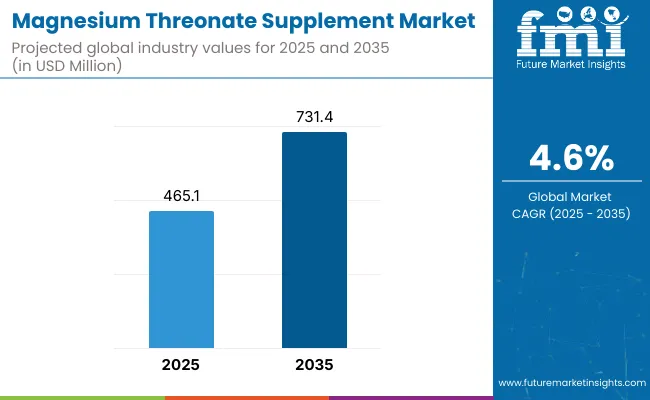

The Magnesium Threonate Supplement Market has been forecasted to attain a valuation of USD 465.1 million in 2025, rising to USD 731.4 million by 2035, resulting in an incremental gain of USD 266.3 million, which reflects a 57.2% increase over the forecast decade. A compound annual growth rate (CAGR) of 4.6% is expected to be recorded, indicating a steady yet resilient expansion trajectory for magnesium-based cognitive support supplements.

Magnesium Threonate Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 465.1 million |

| Market Forecast Value in (2035F) | USD 731.4 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

During the initial five-year phase from 2025 to 2030, a moderate incline is projected from USD 465.1 million to approximately USD 583.3 million adding nearly USD 118.2 million, which would contribute 44.4% of the total decade growth.

This period is expected to be defined by rising mental wellness awareness, growing consumer preference for neuroprotective ingredients, and increasing product availability across e-commerce and practitioner-led channels. Strong uptake is likely to be witnessed across adult populations seeking cognitive optimization, especially in North America and parts of Asia.

Between 2030 and 2035, the market is projected to expand further by USD 148.1 million, contributing the remaining 55.6% of total growth, supported by broader clinical acceptance, deeper penetration in aging demographics, and product innovations featuring synergistic formulations.

Digital therapeutics, personalization technologies, and practitioner-prescribed nutraceutical protocols are expected to serve as growth amplifiers in the latter half. A higher adoption rate across functional beverages and personalized capsule delivery formats is anticipated, shifting volume away from traditional supplements.

From 2020 to 2024, the Magnesium Threonate Supplement Market expanded from USD ~360 million to USD 465.1 million, fueled by mounting interest in nootropics and age-related cognitive health. During this period, growth was led by capsule-based formulations, with Magtein® (magnesium L-threonate) dominating premium product portfolios. Global leaders such as Life Extension and Pure Encapsulations secured early market leadership by aligning their formulations with clinical studies and exclusive ingredient rights.

Revenue concentration was observed in offline pharmacy and online DTC segments, while subscription-based models were still emerging. By 2025, the market is expected to pivot toward personalized wellness bundles, practitioner-guided protocols, and AI-enhanced product recommendations.

The revenue mix is projected to shift as liquid, gummy, and powder formulations grow faster than traditional capsules, contributing to more dynamic growth across demographic groups. Competitive advantage is transitioning from ingredient sourcing alone to ecosystem integration, encompassing practitioner education, compliance support, and multi-format innovation.

Growth in the Magnesium Threonate Supplement Market has been driven by increasing scientific validation of its neuroprotective and cognitive-enhancing properties. The compound’s ability to elevate magnesium levels in the brain considered critical for synaptic plasticity and memory formation has been widely acknowledged through peer-reviewed research.

Rising consumer awareness regarding age-related cognitive decline and stress-related neurological issues has led to heightened demand for preventive solutions. Broader inclusion in clinical wellness protocols has been facilitated through practitioner-led channels and integrative medicine practices.

Adoption has been accelerated by the compound’s differentiation from generic magnesium supplements, as its bioavailability and blood-brain barrier penetration have been recognized as superior. Regulatory shifts toward supporting cognitive health claims have created new pathways for market legitimacy.

Product innovation particularly in functional gummies, powders, and liquid formulations has enabled broader consumer appeal. Continued investments in education by leading nutraceutical brands are expected to expand consumer trust, while premium positioning through practitioner distribution channels is forecast to sustain long-term value creation.

The Magnesium Threonate Supplement Market has been segmented based on Application, Product Format, Sales Channel, and Region, allowing stakeholders to capture nuanced growth patterns and shifting consumer preferences.

Each segment has been shaped by unique adoption drivers, clinical relevance, and evolving distribution strategies. Applications span from cognitive health to general wellness, reflecting the compound’s role in neuroprotection and psychological balance. Product format segmentation includes capsules, powders, liquids, and gummies, each tailored to different demographic and therapeutic needs.

Sales channels encompass traditional pharmacy chains, specialty health stores, and emerging direct-to-consumer brands, each offering distinct consumer engagement models. This granular segmentation is expected to enhance precision in strategic planning and future investment decision-making across the value chain.

| Application | Market Value Share, 2025 |

|---|---|

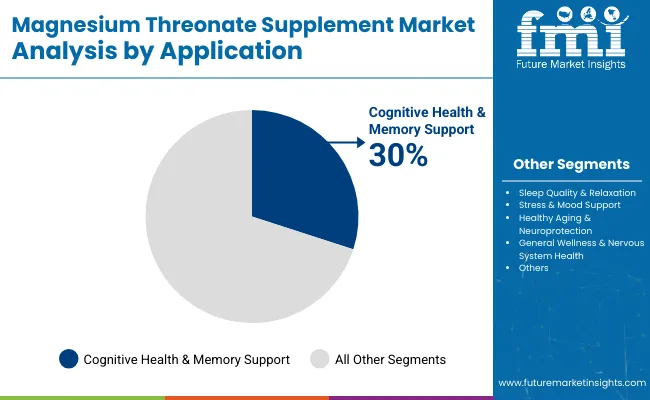

| Cognitive Health & Memory Support | 30% |

| Sleep Quality & Relaxation | 18% |

| Stress & Mood Support | 20% |

| Healthy Aging & Neuroprotection | 22% |

| General Wellness & Nervous System Health | 10% |

The Cognitive Health & Memory Support segment has been projected to lead the market with a 30% share in 2025, supported by an 8.4% CAGR through 2035. This dominance has been attributed to the rising prevalence of cognitive decline in aging populations, heightened interest in brain optimization among younger consumers, and increasing clinical credibility of magnesium threonate as a brain-targeting compound.

The Healthy Aging & Neuroprotection segment, with a CAGR of 8.8%, is expected to emerge as a high-potential growth area, especially as longevity-focused consumers adopt preventive neuro-wellness strategies. Meanwhile, Stress & Mood Support is being positioned as a resilient mid-growth area, driven by urban lifestyle stressors and the shift toward non-pharma mood regulators. Collectively, these segments are expected to anchor long-term adoption across age and demographic groups.

| Product Format | Market Value Share, 2025 |

|---|---|

| Capsules | 40% |

| Tablets | 20% |

| Powder | 12% |

| Gummies | 15% |

| Liquid Formulations | 13% |

Capsules are expected to retain their dominant position with a 40% share in 2025 and a strong CAGR of 8.6%. This performance has been supported by widespread consumer trust, precision dosing capabilities, and clinical preference.

However, the Gummies segment, growing at a robust CAGR of 9.2%, is forecast to attract younger demographics and wellness-focused consumers, particularly in lifestyle-driven markets like North America and Asia. Liquid Formulations, posting an 8.9% CAGR, are gaining traction due to ease of absorption and growing relevance in geriatric and pediatric markets. These format shifts indicate a clear trend toward convenience, compliance, and personalization in supplement consumption.

| Sales Channel | 2025 Share (%) |

|---|---|

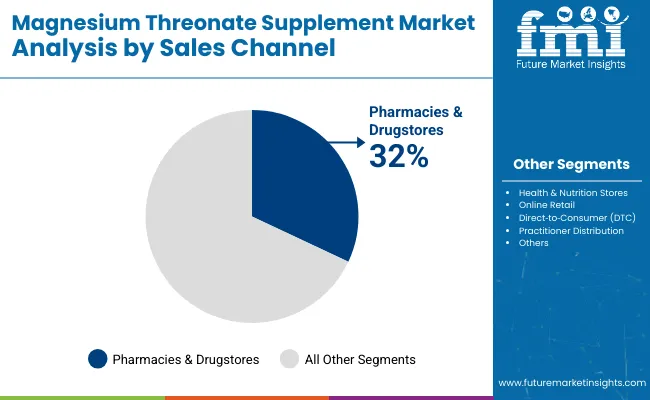

| Pharmacies & Drugstores | 32% |

| Health & Nutrition Stores | 18% |

| Online Retail | 25% |

| Direct to Consumer (DTC) | 15% |

| Practitioner Distribution | 10% |

Pharmacies & Drugstores are forecasted to retain the highest share (32%) in 2025, supported by wide availability and consumer trust in regulated outlets. However, Online Retail and DTC Brands, growing at 9.4% and 9.7% CAGR respectively, are expected to disrupt the landscape.

Their rise has been enabled by digital education, influencer-driven marketing, and personalized subscription models. Meanwhile, Practitioner / Clinic Distribution has been emerging as a niche yet authoritative channel, reinforced by magnesium threonate’s clinical backing. Hybrid models combining online reach with practitioner guidance are anticipated to define the future of channel strategy in this space.

The adoption of Magnesium Threonate supplements has been steadily expanding, though certain scientific and commercial barriers remain. Rising consumer demand for cognitive enhancement is counterbalanced by formulation challenges, regulatory ambiguity, and varying awareness across global regions.

Clinically Validated Cognitive Enhancement Claims Have Strengthened Market Confidence

Market demand has been driven by peer-reviewed evidence highlighting magnesium threonate’s role in improving memory function and neuroplasticity. Unlike generic magnesium salts, this compound has been proven to cross the blood-brain barrier effectively, a feature that has reinforced its clinical value.

Neurologists and integrative medicine practitioners have increasingly recommended it for use in mild cognitive impairment, ADHD, and age-related cognitive decline. Consumer trust has also been enhanced through branded clinical formulations and published trial results, further elevating perceived efficacy. As the burden of neurological disorders rises globally, magnesium threonate is expected to be positioned as a cornerstone in preventive brain health protocols.

Practitioner-Led Supplementation Is Emerging as a Distinct Growth Channel

A notable trend has been observed in the practitioner distribution space, where magnesium threonate is being integrated into functional medicine protocols. Healthcare providers are leveraging diagnostic tools to personalize dosing, thereby enhancing compliance and outcomes. This trend has contributed to a shift from self-selected retail purchases to guided, high-credibility therapeutic use. It is expected that this model will support long-term brand loyalty and sustained patient retention.

| Countries | CAGR |

|---|---|

| China | 6.60% |

| India | 5.69% |

| Germany | 6.60% |

| France | 6.50% |

| UK | 6.77% |

| USA | 5.72% |

| Brazil | 5.18% |

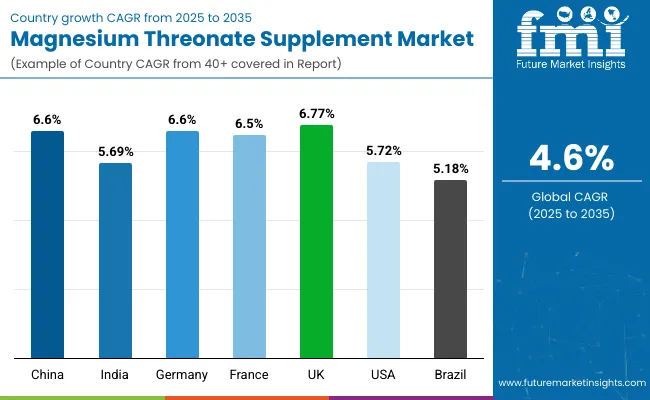

Adoption of magnesium threonate supplements has been progressing unevenly across countries, influenced by clinical literacy, nutraceutical regulations, and consumer access to cognitive health interventions. Asia-Pacific has been identified as the fastest-growing regional cluster, with China and India projected to expand at CAGRs of 6.60% and 5.69%, respectively.

Growth in China has been attributed to the rapid emergence of functional supplement channels, aging population dynamics, and increased usage of magnesium-based cognitive support in integrative healthcare settings. In India, urban wellness trends and the expansion of practitioner-guided formulations have supported uptake, particularly among educated urban consumers and geriatric populations.

In Europe, Germany (6.60%), France (6.50%), and the UK (6.77%) are expected to anchor regional growth through strong demand for brain health products and rising interest in nootropics. Regulatory clarity on health claims and premium positioning in pharmacy chains have further reinforced regional performance.

In North America, the USA (5.72%) is anticipated to remain a mature yet steadily advancing market, driven by a mix of direct-to-consumer brands and practitioner-led wellness protocols. Meanwhile, Brazil (5.18%) leads Latin America’s expansion through expanding e-commerce penetration and growing consumer interest in stress and mood support, positioning the country as an emerging hotspot for cognitive supplements.

| Year | USA |

|---|---|

| 2025 | 111.6 |

| 2026 | 118.8 |

| 2027 | 126.0 |

| 2028 | 133.1 |

| 2029 | 140.4 |

| 2030 | 148.9 |

| 2031 | 157.3 |

| 2032 | 167.7 |

| 2033 | 177.8 |

| 2034 | 187.7 |

| 2035 | 197.7 |

The Magnesium Threonate Supplement Market in the United States has been forecasted to expand at a CAGR of 5.9% between 2025 and 2035. This growth has been supported by the widespread prioritization of cognitive wellness and age-related neuroprotection among aging and high-performance demographics. The supplement’s clinical differentiation particularly its ability to cross the blood-brain barrier has been increasingly recognized by USA-based healthcare practitioners and integrative nutritionists.

Digital health platforms and functional wellness clinics have been playing a critical role in expanding personalized supplementation protocols, within which magnesium threonate has been prominently featured. Market demand has also been enhanced by a shift toward preventive neurological care, particularly among professionals and older adults seeking cognitive resilience.

The Magnesium Threonate Supplement Market in the UK is projected to grow at a CAGR of 6.77% during 2025 to 2035. This expansion has been supported by increased consumer interest in cognitive performance, age-related memory support, and workplace mental stamina.

Regulatory alignment with EFSA guidance and integration of magnesium threonate into pharmacist-recommended brain health protocols have bolstered credibility. Distribution has been enhanced through omni-channel retail models combining high-street pharmacies and personalized DTC brands. Demand has also been rising for vegan, allergen-free formulations that meet stringent clean-label standards. Mental health awareness campaigns and employer-sponsored wellness initiatives are expected to further elevate market visibility and long-term usage across adult segments.

India’s Magnesium Threonate Supplement Market is expected to grow at a CAGR of 5.69% between 2025 and 2035. Urban professionals and students have increasingly turned to magnesium threonate for managing stress, concentration, and digital fatigue.

Rising interest in brain-boosting supplements has been observed in the ayurveda-integrated health market, where magnesium threonate is positioned as a modern cognitive enhancer. Adoption has been driven by greater e-commerce penetration, expansion of e-pharmacies, and personalized wellness platforms. However, regional disparities in supplement access and lower awareness in Tier 3 cities have slowed mass uptake. Endorsement by functional medicine practitioners and neurological therapists is expected to amplify awareness and boost sustained market growth.

China’s Magnesium Threonate Supplement Market is projected to expand at a CAGR of 6.60% from 2025 to 2035. Demand has been reinforced by the convergence of aging demographics, educational competitiveness, and strong trust in functional nutraceuticals. Magnesium threonate’s role in neuroprotection and academic performance has been highlighted by health influencers and TCM-informed practitioners.

Growth has been aided by robust cross-border e-commerce channels and domestic brand innovation. Premium formats such as enteric-coated capsules and high-absorption powders are gaining attention among health-conscious consumers. Further support is expected from the integration of magnesium threonate into neuro-wellness bundles within family-focused health packages.

| Countries | 2025 |

|---|---|

| UK | 18.11% |

| Germany | 20.70% |

| Italy | 9.91% |

| France | 14.52% |

| Spain | 10.87% |

| BENELUX | 6.09% |

| Nordic | 5.79% |

| Rest of Europe | 14% |

| Countries | 2035 |

|---|---|

| UK | 19.14% |

| Germany | 21.59% |

| Italy | 10.84% |

| France | 14.67% |

| Spain | 11.48% |

| BENELUX | 5.46% |

| Nordic | 5.27% |

| Rest of Europe | 12% |

The Magnesium Threonate Supplement Market in Germany is forecasted to achieve a CAGR of 6.60% between 2025 and 2035. A science-first consumer mindset and high trust in pharmacy-based recommendations have positioned magnesium threonate favorably within the cognitive health segment. Aging demographics and strong demand for mental clarity solutions among working professionals have further supported adoption. EFSA-compliant claims and clean-label regulations have facilitated premium placement in functional health stores.

Demand has been further fueled by neurological rehabilitation centers and wellness clinics integrating magnesium threonate into structured cognitive recovery protocols. The continued expansion of practitioner education and neuro-focused supplement portfolios is expected to shape the future market trajectory.

| Application | 2025 Share (%) |

|---|---|

| Cognitive Health & Memory Support | 32% |

| Sleep Quality & Relaxation | 18% |

| Stress & Mood Support | 20% |

| Healthy Aging & Neuroprotection | 20% |

| General Wellness & Nervous System Health | 10% |

The Magnesium Threonate Supplement Market in Japan has been projected to reach USD 46.5 million by 2025. Cognitive Health & Memory Support leads the application landscape with a 32% share, followed by Healthy Aging & Neuroprotection and Stress & Mood Support at 20% each, reflecting Japan’s dual focus on elderly cognitive care and stress mitigation in high-pressure professional environments. Market adoption has been accelerated by Japan’s demographic aging, where magnesium threonate is being positioned as a proactive tool for memory preservation and neuroplasticity.

Sleep support and emotional balance have also emerged as key health goals, with growing consumer preference for non-pharmaceutical interventions. Practitioners and pharmacies have increasingly recommended magnesium threonate-based formulations, especially those aligned with clinical studies and functional food guidelines. Digital platforms and AI-enabled health trackers are enabling tailored cognitive health supplementation, while regulatory openness to functional labeling is fostering premium product positioning.

| Sales Channel | Market Value Share, 2025 |

|---|---|

| Pharmacies & Drugstores | 30% |

| Health & Nutrition Stores | 20% |

| Online Retail | 25% |

| Direct to Consumer (DTC) Brands | 15% |

| Practitioner / Clinic Distribution | 10% |

The Magnesium Threonate Supplement Market in South Korea has been projected to reach USD 25.6 million in 2025. Pharmacies & Drugstores are expected to lead distribution with a 30% share, followed closely by Online Retail (25%) and Health & Nutrition Stores (20%). Growth across digital channels is anticipated to be driven by South Korea’s highly connected population, advanced e-commerce infrastructure, and a growing appetite for nootropic and cognitive wellness products among health-literate consumers.

Direct-to-Consumer (DTC) brands have been gaining momentum, particularly among millennials and working professionals seeking personalized, subscription-based cognitive health solutions. Clinic-led distribution remains niche yet influential, as magnesium threonate continues to be incorporated into physician-guided brain health regimens. Clean-label positioning and premium packaging are expected to influence purchasing behaviors, while AI-integrated health platforms may soon facilitate tailored supplement dosing for neuroprotection and focus enhancement.

| Companies | Global Value Share 2025 |

|---|---|

| NOW Foods | 8% |

| Others | 92% |

The Magnesium Threonate Supplement Market is moderately fragmented, characterised by three tiers of competitors: global leaders, mid‑sized innovators, and niche specialists. Market leadership has been maintained by companies such as Life Extension, NOW Foods, Pure Encapsulations, and Thorne Research, which collectively are estimated to account for 30-40% of the global market. These brands have built authority through patented Magtein® formulations, investment in clinical research, and global distribution in health‑conscious markets

Mid‑sized players including Doctor’s Best, Source Naturals, Jarrow Formulas, Swanson Health Products, and Double Wood Supplements have gained traction by offering clinically positioned magnesium threonate formats in capsules, powders, and gummies. These companies have been driving expansion through regional retail networks and e‑commerce partnerships

Niche specialists such as Nootropics Depot focus on customized, research-grade supplement formulations with small batch production and targeted therapeutic positioning. These firms excel in highly specific sub‑segments like student nootropics or stress‑focused blends.

Competitive differentiation is increasingly shifting toward integrated value propositions such as subscription services, third‑party testing validation, and influencer‑driven transparency. Brands are expected to strengthen their positioning through ecosystem-based offerings: digital health guides, product bundles targeting multiple brain health endpoints, and practitioner partnerships.

Key Developments in Magnesium Threonate Supplement Market

| Item | Value |

|---|---|

| Quantitative Units | USD 465.1 million |

| Ingredient Type | Magnesium L- Threonate (Magtein ® and other branded variants) |

| Application | Cognitive Health & Memory Support, Sleep Quality & Relaxation, Stress & Mood Support, Healthy Aging, General Wellness |

| Product Format | Capsules, Tablets, Powders, Gummies, Liquid Formulations |

| Sales Channel | Pharmacies & Drugstores, Health & Nutrition Stores, Online Retail, DTC Brands, Practitioner / Clinic Distribution |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Japan, South Korea, China, India, Brazil |

| Key Companies Profiled | Life Extension, NOW Foods, Doctor’s Best, Pure Encapsulations, Thorne Research, Source Naturals, Jarrow Formulas, Swanson Health Products, Double Wood Supplements, Nootropics Depot |

| Additional Attributes | Dollar sales by format and region; clinical differentiation vs generic magnesium; use in cognitive protocols; demand driven by aging, stress, digital fatigue; personalized wellness adoption; channel-specific penetration; regulatory developments (e.g., EU novel food approval); competitive positioning of Magtein ®-based formulations. |

The global Magnesium Threonate Supplement Market is estimated to be valued at USD 465.1 million in 2025.

The market size for the Magnesium Threonate Supplement Market is projected to reach approximately USD 731.4 million by 2035.

The Magnesium Threonate Supplement Market is expected to grow at a CAGR of 4.6% between 2025 and 2035.

The key product formats in the Magnesium Threonate Supplement Market include capsules, tablets, powders, gummies, and liquid formulations.

In terms of application, the Cognitive Health & Memory Support segment is projected to command the highest share at 30% in the Magnesium Threonate Supplement Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnesium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Wheel Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Acetate Market

Magnesium Testing Reagents Market

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA