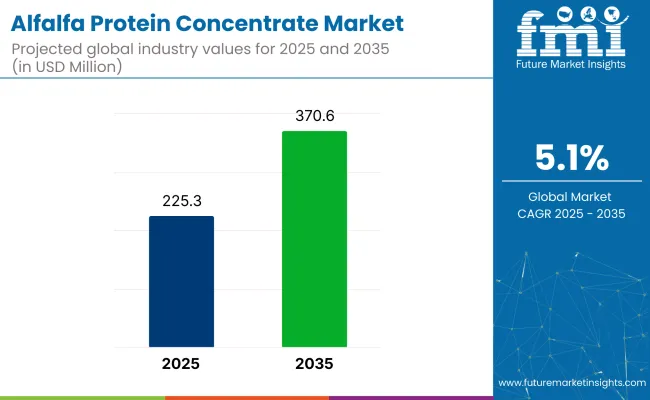

The global alfalfa protein concentrate market, estimated at USD 225.3 million in 2025, is forecast to climb to around USD 370.5 million by 2035, reflecting an absolute gain of USD 145.3 million during the period. This translates into a total growth of 64.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.64X during the same period, supported by rising demand for plant-based protein alternatives and increasing applications in functional food formulations.

| Metric | Value (USD Million) |

|---|---|

| Alfalfa Protein Concentrate Market (2025) | USD 225.3 Million |

| Alfalfa Protein Concentrate Market (2035) | USD 370.5 Million |

| CAGR (2025 to 2035) | 5.1% |

Between 2025 and 2030, the alfalfa protein concentrate market is projected to expand from USD 225.3 million to USD 288.9 million, resulting in a value increase of USD 63.6 million, which represents 43.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of plant-based protein sources in food manufacturing, increasing consumer awareness of nutritional benefits, and expanding applications in nutraceutical formulations. Manufacturers are investing in advanced extraction technologies to improve protein concentration levels and enhance product functionality across various applications.

From 2030 to 2035, the market is forecast to grow from USD 288.9 million to USD 370.5 million, adding another USD 81.7 million, which constitutes 56.2% of the overall ten-year expansion. This period is expected to be characterized by expansion into new geographic markets, development of specialized formulations for targeted applications, and integration of sustainable production practices. The growing demand for clean-label ingredients and protein fortification in functional foods will drive adoption across diverse end-use sectors.

Between 2020 and 2025, the alfalfa protein concentrate market experienced steady expansion, driven by increasing consumer preference for plant-based proteins and growing applications in dietary supplements. The market developed as food manufacturers recognized the nutritional benefits and functional properties of alfalfa protein in various formulations. Research institutions and ingredient suppliers began investing in improved processing technologies to enhance protein quality and expand application possibilities.

Market expansion is being supported by the growing consumer demand for sustainable protein alternatives and increasing recognition of alfalfa protein's nutritional profile. The ingredient provides essential amino acids, vitamins, and minerals while offering functional benefits including emulsification, water-binding capacity, and texture enhancement in food applications. Plant-based protein sources are gaining prominence as consumers seek alternatives to animal-derived proteins for health, environmental, and ethical considerations.

The expanding functional food and nutraceutical sectors are driving demand for high-quality protein concentrates with proven health benefits. Alfalfa protein concentrate offers antioxidant properties, supports digestive health, and provides complete protein profiles that appeal to health-conscious consumers. Food manufacturers are incorporating these concentrates into protein bars, beverages, supplements, and bakery products to meet growing nutritional demands and clean-label requirements.

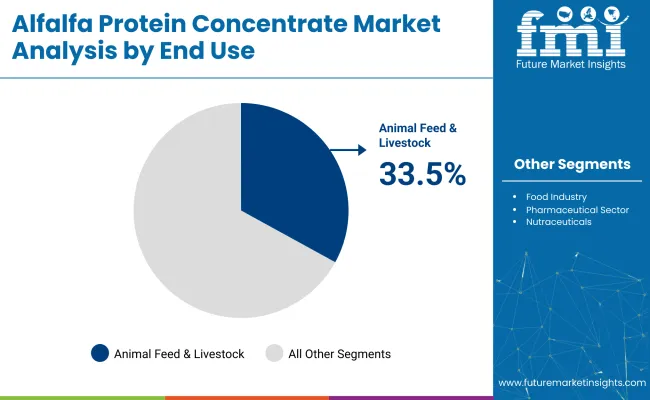

The market is segmented by form, end use, and region. By form, the market is divided into powder and pellet. Based on end use, the market is categorized into food industry, pharmaceutical sector, nutraceuticals, and animal feed. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Powder form is projected to account for 60% of the alfalfa protein concentrate market in 2025. This leading share is supported by the superior solubility and mixing characteristics of powdered alfalfa protein concentrate in various applications. Powder form offers enhanced functionality in beverage formulations, nutritional supplements, and food processing applications where uniform distribution and rapid dissolution are required. The segment benefits from established processing technologies and widespread acceptance across multiple end-use industries.

The food industry is expected to represent 40% of alfalfa protein concentrate demand in 2025. This significant share reflects the growing incorporation of plant-based proteins in food manufacturing and increasing consumer demand for protein-fortified products. Food manufacturers utilize alfalfa protein concentrate in bakery products, protein bars, beverages, and meat alternatives to enhance nutritional profiles and meet clean-label requirements. The segment benefits from expanding applications in functional foods and growing consumer acceptance of plant-based ingredients.

The alfalfa protein concentrate market is advancing steadily due to increasing plant-based protein adoption and growing recognition of nutritional benefits. However, the market faces challenges including seasonal availability variations, processing cost considerations, and competition from other plant protein sources. Quality standardization and supply chain optimization continue to influence market development patterns.

Expansion of Functional Food Applications

The growing integration of alfalfa protein concentrate in functional food formulations is expanding market opportunities across diverse product categories. Manufacturers are developing specialized protein blends that combine alfalfa concentrate with other plant proteins to optimize nutritional profiles and functional properties. These developments enable enhanced texture, improved shelf stability, and superior nutritional density in processed foods and beverages.

Development of Advanced Processing Technologies

Modern processing facilities are incorporating improved extraction and purification technologies that enhance protein concentration levels and maintain nutritional integrity. Advanced spray-drying techniques, membrane filtration systems, and gentle processing methods preserve bioactive compounds while improving product solubility and functionality. These technological improvements support premium product development and expanded application possibilities.

The Alfalfa Protein Concentrate market is on the cusp of transformation, fueled by sustainability, plant-based nutrition, and feed efficiency. By 2030, these pathways together unlock USD 6.3-9.0 billion in incremental revenue opportunities.

Pathway A - Premium Animal Nutrition.

APC’s high digestibility, chlorophyll content, and amino acid balance make it ideal for poultry, aquaculture, and dairy. The largest near-term opportunity worth USD 1.5-2.5 billion.

Pathway B - Functional Human Nutrition.

Plant proteins in sports nutrition, weight management, and active aging supplements are growing fast. APC can carve a niche with its unique amino acid profile. Expected pool: USD 1-1.5 billion.

Pathway C - Plant-based Meat & Dairy Alternatives.

Alfalfa-derived protein can act as a binder and fortifier in meat analogs, plant yogurts, and dairy-free beverages. Incremental pool: USD 0.8-1.2 billion.

Pathway D - Emerging Market Feed Adoption.

Demand for high-quality animal protein is surging in Asia, Middle East, and Africa. APC as a sustainable feed additive represents USD 1.2-1.8 billion.

Pathway E - Circular & Regenerative Systems.

Positioning APC as part of regenerative farming - valorizing alfalfa biomass while improving soil fertility - builds a USD 0.6-1.0 billion opportunity.

Pathway F - Clean-label Certifications.

Securing organic, allergen-free, and sustainability certifications allows premium pricing. Adds USD 0.5-0.8 billion.

Pathway G - Blended Formulations.

Combining APC with pea or soy proteins enhances amino acid balance for specialized nutrition. Expected pool: USD 0.4-0.7 billion.

Pathway H - Digital Transparency & Branding.

Blockchain traceability, QR-enabled storytelling, and D2C channels connect APC directly with sustainability-focused consumers. Smaller but disruptive pool of USD 0.3-0.5 billion.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.3% |

| France | 5.1% |

| Germany | 4.8% |

| China | 4.5% |

| United States | 4.0% |

| Japan | 3.8% |

| South Korea | 3.5% |

The alfalfa protein concentrate market demonstrates strong growth potential across key markets, with India leading at an 8.3% CAGR through 2035, driven by expanding nutraceutical applications and growing health awareness. France follows at 5.1%, supported by advanced food processing capabilities and increasing functional food demand. Germany records 4.8% growth, emphasizing quality manufacturing and premium applications. China shows 4.5% expansion, integrating traditional medicine applications with modern nutritional science. The United States grows at 4.0%, focusing on supplement industry applications and plant-based food manufacturing.

Revenue from alfalfa protein concentrate in India is projected to exhibit the highest growth rate with a CAGR of 8.3% through 2035, driven by increasing awareness of plant-based nutrition and expanding applications in traditional medicine formulations. The country's growing middle class and rising health consciousness are creating significant demand for nutritional supplements and functional food ingredients. Domestic manufacturers are establishing production facilities to serve both local consumption and export markets across South Asia.

Government initiatives promoting agricultural diversification are encouraging alfalfa cultivation and processing infrastructure development throughout key agricultural regions. The expanding pharmaceutical and nutraceutical industries are integrating alfalfa protein concentrate into various formulations that combine traditional Ayurvedic principles with modern nutritional science.

Revenue from alfalfa protein concentrate in France is expanding at a CAGR of 5.1%, supported by advanced food processing technologies and strong consumer demand for sustainable protein alternatives. The country's established food industry infrastructure and emphasis on quality ingredients drive adoption across premium applications. French manufacturers focus on developing specialized formulations for functional foods, dietary supplements, and organic product lines.

The expanding organic food sector and growing consumer preference for clean-label ingredients create opportunities for high-quality alfalfa protein concentrate applications. Research institutions collaborate with industry partners to develop innovative processing techniques that enhance nutritional profiles and expand application possibilities across diverse end-use sectors.

Demand for alfalfa protein concentrate in Germany is projected to grow at a CAGR of 4.8%, supported by the country's emphasis on high-quality ingredient manufacturing and precision processing technologies. German manufacturers implement comprehensive quality control systems and advanced extraction methods that maximize protein concentration while preserving nutritional integrity. The market is characterized by focus on premium applications in functional foods and specialized nutritional supplements.

Industrial food processing facilities integrate alfalfa protein concentrate into diverse applications including protein bars, beverages, and bakery products that meet consumer demand for plant-based nutrition. Manufacturing operations emphasize sustainability practices and traceability systems that support premium product positioning and export market development.

Demand for alfalfa protein concentrate in China is expanding at a CAGR of 4.5%, driven by integration of traditional medicine applications with modern nutritional science and growing consumer awareness of plant-based proteins. Chinese manufacturers develop formulations that combine alfalfa protein with other traditional ingredients to create comprehensive wellness products. The expanding middle class and increasing health consciousness drive demand for premium nutritional supplements and functional food products.

Domestic production capabilities are expanding to serve both local consumption and export markets throughout Asia Pacific. Manufacturing facilities implement modern processing technologies while maintaining connection to traditional applications that have utilized alfalfa for centuries in various wellness formulations.

Demand for alfalfa protein concentrate in the United States is expanding at a CAGR of 4.0%, driven by strong supplement industry demand and growing applications in plant-based food manufacturing. American manufacturers focus on developing standardized formulations that meet FDA requirements while providing consistent nutritional profiles. The market benefits from established distribution networks and consumer acceptance of plant-based protein supplements.

Innovation in processing technologies enables enhanced protein concentration and improved functional properties that support diverse applications across food and supplement sectors. Companies invest in sustainable sourcing practices and quality assurance systems that meet consumer expectations for premium natural ingredients.

Demand for alfalfa protein concentrate in Japan is projected to grow at 3.8% CAGR, driven by the country’s commitment to high-quality livestock production and the growing demand for premium feed ingredients. Japanese farmers, particularly in the dairy and beef sectors, prefer alfalfa protein concentrate for its high nutritional value, making it a key component in enhancing animal performance and health.

Japan’s robust agricultural practices and its advanced feed technology infrastructure support the growing adoption of alfalfa protein concentrate. Additionally, there is increasing interest in natural and sustainable feed ingredients, which boosts demand for plant-based proteins like alfalfa.

Demand for alfalfa protein concentrate in South Korea is projected to grow at 3.5% CAGR, driven by the country's growing focus on high-quality feed ingredients and advancements in livestock farming techniques. South Korean farmers, particularly in the dairy and beef sectors, are increasingly turning to alfalfa protein concentrate for its rich protein content and high digestibility, which support optimal animal health and growth.

South Korea’s innovations in feed technology and its emphasis on more efficient farming practices are propelling the demand for alfalfa protein concentrate. Additionally, the growing consumer preference for natural and plant-based ingredients further supports its adoption in livestock nutrition.

The alfalfa protein concentrate market in Europe is projected to grow from USD 54.3 million in 2025 to USD 83.3 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to remain the market leader with a 25.4% share in 2025, followed by France at 16.7%, supported by demand in animal nutrition and plant-based protein applications. Italy accounts for 11.5% of the market, while BENELUX represents 10.8% and the Nordic countries hold 9.7%. Spain contributes 7.9%, while the Rest of Europe collectively makes up 18.1%. By 2035, Germany will slightly expand its lead to 26.5%, France will grow to 17.9%, and Italy will stabilize at 11.2%. BENELUX and the Nordic region are projected at 10.2% and 9.9%, respectively, while Spain will hold 7.6%, and the Rest of Europe will adjust to 16.7%, highlighting a gradual concentration of demand in Western Europe’s leading feed and nutrition markets.

The alfalfa protein concentrate market is defined by competition among specialized ingredient suppliers, agricultural processors, and nutritional supplement manufacturers. Companies are investing in advanced extraction technologies, quality control systems, sustainable sourcing practices, and product development to deliver consistent, high-quality protein concentrates that meet diverse application requirements. Strategic partnerships, vertical integration, and geographic expansion are central to strengthening market position and customer relationships.

Bioriginal Food & Science Corporation holds a 12% market share, offering comprehensive ingredient solutions with emphasis on quality assurance and application support. The company focuses on sustainable sourcing practices and advanced processing technologies that ensure consistent product specifications. Swanson Vitamins provides retail and manufacturing solutions with established distribution networks across North America.

Xi'an Tianrui Biotech Co., Ltd. specializes in plant extract manufacturing with focus on Asian markets and export development. Acetar Biotech emphasizes research-driven product development and quality manufacturing standards. Nutramax Inc. offers specialized nutritional ingredient solutions with focus on supplement industry applications and regulatory compliance.

Alfalfa protein concentrate (APC) is emerging as a resilient, climate-smart plant protein with strong fitments in animal feed, aquafeed, functional food fortification, and specialty nutrition. Its advantages - low-input cultivation, nitrogen-fixing benefits, and a balanced amino-acid profile - make APC attractive to sustainability-minded formulators and livestock producers seeking alternatives to soy and fishmeal. Scaling APC commerciality requires aligned action across policy, standards bodies, equipment and processing innovators, raw-material suppliers and processors, and capital providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 225.3 Million |

| Form | Powder, Pellet |

| End Use | Food Industry, Pharmaceutical Sector, Nutraceuticals, Animal Feed |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, France, and 40+ countries |

| Key Companies Profiled | Bioriginal Food & Science Corporation, Swanson Vitamins, Xi'an Tianrui Biotech Co., Ltd., Acetar Biotech, Unan Nutramax Inc, 3W Botanical Extract, Hindustan Animal Feeds, Conduzioni Aziende Agricole Forte, and Alfalfas Sat Ansó |

| Additional Attributes | Dollar sales by form and end use, regional trends, competitive landscape, consumer shift to plant-based proteins, sustainability, processing innovations, and specialized formulations for functional foods and nutritional supplements. |

The projected market value of the alfalfa protein concentrate market in 2025 is USD 225.3 million.

The forecast market value of the alfalfa protein concentrate market by 2035 is USD 370.5 million.

The expected CAGR for the Alfalfa Protein Concentrate Market from 2025 to 2035 is 5.1%.

The functional foods and plant-based nutrition segment is expected to lead the alfalfa protein concentrate market in 2035, with around 66.5% market share.

India is expected to be the fastest-growing market in the alfalfa protein concentrate market, with a projected 8.3% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Concentrate Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA