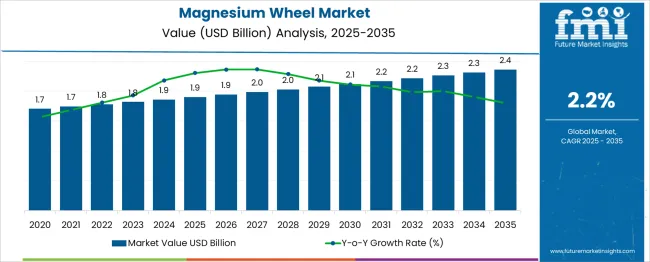

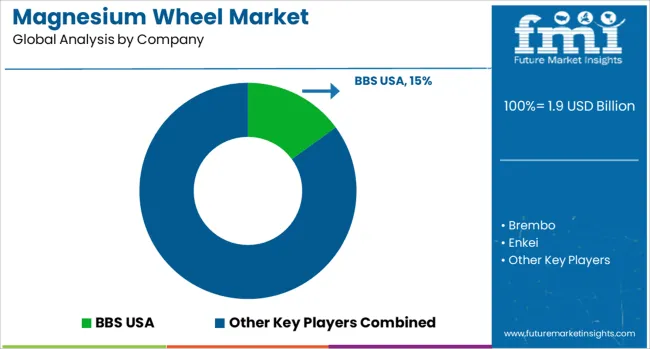

The Magnesium Wheel Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.2% over the forecast period.

The provided data indicates a slow and steady rise, suggesting that the market is already operating near its saturation point in key regions. Between 2025 and 2029, the market increases only from USD 1.9 billion to USD 2.1 billion, with minimal annual increments of USD 0.0 to 0.1 billion. This limited early-phase growth reflects stable demand from performance and luxury automotive segments, where magnesium wheels are valued for their lightweight properties, yet face high cost constraints and competition from advanced aluminum alloys and carbon fiber composites. From 2030 to 2035, gains remain marginal, with values moving from USD 2.2 billion to USD 2.4 billion, adding only USD 0.2 billion over five years. This flat trajectory signals that most potential buyers have already adopted the technology where feasible, leaving little room for volume expansion. The saturation point appears to be driven by high production costs, niche application focus, and limited penetration in mass-market vehicles. Without significant cost reductions or breakthroughs in manufacturing efficiency, the market is likely to remain in a mature stage with constrained growth beyond 2035.

| Metric | Value |

|---|---|

| Magnesium Wheel Market Estimated Value in (2025 E) | USD 1.9 billion |

| Magnesium Wheel Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 2.2% |

The magnesium wheel market is viewed as a specialized yet steadily expanding category across its parent industries. It is estimated to account for about 1.9% of the global automotive wheel market, indicating growing interest in lightweight performance-driven wheel solutions. Within the performance vehicle components sector, a share of approximately 3.2% is assessed, driven by high-end sports cars and premium racing applications. In the alloy and specialty metals market, the segment is calculated at around 2.7%, given the technical demand for magnesium-based structural components. Within the electric vehicle components industry, about 2.4% is evaluated as lightweight wheel options gain traction for efficiency.

In the motorsport and aftermarket vehicle upgrade market, a contribution of roughly 2.9% is observed, supported by demand for enhanced handling and reduced unsprung weight. Trends in this market have been shaped by increasing use of magnesium wheels in performance and electric vehicle segments where weight reduction is valued. Innovations have been focused on advanced manufacturing techniques including high-pressure die casting and forged magnesium alloys offering high strength-to-weight ratios. Interest has increased in ultra-light spoked and hybrid cast-forge wheel formats tailored for sports cars and race teams. The motorsport sector has been observed to lead demand while OEM adoption in premium EV models is emerging. Strategic initiatives have included collaborations between wheel manufacturers and automotive OEMs to deliver certified magnesium wheel sets featuring corrosion-resistant coatings predictive stress-testing and optimized structural design metric verification.

The magnesium wheel market is gaining momentum, fueled by increasing demand for lightweight automotive components that enhance fuel efficiency, acceleration, and overall vehicle performance. Rising adoption of premium and sports vehicles has accelerated the integration of magnesium alloys due to their superior strength-to-weight ratio compared to traditional materials.

Government regulations around CO₂ emissions and fuel economy targets have further driven OEMs to shift toward lighter wheel solutions. Technological improvements in corrosion resistance, structural integrity, and aesthetic customizations have widened the use of magnesium wheels beyond racing applications into mainstream passenger vehicles.

As consumers seek visually distinctive and performance-enhancing components, magnesium wheels are increasingly seen as both a functional upgrade and a luxury statement.

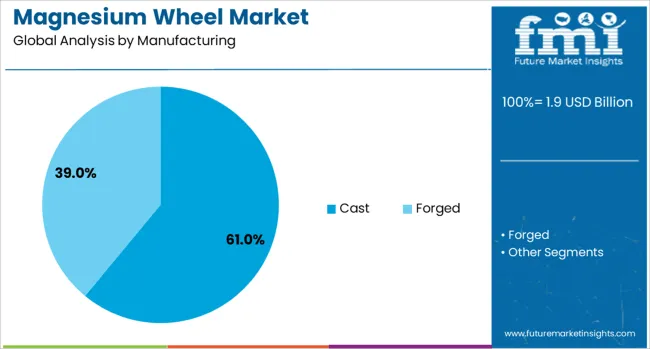

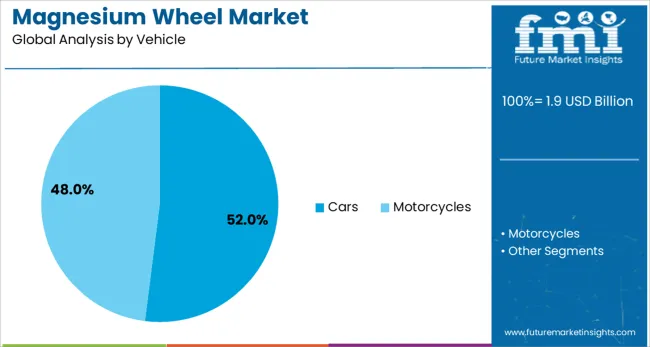

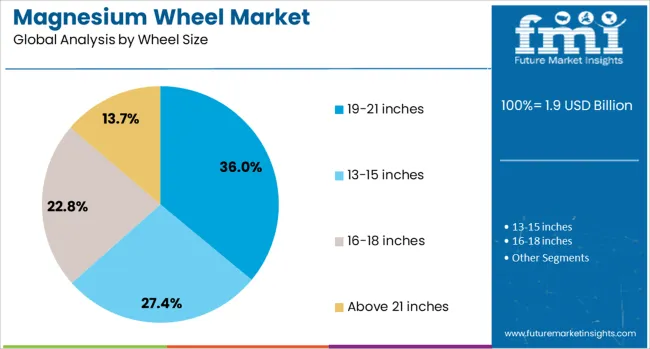

The magnesium wheel market is segmented by manufacturing, vehicle, wheel size, sales channel, and geographic regions. The magnesium wheel market is divided into Cast and Forged. In terms of vehicles, the magnesium wheel market is classified into Cars and Motorcycles. Based on wheel size, the magnesium wheel market is segmented into 19-21 inches, 13-15 inches, 16-18 inches, and above 21 inches. The magnesium wheel market is segmented by sales channel into OEM and Aftermarket. Regionally, the magnesium wheel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By manufacturing type, the cast segment is projected to lead with a 61.00% share of the global magnesium wheel market by 2025. The dominance of cast magnesium wheels stems from their cost-effectiveness, faster production cycles, and enhanced design flexibility.

High-pressure die casting enables precision detailing and dimensional consistency, which is crucial for maintaining balance and performance in high-speed vehicles. Moreover, advancements in casting techniques have improved structural strength, allowing cast magnesium wheels to withstand rigorous driving conditions while remaining economically viable for mass production.

As automakers focus on weight reduction without compromising safety or style, cast manufacturing continues to offer a scalable solution for both luxury and performance vehicle segments.

By vehicle type, cars are expected to account for 52.00% of the magnesium wheel market share in 2025, making them the leading application category. This is driven by the growing use of magnesium wheels in mid-range and high-end passenger vehicles to improve fuel efficiency and handling.

The segment benefits from increasing consumer interest in aftermarket wheel upgrades for personalization and performance. OEMs are also integrating magnesium wheels in factory packages for sports trims and electric vehicles, where weight savings are critical to enhancing battery range and ride dynamics.

As the car segment continues to dominate global vehicle production volumes, its contribution to magnesium wheel demand is expected to remain robust.

By wheel size, the 19-21 inches segment is projected to capture 36.00% of the market share by 2025, leading among all size categories. These wheels strike a balance between visual appeal, performance optimization, and ride comfort, making them highly popular in sports sedans, SUVs, and premium hatchbacks.

Larger diameter magnesium wheels offer enhanced cornering stability and brake clearance while contributing to an aggressive vehicle stance. The rising trend of factory-fitted large wheels in luxury and crossover vehicles, alongside a booming aftermarket for aesthetic upgrades, has further cemented the 19-21 inch category’s market leadership.

As consumer preference shifts toward high-performance styling and customization, demand for magnesium wheels in this size range is expected to remain strong.

Magnesium wheels have been increasingly adopted in automotive, motorcycle, and motorsport industries due to their lightweight properties, high strength-to-weight ratio, and improved heat dissipation. These wheels contribute to reduced vehicle weight, improved handling, and enhanced fuel efficiency. Demand has been driven by performance-oriented vehicles and premium segments where weight savings are a key priority. Manufacturers have been investing in advanced casting and forging techniques, surface treatments, and corrosion protection to improve durability. Growing interest in high-performance customization has also supported market expansion across global automotive markets.

The primary appeal of magnesium wheels lies in their ability to significantly reduce unsprung mass, improving acceleration, braking, and cornering stability. Motorsport teams have utilized these wheels to gain competitive advantages, while luxury and sports car manufacturers have offered them as premium upgrades. Motorcycle racing segments have also widely adopted magnesium wheels for improved agility and heat management in braking systems. Reduced rotational inertia has been beneficial in enhancing throttle response and ride quality. Automotive enthusiasts and aftermarket tuning businesses in Europe, Japan, and North America have been strong proponents of magnesium wheel adoption. The combination of weight savings and performance improvement has solidified their reputation as a high-value component for both competitive and enthusiast markets.

Magnesium wheels have been extensively used in professional motorsport categories such as Formula 1, MotoGP, and endurance racing due to their superior handling characteristics. In the premium automotive market, brands have offered factory-fitted magnesium wheels on limited-edition sports cars to emphasize performance credentials. These wheels have been valued for their ability to dissipate heat efficiently, which enhances brake performance during high-speed driving. Luxury car manufacturers in Italy, Germany, and the United Kingdom have partnered with wheel specialists to develop exclusive magnesium wheel designs. The motorsport-driven technology transfer has also influenced aftermarket products, allowing enthusiasts to access high-performance designs previously limited to racing applications. This association with elite performance has reinforced their desirability in niche but profitable vehicle segments.

Recent developments in casting, forging, and coating processes have improved the structural integrity and lifespan of magnesium wheels. Advanced alloys and protective treatments have been applied to mitigate corrosion risks associated with magnesium’s reactivity. Powder coating, anodizing, and ceramic finishes have been used to enhance surface durability and visual appeal. Computer-aided engineering and simulation have optimized wheel designs for strength without unnecessary weight addition. Manufacturers in Japan, Germany, and the United States have been introducing wheels with improved impact resistance to meet stricter safety standards. These advancements have addressed long-standing concerns over fragility, allowing broader adoption beyond racing into high-end street vehicles. Enhanced production consistency has also lowered defect rates, contributing to better reliability and user confidence.

Despite performance benefits, magnesium wheels have faced limited penetration in mass-market vehicles due to high production costs and specialized manufacturing requirements. Their susceptibility to corrosion and impact damage without proper surface treatment has added to maintenance concerns for everyday users. Insurance and replacement costs have been higher compared to conventional aluminum alloy wheels, discouraging use in budget-conscious segments. In high-volume production vehicles, aluminum alloys have remained the preferred choice due to their balance of cost, durability, and weight savings. The relatively niche demand from motorsport and luxury markets has limited economies of scale, keeping prices elevated. Unless manufacturing costs decline and durability enhancements become more widely recognized, magnesium wheel adoption is expected to remain concentrated in specialized performance-oriented sectors.

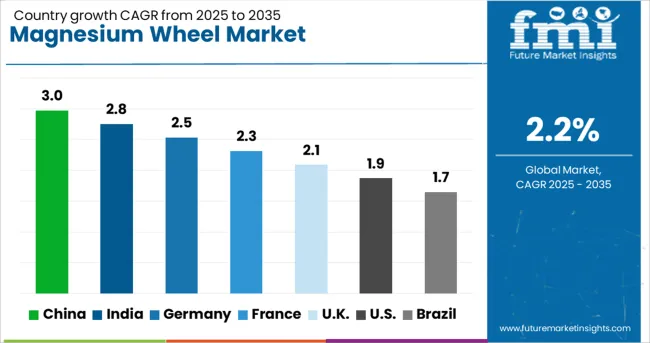

| Country | CAGR |

|---|---|

| China | 3.0% |

| India | 2.8% |

| Germany | 2.5% |

| France | 2.3% |

| UK | 2.1% |

| USA | 1.9% |

| Brazil | 1.7% |

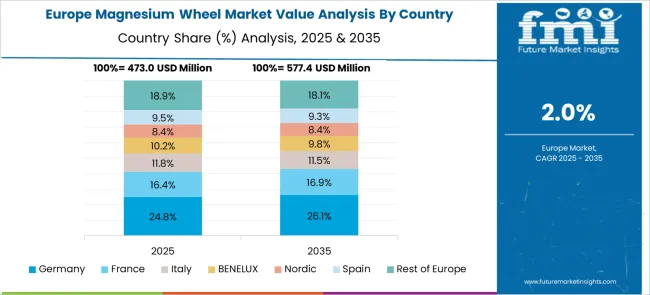

The market is expected to grow at a global CAGR of 2.2% between 2025 and 2035, driven by demand for lightweight automotive components, improved fuel efficiency, and enhanced performance in high-end vehicles. China leads with a 3.0% CAGR, supported by large-scale automotive production and growing aftermarket customization trends. India follows at 2.8%, fueled by rising premium vehicle sales and motorsport adoption. Germany, at 2.5%, benefits from advanced engineering capabilities and strong OEM partnerships. The UK, projected at 2.1%, sees steady demand from luxury and sports car segments. The USA, at 1.9%, reflects a mature automotive market with gradual adoption in performance and specialty vehicles. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 3.0% from 2025 to 2035 in the magnesium wheel market, supported by its position as a major hub for automotive manufacturing and alloy processing. Domestic manufacturers such as Zhejiang Jinfei Kaida, SMW Engineering, and Lioho Machine Works China are expanding production for both OEM and aftermarket segments. The adoption of magnesium wheels is gaining momentum in high-performance vehicles and premium motorcycles due to their lightweight properties and enhanced handling performance. Motorsport and luxury car customization markets are also driving sales, with increasing demand for forged magnesium wheel designs. Government initiatives promoting lightweight materials to improve vehicle efficiency are further encouraging adoption across automotive brands.

India is forecasted to achieve a CAGR of 2.8% from 2025 to 2035, driven by growth in the premium motorcycle and performance car segments. Manufacturers such as Rockman Industries, Steel Strips Wheels, and international players partnering with local OEMs are introducing magnesium wheel options in select high-end models. Motorsport events and track racing culture are influencing consumer interest in lightweight wheel upgrades. With the rise of customization trends among younger buyers, aftermarket magnesium wheel sales are gaining traction in Tier-1 cities. Partnerships between alloy producers and automotive design studios are also enabling innovative wheel styling tailored for the Indian market.

Germany is projected to post a CAGR of 2.5% from 2025 to 2035, supported by its strong luxury automotive sector and engineering expertise. Leading manufacturers such as BBS Kraftfahrzeugtechnik, Ronal Group, and Borbet are focusing on advanced forging and heat-treatment processes to improve wheel strength and fatigue resistance. Magnesium wheels are being increasingly used in motorsport and high-performance car models for weight reduction and improved acceleration. OEM partnerships with Porsche, BMW M, and Audi Sport are playing a pivotal role in market expansion. Additionally, research into corrosion-resistant coatings is enhancing durability for road use in varied weather conditions.

The United Kingdom is expected to record a CAGR of 2.1% from 2025 to 2035, with growth driven by customization, motorsport participation, and the collector car market. Suppliers such as Rimstock PLC and Dymag are producing magnesium wheels for performance motorcycles, sports cars, and endurance racing vehicles. Demand from classic car restoration projects is also contributing to sales, as magnesium wheels offer both authenticity and performance benefits. The trend of personalization in luxury vehicle ownership is increasing demand for bespoke wheel finishes and designs.

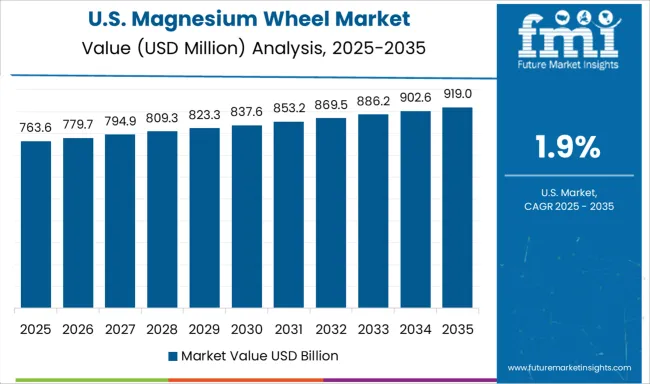

The United States is forecasted to grow at a CAGR of 1.9% from 2025 to 2035, driven by demand in motorsports, luxury SUVs, and aftermarket performance upgrades. Manufacturers such as Forgeline, HRE Wheels, and Carbon Revolution (USA operations) are offering magnesium wheel options in racing and track-focused builds. The popularity of drag racing, autocross, and custom show cars is fueling the aftermarket segment. Lightweight wheel technology is also gaining attention among EV manufacturers aiming to extend range through reduced vehicle mass. Partnerships with racing teams are helping brands validate performance credentials in competitive environments.

The magnesium wheel market is led by high-performance automotive component manufacturers and premium alloy wheel specialists serving motorsports, luxury, and performance vehicle segments. BBS USA and Rays Wheels dominate with lightweight forged magnesium wheels designed to enhance handling, acceleration, and braking efficiency, widely used in professional racing and supercars. Brembo, known for its braking systems, produces magnesium wheels for track applications, leveraging its motorsport engineering expertise. Enkei and OZ Group supply magnesium alloy wheels for both OEM and aftermarket markets, focusing on strength-to-weight optimization and advanced casting or forging processes. Forgiato and Vossen Wheels target the luxury customization segment, offering bespoke magnesium wheel designs with premium finishes for high-end vehicles. Ronal Group delivers OEM-grade magnesium wheels to leading automakers, ensuring compliance with strict performance and durability standards. MKW Alloy serves niche performance and off-road markets with rugged magnesium wheel options, while Vorsteiner specializes in ultra-lightweight, aerodynamically optimized wheels for exotic cars. Key strategies in this market include partnerships with motorsport teams for performance validation, expansion of premium aftermarket product lines, and investment in advanced forging and machining technologies to improve structural integrity. Entry into the magnesium wheel sector is restricted by high raw material and production costs, specialized manufacturing expertise, and established brand loyalty among motorsport and luxury automotive consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Manufacturing | Cast and Forged |

| Vehicle | Cars and Motorcycles |

| Wheel Size | 19-21 inches, 13-15 inches, 16-18 inches, and Above 21 inches |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BBS USA, Brembo, Enkei, Forgiato, MKW Alloy, OZ Group, Rays Wheels, Ronal Group, Vorsteiner, and Vossen Wheels |

The global magnesium wheel market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the magnesium wheel market is projected to reach USD 2.4 billion by 2035.

The magnesium wheel market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in magnesium wheel market are cast and forged.

In terms of vehicle, cars segment to command 52.0% share in the magnesium wheel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnesium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Threonate Supplement Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Acetate Market

Magnesium Testing Reagents Market

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA