific Market Volume (tons) & Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 20: South Asia and Pacific Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 21: South Asia and Pacific Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Table 22: Middle East & Africa Market Volume (tons) & Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Country

Table 23: Middle East & Africa Market Value (US$ million) and Volume (tons) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Product Type

Table 24: Middle East & Africa Market Volume (tons) and Value (US$ million) Analysis 2018 to 2022 and Opportunity Assessment 2023 to 2033, By Application

Figure 01: Global Historical Market Volume (tons) Analysis, 2018 to 2022

Figure 02: Global Current and Future Market Volume (tons) Projections, 2023 to 2033

Figure 03: Global Historical Market Value (US$ million) Analysis, 2018 to 2022

Figure 04: Global Current and Future Market Value (US$ million) Projections, 2023 to 2033

Figure 05: Global Absolute $ Opportunity Analysis, 2018 to 2033

Figure 06: Global Market BPS Analysis by Product Type, 2023 to 2033

Figure 07: Global Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 09: Global Market Abs. $ Opp. Analysis by Product Type, 2023 to 2033

Figure 10: Global Market BPS Analysis by Application, 2023 to 2033

Figure 11: Global Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 12: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 13: Global Market Abs. $ Opp. Analysis by Application, 2023 to 2033

Figure 14: Global Market BPS Analysis by Region, 2023 to 2033

Figure 15: Global Market Y-o-Y Analysis by Region, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 17: Global Market Abs. $ Opp. Analysis by Region, 2023 to 2033

Figure 18: North America Market BPS Analysis by Country, 2023 to 2033

Figure 19: North America Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 20: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 21: North America Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 22: North America Market BPS Analysis by Product Type, 2023 to 2033

Figure 23: North America Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 25: North America Market BPS Analysis by Application, 2023 to 2033

Figure 26: North America Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 28: Latin America Market BPS Analysis by Country, 2023 to 2033

Figure 29: Latin America Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 31: Latin America Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 32: Latin America Market BPS Analysis by Product Type, 2023 to 2033

Figure 33: Latin America Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 34: Latin America Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 35: Latin America Market BPS Analysis by Application, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 37: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 38: Western Europe Market BPS Analysis by Country, 2023 to 2033

Figure 39: Western Europe Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 40: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 41: Western Europe Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market BPS Analysis by Product Type, 2023 to 2033

Figure 43: Western Europe Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 44: Western Europe Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 45: Western Europe Market BPS Analysis by Application, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 47: Western Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 48: Eastern Europe Market BPS Analysis by Country, 2023 to 2033

Figure 49: Eastern Europe Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 50: Eastern Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 51: Eastern Europe Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 52: Eastern Europe Market BPS Analysis by Product Type, 2023 to 2033

Figure 53: Eastern Europe Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 54: Eastern Europe Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 55: Eastern Europe Market BPS Analysis by Application, 2023 to 2033

Figure 56: Eastern Europe Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 57: Eastern Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 58: East Asia Market BPS Analysis by Country, 2023 to 2033

Figure 59: East Asia Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 60: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 61: East Asia Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 62: East Asia Market BPS Analysis by Product Type, 2023 to 2033

Figure 63: East Asia Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 64: East Asia Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 65: East Asia Market BPS Analysis by Application, 2023 to 2033

Figure 66: East Asia Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 67: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 68: South Asia and Pacific Market BPS Analysis by Country, 2023 to 2033

Figure 69: Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 70: South Asia and Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 71: South Asia and Pacific Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 72: South Asia and Pacific Market BPS Analysis by Product Type, 2023 to 2033

Figure 73: South Asia and Pacific Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 74: South Asia and Pacific Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 75: South Asia and Pacific Market BPS Analysis by Application, 2023 to 2033

Figure 76: South Asia and Pacific Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 77: South Asia and Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 78: Middle East & Africa Market BPS Analysis by Country, 2023 to 2033

Figure 79: Middle East & Africa Market Y-o-Y Analysis by Country, 2023 to 2033

Figure 80: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 81: Middle East & Africa Market Abs. $ Opp. Analysis by Country, 2023 to 2033

Figure 82: Middle East & Africa Market BPS Analysis by Product Type, 2023 to 2033

Figure 83: Middle East & Africa Market Y-o-Y Analysis by Product Type, 2023 to 2033

Figure 84: Middle East & Africa Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 85: Middle East & Africa Market BPS Analysis by Application, 2023 to 2033

Figure 86: Middle East & Africa Market Y-o-Y Analysis by Application, 2023 to 2033

Figure 87: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

The global market value totaled USD 4.6 billion in 2025.

Global magnesium oxide demand is projected to rise at 6.6% CAGR through 2035.

The global magnesium oxide market size is projected to reach USD 8.9 billion by 2035.

The refractories segment is expected to lead the market during the forecast period.

Mainland China.

It is used to manufacture cement, castings, bricks, laboratory equipment, and refractory vessels.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA