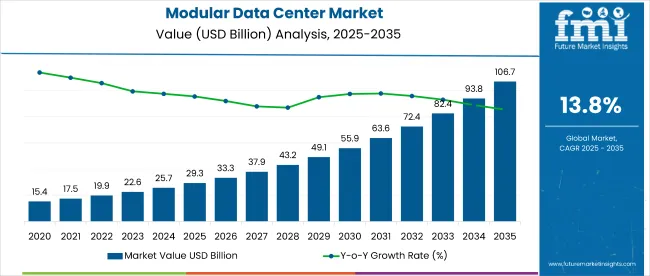

The global Modular Data Center market is projected to grow significantly, from USD 29.3 billion in 2025 to USD 128 billion by 2035 an it is reflecting a strong CAGR of 13.8%.

As organizations are relying more on third-party vendors and partners to provide modular data center infrastructure, managing those risks becomes paramount. With the growth of data, digital capabilities in all the key industries such as BFSI, healthcare, and IT stand and deliver for operational security and compliance. The dependency on third-party providers fuels the demand for effective solutions to help overcome related risk.

Data centers are subject to stringent compliance mandates such as GDPR in Europe and CCPA in California, which focus on data protection and security. Modular data centre solutions offer these automated compliance management tools that help businesses keep pace with ever-changing regulatory requirements easily and prevent them from facing legal penalties as a result of non-compliance. These solutions are essential due to the growing complexities of compliance measures.

Business accelerates digital transformation, modular data centers are the core infrastructure of the cloud, IT infrastructure and edge computing. As third-party integrations become more pervasive, this increasing reliance places demand on superior risk management solutions to ensure any weaknesses in those identifiers do not impact the rest of the system. Secure and compliant deployments are a major driver of growth in this market.

Another area of concern for modular data centers is the rise in cyber threats that makes security a top priority. Therefore organizations need to continuously monitor and assess the risks in real time, to ensure that potential breaches from external vendors can be tracked in real-time. Robust security frameworks make modular data centers resilient against the rising tide of cyber risks.

North America currently accounts for the largest market share, with stringent cybersecurity regulations alongside leading solution providers contributing to this. The modular data center market is also experiencing increased adoption due to a growing digital economy and increasing regulatory scrutiny. India and Australia among countries, which are also seeing growing demand as businesses expand their digital infrastructure and look for enterprise grade data management solutions.

Modular data centers (MDCs) continue to reshape digital infrastructure by offering scalable, energy-efficient, and location-agnostic solutions. Architectures like MODRIC show how modularity and commodity hardware enable agile deployments across edge and cloud environments. Increasingly, MDCs are optimized for environmental performance, with systems like SkyBox aligning workload placement to real-time renewable energy availability. This shift is bolstered by simulation-based power modeling at the module level, allowing operators to predict and manage energy use with precision. Cold-climate and renewable-rich locations help MDCs minimize PUE (Power Usage Effectiveness), making them attractive for green deployments. However, rapid tech refresh cycles within MDCs are contributing to a spike in e-waste, prompting calls for stronger lifecycle management protocols.

In Europe, MDC operators face rising compliance demands under the EU Energy Efficiency Directive (EED) and its May 2024 Delegated Act. Data centers with installed IT power ≥500 kW must now report annually to an EU database, disclosing power usage effectiveness (PUE), water use (WUE), renewable energy share, temperature setpoints, and more. These reports began in late 2024, with a recurring 15 May deadline. Though framed as transparency, this is the scaffolding for future performance thresholds. The Joint Research Centre (JRC), the EU’s science service, underpins these efforts with data quantifying the sector’s energy footprint (45–65 TWh in 2022), used to calibrate ESG narratives.

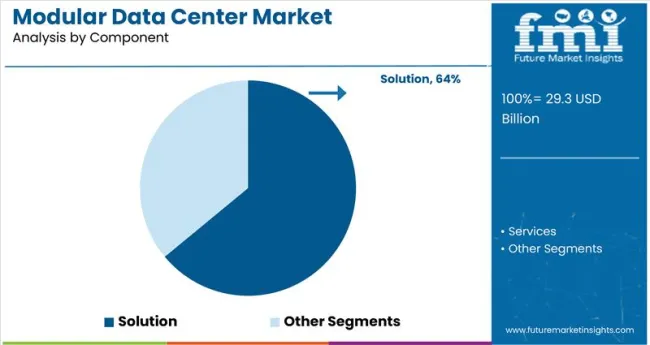

The services segment is projected to grow rapidly at a 15.2% CAGR from 2025 to 2035, driven by increasing demand for professional expertise in deployment and maintenance. The finance industry will hold the largest market share in 2025, driven by stringent security and data processing requirements in financial operations.

The services segment of the modular data center market is expected to grow at a CAGR of 15.2% from 2025 to 2035, as organizations continue to seek third-party expertise for deployment, maintenance, and optimization. This segment’s growth is primarily driven by the increasing need for managed services to ensure the efficient operation of modular data centers. Services in this market include site assessment, installation, real-time monitoring, cybersecurity, and compliance management.

The flexibility, scalability, and cost-effectiveness of modular data centers make them an attractive choice for businesses seeking to improve their infrastructure. Services play a critical role in maximizing performance, minimizing downtime, and ensuring smooth integration with existing systems. Governments across the globe are driving digital transformation initiatives that support the expansion of modular data centers, further fueling demand for related services. As data regulations and cybersecurity concerns become more stringent, businesses are increasingly turning to professional services to meet compliance standards, thus driving further growth in the modular data center services segment.

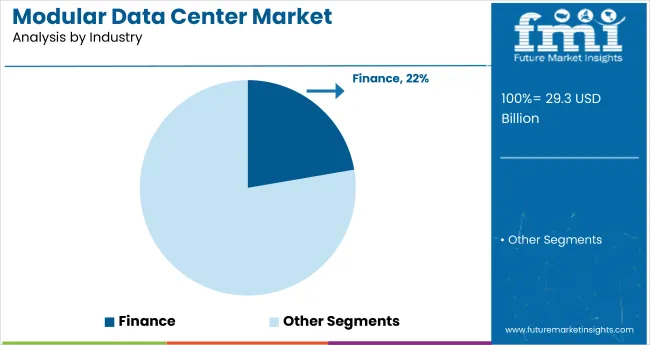

The finance industry is expected to capture a dominant 22.3% share of the modular data center market in 2025, making it the largest end-user sector. This growth is driven by the significant volume of data processing required in digital banking, high-frequency trading, and financial transactions. Modular data centers offer scalability, security, and performance improvements that are essential for the finance sector, where data security and high-speed processing are critical.

Banks, fintech companies, and financial institutions are increasingly adopting modular data centers to improve their digital operations and manage growing data volumes effectively. The rise of AI in financial services, digital payments, and blockchain technology has further fueled the demand for robust IT infrastructure. Additionally, stricter data security regulations and government policies are compelling financial institutions to invest in secure, scalable, and energy-efficient data centers. Recent initiatives, including government funds aimed at modernizing financial infrastructure, are expected to increase investments in modular data centers, driving growth in this segment through 2035.

| Company | Schneider Electric |

|---|---|

| Contract/Development Details | Awarded a contract by a cloud service provider to design and deploy modular data centers, enabling rapid scalability, energy efficiency, and reduced deployment times to meet growing data demands. |

| Date | June 2024 |

| Contract Value (USD Million) | Approximately USD 45 |

| Renewal Period | 6 years |

| Company | Huawei Technologies Co., Ltd. |

|---|---|

| Contract/Development Details | Partnered with a telecommunications company to construct modular data centers in emerging markets, focusing on enhancing network infrastructure, reducing latency, and supporting the expansion of digital services. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 7 years |

Increasing adoption of cloud computing and edge applications is fueling growth of scalable, flexible and modular data centers. With most enterprises moving to hybrid and multi-cloud environments, traditional data centers are unable to keep up with the ever-increasing processing and storage requirements. Modular data centers offer a fast-start deployment model, enabling organizations to provision infrastructure as needed without a heavy capital outlay.

As global cloud computing spending is projected to exceed USD 1 trillion by 2026, enterprises and hyperscaler are increasingly adopting modular solutions to ensure agility, cost-efficiency and reliability. With the growing popularity of 5G networks, autonomous vehicles, and IoT devices, demand continues to increase for modular edge data centers, which enable computing to happen closer to the end user, resulting in reduced latency and enhanced performance.

Data center energy consumption poses a significant environmental challenge, driving the continual transition toward modular data centers that are more sustainable and energy efficient. Standard data centers use almost 200 TWh per year of energy, thus generating substantial carbon emissions. With a strict carbon neutrality policy being introduced by governments, organizations are looking for green data center solutions that integrate advanced cooling technologies, renewable energy and energy-efficient hardware.

Modular data centers deliver PUE with less energy waste and more performance. Liquid cooling systems, AI-driven energy management and waste heat recovery are just some of the innovations that are adding to efficiency in these modular deployments.

The telecom sector is installing modular data centers on the back of rising data traffic along with the rapid growth of 5G networks. With the number of connected mobile devices expected to grow to more than 50 billion by 2030, the global mobile data traffic is expected to be 500 exabytes per month, putting pressure on telecom providers to upgrade their infrastructure to accommodate demands for ultra-low latency, high-connectivity, high-speed, low-cost, and real-time processing.

With the use of modular data centers - a repeatable and very space-efficient design - data can easily be deployed next to a cell tower or base station to function at the edge of the network. Modular solutions are becoming more pressing in telecom with the rise of connected devices, smart cities, and autonomous systems.

Many organizations, particularly in banking, healthcare, and government, still use legacy IT systems that were never built for modular scalability. Traditional systems typically rely on legacy hardware, proprietary software stacks, and rigid network topologies that make it challenging to natively integrate modern modular data center offerings.

Legacy applications cannot operate in a modular environment, which can lead to migration taking place over longer periods of time, disruption of service and inherent costs during the reconfiguration of the workspace.

Moreover, the conventional IT frameworks are not equipped with the needful automation and orchestration capabilities to harness the benefits of modular data centers to its fullest. Operational bottlenecks arise, with enterprises forced to manually reallocate workloads, optimize data streams, and change network configuration settings to ensure seamless integration.

Also, legacy environments can fall short on modern encryption and access controls and real-time monitoring, preferred capabilities in modular data center operation, further exposing the gap in security between old and new systems. These challenges push out deployment timelines, which inhibits organizations from realizing the speed, efficiency, and scalability that modular data centers are meant to deliver.

Tier 1 vendors are industry leaders with a presence worldwide, and offer complete modular data center solutions in a broad spectrum of industries and applications. They have invested years of time and fortunes in R&D, supply chains, and proven implementations. Prominent Tier 1 vendors include Schneider Electric, Huawei, Dell, Vertiv, and Eaton. By offering end-to-end solutions with a global support network, they lead in the modular data center market.

Tier 2 - Well-known companies with a significant regional presence or niche presence in the modular data centre landscape. While they may not have the same level of global presence as Tier 1 vendors, they are critical to addressing particular market niches and regional needs.

Prominent Tiers 2 providers comprise Rittal, Delta Electronics, STULZ, and Johnson Controls. These companies might be targeting specific niches markets or specific technology areas, which gives these companies an upper hand in competing against big companies by addressing specific customer needs in particular geography.

Tier 3: Smaller or new vendors that provide modular data center solutions more targeted toward a specific market or application, often limited to a regional or local area. These vendors have the potential to build customized solutions that are tailored to their customers' unique needs and requirements.

Though lacking the same level of resources as their Tier 1 or Tier 2 counterparts, Tier 3 vendors bring a measure of diversity to the marketplace through innovative solutions that help mitigate different pain points inherent in the modular data center ecosystem.

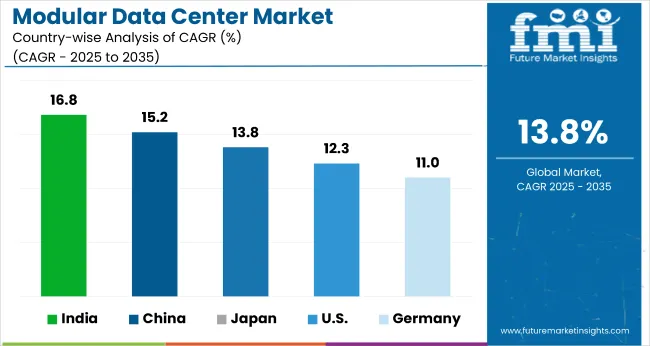

The section highlights the CAGRs of countries experiencing growth in the Modular Data Center market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 16.8% |

| China | 15.2% |

| Germany | 11.0% |

| Japan | 13.8% |

| United States | 12.3% |

Modular data centers capable of being sited nearer to end-users are benefiting from the rapid 5G roll out across China and an increase in edge computing deployment. China is in the midst of a mobile internet boom and an unparalleled surge of mobile connected devices, with a large population and expanding data consumption fed by AI apps and IoT deployments.

Even low-latency requirements are hard to cater using conventional centralized data centers, thus decentralized and modular solutions seem to be the natural choice to cater such needs. The ambition of the government to broaden the 5G infrastructure all over the country has also resulted in massive investment with the construction of edge computing facilities.

According to estimations, by 2025, China will have more than 30 million 5G base stations in place, and the volume of data generated will far exceed the current network standards, necessitating that the data be processed in situ to avoid stressing data networks. China is anticipated to see substantial growth at a CAGR 15.2% from 2025 to 2035 in the Modular Data Center market.

The Digital India Initiative is transforming the digital infrastructure in the country that will create substantial demand for modular data centers. Broadband penetration, cloud computing adoption, and e-governance are some of the top priorities of the government - making a strong data center ecosystem an infrastructural requirement.

Scaled secure modular data centers are a more cost-effective way to provide capacity than traditional facilities, making them perfect for supporting this national digitization. This urgent need for speed can be justified by rapid growth in the country, with the number of internet users exceeding 900 million and the gradual penetration of online services.

The Indian government has taken initiatives like Data Center Policy, which will help in attracting foreign investment and indigenous data center development to support this growth. For 2023, the government has earmarked USD 12 billion for IT infrastructure development; this includes incentives for data center operators who opt for energy-efficient modular systems. India's Modular Data Center market is growing at a CAGR of 16.8% during the forecast period.

The USA modular data center market is witnessing growth, backed by investments in hyperscale and colocation facilities. Cloud service providers and enterprises that are rapidly scaling their infrastructure to accommodate increasing data processing needs are also opting for modular solutions due to their rapid deployment and operational flexibility.

Modular and energy-efficient data centers are also being cultivated, supported by the USA Government. In addition, over 50% of world hyperscale data centers are situated in the USA and need scalable, pre-fabricated solutions like never before. USA is anticipated to see substantial growth in the Modular Data Center market significantly holds dominant share of 76.6% in 2025.

The Modular Data Center market is highly competitive, with a presence of numerous large and small players. Companies differentiate themselves in areas like how quickly they can deploy solutions, cost, sustainability and innovation within their cooling technologies and artificial intelligence-driven management solutions.

The increasing demand for edge computing and hyperscale expansion is driving the competition that requires the vendors to have flexible and prefabricated solutions. Moreover, compliance with regulations and green data center initiatives are directing trends in the climate market and presenting opportunities for market participants in regards to being distinguished through eco-friendly and high-performance designs.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 29.3 billion |

| Projected Market Size (2035) | USD 128 billion |

| CAGR (2025 to 2035) | 13.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and number of modular installations for volume |

| Components Analyzed (Segment 1) | Solution, Services |

| Data Center Sizes Analyzed (Segment 2) | Small, Mid-Size, Large |

| Industries Analyzed (Segment 3) | Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector, Infrastructure |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the Modular Data Center Market | Dell Technologies, Hewlett Packard Enterprise (HPE), Huawei Technologies, Vertiv Group, Eaton, IBM Corporation, Schneider Electric, Cannon Technologies, Rittal GmbH & Co. KG, Baselayer Technology |

| Additional Attributes | Dollar sales growth driven by edge computing and cloud migration, services segment expanding with demand for deployment and maintenance support, finance sector leading adoption due to data compliance needs, modular scalability attracting SMEs and hyperscalers alike, Asia Pacific emerging as a key hub for prefabricated infrastructure. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of component, the segment is segregated into solution and services.

In terms of Data Center Size, the segment is segregated into Small Data Centre, Mid-Size Data Centre and Large Data Centre.

In terms of Industry, it is distributed into Finance, manufacturing & Resources, Distribution Services, Services, Public Sector and Infrastructure.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Modular Data Center industry is projected to witness CAGR of 13.8% between 2025 and 2035.

The Global Modular Data Center industry stood at USD 29.3 billion in 2025.

The Global Modular Data Center industry is anticipated to reach USD 128 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 15.3% in the assessment period.

The key players operating in the Global Modular Data Center Industry Dell Technologies, Hewlett Packard Enterprise (HPE), Huawei Technologies, Vertiv Group, Eaton, IBM Corporation, Schneider Electric, Cannon Technologies, Rittal GmbH & Co. KG, Baselayer Technology.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Organization Size, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Industry Verticals , 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 17: Global Market Attractiveness by Component, 2024 to 2034

Figure 18: Global Market Attractiveness by Organization Size, 2024 to 2034

Figure 19: Global Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 37: North America Market Attractiveness by Component, 2024 to 2034

Figure 38: North America Market Attractiveness by Organization Size, 2024 to 2034

Figure 39: North America Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 57: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Organization Size, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Organization Size, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Organization Size, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Organization Size, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 137: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Organization Size, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Organization Size, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Industry Verticals , 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Organization Size, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Industry Verticals , 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Verticals , 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Verticals , 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Organization Size, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Industry Verticals , 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA